IOTXUSDT🚀 IoTeX (IOTX): A Hidden Gem for Short-Term Gains & Long-Term Growth?

Looking for a crypto project with real-world utility and strong upside potential? IoTeX (IOTX)—a decentralized platform powering the Internet of Things (IoT)—might be worth your attention.

Why IoTeX?

✔ Innovation Meets IoT: Combines blockchain + IoT for secure, privacy-focused machine-to-machine (M2M) ecosystems.

✔ Partnerships & Adoption: Backed by industry giants (like Samsung) and used in real-world applications (smart devices, DePIN).

✔ Price Potential: Volatility offers short-term trading opportunities, while long-term growth aligns with IoT’s explosive expansion (projected $2.4T market by 2029).

📌 Short-Term: Watch for bullish trends amid crypto market rebounds and project updates.

📌 Long-Term: HODL potential as IoT adoption grows and IoTeX cements its niche.

Depin

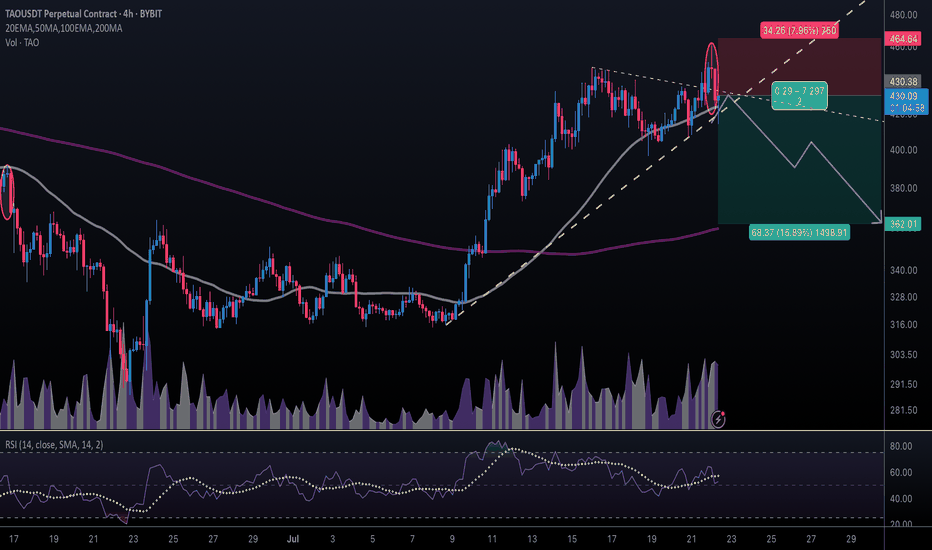

#TAOUSDT #4h (ByBit) Ascending trendline near breakdownBittensor printed an evening doji star deviation, a retracement down to 200 MA support seems next.

⚡️⚡️ #TAO/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Entry Targets:

1) 430.38

Take-Profit Targets:

1) 362.01

Stop Targets:

1) 464.64

Published By: @Zblaba

GETTEX:TAO BYBIT:TAOUSDT.P #4h #Bittensor #AI #DePIN bittensor.com

Risk/Reward= 1:2.0

Expected Profit= +79.4%

Possible Loss= -39.8%

Estimated Gaintime= 1 week

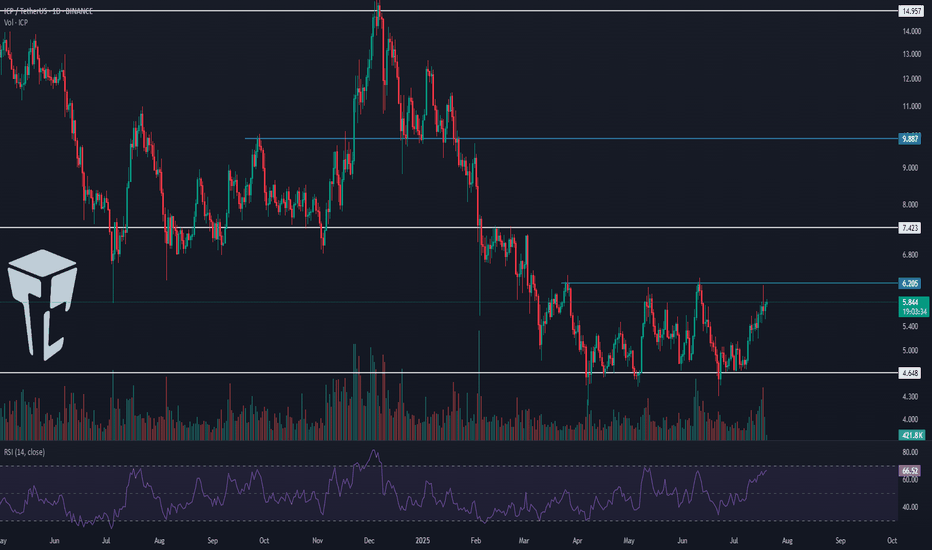

TradeCityPro | ICP Eyes Breakout as Altseason Speculation Grows 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ICP coin for you—one of the DePIN and AI-related coins, ranked 37 on CoinMarketCap with a market cap of 3.11 billion.

📅 Daily timeframe

As you can see on the daily timeframe, a ranging box has formed around the key support at 4.648, and price is fluctuating inside this box.

🔔 The top of the box is at 6.205, and price has touched it multiple times. It just wicked into it again and got rejected.

📈 This level has become a very important resistance. If it breaks, we can enter a long position—and it’s even suitable for a spot buy.

🛒 I already hold this coin in spot from lower entry points and don’t plan to increase my spot volume, but I’ll open a futures position if 6.205 breaks.

🔽 If Bitcoin Dominance moves downward, the 6.205 trigger will be a very good entry point. A break above 70 on the RSI will also be a strong momentum confirmation.

📊 If price gets rejected from the top of the box and drops to the 4.648 support, we can open a short position in lower timeframes. A break below 4.648 would confirm the bearish outlook.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

PEAQ TA: Bullish Breakout Above Key ResistanceSymbol: PEAQUSDT

Timeframe: 4H

Current Price: $0.0753

Date: July 9, 2025

CRYPTO:PEAQUSD has successfully broken above the critical resistance zone of $0.069-$0.075, marking this level a strong resistance where sellers are exhausted, as prices have been above this level for over 2 weeks.

Multiple momentum indicators confirm bullish sentiment, while the peaq network continues to deliver key milestones, including the Machine Economy Free Zone in the UAE, MachineX (DEX) and new listings (Kraken).

Technical Analysis

Breakout Confirmed: Clean break above $0.075 resistance with volume confirmation.

Previous Range: Extended consolidation between $0.069-$0.075 for several weeks.

Current Structure: Higher highs and higher lows pattern starts emerging.

Support Levels: $0.069 (previous resistance now support), $0.060 (secondary support).

Bears seem exhausted.

Key Technical Indicators

Adaptive Causal Trend Filter:

Primary trend: BULLISH

Trend alignment: Strong

Trading bias: STRONG BULLISH

Volatility: Low

EVAR Position Sizing:

Current reading: 2.5555 (positive momentum)

Risk level: Medium

The dramatic green spike indicates significant buying pressure and momentum shift

Tsallis Entropy Risk Management:

Risk score: 41.5 (Medium)

Market entropy levels stable

Risk-adjusted position sizing suggests 6.77% allocation appropriate (positive sign)

Fundamental Backdrop

PEAQ operates in the rapidly expanding Decentralized Physical Infrastructure Networks (DePIN) space, which has seen explosive growth in 2025. Key fundamental drivers of the last 3 months include:

Launched Machine Economy Free Zone in UAE

Kraken Listed PEAQ for trading

Over the Reality Partnership to unite DePIN ecosystems

SkyX and iGAM3 Integrated for AI-powered weather intelligence

Lucid Labs Launched $PEAQ VEO for visibility and engagement

Alpha AI, Over the Reality chose to build on Peaq, expanding the ecosystem

MachineX - peaq DEX is live

Over 5 million addresses are now live on peaq (machines and humans)

Partnerhip with CRYPTO:AUKIUSD

Tokenomics:

Limited token unlock pressure

Deflationary mechanism through network usage

Staking rewards for network validators

Real utility driving organic demand

Price Targets & Risk Management

Bullish Scenario (70% probability)

Short-term target: $0.095 (26% upside)

Medium-term target: $0.120 (59% upside)

Long-term target: $0.150 (99% upside)

Key catalysts to watch:

Q3 partnership announcements

Network growth metrics

Broader DePIN sector developments

Bitcoin/crypto market sentiment

Risk Factors

General crypto market volatility

Regulatory uncertainty around DePIN projects

Competition from other blockchain platforms

Execution risk on roadmap deliverables

Rating: BUY

Risk Level: Medium

Time Horizon: 3-6 months, or longer

Quick note: I'm just sharing my journey - not financial advice! 😊 The analysis above is personal.

#RLCUSDT #1D (Binance Futures) Descending wedge on supportiExec RLC just printed a dragonfly doji which may have marked the bottom on daily.

A morning star is drawing now, recovery towards 100EMA resistance seems around the corner.

⚡️⚡️ #RLC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 5.9%

Current Price:

0.9126

Entry Targets:

1) 0.9002

Take-Profit Targets:

1) 1.1854

Stop Targets:

1) 0.7859

Published By: @Zblaba

GETTEX:RLC BINANCE:RLCUSDT.P #DePIN #AI #iExec iex.ec

Risk/Reward= 1:2.5

Expected Profit= +126.7%

Possible Loss= -50.8%

Estimated Gaintime= 1 month

(jasmy) jasmy "array"I can't share my indicator ideas unless I publish them publicly. I don't feel like sharing my indicators with the public is necessary so I guess I will not be publishing many new ideas because the Trading View website is removing features where unpublished custom indicators are allowed to be included in sharing. Trading View is too strict and they keep choking the freedoms of watchlist, now indicators, what's next to be taken away from users of the website?

TradeCityPro | ICP Approaches Key Resistance with Rising Volume👋 Welcome to TradeCity Pro

In this analysis, I want to review the ICP coin for you. The Internet Computer project operates in the fields of artificial intelligence and DePIN.

⭐ The coin of this project, with the symbol ICP, has a market cap of 3.25 billion dollars and ranks 32nd on CoinMarketCap.

📅 Daily Timeframe

As you can see in the daily timeframe, there is a descending trendline visible on the chart, which has been tested multiple times. The price has broken above it and is now sitting just below the 6.205 resistance level.

🔍 In recent candles, the volume has increased significantly, which raises the likelihood of a breakout above 6.205.

🔔 If the 6.205 level is broken, ICP's bullish trend could begin. In that case, the price could move toward the 7.423 and 9.887 levels.

📊 Entering a position with the breakout of 6.205 is supported by volume confirmation, and we will get RSI momentum confirmation if it enters the overbought zone.

📉 For the bearish scenario to play out, the price must first get rejected from 6.205, and then we’ll look for confirmation of a trend reversal with a break below 4.468.

🛒 You can also use this same 6.205 trigger for a spot buy, but keep in mind that Bitcoin dominance is still in an uptrend, so in my opinion, it’s not yet the right time to buy altcoins.

✔️ The best trigger for buying any altcoin is to wait for confirmation of a trend reversal in Bitcoin dominance. Once that’s confirmed, you can start buying the altcoins you’ve selected.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | IOTA: Testing Key Resistance in RWA-DePIN Rally👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the IOTA coin for you. This project is one of the RWA and DePIN-based initiatives and is among the older projects in this category.

✔️ The coin has a market cap of $822 million and ranks 85th on CoinMarketCap.

📅 Daily Timeframe

As you can see on the daily timeframe, after finding support at 0.1547, the price initiated a bullish leg and moved up to the resistance zone I’ve marked.

💥 This area is a very significant resistance zone, and in this bullish leg, the price has reached it for the first time and got rejected.

🔍 In my view, as long as the price hasn’t confirmed a breakout above 0.1960, the chance of starting a downtrend is higher than continuing the current uptrend. If this resistance zone is broken, we can consider it strong confirmation of buyer strength.

📈 For a long position, we can enter on the breakout of this same zone. For spot buying, this trigger can also be used, but the main long-term triggers are 0.3774 and 0.4918.

⚡️ On the RSI oscillator, there's an important zone at the 50 level. If this level is broken, the probability of breaking 0.1960 increases. If that happens, the next support zone will be 0.1547.

📊 Make sure to pay close attention to volume. If any of our triggers are activated without volume confirmation, the likelihood of a fake breakout increases.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

ALTCOIN BOOM FOR PEAQ NETWORK 2025-2026 PROPOSALWhy This Asset?

Core Info: Peaq Network is a blockchain built for DePIN (Decentralized Physical Infrastructure Networks), enabling machines, IoT devices, and users to collaborate in decentralized ecosystems. Think of it as the "backbone" for real-world infrastructure like energy grids, mobility networks, and connected devices.

Recent News:

Mainnet Launch: Peaq went live on mainnet in June 2024, marking its shift from testnet to full decentralization.

Partnership with Fetch.ai: Integrating AI-powered autonomous agents to optimize machine-to-machine (M2M) transactions.

Ecosystem Grants: $15M fund announced to onboard DePIN builders (e.g., solar energy grids, EV charging networks).

Deep Dive:

PEAQ is riding the DePIN megatrend, which analysts predict will be a $3.5T market by 2030. Its focus on real-world utility sets it apart from "pure DeFi" chains.

Latest Tech/Utility Update

Update: Mainnet launch + Machine ID feature, which assigns decentralized identities to IoT devices for secure interactions.

Implications:

For Users: Developers can build DePIN apps faster (e.g., decentralized Uber rivals, community-owned 5G networks).

For Investors: Mainnet reduces "vaporware" risk. Machine ID could become a industry standard for IoT security.

Biggest Partner & Investment

Partner Spotlight: Fetch.ai (AI/blockchain leader) merged its autonomous agents with Peaq’s DePIN infrastructure.

Deal: Strategic collaboration (no $$ disclosed), but Fetch’s tech stack adds AI-driven decision-making to Peaq’s IoT networks.

Impact: Fetch.ai’s 200+ enterprise partnerships give Peaq instant credibility in AI x IoT verticals. This is a long-term play for smart cities and Industry 4.0.

Most Recent Added Partner

New Collab: Silencio (noise pollution data network) migrated to Peaq to build a decentralized environmental monitoring system.

Deal: $2M investment over 18 months.

Future Prospects: Silencio’s 500k+ users bring real-world data flows to Peaq, but adoption depends on proving DePIN’s cost efficiency vs. traditional models.

Tokenomics Update

Changes:

Staking: 12-15% APY for securing the network, with rewards locked for 30 days to prevent dumping.

Supply: Fixed at 4.2B tokens, with 60% allocated to ecosystem growth (grants, staking rewards).

Analysis: High staking APY attracts early holders, but long-term sustainability hinges on DePIN adoption. Only 10% of tokens are circulating, so watch for unlocks from team/advisor wallets.

Overall Sentiment Analysis

Market Behavior: Neutral. PEAQ is up 25% since mainnet, but trading volume remains low ($2M daily). Whales are accumulating quietly.

Driving Forces:

Bullish: DePIN narrative gaining steam, Fetch.ai partnership, real-world use cases.

Bearish: Niche focus (IoT/DePIN) limits hype compared to AI/meme coins. Competitors like Helium and IOTA have bigger communities.

Insight: Sentiment is cautiously optimistic. PEAQ isn’t a "moonbag" play, but its fundamentals could shine in a bear market where utility matters.

Recent Popular Holders & Their Influence

Key Investors:

Borderless Capital (DePIN-focused VC) added PEAQ to its portfolio, signaling institutional confidence.

MEXC Exchange accumulated 5M tokens, likely for future liquidity provision.

Why Follow Them: Borderless Capital’s bets often align with long-term infrastructure trends, not short-term pumps.

Summary & Final Verdict

Recap: PEAQ is a high-conviction DePIN bet with a working mainnet, strong partners (Fetch.ai), and real-world use cases. Its success depends on onboarding builders who can prove DePIN’s economic advantages.

Verdict: PEAQ is a patient investor’s play. It won’t pump 10x overnight, but it’s one of the few projects bridging crypto with trillion-dollar physical industries. High risk (low adoption so far), but asymmetric upside if DePIN explodes.

Final Thought: If you believe blockchain will underpin future infrastructure, PEAQ deserves a portfolio slot. If you need instant gains, skip it.

TradeCityPro | WAL: Squeezing Tight Before the Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WAL coin for you. This coin belongs to the Walrus project, which is part of the SUI ecosystem and falls under the DePIN and Storage categories.

⚡️ After its airdrop, this project’s token has managed to maintain its hype and, with a market cap of $589 million, is currently ranked 97th on CoinMarketCap. Since this token has just recently launched, the analysis will be done on the 4-hour time frame.

⏳ 4-Hour Time Frame

As you can see in the 4-hour time frame, after this token’s launch on March 27, the price has formed a low and a high at the 0.3899 and 0.5903 zones respectively. It is still trading between these two levels and has yet to start a clear trend.

✔️ Currently, a descending triangle has formed. The price is forming lower highs, while maintaining equal lows, and each time the price touches these lows, the probability of a breakdown from the triangle increases.

📉 So, for a short position, I suggest definitely having a position open if the 0.3899 zone breaks. You can open this position earlier by entering on a rejection from the descending trendline or the break of 0.4101, but keep in mind that these are not the main triggers—they're just early entries in anticipation of a breakdown, so you’ll have a position ready if the zone breaks.

🔼 For a long position, the first high formed was at 0.4362. The price is currently above this level, but the breakout candle isn’t very strong, and the price hasn’t confirmed stabilization above this level yet. Also, this zone is very close to the descending trendline, so it’s not logical to enter a long position while this trendline remains unbroken.

📈 Therefore, for a long, wait for the break of the descending trendline and a pullback to this dynamic level before entering. The next triggers for upward movement are the 0.5167 and 0.5903 zones.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

(JASMY) jasmy "sectioned macd - wave phase"As seen between the purple lines are the phases of the MACD with no overlap between each of the purple lines. The final bottom phase(5) was reached at which point the price rose to an astonishing 75%. Not sure if these purple lines will be of much use from here on out. I may delete them at some point.

(JASMY) jasmy "cycle-phase-wave"According to an enhanced MACD indicator that follows three layers of information I found the peak MACD green to line up with the yellow lines on the chart that are assigned with the next alternative colored line to be aligned with the most recent improvement in the otherwise losing price for the last months of time. Although an elliott wave is not seen I figured it would be possible to create a measurement like wave using an indicator to guide where those points should be.

$VVV - AI Moonshot ticketThe big drawdown prior was due to 50% of the supply being airdrop on TGE -- no VC's, no Presale. The airdrop claim window was open for 45 days and has now closed.

33m tokens were remaining, over $130m in value and the team burnt the lot of it.

basescan.org

Updated tokenomics can be found on CoinGecko, and currently 51% of circulating supply is timelocked and staked with massive 80% APR.

Can see a breakout of prior downtrend, triangle correction (abcde on 1hr chart). Price retested and moving up for the Wave 3 rally.

USA Based project providing inference service for AI -- product ready, similar to OpenAI but crypto native. Founder: Erik Voorhees, multi-millionaire Bitcoin OG from 2011 and founder of ShapeShift.

You do not want to miss this one, already listed on Coinbase, Kraken, and Binance Futures. Can pick up on Aero aswel. Still only 100m mcap with $255m FDV.

(JASMY) JASMY "that sux"Jasmy losing like there is no tomorrow. The Elliott Wave prospects of Jasmy seem to have fallen through. The December price was what I wanted to believe was a peak of Elliott Wave patterns with two more to follow only slightly lower but this prolonged down angle on the chart is a bummer.

(jasmy) JASMYperhaps the numerical ideologies are not here, perhaps the theoretical possibility is not strong, perhaps the chance, rare, perhaps perhaps; what else can a person do other than wait and wonder and watch as the world storms to the top, only to crash all the way back down. What is learned is nothing other than the same redundant story about how to wait for the moment to jump from the top and be freed of the burden of care running off into the sunset never to worry about anyone left behind.

iotex is best depin projectIoTeX (IOTX) has recently garnered significant attention in the cryptocurrency market, particularly following a substantial $50 million investment from a consortium of venture capital firms. This infusion of capital is poised to accelerate the growth and adoption of Decentralized Physical Infrastructure Networks (DePIN), positioning IoTeX for a promising future. citeturn0search14

**Strategic Investments and Partnerships**

The recent $50 million funding round, led by prominent investors such as Borderless Capital and Amber Group, underscores the confidence in IoTeX's vision and technological capabilities. These strategic partnerships are expected to enhance IoTeX's infrastructure and expand its ecosystem, fostering increased adoption and utility of the IOTX token. citeturn0search2

**Market Performance and Future Projections**

As of now, IOTX is trading at approximately $0.0201, with a 24-hour trading volume of around $9.49 million. The token has experienced a slight decline of 1.68% in the past day.

Looking ahead, various analyses offer optimistic projections for IOTX. For instance, CoinCodex forecasts that IoTeX could reach a high of $0.2922 by 2025, representing a potential increase of over 1,350% from its current price. citeturn0search1 Similarly, DigitalCoinPrice anticipates that IOTX may reach $0.068 by 2025 and $0.16 by 2030, indicating sustained growth over the long term.

The substantial venture capital investment, coupled with strategic partnerships and favorable market projections, suggests a promising trajectory for IoTeX. As the platform continues to develop and expand its DePIN initiatives, the value of IOTX is well-positioned for significant appreciation in the coming years.

*Note: This analysis is based on information available as of February 10, 2025. Investors are advised to conduct their own research and consider market dynamics before making investment decisions.*

xyo (XYO) Looks like XYO is falling underneath this line I drew to represent the first big candle at the end of the year. The lack of sustaining value from XYO holders is more than disappointing. It is like these people have not seen all these other cryptocurrency make money so long as the people don't panic sell from the first big candle.

A lot of room to grow for $EDGE in DePINEDGE has been in a major uptrend since december fueled by new attention to its supercloud products that have been in development for over a decade and its recent partnership with Tinder, gaining them as a client to run the YearInSwipe competition on the edge network. This year there is a large number of releases to be expected, from its all new storage product, VPN, to AI Agents. Revenue has been on the rise to the tune of 1.3 million USD ARR from users of the supercloud, which is similar to some 10x valued project like Akash. Combined with the fact that it is not on any reputeable CEX yet, exchange listings can be seen as catalysts for further growth. In summary, a lot is aligning in the macro-picture for EDGE this year giving it the very good chance to catch up and overtake other DePIN projects price-wise. This is a project solving real-world issues with growing real-world revenue and deflationary tokenomics, making it an ideal long-term hold

IO.net Bullish Chart prediction 2025IO.net, like SUI, was one of the few coins that did not dip much in this retracement.

IO is strong for the mid-term if DePin AI won't be a thing and truly making money in IO sucks.

You can enter at $3 or $2.8 worst.

Future Potential: IO.net's robust infrastructure supports decentralized applications (dApps) and smart contracts, offering scalability and security.

As the demand for dApps increases, IO could become a backbone for various blockchain projects.

Latest News: IO.net Secures Funding for Development of Next-Gen dApps

io.net and Alpha Network have partnered to enhance secure AI and web3 development by addressing data security challenges and improving accessibility to AI tools.

The collaboration will utilize io.net’s decentralized GPU infrastructure to create a secure environment for AI training, ensuring data privacy through Alpha Network’s ZK technology.

Tausif Ahmed of io.net highlighted that the partnership will expand access to decentralized, privacy-compliant AI compute for web3 developers, combining Alpha Network’s privacy solutions with io.net’s GPU capabilities.

Lina Zhang, CEO of Alpha Network, emphasized that the partnership will enable access to advanced AI tools while maintaining privacy and security, fostering the development of new decentralized applications.

The collaboration will also support Alpha Network’s data sharding and model generation solutions, making AI training on large datasets more efficient and scalable.

This partnership is seen as a significant step towards creating secure and accessible tools for AI and web3, benefiting developers, businesses, and GPU owners in a decentralized system.

PHA - Under the radar potentialThe good looking chart shows us breakout and retest confirmation on the weekly very clearly. This is an AI focused coin PHA.

I have followed their recent updates and seems like they have a very unique business model when it comes to utilizing AI agents. I think the coin has a good use case and a good inflation model to be sustainable.

I will hop on this one. Lets ride the AI train.

Let me know of your thoughts.