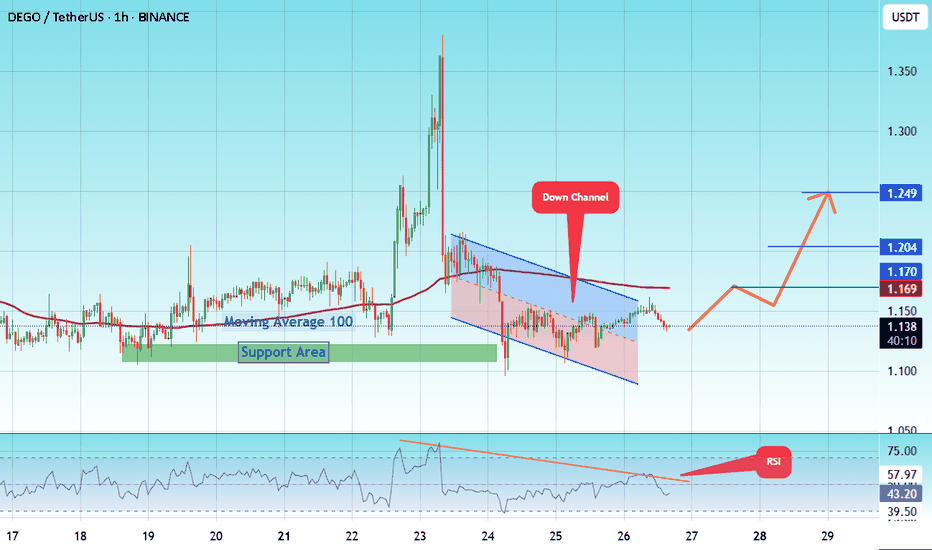

#DEGO/USDT Forming Bullish Wave#DEGO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 1.10, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 1.10.

Entry price: 1.13

First target: 1.17

Second target: 1.20

Third target: 1.25

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

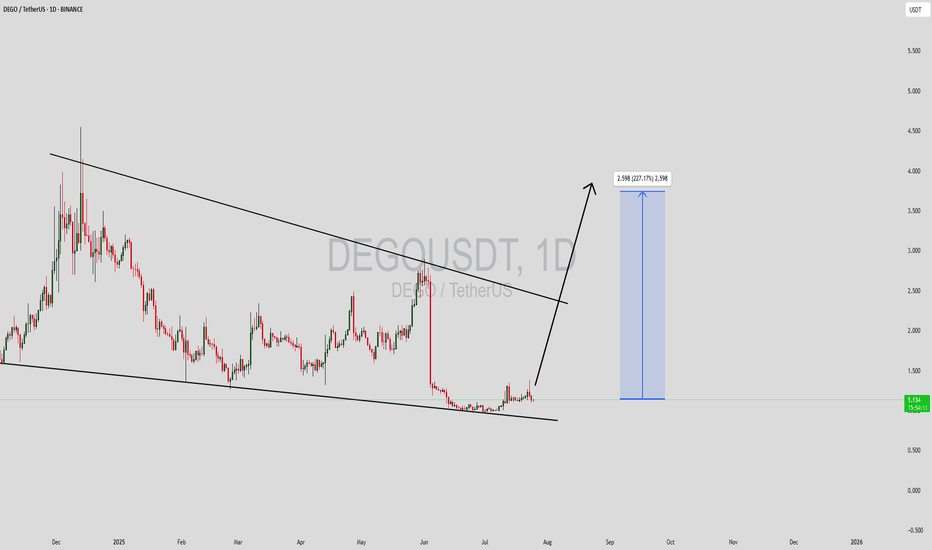

DEGOUSDT

DEGOUSDT Forming Descending ChannelDEGOUSDT is currently showing signs of a strong bullish reversal setup after forming a well-defined descending channel pattern on the daily timeframe. Historically, descending channels are seen as bullish continuation or reversal patterns when price breaks above the upper trendline with increased volume. At present, DEGO appears to be nearing a breakout zone, accompanied by healthy volume, which may signal the start of a major upward move. The technical projection estimates a potential gain of 240% to 250%+, making this setup attractive for swing and position traders.

The increasing investor interest in DEGO Finance is another factor supporting the bullish outlook. As a DeFi and NFT infrastructure protocol, DEGO has maintained relevance even in volatile market phases. The combination of strong fundamentals and technical confirmation from a descending channel breakout could serve as a catalyst for an explosive price surge. Traders should keep an eye on confirmed daily closes above the resistance line and volume spikes for potential entry opportunities.

From a risk-reward perspective, DEGOUSDT offers an asymmetric setup, with the current price trading near the lower range of its historical levels. If the momentum continues and buyers step in with strength, the target range marked by the channel breakout could be hit quickly. Always watch for confirmation signals like retest support and bullish candle formations before entry to manage trade exposure effectively.

This setup is ideal for those who track high-volatility breakout patterns and understand how volume signals can lead to explosive rallies. DEGO is worth watching closely over the next few sessions, especially if market sentiment across the DeFi sector strengthens.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

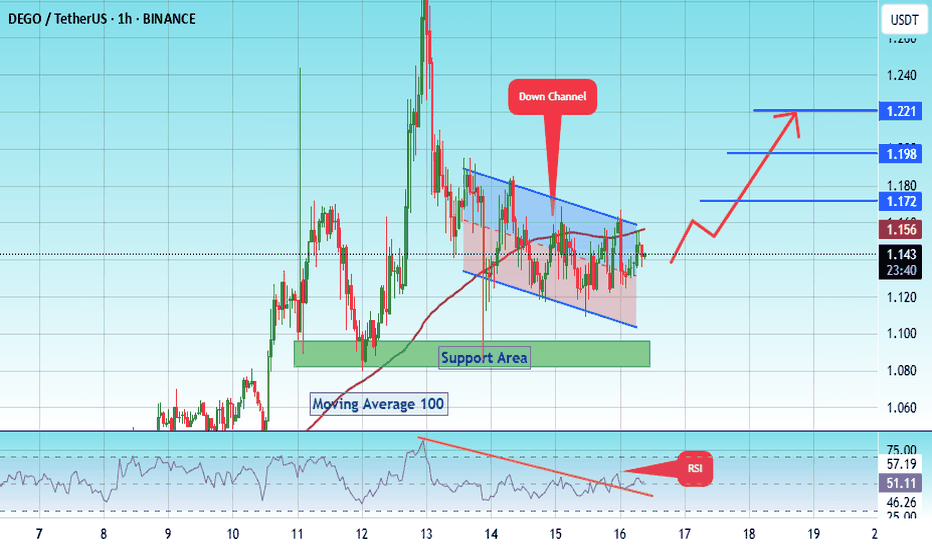

#DEGO/USDT – Bullish Breakout Setup | 1H Chart Analys#DEGO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a bounce from the lower boundary of the descending channel. This support is at 1.10.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.08, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 1.14.

First target: 1.17.

Second target: 1.20.

Third target: 1.22.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

DEGOUSDT Forming Bullish WaveDEGOUSDT is emerging as a strong contender for traders who are looking for high-potential altcoins with an impressive upside. The chart is currently forming a good bullish wave pattern, which is often a reliable signal for the start of a major uptrend. This setup, combined with steadily increasing trading volume, indicates that buyers are stepping in aggressively. The projected gain of 190% to 200%+ shows just how much potential this crypto pair holds for swing and position traders eyeing explosive moves in the DeFi sector.

Many market participants are paying close attention to DEGOUSDT because it consistently demonstrates strong volatility and clear technical patterns, making it an attractive asset for both short-term and long-term strategies. As the broader crypto market begins to regain momentum, coins like DEGO are becoming more appealing, especially with fresh capital flowing into altcoins that show healthy bullish structures. The current wave pattern suggests that once the price confirms its breakout levels, a powerful rally could be underway, capturing the attention of new investors.

Another key point that supports this bullish outlook is the active community and innovative utility that DEGO Finance brings to the DeFi ecosystem. With partnerships and developments on the horizon, sentiment around the project continues to improve. Investors are keen to position themselves early in projects like this before the next major leg up. If the current trend holds, DEGOUSDT could outperform many of its peers and deliver exceptional returns in the upcoming months.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.23.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 1.24

First target: 1.25

Second target: 1.26

Third target: 1.80

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.04.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 1.050

First target: 1.076

Second target: 1.097

Third target: 1.12

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 1.19, acting as strong support from which the price can rebound.

Entry price: 1.26

First target: 1.31

Second target: 1.37

Third target: 1.46

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 1.94, which acts as strong support from which the price can rebound.

Entry price: 1.98

First target: 2.02

Second target: 2.07

Third target: 2.13

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.76.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.79

First target: 1.83

Second target: 1.92

Third target: 2.02

DEGO Analysis (12H)The larger structure of DEGO is bearish and has now reached the supply zone. It is expected to move toward the specified targets on the chart soon.

The closure of a daily candle above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Dego Finance New 2025 All-Time High Confirmed (4,400% PP)The volume gives it away, truly. Dego-finance produced the highest volume ever in March 2025, even higher than in early 2021 before the major bull market rise. A rise that ended with more than 7,000% total gains.

Highest volume ever and long-term higher lows. It seems DEGOUSDT is getting ready for a new All-Time High in the coming months. This pair and chart seen pretty strong.

Let's skip the TA because this one is just too say. Since it is too easy and fully confirmed, let's map the potential ATH price.

» Two targets: $55 (~2,700% Profits Potential) and $89 (~4,400% PP). Pick one.

Namaste.

#DEGO/USDT#DEGO

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a resistance area at the upper limit of the channel at 1.823.

Entry price: 1.803

First target: 1.77

Second target: 1.74

Third target: 1.700

DEGOUSDT - HUGE VOLUME SPIKE NOW WHAT TO DO!Alright, let's sprinkle in some charm and make this analysis even more engaging! 😄

Alright, buckle up traders, because we're about to dissect DEGOUSDT and map out a potential path to profits. 💰 Forget the noise; we're focusing on precision and probabilities, guided by cold, hard data and a disciplined approach. I've identified a key area on the DEGOUSDT chart, marked by the blue box you see there. 🟦 This isn't just some arbitrary zone; it represents a potential resistance level, an area where sellers might step in and halt any upward momentum. 🤔

Now, let's be crystal clear. Simply seeing a blue box isn't a signal to blindly short. 🙅♀️ This is where the art and science of trading intertwine, and where your disciplined approach, informed by my analysis, will set you apart from the herd. The key here is patience, a virtue often overlooked but absolutely essential for consistently profitable trading. 🧘♀️

We need to see how the price action reacts when it approaches this blue zone. Are we seeing an increase in volume as the price tests this level? 📈 Is the Cumulative Delta Volume (CDV) confirming that sellers are indeed stepping in and pushing the price back down? 🐻 These are the critical clues we need to validate our short idea. Don't jump the gun! Trading without confirmation is a dangerous game, a gamble where the odds are stacked against you. 🎲 Let the market tell you what it wants to do, and then react accordingly. 👂

But remember, the market is a dynamic beast, constantly evolving. 🌍 That’s why I have a core principle, a bedrock belief that anchors my trading: "I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long." This isn't just a rule; it's a mindset, a commitment to adapting to the market's signals rather than clinging to a preconceived notion. 🧠

Therefore, pay attention to the lower time frames (LTF). This is where the real magic happens. ✨ If the price breaks above the blue box with significant volume and then retests it, turning what was once resistance into support, we have a completely different scenario. 🐂 We'd then be looking for long opportunities, capitalizing on the newfound bullish momentum. The retest is the critical confirmation. It shows that buyers are willing to defend this level, solidifying its new role as support. 💪

Listen closely. 👂 Ignoring these confirmations and simply hoping your initial bias is correct is a recipe for disaster. 😩 You need a clear plan, a set of rules, and the discipline to execute them flawlessly. That’s what I strive to provide with every analysis, but you need to follow me closely to see it through. 👀 This isn't about getting lucky; it's about consistently applying a proven methodology to identify high-probability trading setups. 🎯

The market doesn't care about your opinions or your hopes and dreams. It only responds to price action, volume, and liquidity. Master these elements, and you'll master the market. 👑 Fail to do so, and you'll become just another statistic. 💔 So, stay tuned, stay patient, and let's navigate these treacherous waters together. 🤝 By following my guidance, you'll gain the edge you need to thrive in this competitive arena. Don't be left behind while others are profiting. This is your chance to elevate your trading game. Don't miss out!

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

DEGO (SPOT)BINANCE:DEGOUSDT

DEGO / USDT

1D time frame ( wait for the price to come to buying zone)

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

#DEGO/USDT#DEGO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.75

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.86

First target 1.90

Second target 2.00

Third target 2.10

ACHUSDT UPDATEACHUSDT is a cryptocurrency trading at $0.03285. Its target price is $0.06500, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about ACHUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. ACHUSDT is poised for a potential breakout and substantial gains.

#DEGO/USDT#DEGO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 2.10

Entry price 2.28

First target 2.47

Second target 2.65

Third target 2.85

Dego/Usdt Plan Dego/USDT is currently consolidating within a box setup on the higher time frame. This consolidation phase often indicates accumulation, which could lead to a significant breakout in either direction.

The current setup suggests patience is key, as a breakout from this range could result in a strong directional move. Traders should closely monitor the price action near the box boundaries, as a confirmed breakout could open the door to substantial gains. However, always manage your risk and avoid over-leveraging, as fakeouts are possible.

As always, this is not financial advice—conduct your own research before making any decisions.

#DEGO (SPOT) entry range( 1.320- 1.620) T.(2.900) SL(1.270)BINANCE:DEGOUSDT

entry range( 1.320- 1.620)

Target1 (2.456) - Target2 (2.900)

2 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (1.270)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO ****