DXY weekly outlookDXY Weekly Outlook

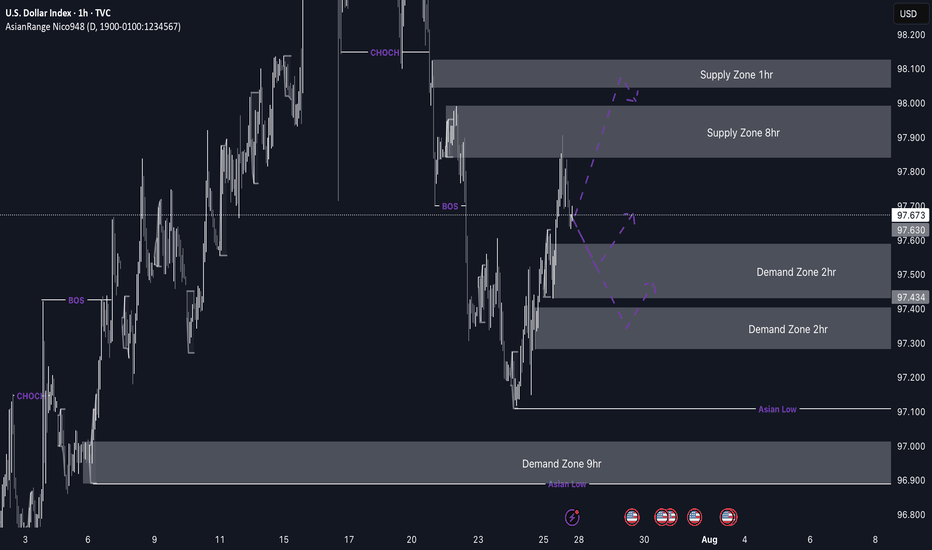

This week, I’m watching to see if the dollar continues its bearish trend or breaks above the current supply zone. We've already seen a strong reaction from the 8hr supply, but price could still tap into the 1hr supply before making its next move.

If price drops from here, I’ll be looking at the 2hr demand zone below for a possible bullish reaction. If DXY pushes up from that zone, pairs like EU and GU could drop — which lines up with my overall short bias on those.

Gold may not always move in sync with the dollar, but DXY still gives a good idea of market sentiment.

Let’s see how it plays out and stay reactive.

Dollarindexforecast

DXY "Dollar Index" Bank Money Heist Plan on Bullish SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist DXY "Dollar Index" Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 1h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

US Dollar Index Short Term Sell IdeaH4 - Price respected a key resistance zone and bounced lower.

Uptrend line breakout.

Lower lows.

H1 - Bearish trend pattern.

Currently it looks like a correction is happening.

Until the two strong resistance zones hold I expect the price to move lower further after pullbacks.

BluetonaFX - DXY US Dollar Strength Ahead of PMI DataHi Traders,

The US dollar index is trading with momentum after the 6-week high at 103.572 was broken and is now approaching its 3-month high at 104.714.

Looking at the price action on the chart, the market is still inside the ascending price channel, and the highs and lows are still higher, so our bullish outlook on the dollar index continues.

We have the manufacturing and services PMI figures for the US coming out in just under a couple of hours, which the market will be keeping an eye on. A strong PMI reading will continue our bullish bias even further, and 104.714 will be the target. 103.572 will now be the support level if there are any pullbacks.

Please do not forget to like, comment, and follow as your support greatly helps.

Thank you for your support.

BluetonaFX

Dollar Index Will Go Lower! Short!

Please, check our technical analysis on DXY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 103.37.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish

movement to the downside at least to 100.965 level.

Like and subscribe and comment my ideas if you enjoy them!

DXY Daily TA Cautiously BearishDXYUSD daily guidance is cautiously bearish. Recommended ratio: 10% DXY, 90% Cash.

* DEATH CROSS WATCH . Final US Q3 GDP estimate was +3.2%, compared to a decline of -0.6% in Q2 , and was primarily led by upward revisions to exports, nonresidential fixed investments (IP and equipment) and consumer spending. The latest GDPNow US Q4 GDP estimate was 3.7% on 10/23 , with the next estimate due on 01/03/23. Russia announced a ban of oil sales to any countries or companies abiding by the $60 price-cap imposed by the G-7 (+ Australia) . North Korea sent 5 reconnaissance drones into South Korea and SK failed to hit any of them in their defensive counter-assault .

Bank of Japan's Governor Kuroda expressed that the latest BOJ move to allow their 10-year bond yield to rise to 0.5% from 0.25% shouldn't be viewed as an "exit" from their ultra-loose monetary policy and that they maintain a 2% inflation target , although investors are now betting on a higher likelihood of a departure from negative interest rates come next April when Kuroda's second 5-year term comes to end. The Treasury General Account and Reverse Repos seemed to have found a short-term floor and are expected to continue rising, which poses a threat to the Fed balance sheet but a bullish catalyst for US Treasurys, and lesser so for DXY. A continually rising Fed funds rate which is expected to top out at 5.1%-5.2% at the moment also acts as a bearish catalyst for Risk-On markets and bullish for US Treasurys, and lesser so to DXY. A main reason why DXY has been going down recently is due to a bounce in EURUSD, JPYUSD and GBPUSD; along with inflation coming down and a terminal Fed funds rate being anticipated in 2023.

Energy, US Equity Futures, DXY, Short-Term US Treasurys, VIX, HSI, N100, EURUSD, JPYUSD, GBPUSD and CNYUSD are up. US Equities, Cryptos, Long-Term US Treasurys, Metals, Agriculture and NI225 are down.

Key Upcoming Dates: Next GDPNow US Q4 GDP Estimate 01/03; S&P Global Manufacturing PMI at 945am EST 01/03; FOMC Minutes at 2pm EST 01/04; December US Employment Situation at 830am 01/06. *

Price is currently trending sideways at ~$104 as it nears a retest of the uptrend line from May 2021 at $103.15 support for the first time since February 2022. The 50MA is currently trending down at $107 as it approaches a seemingly inevitable Death Cross if it is to cross below the 200MA at $106. Parabolic SAR flips bearish at $103.85, this margin is bearish at the moment. RSI continues to trend sideways as it tests 39.43 resistance for the ninth consecutive session. Stochastic remains bearish but is on the verge of crossing over bullish just below 86.26 resistance. MACD remains bullish and is currently testing -0.832 resistance with no sign of peak formation at the moment. ADX continues to trend sideways at ~31 for the tenth consecutive session as Price continues to trend in a tight range for the same amount of time as it forms a Symmetrical Triangle, this is neutral at the moment.

If Price is able to breakout here then it will likely retest the 200MA at ~$108 as resistance . However, if Price breaks down here, it will likely retest the uptrend line from May 2021 at $103.15 support . Mental Stop Loss: (one close above) $105.

DXY Daily TA Neutral BearishDXYUSD daily guidance is neutral with a bearish bias. Recommended ratio: 40% DXY, 60% Cash.

* FOMC WATCH . US November CPI was estimated to come in at 0.3% but instead came in at 0.1% , compared to October's 0.4% it's fair to say that it eased a bit. Meanwhile Core CPI rose 0.2% in November compared to 0.3% in October. The last FOMC rate hike is expected to be announced tomorrow, though there is still a chance for another 75bps rate hike, the majority of speculators are anticipating 50bps. If they go with 50bps, it's reasonable to expect volatility tomorrow followed by further downside to DXY; however, if they go with 75bps, DXY should see a bit of a reversal in the short/medium-term. In a surprising move which is likely due to national security interests, China banned exports of their Loongson military grade processors to Russia ; Russia had apparently been testing them for a while as opposed to Intel and AMD processors due to Western sanctions. The USA is preparing to send their Patriot Air Defense system to Ukraine in response to Russia continuing to bombard key energy infrastructure as Ukraine approaches their coldest parts of winter.

DXY, Cryptos, US Equities, US Equity Futures, JPYUSD, HSI, NI225, N100 and Short-Term US Treasurys are up. While Commodities, GBPUSD, EURUSD, CNYUSD, Long-Term US Treasurys and VIX are down.

Key Upcoming Dates: Last FOMC Rate Hike Announcement of 2022 at 2pm EST 12/14; Next GDPNow US Q4 GDP estimate 12/15; US November New Residential Construction at 830am EST 12/20; US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23. *

Price is currently attempting to bounce here at $104.06 before retesting the uptrend line from May 2021 at $103.15 support for the first time since February 2022. Parabolic SAR flips bullish at $105.27, this margin is mildly bullish at the moment. RSI is currently trending up slightly at 34, the next resistance is at 39.43 and the next support at 23.34. Stochastic remains bearish and is currently testing 29.40 support. MACD remains bullish and is on the verge of crossing over bearish as it trends sideways at -1.21 support; if it breaks below this support level it would be a bearish crossover. ADX is currently trending up slightly at 33 as Price continues to fall, this is bearish at the moment.

If Price is able to bounce here then it will likely retest the 200MA at ~$105.80 as resistance . However, if Price continues to break down here, it will likely retest the uptrend line from May 2021 at $103.15 support . Mental Stop Loss: (two consecutive closes above) $105.80.

DXY Daily TA BearishDXYUSD daily guidance is bearish. Recommended ratio: 5% DXY, 95% Cash.

* Oil tankers are reportedly beginning to jam up the Black Sea with 28 tankers waiting to be checked for having proper insurance by Turkish officials . This will likely put upward pressure on the price of oil in the near/medium term. Investors appear to be anticipating a 50bps rate hike by the FOMC on 12/14, which will be their last rate hike announcement until February 1st 2023. Interestingly, investors appear to be equating a slowing in rate hike increases with a lowering of the terminal FFR, which is unlikely to be true; Federal Reserve staff/member consensus is currently projecting a 5%-5.5% terminal funds rate to be achieved by mid-2023, the FFR is currently at 3.75%-4%. So going forward, 50bps on 12/14/22 brings it to 4.25%-4.5%, another hypothetical 50bps on 02/01/23 would bring it to 4.75%-5%, another hypothetical 25bps on 03/16/23 would bring it to 5%-5.25% and then a last hypothetical 25bps on 05/04/23 would bring it to 5.25%-5.5%. This all assumes that Russia doesn't continue to escalate the war and that supply chains reach a newfound stability/order; a somewhat unrealistic assumption at the moment.

US Equities, US Equity Futures, US Treasurys, Cryptos, Metals, Natural Gas, Agriculture, EURUSD, GBPUSD, CNYUSD, HSI, N100 are up. DXY, VIX, JPYUSD, NI225 and Oil are down.

Key Upcoming Dates: US November PPI 830am EST 12/09; US November CPI 830am EST 12/13; Last FOMC Rate Hike Announcement of 2022 at 2pm EST 12/14; US November New Residential Construction at 830am EST 12/20; US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23. *

Price is currently trending down at $104.80 after being rejected by the 200MA at ~$105.80 as resistance. Parabolic SAR flips bullish at ~$105.80, this margin is mildly bullish. RSI is currently trending down at 36 after being rejected by 39 resistance for the third time since 11/21/22, the next support (minor) is at 23.34. Stochastic remains bullish and is on the verge of crossing over bearish as it trends down at 58 after getting rejected by 67 resistance, if it falls below 56 it would be a bearish crossover; the next support is at 45.65. MACD remains barely bullish for a second consecutive day as it trends sideways just below -1.21 support. ADX is currently trending up slightly at 31 as Price continues to see selling pressure, this is bearish at the moment.

If Price is able to bounce here and reestablish support at the 200MA (~$105.80) , the next likely target is a retest of $108 resistance . However, if Price continues to break down here, it will likely retest the uptrend line from May 2021 as support for the first time since February 2022 which would coincide with $103 support . Mental Stop Loss: (one close above) $105.80 .

Dollar Index, perfectThe price responded perfectly to the signal sent by the MCS in H4.

After this excess of strength, the price pushed down until it reached MML H4, giving us the opportunity now to place a Stop Profit below the entry point.

Let's set the new Stop Profit at 96.72

Once we reach 38.2% of the last bullish vector we can lower the Stop Profit on the MML to 96.05, where the price is now.