DJI 30 min Chart - Sell to reach 2nd targetbeside March 10 posts

now we Sell US30 30 min - Head and shoulder pattern

expect to reach 2nd target 18000 - 17826.

Djiaforecast

DOW Outlook 26 FEB 20See chart for key pivot points for todays trading day.

futures are up small at this moment, if we cannot obtain the pivots shown and we roll over into yesterdays low more volatility is to come, looking for sell setups

on the other hand if we can penitrate the pivot lines we could see a relief rally towards yesterdays open levels

US30 Index - Free Fall To 29000This is my favorite stock to trade. The smell for this stock making a free fall jump back flip style is around the corner.

I am targeting this index will going to 29250 or worst 29000 after failed for the 1/2 into the course.

As you can see the chart, the signal tells us the rumbling of the interested buyer and mix with uninterested buyer.

I have sell this stock just now.

by Zezu Zaza

Trading Pathways Analysis of DJI H4 Chart

The outlined white arrow pathway is the predicted pathway that the DJI H4 will follow in the coming days or weeks. Using my unique charting methods, I have been able to arrive at HIGH PROBABILITY turning points where DJI H4 will turn.

PLEASE NOTE THE ABOVE ANALYSIS IS FOR EDUCATIONAL PURPOSES ONLY. THEY ARE NOT DIRECT INSTRUCTIONS TO TRADE AND ANY LOSS INCURRED BY FOLLOWING THIS ANALYSIS IS AT YOUR OWN RISK.

Eiseprod of Trading Pathways

DJI Future Map - A Correction is Imminent$DJI has been on an absolutely MASSIVE bull run since the collapse back in 2008-2009; a decade ago!

We all know what goes up must come down though and the DJI is due for another +50% correction.

This chart is on the Weekly. I usually prefer using the Day charts however I noticed some interesting trends that I hoped to share.

2008-2009

-The correction in 2008 was 55% from top to bottom

-The RSI at the peak was slightly Overbought so a little surprised the price tanked -7784 points

2016-2018

-The 1.618 ratio (19008) took 8 years to be hit

-The 2.618 ratio (26793) took 1 year, 2016-2017

-The RSI at the 2.618 level was 95 – Super Overbought which made sense to see the beginning of a huge correction however that wasn’t the case. A double top formed at the same level and then -

the price corrected roughly -5000 points, -18-20% towards the end of 2018-2019

-This correction pinged off possibly the 1.702-1.786 level (21712) from the first FIB (08-09)

-The RSI was once again just slightly Overbought at 70-72 level

-Price has continued to climb due to various political measures; volatility between Trump and China (Tariffs) as well as the beginning of the Impeachment talk

-The FED also injecting the ‘NOT QE’ funds into the REPO arena has stimulated the economy as well

-The current RSI is at 67 so it’s getting once again very close to those Overbought levels that haven’t been met since a year ago when the correction occurred

-Trump officially Impeached on December 18th and the $DJI keeps pumping

Beyond

I can’t predict the future but based on my FIB mapping, I’m expecting the possibility of a massive recession/depression type correction to be made when the 3.618 (34577) level is met. This is based on the FIB calculation from 2008-2009.

The current movements are lining up quite nicely with this FIB chart and the new FIB chart if calculated from the future ‘top’ indicates that we will see a re-tracement to the 0.618 (26627) level and in my opinion ultimately back down to the 1.618 (13761) level where I believe a good amount of resistance will be met. This is a negative 60% drop!

In the event 2.618 (896) level is met (worse than a Depression) that’s a negative 96% dump. I dunno if this will happen, but my guess is that we'll see this drop in-between 2021-2022.

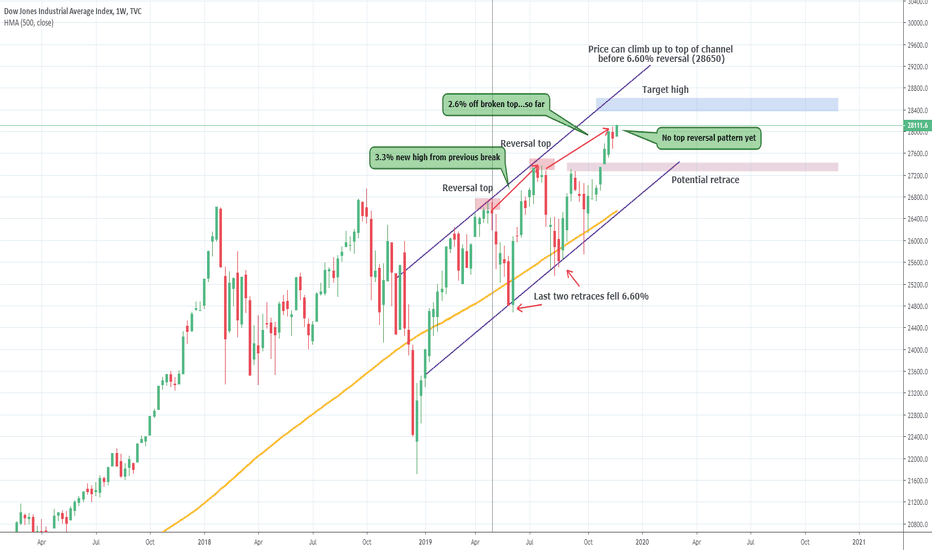

DOW JONES NOT REVERSING YET: WEEKLYThe Dow Jones Industrial Average is still looking like a strong bull on the weekly timeframe. The candles have not yet formed a reversal pattern, there is still potential for the upside after breaking the previous top. On a weekly candle once a pin bar formation of a strong reversal Doji forms then we can talk about the potential downside. For now, the target is still the top of the channel at 28650-28700.

There is a potential for a slight retrace but price should not get much below 27300 on a long-term perspective. That will ensure structure holds well bullish. Each failure off the top of the channel was followed by a 6.60% retrace, for that to occur price has to move up to the top of the channel, IF there is a 6+% retrace, the channel and bull structure is broken and the move lower can price the Dow Jones into correction territory.

DJIA - Dow Jones Overbought, President Race 2021, BitcoinShort-Term

DJIA is overbought with RSI over 75.

On the Daily, we are going to see a correction in the next 4 weeks.

RSI over 80 or greater and we will have a decent correction in my opinion (RSI 80+ is like December 2018 selloff).

Long-Term

From where price meets white line resistance in December 2018, we use same 427 Day Period.

427 from current price brings us to January 2021.

January 2021 is when the outcome of the Presidential Election is confirmed - 427 Days.

November 2020 is the Presidential Election.

Bitcoin Correlation

Bitcoin Halving (when supply is cut in half) occurs May 2020. Price normally peaks over a year after halving.

December 2021 giant 10-year white wedge on chart basically has no room, while Bitcoin is peaking, and we have political uncertainty.

Bitcoin and other hard assets like Gold may see a supercycle if:

-government adds to $13 Trillion sovereign debt, go towards zero interest rates, and continues printing money like September 2019 with "not exactly QE $200B a month".

Confirmation

Multiple charts are telling the same story at around the same time.

If the 2Yr/10Yr inversion holds correct (with it's 100% track record over 90 years), we have about 1 year.

We should be prepared by July 2020 in my opinion at the latest. Earlier the better.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short - AAPL , SPY.

Look for potential rebound in DJILook for an hourly close above 26195 to confirm potential reversal, based on 1hr renko chart.

Look for a retracement and enter LONG around the range 26130 and 26195.

Stop Loss placed under 26020, below the long 1hr candle.

The target level is 26560, with Risk / Reward Ratio 1:2

Thoughts on the Dow Jones Heading Into the WeekendHope you guys enjoy the video, be sure to leave a like, comment, and follow for future posts!

The Dow Jones was down about 600 points today as President Trump continued his sparring session with China, and increased tariffs yet again. We can see a dangerous M forming on our 1 day time frame and I indicated crucial support levels with the fibonacci as well as the dashed red line. If those levels do not hold, we will see the Dow take a plummet in the next week, and the talk of a recession may become a reality. Looking at our shorter time frame, we can see the Megalodon timer giving us a green. I hope that this is a sign that buyers will hold the support levels for the Dow Jones, and hopefully the US and China can come to an agreement soon, so that we may continue our bullish run in the stock market!

Our most powerful indicator called the bottom on Bitcoin! Check it out here!

What's Next For the Dow Jones?The Dow Jones has been all over the news as always, but very volatile as of late. With trade wars escalating, the question of a recession is at the front of the headlines. If we look at our 1 day time frame we can see our fibonacci retracement level right below the dashed line I put on the chart. This is the danger zone. Looking at the chart pattern we can see a dangerous M beginning to form. The MacD also looks suspect as the DJI had a rough day. If the Dow cannot hold these levels between the dashed line and the fibonacci line, we may really see a volatile downwards movement. It is not looking great. If we turn to our shorter time frame though, we can see that the Megalodon timer is giving us a green. Hopefully this will be enough to boost us back upwards, because if not... the talk of a recession may become a reality!

The Megalodon indicator uses a machine learning algorithm, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! You will also receive real time buy and sell signals for the stock market, cryptocurrency, as well as forex markets! We also completed our cryptocurrency automated trade bot. It trades for you, using our backtested indicator with phenomenal results! Click the link in my bio and try out the megalodon indicators today!

DJI big fall aheadThe Dow Jones hit historical maximums. I believe this is just a bull trap and a big fall is on the cards.

We see on the chart a big RSI divergence and the price printed somewhat of a doji just before season earnings started. Also MACD (not in picture) confirms the bearish momentum. It has been reported that earnings this quarter are going to be pretty bad and the Fed rate cut has probably already been weighted in.

A fall to the 26700 area will happen in a quick way. I believe the correction will be stronger and a fall all the way to the 25400 area is very very plausible.

I am ready to short this market at the minimum retracement.

Do you have different ideas? Let me know in comments!

Recession Part 1 : The Dow CrashSince last recession(2007-09) DJI have been growing steadily in last 10 years without any break.

All impulsive trends comes with pullback/recession/ and DJI is no such exception..

If dow jones cant hold above the redline (21640) we might see big down trend coming in markets which has already been started.

Few reason:

www.nasdaq.com

www.theguardian.com

www.washingtonpost.com

If recession comes then it would be a new opportunity in coming decade and can make you super rich and wealthy.But the question is will you be at the right side of the trend?

DJi (Dow Jones), Waiting for sell signalI'll open sell after fake broke of key level 26954.0 because:

- 26954.0 is a historical 10-Month High.

- Many traders will close their buy positions near this level and it can cause falling of the price.

- Potential profit will be in 5...20 times bigger than risk.