DOGSUSDT: Inverse Head & Shoulders Pattern in PlayHello.

The chart clearly shows an inverse head and shoulders formation. Price has now formed:

Left Shoulder

Head

Right Shoulder (recently completed)

The neckline was engulfed after a strong move, which adds confidence to the breakout potential. If the price continues to hold above the right shoulder and gains momentum:

First target is around the 0.0002280 area

Second target is marked near 0.0003430

If volume increases or we see continuation candles, this setup could offer a good bullish opportunity.

Invalidation: Breakdown below the right shoulder lows would weaken the pattern.

Dogsusd

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the descending channel, at 0.0001432.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001402, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001460

First target: 0.0001538

Second target: 0.0001500

Third target: 0.0001581

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

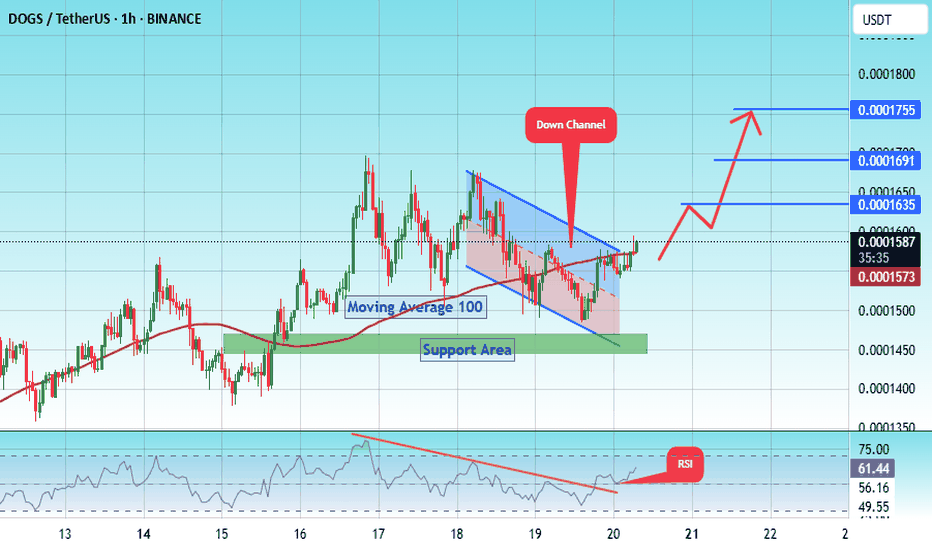

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the descending channel, at 0.0001485.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area in green at 0.0001450, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the moving average of 100.

Entry price: 0.0001580

First target: 0.0001635

Second target: 0.0001690

Third target: 0.0001755

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

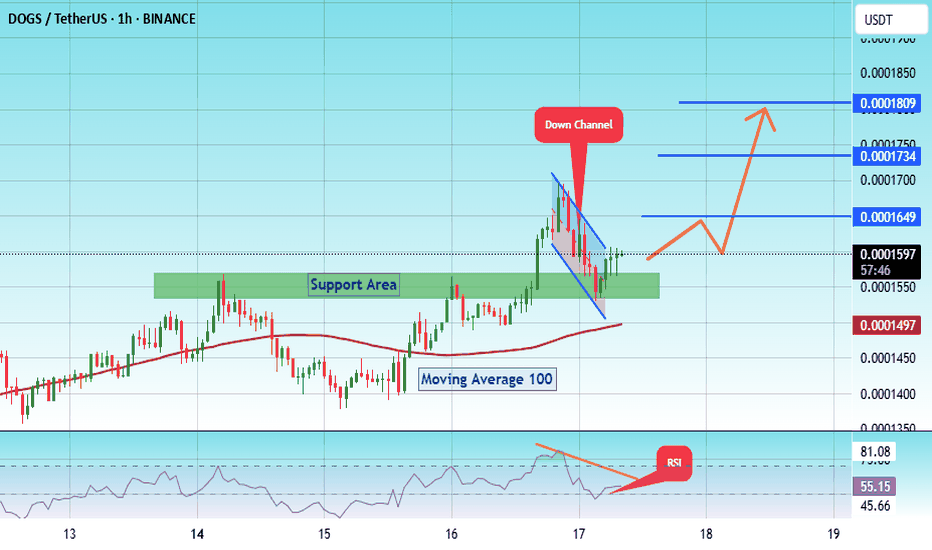

#DOGS/USDT – Launchpad or Breakdown?#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0001500.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a key support area in green at 0.0001544, which represents strong support as a basis for the upside.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the moving average of 100.

Entry price: 0.0001600

First target: 0.0001650

Second target: 0.0001733

Third target: 0.0001800

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

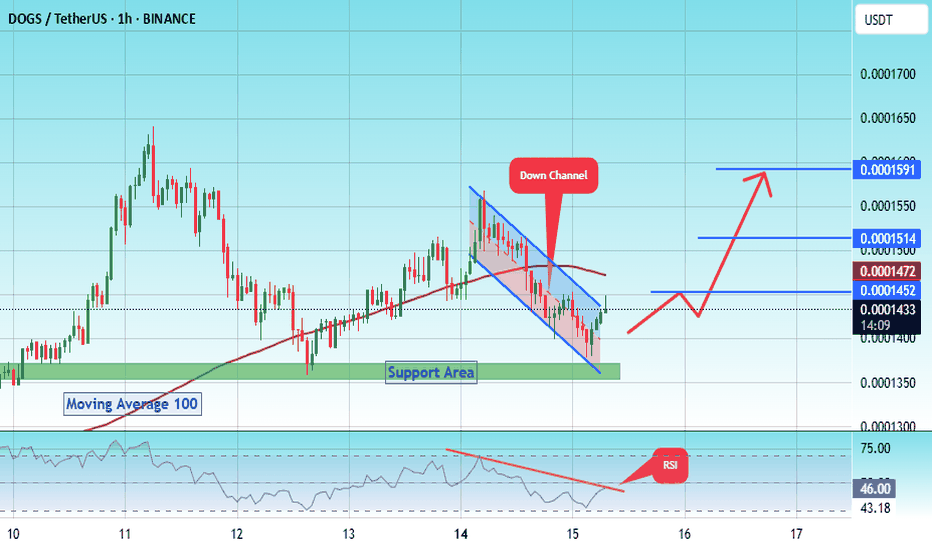

#DOGS/USDT – Launchpad or Breakdown?#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0001385.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001362, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001430

First target: 0.0001452

Second target: 0.0001514

Third target: 0.0001590

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

DOGS BUY !!!Hello friends🙌

📉Regarding the price drop, you can see that the price has been suffering for a while and even the resistance has broken, which is not a valid failure (80% of failures are fake in the range)

📈Now, with the successful failure we had and the moneyback that the price has made, we can expect the price to move to the specified targets. Note that for trading, be sure to observe capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

Dogs:Where is the time and point of purchase?hello friends👋

We come to another analysis, this time a popular coin meme that you requested a lot🔥

Well, let me start with the pattern that we specified for you, which is a sign of a price drop, and you can see this happening...

Now, in the important support areas that we have specified for you, you can buy step by step, of course, with risk and capital management.💰

🔥Follow us for more signals🔥

*Trade safely with us*

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0001370, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0001330.

Entry price: 0.0001380.

First target: 0.0001422.

Second target: 0.0001490.

Third target: 0.0001562.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

DOGS/USDT – Preparing to Break Out from Accumulation Zone!

DOGS/USDT is currently at a crucial technical point, offering an exciting setup for both short-term traders and long-term investors. After a prolonged downtrend since mid-2024, the price has now stabilized within a major demand zone, forming what appears to be a classic accumulation structure.

🔍 🔹 TECHNICAL STRUCTURE & PATTERN

Accumulation Zone (Base Area): Price has been consolidating between 0.00010 – 0.00018 USDT, retesting this range multiple times since February 2025.

Stable Volume During Sideways Movement: Indicates that selling pressure has weakened and smart money may be entering.

Bullish Impulse Arrow: Suggests potential for vertical breakout if resistance is broken with strong momentum.

Possible Double Bottom or Rounded Base Formation: Classic bullish reversal patterns indicating trend exhaustion.

✅ Bullish Scenario – Multi-X Potential on Breakout

If DOGS breaks and holds above 0.00023 USDT, this could mark the beginning of a major bullish reversal. Potential targets include:

1. 📍 0.00049155 USDT — Initial resistance, ideal for quick profit-taking.

2. 📍 0.00083986 USDT — Previous price floor turned into a new ceiling.

3. 📍 0.00116782 USDT — A key psychological level that may trigger FOMO buying.

4. 📍 0.00238542 USDT — Mid-term bullish target if trend accelerates.

5. 🚀 0.00867539 USDT — Long-term potential if breakout gains serious momentum.

🧠 Market Psychology Note: Smart money tends to accumulate when retail is uncertain. A breakout from this range can cause a momentum rally as retail joins the move, driving prices up exponentially.

❌ Bearish Scenario – Breakdown Risks

If the price fails to hold above 0.00010 USDT, we may see:

A rejection of the current bullish structure.

A drop toward 0.00007 or even 0.000045 USDT for deeper liquidity grabs.

A prolonged accumulation phase before any potential trend reversal resumes.

📌 Key Takeaway

> DOGS/USDT is at a pivotal point — either poised for a powerful breakout with multi-fold returns or headed for a deeper dip if support is lost. All eyes should be on the 0.00023 USDT resistance as the breakout trigger. A confirmed breakout with volume could present a high-reward trading opportunity.

#DOGSUSDT #CryptoBreakout #AltcoinSetup #ReversalZone #TechnicalAnalysis #CryptoSignals #GateIO #BreakoutTrading #DOGS #BullishSetup

#DOGS/USDT Breakout in Play ?#DOGS

The price is moving within a descending channel on the 15-minute frame and is expected to break it and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0001527, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.0001493.

Entry price: 0.0001570.

First target: 0.0001610.

Second target: 0.0001650.

Third target: 0.0001712.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#DOGS/USDT Long ?#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0001192.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

There is a key support area (in green) at 0.0001180, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the moving average of 100.

Entry price: 0.0001250

First target: 0.0001276

Second target: 0.0001314

Third target: 0.0001355

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.0001230, acting as strong support from which the price can rebound.

Entry price: 0.0001261

First target: 0.0001286

Second target: 0.0001314

Third target: 0.0001352

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0001188.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001176, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001235

First target: 0.0001268

Second target: 0.0001300

Third target: 0.0001344

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.0001311.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0001337

First target: 0.0001367

Second target: 0.0001395

Third target: 0.0001432

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0001608.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.0001676

First target: 0.0001700

Second target: 0.0001732

Third target: 0.0001745

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0001575.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.0001604

First target: 0.0001656

Second target: 0.0001656

Third target: 0.0001680

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0001400, acting as strong support from which the price can rebound.

Entry price: 0.0001412

First target: 0.0001465

Second target: 0.0001511

Third target: 0.0001570

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.0001922, acting as strong support from which the price can rebound.

Entry price: 0.0001994

First target: 0.0002055

Second target: 0.0002147

Third target: 0.0002255

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.0002267.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0002323

First target: 0.0002400

Second target: 0.0002516

Third target: 0.0002620

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.0002050.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0002100

First target: 0.0002274

Second target: 0.0002406

Third target: 0.0002555

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0001510. This area acts as strong support from which the price can rebound.

Entry price: 0.0001545

First target: 0.00001611

Second target: 0.0001680

Third target: 0.0001750

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.0001400.

Entry price: 0.000135

First target: 0.0001291

Second target: 0.0001220

Third target: 0.0001146