Fourth HalvingSometime in early Q2 of 2024 the Bitcoin network will experience it's fourth supply cut,

Economically I am seeing rapid cooldown of inflation with month over month inflation currently sitting at -0.10 month over month

5 year forward expectation rate of inflation as of today is currently sitting at 2.16 only 16 basis points away from 2% target

in my opinion inflation should level off in about 1 and a half months from now maybe around end of Q1

but in the immediate term we are also facing a debt ceiling crisis where the debt ceiling will need to be raised or suspended by the end of next week.

additionally short term government bonds are yielding higher than the long term government bonds

specifically the 2 month is yielding higher than the 2 year bond

the situation is an inverted yield curve during a liquidity crunch

therefore in my opinion this places Bitcoin in a 2015 situation and I expect long term logarithmic growth

and the occasional aggressive parabola

***Not financial advice always do your own research educational purposes only under the right of fair use***

Debt

Gold miners have underperformed the major indices since 2011Historically, gold and gold related stocks dont do well until the money supply needs to be expanded. When the central bank decides they need more printing and more debt, they devalue the dollar and tax the holder of currency.

US debt and m2 is so large relative to the GDP, the central banks will need to relieve the bottleneck of money and increase money supply.

Book recommendation: Currency Wars by Jim Rickards.

The Resistance Hit 4th Time - SPX500

Saw the red line! It is now hit the 4th time by the market.

Although oil has come down from 130 to 80 USD per barrel giving some relief to the oil-dependent economies and inflation is also in a downtrend, the problem is worse and deeper. This alarming deeper problem is US debt which is now 137% of the GDP. Imagine it was hardly 67% in 2008 during the financial crunch. If things were good, why did this debt rise to 137%.

Debt is good for industries till it remains fuel for growth. But when it becomes fuel for existing debt it is really problematic.

USDJPY falling, because of Treasury buying?Private foreigners have purchased just over half a trillion - yes, Trillion - LT USTs in the past six months (sorry, no #brettonwoods3)

Why such huge demand for safe, liquid US$ instruments? Not a whole lot of trust for the Fed's toolkit and use. © Jeff Snider

What is the reaction to buying UST's? The yields come lower. Interest rates come lower.

What does the Fed do? Follows the markets.

We're seeing a drop off in the US 10 Year Yield and this is also part of a wider yield curve inversion in the eurodollar market. Inversions signal troubles ahead, so anyone with money goes to the safest assets. Namely sovereign bonds and ultimately US sovereign debt.

The USDJPY has been tracking the move of US10Y and also either accelerated or decelerated depending on whats going on in the oil markets.

Japan is heavily dependent on importing energy, so a higher Oil price means the Japanese economy gets crushed and the yen drops. Oil prices are coming lower at present.

Catalysts for The Global Financial Crisis 2.0The current level of euphoria and speculation on Wall Street is likely to go down in history in the same way that the misplaced optimism of speculators in 1929 was immortalized by the tremendous crash and ensuing depression. The current dynamics at play are more similar to that period than most realize.

Many potential catalysts for the Global Financial Crisis 2.0 are beginning to rear their heads, including things such as:

-The auto loan bubble

-The residential & commercial real estate bubble

-The private equity and venture capital bubble

-The largest losses in the total bond market in generations

-Highest level of Federal Debt to GDP in US history and extremely high level of consumer & corporate debt in US history

-The most overvalued market based on forward earnings in history (Based on my expectations of S&P 2023 earnings will fall below 140). Peak margins above -13% coming back under 10% will also help to drive this.

-The fastest pace of interest rate hikes since Paul Volcker and $90 billion of quantitative tightening per month.

-The crypto bubble implosion where many exchanges are likely to fail due to their ponzi-like staking dynamics and unprofitable nature of exchanges like Coinbase. We are starting to see the beginnings of the financial contagion from FTX into other exchanges and coins. This is happening in an industry valued at over $3 trillion at its peak.

-The Chinese real estate crisis and recession

-The energy crisis which has curtailed over 20% of EU industrial capacity and is sending Europe into a recession. This is leading to increased energy costs around the world.

-Looming sovereign debt crises & currency crises for many emerging and certain developed economies.

The $1.6 trillion auto loan bubble is reminiscent of the subprime lending bubble. There were incredibly loose lending standards in this auto loan bubble, where people that received federal stimulus checks were able to claim these as income. This entitled them to larger sized loans than they would have otherwise had access too. Many of these loans were made at over 130% loan to value ratio. These loans have been packaged up as bonds and sold off to investors hungry in search for yield in a world of artificially low interest rates, suppressed by the Fed for the better part of 14 years since the Global Financial Crisis. The amount of delinquent auto loans has continued to increase, and the looming crisis represents a huge threat to financial stability. As real wages and employment continue to fall, the amount of delinquent loans will continue to rise.

Earnings for the S&P 500 in Q3 have already started to contract more than 5% year over year (excluding energy) and yet many analysts still expect some, to no growth of earnings in 2023. Earnings are likely to collapse over 40% in 2023, pressured by falling consumer demand and falling operating margins. Consumer sentiment registered the worst sentiment among US consumers since the great depression.

All of the Fed manufacturing and service data components show comparable data now to data being released in mid 2008 to the spring of 2009, all with continuously negative trends. Capital expenditures have begun decreasing and mass layoffs are just beginning. 37% of US small businesses could not pay their rent in full in October. Many companies will be forced to close their doors permanently and layoff their entire staff. Consumption began to fall rapidly after the Fed began quantitative tightening and ended quantitative easing. The effects finally began hitting company earnings largely in Q3, with much more pain to follow. Meanwhile, many companies continued to hire large amounts of people unaware that consumption would continue to collapse. As asset prices fall further and inflation stays elevated, real wages will continue falling.

Student loan payments begin again at the start of 2023, further harming consumer sentiment.

Money supply growth began stagnating early in the year in 1929 and the federal government began to tighten spending with the New Deal programs in 1936 before the crash happened in 1937. Bank balance sheets have been flat for 2022 while the central bank balance sheet has been contracting leading to a slight contraction in the money supply. The contracting growth of monetary supply and fast paced increases in interest rates will lead to a large-scale downturn in GDP. On a technical basis, the current market setup looks very similar to 1929, 1937, 1973-1974, 1987, and 2008. All of which had major rallies that topped in late summer / fall before crashing over 30%. All of these crashes took place over the span of less than 3 months, with the majority of the percentage decline occurring over a period of 2-3 weeks.

There are dozens of companies that are virtually guaranteed to go bust in this downturn based on an overview of their financials. There have never been so many listed companies that reached valuations in the billions at their peak with no earnings. Many companies at the time of this writing still have valuations of over 6 times sales and many companies such as Coinbase, Uber, and Rivian are still valued at over $10 billion market caps whilst losing hundreds of millions of dollars per quarter. The dozens of zombie companies in the S&P 500 are being forced into rolling their debts at higher interest rates while their earnings fall. This will be the largest debt deleveraging cycle in the US economy since the great depression, because this is the largest accumulation of bad debts since the roaring twenties.

It is not long until the credit risk is truly realized by market participants, and interest rates spike throughout the economy. This would include the inter-bank lending rate and junk rated bonds which would lead to a financial crisis. The longer the Fed’s quantitative tightening runs, the more inevitable the financial crisis becomes. The Fed ran the balance sheet down around $600 billion over the course of 2018 into late summer of 2019 before inter-bank lending rates started to spike. This time, the Fed has run the balance sheet down close to $300 billion so far with a plan of reaching over a $600 billion runoff in Q1 of 2023.

The hopes for a Fed pivot are misplaced. A Fed pivot on interest rate hikes and even a reversal of the rate hikes cannot re-incentivize people to borrow. When you’re in a contracting credit cycle and business cycle downturn, debt begins to be paid off and defaulted on rather than excessively accumulated. The demand to borrow collapses even if interest rates were lowered by the Fed. Therefore, bear markets and recessions usually don’t end until many months after the Fed has already begun cutting interest rates. This was seen in the Great Recession and the dot com bubble of 2000; where the market didn’t bottom until over 18 months after the Fed began cutting rates.

The Great Reset!!!CAUTION ONLY BIG BRAINS FROM HERE ON OUT!!!

White: US 10 Year Bond Yield

Orange: US Debt to GDP

Blue: US yoy inflation

"Inflation transfers wealth from creditors to borrowers for all sorts of nominal debt, not just government debt." -- Christopher J. Neely, Vice President at St. Louis Fed.

What is the Great Reset? Is it a new 1929 Crash, a new Great Depression? No. The real Great Reset is the controlled writing down of US debt-to-GDP which has reached unsustainable levels and surpassed those at the end of WW2. In fact this chart only shows government debt (orange), in truth when you add corporate and all other forms of private debt, you get a figure currently in excess of 700% of GDP.

People believe inflation is the problem, they don't understand that in most of the world it is a tool for writing down debt. This was also the case in the US after WW2.

How do you write down debt measured against a country's productive output? Well, the easiest way is to increase GDP, but because in reality growth is limited (in some cases almost zero), it's easiest to do this by increasing the nominal value of GDP by ramping up inflation:

Nominal GDP = Real GDP * inflation factor

So by increasing inflation we increase GDP nominally and we decrease our debt with respect to productivity.

So what does this have to do with the chart? Look what happened after WW2, when bond yields bottomed and debt-to-GDP peaked. These two reversed over the next 40 years until 1980, when they reversed again. Look what happened to the long-term inflation in that same 1945 to 1980 period: ignoring the many short-term spikes (known as surprise inflation), the curve slopes exponentially upwards, gently at first until culminating in the inflationary spial of the late 1970s. This same process is beginning again. We will see many short-term inflation spikes in the coming years (surprise inflation) but they will mask an underlying increase in long-term inflation. What does this mean? It means your savings will be wiped out with respect to purchasing power. It means diversify into bitcoin and other dead (non-productivity related) assets over the coming decade and decouple from the fiat.

The same principle applies to Eurozone and other so-called developed countries with excessive debt-to-gdp ratios.

Further reading:

St. Louis Fed blog entry "Inflation and the Real Value of Debt: A Double-edged Sword"

Russell Napier interview "We Will See the Return of Capital Investment on a Massive Scale"

The truth is wealth is being transferred from the creditors, i.e. the citizen, to pay down government debt: as your savings lose purchasing power, the value of debt also vanishes. This is really why we say inflation is a tax!

Future interest payments will skyrocketThis shows expected interest payments as a moving average divergence around current interest payments which acts as a moving average that is delayed by one to two years. Anyways, the current "future" interest payments as calculated by the US05Y yield have never had a larger divergence from current payments. It is expected that in one to two years, US interest payments on the national debt will be more than 30% of tax receipts (see FRED:A091RC1Q027SBEA/FRED:W006RC1Q027SBEA)

10 Charts You Must See#10 Mortgages

The chart below shows the average single-family U.S. home price multiplied by the 30-year fixed mortgage rate. This chart attempts to show how dramatically higher the financial burden of home ownership has become in the United States. Using a cross chart allows us to better visualize the rate of change. Each cross represents one month.

We can see that the current situation looks even more drastic than the subprime mortgage crisis that preceded the Great Recession. Although wages are rising, the rate of change in the cost of home ownership is rising much faster. In this regard, one may conclude that extreme inflation in home prices coupled with a rapidly rising mortgage rates makes every borrower today subprime.

#9 Tech Bubble

The yearly chart below shows the ratio between tech's performance (QQQ) and the performance of the S&P 500 (SPY). Notice that in 2020 and 2021 tech tried but was unable to close above the peak before the Dotcom Bust. Tech stocks then crashed in the first half of 2022.

Take a look at the yearly (or semi-yearly) Stochastic RSI oscillators in the series of relative charts below.

Could these charts suggest that Microsoft is about to underperform the Nasdaq for years, that the Nasdaq in turn may underperform the S&P 500 for years, that the S&P 500 in turn may underperform Gold for years, and that Gold may underperform U.S. Treasuries on the 6-month timeframe? Using oscillators in this manner is limitedly valid but one may ponder what these charts say about the future. A shift of investment allocation in this manner typically occurs during a financial crisis. For those who may not already be familiar, check out Exter's Pyramid below.

During financial crises market participants typically flee the riskier assets near the top of the inverted pyramid due to these assets' vulnerability to default. Simultaneously, market participants accumulate the more secure and tangible assets lower on the inverted pyramid.

This is not a trade or portfolio reallocation recommendation. The QQQ/SPY chart is adjusted for dividends. The GOLD/TLT chart is on a 6M rather than yearly chart merely because not enough data exists to generate a Stochastic RSI on the yearly level.

#8 Japan's Debt

Although what you see below may look like a single chart of a bell curve, it is actually two charts placed side-by-side.

On the left side is a quarterly chart of the balance sheet of Japan's central bank. As you can see, the amount of Yen on the central bank's balance sheet is trending up toward one quadrillion.

In contrast, on the right side is a chart that shows the amount of gold that each Japanese Yen can purchase. As you can see, the amount of Gold that a single Japanese Yen can purchase is quickly approaching zero.

Smoothened moving averages were used to generate these charts to simplify and enhance the visualization of trends.

#7 Crypto Winter

The below yearly chart shows the equation 1/BTCUSD, which mathematically represents how much Bitcoin a single U.S. dollar can buy, (or simply USD/BTC).

Despite having major “crypto winters” about once every several years, the amount of Bitcoin that one fiat U.S. dollar can buy continues to trend endlessly toward zero (not much unlike the Yen to Gold chart above). The U.S. dollar loses value over time as more and more dollars are created, which must always continue in a debt-based economy.

During periods when the Federal Reserve tightens the money supply, the rise in the U.S. dollar’s value relative to Bitcoin is barely noticeable in the chart, even when log-adjusted. Next time someone tells you that Bitcoin is going to zero show them this chart, which technically shows that the exact opposite is more true.

This is not trading or investment advice, Bitcoin and all intangible cryptocurrency assets are highly volatile. You can lose a lot or all of your money trading or investing in these assets.

#6 Dollar Index

As the below chart shows, the dollar index appears be breaking out of a yearly bull flag and breaking above the yearly exponential moving averages (EMA) ribbon for the first time ever.

If this trend continues, what economic consequences might this have?

The Dollar Milkshake Theory attempts to answer that question: www.youtube.com

#5 Shiller PE Ratio

The Shiller PE Ratio is often used as a measure of stock market valuation. The below chart shows that stocks are so overvalued that even after one of the worst first halves of the year in stock market history, stock valuations have merely come down to the same level as the peak before the Great Depression.

#4 Stock Market Channel

The below stock market channel was created by me using a series of regression lines based on standard deviation from the mean price of the entire history of the S&P 500.

As the charts show, the S&P 500 is near record levels above the mean even after the selloff during the first half of 2022.

#3 Cost of Debt

The below chart attempts to illustrate the cost to the United States of servicing its debt (i.e. interest payments). More specifically, the chart shows the monthly rate of change for the equation of total public debt multiplied by the Fed Funds rate (as a decimal).

As you can see, we've never seen an explosive jump in the monthly rate of change in debt service to this degree ever since data became available about 55 years ago.

This chart was introduced to me by @prd001 . It is unscientific and is a mere thought experiment. For official, but lagging, data you can view the Federal Reserve's data on interest payments (Symbol: A091RC1Q027SBEA).

#2 Monetary Easing

The below chart attempts to illustrate just how unprecedented monetary easing is. It provides a visual representation of the total assets on the government's balance sheet as a percentage of nominal GDP. It uses the Bank of England's balance sheet because it provides the most reliable comprehensive records since 1700. The chart then superimposes the Federal Reserves' assets (relative to the U.S. nominal GDP) in the present-day to illustrate the fact that at no point over the past 322 years has such a large amount of assets, as a percentage of nominal GDP, been the norm.

Monetary easing is therefore a modern economic experiment. How might it end?

#1 Climate Change

This chart is so consequential that it has led to the creation of a new epoch in human existence: the Anthropocene Epoch. The chart shows the meteoric rise of carbon dioxide in the earth's atmosphere.

Here are some video you should watch:

Climate Spiral: www.youtube.com

Carbon Dioxide Pump Handle: www.youtube.com

If there is one chart that all future generations will attribute to everyone living today, it is this.

SXP ELLIOT WAVE COUNT!!! GREAT DEPRESSION 2.0If u know Elliot wave I’d reccoment testing that count lmfao. Essentially all ratios align perfectly not only through proportions between waves but also through history aligning with these shifts.

I provided two retracement which represent the potential pull down of this wave 4 we are most likely in. (The wave 1-3 ratio is 1-2.474 as seen by the blue dotted line). Honestly my strat is just dollar cost average those points. Happy depression everyone :)

Current vs Future debt payments as percent of incomeThere appears to be a 2-3 year delay between the current debt rates (US) and actually debt payment increases. It seems very likely that debt payments as a percent of tax receipts will go up to 28% similar to 2019 and 2020. What happens after that. It seems unlikely to me that GDP will continue to feed increases in federal tax receipts. 30% and above is next.

A Decade of DebtIt felt like yesterday that Obama Care was the biggest concern on everyones minds.

After 1.4 Trillion in healthcare spendings in 2021 and COVID pounding on weaker baby boomer populations has driven total debt into a parabolic upwards trend.

War is festering in Ukraine, Wars get expensive.

EU is on the brink of an Energy Crisis unlike anyone has seen before.

Battery and Solar are incredible expensive and low margins.

Practical thinking would suggest this is not sustainable.

Inflation will continue, debtors gain from inflation because they are repaid with dollars that are worth less.

If you think this past weeks Bear Market rally marks the end of inflation fears and rising interest rates, think again.

This easing of market conditions can therefore only be temporary and only serve to provide fuel for a second leg down.

Does WING's Earnings Bounce Have Legs?WING has been an interesting story in the restaurant sector over the past 7 years. Wingstop has experienced above-average growth in both top and bottom line figures over this timeframe. Let us explore why this is the case and where the stock may go from here...

Fundamentals: WING's fundamentals are nightmarish. Incredibly high levels of debt (likely why WING has been able to expand so quickly), negative stockholders equity, 17% of shares float are short, a forward P/E of 70, yoy revenue beginning to stall with current year-end revenue expectations up only 2-3% from 2021 year-end. WING's total liabilities make up more than double its total assets. The company is grossly overvalued, Wingstop's intrinsic value is roughly 35-45 dollars a share. This bounce off of earnings is unsustainable, to say the least. The company did not even post a beat, and its shares surge 20%... this move simply does not make sense.

Technicals: Long-term uptrend still intact. This will change if a move below the A trend line occurs. Currently, WING is struggling to break above the short-term bearish trend line labeled as B . A touch at 128.43 resistance and a quick retreat back to trend line B leads me to believe this is a temporary bull run in what is a longer-term downtrend for WING.

Global macro conditions: Tightening of financial conditions, supply chain woes, war, sanctions, Supply crunches in energy commodities, climate crises, hot inflation, political unrest, and sovereign default concerns intensifying -along with other factors- all play a role in a rapidly worsening macroeconomic narrative. These factors are often talked about by economists but I fear they are overlooked in cases such as these when the market rewards a weak growth stock such as WING with a massive bounce in price off of an average earnings report, all during an unprecedentedly difficult global economy.

Targets: Unclear as to when WING will significantly fall in price. I think the deterioration of financial markets over the next few years will be serious- things will get worse and stay worse for longer than expected- and companies with trash fundamentals like WING will be the first to suffer. Needless to say, I would be short WING if given an option. I see a fall to 113.92 as a short-term lock. Longer term I expect a choppy downward trade from lower support levels to lower support levels eventually forming fresh lows at the 49.89 support level. Seems like a bit of a wild prediction I'm sure, but this is what I see.

As always this is not trading advice, good luck!

Why Price Matters - SPX to $4200The SPX reversal to $4,200 provides an opportunity to learn from the pros and get back to the basics of trading. This means understanding the numbers and being able to buy things wholesale and sell them at a retail price. With this knowledge, you can be a successful trader.

When this trendline breaks, Japan may hyperinflateJapan's central bank is buying unlimited amounts of Japanese debt in order to maintain yields around 0.25%. This ratio shows yields over the central bank's balance sheet. When this trendline breaks to the upside, it essentially means that Japanese debt is being sold faster than the central bank can buy. Japan may be going through some serious financial events very soon.

www.cnbc.com

The bank of Japan is selling US treasuries in order to buy more Japanese treasuries. This may cascade into US problem of rising interest rates and unsustainable debt levels being that Japan is the largest foreign holder.

www.bloomberg.com

TLT dangerously close to 2008 supportNASDAQ:TLT not looking to HOT here. The federal reserve has the following 3 options:

1) Stick to 0.50 basis points and continue the slow bleed. ~ This will piss off investors with cash on the sidelines and will most like hit the market harder.

2) Get aggressive and raise 0.75-1 basis point ~ Market may react positively. This would show the federal reserve is "serious" on fighting inflation.

3) Take the foot off the accelerator and step back into the market. Using macro environment as an excuse, for example Russia invasion of Ukraine and China lockdowns.

I think it is noteworthy to mention that China has lowered their interest rates and are outperforming US equities. It honestly looks way more attractive and this is something the fed will have to ponder. This is a lose/lose battle because the federal reserve cannot magically print supply.

Have corporate bonds bottomed?The Corporate bond market got extremely oversold and it bounced without the Fed having to pivot. Essentially the market got to 2013-2018 levels, and bounced nicely at the old support. But we still don't know whether the bottom is in or now, as there are more questions that need to be answered, like: Does the market expect the Fed to reverse course soon? Does the market think the bottom is in for bond yields? Does it think inflation has peaked?

In my opinion the market did the tightening itself without the Fed. The Fed did a mistake for not raising rates and ending QE faster, however they were right on their approach to go slowly, as one way or another inflation would slow down. By inflation slowing down down I don't mean that prices will go down, just that prices will go up a lot less than they did over the last 1-2 years. At the same time I do believe that as inflation comes down, it is possible that we get to see the Fed say that they will pause their hikes after raising them to around 2% and will let their balance sheet roll off on its own.

Essentially higher interest rates, lower asset prices, tight fiscal and monetary policy, and already high energy prices are crushing demand. The Fed was/is behind the curve, but as the curve seems to be now moving to the direction of the Fed. To a large extend their objective has been achieved, as this correction was similar to the 2018 correction, only that this time around the correction was welcomed when back then it wasn't.

Now I don't really think the bottom is in for corporate bonds, however I also don't think they are going to roll over very quickly. If the food & energy crisis gets worse, I have no doubt that these will get crushed. It just seems that in the short-medium term things will cool down a bit and part of them Fed's goals have been achieved. The US economy remains fairly strong and its corporations are in a fairly good shape, despite everything that has been going in the world over the last few years.

Having said all that I don't want to be a buyer of HYG at 80. At those levels I think it is better to short and aim for 77-78, and then if the price action looks decent, go long at those levels. The bounce is too sharp for it to have legs to go higher immediately. I'd expect more chop in the 75-81 area before the market decides whether it is going to go higher or lower.

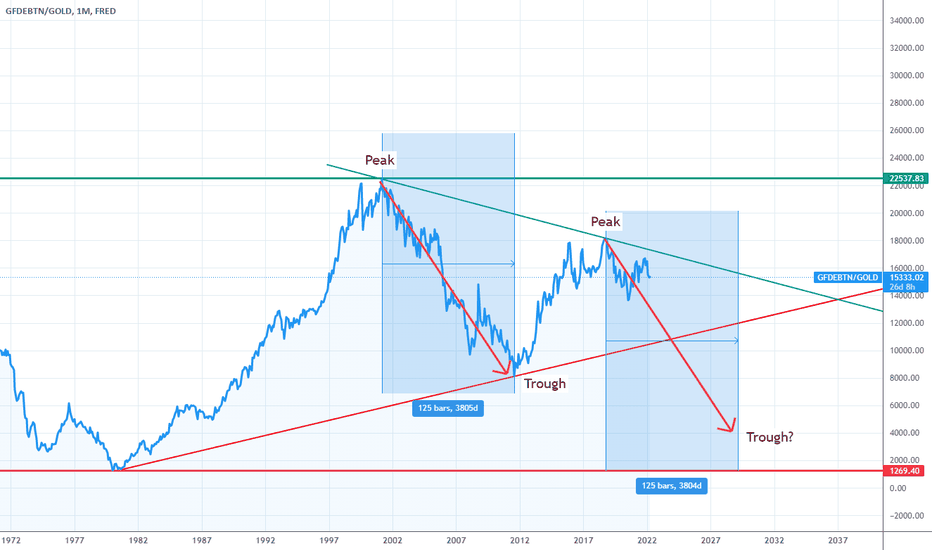

US Debt divided by Gold The US debt to Gold ratio looks to be topping.

The lower this ratio, the more US debt is covered by gold and generally means a rally in the price of gold.

When this ratio breaks the minor diagonal support line, the major support line will be the next target and gold will see gains not seen since the late 1970's.

Visualizing Yield InversionWhen investors have a poor outlook for the economy, what do they do? They buy the longest term debt they can because it's one of the ways to price in the uncertainty of "right now" into the long term. Therefore, rational actors would do something like this:

Buy 30 year treasuries. Buying ensues, yield goes down, price goes up. Eventually 20 year yield becomes greater than 30, as described in purple. Right now for example, you'd get about 3% more yield buying the 20 year VERSUS the 30 year (note: relative yield, not nominal yield), giving us a purple line of 0.968.

The teal line (1.0) is where the relative yields are inverted if the price is below this line. Short term debt pays more than long term debt under this line, which is usually not the case and signals that things are awry.

Now simply repeat this cycle until the rational short term outlook is priced into all irrationally priced long term treasuries. Prices are too low, therefore yields are too high, and rational actors begin buying them. Prices go up, yields go down.

Next up, we have 20Y/10Y (red) at 1.235, which is intriguingly lagging behind the shorter term inversions of 10Y/5Y and 5Y/2Y. If anyone knows why, I would be interested to know! I'm not exactly an expert on debt.

Eventually this cycle repeats until the ratio of short term yields are all very close to long term yields. These conditions always precede a recession, which, by the way, is NOT a well defined term. A recession simply describes "a general decline in economic activity". Not very scientific, is it? Economists utilize a wide range of data to attempt to foresee a recession, yet the outcome is inevitable and uncontrollable. As history shows, any attempt to control the economy and avoid recession (1930s, 1970s) often make things much worse than had policy makers simply let the storm pass initially.

I like to use ratios of yields. Some people subtract the yield of one from the other, which is fine too. I think a ratioized signal is much more pure as ratios rule the world around us. Not only that, given that we're monitoring multiple relative yields, we can get a good overall picture of the current landscape.

Unfortunately there's not much history for the longer term instruments, though as I believe the 30 year has been around for atleast 50 years but only has a few years of TradingView data.

Hopefully the illustrations on this chart along with relative yields help you visualize some of what's happening. I keep this chart of relative yields up ALL the time in a tab! If you have any feedback or comments, I would appreciate it.

Good luck and hedge your bets!

Quick note: In March 2020 not only did the FED setup new centralized repo facilities directly (reverse repo, unprecedented, it's ILLEGAL by the way) and at the same time, engaged in "QE Infinity". In essence there's more avenues at which they are "forced" to buy things that nobody wants. Albeit, they buy it at about market price, assume that's the right price and that they are somehow protecting the economy by pricing in bankruptcy in one asset class and spreading it to the rest of the economy. Belligerent and thoughtless, what more could you want? At the same time, they've sucked a lot of excess cash out of the system once again by offering banks an interest rate of 0.05% for their cash in exchange for some FED junk assets. So suddenly banks are bagholding assets nobody wanted, in order to get interest on their cash, genius huh? OH yeah, and banks are SHORTING those assets on the open market! Effectively making the cash tend towards zero value (the real contract value of those assets which were originally exchanged). Next time something goes wrong, they will unload this ~1.5T diaper of dollars directly into our faces, probably sooner than later, causing more inflation.