Dogecoin

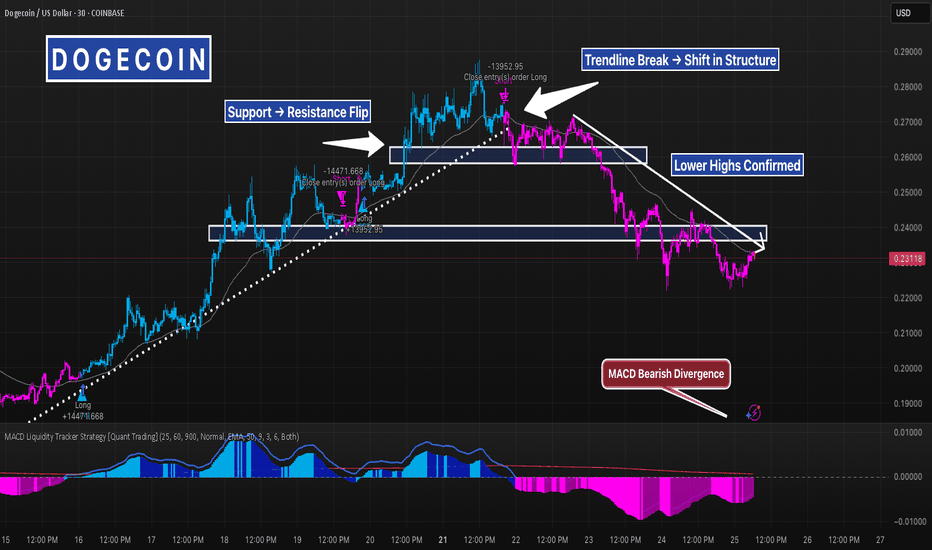

DOGE 30m – Trendline Break + Bearish Divergence = Clean ReversalThis DOGE 30-minute chart offered a textbook reversal sequence:

Price was riding a clean ascending trendline with support from moving averages and strong bullish structure. But things shifted fast.

We saw:

– A clear MACD bearish divergence (momentum fading as price pushed higher)

– A trendline break and lower high, signaling loss of bullish control

– Former support flipped into resistance, confirming the structure shift

– Price now consolidating near the last major demand zone

If this zone breaks, expect continuation lower. If it holds, this could become a temporary bounce area — but momentum is clearly in the bears’ hands for now.

Zoom out for confluence and track price behavior around this zone for your next move.

#DOGE #CryptoTrading #TechnicalAnalysis #MACD #ReversalSetup #TrendlineBreak #SupportResistance #QuantTradingPro

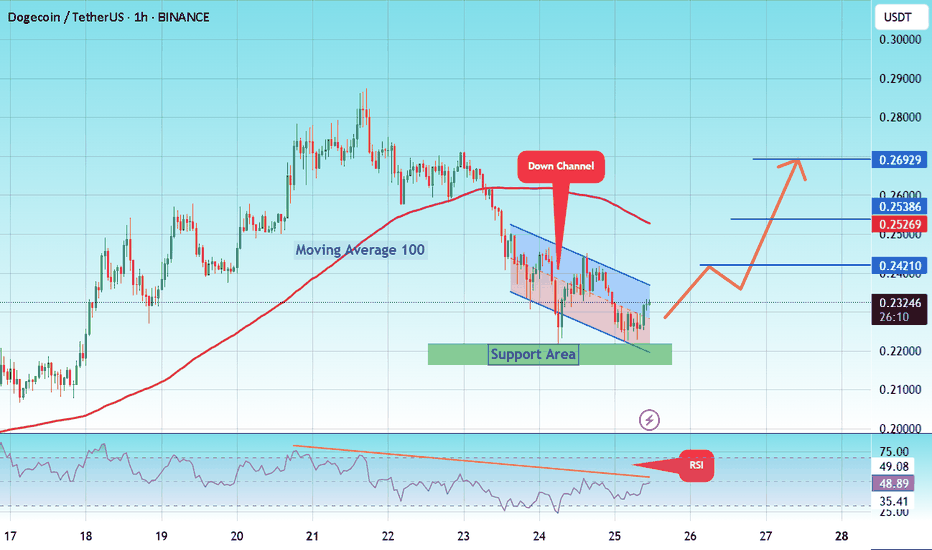

#DOGE/USDT falling wedge#DOGE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.22270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.21777.

Entry price: 0.2320

First target: 0.24210

Second target: 0.25380

Third target: 0.26920

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

The Pullback Panic? Your Whole Plan Dies?!!!!!One red candle is all it takes to destroy your entire plan.

Why do we panic so fast? Why do we exit too early before a rally?

And worse: why do we FOMO back in at the worst possible time?

Hello✌️

Spend 3 minutes ⏰ reading this educational material.

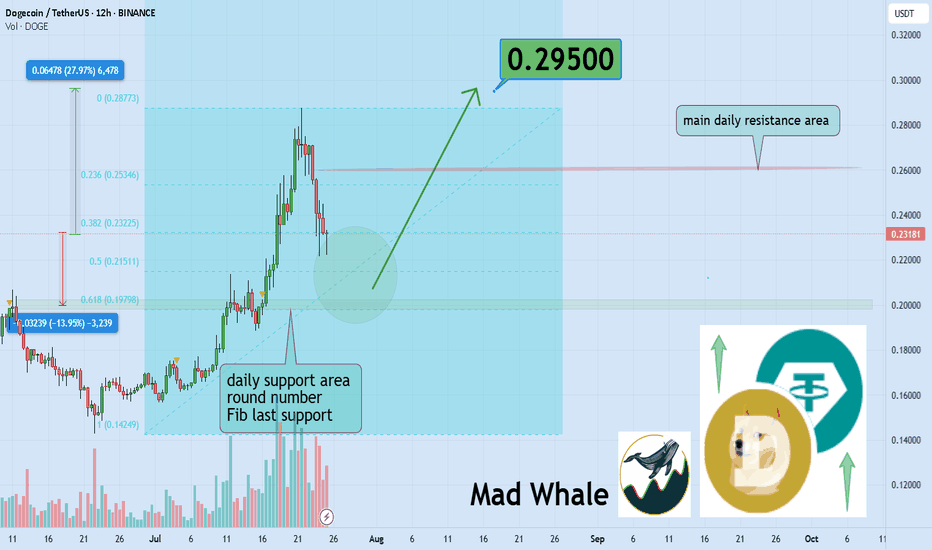

🎯 Analytical Insight on Dogecoin:

BINANCE:DOGEUSDT is approaching the key psychological level of 0.20, which also aligns with a strong daily support and the final Fibonacci retracement zone 🧭. Despite recent volatility, it continues to hold its mid-range Fib level, suggesting potential accumulation. If this support holds, a rebound toward the 0.30 resistance — a move of around 27% remains on the table 🎯.

Now , let's dive into the educational section,

🧠 The Victim Mindset in Crypto Markets

Here’s the uncomfortable truth.

Most traders believe they’re making rational decisions but in reality, they’re reacting emotionally to past pain.

One bad experience during a correction makes us fear all pullbacks.

Missing one big rally creates constant FOMO.

We can’t handle drawdowns but we accept buying tops again and again.

It’s not just you. This is how most retail traders operate and whales know it.

🐳 How Whales Profit From Our Fear

Whales never buy during hype. They buy during fear.

Mini pullbacks, shakeouts and false breakdowns are designed for one thing.

To make you exit so they can enter.

A red candle, a small wick, maybe a fake support break.

We sell out of fear, they buy the dip.

We FOMO back in too late.

Pullbacks are not just price moves. They are psychological traps.

📈 How to Break This Cycle

You don’t need to predict the future. You need to understand yourself.

Ask if this correction is technical or emotional.

Use confirmation from volume, OI and divergence.

Enter after traps, not inside them.

Question your feelings before every move.

You are not trading the chart. You’re trading your mind reacting to the chart.

📊 TradingView Tools to Escape the Fear Greed Cycle

TradingView gives you access to several practical indicators that can help protect your capital from emotional decision-making.

🔹 Fear and Greed Index (Crypto)

Simple but powerful. When the index drops below 30, most traders are in panic mode. That is exactly where whales accumulate, while we run away.

🔹 Open Interest Heatmaps

When open interest rises but price stays flat, it often signals an upcoming shakeout. One scary-looking red candle and the weak hands are gone.

🔹 Volume Profile and VPVR

Perfect for distinguishing between healthy corrections and manipulative dumps. If price pulls back but buying volume remains strong, it's not a real sell-off. It’s a trap.

🔹 Divergence Indicators like MACD or RSI

If RSI rises during a pullback, there’s a hidden bullish divergence. Exiting may be the worst thing to do.

🔹 Liquidity Maps

These show where stop losses and liquidation clusters are located. Often before any major move up, the market takes a detour to liquidate these levels.

Use these tools to stop reacting emotionally and start trading rationally.

📍 Final Thoughts

Small corrections are not the enemy.

Your emotional reaction to them is the real threat.

Before you panic-exit, ask yourself if this fear is justified or just mental conditioning.

The market always gives second chances but we rarely wait for them.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

DOGECOIN : Should we expect an increase?Hello friends🙌

📈Given the decline we had, you can see that buyers entered at the specified support and formed a double bottom reversal pattern, which is a strong signal on support.

📉Considering the possible market correction, we placed two more buy levels lower so that we can buy there if the price corrects.

⚠Don't forget about capital and risk management, friends.

🔥Follow us for more signals🔥

*Trade safely with us*

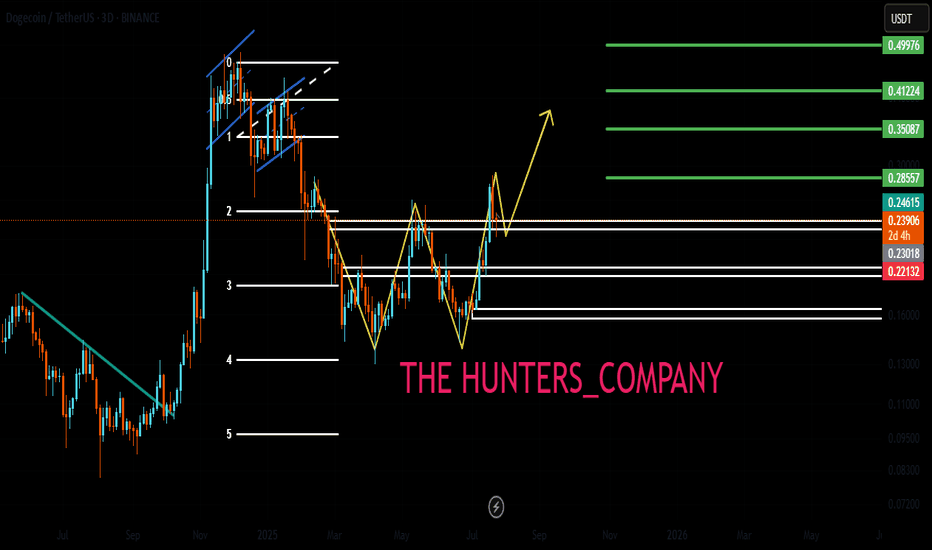

DOGEUSDT | Bullish Cup & Handle Revisiting Target +500% (1 USD)?Price Action and Chart Pattern Analysis:

DOGE cup bottom happened around $0.05 with the rim around $0.48. That gives a depth of roughly $0.42. If the breakout occurs near the rim, the measured move target would be $0.90 zone.

This aligns with several analyst projections suggesting DOGE could reach $0.90 to $1.00 if the breakout confirms.

Another way to project this cup & handle is the fibonacci-based target. These levels suggest that if DOGE breaks above the handle and sustains momentum, $0.85–$1.00 is a realistic zone for profit-taking at 161.8% and 200% extension as 1-2-3 wave pattern.

Reliability of the Cup and Handle Pattern for DOGE

The cup and handle is a classic bullish continuation pattern, but when applied to Dogecoin, its reliability depends on several dynamic factors:

Strengths of the Pattern in DOGE’s Context

Historical Accuracy: DOGE has previously respected technical patterns like rounded bottoms or (THE CUP) and breakout channels (THE HANDLE), especially during alt coin rallies.

Current Setup: a well-formed cup and handle on DOGE’s weekly chart, with price rebounding from $0.14 and testing resistance at $0.2 zone which also the key resistance SMA50W and the downtrend channel (the handle)

WATCH OUT: still a possible throw-under pattern or a final bear trap liquidity below previous low!

Key Action: If breakout confirmed with volume > Follow BUY | if not, wait for retraced SMA20 or breakout support.

Always trade with affordable risk and respect your stop...

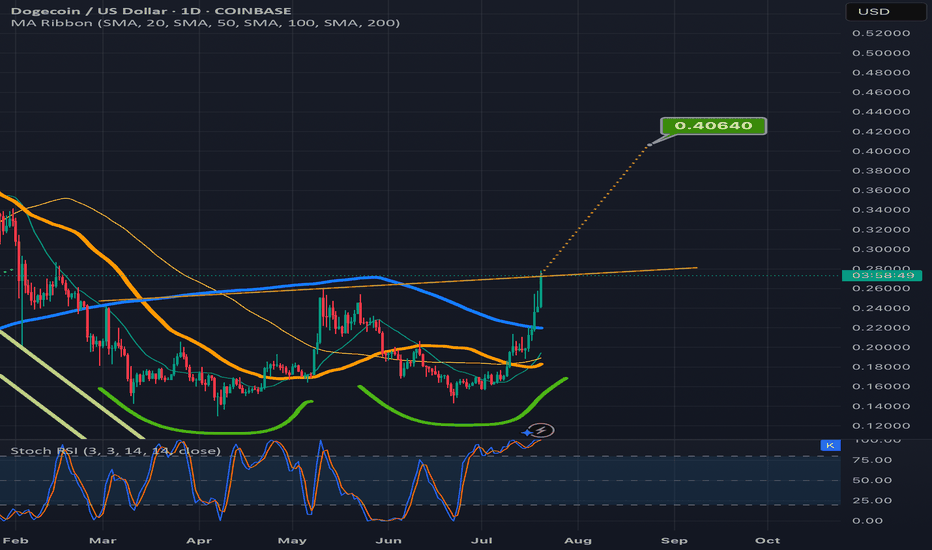

DOGE Strategy — Momentum Entry, MA Trend Hold, Pullback PhaseThis chart showcases how the MACD Liquidity Tracker Strategy performed on DOGE over the past several days. The strategy entered during a clear momentum breakout and trended cleanly above its MA filter for nearly 48 hours.

Let’s break it down:

🔹 First Signal: Early compression breakout long, but price stayed flat. This entry was managed with a tight close before the second impulse began.

🔹 Second Long: Clean breakout on rising momentum — confirmed by MACD histogram expansion and strong Stoch RSI crossover.

🔹 Trend Structure: MA support held multiple times during this move, reinforcing the uptrend. Dotted trendline shows price respecting structure cleanly.

🔹 Exit Trigger: Price began consolidating and histogram showed waning momentum. The strategy correctly exited before the full reversal began.

🔹 Current Action: Pullback in progress. MACD histogram flipping red, Stoch RSI resetting. This may just be a correction… or the trend might be breaking.

📊 This setup is a textbook use of trend filters, confluence, and exit logic — and a good reminder that the strategy isn’t just about entry… it’s about managing exits with discipline.

Whether this develops into a higher low continuation or rolls into full reversal, momentum confirmation is key before the next entry.

#DOGE #TradingStrategy #AlgoTrading #MACDStrategy #QuantTrading #CryptoTechnicalAnalysis #PriceAction #TrendFollowing #Backtesting #CryptoCharts

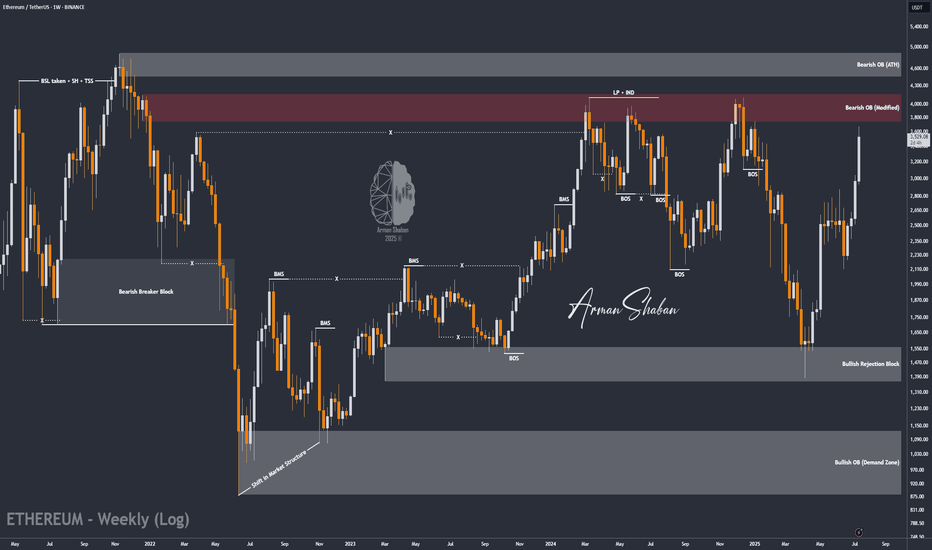

ETH/USDT | The Next Target is $4000 and it's Close! (READ)By analyzing the Ethereum chart on the weekly timeframe, we can see that this cryptocurrency remains one of the strongest major cryptos in the market, continuing its bullish rally despite the overall market correction. It has already hit the next target at $3500, and I believe we might see Ethereum reaching $4000 sooner than expected! Based on previous analyses, if this bullish momentum continues, the next targets will be $3740, $4100, and $4470.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

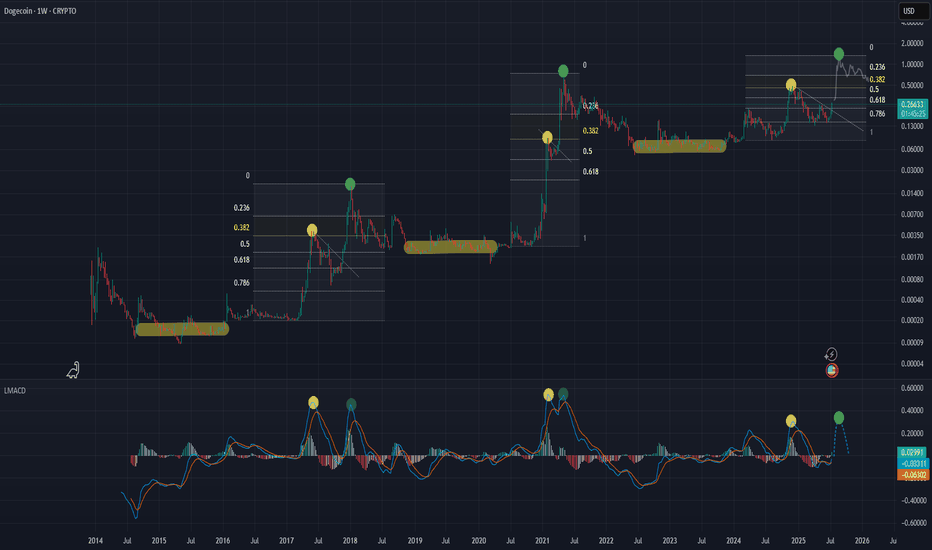

DOGEUSD Is that a textbook Livermore Cylinder to $1.5 ??Doge (DOGEUSD) has been trading within a Bullish Megaphone for the majority of its Bull Cycle since the October 09 2023 Low. We may technically claim that this has been so far one massive Accumulation Phase, along with the rest of the altcoin market.

A pattern that draws strong comparisons with that Megaphone has been 'Livermore's Accumulation Cylinder'. Jesse Livermore, an American stock trader, came with a revolutionary trading pattern a century ago, whose principles often apply perfectly to today's financial assets.

This is what we do on today's Dogecoin analysis, we apply this Accumulation Cyclinder on Doge's Bullish Megaphone. Even though not a perfect fit obviously, the main characteristics apply, with clearly visible Bullish and Bearish Legs.

Based on this model, the market is right now starting the aggressive break-out phase above the Cylinder. Technically the Accumulation is over and the price may pursue levels 8 and 9, which give price Targets of $1.50 and $12.00 respectively.

Now, even though $12.00 falls well after (6 months or so) the expected duration of the current Bull Cycle, $1.50 is well within its limits (October - November 2025) and exactly double the price of the previous Cycle High. This makes it a very attractive Top candidate.

So do you think Doge is inside a Livermore Cylinder that is about to break out parabolically?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

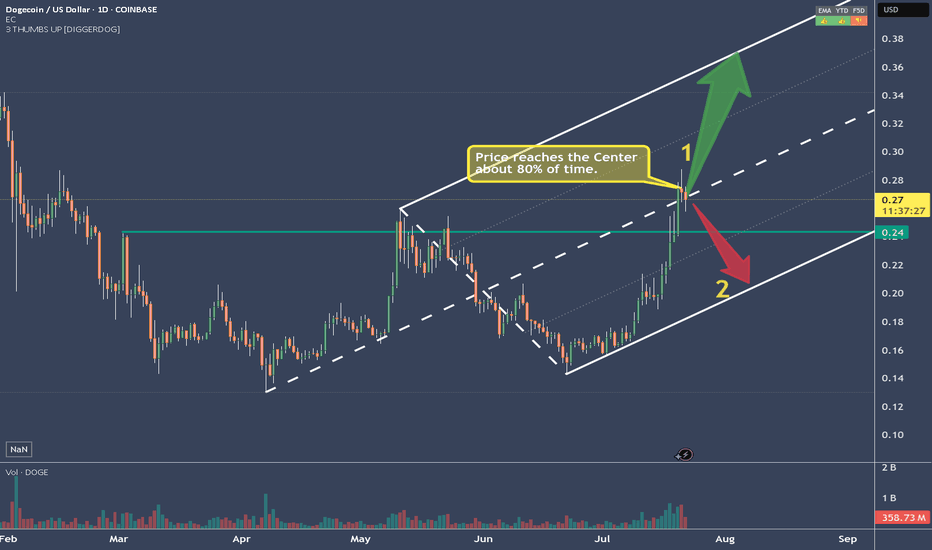

DOGEUSD Has reached it's (first?) targetAfter reaching the Centerline, price eitheradvances to the Upper Extreme (U-MLH), or it reverses and it's target is the L-MLH, the lower Extreme of the Fork.

An Open & Close below the Centerline would indicate further progress to the downside.

A stop above the last high with a target around 2 would be the trade I would take.

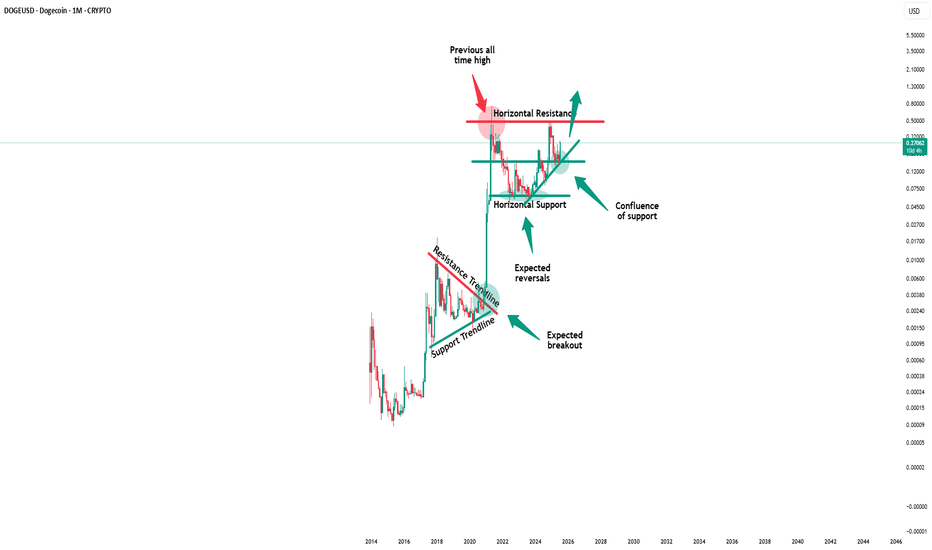

Dogecoin - It is all totally expected!🐶Dogecoin ( CRYPTO:DOGEUSD ) will break out soon:

🔎Analysis summary:

Just this month, Dogecoin perfectly retested a significant confluence of support and is starting the expected rejection. With bullish momentum picking up, there is a very high chance that Dogecoin will break the all time high in the near future.

📝Levels to watch:

$0.5

🙏🏻#LONGTERMVISION

SwingTraderPhil

SOL/USDT | Next Bullish Leg Ahead if Key Support (READ)By analyzing the Solana chart on the daily timeframe, we can see that today the price climbed to $184, almost hitting the next target at $187, before facing a correction. It is currently trading around $176. If Solana manages to hold above the key support zone between $168 and $174, we can expect the next bullish leg to start, potentially extending up to $227. The previous analysis remains valid, with the next upside targets at $187, $220, and $263.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

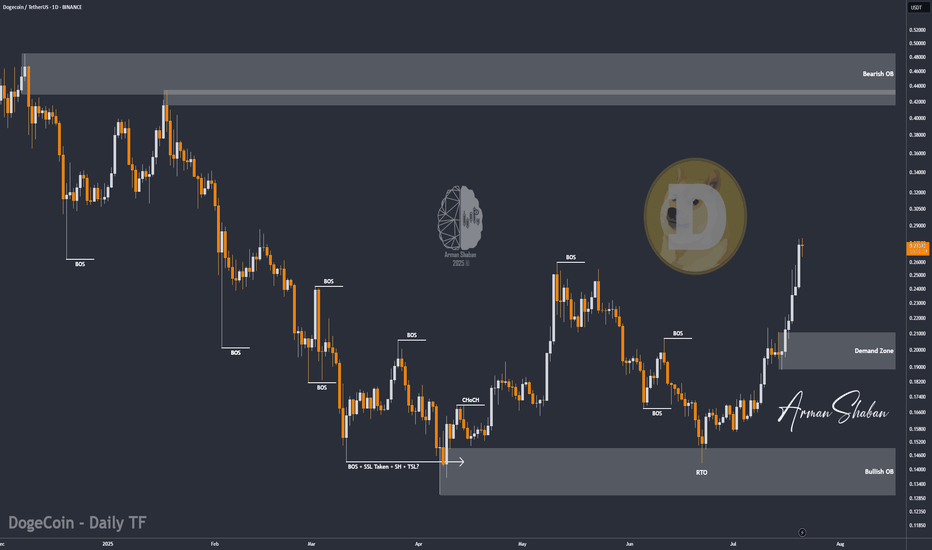

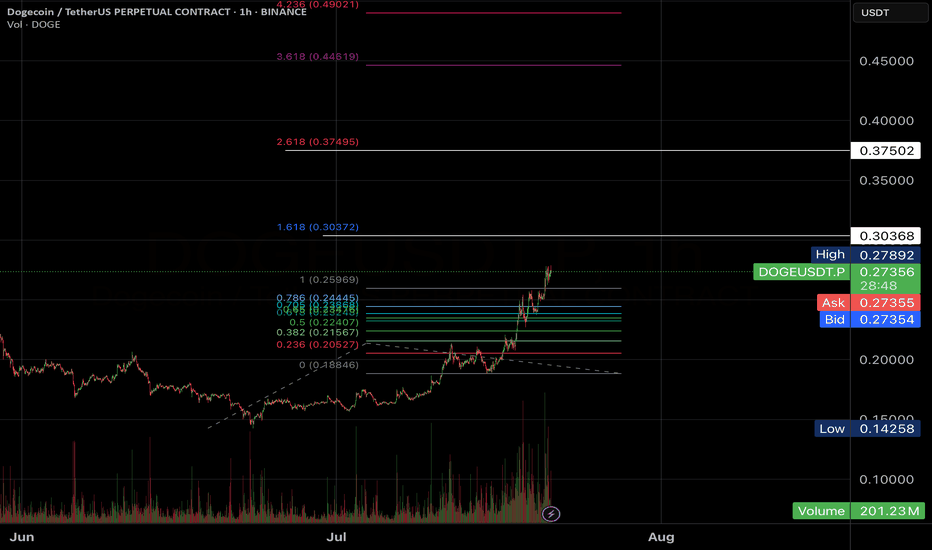

DOGE/USDT : eyes More Gains – Mid-Term Targets Up to $0.70! By analyzing the Dogecoin chart on the daily timeframe, we can see that since our last analysis around 7–8 months ago, the price started its rally from $0.10 and surged over 370% to reach $0.48. After that, it corrected back to around $0.13 and is currently trading near $0.27. If Dogecoin manages to hold above $0.25, we can expect further upside movement in the mid-term. The next targets are $0.287, $0.32, $0.41, and $0.70.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

DOGE | Gearing up For a BIG MOVEDoge is looking mighty bullish after establishing a clear bottom.

Together with confirmation from BTC, we can safely say that altseason is yet ahead of us. BTC's recent increase show that the bullish impulse is still upon us. And after ETH increases, the rest of the altcoin market will follow suit as per usual.

DOGE is bullish because:

✅ Clear bottom

✅ Higher lows, daily looking to reclaim the moving averages:

✅ Altseason upon us after ETH increase

Ultimately, we need to wait for confirmation - if THIS major resistance zone is cleared (in other words if daily candles close ABOVE this zone) then we're full bull mode.

________________

BINANCE:DOGEUSDT

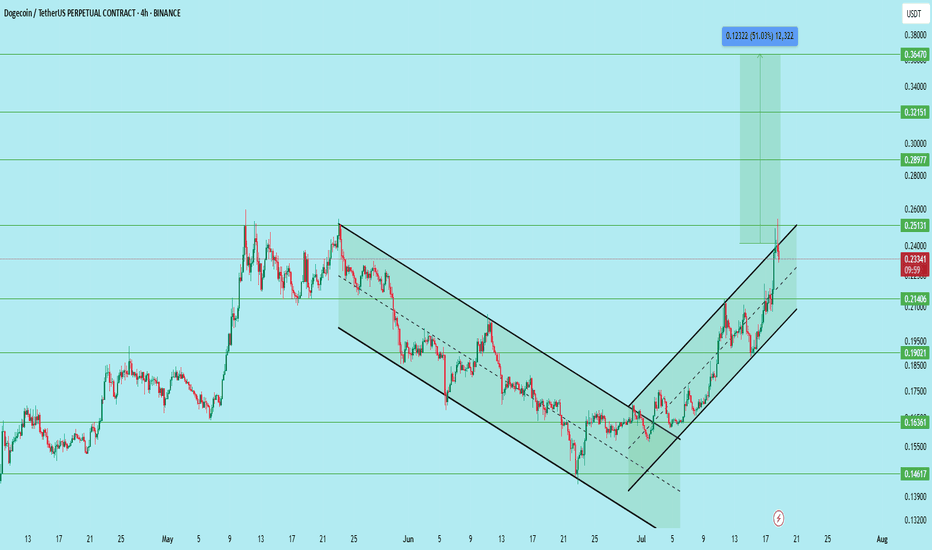

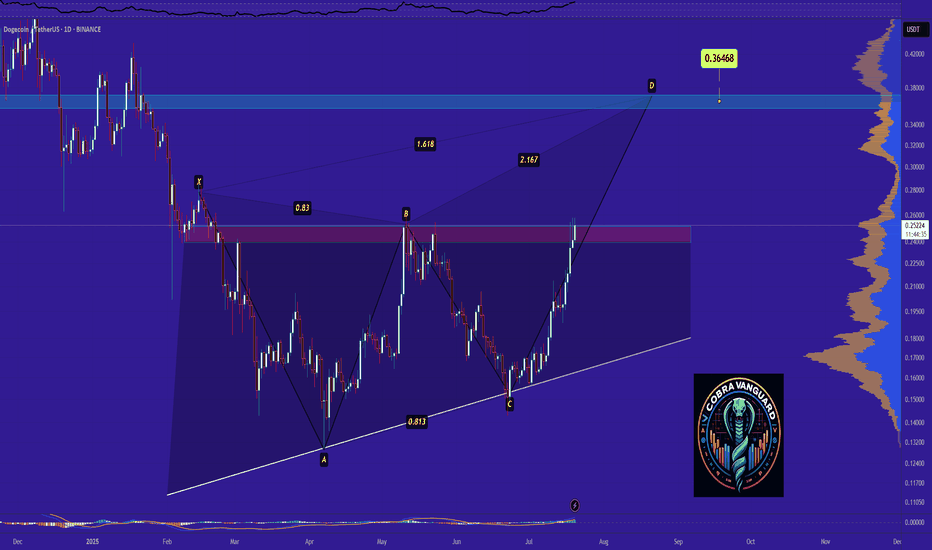

DOGE/USDT – Bullish Setup with Clear Channel BreakoutDogecoin has successfully broken out of a falling wedge and is now trending within a rising channel on the 4H timeframe. The price recently reclaimed the 0.214 support zone and is now showing continuation with strong volume and structure.

After the breakout and multiple retests, the pair offers a compelling long opportunity.

Setup Details:

Entry Zone: 0.208 to 0.214

Stop Loss: 0.186

Targets:

• 0.251 – First major resistance

• 0.289 – Mid-level breakout target

• 0.321 – Psychological round number

• 0.364 – Final target (approx. 51% move)

Technical Structure:

Breakout from falling wedge followed by bullish channel, Higher highs and higher lows clearly forming, Volume supports accumulation near breakout levels, Support holding above 0.214, confirming demand

Support Zones:

0.214 (reclaimed)

0.190 (intermediate)

0.163 (major demand zone)

Resistance Zones:

0.251

0.289

0.321

0.364

This setup offers a clean risk-reward ratio with confirmation on trend continuation. A rejection at 0.251 may present another opportunity to re-enter on a retest.

DYOR. Not financial advice.

DOGE Coiling Below Resistance — Liquidity Tracker Already TriggeDOGE broke structure last week and pushed into a key resistance zone — but now price is going flat, consolidating just below breakout territory. This type of pause can either lead to continuation or a trap, and that’s exactly what we’re watching for.

The MACD Liquidity Tracker Strategy already triggered long earlier in the move, right around the $0.226 reclaim — a clean entry confirmed by bullish histogram shift, crossover, and trend alignment.

Since then, price has respected the EMA and gradually built up pressure just under the $0.257–0.270 zone.

The strength of this strategy is in combining MACD compression/expansion with trend filters, so it avoids whipsaw entries and only triggers when momentum AND structure align. This helps traders catch the beginning of a move — not the middle or end.

Right now, momentum is compressing again on lower timeframes, which often leads to a volatility expansion. The strategy is quiet for now, but the earlier long is still holding and valid.

We’re watching closely for a clean breakout above resistance — or signs of weakness that invalidate the move.

Whether this consolidates further or explodes from here, the setup has already shown how effective good filtering and timing can be.

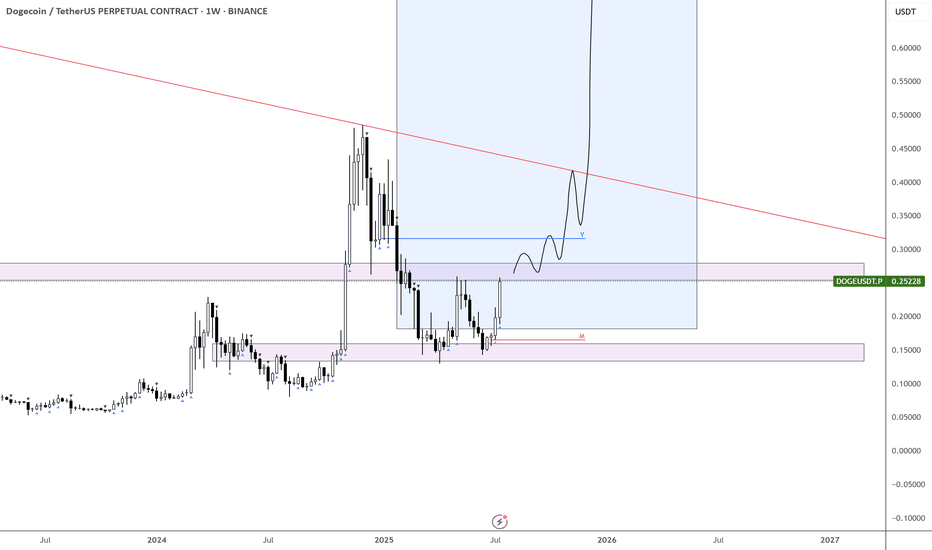

$1 in the Horizon for $DOGE!We’ve got something interesting brewing on CRYPTOCAP:DOGE right now:

Monthly trend is active

Uptrend in place for over a year (not relying on that timeline, but historically, targets hit within it)

If we can get above $0.30 and hold, the path to $1 opens up for the first time.

Other similar charts are also aligning for exponential moves, setting up to break out of multi-year consolidation patterns.

Keep a close eye on CRYPTOCAP:XLM as well — it’s shaping up with a very similar structure.