$NOC or Notice of change, we are heading down!Northrop Grumman Corp

Technicals

1# 20 Crosses 50 Moving Average in a downwards fashion. Stayed under since October 19th.

2# Price close to 200 Moving Average

3# Lots of distribution within the Descending Triangle, aka bearish formation and Big selling blocks!

4# Higher Bullish volume the recent days, could lead to a false breakout to 360$

Relevant

# Received recent upgrades from Morgan Stanley 449$ PT

# Consensus Analyst Price Target 400$ Based on 7 analysts.

# Insider SELLING, lots of it throughout the year.

Distribution

For Hodlers : Distributional Buy Signal for This WeekThis week can be a nice opportunity to lower your average.

Especially those with a higher buying average than 268.34 should watch this week very carefully.

If you missed under 268.34, don't buy and watch because parity may fall more.

But I do not recommend buying on the first day because the price may become cheaper, it should be carefully monitored.

But I would recommend buying if 10-20 percent of hot money from outside . ( My suggestion : %15 of hot money from outside .)

No one can guarantee that prices will not fall further.

Good week to all investors and traders !

Note : This trade contains no leverage and most suitable for heavy load ( current price <= average cost ) investors.

Or it is suitable for investors who have a lot of hot capital more than the size in that position.

In related ideas, you can see the logic of this trade.

S&P 500 STRATEGIC OVERVIEWStrategically the support resistance levels in S&P 500, the channel entered the index,

and here we can observe the distributional sell signal from last week for this week (current bar).

Do not forget to read the notes in the presentation.

In summary, this week has been affected by distributional sales and I think it will continue until the closing.

We have been under the influence of the positive trend since October 21st.

There is no mention of a bear market.

JSE:AFT Afrimat DistributionIt looks like Afrimat is being distributed. Following the Wyckoff logic, we have likely seen an upthrust of distribution (UTAD), a test to the UTAD and am now looking for the markdown in phase D. The distribution started after a throw over of the overbought line forming a buying climax (BC), automatic reaction (AR), secondary test (ST) in phase A. Some volume of the highs and divergence on the volume RSI gives some indication that this is distribution. Looking for a break of the upward stride to go short.

History is a guide, NKE needs to dropFrom Nike's history we see that almost all gaps get filled on this stock. Three randomly chosen shaded horizontal rectangles represent three gaps (there are many more) that all got filled eventually. Recently price action has been "sloppy" with wide gaps being made which will surely be filled sooner or later, there is also one at 84.83 which I have labeled which never got filled. Further we see that a recent Cup and Handle that has formed has almost reached it's target price in the low 98s and I will probably be shorting there unless there is strong volume supporting any move higher. Last but not least from the angled trend lines we see relatively string divergence indicating that institutional investors are more likely than not disposing of the stock. Earnings on Dec. 19th will be interesting. Please leave any comments or ask questions.

Improved Version : How Do "Whales" Trade ? CAUTION : EXPERIMENTAL

Hello friends.

Whale trading system has been developed and placed on a more reasonable ground.

So this publication is an improved version of the educational idea : How do "Whales" Trade?

Before Starting

In related ideas, you can see the first version and the script I used to create this idea.

And there is an intermediate version that shows the logic after separating the bull - bear zones.

RULES

First of all, there is absolutely no short position to reduce the risk of this system.

Negative regions are sales regions. (Not short position)

Position sizes are shown in the presentation.We split our capital 100 . (Or you can accept your entire position size 100.)

We certainly don't try with all our capital.

It can be tested with reasonable capital allocated for instruments.

At each change of region, we dispose or purchase all of our position size.

And the values in the presentation are our graded position amounts .

Now that we've benefited from regional changes, I found 10 levels reasonable.

Let's write our position sizes here too :

STAKES

Pos Size 1 : % 0.4329

Pos Size 2 : % 0.8658

Pos Size 3 : % 1.2987

Pos Size 4 : % 2.1645

Pos Size 5 : % 3.4632

Pos Size 6 : % 5.6277

Pos Size 7 : % 9.1

Pos Size 8 : % 14.719

Pos Size 9 : % 23.81

Pos Size 10 :% 38.52

Note : Position size ratios are formed by coefficients based on gold ratio to provide a logical example.

Let us now examine the region from January 22, 2018 to August 26, 2019.

I'm doing trade and distributional trades for 1 bar after eye decision and signals to be fair.

TRADES AND TRICKS

After the sell order arrives on January 22, we wait until distributional buying points arrive.

First distributional Buy Signal was on 7 May 2018 (close ) , so it means : Our first Distributional Buy was between 7 - 14 May 2018.

Let's start :

Distributional Buys :

1.Buy : 8572.5 Position Size : %0.4329

2.Buy : 7847 Position Size : %0.8658

3.Buy : 7456.5 Position Size : %1.2987

4.Buy : 6563.5 Position Size : %2.1645

5.Buy : 6786.5 ==> Rejected , because price is higher than last Buy.

5.Buy : 6507.5 Position Size : % 3.4632

6.Buy : 6396 Position Size : % 5.6277

7.Buy : 5837.5 Position Size : %9.1

8.Buy : 3940 Position Size : %14.719

9.Buy : NET Long Signal : 3493.5 Position Size : The Rest ==> (100 - All) = %62.328

Distributional Sells

1.Sell : 10919 Position Size : %0.4329 (May be higher than the amount of earnings. For example : % 25

Here we are improvising according to obligatory market conditions.

I wrote the first rate in order to follow the example rule, but I would sell between 25% and 40% in live trade.

Because the profit is too high.)

2.Sell : 10146 Position Size : %0.8658 ( Normally I shouldn't have sold it because it was lower than the first sale.

But the profit is still very high, but it is decreasing, so I sell.

A much higher quantity can be sold here, as is the same on the top.

I'm writing the next rate to keep the rule.)

3. Sell : 11376 Position Size : % 60 ( Now profitability is at its peak , I ignore the stake rules and going to improvise.

Instead, the first 3 - distributional sales: 10% - 20% - 40% with values such as making it much more reasonable.)

4.Sell : NET Sell Signal : 9970.5 Position Size : The Rest ==> (100 - All) = %38.8

Note : I could have gone a lot more profitable than my earnings, but to avoid stretching the template, I applied the first 2 ratios.

A professional could have been more profitable here: Example: 40 - 60 and close.

So I'm going to calculate these rates.

CALCULATIONS ( For 100 unit = Full Position Size )

Average Cost : (8572.5 * 0.4329 + 7847 * 0.8658 + 7456.5 * 1.2987 + 6563.5 * 2.1645 + 6507.5 * 3.4632 + 6396 * 5.6277 + 5837.5 * 9.1 + 3940 * 14.719 + 3493.5 * 62.238) / 100 = (3711.04 + 6793.93 + 9683.76 + 14206.7 + 22536.8 + 35994.77 + 53121.25 + 57992.9 + 217428.5 ) / 100

Average Cost = 4215

Average Sell : (10919 * 0.4329 + 10146 * 0.8658 + 11376 * 60 + 9970.5 * 38.8 ) / 100 = (4726.84 + 8784.41 + 682560 + 386855.4) / 100

Average Sell Price = 10829.27

SUMMARY

Percentage of net earnings per unit (Full Position Size): ((10829.27 - 4215 ) / 4215) * 100 = %156.92

In doing so, commercials provided liquidity to the markets and did not have the problem of not finding buyers.

Stoploss here means emptying the whole position, for me 4 bars means stoploss in all directions.

More importantly, increasing rates will not harm us in non-trend areas.

Because we start with low rates.

Although comments and improvisation are very important, I tried to explain the system outlines by linking them to certain rules.

Now we have gone more systematically than the first version !

Accumulation is waving bye byeHere is my personal opinion, this is a wave of accumulation by those who see the real use case of XRP, and those who enter now can reap the best profits. Im all in LONG til end of next year, where i should be just fine.

-All the best saith the guy on the ferry leaving the dock, either we sink and i swim out or eaten by the whales, and i just go JONAH on them...

.2221 is ok, but ill be looking for anything below that

Thank you for liking, but commenting is best, either in or against this thought

Some informational videos to see on youtube showing good use cases and news others dont want you to see

I have no affiliate but just sharing some common sense logic and research by some good people

www.youtube.com

www.youtube.com

www.youtube.com

India is on the verge of collapsingFUD & HOPES all mixed up, not just changing every week now.

On a daily basis.

Different sources even say opposite things.

Trade war & HKG good or bad news on the same day.

No direction it's all coinflip.

India has a weaker rupee and a weak industrial output.

So a catalyst to reverse. There is enough FUD to sell.

Maybe US indices push it higher, I am long DJI.

If DJI pullsback Nifty should too and I'll get money there.

No call on the Nifty or India long term.

The Importance of Distributional MovementsWe identified trade zones. Now I'm going to look at how far the distributional buying and selling points are.

The same logic applies to the short position. We can set a stable stop-loss and exit position before waiting trade zone change. I have a good idea of position size, but what is difficult is how many distributional orders come in a trade cycle. I will determine them by looking a lot of samples and will find out optimum distributional ratios. Once i have identified them, i will be presenting you with a new idea, and it will be the highest level of this series. Regards.

Shakeout/spring vs Drop after distribution On the left we have the coinbase 4hr chart from October.

You can see the shakeout drop from 7990 to 7300

There is a spike in volume which acts as a spring to pump price to 10540

On the right we have the coinbase 4hr chart from November.

Don't be fooled in to thinking this is the same price action.

After distribution finished, the price dropped.

Slowed by the moving average, walls on exchanges to encourage people to long.

Compare the volume profile.

So far there is no volume here and once enough leveraged longs are in, I expect the drop to continue.

There could be a small rise to liquidate bottom shorters, in which case I would be looking at 9030-9070.

How Do 'Whales' Trade ? Hey! Now calm down and erase all of your coffee fortune-telling stories, throw the pump and dump signals you've been waiting for!

You can only draw trend lines and long-term channels.

If you're still not mad at me, we're starting now !

Trade is a relative concept and the buyer meets the seller relatively.

Therefore, trendlines and channels can provide little information about trendlines in relatively time-dependent breaks.

I am not a licensed broker at first, but I spent a lot of time in the CFTC and COT section, especially in interpreting Commercial positions with all other relative indicators and volume.

The so-called concept of the whales in recent times is actually producers and owners of large official capital.

They have to divide the amount of sales they find in their sales because the positions they carry are huge.

While the price is falling while buying, they have to make gradually while the price is rising.

Or they will not find buyers for their goods.

Now we will consider a trade cycle with reasonable figures in the figures you see in the picture.

We are doing it first bar after signal with average price as real trade :

Example Rule : Our position size : Last block * 1.5

Distributional Buy Blocks :

1.Buy point = 1298.3 ( Position size = %1 )

2.Buy point = 1214.1 (Position size = %1.5 )

3.Buy point = 1194.5 (Position size = %2.25 )

4.Buy point = 1193.1 (Position size = %3.375 )

Cost = (1298.3 * 1 + 1214.1 * 1.5 + 1194.5 * 2.25 + 1193.1 * 3.375) / 8.125 = 1210.4

Distributional Sell Blocks :

Example Rule :

Let's divide our sales into same levels according to our expectations.

But in risky places that we think to be a definite negative trend, let's definitely empty our position and not carry a position.

If the negative trend came after the first sale, then let's clear it all.

All experts draw channels and trends for this.

(I started using my high-end system, but channels and trend lines are still important, because I think everything that shows relativity in trade is very important! )

Our buy levels was 4 and sum of ratios = 8.125

1. Sell block = 1 / 8.125 = %12.3

2. Sell block = 1.5/ 8.125 = %18.46

3. Sell block = 2.25 / 8.125 = %27.69

4. Sell block = 100 - (1.sell block + 2.sell block + 3. sell block ) = 41.55

Finally : Sell Points

1. Sell point = 1223.923 (3 consecutive purchases were shortened in one buy , If I had sold 3 times in a row, my wife would have been much higher because the rate would have increased in the hills, but the sample would have been too long.Although I use a very successful system, I divide it into 10 and I empty all of them in the definite negative trend.You may divide by 15 or 20 with distributional buy too or decrease dist ratio.Here you can not sell anywhere in the whole position can be seen when you see the negative signs, I do not prefer only as a stoploss I use this last safety.)

2. Sell point = 1243.57

3. Sell point = 1285.67

4. Sell point = 1310.93

Average sell point : (1223.923 * 12.3 + 1243.57 * 18.46 + 1285.67 * 27.69 + 1310.93 * 41.55 ) / 100 = 1280.798

RESULTS :

Net profit = ((1280.798 - 1210.4) / 1210.4) * 100 = 5.816

As a result, our senior investor has already increased per unit 5.8 percent in a short time.

In doing so, commercials provided liquidity to the markets and did not have the problem of not finding buyers.

Stoploss here means emptying the whole position, for me 4 bars means stoploss in all directions.

I will adjust the rates and use it in real ideas and real trade.

Stay tuned! Noldo.

EURGBP - POTENCIAL WICKOFF DISTRIBUTION SCHEMATIC 10/2019Hello Traders,

it looks like we are on higher TF in distribution phase on this particular pair, so we gonna expect long term bearish movement.

Hopefully this example will help u identify Wickoff schematics on chart, cause they keep printing over and over again on all time frames..

Understanding market structure is the key so we are focusing on this type of analyses.

God bless u all !

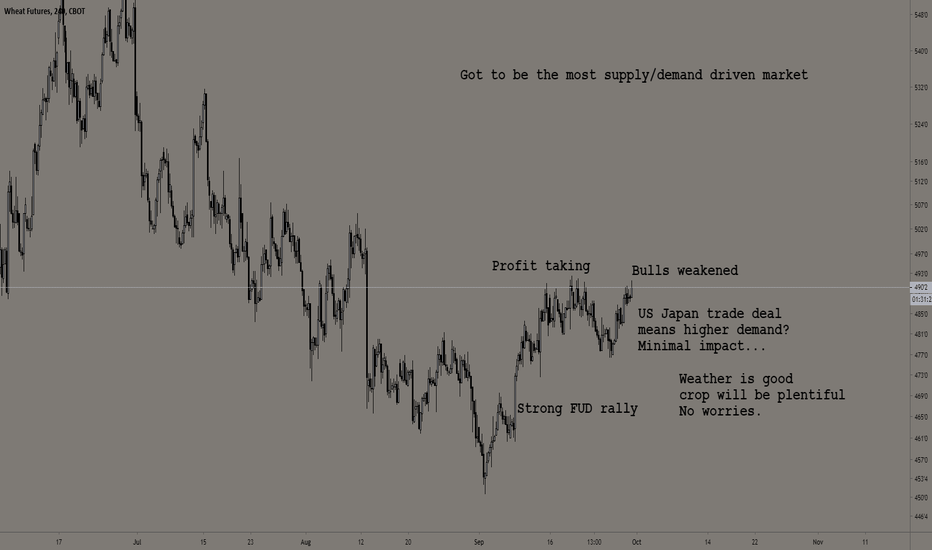

Bearish on grains & wheatBeen a while since I posted about agri.

Price is around its average now, I see no reason for it to skyrocket.

I don't think this little rally is a new trend, I see it as a correction.

And the short term uptrend is probably just noise that kindly comes fill my shorts.

Technically the price around 490-495 is a sweet spot to short this which makes it interesting.

We let the amateurs trade everything to make sure they don't miss out.

Market can stay irrational longer than you stay solvent so use a stop loss.

And also, it's not 100% sure the price is supposed to go down, might be wrong.

So in any case, stop loss (or something else) is good.

Bitcoin has now broken below 9k. Were you surprised?If you guys saw my other BTC post (link: ) then you would know I had been mentioning this distribution schematic for some time, and we have now broken below 9k giving it a lot more validation. We are now trading under 8750, and price is looking quite bearish. I think this 8k range might be just a temporary stopping point before we eventually head down into the 7k region. The 9k region should act as a major resistance level now as well. Also, for any crypto traders out there, Binance just launched their US exchange (Binance US.) If you need a link to go sign up, click here--> www.binance.us

-This is not financial advice. Always do your own research and own due-diligence before investing and trading, as for investing and trading comes with high amounts of risk. I am not liable for any incurred losses or financial distress.

My favorite kind of top (and bottom)Screenshots will be better than words:

I only trade tops & bottoms (accumulation & distribution, supply & demand), and I select good ones.

The "rectangle" type is my favorite.

"Continuation flag" they said. I always go opposite.

Use other filters, the price action pattern is just here to pull the trigger. Use stop losses.

Road Map Cypher Trading System by Charter XHello,

This is a System I have developed after months of case studies to trace a map when price reach Buying Climax (BC) on a Wyckoff Distribution System or just a simple BC.

I'm pretty sure that all of you have wondered sometime where do the measures come from after BC and where will the price could go. Well if you have never asked that question maybe this is the moment, and if you do, this is the possible answer.

This study and research i have been doing is based in the study of Fractals or Harmonics that takes place in trading. Measures are done using Fibonacci Retracement tools and with the help of Chuvashov Fork System to verify some of the stages after Wyckoff Distribution System.

I usually use Cypher tool for representations as you could probably have seen in previous analysis. If you have not, i invite you to take five minutes of your time and check other analysis (like XAUUSD for instance). But i believe this will be an easier way to visualize it. It is not easy to detect fractals at simple view since they may vary in different time frames.

Take in count that if one of the points are broken, it probably means that the fractal in Stage 0 could have been miss calculated, or the time frame is not the right one, or as simple as it has been a mayor change in market due external causes.

I would try to use this case on XBTEUR as a sample to explain how it works along time.

I hope this helps you out on your tradings and gives you a little bit more of knowledge about Harmonics, Fibonacci Retracement, Chuvashov Fork, Wyckoff and other systems and tools, all combined in one.

Cheers!

Charter X

PS: I leave you the first snapshot to keep track.