Dbk

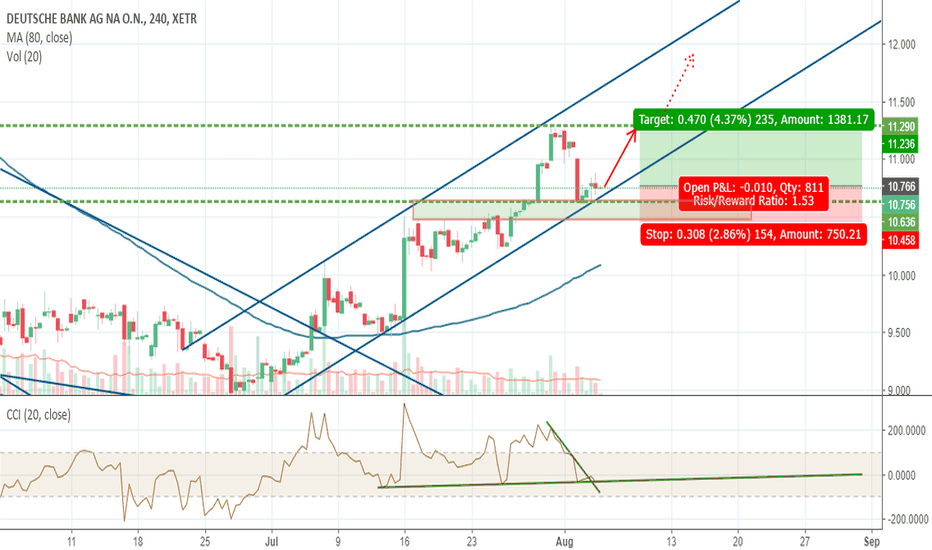

Deutsche bank - bulls at the helm again?Detsche bank looks that the worst times are over. Bulls are getting stronger and downtrend can be possibly at the end.

Actualy, the price is in bullish channel and the price is on the support. In my opinion this is good setup and tradable. CCI looks that is turning over.

Deutsche Bank (DBK) going bust - Banking Crisis in EUWith volatility coming back and with the VIX seriously threatening with a "fear spike", I am now looking at Deutsche Bank DBK .

It seems like it could fail, which would agree with the DAX wave count and the overall Market Crash pattern.

Could this be the next Banking Crisis ?

Deutsche - Bottom not yet reachedDeutsche Bank has been in a long-term downtrend since May 2007 and is still in tact. A short backlash should, however, be taken into account and bring the shareprice again in the range of about 11 €, before the final low can be formed and the correction pattern will end with the 5 of the 5 of the C.

Deutsche Bank - Smart Money in Action?Deutsche Bank DBK is in the middle of the storm of bad news. The first menace was this Thursday where the Federal Reserve commentary which said that the financial sector in the U.S is "in trouble." This Friday, the Standard & Poor's slashed its credit rating. The agency also questioned the Deutsche Bank's CEO Christian Sewing.

Despite this uncertain scenario for DBK, the price dropped to our long-term target between 9.380 and 9.119, with a volume considerably higher than previous trading sessions. The key resistance level to follow is 9.950.

BNK ETFChallenge to multi-year Overhead supply, run by non-commercial traders.

According to many colleagues usually, this behavior encourages retailers to take the trade but in reality fails as it is run late.

Therefore, I personally think that at some point European banks as a whole are to outperform.

Do you like to play with fire?A high risk movement, although it seems to me that going short at this level is quite risky there is a possibility of success.

It seems to me that there is a good chance of touch the level of 11.18 near the 16th of March, or even the historic minimums. But, why does it seem high risk ?. Because we are too close to historical minimums and if that were not enough, at this moment the price is sitting on the R & S, which is usually a very good support, and could cause the price to bounce from here.

In case the movement was correct there is a very high chance of a rebound after touching 11.18 and not retesting the historical minimum.

This is what I see in the chart, and obviously I'm not giving any kind of advice, just sharing what I think ... let's see how it develops.

Deutsche Bank needs you...DBK is currently at a very important point where he will define the continue descending to the strong support area or he will bounce back to the area of 16.3 ... which was his first confirmed resistance.

Obviously in trading always the question is where will we go ... up or down? It seems silly to mark an area where that question is not answered. However, it is obvious that we have come down and this point will help us to emphasize if the trend continues or not.

DBK needs your help ..

what are you going to do? ... give him a hand? or kick it to the well?

I hope it is useful for you

As always... best wishes to all!

DBK.DE ,XETR en triángulo ascendente en OctubreDBK, XETR ,a pesar de sufrir una serie de escándalos, parece que finalmente el banco Aleman está saneando las cuentas, también esta expuesto a MiFID II, y puede que sufra las consecuencias,

pero de momento está metido dentro de un canal formado por triángulos con tendencia alcista.

GREAT TIME FOR A BUY ON DBK STOCK!Hello traders i hope you all had a very good trading month,EUR-USD pair it's still on a crazy rally that's very good for those forex traders who placed their long orders on this pair but EUR is slowly becoming too expensive for european businesses.

In those businesses european banks are included and if you count in the quantitive easing,the low rates and the expensive euro cetrainly is not a good combination for european banks.Altough this unfriendly environment gives us a nice trade opportunity on Deutsche bank stock.

German elections also may play a role in stock's volatility.

TECHNICAL OBSERVATIONS

1.Price is entering a well respected area.Everytime visit that 13 area a lot of buyers were found and led price up again.

2.We have a double bottom formed on 4H chart signing a possible change of the trend area.

3.We have bullish divergence on the RSI indicator.

4.We have the Stochastics exactly above 50 area on 4H chart that shows there is still some strength on the latest move upwards.

5.Next interesting areas to get ivolved are 9,50 for longs and 17-18 for shorts.

POSSIBLE LONG TRADE

ENTRY PRICE AT 13,40

STOP LOSS 12,90

FIRST TARGET T1 AT 15,60

SECOND TARGET T2 AT 16,50

THANKS FOR SUPPORT!

KEEP FOLLOWING FOR MORE PROFITS!!!

DEUTSCHE BANK wave 4 might be over.There are increased chances that wave 4 was complete in Deutsche BANK right on the 38% Fibonacci retracement. The recent decline from 19.79€ is impulsive with 5 waves complete at 17.07€. I expect a bounce towards 18-18.50€ for wave 2 and then a strong wave 3 downwards targeting 15.50€ first and then 13.80€. Stop for this idea is the recent high. Confirmation will come with the break below 17.07€.

DBK: Time at mode target caps upside at 15.23Updating my previous posts about Deutsche Bank, it seems like we'll see a bullish phase in equities, with a rally in Deutsche Bank shares for the next few days. It'll be interesting to see how it evolves after the time at mode time and price target is met. Keep an eye on either 15.23 being hit, and October 27th.

Cheers,

Ivan Labrie.

DB: Contrarian long opportunityI'm pretty sure 97% of people were short DB lately, and pessimistic about its outlook.

I was on that bandwagon, and shorting every rally for some time, but the latest developments made me change my mind on it. I think we have a great opportunity to long the stock here, if not already in that is.

I'm in with a 0.25% risk position, and will add gradually to it, until I reach 1% exposure.

We have to monitor the activity here, but it's possible this was a terminal wedge or ending diagonal pattern, in Elliott Wave parlance.

We can add to longs on a break of Friday's close, to the upside, risking a drop under the lowest low, and add more once we break above the earnings resistance above, at around 13.72, using the same stop loss.

We can also buy dips under 12.38 but I think it's unlikely to happen here. We need to reach 14.89 within 3 days to confirm the bullish momentum in the short term.

Good luck,

Ivan Labrie.

EURUSD: Euro and inverted Euro, how to avoid bias and some tipsIn this chart, I'm looking at the Euro and an inverted Euro chart, to help me determine if I have a bias when trading it. Seeing the bottom chart, I feel it is a long here, specially since we're breaking out above an inside trendline. You can refer to my analysis in related ideas.

I also see a short in the inverted chart, with Friday's action being quite decisive for me, when seeing this chart presented in this way.

What do you see in these two?

Ask yourselves this question also: what is the stupidest trade to take right now? Of all the instruments you follow...what would be the trading idea, that would make you laugh and mock whoever presented it to you?

Let me know what you think, we can benefit from asking ourselves questions, and others, and thus, enrich our trading view.

Cheers,

Ivan Labrie.