ZRO – Best SetupPrice is consolidating near key equal lows around $1.48–1.50. Liquidity likely sits below these lows, making a sweep into that zone attractive for larger players. Chasing longs here is risky without confirmation.

Plan:

• Wait for a clean sweep below the equal lows

• Look for a strong reclaim of the range back above $1.50 (failed breakdown)

• Entry trigger is confirmation of buyers stepping in after the sweep

If these conditions are met, targeting $2.46 and higher makes sense. No sweep/reclaim = no trade.

Deviation

PUMP | Watching for Base ConfirmationThe sharp downtrend is showing signs of exhaustion as price starts to consolidate and build a potential range.

If we see a sweep and reclaim of the range low, that would confirm the start of a new accumulation phase and signal a potential reversal.

The invalidation for any long attempt is a confirmed breakdown below the deviation or the origin of the reclaim.

Plan:

Wait for a clean sweep and reclaim of the range low to trigger a long entry.

Target resistance levels above, with stops set below the reclaim origin.

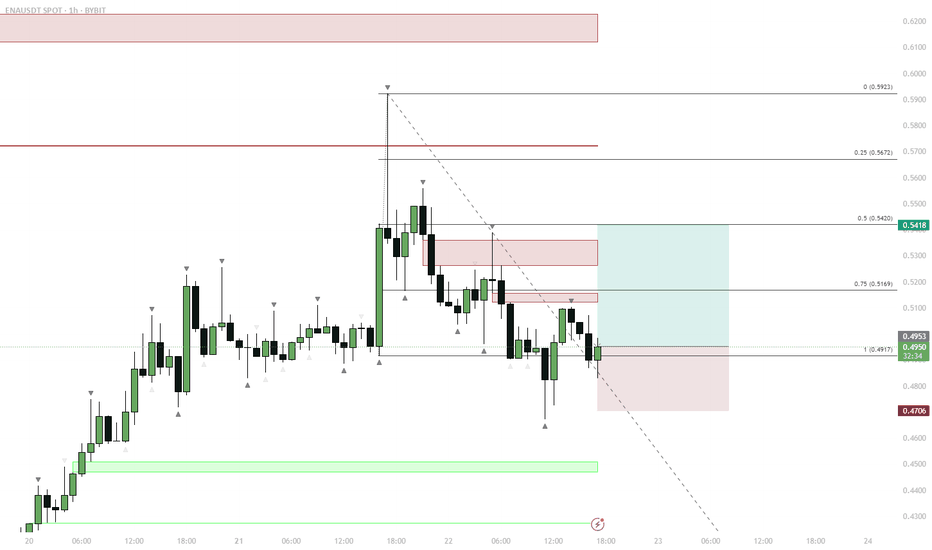

ENA — Range Deviation & Reclaim: LTF Long Setup

ENA traded in a tight LTF range, then deviated below support, forming a sweep/liquidity grab.

Price quickly reclaimed the range low and retested the FVG (Fair Value Gap) below the range.

This reclaim/flip is a classic bullish reversal setup after a sweep.

Entry on the retest of FVG and previous support, targeting a move back to mid-range and then range highs.

Invalidation below the deviation low (stop).

Price action shows a textbook range deviation and reclaim setup. ENA swept liquidity below the range, trapped shorts, and reclaimed support, forming a bullish reversal signal. The retest of the FVG provided a high-probability entry for a move back to the range highs. This play relies on the principle that deviation and reclaim below a range often leads to a reversal as trapped sellers are forced to cover.

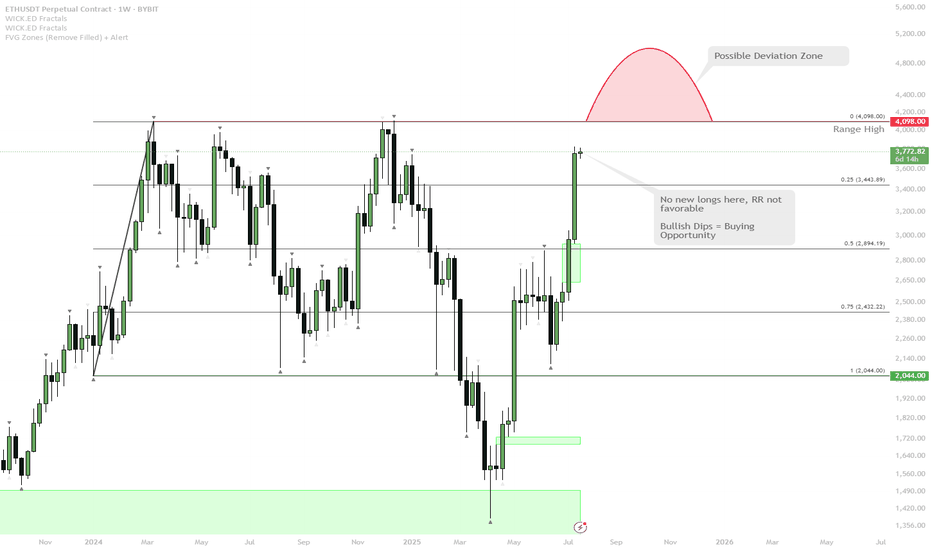

ETH Approaching Major Resistance — Watch for Range High Deviatio

ETH has rallied strongly and is now testing the range highs around $4,100.

The most likely scenario is a direct tap or wick above the range highs — this is a classic spot where the majority expects continuation, but also where deviations (fakeouts) frequently occur.

If price closes above and holds, it could trigger further upside. However, the risk/reward (RR) for fresh longs here is not attractive after such an extended move.

A deviation above range high (quick push above, then close back inside) is possible and would be a bearish signal in the short term.

After this wave, any deep dips in ETH will likely be a high-conviction buy, given the strong bullish momentum.

ETH is showing extremely bullish momentum as it approaches a major weekly resistance at the range high. The obvious play here is a sweep or break of this level, but with the move being so extended, a deviation or fakeout becomes increasingly likely. While momentum is still up, waiting for a dip or failed breakout (deviation) is a better risk/reward play than chasing longs here. Any meaningful pullback will likely present an excellent buying opportunity given the macro strength.

Two zones to long the SPX500Hello Traders, there are 2 zones that you can enter market.

the first one is between 5980 and 5950. If it coincides with Bollinger lower band, it could go up more sharply.

in that case top of red bearish channel could be considered as the 1st tp.

The 2nd option available after breaking the top zone, in reverse to 6132 we could enter the market again. Remember that again Bollinger band could help us to confirm the long trade. 6240 could be used as TP, as well as the higher band of Bollinger band is a good place to take profit.

10% PUMP Incoming If...Keeping an eye on $GRASS here. Once level is #reclaimed, 10% pump to next #resistance more likely.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

BIGTIME/USDT: LOW RISK, HIGH REWARD TRADE SETUP!!Hey everyone!

If you're enjoying this analysis, please give it a thumbs up and follow!

BIGTIME is showing strong potential! It’s forming a descending triangle and has created a confirmed deviation. Currently, it’s bouncing off the lower trendline of the triangle, presenting a solid buying opportunity. Consider entering here and adding more on dips.

Entry range: CMP and accumulate up to $0.106

Targets: $0.121 / $0.132 / $0.149 / $0.175 / $0.20 / $0.222

Stop Loss (SL): $0.0965

Leverage: 2x - 4x

What do you think of BIGTIME's current price action? Are you spotting a bullish setup? Share your thoughts and analysis in the comments below!

FTM/USDT LTF RANGELocally, I'm considering the formation of a sideways range between the 1-hour order block (OB), with targets below for a partial and full fill of the 4-hour fair value gap (FVG) imbalance, followed by a growth reaction. If there is consolidation above the local support level (SUP), I anticipate a sweep of the upper liquidity pools, a cover of the 4-hour order block (OB), and then a downward price movement to capture the lower liquidity pools.

NFP/USDT: READY FOR AN ATH! 6X FROM HERE!!Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

NFP looks good here. Forming a falling wedge-like structure in the daily time frame confirms its deviation below the trendline and gets back inside the wedge which is a bullish scenario. Buy some now and add more in the dip.

Entry range:- $0.28-$0.31

Targets:- $0.43/$0.58/$0.76/$1.12/$1.44/$1.84

SL:- $0.20

What are your thoughts on NFP's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

FIL/USDT READY FOR AN ATH!Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

FIL looks good here. Forming a bull flag-like structure in the daily time frame and confirming, it's deviation.

Also, fundamentally it is a solid coin. Buy some here and add more in red days.

Entry range:- $4.0-$4.6

Targets:- $5.2/$6.4/$8.1/$9.8

Invalidation: Daily close below $4

What are your thoughts on FIL's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

DOT/USDT: Potential Breakout from Falling Wedge?Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

DOT/USDT looks good in the daily time frame. Forming a falling wedge-like structure here and trying to break it out. A successful breakout will take the price to bear ATH. Buy some here and add more in the dip.

Entry zone:- $6.04-$6.48

Targets:- $7.4/$8.8/$10.5

SL:- $5.7

What are your thoughts on DOT's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

BTC run commencesBTCUSD has dipped of recent days after been range bound for several months.

It has seen a lot of selling pressure over the last week, while the bears have had some control. However, bears haven't been strong enough and price has failed to break through a key support level around 60,5 that has kept this rally in strong bull territory.

Mt Gox news should have given bears enough ammunition to break this level, but was stopped by bull market indicator at the 200 ema.

As long as the 200 ema holds we remain in strong bull territory and this deviation at a key support level and rejection at 200 ema confirms for me that prices want to go higher.

RSI has dipped into oversold territory, coinciding with the bounce.

Invalidation currently sits at 57,3 while we target the mid 80's with partial profits to be taken around ATH.

#BTC: Upward Trend Emerging? Breakout from Falling Wedge PatternHello everyone! If you enjoy this content, please consider giving it a like and following for more updates.

Great recovery so far! After a quick dip to $56k, Bitcoin has shown some resilience.

As you can see on the chart, the price surged above the crucial resistance level of $62k, potentially confirming a bullish reversal or deviation. Additionally, the breakout from the falling wedge pattern adds further bullish technical momentum.

Based on this pattern, we could potentially see a price increase towards the previous high of $73,400. However, it's important to note that this is just a possibility.

Invalidation of this bullish scenario: A daily close below the $62k level would weaken the current bullish momentum. ⬇️

What are your thoughts? Share your technical analysis and insights in the comments below!

YFI Huge Fakeout ! Yearn Finance (YFI) has orchestrated a strategic move, executing a feigned breakout from a descending triangle—a bullish pattern that saw a swift sweep of the $14,000 level. In this analysis, we unravel the narrative behind YFI's tactical retreat, its implications, and the anticipated journey back into accumulation.

Chart Analysis: The Intricate Dance of YFI

YFI's recent price action presents a nuanced storyline on the charts, characterized by a false breakout and a subsequent retreat into a potential accumulation zone.

Key Observations:

Feigned Breakout from Descending Triangle:

YFI exhibited a false breakout from the descending triangle, creating an illusion of bearish momentum.

The rapid sweep of the $14,000 level marked a calculated move to trigger liquidity.

Retreat into Accumulation:

Following the feigned breakout, YFI is retracing back into what appears to be an accumulation zone.

Accumulation zones are often strategic areas where institutions and savvy traders gather positions.

Critical Levels: YFI's Recharge at $14,000

Strategic Retreat and Accumulation:

The retreat from the false breakout aims to accumulate positions at a key level.

$14,000 emerges as a critical zone for replenishing liquidity and preparing for the next move.

Potential Scenarios: YFI's Journey Back to Prominence

Accumulation and Strategic Reentry:

The retreat into the accumulation zone sets the stage for strategic reentry.

Savvy traders may position themselves within this zone, anticipating a renewed bullish surge.

False Breakout as a Tactical Move:

YFI's false breakout could be interpreted as a tactical move to shake out weak hands.

The subsequent accumulation phase may serve as preparation for a more sustained bullish advance.

Trading Strategy: Navigating YFI's Tactical Landscape

For traders considering YFI in their strategy:

Accumulation Zone Entry: Assess entry opportunities within the identified accumulation zone.

Monitoring $14,000 Level: Keep a close eye on the $14,000 level for potential confirmation of strategic moves.

Risk Management: Implement risk management strategies to navigate the inherent volatility.

Conclusion: YFI's Strategic Maneuver and the Road Ahead

As YFI retraces from its feigned breakout, the narrative suggests a strategic accumulation phase underway. Traders are poised for potential bullish movements as YFI recharges at the $14,000 level, highlighting the intricate dance between feints and strategic positioning in the crypto arena.

🚀 YFI Analysis | 🛡️ False Breakout Tactics | 🔄 Retreat into Accumulation

❗See related ideas below❗

Share your insights and analyses on YFI's tactical retreat in the comments, contributing to the collective intelligence of the crypto community. The journey through false breakouts and strategic retreats adds layers of complexity to the YFI saga. 🌐📈🚀

29.5K PIVOT POINT After many days of sideways choppiness between 29 & 29.5K. The pattern was broke sending us into that FVG I have mentioned in previous posts with a target of 26.5K. However, having dropped down to 28.5k and back up to 30k in 11 hours some volatility has been reintroduced into the market in the short term.

I have mapped out a mini range that I am observing, the 29.5K pivot is still the controlling factor in my mind. Now that price has deviated above and is now back in range printing a SFP, in addition to a bullish orderblock that is providing a reaction as the time of writing this post. I still think we have some downside to come should this reaction now clear the pivot point of 29.5K

Because of this, I am still confident that reaching the 26.5k target is possible. Regaining 29.5k confidently and proof that it is now support would make me reconsider this strategy.

BTC UPDATE!!Nothing changed for BTC yet. After the deviation above the $31.4k level price came back again in the consolidation range.

Upside liquidity was taken, now expecting the price to go below the $29.5k level in order to gather the liquidity from opened LONG positions and then fly upwards with the $31,000 confident breakout.

$28k- FWB:29K is a good zone to go long with a tight invalidation. If we lose the $28k support then we might see another dump up to the $24k- FWB:25K area.

This is my simple plan. Share yours in the comment section.

If this idea is helpful for you, then hit the like button and also press the follow button if you haven't yet.

Thank You!

BTC Looking for deviation.BTC has traded into local range highs. On higher timeframes BTC is sitting around 12 and 21 weekly ma's. On lower timeframes it has already broken below these. Expecting price to deviate/reject on daily timeframe above local range high here and then revisit the range lows.

Looking for entry at an underside retest of 27460 and will look for first a T.p at 26600 and second t.p at 25900...

alternatively of price retests this range high and stays/reclaims above, then i will look for long positions towards 29k