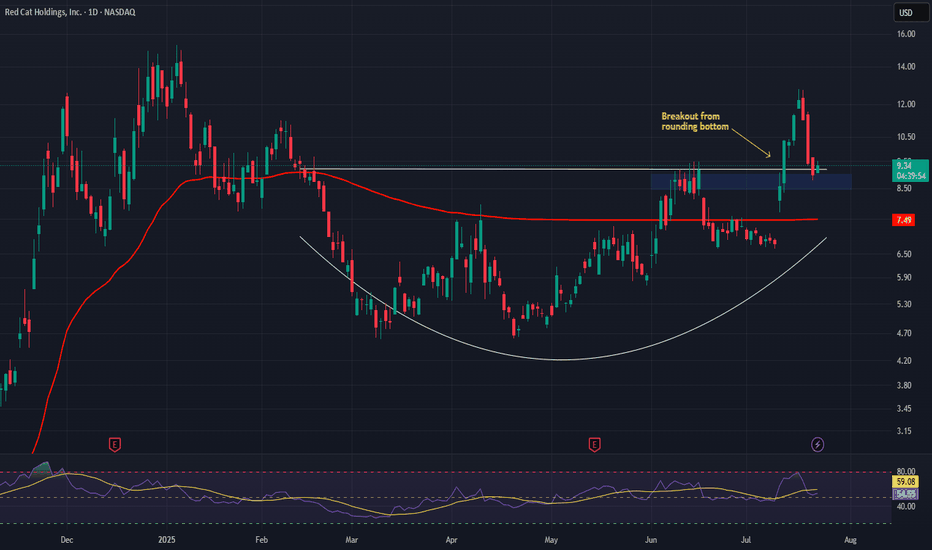

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

Defensestocks

Equity Research Report – Paras Defence & Space Tech Ltd Technical Summary

Volume Spike: Sharp surge in volume confirms breakout strength.

Resistance Flipped: ₹1,299 now acting as strong support.

Momentum: RSI near 75 (overbought but strong bullish trend), indicating short-term potential with caution.

Moving Averages: 20/50/200 EMA crossover in bullish alignment.

🛒 Trade Setup

Short-Term View (Swing/Positional Trade):

Buy Zone: ₹1,315–₹1,330 (on dip near support ₹1,299)

Target 1: ₹1,435

Target 2: ₹1,475

Stop-Loss: ₹1,255 (below support & 5-day EMA)

Timeframe: 2–3 weeks

Short-Term View (Swing/Positional Trade):

Sell Zone below: ₹1,299

Target 1: ₹1,222

Target 2: ₹1,200

Stop-Loss: ₹1,255

For Education purposes only

BEML Ltd: Bullish Breakout AnalysisUpdate:

BEML secured a ₹136 crore order from the Ministry of Defence, strengthening its fundamentals and boosting investor sentiment.

Technical Highlights:

Breakout Zone: Stock broke above ₹4,500 resistance with strong volumes, confirming bullish momentum.

Key Levels:

Support: ₹4,300 | ₹4,040

Resistance: ₹4,762 | ₹4,995 | ₹5,205 | ₹5,472 (Fibonacci target).

Trend: Higher highs and higher lows indicate a sustained uptrend.

Momentum: RSI in overbought territory suggests strong buying pressure, with potential minor pullbacks.

Outlook:

The technical breakout, combined with a solid fundamental catalyst, positions BEML for a potential rally toward ₹5,200–₹5,470. A stop-loss below ₹4,300 is advised for risk management.

Disclaimer:

This is for educational purposes only. Please consult a financial advisor before investing.

Raytehon (RTX) Head and Shoulders. Fundamental reasoning: DJT is a peace president vs Biden who allowed build of geopolitical tensions and warfare.

D.O.G.E dept. to radically overhaul the deep state and waste.

Other notable Military contractors include:.

#LMT

Northrup Grumman

Avic

Boeing

General Dynamics

BAE

Why Are Defense Giants Chasing Rocket Engines?In the ever-evolving landscape of global security, the production of advanced military systems has become a strategic imperative. However, a critical component—rocket engines—is facing a supply crisis that threatens to undermine the capabilities of even the most powerful defense industries.

Defense giants like Lockheed Martin and General Dynamics, renowned for their technological prowess, have recognized the urgency of this situation. To safeguard national security and maintain a competitive edge, they have embarked on a bold initiative to address the rocket engine shortage.

The shortage of rocket engines has far-reaching implications for the defense industry. It limits the production of essential military systems, such as air defense missiles and long-range strike capabilities. Moreover, it exposes countries to potential vulnerabilities in the face of emerging threats.

To mitigate these risks, Lockheed Martin and General Dynamics have formed a strategic partnership. By combining their expertise and resources, they aim to develop innovative solutions to the rocket engine shortage. Their efforts could revolutionize the production of these critical components, ensuring the continued effectiveness of military forces worldwide.

The Silent Assassin - A New Era of Targeted WarfareDelve into the world of precision weaponry with a deep dive into the Lockheed Martin AGM-114 R9X. This non-explosive missile, designed for targeted elimination, challenges traditional warfare concepts. Explore its technical capabilities, potential implications for global security, and ethical considerations.

This analysis explores the Lockheed Martin AGM-114 R9X, a specialized missile designed for precision strikes with minimal collateral damage. Often referred to as the 'Ninja Missile,' the R9X has gained notoriety for its role in high-profile operations. This article delves into the technical specifications, operational history, and implications of this unconventional weapon system.

Key Points:

Detailed technical breakdown of the R9X's design and functioning.

Analysis of the R9X's role in counterterrorism operations, particularly the killing of Ayman al-Zawahiri.

Examination of the ethical and legal implications of using such a weapon.

Comparative analysis of the R9X with other precision strike systems.

Assessment of the R9X's potential for future development and applications.

Let's Focus on the Ethical Implications of the R9X

The ethical dimensions of the R9X are particularly compelling. Given its precision and the potential to minimize civilian casualties, it raises complex questions about the changing nature of warfare.

Hellfire is a low-collateral damage, precision air-to-ground missile with semi-active laser guidance for use against light armor and personnel.

Missiles are used on the MQ-9 Reaper. AFSOC dropped previous plans to integrate the weapons onto its AC-130W gunships in favor of the Small Glide Munition.

Hellfire is procured through the Army, and numerous variants are utilized based on overseas contingency demands. An MQ-1 Predator employed Hellfire in combat for the first time in Afghanistan on Oct. 7, 2001.

The latest AGM-114R replaces several types with a single, multitarget weapon, and USAF is also buying variable Height-of-Burst (HOB) kits to enhance lethality.

The next-generation Joint Air-to-Ground Missile (JAGM) is also procured via the Army, and adds a new multimode guidance section to the AGM-114R. JAGM is used against high-value moving or stationary targets in all weather. FY21 funds 2,497 Hellfire/JAGM via a common production contract.

Technical Analysis of RTX (Raytheon Technologies) Weekly ChartSubscribe & Follow For:

➞ Quick Chart Summary Breakdown

➞ Pertinent Supply Demand Zones and Considerations

➞ US Stocks / Crypto Only

➞ Before / After Analysis

🙏 Like & Subscribe

💬 Drop a line and let me know what you think

🍯 Coin donations always appreciated

🚀 Boost this post to share value

NYSE:RTX is currently exhibiting a double megaphone pattern on the weekly chart, indicating a period of increased volatility and potential uncertainty in the market sentiment. This pattern typically suggests conflicting forces at play, with widening price swings signaling indecision among traders.

Key Pattern: Double Megaphone

A megaphone pattern, also known as a broadening formation, consists of two expanding trendlines that diverge away from each other. This pattern reflects growing volatility and uncertainty, with higher highs and lower lows being established over time. In this scenario with RTX we are showing two long term trends one inside of another.

Explanation:

Textbook Answer: This double megaphone pattern often signifies a struggle between bulls and bears, with neither side gaining a clear advantage. It also represents volatility & opportunity. It's up to us to determine price point where we can capitalize on positioning for profitability!

Real World Answer: Manipulation & Perfect Timing

As the price oscillates between the expanding trendlines, traders should exercise caution and closely monitor key support and resistance levels for potential trading opportunities. I got a feeling this one is going to be a mover!

RSI Breakout with Hidden Divergence:

In addition to the double megaphone pattern, RTX is exhibiting a notable breakout on the Relative Strength Index (RSI) with hidden bullish divergence and the highs are currently compromised with clear and visible hidden bearish divergence leading me to believe that we will revisit the 5th swing level (or in the vicinity of) one more time and see how well prices hold.

Current Situation:

At present, NYSE:RTX is approaching a critical juncture within the double megaphone pattern. Traders must evaluate whether the price will push through the upper trendline or revisit the lower trendline, known as the 5th swing in Elliott Wave Theory.

Potential Scenarios:

Managing Breakout:

If RTX manages to break above the upper trendline of the double megaphone pattern, it could signal a bullish continuation, with the potential for further upside momentum. Traders may consider initiating long positions with appropriate risk management strategies in place.

Revisit of 5th Swing (Lower Trendline)

Conversely, if RTX fails to sustain upward momentum and revisits the lower trendline, it could indicate a bearish reversal or consolidation phase. Traders should be prepared for increased volatility and monitor key support levels for potential downside targets.

Key Levels to Watch:

Resistance: Upper trendline of both of the megaphone patterns.

Support: Lower trendline (5th swing) and previous swing lows within the pattern.

Conclusion:

In conclusion, the presence of a double megaphone pattern on the RTX weekly chart suggests heightened volatility and uncertainty in the market. Traders should remain vigilant and adapt their strategies based on the price action relative to the pattern's trendlines. Granted the series of unfortunate events occurring on the global stage I could almost anticipate what is going to happen here in the long term

As always, it's essential to incorporate risk management techniques and exercise caution when navigating such volatile market conditions.

Note: Ensure to identify your price levels accordingly. This analysis is for educational purposes only and should not be construed as financial advice. Traders should conduct their own research and consult with a financial advisor before making any investment decisions.

PLTR LONG on a 0.5 Fib PullbackPLTR services DOD and military contractors which is a growth industry given current geopolitical

backdrops. I see this as an opportune time to buy the dip which is a healthy correction from

a recent trend up. The idea is illustrated on this 120 minute chart with targets and stop loss.

RTX a defense contractor large cap LONGRTX has earnings on April 23rd. It has been on a good trend higher since the last earnings. The

Russian war means US defense contractors will be in a growth mode for the intermediate

future. Depleted stores of weapons systems need to be replenished. Pieces and parts are

needed for damaged systems in need of maintenance. I see RTX and others such as GD and

LMT as good long-term trades or investments. Smaller companies in the areas of robotics and

drones may be worth a look. RTX is at its all-time high but it seems much higher is in its future.

RTX falls on good earnings and defense budget issuesRTX is part of the boom defense sector thriving because of back orders created by

the Russian war against Ukraine. No matter good earnings it fell this week because

of the defense budget debate in Congress. No matter good intents to rein in the

defend spending escalation and spend in other areas such as social and infrastructure,

Russia has made the world more dangerous and national security of the US and its allies

trumps most spending except perhaps insterest on the national debt and paying the

holders of Treasuries. RTX dropped more than 10% from its tight consolidation range,

I see this dip as an excellent buying opportunity into a leader in the defense sector.

Middle East conflict up, oil up, gold up, defense stocks upWTI and Brent crude futures both jumped more than 4% to above $86 and $88 per barrel, respectively, on Monday, after a surprise attack by Hamas on Israel over the weekend.

More than 900 Israelis have lost their lives, with 130 more held hostage, and nearly 700 Palestinians have been killed in Israel’s retaliation. A truce is unlikely in the short term.

Investors are wary of a wider conflict too. Gold jumped 1.45% to around $1,850 an ounce on Monday, adding to the 0.7% gain the metal made on Friday (as the Non-Farm Payrolls jobs report came in ridiculously stronger than expected).

In some cases, investors are not wary, but welcome a wider conflict, with defense stocks in the US being some of the better performing on Monday. Raytheon (+4.5%), Lockheed Martin (+8.5%), and Northrop Grumman (+11.2%) all recording some of their best daily gains in some time.

A question that arises, and which could affect oil markets is; what was Iran’s contribution to the situation, if any? Tehran has denied involvement but did commend the attack. Investors will be looking for any events that could affect supply from Iran (they currently send 1.5 million barrels per day to China) or through Iran (via the Strait of Hormuz which is vital for about 30% of oil supply).

In any case, the world might be facing higher-for-longer oil prices.

LMT a defense sector leader setup LONGOn the daily LMT, over the long term is shown to have descended into the support

of the ascending support trendline in what appears to be an ascending wedge.

Confluent with the support trendline is the mean VWAP and the mean band of

the Bollinger Bands. I see an opening for a long trade targeting the resistance

trendline and also the second standard deviation of the anchored VWAP ( red

thick line) Fundamentally, LMT just beat on both the top and bottom lines.

It is in a obvious growth industry with a bakclog of production in the setting

of the Russian Ukraine war and the need for US and NATO to replenish their

stockpiles. This long trade is best for investors content with slow moving blue

chip Dow Jones type stocks or alternatively agile options traders able to leverage

low magnitude up trends. I see about 10% upside and will buy some call options

to exploit this setup.

Is the DFEN dip buyable?I think that the dip is very buyable. Fundamentally, Russia has made the world more

dangerous. Shipments of weapons to Ukraine have depleted US and European stockpiles.

NATO is in a growth mode as proposed by former president Trump some years ago.

While many would like less defense spending and shift it into social spending or

infrastructure or clean technology government funding. the pragmatics are that

national security is generally higher on the priority list. DFEN just dropped below

the high volume area of the volume profile on the 15 minute chart in a VWAP breakdown.

The relative strength lines did a bottom bounce on the indicator. I will exploit this

as a long buying opportunity looking to a modest 5% upside target at minimal risk.

Lockheed Martin Bull PennantThis is a monthly chart of the defense company Lockheed Martin (LMT).

As you can see, a bull pennant is appearing.

In my experience, I have found that the most valid bull flags or pennants usually retrace back to the Golden Ratio (0.618), then bounce and continue higher (see below chart).

When this occurs, the measured move up is typically one full Fibonacci spiral from this retracement level, which usually occurs over a period of time that is about the same as the period of time it took the bull flag or pennant to form (see below chart)

The above chart suggests that LMT could climb into the 500s or as high as about 600 by the second quarter of next year. The best time to enter a trade would probably be after the seasonal volatility ends, and after a breakout occurs on some lower timeframe.

From a regression standpoint, this bull pennant formed when price rose from the mean to the 1 standard deviation, and retraced to the 0.5 standard deviation. If it pans out, the measured move may reach one full standard deviation higher (to the 1.5 standard deviations). See below chart.

To learn more about the log-linear regression channel that I used here, you can check out my prior post that described it in more detail:

Obviously, anything can happen. Not trading advice. Please do your own research and trade at your own risk. If you disagree, I welcome respectful comments and charts below.

Disclosure: I have no trade position in LMT and do not plan to open any trade at the current time.

PLTR upcoming new cycle W3 if BO >12, then 16 & 20 will be next.The 2020 low of PLTR is 8.90 which it broke below to make an ABC (A=C) at near 7.21 my max pain zone.

Max risk is only at 7.21 but the upsides are 8.90, 16 & 20. VERY GOOD risk to reward ratio.

A new Elliott wave cycle may have begun if PLTR holds the green 7.21 zone.

Not trading advice

ITA Aero-Defence etf bottommed if 93 holds & it BO channel @103ITA has been in a downchannel even before invasion. It only overshot during invasion to make an ATH @113.37. Since then, it made an ABC corrective wave & came back down to retest channel base near the 93 zone.

BULLISH CASE: it bounced after retesting channel base @93 but was stalled by ma50.. 93 is a VOLUME PROFILE zone & is the Fib 0.382 retracement level. It is also the vwap from 2009 low. If 93 holds,

ITA will break above ma50 & target the 103 yellow resistance zone & try to BO of the downchannel started in May2021. 103 is the 0.382 Fib level.

BEARISH CASE WARNING: if ITA fails 93 zone & break down from the channel, there is very low volume below until 85, with only a small support at 90. Measuring the H&S move from ATH will send ITA to as low as the 80 zone.

Not trading advice

6/5/22 LMTLockheed Martin Corporation ( NYSE:LMT )

Sector: Electronic Technology (Aerospace & Defense)

Market Capitalization: 117.803B

Current Price: $442.69

Breakout price: $446.45

Buy Zone (Top/Bottom Range): $439.40-$426.40

Price Target: $474.40-$485.30 (3rd)

Estimated Duration to Target: 70-73d (3rd)

Contract of Interest: $LMT 9/16/22 445c

Trade price as of publish date: $21.35/contract

$CW: Defense stocks look primedQuarterly charts look extremely appealing in various defense names, $CW is one example of a good valuation and technical setup being present in tandem, together with the right macro backdrop for long term appreciation in this stock. Price to sales is at reasonable levels vs margins here, and free cash flow yield is around 5.95%, with a 4.35% earnings yield (TTM). The stock can reach between $263.08 and $558.90 by Q2 2025, according to the Time@Mode trend signal present here. Long term, the invalidation for said trend sits below $123.84, but I would use a tighter stop for sizing at least, best bet is to not let yourself be stopped out and rather assign a determined % of your long term account to the sector, and rather monitor the long term invalidation and also the evolution of fundamentals on each quarterly report and main corporate event every year to determine if the long term bullish thesis remains viable.

Best of luck,

Ivan Labrie.