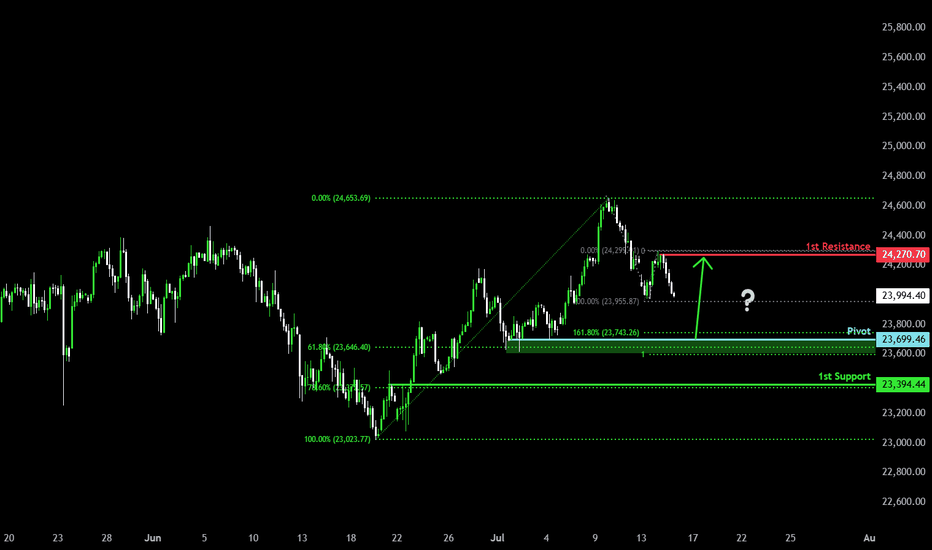

Falling towards Fibonacci confluence?DAX40 (DE40) is falling towards the pivot, which is a pullback support and could bounce to the pullback resistance.

Pivot: 23,699.46

1st Support: 23,394.44

1st Resistance: 24,270.70

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Dax40long

Bullish bounce off 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 23,409.26

1st Support: 23,261.27

1st Resistance: 23,759.37

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?DAX40 (DE40) is reacting off the pivot and could rise from this level to the 1st resistance which aligns with the 78.6% Fibonacci retracement.

Pivot: 23,602.60

1st Support: 23,390.34

1st Resistance: 24,148.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DE40 / GER40 "Germany40" Index Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Line Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (22600) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (21700) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Money Heist is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX GE40 on the Move! Bullish Trend Breakdown + Trade PlanI'm currently watching the GER40 / DAX 🇩🇪📈 and can see it’s been in a strong bullish trend on the weekly timeframe 🕒🔥. Price is pushing into new highs 🚀, and I’m eyeing a potential buy opportunity based on this bullish momentum 💪.

However, since we don’t have previous structure levels to work from 📉⛔, we're using the Fibonacci extension tool 🔢📐 — focusing on two key levels for potential take profit targets 🎯💰.

In the video, we break all of this down — including the trend, price action, market structure, and the full trade idea 🧠📊: entry 🎯, stop loss 🛑, and targets 🎯✅.

⚠️ Not financial advice.

Quarter Ends, Setup Begins: Long from DAX Support ZoneDAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup. Let’s see where this one heads as NFP and PMI data come in.

Technicals

• Timeframe: 1H

• Entry Zone: Strong support retest at 22,000

• Setup: Long triggered on reaction from major support

• Target: Zone around 22,950

• SL: Below the support zone (~21,800)

• Fibcloud: Still trending below, watching for reclaim

• End-of-month rebalancing and Quarter close may add volatility.

Fundamentals

• DAX dropped nearly 2% on Monday, hitting its lowest levels since Feb 10, in line with global market weakness.

• US trade tariff uncertainty under Trump’s “reciprocal” rhetoric weighs on sentiment.

• Germany’s CPI eased to 2.2%, the lowest since Nov 2024, aligning with market expectations.

• Q1 performance remains strong overall, up nearly 11%, supported by Germany’s spending plan.

• Eyes on this week’s NFP and PMI data which could drive further price action.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Falling towards 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 22,884.11

1st Support: 22,267.92

1st Resistance: 23,476.03

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DAX 40 Index Technical AnalysisDAX 40 Index Technical Analysis

Market Profile Insights

Value Area Analysis

Trading ABOVE yesterday's value area high

Seeking extension from Monday's Point of Control (POC)

Anticipating potential reaction zones at Monday's High Volume Nodes (HVNs)

Current price positioning suggests bullish market sentiment

Trade Parameters

Entry Point: 22,833.71

Target Price: 23,356.52

Stop Loss: 22,572.31

Risk-Reward Ratio: 1:2

Technical Narrative

Price breaking through previous resistance levels

Showing strength by trading above key market profile structures

Volume profile indicates institutional accumulation

Momentum suggesting potential trend continuation

Entry Confirmation Criteria

Multiple timeframe alignment

Strong volume profile

Market profile structural support

Momentum indicator confirmation

Risk Management Considerations

Monitor reactions at previous HVNs

Use market profile levels for dynamic stop management

Be prepared for potential consolidation zones

Conclusion

High-probability bullish setup with robust market profile confirmation. Disciplined, structure-based approach recommended.

DAX GE40 Counter Trend Trade IdeaThe DAX is currently overextended, having reached all-time highs and trading at the top of its range. I'm anticipating a pullback on GE40 down to equilibrium for a potential counter-trend short. Once price retraces and establishes support, I'll be watching for a bullish market structure break as a signal to go long. This is not financial advice.

DAX40 has a strong bullish momentum, could it rise further?The price is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 21,471.10

1st Support: 20,926.30

1st Resistance: 22,397.17

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Falling towards 50% Fibonacci support?DAX40 (DE40) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 20,103.77

1st Support: 19,782.76

1st Resistance: 20,493.34

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off pullback support?DAX40 (DE40) is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 20,103.77

1st Support: 19,782.76

1st Resistance: 20,493.34

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance which has been identified as a pullback resistance.

Pivot: 19,678.38

1st Support: 19,487.74

1st Resistance: 19,978.37

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

DAX to break to the upside?DE30EUR - 24h expiry

Posted Mixed Daily results for the last 2 days.

Overnight losses have been limited.

We are trading at overbought extremes.

There is no clear indication that the upward move is coming to an end.

15956 has been pivotal.

A break of the recent high at 15956 should result in a further move higher.

The bias is to break to the upside.

We look to Buy a break of 15966 (stop at 15866)

Our profit targets will be 16216 and 16276

Resistance: 15956 / 16000 / 16100

Support: 15917 / 15800 / 15720

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Don't give up on the DAX just yetYes, the DAX is clearly within an established downtrend on the daily chart. And its drawdown from its record high is relatively shallow at just -11.5% by historical standards - meaning we suspect further losses could be coming.

Yet its failure to break beneath the December high and March low has not gone unnoticed. And given it formed a bullish hammer around these key level with a mild bullish RSI divergence, we see the potential for some mean reversion over the near term.

Keep in mind that we have flash PMIs for the US and Europe today along with a speech from ECB President Lagarde, US GDP, PCE inflation and a Jerome Powell speech also in focus this week. And that leaves plenty of room for volatility for global markets.

DE30EUR to form a higher low?GER40 - 24h expiry

Intraday signals are mildly bearish.

Trend line support is located at 15700.

Preferred trade is to buy on dips.

Prices expected to stall near trend line support.

We look for a temporary move lower.

We look to Buy at 15713 (stop at 15613)

Our profit targets will be 15963 and 16013

Resistance: 15800 / 15900 / 15960

Support: 15772 / 15700 / 15600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Dax-DE40 Perfect ForecastWe successfully reacted from the golden box, where I placed a long trade. Looking for further upside into wave {i} as we seem to find bullish structure.

Check out the linked idea on the DAX where you'll see my prediction before the bounce!

Feel free to ask me questions, trade safe!

Dax to be supported soonI am looking at the possibility of a potential flat in wave 2 as we keep falling in what could be a wave {c}. Equality of wave {c} vs.{a} is where I would like to start seeing some support and that would be at the beginning of the golden box.

Feel free to ask question, trade safe!