How to Trade Doji Candles on TradingViewLearn to identify and trade doji candlestick patterns using TradingView's charting tools in this comprehensive tutorial from Optimus Futures. Doji candles are among the most significant candlestick formations because they signal market indecision and can help you spot potential trend reversal opportunities.

What You'll Learn:

• Understanding doji candlestick patterns and their significance in market analysis

• How to identify valid doji formations

• The psychology behind doji candles: when buyers and sellers fight to a draw

• Using volume analysis to confirm doji pattern validity

• Finding meaningful doji patterns at trend highs and lows for reversal setups

• Timeframe considerations for doji analysis on any chart period

• Step-by-step trading strategy for doji reversal setups

• How to set stop losses and profit targets

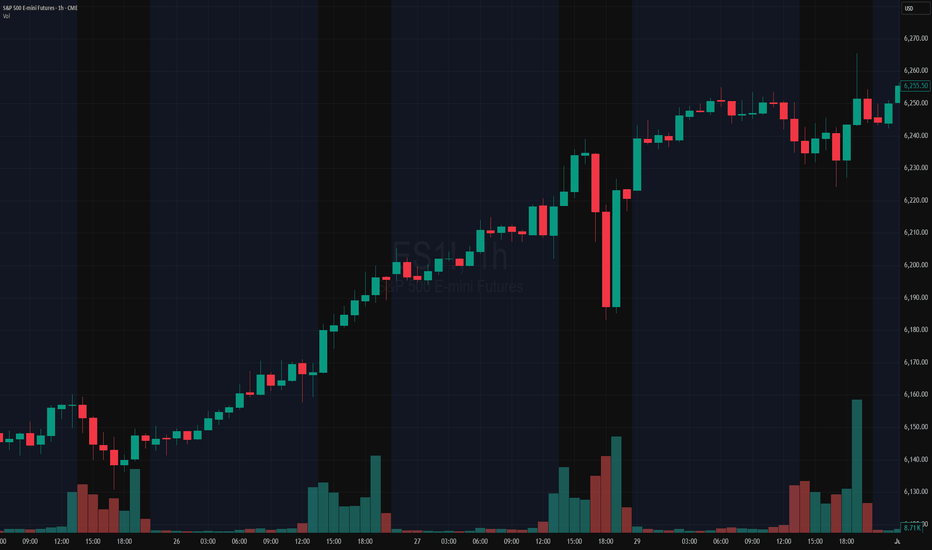

• Real example using E-Mini S&P 500 futures on 60-minute charts

This tutorial may help futures traders and technical analysts who want to use candlestick patterns to identify potential trend reversals. The strategies covered could assist you in creating straightforward reversal setups when market indecision appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

Dojicandlestick

How Do Traders Spot and Use the Dragonfly Doji CandlestickHow Do Traders Spot and Use the Dragonfly Doji Candlestick Pattern?

The dragonfly doji candlestick pattern holds intrigue and fascination for traders in financial markets. Its distinct shape and positioning on price charts make it a keen subject for observation and analysis. In this article, we will explore this setup, its significance, and how traders use it in their trading strategies.

What Does a Dragonfly Doji Mean?

The red or green dragonfly doji is a candlestick pattern that forms when the opening, closing, and high prices of an asset are equal or almost equal. This formation resembles the shape of a dragonfly because it has an extended lower shadow. It provides bullish signals and is considered a neutral pattern as it provides continuation and reversal signals, depending on its context within a trend. The meaning of a dragonfly doji is that there is uncertainty in the market, and traders are prompted to carefully analyse other factors before making trading decisions.

Traders may find the dragonfly doji pattern on charts of different financial instruments, such as currencies, stocks, cryptocurrencies*, ETFs, and indices, regardless of the timeframe. Test this pattern on various assets with FXOpen’s TickTrader platform.

The Psychology Behind the Dragonfly Doji

The dragonfly doji candle pattern reflects a tug-of-war between buyers and sellers, where neither side gains a decisive advantage. Its formation indicates that sellers initially push prices lower, but buyers step in to push prices back up to the opening level. This results in the distinct long lower shadow and minimal upper shadow.

The psychological meaning of the dragonfly candlestick pattern is significant; it shows that despite bearish pressure, buyers are strong enough to regain control by the close. It signals indecision, highlighting the need for traders to carefully evaluate other indicators and the broader trend before making trading decisions.

How Can You Trade the Dragonfly Doji?

The bullish dragonfly doji provides valuable information about market sentiment. Here are two scenarios where this formation can be significant:

The Dragonfly Doji in an Uptrend

In a bullish trend, the dragonfly doji is generally seen as a continuation signal. This is because, despite sellers attempting to push the price lower, buyers remain active and prevent a significant decline. However, it is worth noting that the inability of buyers to push the price above its open level may indicate a potential weakening of bullish momentum. Traders may consider entering the trade above the open/close of the doji’s candle or if the proceeding bar closes above the doji’s open/close. The stop-loss level may be placed below the candlesticks, while the take-profit target may be set at the nearest resistance level.

In the chart above, the pattern formed in an uptrend, and the trader placed a long trade on the next bar. The stop loss was set below the candle, with the take profit at the closest resistance level.

Dragonfly Doji in a Downtrend

The dragonfly doji in bearish trends may suggest a possible upward reversal. The long lower shadow indicates that buyers entered the market, pushing the price up from its lows. This could be seen as a signal to consider going long or watching for a further bullish confirmation before taking action. Traders may place a stop loss below the candle with a take profit at the closest resistance level or may consider the appropriate risk/reward ratio.

The candle at the end of a downtrend signals a price reversal. The trader placed a buy order at the high of the doji with a stop-loss level below it. The take profit is calculated based on the risk/reward ratio.

Traders can enhance their trading strategies by utilising the free TickTrader trading platform.

How Can You Confirm the Dragonfly Doji?

Confirming the dragonfly doji may increase the reliability of trading decisions. Here are key factors to consider:

- Volume Analysis: High trading volume during the formation of a dragonfly candle may indicate stronger market sentiment and increase the likelihood of a significant move.

- Subsequent Candlesticks: Traders look for a bullish candlestick following the dragonfly candlestick. This reinforces the potential for a trend reversal or continuation.

- Support and Resistance Levels: A formation occurring near significant support levels can strengthen its validity as a potential reversal signal.

- Technical Indicators: To gauge momentum and confirm signals, traders often complement the analysis with indicators like the Relative Strength Index (RSI), moving averages, and Bollinger Bands.

- Market Context: It’s best to evaluate the broader market trend and news that may impact market sentiment to provide a clearer picture of its implications.

Dragonfly and Other Patterns

Dragonfly doji, gravestone doji, spinning top, and long-legged doji are all types of candlestick patterns commonly used in technical analysis to indicate potential reversals or indecision in the market. Traders often pay close attention to them when making trading decisions.

Dragonfly Doji vs Gravestone Doji

While the dragonfly doji has a long lower shadow and little or non-existent upper one, the gravestone or inverted dragonfly doji has a long upper wick and little or non-existent lower one. Both patterns indicate indecision, but the dragonfly provides bullish signals, whereas the gravestone indicates potential bearish reversals.

Dragonfly Doji vs Long-Legged Doji

The dragonfly has a long lower shadow with little to no upper shadow, indicating a potential bullish reversal. In contrast, the long-legged version has long upper and lower shadows, reflecting significant indecision and equal pressure from buyers and sellers without a clear directional bias.

Dragonfly Doji vs Hammer

The dragonfly and the hammer both signal potential bullish reversals, but they differ in appearance and context. The dragonfly has no upper shadow, but it has a very small body and an extended lower shadow, while the hammer has a body at the top of the candlestick and a long lower shadow. The hammer typically appears after a downtrend, signalling a reversal, while the dragonfly doji appears in uptrends and downtrends.

Limitations of the Dragonfly Doji

While the dragonfly doji is a valuable candlestick formation for traders, it is not without its limitations. Recognising these constraints can help them understand how to use it most effectively.

- False Signals: The dragonfly sometimes produces false signals, leading traders to anticipate reversals that do not materialise.

- Market Context: Its effectiveness is heavily influenced by the broader market context. It may not be reliable in all situations, particularly in choppy or sideways assets.

- Confirmation Needed: Additional indicators or subsequent price action are usually required to confirm the pattern, as relying solely on its appearance can be risky.

- Limited Power: It does not provide information on the magnitude of the subsequent price movement, making it challenging to set precise profit targets.

Closing Thoughts

Candlestick patterns should not be relied upon as the sole factor in trading decisions. It is essential to perform a comprehensive analysis and implement robust risk management strategies before making any trades. Once you are confident in your analysis, consider opening an FXOpen account to take advantage of spreads as tight as 0.0 pips and commissions starting at just $1.50.

FAQ

What Does Doji Candle Mean?

A doji candle represents a session where the opening and closing prices are almost equal, indicating market indecision. It suggests neither buyers nor sellers are in control, resulting in a standoff. Doji candles can take various forms, including dragonfly, gravestone, and long-legged, each with unique implications.

What Does a Dragonfly Doji Indicate?

A dragonfly doji indicates indecision and potential trend reversal. It forms when the open, high, and close prices are near the same level but it has a long lower shadow. This formation suggests buyers counteracted initial selling pressure, signalling a possible bullish shift.

Is the Dragonfly Doji Bullish or Bearish?

The dragonfly is generally considered bullish, especially after a downtrend. Its formation indicates buyers pushed prices back to the opening level, potentially leading to a price increase.

What Is the Opposite of the Dragonfly Doji?

The opposite of the dragonfly doji is the gravestone doji. The dragonfly has a long lower shadow and little to no upper shadow, while the gravestone features a long upper shadow and minimal lower shadow, indicating a potential bearish reversal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Hanging Man and Doji Patterns in Focus!XAUUSD

2H Chart

Price: 2622.23

Hanging Man:

The highlighted candle in the chart represents a Hanging Man pattern, which is a bearish reversal pattern typically found at the top of an uptrend.

The long lower wick signifies that sellers pushed the price down during the session, but buyers managed to bring it back up close to the open price, though not with strong bullish conviction.

The fact that this pattern appears after a sharp upward move signals a potential bearish reversal, especially if followed by a bearish confirmation candle.

Doji:

The Doji signals indecision, with buyers and sellers unable to gain control as the open and close prices are nearly the same. Following the Hanging Man and with an overbought RSI of 73.32, it suggests weakening bullish momentum and potential for a bearish reversal.

Place a stop loss above the Hanging Man’s high and set take profit near the next key support at 2,613.732. These levels are derived from the Hanging Man, providing some bearish confirmation. However, traders should feel free to skip the trade if they aren’t confident with the setup, as prioritising risk management is crucial.

Confirmation:

A bearish candle closing below the low of the Doji would provide strong confirmation of a trend reversal.

Good luck in the markets!

🔔 To stay updated, don’t hesitate to follow!

💡 Learn

💹 Trade

🤑 Grow

Manipulation in BTC Supply Zone:

A supply zone occurs when the supply of a cryptocurrency exceeds the demand.

In this area, there is excess supply, leading to a falling price.

On a price chart, a supply zone is associated with a downtrend.

Traders often place sell orders in supply zones, expecting prices to decline further.

Imp : forming doji candles in weekly chart

Interpreting Doji Patterns:

Bearish Doji: When a Doji forms at a resistance area, it can signal indecision or a potential trend reversal.

However, the context matters:

If the preceding trend is upward, a bearish Doji may indicate a reversal.

If the preceding trend is downward, it could reinforce the existing bearish sentiment.

EPIX - Biotech Pre-earnings Run LONGEPIX on the 15-minute chart shows a solid trend up with a set of moving averages as the

guardrails now in a bit of a pullback. The after-hours price action will not appear on the chart

but price jumped 5%. Earnings are anticipated for 2/8 or 2/9 as best as I can tell. Internet

search information is not consistent. So, if tomorrow this is still pre-earnings but price popped

5% overnight, I will take a small long position. If the price is still pulled back to the slowest

moving average, I will take a larger position. No matter I will assess it on a 3-5 minute time

frame and recheck internet information regarding an earnings report. One news catalyst is that

Secretary of Defense has been in and out of the hospital ( DC VAMC) with prostate cancer

and maybe currently getting treatment in a clinical trial of an EPIX drug per the NIH

in Bethesda. Biotech is forecasted to be one of the hottest sectors for 2024. EPIX has

a trend up that impresses me. I will go long on this when I find a best entry and possibly in the

next trading session. The options chain is minimal volume as so represents a liquidity trap.

I will not go there.

PLCE crash and flush on pre-emptive warning from executives LONGPLCE as shown on the 30 minute time frame had a "waterfall" event when a bad news catalyst

hit the wires. Executives announced earnings issues one month out from the report due about

March 14th. Maybe is real and may not. The are no filings available to show any insider sell-

off unlike what is going on at General Dynamics at its all-time high. Could those executives

push traders to bail on the stock, force it to crater and then buy even more at the bottom or

have friends and family help them if they are well informed ? Who knows ? Does the CEO of

TSLA have a plan to help share prices drop so when his new compensation plan is set up he

gets even more shares and price rises to make his unrealized losses magically disappear.

Is there manipulation in the market ? Is this a case of it ?

Anyway enough said. PLCE is in early reversal and recovery. It has crossed the moving averages

on the chart and there is a massive volume of buyers scooping from the bottom in the

closing Friday afternoon. I was one of them. My shares and options are few. ( compared with

the CEO/COO/CFO guys at Children's Place.- they typically buy 100,000 shares at a pop - after

all they have the confidence of already knowing what is going on inside) I typically want to

see 2-3X relative volume to put on a big position. This is 4X. Seems the risk is low compared

with a 60% upside back to price levels before the news. Price has already recovered partially.

My stock trade is 5% above break even after less than a day and now has a 3% trail stop so

I don't need to pay attention to it. The call options targeting $19 for March 16th are up 16%

in the first day. I will sell to close a day or two before earnings to hedge my suppositions.

If earnings are as bad as these executives say. The call options will plummet.

My alternative is to keep the call options running but hedge them with a single put option

below ITM for a strike OTM expiring the same day setting up a strangle to take much of the risk

way. In that case, the call options would still fall with a bad earnings miss but the put option

will provide insurance buffering the loss. It remains to be seen how this plays out and I will

check for SEC filings at intervals. For now, I will chase the relative volume because it is higher

than the typical for similar scenarios. Best of luck to any traders who take this trade.

Monthly on btcusd.January ended with a Doji candle, a symbol of uncertainty and often when seen on the tops a prelude to reversals. But for a reversal of the trend, confirmation will be needed and we know that the underlying trend is bullish, so in this context we can use the doji candle to understand whether it will make a retracement or not, using the highs and lows of the candle. For the February or March candles, a closing below the minimum should be seen as a retracement signal because to reverse the underlying trend, in addition to confirmation, time is also needed and on this we have seen that the trend has been bullish for more than a year . A close above the doji's high, however, would be a very strong bullish signal, consolidating a trend that for now seems to catch its breath in the short term and that's all.

CVNA Long after completed Fib. RetracementCVNA on a 30 minute chart trended up from November post earnings for 6-7 weeks until

December 20th and then started falling from a head and shoulders pattern at the pivot.

The Fib retracement tool is used to draw the retracement of the prior up trend. The Trend

Based Fib Time is used on that prior up trend to show fib levels across time instead of price.

Price is currently at the 0.5 Fib retracement for price and also at 0.5 for the latter tool.

The other indicators show rising RSI, a flip between positive and negative directional indices

and volatility beyond the running mean. I will take a long trade here targeting 52.3 which is

just under a 0.5 fib retracement of the recent trend down. The stop loss will be set

at 42.8 at the level of the reversal narrow-ranged candles. A option trade will be entertained

for the February monthly expiration.

Learn Profitable Doji Candle Trading Strategy

In the today's post, I will share my Doji Candle trading strategy.

This strategy combines the elements of multiple time frame analysis, price action and key levels.

Step 1

Analyze key levels on a daily time frame.

Identify vertical and horizontal supports and resistances.

Here are the key structures that I spotted on on AUDUSD.

Step 2

Look for a formation Doji Candle on a key structure.

This rule is crucially important: we will trade only the Doji candles that are formed on key levels.

From key supports, we will look for buying, and we will look for shorting from key resistances.

Look at this Doji Candle that was formed on a key daily support on AUDUSD.

Step 3

Look for a horizontal range on a 4h/1h time frames.

Doji Candle signifies indecision. Quite often, you will notice the horizontal ranges on lower time frames when this candlestick is formed.

Here is a horizontal range that was formed on a 4H time frame on AUDUSD after a formation of Doj i.

Step 4

Look for a breakout of the range.

To sell from a key resistance, we will need a bearish breakout of the support of the range. That will be our bearish confirmation.

To buy from a key support, we will need a bullish breakout of the resistance of the range. It will be our bullish signal.

Here is a confirmed breakout of the resistance of the range with a 4H candle close above. That is our bullish confirmation on AUDUSD.

Step 5

Buy aggressively or on a retest.

After you spotted a confirmed breakout of the range, open a trading position aggressively or on a retest.

Personally, I prefer trading on a retest.

If you sell, a stop loss should be above the high of the range and your target should be the closest key daily support.

If you buy, your stop loss should be below the low of the range and a take profit will be on the closest daily resistance.

On AUDUSD, a long position was opened on a retest. Stop loss is lying below the lows. Take profit is the closest resistance.

Here is how the great strategy works!

Always patiently wait for a confirmation! That is your key to successful trading Doji Candle.

❤️Please, support my work with like, thank you!❤️

Think You Know Candlestick Patterns?Welcome to the world of candlestick patterns!

💜If you appreciate our charts, give us a quick 💜

Doji candlesticks, with their equal or nearly equal open and close, offer crucial insights into market indecision. Understanding these formations is key to anticipating potential reversals and trade decisions. Let’s delve deeper into their significance and how to incorporate them effectively into your trading strategy.

Understanding Doji:

A Doji occurs when opening and closing prices are almost identical, signaling market indecision.

Neutral Nature: Doji are neutral signals, highlighting the tug-of-war between buyers and sellers.

Psychological Insight: Forming amid market uncertainty, Doji reflect hesitancy and potential trend shifts.

4 Types of Doji and Their Meanings:

Dragonfly Doji:

Description: Open and close near the high of the day.

Interpretation: Sellers drive prices down, but buyers regain control.

Action: Explore long positions with support from trend analysis and resistance levels.

Gravestone Doji:

Description: Open and close occur near the low of the day.

Interpretation: Buyers initially push prices up, but sellers regain control.

Action: Consider short positions if confirmed by trend analysis and support/resistance levels.

Traditional Doji:

Description: Open and close are almost identical.

Interpretation: Strong market indecision; trend reversal potential.

Action: Confirm with trend analysis; consider reversal or continuation trades accordingly.

Long-Legged Doji:

Description: Significantly long upper and lower shadows.

Interpretation: Represents high indecision; neither buyers nor sellers dominate.

Action: Await confirmation from other indicators for trade decisions.

Incorporating Doji Into Your Strategy:

Combining with Support/Resistance: Doji at key support/resistance levels enhance their significance. Use them to validate potential reversal points.

Utilizing Trend Analysis: Doji are potent when aligned with prevailing trends. In an uptrend, Doji signal potential reversals, while in downtrends, they may indicate trend exhaustion.

Implementing Fibonacci Levels: Combine Doji with Fibonacci retracement levels for robust entry/exit points. A Doji at a Fibonacci level strengthens the reversal signal.

Risk Management: Define stop-loss and take-profit levels logically. Doji, while insightful, don’t guarantee outcomes. Protect your investments with sound risk management.

Remember, successful trading is a blend of strategy, discipline, and adaptability. Doji candlesticks, as valuable tools, provide glimpses into market psychology. When integrated wisely, they can bolster your trading decisions, enhancing your overall effectiveness in the dynamic world of trading.

THIS IS BHARTI AIRTEL IDEA FOR TRADINGAs we can see stock is trading above 50ema and making hammer candles with good volume.

from ATH and rsi divergence stock correct almost 5%

And Doji candle on 8th Dec after a downtrend ends and the next candle formed is a hammer candlestick. which is indicating a bullish reversal, Singh.

Bharti Airtel Ties Up with Meta, STC to Bring World's Longest Subsea Cable to India. (07-12-2022)

The chart mentions a good support level and entry point, so plan accordingly.

if you are a value buyer wait for more cuts till S1 and S2. otherwise, you can enter with strict SL which is mentioned on the chart.

GOOD STOCK FOR THE LONG RUN ALL THE BEST!

indicators

HV=14

RSI=52

educational purpose only!

📊 The Doji Candle Pattern📍What is the Doji Candlestick Pattern?

The Doji Candlestick Pattern refers to a chart pattern consisting of a single candle. This pattern appears when the opening and closing prices of a candle are nearly the same or identical, resulting in a small-bodied candle with upper and lower wicks resembling a "+". Different variations of Doji patterns exist, with unique names like the Long-legged Doji, Gravestone Doji, Dragonfly Doji, and Doji star candlestick pattern. Regardless of the type, all Doji patterns provide traders with four critical data points: the open, close, high, and low prices for the given period. Doji patterns can occur on any timeframe and in any market, making them the foundation of many trading strategies

🔹Long-legged Doji

The Long-legged Doji pattern has an elongated upper and lower wick and a small body

The Long-legged Doji can be interpreted in several ways and works best when viewed in context with price action. It is a potential price reversal signal in a defined up or downtrend. If it occurs in a flat market, it suggests further consolidation.

🔹Dragonfly Doji

The Dragonfly Doji sets up when the candle’s open, close, and high is approximately the same. Visually, the Dragonfly looks like a “T,” as depicted in the image below. This formation suggests that heavy selling was present, but the market has rebounded. As a general rule, the Dragonfly is considered a reversal indicator. A retracement in price is expected when it occurs at the top of a bullish trend.

🔹Gravestone Doji

The Gravestone Doji pattern is the polar opposite of the Dragonfly; it appears as an inverted “T” and signals that heavy buying has given way to selling. The Gravestone Doji is a reversal chart pattern that signals downward or upward pressure may be on the way. The Gravestone suggests that a reversal is possible when observed within a defined uptrend. Within a downtrend, bullish price action may be forthcoming.

🔸Reversals

Doji candlesticks can be a great way to get in or out of the market in trending markets. The Gravestone and Dragonfly are ideal for reversal strategies as they indicate forthcoming upward and downward movements in price.

🔸Breakouts

One of the lowest-risk ways to utilize Dojis in the FX market is to trade breakouts. A breakout is a sudden directional move in price. Dojis often precede breakouts, as they are a signal of indecisiveness. As soon as the market makes up its mind, a significant move may be in the offing.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

EURUSD : Bear's Can fight Back from major resistance OANDA:EURUSD

Hi , trader's .. As per technical analysis , it's visible that market is near to major resistance

price can possibly form double top which can lead market to downside

As price reject from this important resistance there is possible chance of Hanging man or doji candle formation

Any reversal shape candle will be helpful for bear's to take there selling position's

❤️Please, support my work with follow ,share and like, thank you!❤️