DAX Potential Short! Sell!

Hello,Traders!

DAX went up nicely

But is now about to hit

A horizontal resistance

Around 24,000 so after

The retest we will be

Expecting a local pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DAX Index

DAX Resilience To Shine ThroughThe DAX Index continues to hold strength just beneath all-time highs, popping higher above 24,000 after three consecutive sessions of gains.

Bulls are keeping control through strong earnings in tech and auto sectors, combined with supportive macro tailwinds. However, the major resistance and previous ATH remain to be tested.

U.S. Interest Rate Path in Focus

The Federal Reserve held rates steady at its July meeting but left the door open for a possible cut in September, should inflation and labor market data soften.

Markets are pricing in an increasing probability of a cut, which is fueling optimism across global equities.

A dovish Fed supports global risk sentiment and weakens the USD, indirectly benefiting European exporters.

ECB Holds, But Dovish Undertone Grows

The European Central Bank left rates unchanged in its latest decision, but ECB President Christine Lagarde acknowledged that “disinflation is progressing” and that further tightening is unlikely.

Forward guidance was interpreted as dovish, with the market now expecting a cut by December, possibly sooner if economic activity remains sluggish.

A dovish ECB lowers borrowing costs and improves equity risk premiums, especially for cyclical-heavy indices like the DAX.

EU–U.S. Trade Tensions

Recent rhetoric from U.S. officials, including renewed tariff threats on European pharmaceutical and automotive exports, has reignited trade tensions.

The EU has signaled its willingness to respond proportionally, but negotiations are ongoing.

While no measures have been enacted yet, uncertainty over trade policy is capping some upside momentum in European equities.

German automakers and industrial exporters are vulnerable to tariffs. Continued trade uncertainty may limit gains unless diplomacy resolves key friction points.

The DAX remains resilient, buoyed by improving fundamentals, strong earnings, and global rate expectations.

The index is coiled just under a key psychological resistance at 24,000, with bulls eyeing a breakout toward the all-time high near 24,639.

Momentum remains favorable, but traders should watch macro headlines and volume closely around resistance zones.

GER30 H4 | Bullish bounce off overlap supportGER30 is falling towards the buy entry at 23,935.46, which is an overlap support that lines up with the 50% Fibonacci retracement and could bounce from this level to the upside.

Stop loss is at 23,466.40, which is a multi-swing low support.

Take profit is at 24,642.79, which is a swing high resistance that is slightly below the 127.2% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

DAX: Bulls Are Winning! Long!

My dear friends,

Today we will analyse DAX together☺️

The market is at an inflection zone and price has now reached an area around 23,755.89 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 23,976.72.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

DAX Futures Rebound Amid Shifting US Economic SentimentThe DAX futures are showing a more optimistic tone today, shifting from concerns over weak US labor market data—which initially signaled economic trouble—to a more hopeful outlook that this might prompt the Federal Reserve to consider cutting interest rates, a move that investors see as positive. This shift in sentiment has provided some reassurance as the new week begins.

Following a brief decline on Friday, the market experienced a rebound today, supported by a weekly demand zone. We’re now watching for a retest of key levels within this zone, which could serve as a potential entry point for long positions, aiming for a continuation of the upward momentum driven by the weekly support area.

✅ Please share your thoughts about GER30 in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Potential bullish bounce?DAX40 (DE40) is falling towards the pivot, which has been identified as a swing low support and could bounce to the 1st resistance, which is a pullback resistance.

Pivot: 23,032.38

1st Support: 22,503.52

1st Resistance: 23,939.75

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#DAXDate: 01-08-2025

#DAX Current Price: 23680

Pivot Point: 24193.295 Support: 23822.409 Resistance:24566.692

Upside Targets:

🎯 Target 1: 24882.344

🎯 Target 2: 25197.995

🎯 Target 3: 25574.758

🎯 Target 4: 25951.520

Downside Targets:

🎯 Target 1: 23505.502

🎯 Target 2: 23188.595

🎯 Target 3: 22811.833

🎯 Target 4: 22435.070

#TradingView #Nifty #BankNifty #DJI #NDQ #SENSEX #DAX #USOIL #GOLD #SILVER

#BHEL #HUDCO #LT #LTF #ABB #DIXON #SIEMENS #BALKRISIND #MRF #DIVISLAB

#MARUTI #HAL #SHREECEM #JSWSTEEL #MPHASIS #NATIONALUM #BALRAMCHIN #TRIVENI

#USDINR #EURUSD #USDJPY

#SOLANA #ETHEREUM #BTCUSD #MATICUSDT #XRPUSDT

#Crypto #Bitcoin #BTC #CryptoTA #TradingView #PivotPoints #SupportResistance

DAX: Next Move Is Up! Long!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 23,502.95 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

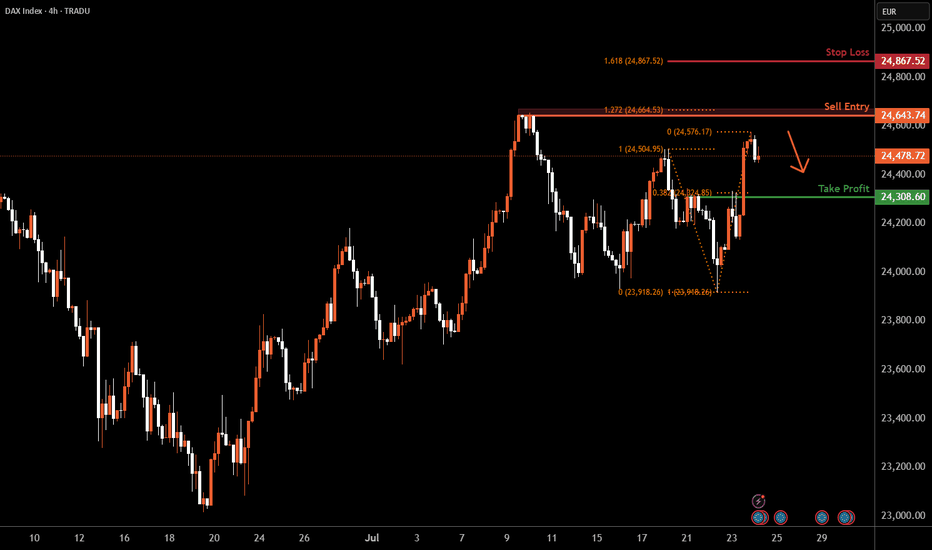

DAX H4 | Heading into a swing-high resistanceThe DAX (GER30) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 24,643.74 which is a swing-high resistance that aligns with the 127.2% Fibonacci extension.

Stop loss is at 24,867.52 which is a level that aligns with the 161.8% Fibonacci extension.

Take profit is at 24,308.60 which is a pullbacl support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

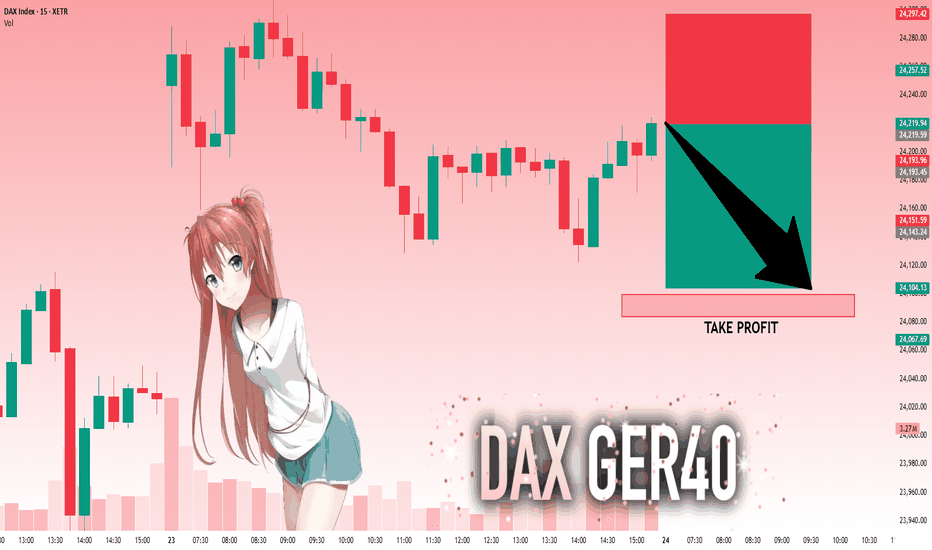

DAX: Target Is Down! Short!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 24,219.59 will confirm the new direction downwards with the target being the next key level of 24,099.27.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

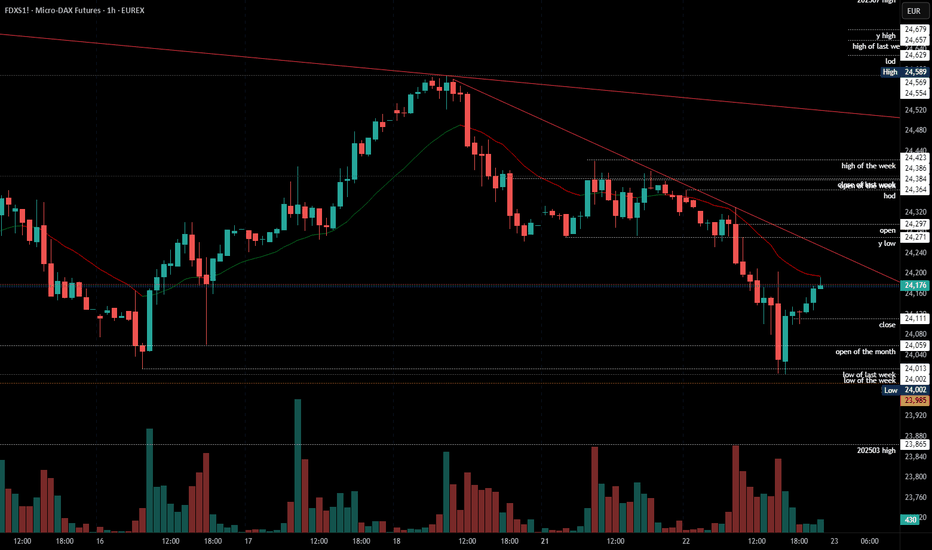

2025-07-22 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears had two legs down and the reversal from 24000 was strong enough to doubt this can go below 24000. I do expect some form of re-test of 24000 but the buying since then was insane again. Not a single 1h bar dropped below the prior one.

current market cycle: trading range

key levels: 24000 - 24600

bull case: Bulls next target is the breakout re-test of 24271 and if they can break above, the next target is today’s high at 24364. Above is likely no more resistance until 24450 or 24500. A print above 24271 would confirm the trading range and conclude the selling for now. This looks more like a two-legged move in a bigger trading range than stronger selling.

Invalidation is below 24350.

bear case: Bears need to keep it below the breakout price and re-test 24000. If they can leave an open gap, that would be great. Best would be to go sideways and stay below 24100 then but for now I have no trust in the bears.

Invalidation is above 24271.

short term: Neutral. No trust in bears but it would be great if we would stay below 23271 and test 24000 again. Daily close below 24000 would be a dream for bears. Above 24271 I would probably look for longs and higher prices again.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Selling EU open, no bigger resistance and only red bars on the 1h chart.

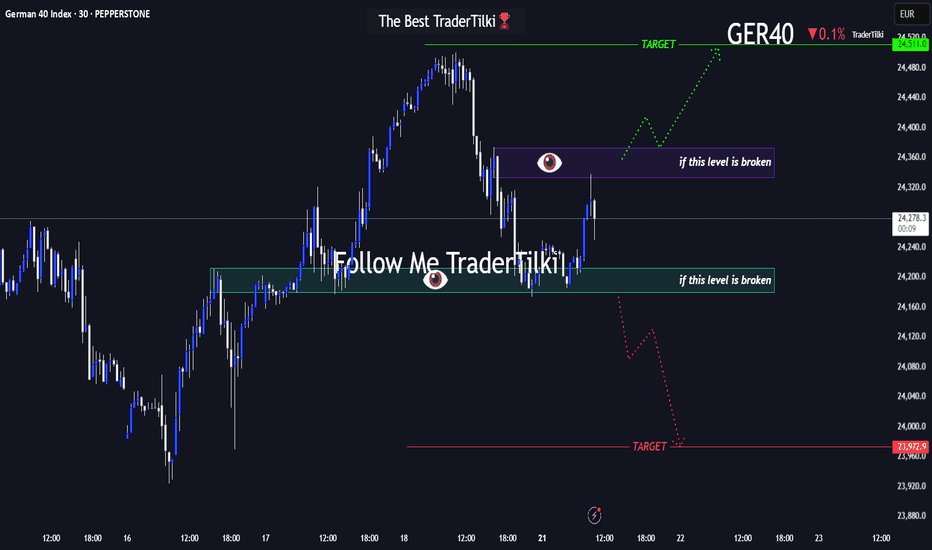

Before GER40 Roars, It WhispersHey guys👋

Here’s the latest GER40 analysis I’ve prepared for you:

🔻 If the **24,179** support level breaks, the next target is **23,972**.

🔺 If the **24,373** resistance level breaks, the next target is **24,511**.

🎯 I’ve shared two key levels with you — please monitor them carefully.

Every like from you gives me a big boost of motivation 🙏

Thanks to everyone who supports my work — truly appreciate it 💙

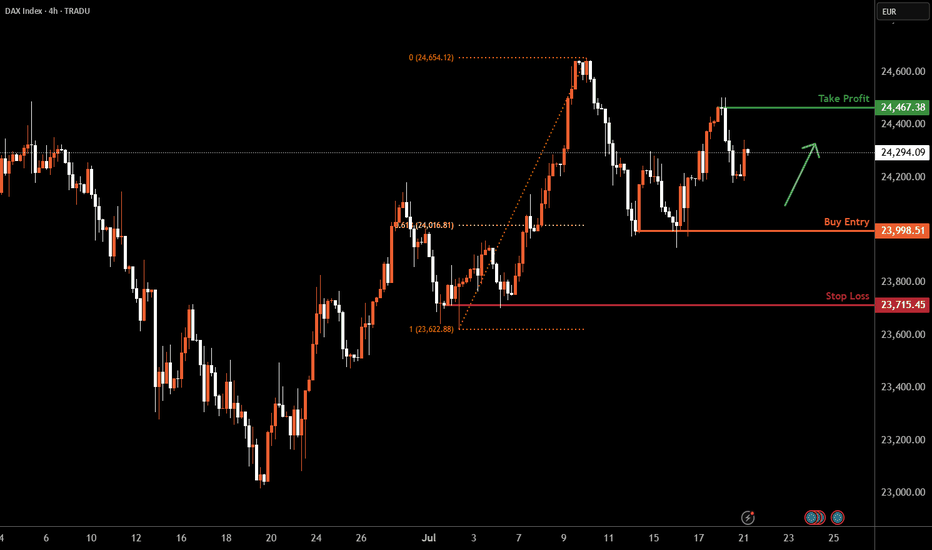

DAX H4 | Multi-swing-low support at 61.8% Fibonacci retracementThe DAX (GER30) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 23,998.51 which is a multi-swing-low support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 23,715.45 which is a swing-low support.

Take profit is at 24,467.38 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

#202529 - priceactiontds - weekly update - daxGood Day and I hope you are well.

comment: Prior weeks close was 24332 and this was it was 24386. Bulls need to continue with higher lows and bears need to break below 24000 for lower prices. Not more magic to.

current market cycle: bull wedge

key levels for next week: 24000 - 25000

bull case: Bulls are still in control until we print lower lows again. We have 2 potential bull trend lines close to the daily ema and that’s around 24200 and will be my line in the sand for bulls next week. Below, chances of 24000 go up big time. If we stay above 24300, there is no reason we can not test back up to 24500 and above that we will likely try 24700+ again.

Invalidation is below 24000

bear case: Bears need a lower low below 24000. That’s really all there is to it. As of now the selling on Friday was decent but it’s not enough to expect follow-through selling. Below 24000 I think we can test the 50% retracement at 23900 but I’d be surprised if we go lower. Only an event could trigger that. Lower targets would be as marked on the chart.

Invalidation is above 24749

short term: Neutral. I want follow-through selling but will likely won’t get it. It’s still a bull wedge until we have a daily close below 24000.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

Dax Breaks Higher to keep the bullish toneDax has moved back above the 24245-24295 zone impulsively and we retain the overall bullish tone

Retests of this area can provide an opportunity to get long

Stops need to be below 24170

Targets can be back towards 24400 and even hold a runner back to the All time highs

2025-07-17 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Selling down from 24400 to 24300 on high volume and the bears just gave up and market showed where it really wants to go. Almost without resistance we just grinded higher for 24500. No more obvious resistance until ath.

current market cycle: bull trend

key levels: 24000 - 25000

bull case: Bulls want to leave the big gap open down to 24350 and go higher from here. 24750 is the obvious target but if bulls want it, there is no reason we can not print 25000. Any pullback should stay above 24350 or this rally is over again. Will be looking for longs against 1h 20ema tomorrow, unless bears clearly took over.

Invalidation is below 24350.

bear case: Bears tried down to 24275 but failed at the 1h 20ema and I doubt many will try to keep this a lower high below 24750. Bears have absolutely nothing once again. Nothing bearish about this on any time frame.

Invalidation is above 25100.

short term: Bullish. What could stop this? Only If they fire Jpow tomorrow but I doubt they will do it before markets close. Can only expect higher prices but I would not hold anything over the weekend. Make no mistake, if orange face fires Jpow, bonds will go apefeces and stonkz as well.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Long 24300 because Globex low was 24242 and market clearly found no acceptance below the 1h 20ema.

DAX: Will Go Up! Long!

My dear friends,

Today we will analyse DAX together☺️

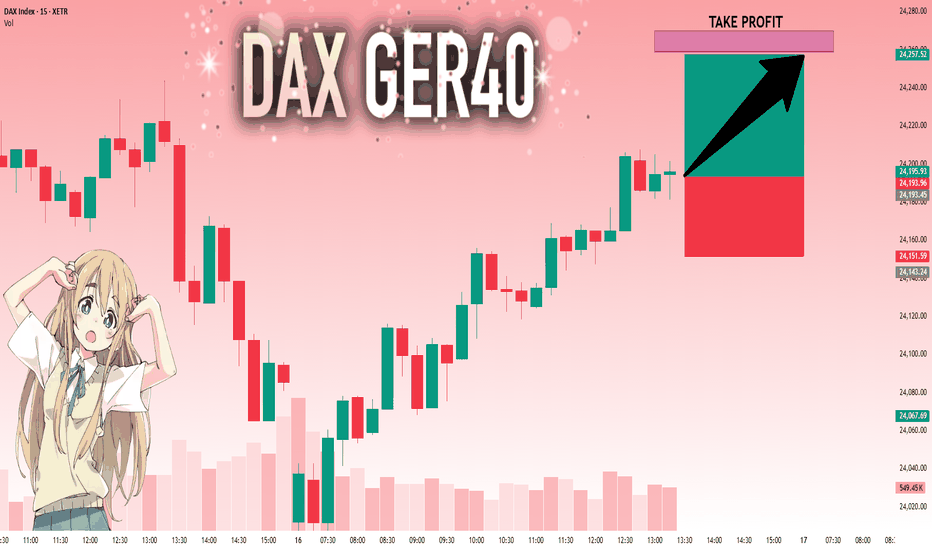

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 24,193.45 will confirm the new direction upwards with the target being the next key level of 24,258.97 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

2025-07-15 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Very important day tomorrow. If we trade below 24000, this means we saw leg 1 from 24749 down to 24100 and leg 2 could lead us to 23500 or lower. Until we have clearly broken below 24000, I remain neutral but hopeful we can finally go lower again.

current market cycle: trading range

key levels: 23000 - 24750

bull case: Bulls need to stay above 24000 or risk a sell-off down to 23700ish. No matter how you try to draw the bull trend lines, they are all broken now but bears need lower lows below 23690 to confirm it. Daily ema is around 24100 and it has been support for 3 weeks and that is the reason I remain neutral for now.

Invalidation is below 24270.

bear case: Bears need to break below the daily ema and close below. Only then can we go lower. It’s good for the bears that they printed a lower high below 24400 but we are still too high for bulls to give up on BTFD.

Invalidation is above 24400.

short term: Neutral. If we stay below 24400, we have a shot at breaking down but 24000ish is support until proven otherwise. The selling today was not strong and the chart is rather neutral. Bears have only set up a potential structure which could break down but you have to wait for confirmation before betting on it.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Scalping between 24250 - 24300 which was clear support & resistance for 4h after EU open. The bear breakdown was a surprise and not obvious to trade.

#202528 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

comment: Third leg up is done and now it’s all about how long do we need for a lower low below 23680 again. For now I don’t know since we have another risk-off news but of them were bought the past 3 months, so I remain skeptical. Too early for shorts but I think longs near 24000 are likely good for a bounce to either retest 24749 or print a lower high.

current market cycle: bull wedge

key levels for next week: 23000 - 24800

bull case: Bulls want to continue sideways to up and trap all eager bears again who think that 30% tariffs between the US-EU are bad. Those poor souls. Markets can only go up.

Invalidation is below 23680

bear case: Bears need a lower low below 23680. That’s all there is to it. No idea how fast and if we get there but shorts before are most likely a gamble, since literally every dip since April has been bought and especially every Sunday Globex gap down became a giant trap. I do think 24749 is a perfect double top with the prior ath from June and we can go down from here but until we have a daily close below 23680, I am not eager to run into another bear trap.

Invalidation is above 24749

short term: Neutral. Tariff news are bad but they are not in-effect, so could be that we see another bear trap. I don’t know and I won’t pretend otherwise. Sitting on hands.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

2025-07-10 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: 50% retracement of the last bull leg is pretty much exactly 24530 and low of the day was 24531. Could always be a coincidence eh. Bull gap still open to 24383, so do not look for shorts. I doubt we will go red into the weekend unless we get bad news. Technically we could pull back to the bull trend line 24200ish but I can not, for the life of me, see that happening tomorrow.

current market cycle: trading range - bull trend on the 1h tf

key levels: 24300 - 25000

bull case: Bulls want 25000 now. They are correcting sideways, which is as bullish as it gets. Even if bears close the gap to 24383, I would still expect another push for 24700+ with at least a lower high. Bulls remain in full control.

Invalidation is below 24270.

bear case: Bears likely not doing much but rather bulls taking profits. It was a slow grind lower on low volume. I would not expect follow-through selling tomorrow. Bears still have nothing until we see lower lows again.

Invalidation is above 25100.

short term: Neutral. Bulls remain in control but the spike phase is over and we are trading below the 1h ema, which means the trend is getting weaker. We could pull back further or stop at the 50% retracement and leave the gap open. No bigger interest in guessing what it’s gonna be, so I sit on hands.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000

trade of the day: Tough to short this and hold tbh. Not really obvious today, so no trade of the day from me.

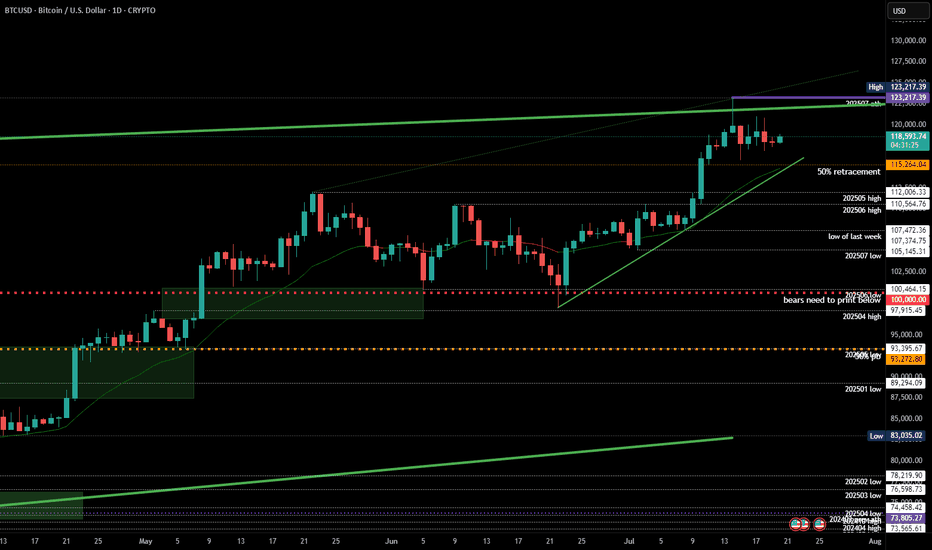

DAX (Ger40): Defying Global TensionsDespite all this tariff drama, the DAX hit another record high. What gives? Markets seem to be betting that Trump enjoys the threat of tariffs more than the implementation. Some traders are pricing in yet another extension beyond the August 1 deadline.

The DAX is riding momentum from both global AI enthusiasm, thanks to Nvidia’s $4 trillion market cap milestone, and the assumption that European exporters might dodge the worst of Trump’s trade penalties, at least for now. However, this rally is precarious. If a tariff letter hits Brussels, or copper tariffs ripple into industrial demand expectations, we could see a swift correction.

Technically, near term resistance is sitting around. 24,700. However as stated, should sentiment change. A correction back down, to the support level at 24,200, which also aligns with the 50 Fibonacci retracement level, could be on the cards. Or even all the way down to 23,800, aligning with the 88% Fibonacci level.