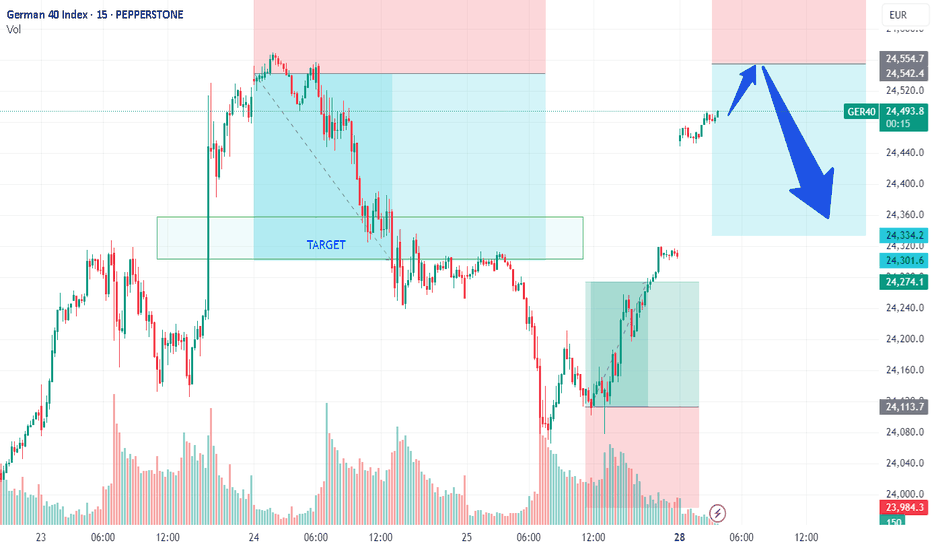

DAX/GER - PREPARE TO SHORT on DAX market opening Team,

We all know that the European Union and the United States agreed on Sunday to a broad trade deal that sets a 15 per cent tariff on most E.U. goods, including cars and pharmaceuticals.

The 27-nation bloc also agreed to increase its investment in the United States by more than $600 billion above current levels.

If the DEAL does not go through, it would be nasty to the market—especially to the Europeans, who are likely to get hurt by the export cost to the United States, especially the Car. The EUROPEAN is currently facing many challenges from Chinese car manufacturing.

We have been trading very well with the DAX in the past. We expect that when the market opens, we should short-range at 24530-60 - GET READY.

Stop loss at 24620-50

Please NOTE: once the price pulls back toward 24475-50, bring our STOP LOSS TO BE (Break even)

Our 1st target at 24425-24400

2nd Target at 24350-24300

Last Friday, in OUR LIVE TRADING, we mentioned that LONG DAX at 24100

Dax30short

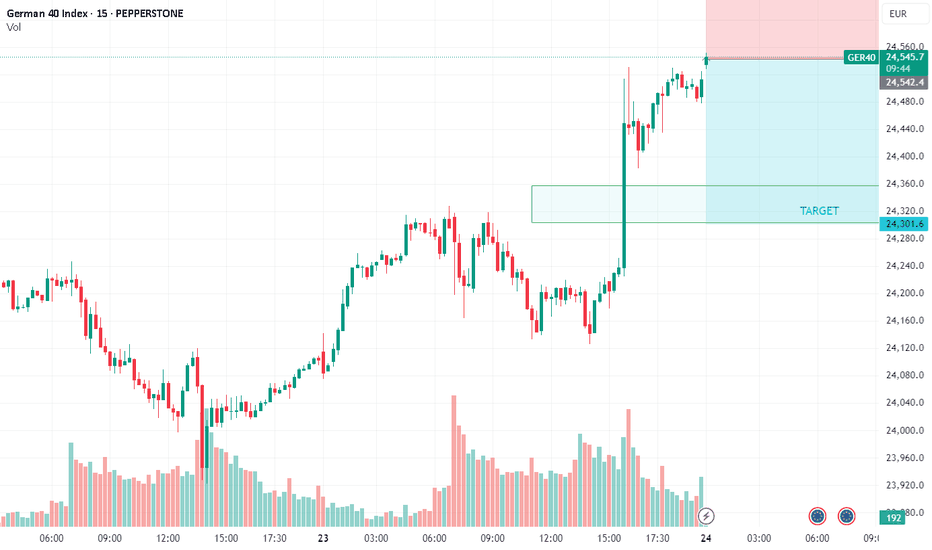

DAX/GER30 - TIME TO SHORT AT CURRENT PRICETeam, great win for the US30 on trade surplus 26 billion last month

expect to have great trade surplus over 300 billion

the Japanese went crazy 3.5% due to tariff drop from 25% down to 15%

The whole market has been pumping

We find an opportunity to SHORT THE DAX/GER 30 at the current level 24543-24556

STOP LOSS AT 24650

WITH TARGET at 24360-24320

PLEASE NOTE: once the price drop below 24500, bring stop loss to BE to protect your trade.

STICK TO THE PLAN.

DAX/GER - TIME TO KILLHi everyone, I have been very patience on DAX

last week, we kill them nicely

and now we are waiting for them to hit our short zone and kill more

when you look at the chart, ensure to add extra short at those price ranges.

There will be two target

70-110 points - take 50% profit and bring stop loss to BE

Aim for second target between 120-230 points

Today we did LIVE trading on NAS and very profitable. In fact everyday we kill the market well.

Hope everyone making millions

From Euphoria to Exhaustion: DAX 8H Short LoadedAfter an impressive rally, DAX has now returned to its previous highs. But this upward move looks more like an engineered push rather than a healthy breakout. From a technical and sentiment-based perspective, it feels overextended. That’s why I initiated a short position from this level. No need to predict the top—just follow the setup and manage risk.

Technicals:

• Price has returned to previous highs after a sharp V-shaped recovery.

• The rally lacks structure—no clear consolidation or volume support.

• We’re also near a historical EQ level that has acted as a turning point before.

Fundamentals:

• Philips cut its 2025 profit margin forecast citing U.S. tariffs as a major drag—this isn’t an isolated signal.

• Hugo Boss and other exporters confirmed revenue weakness due to U.S. trade tensions, adding to the bearish bias for European equities.

• President Trump’s warning about additional tariffs on pharmaceuticals could severely affect key European sectors.

• Global trade uncertainty and tariff retaliation fears have returned. These external shocks are significant for export-heavy indices like the DAX.

• With the Fed’s policy decision pending and no concrete trade deals, markets are shaky. Sentiment remains fragile.

This isn’t just a chart move — it’s a narrative setup. Markets can push higher on euphoria, but engineered rallies without backing tend to snap. I don’t need to catch the top perfectly — just be in when reality bites back.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

DAX Daily Short Setup: Targeting 19,700The DAX approached its previous high but failed to break through, signaling potential exhaustion at these levels. In response, I have initiated a short position, targeting a retracement to the 19,700 price zone.

Fundamental Insights:

1. Economic Uncertainty: Disappointing inflation data from China has sparked concerns about demand for German goods, which weighed heavily on DAX futures during the Asian session.

2. Sector Weakness: The auto sector, including Porsche, BMW, and Volkswagen, saw significant declines due to lingering tariff threats and softening demand.

3. US Jobs Report Impact: Friday’s US Jobs Report could further dictate market sentiment. A weaker report may boost expectations for rate cuts, providing temporary support to the DAX. Conversely, stronger data may reinforce bearish momentum.

4. German Economic Indicators: While November’s industrial production showed a 1.5% rise, weak factory orders suggest limited optimism. Imports fell 3.3%, signaling declining demand, further justifying a cautious short bias.

Technical Outlook:

• The DAX remains above its 50-day and 200-day EMAs, indicating bullish momentum. However, failure to sustain above 20,523 strengthens the likelihood of a retracement.

• The RSI near 59 suggests room for further downside before approaching oversold conditions.

As always, maintain disciplined risk management. Let’s see how this setup unfolds!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

GER40/DAX "GERMANY 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "GERMANY 40" Indices Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 3H period, the recent / nearest high level.

Target 🎯: 19,300 or Before 19,400

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

Economic Factors:

Global economic slowdown: A slowdown in global economic growth, particularly in China and the US, could negatively impact German exports and growth.

Trade tensions: Escalating trade tensions between the US and China, as well as between the US and the EU, could negatively impact German exports and growth.

Brexit uncertainty: The ongoing Brexit process could lead to uncertainty and volatility in the European markets.

Monetary Policy Factors:

ECB's monetary policy: A less accommodative monetary policy from the European Central Bank (ECB), potentially leading to higher interest rates, could negatively impact the index.

Interest rate differential: A widening interest rate differential between the US and the EU could lead to a stronger USD and weaker EUR, negatively impacting the index.

Geopolitical Factors:

EU political instability: Political instability in the EU, potentially driven by a more fragmented European Parliament, could negatively impact the index.

Global geopolitical tensions: Escalating global geopolitical tensions, particularly between the US and China, could negatively impact the index.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any decisions.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

DAX - short term correction currently very Overbought!Hi guys, we are following up with our next opportunity DAX :

Currently it has been perfoming fantastic as being part of the biggest Economy in Europe, and it reached a glorious All time High, following up with the western Indices , SP500,NASDAQ100 and Dow Jones. Currently the price has reached a very overbought level based on the RSI check on 1H time frame and 4H time frame, so for the time being I am looking into a short term correction with a follow up to maybe break down the current all time high and get passed it.

Entry : 20,400

Target : 19,916

Let's see how things are going to formulate and move from there.

As always my friends happy trading!

P.S. If you have questions or inquiries about one of my existing set-ups or personal questions / 1 on 1 sessions consider joining my channel so you can follow up with me in private!

GER 40 Trade LogGER40 1H Short Setup

Trade Logic:

- Setup: Short position initiated within the 1-hour Fair Value Gap (FVG) after a confirmed bearish structure and pre-market rejection.

- Confluence Factors:

- Fair Value Gap (FVG): Price retraces into a bearish FVG for a high-probability short entry.

- Break of Structure (BOS): Confirmed bearish break supports downside continuation.

- Kijun Resistance: 1H Kijun line aligns with the FVG, reinforcing dynamic resistance.

- Liquidity Grab: The price action indicates a sweep of liquidity above the FVG, creating strong rejection signals.

- Risk-Reward Ratio (RRR):

- Stop-loss set just above the FVG zone for tight risk management.

- 1:2.35 RRR as per chart, targeting liquidity zones below.

- Targets:

- TP1 near 20,309 , aligning with intermediate liquidity.

- TP2 around 20,250 for a deeper liquidity sweep.

Macro Context:

- Market Sentiment: GER40 shows bearish signals with a weakening broader market sentiment.

- Volume Profile: Declining buy-side volume within the FVG zone signals limited bullish interest.

- Pre-Market Behavior: Rejection from the FVG aligns with pre-market bearish tendencies, further supporting the setup.

Execution Plan:

- Short entry within the FVG zone, managing risk with a stop-loss above the FVG.

- Strict adherence to the 1:2.35 RRR with partial profit-taking at TP1 and remaining at TP2.

- Monitor market conditions and invalidate if price reclaims the FVG or breaks the Kijun level.

Extra Note: Keep an eye on macroeconomic triggers that could cause sudden volatility, particularly during the European session. Let me know if further adjustments are needed!

GER 40 Trade LogGER40 1H Short Setup

Trade Logic:

- Setup: Short within the 1-hour Fair Value Gap (FVG) following a clear bearish shift in market structure.

- Confluence Factors:

- Break of Structure (BOS): Price confirms a bearish break, with a clear Change of Character (ChoCH) reinforcing downside bias.

- FVG Rejection: Anticipating rejection within the 1H FVG as price retests this imbalance area, providing an optimal entry point.

- Kijun Resistance: Kijun line on the 1H timeframe aligns as a dynamic resistance level, further supporting bearish continuation.

- Risk-Reward: Minimum 1:2 RRR with a tight stop-loss above the FVG zone.

- Target: TP1 near liquidity at 20,306 ; TP2 at deeper liquidity grab around 20,260 .

Confluence Factors:

- Market Context: Indices showing signs of pullback after extended bullish momentum, with GER40 leading a potential retracement.

- Volume Signals: Declining buy-side volume during recent highs, indicating exhaustion and paving the way for downside.

- Liquidity Levels: Price action aligns with tapping liquidity from equal highs before driving into lower demand zones.

Execution Plan:

- Place short entries within the 1H FVG.

- Maintain tight risk management with a stop-loss just above the FVG zone.

- Reassess trade if price closes above the Kijun or invalidates the bearish structure.

Extra Note: Monitor macroeconomic news or EUR-related sentiment for potential catalysts that could impact volatility in GER40. Let me know if you'd like any additional details or adjustments!

GER 40 Trade LogGER40 Pre-Market Short Setup

Trade Logic:

- Setup: Short position initiated within the pre-market bearish Fair Value Gap (FVG), targeting the defined downside liquidity zones.

- Confluence Factors:

- Pre-Market Gap: Price retraced into the FVG formed during bearish pre-market movement, offering a low-risk, high-reward entry.

- Break of Structure (BOS): A confirmed bearish structure break reinforces downside momentum.

- Kijun Resistance: 1H and 4H Kijun levels align with the FVG, acting as strong dynamic resistance.

- Liquidity Grab: Recent liquidity sweep near the highs sets the stage for further bearish continuation.

- Risk-Reward Ratio (RRR):

- Stop-loss set just above the FVG to maintain a tight risk.

- 1:3.83 RRR as per the defined target zones on the chart.

- Targets:

- TP1 near 20,267 , aligning with local liquidity.

- TP2 at 20,240 , deeper liquidity grab zone for full target execution.

Macro Context:

- Market Sentiment: Pre-market signals and reduced buyer strength suggest increased selling pressure ahead of European market open.

- Economic Indicators: Risk-off behavior in broader markets supports bearish bias.

- Volume Profile: Weak buyer volume within the FVG zone adds confluence for downside continuation.

Execution Plan:

- Place short entries within the FVG zone with a stop-loss just above it.

- Strictly adhere to the 1:3.83 RRR, with partial profit-taking at TP1 and the remainder at TP2.

- Monitor the European open for any shifts in momentum that could invalidate the setup.

Extra Note: Stay updated on economic news or key macro triggers that could influence GER40's short-term price action. Let me know if you'd like further refinements!

DAX may have topped alreadySince mid-August, the German index has risen nicely, gaining 2,000 points, or around 10%. However, at the end of October, the GER30 broke below its rising trendline, suggesting a potential top.

Currently, the price is consolidating within a range, and a break below 19,000 could indicate a future decline. Key support levels are at 18,300, followed by 17,300.

If you expect the index to stay below 20,000, selling rallies around 19,300 could be a viable strategy.

DAX/GER retest yesterday high - prepare to shortTeam, with the DAX, we need to wait for the confirmation before we enter the short. We are waiting for the trend to be retested. And Confirm if it is a FAKE breakout.

We consider entering the short position at 18887-18883. STOP LOSS at 18953. We are updating pricing as well. Less confuse

Target 1 - 18832

Target 2 - 18790-18784

Target 3 - 18746-18723

DAX30/GER30 PREPARE TO SHORT ONCE THE PRICE HITTeam, I am waiting for the price to move toward our position to short.

We are considering shorting once the price hits below 18703-18697. The current price is at 18720

We assume the stop loss at 18775, but a safer stop loss level would be at 18817

Our target would be 18619.4. Please reduce or take profit from 50% to 70% of your volume at this price and trail your stop loss toward BE.

And second target is 18526

SHORT DAX40 at the current market price Team we are shorting the at the current price of 18556, you can use stop loss at 18613 or 18684

Target 1 at 18511.2

target 2 at 18422

target 3 at 18383

Please note: once the price hit the first target at 18511.1 take 50-60% volume

trail your stop loss to 18613. There will be a consolidated period between 18480-18555, so please be aware