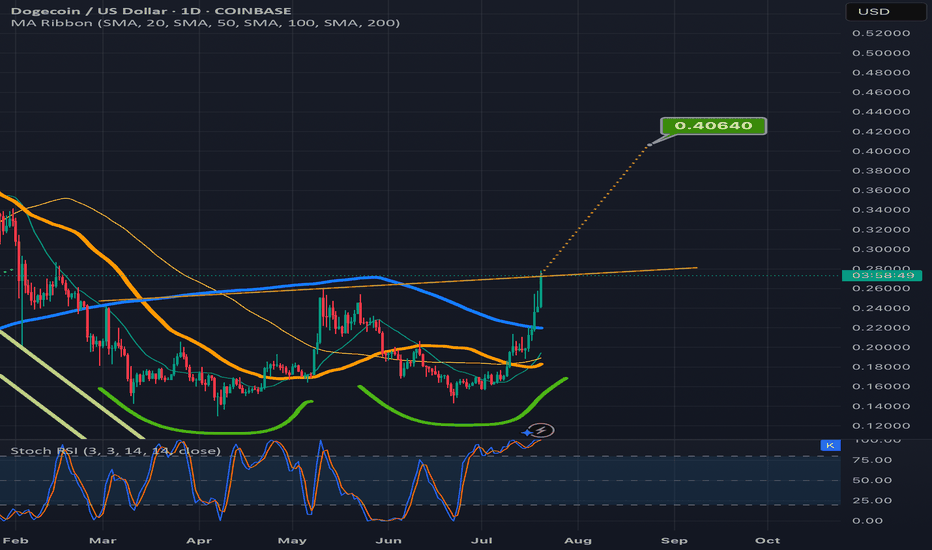

DOGE 4H – Strong Support Test Before Alt-Season??DOGE is approaching a pivotal support zone on the 4H chart — the same area that acted as the breakout base in mid-July before price surged nearly 40% higher. This horizontal level is now being tested again, offering a potential opportunity for trend continuation if bulls can defend it.

The support zone also aligns with an ascending trendline that has been respected for nearly a month, creating a key confluence point. Combined with an oversold Stochastic RSI reading, the setup is beginning to show early signs of a potential reversal — but confirmation is still needed.

Price structure remains technically bullish unless this area breaks. A clean bounce here could trigger a new wave toward the prior high at $0.29. On the flip side, a breakdown of this confluence zone would invalidate the current trend structure and likely target the $0.19–0.20 region.

📊 What I’m Watching For:

– Bullish price action (e.g., hammer candle, engulfing) off this zone

– Higher low confirmation with volume

– Trendline retest and hold

– Momentum alignment with RSI/Stoch flip

DOGE remains one of the more technically clean charts among majors — but holding here is key. Watching closely.

Dogeusd

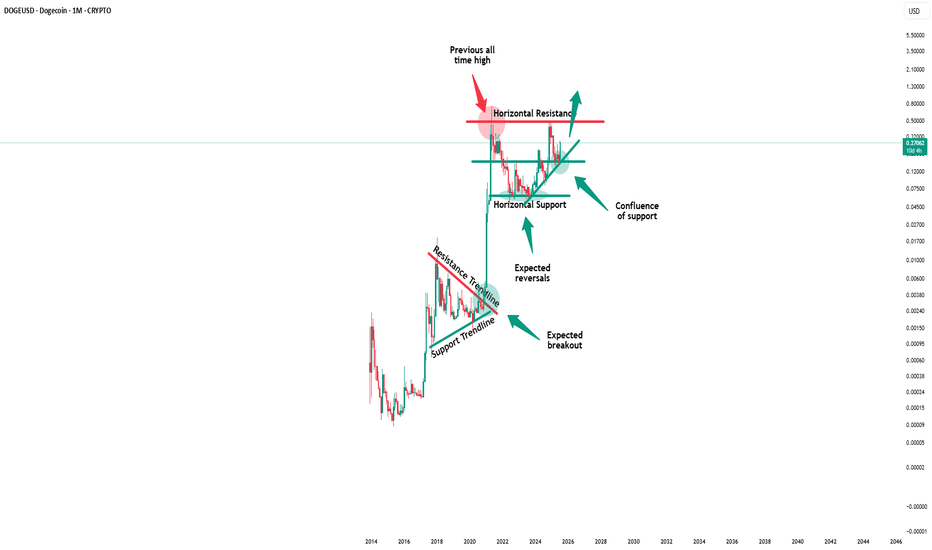

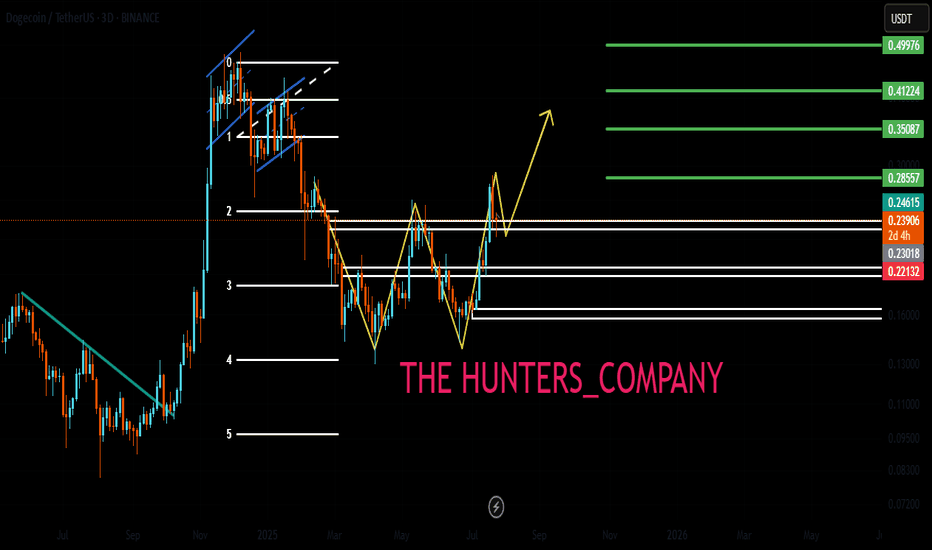

Dogecoin - It is all totally expected!🐶Dogecoin ( CRYPTO:DOGEUSD ) will break out soon:

🔎Analysis summary:

Just this month, Dogecoin perfectly retested a significant confluence of support and is starting the expected rejection. With bullish momentum picking up, there is a very high chance that Dogecoin will break the all time high in the near future.

📝Levels to watch:

$0.5

🙏🏻#LONGTERMVISION

SwingTraderPhil

Thief Strategy Unlocked: DOGE/USDT Swing Robbery🐕💸 "DogeCoin Heist Plan: Swipe the Vault Before the Bark Bites!" 💥🔐

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

🎩 Welcome back, Money Makers & Market Robbers! 🏴☠️

💥 This is your DOGE/USDT (Dogecoin vs Tether) Crypto Market Heist Plan – fully loaded with Thief Trading Style tactics combining technical firepower 🔥 and macro intel 📊 for a high-voltage entry!

💣 Plan of Attack: The Robbery Blueprint 📈

🎯 Entry Point:

🟢 The vault's wide open! Enter LONG at any price—pullback is your sneak path in.

Set your BUY LIMIT orders using 15m or 30m timeframes at the recent swing zones.

Layer them like a pro 💹 with DCA (Dollar Cost Averaging) precision.

🛑 Stop Loss (SL):

👂 "Listen up!" Don’t slap a stop loss before the pullback confirms—it’s like triggering the alarm too early!

📍 Thief's SL placed only after pullback occurs—use the 4H swing low around 0.19000.

✍️ Adjust SL based on your risk appetite, lot size, and number of entries.

🏁 Target Zone:

🎯 Aim for 0.28000, or make a stealthy exit before the escape door shuts.

💰 Special Note for Scalpers:

Only go LONG—this market’s barking up, not down!

Big pockets? Straight in.

Smaller stack? Join the swing crew and rob with patience.

Use a trailing SL to secure the loot 🏆.

📊 Market Overview:

Currently bullish bias due to:

Macro inflows

Risk sentiment shift

Volume surge

On-chain support

Check 📡: Fundamentals | COT | Intermarket | Sentiment | Price Action.

⚠️ Heist Hazard - News Alert:

📰 Don’t enter new positions around high-impact news.

Set trailing SLs to guard your open trades during these volatile spikes.

💖💬 Robbers' Call to Action:

💥 Hit that BOOST Button on the idea 💥

Not just for likes—it fuels our squad’s energy and signals more Thief Heist Plans are coming 🐱👤💸

Let’s rob these charts—strategically, smartly, & silently.

📌 Stay Tuned for more explosive trade setups from the vault of Thief Trader.

🤑🛸 Trade smart. Trade bold. Trade like a Thief.

DOGE MACD Liquidity Tracker Strategy – Trend Flip & Breakdown 1DThis DOGE 1D chart highlights two key directional shifts caught by the MACD Liquidity Tracker Strategy — a bullish breakout near $0.12 and a clean reversal near $0.33. The system flipped long once MACD momentum aligned with trend structure, and later rotated bearish as the trend exhausted.

Both moves were captured without guessing — using dynamic trend coloring and a momentum-backed entry logic. Visual bias (blue/pink) helps contextualize the trend at a glance, and the EMA filters reduce chop during sideways conditions.

To explore this setup yourself, search for the strategy by name and run your own backtests to refine inputs per asset and timeframe.

📊 Strategy Name:

MACD Liquidity Tracker Strategy

This is one of several strategy visualizations — more incoming.

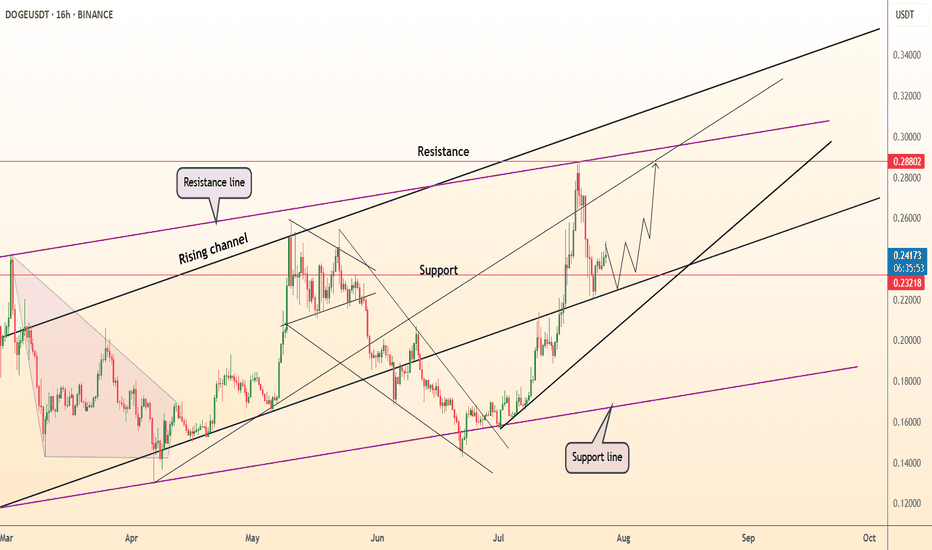

DeGRAM | DOGEUSD above the support level📊 Technical Analysis

● DOGE keeps printing higher swing-lows inside the 5-month rising channel; the latest pull-back bounced precisely at the mid-band/0.232 support, turning May’s flag roof into demand.

● A fresh micro bull-flag is unfolding above that rail; its pole height and channel geometry project follow-through toward the upper red supply 0.288-0.300 where the purple macro cap meets the channel crest.

💡 Fundamental Analysis

● Binance confirmed its late-July quarterly burn will include >150 M DOGE trading-fee tokens, trimming float, while reports of X testing DOGE micro-payments boosted social volume this week.

✨ Summary

Long 0.232-0.245; hold above 0.232 targets 0.272 → 0.288. Invalidate on a 16 h close below 0.214.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

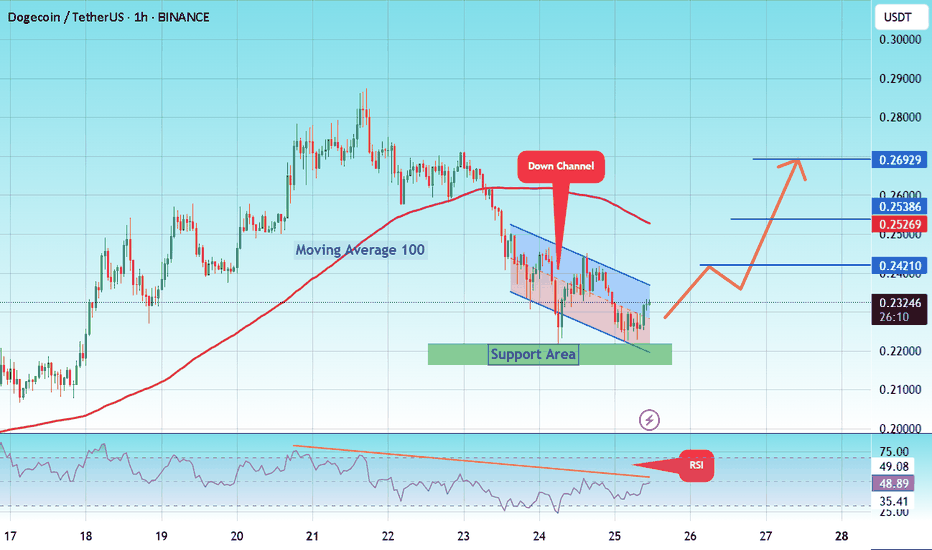

#DOGE/USDT falling wedge#DOGE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.22270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.21777.

Entry price: 0.2320

First target: 0.24210

Second target: 0.25380

Third target: 0.26920

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

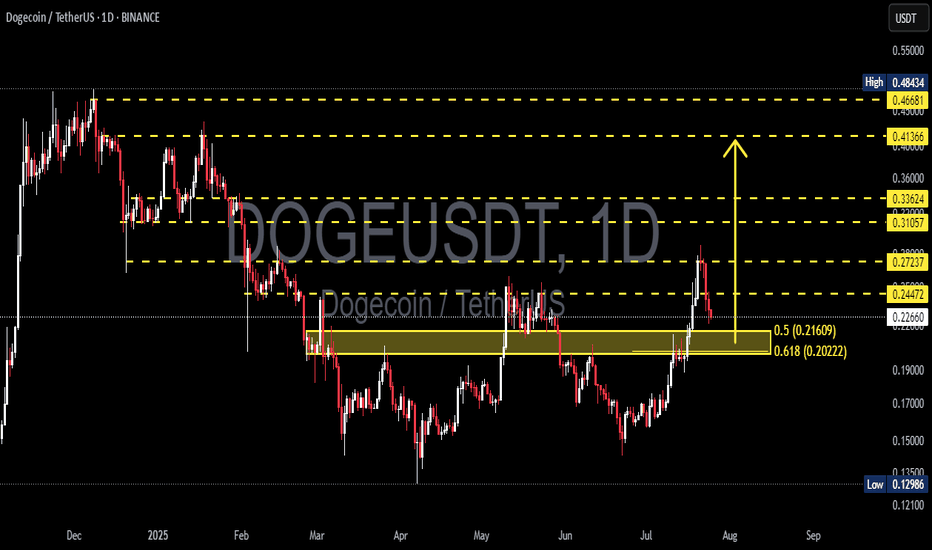

DOGEUSDT at a Make-or-Break Level: Bounce or a Breakdown?📉 Overview:

After a strong rally from the $0.13 zone to a recent local high of $0.272, DOGE is now undergoing a healthy correction. The price has retraced to a critical Fibonacci Golden Pocket zone (0.5–0.618) between $0.21609 and $0.20222 — historically one of the most powerful zones for market reactions.

This area also aligns with a previous resistance zone that is now being retested as support — a classic SR Flip (Support/Resistance Flip).

---

📌 Key Technical Structure:

🔸 Support & Demand Zone (Golden Pocket):

$0.21609 (Fib 0.5) and $0.20222 (Fib 0.618) – key retracement levels of the recent bullish swing.

Acts as a confluence zone with horizontal support from prior consolidation.

🔸 Major Resistance Levels:

$0.24472 – immediate resistance to reclaim.

$0.27237 – recent high and a major supply zone.

$0.31057, $0.33624 – historical distribution zones.

$0.41366 – breakout confirmation zone for a full trend reversal.

---

🧠 Market Psychology & Patterns:

Breakout & Retest: DOGE recently broke out from a long-term range and is now retesting the breakout zone.

Potential Bull Flag or Descending Channel: Current pullback resembles a flag or bull pennant — both continuation patterns if confirmed with volume.

---

✅ Bullish Scenario (Bounce):

If DOGE holds the Golden Pocket ($0.216–$0.202) and prints a strong bullish reversal candle:

A bounce may push price back to $0.244, and if reclaimed, back to $0.272.

A confirmed breakout above $0.272 with volume could lead to:

Mid-term targets: $0.310 → $0.336 → $0.413 → $0.466.

📈 Confirmation: Daily candle close above $0.244 with rising volume.

---

❌ Bearish Scenario (Breakdown):

If price fails to hold above $0.202 and breaks below with daily close:

It signals invalidation of the bullish structure and possible reversal.

Downside targets:

$0.186 – short-term support.

$0.150 – psychological support.

$0.129 – Year-to-date low (YTD Low).

This would also form a Lower High – Lower Low structure indicating a shift to a bearish trend.

---

🔍 Volume & Momentum Clues:

Watch for volume spikes near $0.202–$0.216.

Strong green candle + volume = likely reversal.

Weak reaction or breakdown on low volume = potential continuation downward.

---

🎯 Trader Playbook:

Signal Action Target

Bounce from $0.216–$0.202 Long Entry $0.244 – $0.272

Daily close below $0.202 Short / Avoid Longs $0.186 → $0.150

Breakout above $0.272 w/ volume Breakout Entry $0.31 → $0.336 → $0.41+

---

🏁 Conclusion:

DOGE is currently at a critical inflection point. The Golden Pocket zone will likely determine whether bulls are accumulating for another leg up or bears are about to reclaim control.

💡 This is a time for strategy, not prediction. Wait for confirmation before committing to either direction. The market is speaking — all we have to do is listen.

---

📊 Chart Summary:

Timeframe: Daily (1D)

Pattern: Breakout Retest + Fibonacci Retracement + Bull Flag

Structure: Higher High – looking for Higher Low confirmation

#DOGEUSDT #Dogecoin #CryptoTA #GoldenPocket #AltcoinAnalysis #FibonacciTrading #BreakoutSetup #BullishContinuation #BearishReversal

DOGECOIN : Should we expect an increase?Hello friends🙌

📈Given the decline we had, you can see that buyers entered at the specified support and formed a double bottom reversal pattern, which is a strong signal on support.

📉Considering the possible market correction, we placed two more buy levels lower so that we can buy there if the price corrects.

⚠Don't forget about capital and risk management, friends.

🔥Follow us for more signals🔥

*Trade safely with us*

DOGE Strategy — Momentum Entry, MA Trend Hold, Pullback PhaseThis chart showcases how the MACD Liquidity Tracker Strategy performed on DOGE over the past several days. The strategy entered during a clear momentum breakout and trended cleanly above its MA filter for nearly 48 hours.

Let’s break it down:

🔹 First Signal: Early compression breakout long, but price stayed flat. This entry was managed with a tight close before the second impulse began.

🔹 Second Long: Clean breakout on rising momentum — confirmed by MACD histogram expansion and strong Stoch RSI crossover.

🔹 Trend Structure: MA support held multiple times during this move, reinforcing the uptrend. Dotted trendline shows price respecting structure cleanly.

🔹 Exit Trigger: Price began consolidating and histogram showed waning momentum. The strategy correctly exited before the full reversal began.

🔹 Current Action: Pullback in progress. MACD histogram flipping red, Stoch RSI resetting. This may just be a correction… or the trend might be breaking.

📊 This setup is a textbook use of trend filters, confluence, and exit logic — and a good reminder that the strategy isn’t just about entry… it’s about managing exits with discipline.

Whether this develops into a higher low continuation or rolls into full reversal, momentum confirmation is key before the next entry.

#DOGE #TradingStrategy #AlgoTrading #MACDStrategy #QuantTrading #CryptoTechnicalAnalysis #PriceAction #TrendFollowing #Backtesting #CryptoCharts

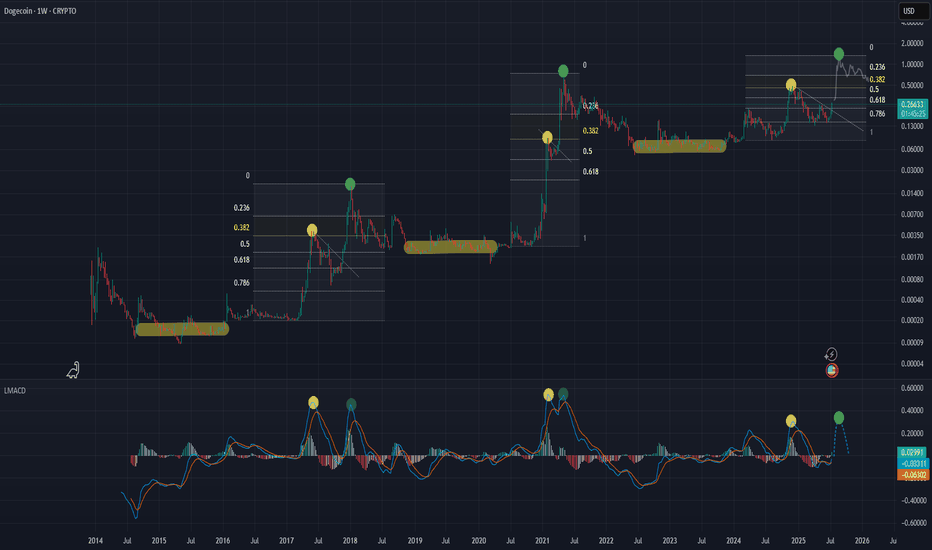

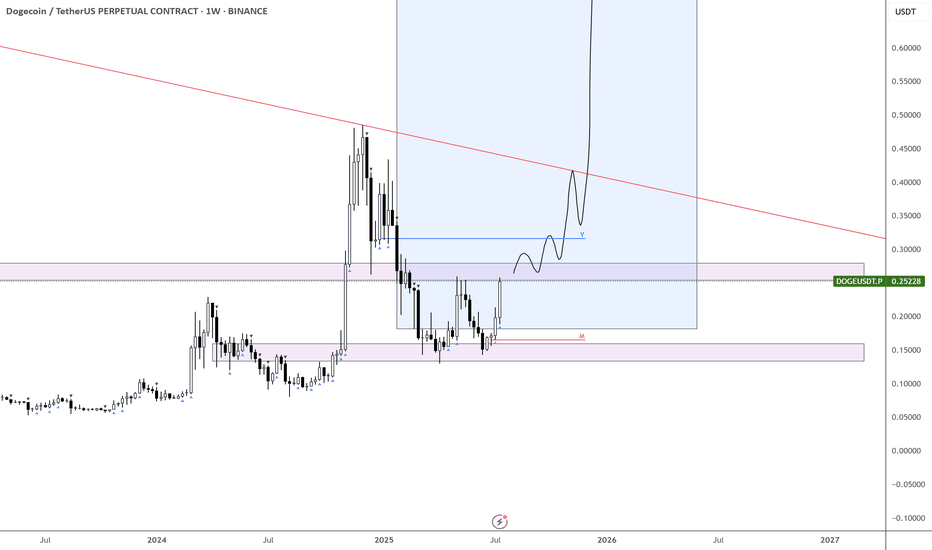

DOGEUSD Is that a textbook Livermore Cylinder to $1.5 ??Doge (DOGEUSD) has been trading within a Bullish Megaphone for the majority of its Bull Cycle since the October 09 2023 Low. We may technically claim that this has been so far one massive Accumulation Phase, along with the rest of the altcoin market.

A pattern that draws strong comparisons with that Megaphone has been 'Livermore's Accumulation Cylinder'. Jesse Livermore, an American stock trader, came with a revolutionary trading pattern a century ago, whose principles often apply perfectly to today's financial assets.

This is what we do on today's Dogecoin analysis, we apply this Accumulation Cyclinder on Doge's Bullish Megaphone. Even though not a perfect fit obviously, the main characteristics apply, with clearly visible Bullish and Bearish Legs.

Based on this model, the market is right now starting the aggressive break-out phase above the Cylinder. Technically the Accumulation is over and the price may pursue levels 8 and 9, which give price Targets of $1.50 and $12.00 respectively.

Now, even though $12.00 falls well after (6 months or so) the expected duration of the current Bull Cycle, $1.50 is well within its limits (October - November 2025) and exactly double the price of the previous Cycle High. This makes it a very attractive Top candidate.

So do you think Doge is inside a Livermore Cylinder that is about to break out parabolically?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

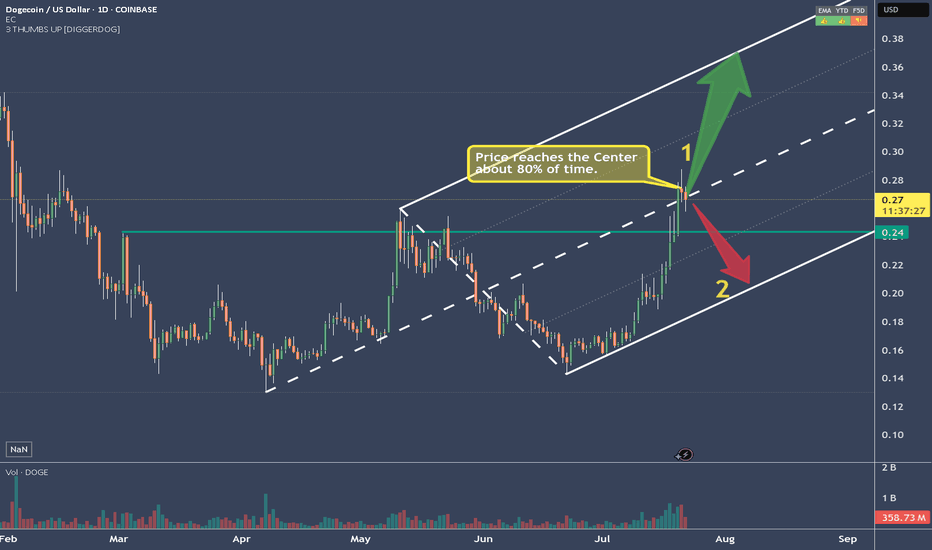

DOGEUSD Has reached it's (first?) targetAfter reaching the Centerline, price eitheradvances to the Upper Extreme (U-MLH), or it reverses and it's target is the L-MLH, the lower Extreme of the Fork.

An Open & Close below the Centerline would indicate further progress to the downside.

A stop above the last high with a target around 2 would be the trade I would take.

DOGE | Gearing up For a BIG MOVEDoge is looking mighty bullish after establishing a clear bottom.

Together with confirmation from BTC, we can safely say that altseason is yet ahead of us. BTC's recent increase show that the bullish impulse is still upon us. And after ETH increases, the rest of the altcoin market will follow suit as per usual.

DOGE is bullish because:

✅ Clear bottom

✅ Higher lows, daily looking to reclaim the moving averages:

✅ Altseason upon us after ETH increase

Ultimately, we need to wait for confirmation - if THIS major resistance zone is cleared (in other words if daily candles close ABOVE this zone) then we're full bull mode.

________________

BINANCE:DOGEUSDT

$DOGE Flipping to Bullish Structure!CRYPTOCAP:DOGE is coming to life after a second test of the weekly 200EMA as support and about to make a higher high, cementing in that higher low and flipping the macro structure bullish!

If the count is correct wave 3 of (III) should be powerful! The weekly pivot should put up a challenge as the first resistance before the High Volume Node at $0.45

Safe Trading

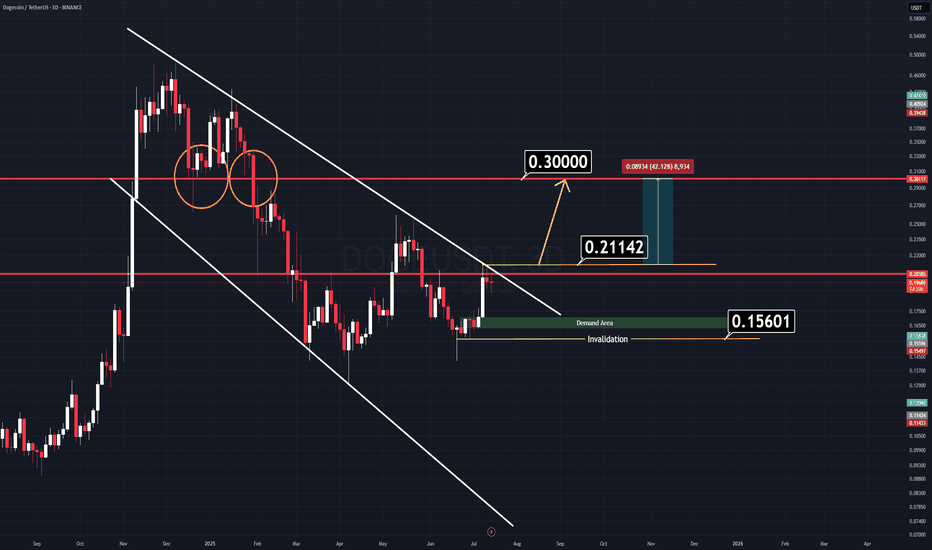

DOGE Analysis (3D)There’s a very simple and clear chart setup on Dogecoin (DOGE) right now.

We have two major horizontal key levels and a channel that is about to break down. If the price manages to close above the yellow-marked line ($0.21142), we can expect a strong rally to follow.

There’s no need for complicated indicators cluttering the screen — all relevant levels are clearly marked on the chart.

Two Logical Entry Approaches:

1️⃣ Breakout Entry: Enter on a confirmed breakout. (Waiting for a daily candle close on a memecoin might slightly reduce your profit range, but it’s the safer approach.)

2️⃣ Demand Zone Entry: Wait for the price to retrace to the green demand zone — though this scenario seems less likely for now.

A combined approach can work best: enter on breakout, use the horizontal levels as support, and set a tight stop-loss to manage risk.

Good Luck.

$1 in the Horizon for $DOGE!We’ve got something interesting brewing on CRYPTOCAP:DOGE right now:

Monthly trend is active

Uptrend in place for over a year (not relying on that timeline, but historically, targets hit within it)

If we can get above $0.30 and hold, the path to $1 opens up for the first time.

Other similar charts are also aligning for exponential moves, setting up to break out of multi-year consolidation patterns.

Keep a close eye on CRYPTOCAP:XLM as well — it’s shaping up with a very similar structure.

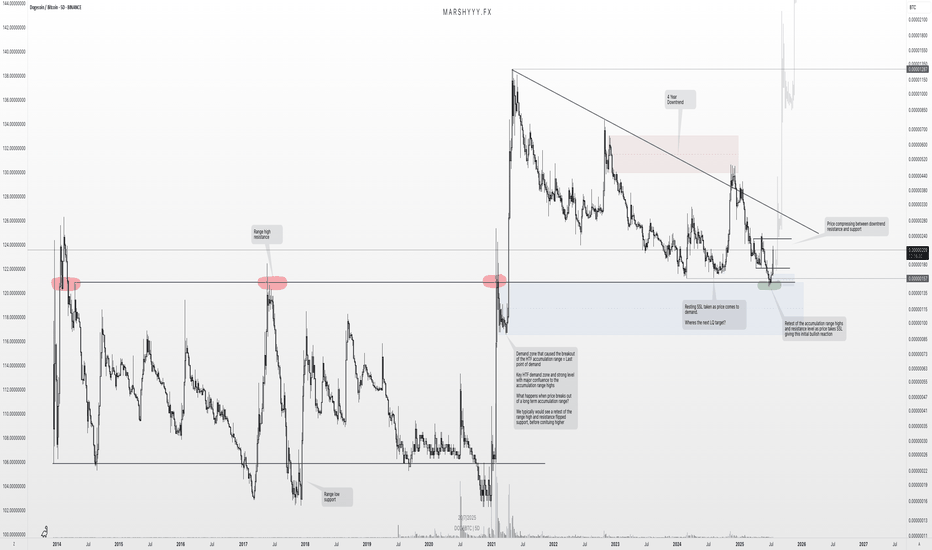

DOGE/BTC: HTF Retest Complete — Reversal BrewingDiving into DOGE/BTC, we’re seeing strong bullish confluences that align well with the DOGE/USDT structure and support the idea that the macro low is in.

Looking back across all available data, DOGE/BTC has traded within a clear 7-year accumulation range dating back to 2014, bounded by a defined range high resistance and range low support. This long period of consolidation enabled massive accumulation, ultimately leading to the first breakout in 2021, which rejected at the highs, pulled back, and then exploded into a cycle ATH.

Since that 2021 high, DOGE/BTC has been in a 4-year downtrend, retracing back into discount pricing, right into the range high of that original accumulation zone — which now acts as a major HTF demand level and last point of support before the original breakout.

📉 What’s happened recently?

- Price swept 2024 swing lows (SSL)

- Tagged the HTF demand zone

- Retested the 2021 breakout level (accumulation range high)

- Coiling inside a descending wedge with contracting volatility

This entire region is a key reversal zone from both a structural and psychological standpoint. It’s where we typically see major trend shifts form, and the structure suggests we’re forming a HTF swing low and bottom from this area.

🧠 Add this to the confluence from DOGE/USDT — which also appears to have printed its bottom — and the case for a macro reversal gets even stronger.

As this wedge tightens and price continues to compress against long-term support, I’m anticipating an explosive breakout that kickstarts the next leg of the HTF uptrend — effectively a continuation of the original breakout from the 7-year range.

5D:

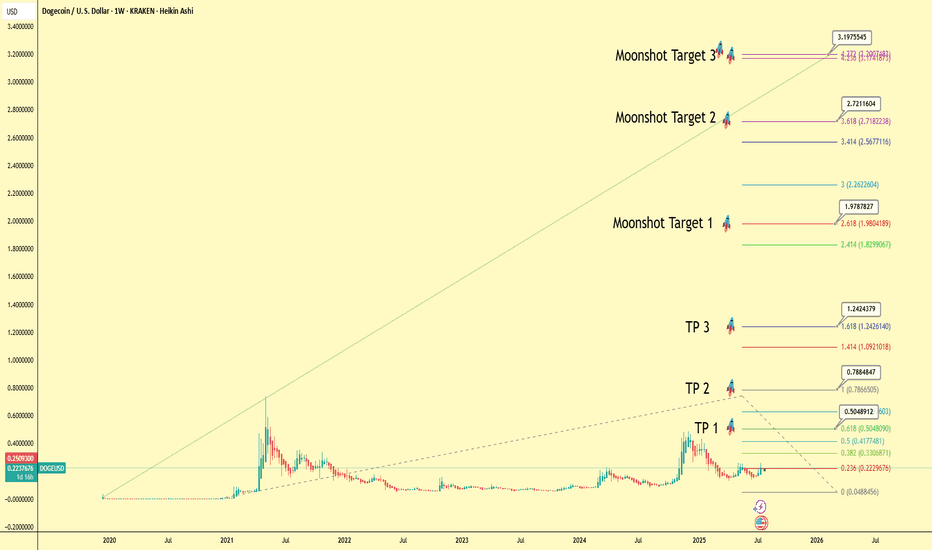

DOGE Macro Analysis: A Technical and Fundamental Blueprint to $3This analysis presents a long-term macro view for Dogecoin (DOGE/USD) using a daily Heikin Ashi chart to smooth out price action and better identify the underlying trend. The primary technical tool employed is a multi-year Fibonacci extension, a powerful instrument for projecting potential price targets in a trending market.

Based on the key swing low and high of the previous cycle, we have mapped out several conservative take-profit (TP) levels and more ambitious "Moonshot" targets.

The Technical Targets

The core of this projection lies in the Fibonacci extension levels. Assuming an entry or cost basis around the current consolidation level of $0.25, the potential targets are as follows:

TP 1 (0.618 Fib): $0.505 (+102% Profit)

TP 2 (1.000 Fib): $0.788 (+215% Profit)

TP 3 (1.618 Fib): $1.242 (+397% Profit)

Moonshot Targets

For longer-term holders, the upper Fibonacci levels suggest significant upside potential:

Moonshot Target 1 (2.618 Fib): $1.979 (+692% Profit)

Moonshot Target 2 (3.618 Fib): $2.721 (+988% Profit)

Moonshot Target 3 (4.236 Fib): $3.175 (+1170% Profit)

The Rationale: Why These Prices are Expected

This bullish outlook is supported by a combination of historical technical patterns and strengthening fundamental catalysts:

Historical Cycle Performance: In previous bull cycles, Dogecoin has shown a remarkable tendency to not just meet, but exceed standard Fibonacci targets, often running all the way to the 4.236 extension level. While past performance is not a guarantee, this historical precedent forms a strong basis for the "Moonshot Target 3" as a cycle peak objective.

Growing Institutional Legitimacy: The landscape for digital assets is maturing. Recent news about a major player filing with the SEC to list Dogecoin futures is a significant catalyst. Such a product would open the door for institutional capital, enhance liquidity, and provide a regulated pathway for investment, fundamentally increasing Dogecoin's legitimacy and market depth.

Renewed Investor Inflows: Dogecoin possesses one of the most resilient and loyal retail communities in cryptocurrency. As the market cycle progresses, the combination of re-energized retail interest and new institutional inflows could create a powerful demand-side shock, providing the fuel needed to reach these upper price targets.

Conclusion

This analysis outlines a clear, multi-stage roadmap for Dogecoin's potential path forward. The confluence of a historically reliable technical pattern (Fibonacci extension) and major fundamental catalysts (futures listing, broad investor interest) creates a compelling long-term thesis.

Disclaimer: This is a personal analysis and projection for educational purposes only. It is not financial advice. Always conduct your own research and manage your risk accordingly.

#Dogecoin #DOGE #Crypto #TechnicalAnalysis #Fibonacci #Altcoin #TradingView #ToTheMoon

DOGE - Another Perspective- DOGE is currently trading nearing the trendline resistance and pending breakout

- A clear breakout from this resistance line is a must to continue to bullish momentum.

- we will enter the trade after confirmed breakout

Entry: 0.221

SL at: 0.14103

TP1: 0.26035

TP2: 0.33892

TP3: 0.47751

Stay tuned for more updates.

Cheers

GreenCrypto

Will DOGE Hit $1? Ascending Broadening Wedge in PlayDogecoin is trading within a clear ascending broadening wedge on the weekly chart. The price has bounced strongly from wedge support and the 100 and 200 EMAs, now pushing upward with growing volume and bullish candles. If momentum sustains, DOGE could rally toward the $1 psychological target and broadening wedge resistance.

Resistance 1: $0.35

Resistance 2: $0.60

Resistance 3: $1.00

Stop Loss: $0.14

Cheers

Hexa

COINBASE:DOGEUSD BINANCE:DOGEUSDT