Dollar

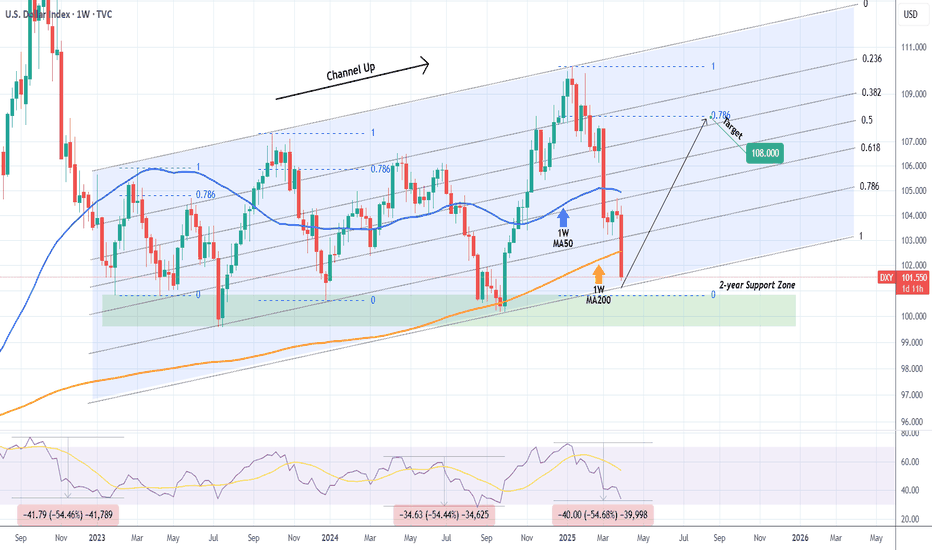

DXY just broke below the 1W MA200 after 6 months!The U.S. Dollar index (DXY) broke today below its 1W MA200 (orange trend-line) for the first time in 6 months (since the week of September 30 2024). By doing so, it has almost hit the bottom (Higher Lows trend-line) of the long-term Channel Up.

The last contact with the 1W MA200 initiated a massive Bullish Leg two weeks after, so it would be an encouraging development if the candle holds here or better yet even close above the 1W MA200.

If it does, we expect a new strong Bullish Leg to start, targeting initially at least the 0.786 horizontal (blue) Fibonacci level at 108.000.

If not, the 2-year Support Zone is the last defense, with 99.600 as its lowest level (the July 10 2023 Low). Below that, a multi-year downtrend for DXY awaits.

Notice however, the incredible 1W RSI symmetry between selling sequences. Since January 2023, we've had two -54.50% declines. Right now, the current decline since January 2025 is exactly at -54.50%. If DXY rebounds here, it will confirm this amazing symmetry.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Market Analysis: USD/CAD DipsMarket Analysis: USD/CAD Dips

USD/CAD declined and now consolidates below the 1.4350 level.

Important Takeaways for USD/CAD Analysis Today

- USD/CAD started a fresh decline after it failed to clear the 1.4415 resistance.

- There was a break below a major bullish trend line

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair climbed toward the 1.4420 resistance zone before the bears appeared. The US Dollar formed a swing high near 1.4415 and recently declined below the 1.4350 support against the Canadian Dollar.

There was also a close below the 50-hour simple moving average and 1.4310. There was a break below a major bullish trend line with support at 1.4310.

The bulls are now active near the 1.4300 level. The pair is now consolidating losses below the 23.6% Fib retracement level of the downward move from the 1.4415 swing high to the 1.4288 low. If there is a fresh increase, the pair could face resistance near the 1.4330 level.

The next key resistance on the USD/CAD chart is near the 1.4350 level and the 50% Fib retracement level of the downward move from the 1.4415 swing high to the 1.4288 low.

If there is an upside break above 1.4350, the pair could rise toward the 1.4400 resistance. The next major resistance is near the 1.4415 zone, above which it could rise steadily toward the 1.4450 resistance zone.

Immediate support is near the 1.4290 level. The first major support is near 1.4260. A close below the 1.4260 level might trigger a strong decline. In the stated case, USD/CAD might test 1.4240. Any more losses may possibly open the doors for a drop toward the 1.4400 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Fundamental Market Analysis for April 2, 2025 USDJPYThe Japanese Yen (JPY) fails to capitalise on the previous day's modest gains against its US counterpart and attracts fresh sellers during Wednesday's Asian session. The USD/JPY pair, however, remains in the range it has been in since the beginning of this week as traders await a new catalyst before positioning for the next leg of directional movement. As such, attention will remain focused on US President Donald Trump's announcement of retaliatory tariffs later today.

Meanwhile, speculation that the slowdown in the economy caused by the tariffs may force the Bank of Japan (BoJ) to keep policy steady for now is undermining the yen. However, investors seem convinced that the BoJ will continue to raise interest rates amid signs of rising inflation in Japan. This is a significant divergence from the growing confidence that the Federal Reserve (BoJ) will resume its rate-cutting cycle in June, and should support the lower-yielding Japanese Yen.

Trade recommendation: SELL 150.00, SL 150.90, TP 148.60

Gold running out of Gas to keep pushing up!I have been waiting for a solid pull back. Price looks like it wants to give it up. But since it is so bullish I have to wait for it to show its hand first before assuming. If price wants to continue with the strong bullish action I feel they need to come back and correct some of the price action first. Looking for signs they want to continue for Asian Session.

Dollar Index Bullish to $111.350 (UPDATE)The DXY price action from my last video analysis has been moving as we expected & following the arrow accordingly.

We’ve seen a nice dip for the Dollar, a healthy retracement to the downside which should now be followed by the next bull run back up.

Major Wave 5 (Wave Y) en-route to $111.350📈

Will the BoJ's hawkish approach affect the yen's strength?

US equity markets plunged amid growing concerns that the Trump administration's tariffs, set to be announced on April 2, could be aggressively implemented. Goldman Sachs warned that US tariff rates could reach as high as 18%, potentially shaving 1.0% off GDP growth and pushing the unemployment rate to 4.5% this year.

Bank of Japan Governor Kazuo Ueda signaled a continued tightening stance, stating that if persistently rising food prices lead to broader inflation, the central bank would consider raising interest rates.

USDJPY broke below the support at 149.50 before retracing to 150.00. However, failing to reenter the channel, the price hovers near the channel’s lower bound. If USDJPY fails to reenter the channel, the price may break below 149.50 again. Conversely, if USDJPY reenters the channel, the price could gain upward momentum toward the resistance at 151.30.

GOLD - New Week, New Month, New Quarter! = Opportunity Gold has not been moving how I feel it normally should. The last 2 weeks have been extremely bullish with no significant pullbacks. I believe they wanted to close last month completely bullish before they offer the solid pullback that we are looking for. Also this is a new quarter. Taking it easy as we come into this new quarter but keeping a eye on all the signs for direction.

Dollar IndexWe are expecting Dollar index to give us reaction above he recent top, if it corrects above the Top then NFP will push it further up otherwise break it down to break the last bottom.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

EURUSD: Detailed Support & Resistance Analysis For Next Week

Here is my latest support and resistance analysis

for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ICT Concepts for FX and GOLD traders: 2025 edition🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

Dollar Bullish To $118?!During the last market analysis I said I remain bullish on the DXY for the upcoming future & that bias still remains the same. After the strong bullish rally from October - December 2024, The Dollar started off this year with an ease off, seeing prices drop for the first quarter of 2025. However, this cool off has not changed the long term perspective for the Dollar as we still remain bullish. This correction (sell off) this quarter was simply a dip.

The Dollar has completed its Wave D consolidation phase & is now getting ready for further upside towards Wave E. Wave E being priced around $116 - $118.

Dollar Bullish To $118?! During the last update I said I remain bullish on the Dollar for the upcoming future & that bias still remains the same. After the strong bullish rally from October - December 2024, The Dollar started off this year with an ease off, seeing prices drop for the first quarter of 2025. However, this cool off has not changed the long term perspective for the Dollar as we still remain bullish. This correction (sell off) this quarter was simply a dip.

The Dollar has completed its Wave D consolidation phase & is now getting ready for further upside towards Wave E. Wave E being priced around $116 - $118.

DXY Monthly Analysis: Key Support Holding, Bullish Move Ahead?📊 DXY Monthly Chart Analysis (March 27, 2025)

Key Observations:

Current Price Action:

The U.S. Dollar Index (DXY) is trading near 104.267, with notable resistance ahead.

Price is consolidating within a key demand zone (~102.5–104) after rejecting higher levels.

Technical Levels:

Support Zone: 100.2–104 (Highlighted in purple)

Resistance Zone: 112.5–114.7 (Highlighted in purple)

Major Resistance: 114.77 (Previous high, acting as a supply zone)

200-MA Support: Located below current price, offering a long-term bullish confluence.

Market Structure:

Price remains in a higher time-frame bullish trend but is experiencing a correction.

The "BOSS" level (Break of Structure) suggests a prior bullish breakout.

If the demand zone holds, a bullish continuation towards 112.5–114.7 is possible.

Projected Move:

A bounce from 102–104 could trigger a rally toward the upper resistance zone (~112.5).

A break below 100.2 could indicate a shift in trend and further downside.

Conclusion:

DXY is at a critical decision point. Holding the current support zone (~102–104) could fuel a bullish continuation toward 112–114, while a breakdown below 100.2 would weaken bullish momentum.

AUDUSD 110 buy setup!!The current market structure shows a strong alignment for a potential upward movement, forming a double bottom at a significant support level. This pattern respects both the structural levels and Fibonacci retracement levels. With important news scheduled for release today at 8 PM, particularly positive developments for the dollar could influence market direction. Given the risk-to-reward ratio, it appears favorable to consider positioning for an upward trend.

follow me for more breakdown

DOLLAR INDEX (DXY): Strong Bullish Sentiment

As I predicted yesterday, Dollar Index continued growing.

Analyzing the intraday price action today,

we can see that the market established a nice rising channel on a 4H.

I think that the Index will keep rising within a channel and will reach 105.0 level soon.

❤️Please, support my work with like, thank you!❤️

Eur/Usd Mar/24 Weekly analyzeHello eveyone.

Price reject at W200 ma for 2 weeks and Closed below W 200 MA also this w open below W pivot so i'm gonna sell for this week

..............................

( This is an idea and entry-tp-sl placed for my own trade , you can change entry-tp-sl depends on your risk management )

DOLLAR INDEX Good Day Fellow Traders

We have seen that the Dollar has stopped trending at 110 area as market on the chart as a weekly level of resistance, with thus we have closely been tracking the cot index which indicates that a correction is due, although there has not been much action of impulsive move down, we do expect at least a 3-wave pullback down to the 105 area, should this level break it open the chart for a drop down to the weekly level at 104.00.

Yesterday we had a higher inflation reading, with trump policies in action we could expect more of the same higher volatile moves to come and USD to be the dominant trading currency under the rain of Trump. My personal opinion would be to stay away from forex pairs and rather shift focus to swing and position trade the global indices as political turmoil will affect currencies most, look at monthly, weekly and daily charts(entries) with wide stops

Dollar near term strenght coming, Weekly demand holdingThe DOllar has been in a decline over the last couple of months, We can see from tracking how the COT INDEX

COT Index in Forex for 6 months and 36 months

The 6-month and 36-month time frames typically refer to the historical analysis of COT data for specific currency pairs, providing insights into:

6-month COT Index:

This reflects the trading positions over the past 6 months.

It shows the trends in how market participants (e.g., hedge funds or commercial traders) have been positioned recently.

Traders typically use this shorter time frame to gauge recent trends and near-term sentiment.

A higher COT Index value indicates that speculators have a larger net long position, suggesting potential bullish sentiment, and vice versa for a lower COT Index.

36-month COT Index:

This reflects the trading positions over the past 3 years.

It provides a longer-term view of trader positioning, helping to identify historical trends and market cycles.

A higher 36-month COT Index suggests persistent bullish positioning over the longer term,

we can see the Dollar has been bought up at WEEKLY Demand, we will start looking for a shift to buy the Dollar on a daily chart.

Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

Dollar Index Bullish to $111.350 (VIDEO UPDATE)If you remember on the last update, I showed the possibility of the previous Wave 4 low getting taken out, which did happen. I’ve now re-counted the waves, as analysed on the video above.

⭕️3 Sub-Wave Correction (A,B,C) relabelled.

⭕️Wave 4 Low relabelled.

⭕️Main Supply Zone highlighted.

DOLLAR INDEX (DXY): Time to Recover

I see a confirmed bullish reversal on Dollar Index

initiated after a test of a key daily horizontal support.

A formation of a double bottom pattern on that and a consequent

violation of its neckline provides a strong bullish signal.

I think that the index will reach at least 105.0 level soon.

❤️Please, support my work with like, thank you!❤️