DOGECOIN : Should we expect an increase?Hello friends🙌

📈Given the decline we had, you can see that buyers entered at the specified support and formed a double bottom reversal pattern, which is a strong signal on support.

📉Considering the possible market correction, we placed two more buy levels lower so that we can buy there if the price corrects.

⚠Don't forget about capital and risk management, friends.

🔥Follow us for more signals🔥

*Trade safely with us*

DOGEBTC

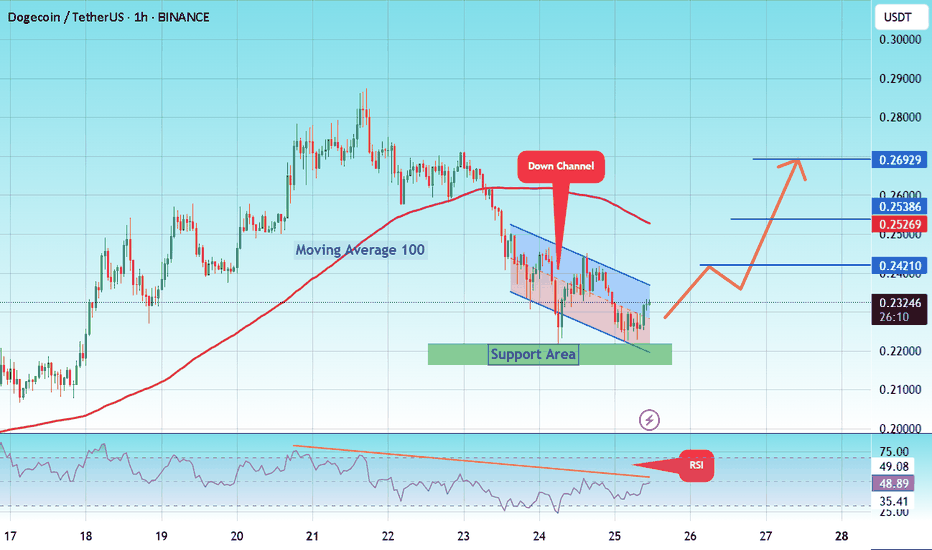

#DOGE/USDT falling wedge#DOGE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.22270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.21777.

Entry price: 0.2320

First target: 0.24210

Second target: 0.25380

Third target: 0.26920

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

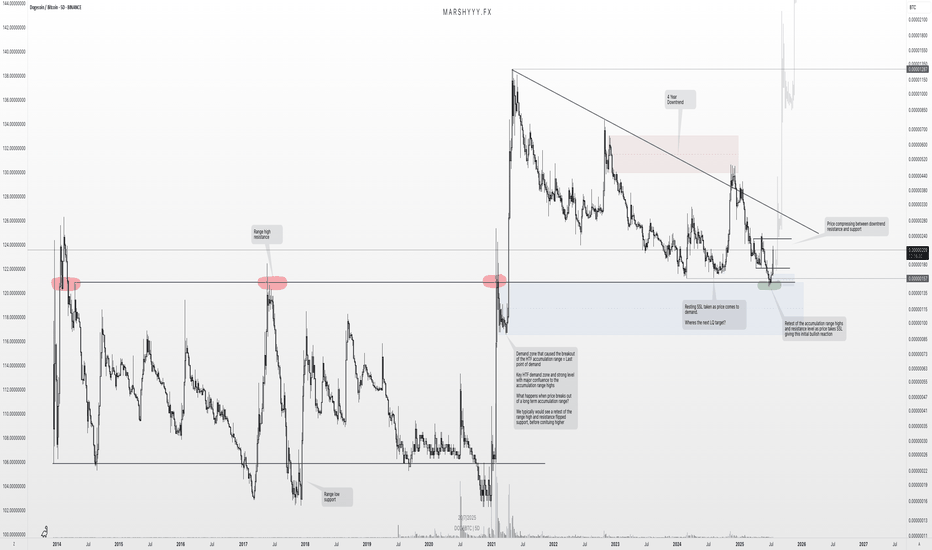

DOGE/BTC: HTF Retest Complete — Reversal BrewingDiving into DOGE/BTC, we’re seeing strong bullish confluences that align well with the DOGE/USDT structure and support the idea that the macro low is in.

Looking back across all available data, DOGE/BTC has traded within a clear 7-year accumulation range dating back to 2014, bounded by a defined range high resistance and range low support. This long period of consolidation enabled massive accumulation, ultimately leading to the first breakout in 2021, which rejected at the highs, pulled back, and then exploded into a cycle ATH.

Since that 2021 high, DOGE/BTC has been in a 4-year downtrend, retracing back into discount pricing, right into the range high of that original accumulation zone — which now acts as a major HTF demand level and last point of support before the original breakout.

📉 What’s happened recently?

- Price swept 2024 swing lows (SSL)

- Tagged the HTF demand zone

- Retested the 2021 breakout level (accumulation range high)

- Coiling inside a descending wedge with contracting volatility

This entire region is a key reversal zone from both a structural and psychological standpoint. It’s where we typically see major trend shifts form, and the structure suggests we’re forming a HTF swing low and bottom from this area.

🧠 Add this to the confluence from DOGE/USDT — which also appears to have printed its bottom — and the case for a macro reversal gets even stronger.

As this wedge tightens and price continues to compress against long-term support, I’m anticipating an explosive breakout that kickstarts the next leg of the HTF uptrend — effectively a continuation of the original breakout from the 7-year range.

5D:

DOGE - Another Perspective- DOGE is currently trading nearing the trendline resistance and pending breakout

- A clear breakout from this resistance line is a must to continue to bullish momentum.

- we will enter the trade after confirmed breakout

Entry: 0.221

SL at: 0.14103

TP1: 0.26035

TP2: 0.33892

TP3: 0.47751

Stay tuned for more updates.

Cheers

GreenCrypto

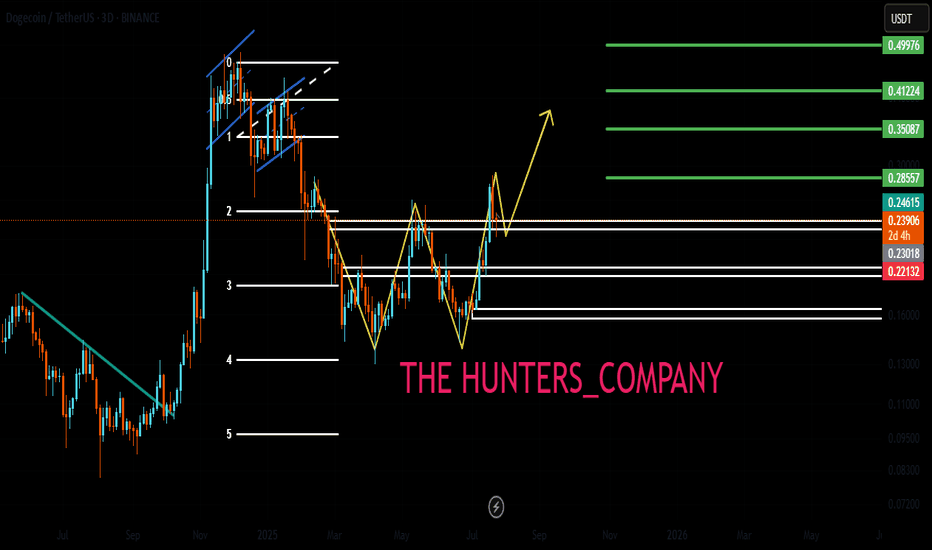

Will DOGE Hit $1? Ascending Broadening Wedge in PlayDogecoin is trading within a clear ascending broadening wedge on the weekly chart. The price has bounced strongly from wedge support and the 100 and 200 EMAs, now pushing upward with growing volume and bullish candles. If momentum sustains, DOGE could rally toward the $1 psychological target and broadening wedge resistance.

Resistance 1: $0.35

Resistance 2: $0.60

Resistance 3: $1.00

Stop Loss: $0.14

Cheers

Hexa

COINBASE:DOGEUSD BINANCE:DOGEUSDT

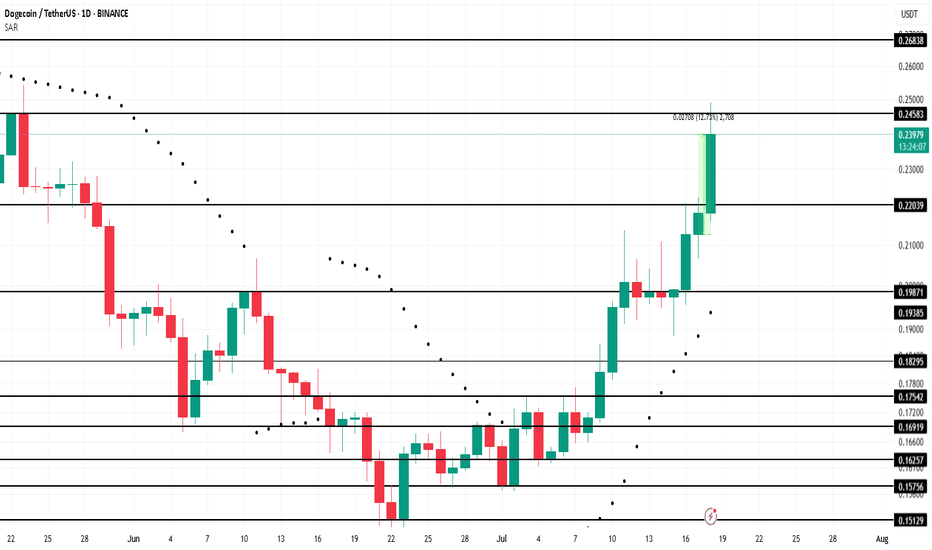

Dogecoin Leads Meme Coins With 12% Rally In 24 HoursBINANCE:DOGEUSDT , the leader of meme coins, surged 12% over the last 24 hours , reaching $0.239. This rally has positively impacted other meme tokens, showcasing DOGE’s influence within the market.

Currently facing resistance at $0.245, BINANCE:DOGEUSDT has reached a 2-month high . The Parabolic SAR below the candlesticks signals that DOGE is likely to maintain its upward trend in the coming days. If this support holds, the meme coin could continue pushing towards higher price levels, attracting more buyers and momentum.

However, meme coins are volatile. If BINANCE:DOGEUSDT holders decide to cash out their profits, the price could drop back down to $0.220 . Losing this support would invalidate the bullish outlook, signaling a possible downturn for the altcoin in the short term.

$Doge Dogecoin about 60% retracement from all time high...CRYPTOCAP:DOGE dogecoin has retraced about 60% from an all time high of about 0.49

Current price: 0.20

Reasons why i am bullish on #Doge

CRYPTOCAP:DOGE price action has remained above the 200ema on the weekly timeframe ...bullish!

- $dogecoin has committed an over 60% retracement from all time high of 0.49

- It is currently at double bottom support seen in April

#dogecoin negative money flow is thinning out

- Sentiments are neutral : neither greedy for fearful

- Price action is exactly at point of control on the weekly time frame!

Resistances above to watch: 0.32, 0.42 up to 0.69

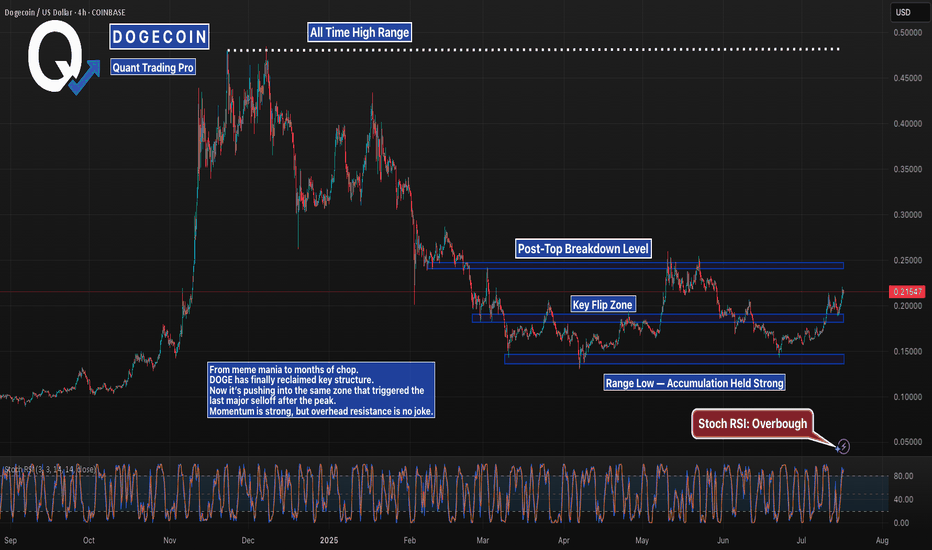

DOGE Is Climbing Back Toward Its Post-Hype BreakdownDOGE peaked near $0.50 during peak hype and crashed hard.

After grinding sideways for months, it’s now reclaiming lost ground.

The $0.245–0.25 zone is where the real test begins — it’s the same area that triggered the major breakdown after the blowoff top.

If bulls hold above $0.20, this push might have real legs.

#Dogecoin #DOGEUSD #CryptoCharts #ChartBreakdown #ResistanceTest #QuantTradingPro #CryptoAnalysis #BacktestEverything #TradingView

DOGEUSDT Breaking Out. 250% Rally Incoming? History Says Yes!BINANCE:DOGEUSDT is once again showing its classic breakout behavior, This time breaking above a key trendline with strong momentum. Historically, every time CRYPTOCAP:DOGE has broken out of similar structures, it has delivered powerful rallies averaging around 250% gains. And with the current bullish sentiment across the market, this setup looks ready to repeat history.

CRYPTOCAP:DOGE still appears undervalued, especially considering the broader market is already heating up. Once CRYPTOCAP:DOGE starts its move, it tends to run fast and hard – often leaving latecomers behind. This could be the start of the next explosive leg up.

For investors, this is a prime “BUY and HOLD” zone. For traders, this is the time to enter with proper risk management in place. Always use a stop loss and trail your profits accordingly.

BINANCE:DOGEUSDT Currently trading at $0.204

Buy level : Above $0.2

Stop loss : Below $0.15

Target 1: $0.27

Target 2: $0.35

Target 3: $0.48

Target 4: $0.7

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#DOGE/USDT Long Swing Setup #DOGE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel, this support at 0.1660.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a key support area in green at 0.16200, which represents a strong basis for the upside.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.17120

First target: 0.17420

Second target: 0.17788

Third target: 0.18250

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Dogecoin $0.1725 Next Target ? #DOGE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.1624.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.16000, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1656

First target: 0.1682

Second target: 0.1713

Third target: 0.1752

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

DOGE ANALYSIS (12H)Based on the current available data, it appears that Dogecoin has entered a bullish phase after completing the diametric pattern marked on the chart. We are currently in wave B of this bullish phase.

Wave B may complete within the green zone, which is a key support area.

The targets for wave C have been marked on the chart.

A daily candle closing below the invalidation level would negate this outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

DOGEUSDT BINANCE:DOGEUSDT Price is ranging between 0.18200 and 0.18650 dollars after a sharp rise from 0.17000. A break above 0.186 triggers a buy, targeting 0.19450 and 0.19950 dollars. A break below 0.182 triggers a sell, with supports at 0.17650 and 0.17000 dollars.

Trigger Levels:

Buy Trigger: 0.186

Sell Trigger: 0.182

⚠️Contorl Risk management for trades.

#DOGE/USDT#DOGE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.1800, acting as strong support from which the price can rebound.

Entry price: 0.1838

First target: 0.1886

Second target: 0.1928

Third target: 0.1972

I positioned here — while others waited for confirmation.This was a textbook setup. Clean structure, high-probability narrative, and the kind of zone that doesn’t ask for your belief — it commands it.

Breakdown:

Price delivered a sharp move into a 1H OB confluence with an untouched 60min FVG sitting just below. That OB wasn’t noise — it was a true origin point, the last down candle before a major rally.

As price retraced, it swept short-term liquidity and tapped into that OB with precision. I watched volume spike on the drop — not retail fear, but Smart Money engineering the entry.

The 0.1795 zone wasn’t random. It was deliberate. A key equilibrium between displacement and rebalancing. And if this holds, the next logical draw is above 0.1860 — into the unmitigated FVG and resting buy-side liquidity.

Expectation:

From this 1H OB / FVG stack, I’m looking for:

Entry: ~0.1795

SL: Just under the 1.0 fib — under 0.1777

TP1: Mid FVG at 0.1831 (0.5)

TP2: Full inefficiency fill at 0.1887

I’m not forcing anything. If the market wants lower, there’s another FVG just below to absorb it — but structure still favors premium re-pricing.

Final note:

I don’t chase breakouts. I trap Smart Money setups, wait in silence — and strike when the chart gives me the story.

“The market doesn’t move by chance. It moves by design. And I design my trades the same way.”

They see relief. I see rebalancing.BINANCE:DOGEUSDT.P isn't bullish — it's rebalancing. What we’re witnessing now is price doing what it always does after manipulation: return to efficiency before delivering its next displacement.

Here’s the setup:

Price tapped into the 4H discount zone — a structural STB

We’re now reacting from the 0.618 (0.1940) and pushing up toward the 4H OB at 0.20403

That OB is perfectly nested just above the 0.5 fib (0.20190), and below the 0.382 (0.20970) — prime for internal liquidity collection

If price fails to break structure above that 4H OB, the move is complete. This isn’t bullish continuation — it’s cleanup. From there, I’m watching closely for signs of rejection and displacement back toward the OB + BTS zone near 0.16884.

This is where real risk is priced in — and where Smart Money actually loads up.

Execution mindset:

Let price reach into 0.204–0.209

Watch for rejection — that’s the trigger

Downside target: 0.18299 → 0.16884

If we impulsively break 0.2097 and reclaim it, the bearish thesis is invalidated and I’ll re-evaluate

This isn’t trading a bounce. It’s reading the cleanup.

You want real entries, real invalidations, real structure? Check the profile description. The trades speak louder than the noise.

Price tapped the discount — now it’s time to test premium.This setup on DOGE/USDT was mechanical. Not emotional.

I’ve seen this formation enough to know what comes next. The chart has already spoken.

After a clean markdown into the 4H OB, price hit the 0.786 retracement level — right inside a prior imbalance zone. That wasn’t a random drop. That was engineered. Liquidity was swept, sentiment reset, and now we have structure ready to reverse.

Notice this:

We’re sitting in a 4H demand OB with confluence from the FVG just above.

The Fibonacci levels are aligning with Smart Money delivery: 0.5 sits right at the base of the new rally expectation.

The 0.20928 level is the first key reaction point — I expect a stall or consolidation there.

But the real test comes higher: the 0.22094 OB, which also aligns with the 0.382 fib level — the market’s threshold between discount and premium.

I’ll be watching price closely on its approach into that 0.209–0.22094 region. If it delivers clean displacement through FVG, the next liquidity grab sets up a premium continuation model.

If we reject early — that tells me distribution is starting, and I’ll prep for a secondary sweep below 0.18 to retest the deeper 4H OB near 0.16387.

This setup didn’t require a confirmation signal.

It required understanding why price dropped — and where it’s designed to go.

I don’t need to guess. I just need to be aligned.

DOGE Analysis (4H)It appears that Dogecoin's correction has started from the point where we placed the red arrow on the chart. This correction seems to be a flat pattern, with the first two parts forming a diametric and a triangle.

If the price reaches the green zone | which is a key area | we can start looking for buy/long positions.

Targets : 0.23092 _ 0.25283 _ 0.29426 _ 0.32217

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

DOGEBTC Strong chance that Dogecoin outperforms Bitcoin soon.DOGEBTC is testing its 1W MA50 (blue trend-line), which keeps it into a buy zone, exhibiting the same kind of price action it had during its previous Cycle in late December 2020.

That was right before the parabolic rally started where Dogecoin outperformed Bitcoin massively on the last strong known Altseason.

Right now the market is forming the same 1W MACD Bullish Cross it did on December 21 2020, straight after which it broke above the 1W MA50. The rebounded that was causes even broke above the Cycle's Falling Wedge in a rally that lasted 4 months.

We are inside a similar Falling Wedge since 2021 so a break-out may have a similar outcome. This chart shows that it may be time to move some capital to Doge.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOGEUSDT - Worth to Take Some RisksBINANCE:DOGEUSDT — Buyer Stepping in After the Sweep?

BINANCE:DOGEUSDT just pulled a textbook move I’ve seen play out hundreds of times — swept a key low, triggered stops, then snapped back up. That’s never accidental.

I’ve been watching this carefully, and I believe we just entered an area with a real buyer behind it.

🔵 Blue Box: Hidden Demand Zone

Price made a new local low, then quickly reversed, printing a bullish engulfing candle on high volume — but here’s what matters more:

On the drop, CDV didn’t follow. That’s a subtle but powerful divergence that shows aggressive selling wasn't truly present — just a liquidity sweep.

Now price is hovering above that zone. This blue box is where I believe the real position was built. If we come back down and test it with weak selling and small-bodied candles, I’m looking for an entry.

🔁 Game Plan

If price pulls back into the blue box and shows buyer defense on the 1m/5m, I’ll enter long. Simple.

If we break lower again but reclaim the box with force and retest it cleanly, I’ll also long that reclaim.

No long if the zone breaks cleanly and volume confirms the breakdown — I’ll reassess for shorts only if it retests from below.

I will not insist on my long idea.

If this level gives way and doesn’t reclaim with conviction, I’ll step aside.

But if it reclaims and gives me confirmation, I’ll take it.

📊 Order Flow & Volume

This entire sweep was followed by a volume spike into the low and a delta absorption pattern — price moved down, but aggressive buyers were filling in. That’s never retail.

Now we’re seeing low effort in pushes downward. That’s when traps get set. Don’t be surprised if we see a sharp move upward in the next sessions.

🧠 Final Word

Most traders will only see a “double bottom” if this plays out. They won’t realize the liquidity grab has already happened.

If you ignore this level, you might regret it.

This is how the big moves start — quietly, after the sweep, before the crowd even notices.

And these are the setups that have built my high win rate.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Dogecoin (DOGE) OverboughtI have been trading for a long time using the DCA strategy indicator that I have developed and I have recently published the indicator on my Tradingview page.

According to this indicator, I have been buying DOGEs at support levels with more money than I would have thrown away so far. This support level is generally seen at $0.056. In addition, I dumped some of my DOGE at $0.2285, but then bought again at $0.107. I have already shared this analysis.

I think that DOGE, which has broken through two resistances, will advance at least up to $0.75 (potential 89% return). But for this progress, I think that it must first find support at the $0.2285 level, which was broken again. This is because the indicator also gives an overbought signal. Therefore, I will tailor my portfolio accordingly. But I wouldn't be surprised if it continues relentlessly.

As long as Elon Musk remains in government, I think this cryptocurrency will be on a continuous upward trend.