ProShares UltraPro QQQ (TQQQ) LONGThe Technology Sector Continues to Break Records

The tech sector keeps setting new highs, and alongside individual stocks, it's a great idea to consider investing in an ETF that mirrors the profits of the NASDAQ 100 index. One of the most attractive options is TQQQ - it’s more affordable than the index itself, yet offers similar growth potential aligned with the entire tech sector.

I expect continued growth through the end of the year, assuming the geopolitical landscape remains relatively stable.

From a technical standpoint, those looking to minimize risk might prefer to wait for a retest of previous highs. However, my approach is to gradually build a position both before the breakout and after the retest of the highs.

A classic technical analysis pattern -the cup formation, also supports the bullish case for entry. As George Soros wrote in his book: “What moves the market : our expectations or the events themselves?” I’d say it’s both. The key is not to miss the wave.

P.S. Don’t forget: with TQQQ, you also receive dividends - a nice bonus while riding the trend.

Dividendstocks

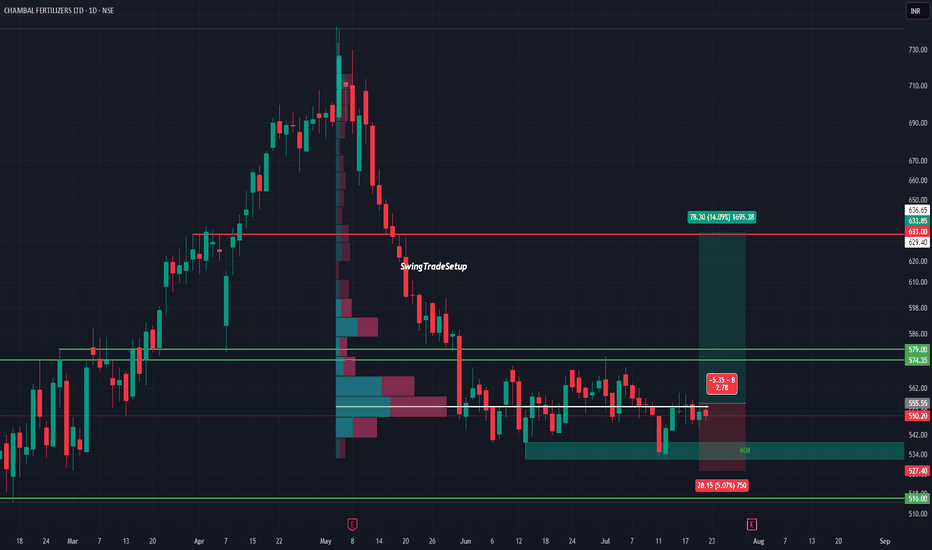

CHAMBAL FERTILISERS LTD – Potential Bottoming Out‽CHAMBAL at Demand Zone | Volumes story

After a steep fall from 730 to 516, Chambal is now consolidating in a critical demand zone backed by visible volume activity. This range has previously triggered price reversals, and now history might repeat.

The stock is respecting the support between 527–516, forming a potential base. On the upside, a clean breakout above ₹555.55 can unlock a near-term target of 633+, a move of over 14%.

The risk-to-reward ratio remains attractive with a tight invalidation below ₹527, while the volume profile suggests accumulation in this range.

Technical View :

• Major support: ₹516–527

• Breakout trigger: ₹555.55

• Upside target: ₹633–636

• Risk below: ₹527

• Volume profile: Dense node suggests buyer interest

Valuation :

• PE: ~10.3 (undervalued vs peers)

• Dividend Yield: ~6.5% (steady income potential)

• Promoter Holding: 60.62% (strong & stable)

• No recent equity dilution

• DII/FII: Activity neutral, could turn if technical align

A good mix of fundamentals, attractive valuation, and technical structure makes this a stock to keep an eye on. If it crosses ₹560 with volume, it may kick off a short-term trend reversal.

This chart is for educational use only and not a buy/sell recommendation.

PEP: Long Buy OpportunityPEP is about to touch the 200 Monthly Moving Average. This last 2009.

The RSI is touching less than 30, which last happened in 1973.

PEP is a Dividend King which has increased it's dividend for 53 years. Did Warren Buffett say compounding is the 8th wonder of the world? Oh no, it was Einstein.

Evidence suggests great Long Term BUY opportunity on the price and momentum signals. Compelling.

#PEPSICO (PEP)

Czech Republic: A Dividend HeavenThe Prague Stock Exchange (PSE) PSECZ:PX is characterized by a concentration of mature, dividend-paying companies, particularly in sectors such as energy, banking, and heavy industry. Unlike growth-focused exchanges in the U.S. or Asia, the Czech market offers relatively few stocks with high reinvestment or expansion trajectories.

Preference for Payouts

Over the past two decades, Czech listed companies have consistently distributed a significant share of profits as dividends. This reflects both limited reinvestment opportunities in a relatively saturated domestic market and a shareholder preference for cash returns. For example, CEZ and Komercni banka have maintained payout ratios above 70% in most years.

Structural Support & Tax environment

The Czech Republic provides a structurally supportive environment for dividend-oriented investors. One key advantage is the tax framework. Czech residents are exempt from capital gains tax if they hold an investment for more than three years. This strongly favors long-term investing.

For non-residents, a 15% withholding tax on dividends applies—unless the investor resides in a country outside the EU/EEA that does not have a tax treaty or tax information exchange agreement with the Czech Republic.

Key Dividend-Paying Companies

CEZ (CEZ) PSECZ:CEZ

Industry: Energy (Electricity generation and distribution)

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 34 10.1%

2021: CZK 52 5.8%

2022: CZK 48 18.83%

2023: CZK 145 5.43%

2024: CZK 52 5.9%

Dividend Growth:

2020 to 2021: +52.9%

2021 to 2022: -7.7%

2022 to 2023: +202%

2023 to 2024: -64.1%

Komercni banka (KOMB) PSECZ:KOMB

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 23.9 3.63%

2021: CZK 99.3 10.62%

2022: CZK 60.42 9.22%

2023: CZK 82.7 11.41%

2024: CZK 91.3 10.76%

Dividend Growth:

2020 to 2021: +315.6%

2021 to 2022: -39.2%

2022 to 2023: +36.9%

2023 to 2024: +10.4%

Moneta Money Bank (MONET) PSECZ:MONET

Industry: Banking and financial services

Dividend History (Gross per Share) / Dividend Yield (%)

2020: CZK 0 (dividend suspended)

2021: CZK 3 10.67%

2022: CZK 7 10.53%

2023: CZK 8 12.82%

2024: CZK 9 8.08%

Dividend Growth:

2020 to 2021: N/A

2021 to 2022: +133.3%

2022 to 2023: +14.3%

2023 to 2024: +12.5%

Unipro UPRO Stock Technical Analysis and Fundamental Analysis📊 Technical Analysis of Unipro ( RUS:UPRO ) Stock

Current Price: 2.043 RUB (+2.46%)

Trend: The stock is in a growth phase, but signs of overbought conditions are emerging.

RSI (14): 78.91 (overbought, possible correction ahead)

MACD (12,26,9): +0.13 (bullish signal, but a reversal is possible)

Support Levels: 1.95 RUB and 1.80 RUB

Resistance Levels: 2.10 RUB and 2.30 RUB

Entry Points:

A pullback to 1.95 RUB may be a good opportunity for long positions.

If the price consolidates above 2.10 RUB, further growth toward 2.30 RUB is likely.

Stop-Loss: 1.85 RUB (if breached, the trend could reverse downward)

📈 Fundamental Analysis

Financial Performance:

Revenue remains stable, but growth rates are slowing.

Net profit declined in 2024 due to rising operating expenses.

Debt burden is low, ensuring resilience to macroeconomic shocks.

Impact of the Russian Central Bank:

The high key interest rate is limiting market capitalization growth.

Investors are waiting for rate decisions—any cuts could accelerate stock growth.

Dividends:

Expected to remain at 6 RUB per share.

Dividend yield remains attractive for long-term investors.

Macroeconomic Factors:

External sanctions and political risks may influence business growth.

A potential IPO of RTK-DPC (a Unipro subsidiary) could strengthen the company’s financial position.

🔍 Conclusion

Short-term: The stock may experience a correction due to overbought conditions. The best entry point is around 1.95 RUB.

Mid-term: If the price consolidates above 2.10 RUB, growth toward 2.30 RUB is likely.

Long-term: Unipro remains attractive for investors focused on dividends and stability.

❗ Keep an eye on Russian Central Bank decisions and overall market sentiment.

HOME DEPOT ($HD) Q4—HOME FIXES SPARK A SURGEHOME DEPOT ( NYSE:HD ) Q4—HOME FIXES SPARK A SURGE

(1/9)

Good afternoon, TradingView! Home Depot ( NYSE:HD ) is buzzing—$ 39.7B Q4 sales, up 14.1% 📈🔥. Extra week and SRS deal fuel zing—let’s unpack this retail giant! 🚀

(2/9) – REVENUE RUSH

• Q4 Sales: $ 39.7B—14.1% up from $ 34.8B 💥

• Full ‘24: $ 159.5B—4.5% rise from $ 152.7B 📊

• Boost: $ 4.9B from 14th week

NYSE:HD ’s humming—fixer-uppers unite!

(3/9) – EARNINGS GLOW

• Q4 EPS: $ 3.13—beats $ 3.03 est. 🌍

• Net: $ 3.0B—up from $ 2.8B 🚗

• Dividend: $ 2.30—up 2.2%, juicy 🌟

NYSE:HD ’s profit shines—steady cash!

(4/9) – BIG PLAYS

• SRS Buy: Pro segment zaps growth 📈

• Comp Sales: +0.8%—first up in 2 yrs 🌍

• Stores: 12 newbies—expansion zip 🚗

NYSE:HD ’s flexing—home king reigns!

(5/9) – RISKS IN VIEW

• Housing: Rates, $ 396.9K homes—yikes ⚠️

• Inflation: Wallets tighten—sting 🏛️

• Comp: Lowe’s nips—tight race 📉

Hot run—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• Lead: $ 159.5B—top dog 🌟

• Comp: +0.8%, 7.6% trans. jump 🔍

• SRS: Pro cash flows—steady juice 🚦

NYSE:HD ’s a retail beast—rock solid!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Housing drag—boo 💸

• Opportunities: Rate cuts, SRS lift—zing 🌍

Can NYSE:HD zap past the risks?

(8/9) – NYSE:HD ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Growth shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—Housing stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:HD ’s $ 39.7B Q4 and SRS spark zing—$ 159.5B year hums 🌍🪙. Premium P/E, but grit rules—gem or pause?

MBSB Cup & Handle Formation in the MakingShort term MBSB could be heading to support area around 0.700

If Cup and Handle pattern forms, TPs are the greenline marked on the chart.

Dividends have been good from this stock, plus it's a Banking stock.. with interest rates stable and potentially going down from here, loans are going to be cheaper and banks profit will grow Q-on-Q. It's also one of the only two Banking stocks that are Shariah Compliant.

I am looking to add position at 0.690 (support area) and keep it on my portfolio long term.

Continuation of the Trend Bullish Divergence on the annual time frame indicating a continuation of the annual trend targeting $300.

Oversold stochastic showing that bears are loosing control and bulls are entering the market gaining the opportunity to earn some sweet dividend pay outs.

RSI indicating Market exhaustion the the downside is over and a bull run is beginning and will continue for the weeks and months ahead.

Enter: $206

SL: $180

Target 1:$250

Target 2: $300

BOUNCE FOLLOWED BY LOWER PRICES FORECASTEDWhile the higher degree long-term outlook for this dividend giant is bullish, the short-term outlook is not likely to bring new all-time highs. Earlier this year we anticipated new all-time highs, but that changed when KO hit it’s 63.18 low last week. What changed the forecast was the technicals surrounding that low. While the price action is currently cooked to the downside, there are no clear indications of a reversal, with the weekly RSI indicating more room to the downside, and the MACD supporting that theory. This tells us to turn to the most telling indicator, which is volume, which indicates there is still strength to the downside. That said, we know the market does not move in straight lines and a strong bounce off the 63.18 low is likely. We currently forecast that bounce to target the round number zone of 70, forming a B-Wave rejection of higher prices, that will be followed by a C-wave, which will likely target the weekly point of control around 60. With that in mind, C-waves can truncate their targets, especially when the ticket involved is a popular long-term dividend target like KO, and we are talking about a long-term low that will create a significant buying opportunity. That said, if you can deal with the near-term volatility, the 63 zone may not be a bad entry zone.

LANKEM DEVELOPMENTS PLC : LDEV.N0000 : CSEOverview

LDEV is the parent company of AGARAPATANA PLANTATIONS PLC (AGPL.N0000) and 98% of group revenue of LDEV is from AGPL.

Strategy

1. Getting exposure to a probable interim dividend expected to be LKR 2.00.

LDEV subsidiary AGPL declared an interim dividend of LKR 1.00 payable on 28th Oct. 2024 which will generate LKR 239M as net dividend (after tax) proceeds for LDEV. As LDEV doesn't have bank borrowings we can assume this dividend receipt will be re-distributed as a dividend to LDEV shareholders. If the board decided to distribute the entire amount, it can be an interim dividend of LKR 2.00.

Assumption: Not deciding to utilize the proceeds in settling intercompany balances.

2. Getting exposure to a continuous dividend stream and exposure to one of the best performing plantation companies in CSE.

AGPL is currently with almost zero net borrowings. If tea prices remain @ current levels, we can expect the dividend stream will continue with enhancements.

EPS FY 2023 = LKR 1.20

EPS 1Q 2024 = LKR 0.71 (If tea prices remain @ current levels with current yields, we can assume a FWD EPS for FY 2024 = LKR 2.84)

Fundamentals

1. FY 2023 earnings

* FY 2023 EPS LKR 1.90

2. Q1 2024 earnings

* 1Q 2024 EPS LKR 1.52

* Assuming AGPL managed to maintain current earnings we can assume a FWD EPS of LKR 6.00 for LDEV. (FWD PE 3)

52 Week Price Range

High : LKR 23.90

Low : LKR 13.80

All time high LKR 38.90

Technical Analysis (Chart Patterns)

* LDEV had created a Descending Wedge pattern during the 2-year price correction and another wedge pattern during last 10 months of consolidation process. During last week both of these patterns recorded break outs.

Potential Pattern Targets

* 10-month consolidation wedge pattern target LKR 22.80

* 2-year descending wedge pattern target LKR 35.30

This is what Winner Stocks looks likeGreat stock for good returns. ADP's moat stems from its dominant position in the payroll and human capital management industry, which is bolstered by its extensive scale and network effects. The company's large customer base and integrated services create a significant barrier to entry for competitors, enhancing its value proposition. ADP's long-standing reputation for reliability and accuracy has built substantial customer loyalty, making it difficult for new entrants to challenge its market share. Additionally, ADP’s comprehensive suite of services, including payroll, benefits administration, and tax compliance, increases switching costs for clients. The company's ongoing investment in technology and data security helps it maintain a competitive edge, driving sustained financial performance and contributing to its high stock valuation.

CSCO Layoffs Positive for the StockNASDAQ:CSCO gapped up on its earnings report even though the company has failed to reinvent and failed to change to HyperAutomation in its IT departments quickly enough.

News of layoffs is considered a positive action on the part of the officers of the corporation who are responsible first and foremost to INVESTORS and cutting costs so that the company can slowly regain revenues and earnings for dividends for INVESTORS.

Delaying layoffs, which may be kind and thoughtful for employees, is a negative for INVESTORS, namely the giant Buy-Side Institutions, because it extends and worsens the financial condition of the company.

As more and more companies buy robots/robotics and AI technology, these will reduce payroll expenses and help to control internal business inflation, which is caused mostly by rising payroll expenses with declining productivity from the workforce of the company.

This is always misunderstood by retail groups who believe layoffs are a bad thing for the "economy." The world of commerce and the financial markets is not a fair or kind place.

GIS - Conservative Income PlayGeneral Mills has been gaining a bit of strength crossing above it's 20 week moving average. Volatility is dead flat.

Transacting a June 25 67.5 buy/write, in addition to a 3.5% dividend results in this play producing in annualized rate of return in excess of 12%.

I do this kind of strategy in a qualified account as dividends received in a buy/write transaction may not be considered qualified dividends. Be sure to seek the advice of an investment adviser before trading any of my ideas.

SUPREME INDUSTRIES TRADING IDEACup & Handle Breakout with good volume.

Stock can go as marked on the chart

Technicals

—Bullish Crossover

—Above 20 EMA

—Higher High breakout

—RSI 71

Fundamental

Stock P/E 44.2

ROCE 26.8%

ROE 21.0 %

Market Cap ₹38,226Cr.

educational purpose only!✨

Do your research before making any investment🥂

Bayer (BAYN): Is the Bottom Finally Here?Since our initial analysis in November, Bayer's stock has experienced a 40% pullback. Despite missing our limit order by 2%, we have decided to enter the market now and plan to make additional purchases if the price drops further.

The stock has held around the 88.2% Fibonacci retracement level. We are currently within the 50-61.8% Fibonacci extension zone for Wave 5, which aligns with our bottom outlook.

Our entry strategy involves making an initial purchase now, acknowledging the recent support levels. We plan to add to our position with multiple entries if the price drops further. Our stop-loss is set wide, at an additional 44% below our entry price, to accommodate potential volatility. This is considered a long-term swing trade, with an expectation of significant upward movement once the bottom is confirmed. This could be a knife catch here so please don't cut yourself too deep.

PG - A stock to buy for the long termFor long-term investors, Procter & Gamble presents a compelling opportunity due to its strong fundamentals and growth prospects. PG’s consistent financial performance, characterized by steady revenue growth and robust profit margins, underscores its resilience and ability to generate shareholder value. The company’s strong brand portfolio and market leadership in key product categories provide a competitive moat, ensuring long-term revenue stability.

The company’s strong balance sheet and cash flow generation capabilities provide a solid financial foundation for dividend growth and share buybacks while also investing in growth opportunities. For long-term investors, this translates to both income and potential capital appreciation.

AMZN Under Pressure to Offer a DividendInventory adjustments are underway for $NASDAQ:AMZN. These adjustments are minor as Dark Pools are holding AMZN long-term, but there are other opportunities to boost ROI in younger companies.

AMZN needs to provide a dividend now that it is a Dow 30 stock. The mild rotation is a gentle reminder to the Board of Directors from their most critical and important investors, the Giant Buy Side Institutions. AMZN is the only fortune 500 company on the S&P500 that doesn't provide a dividend YET. The company's CEO is seasoned and aware that the Board must soon offer dividends, as it is no longer merely a "growth" company.

The pressure is increasing to force a dividend by the Giant investors. This should happen this year. There are no buybacks going on right now either. So the lowering of inventory is a warning to get this done. The Buy Side has the clout to influence the Board's decisions. This would benefit all investors big and small.

The support is at the lows of the red box on the chart, as indicated by the gap down white candle that quickly ended the previous selling by smaller funds.

WHEN, not if, AMZN announces a dividend, there is likely to be some brief momentum activity to the upside.

$PFE on the moveVery clear picture on NYSE:PFE on a weekly timeframe

If it stays above the centre line, the trend is up and I have an initial target of around $35

If takes out the protective stock we have a continuation of the downtrend and this was just a minor upward correction.

Risk/Reward ratio 2.90

What's your take on NYSE:PFE from here?

Up or Down

Dividends Are Coming. S&P500 Annual Dividend Index FuturesA few months ago I started this research, research of Equity Index Dividend futures, provided by CME Group.

Well, sounds good. Let's continue..

Were you ready or not, but in February, 2024 Meta platforms (META) announced its first-ever in history cash dividend of $0.50 per share to be paid out on quarterly basis.

“We intend to pay a cash dividend on a quarterly basis going forward,” the company said in a release .

Meta stock surged for 20% after that amid other huge reasons.

Alphabet (GOOG) also issued first-ever dividend of 20 cents per share in April, 2024.

The news, announced alongside first-quarter earnings, helped to send the Google parent’s shares up 15%.

Dividend Market as well as Dividend futures trading shines bright.

Understanding Dividends and Dividend Market Futures

👉 A dividend is the distribution of corporate earnings to eligible shareholders.

👉 Dividend payments and amounts are determined by a company's board of directors. Dividends must be approved by the shareholders by voting rights. Although cash dividends are common, dividends can also be issued as shares of stock.

👉 The dividend yield is the dividend per share, and expressed as a percentage of a company's share price.

👉 Many companies - constituents of S&P500 Index still DO NOT PAY dividends and instead retain earnings to be invested back into the company.

👉 The S&P500 Dividend Points Index (Annual) tracks the total dividends from the constituents of the S&P 500 Index. The index provides investors the opportunity to hedge or take a view on dividends for U.S. stocks, independent of price movement, as S&P500 Dividend Index Futures is a market expectation of how many points Dividends Index will collect by the end of year.

👉 Using the S&P500 Dividend Index as the underlying in financial products, investors can hedge or gain exposure to the dividend performance of the S&P500 Index.

Understanding S&P500 Annual Dividend Index Futures

👉 The S&P500 Annual Dividend Index futures (main technical graph is for 2025 S&P500 Annual Dividend Index Futures) calculates the accumulation of all ordinary gross dividends paid on the S&P500 index constituent stocks that have gone ex-dividend over a 12-month period. The amounts are expressed as dividend index points.

👉 The underlying index for S&P500 Annual Dividend Index futures is the S&P500 Dividend Index. The methodology for the index can be found here at S&P Global website.

👉 Dividend index points specifically refer to the level of index points that are directly attributable to the dividends of index constituents. They typically only capture regular dividends and calculate this on the ex-date of the respective constituents within each index.

👉 In general, “special” or “extraordinary” dividends are not included as dividend points in the respective annual dividend indices.

👉 Futures contract Unit is $ 250 x S&P 500 Annual Dividends Index.

Technical considerations

🤝 Main technical graph (S&P500 Annual Dividend Index Futures 2025) indicates on strong bullish bias. Who knows, maybe at one sunny day even Tesla King, Elon Musk will unleash his E-pocket 😂

🤝 Happy Dividend Market Trading to Everyone! Enjoy!

SONAE: Fundamental figures too good to overlook. Time to buy?Fundamental Analysis

EBITDA: +7.2% YoY (to €990M in 2023)

Margin: 11.8% (-0.2 points YoY)

Net Income Group Share = 357 (+6.3% YoY)

PER: 1680 / 357 = 4.71 (heavily undervalued considering below data and historical PERs)

Net Gearing (Net Debt To Equity Ratio, ): 526/3462 = 0.15 (15%, Prudent)

Total Debt To Equity Ratio: 5383 / 3462 = 1.55 (around 1 to 1.5 is healthy according to British Business Bank's article "Debt to equity ratios for healthy businesses")

Current ratio: 2010/2502= 0.80 (not healthy and almost unchanged with respect to 2022, see next line. According to Wall Street Prep, 1.5 to 3.0 is healthy)

Net Debt to Ebitda = 526 / 990 = 0.53

Working Capital = -1220M€, keeps being negative. Very interesting article from eFinanceManagement explains the Advantages of Negative Working Capital for a cash-rich company whose operating cycle is fast (it may mean that they can bargain very well with their suppliers who provide the funds and the flexible time limit to pay).

Prev Current ratio (2022): 1938/2465 = 0.79

Proposed dividend for 2023: 0.05639€

EPS = 357M€ / 2000M = 0.18€/share (ATH?)

Current dividend yield = 6.19%

Dividend Payout Ratio = x 100 = 31%

Free cash flow Dividend payout ratio = x 100 = 60%

Technical Analysis

There was a disjoint channel happening since July 2022 on the Daily Graph in which the share price dropped out in the lower end in December 2023. Since the company has very good fundamentals, the possibility of an inverse H&S could be around the corner, having an interesting point of entry at 0.78-0.81. However, the share price is already heavily undervalued considering the fundamental analysis previously done. The daily RSI (14) bounced back in March 2023 from below 30 directly to the upper band at 70 indicating the possibility of a continuation of share price upward movement up to +20%. Therefore, it is up to the investor to decide whether at current prices (0.85-0.88€) is already worth the risk (if the 0.78€ ever gets touched and then bounces back up, the drawdown risk would be -11.4%).

Finally, it is expected that on May the company will pay the dividend. Therefore, the share price may re-adjust its value upwards in April before the dividend is paid and the share price is subsequently slashed down again.

Have a great week ahead.

The magic of technical analysis My way of investing in $O.

White bars- the price of NYSE:O

Orange line- US10Y -10 Year US Government Bonds Yield

If you are a dividend investor buy when Yields are falling and ride the dividends up.

How do you do it?

Legal Disclaimer: The information presented in this analysis is solely for informational and educational purposes only and does not serve as financial advice.