Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

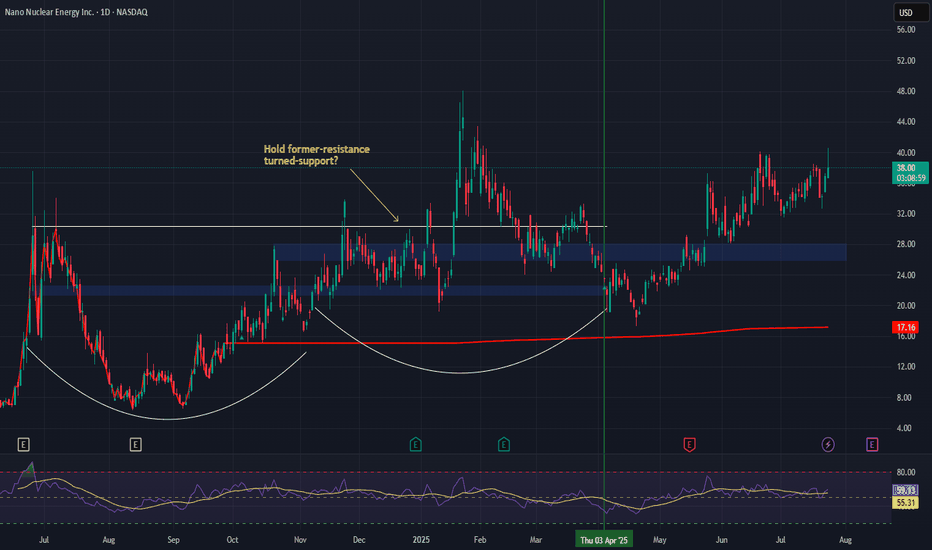

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

Defensetech

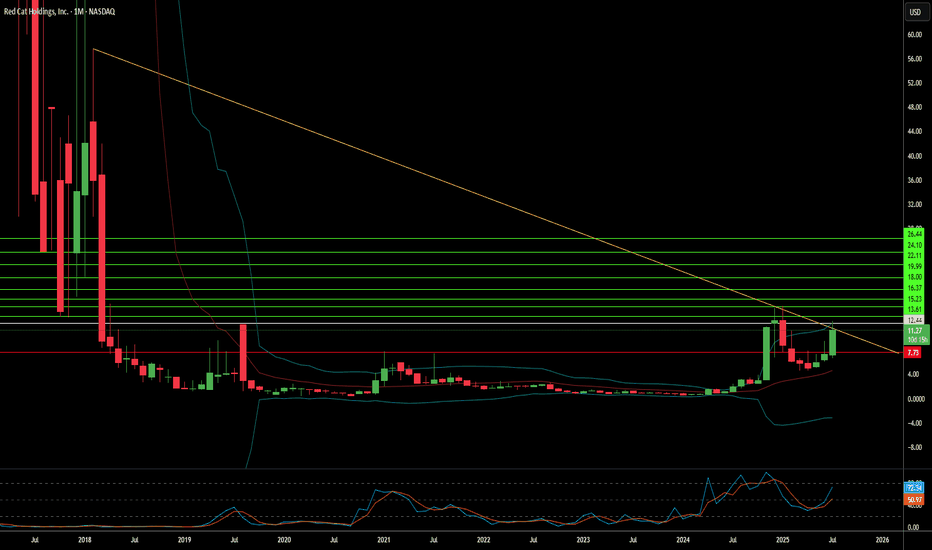

Is Red Cat Holdings a Drone Industry Maverick?Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions, particularly the escalating demand for advanced military drone capabilities, create a favorable backdrop for companies like Red Cat, which offer NDAA-compliant and Blue UAS-certified solutions. These certifications are critical, ensuring drones meet stringent U.S. defense and security standards, differentiating Red Cat from foreign competitors.

Despite its strategic positioning and significant contract wins, Red Cat faces considerable financial and operational challenges. The company currently operates at a loss, with a net loss of $23.1 million in Q1 2025 against modest revenues of $1.6 million. Its revenue projections of $80-$120 million for 2025 underscore the lumpy nature of government contracts. To bolster its capital, Red Cat completed a $30 million equity offering in April 2025. This financial volatility is compounded by an ongoing class action lawsuit. This lawsuit alleges misleading statements regarding the production capacity of its Salt Lake City facility and the value of its U.S. Army Short Range Reconnaissance (SRR) program contract.

The SRR contract, which could involve up to 5,880 Teal 2 systems over five years, represents a substantial opportunity. However, the lawsuit highlights a significant discrepancy, with allegations from short-seller Kerrisdale Capital suggesting a much lower annual budget allocation for the program compared to Red Cat's initially intimated "hundreds of millions to over a billion dollars." This legal challenge and the inherent risks of government funding cycles contribute to the stock's high volatility and elevated short interest, which recently exceeded 18%. For risk-tolerant investors, Red Cat presents a "moonshot" opportunity, contingent on its ability to convert contract wins into sustainable, scalable revenue and successfully navigate its legal and financial hurdles.

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

American Superconductor–Powering the Future of Energy & Defense Company Overview:

NASDAQ:AMSC is at the intersection of three megatrends: grid modernization, clean energy, and military innovation. With proprietary high-temperature superconducting (HTS) technology and a growing portfolio of energy and defense solutions, the company is moving from niche player to strategic infrastructure enabler.

🔑 Growth Catalysts:

📈 Grid Modernization & NWL Acquisition

Grid segment revenue +56% YoY in Q3 2024, accelerated by NWL integration

NWL expands footprint in grid-scale capacitors, transformers, and military-grade systems

Heightened U.S. focus on grid resiliency due to aging infrastructure and climate pressures

🌬️ Renewable Energy Tailwinds

Wind segment grew +58% YoY, bolstered by demand for advanced turbine control systems

Aligns with global decarbonization and offshore wind investment

🛡️ Defense Expansion

HTS tech used in shipboard systems, degaussing solutions, and high-power electronics

NWL opens doors to increased DoD contracts amid rising national security budgets

🔁 Recurring Revenue & Policy Support

Shift toward long-term service and tech licensing agreements

Backed by U.S. energy and defense spending, including DOE and DOD initiatives

📊 Fundamental Highlights:

Lean balance sheet and operating leverage

Strong YoY revenue acceleration across all segments

Diversified exposure to energy, defense, and renewables

📈 Investment Outlook:

✅ Bullish Above: $21.00–$22.00

🚀 Upside Target: $38.00–$40.00

🎯 Thesis: With breakthrough superconducting tech, strategic acquisitions, and bipartisan support for energy security, AMSC is emerging as a small-cap innovator in critical infrastructure.

#AMSC #GridModernization #DefenseTech #Renewables #Superconductors #EnergyResilience #CleanTech