Bitcoin Dominance to set All time lows We should see bitcoin dominance ( BTC.D ) slowly decay as we get towards summer. I expect a rebound later this year and then as altcoin season kicks into final gear, bitcoin should print a lower high while altcoins take off to new highs. Causing bitcoin dominance to potentially break all time lows. However, if that happens it will be quick rebounding meaning that altcoins will top at the same time ( TOTAL2 TOTAL2). Bullish all around but altcoins set to outperform. Very similar to 2017 except it has been 1230 days since the 20k peak and a lot of new money is here. Exciting. Take profits in summer, buy the dips, and sell most altcoin holdings come 2022 :). BINANCE:MATICUSDT BINANCE:VETUSDT KUCOIN:API3USDT

Dominancebtc

Btc dominance drop cenarioAs mentioned before, Btc might print a double bottom.

Check previous TA.

Coinmarketcap shows 49.9% btc dominance at the moment.

Its happening really fast!

Faster than what i draw before in those pink lines.

Will BTC hold the ground at 50% dominance, or continue droping?

A 50% drop from last top will create a double bottom at 37% btc dominance.

If we continue droping. I guess we can say that the alt season actually started in early January this year.

Anyhow, still bullish on BTC .

Bull run is still intact imo.

Bitcoin Dominance 5Y Trend LineBTCD Trendline

It appears the BTC Dominance trendline is continuing its long term move lower. However, on a short term time frame, it does seem due for a bounce back up towards the trendline. I expect it to jump back up to the 55-65% zone in the near future.

So long as the global crypto market cap keeps going up, it's just a matter of time. People are just cycling through different alts. Eventually it finds its way back to BTC and the cycle starts again.

One noteworthy change each Supercycle is that the alts become more and more advanced each time. In 2013, the alts were quite honestly pathetic. LTC, Namecoin, Feathercoin, very early XRP. Bitcoin Dominance went from near 95% down to the high 80's.

Then 2017 came along and was the real "coming out" party for alts. ETH being the real breakthrough with smart contracts and ERC20 tokens, which led to the ICO Bubble. This one really had that 1999 tech bubble feel. People were making altcoins using copy paste technology, desperately trying to make up a use case. A lot of words, a lot of "ideas", very little execution. Tons of vaporcoins.

Now we have this Supercycle, where the alts are clearly seeing a lot more use cases, largely thanks to DeFi. Yield farming, collateralized loans, on-chain insurance, synthetic assets, futures and options, NFT's. All of this stuff is crowding the ETH network and opening doors for other projects to get real utility.

We are seeing that the multiple blockchains act like multiple highways. ETH is congested? People will head over to Binance Smart Chain, MATIC, even Tron. We are seeing why it's important to have multiple chains. There are enough transactions to go around at the moment. This could change if Ethereum really solves the scaling issue, but for the near future, it seems that other blockchains are going to capture increasing volume.

All that to say, it seems as time passes, more and more projects are solving real use cases, and thus we should expect Bitcoin Dominance (BTCD) to ebb and flow, but generally trend downwards. The good news is, BTCD decreasing is often aligned with Global Crypto Cap increasing.

BTC Dominance possible bounce scenario (just a possibility)Fractal taken directly from when we reached this support zone in the last bull run and saw multiple bounces over the course of many months. The RSI indicates that this is a possibility as right now BTC dominance is undervalued by a few % - every time we have seen this we have seen a bounce. This is not the scenario we want as it means we likely won't see a full-blown alt season for many months (October according to this analysis).

Personally, I do not think we will see something like this happen, we may see a bounce or two however I am expecting a drop below that support line in May.

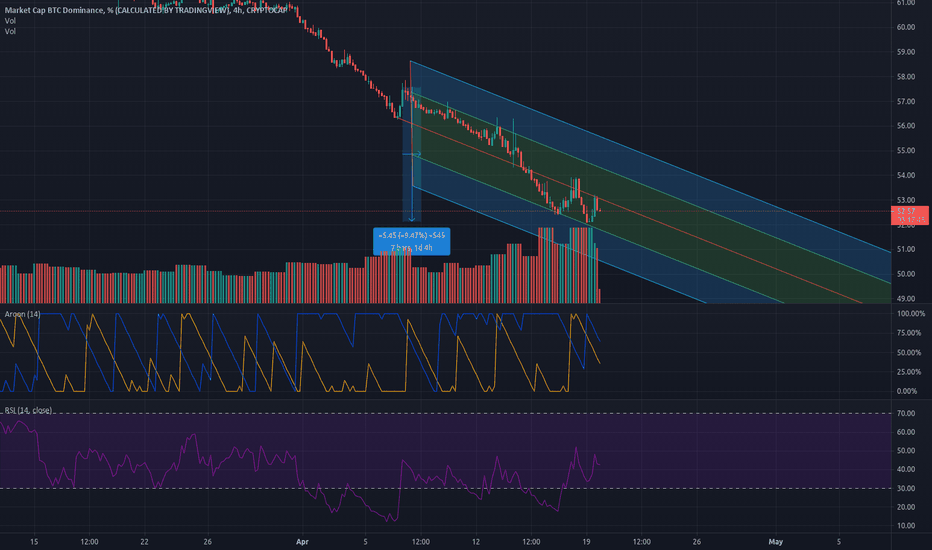

#BTC.D #4H #dominance #bitcoindominanceHi guys..its the latest analyze chart of btc.d in #4H time frame(folowers Requested analysis) .if you are interested any crypto that you want analyze with me and any questions please do not hesitate and comment below the chart!

if u like it press like-comment and folow me.thx

Alt season will be start ? BTC Dominance after rejected from middle of uptrend channel goes to channel floor. Stochastic RSI is overbought and show a hidden bearish divergence . if broken channel and broke zone 1 alt season will be start.

If return from Zone 1 bitcoin will be start goes to upper band of channel.

what to you think?

Bitcoin Dominance Update, Put Stop loss in all tradesBitcoin Dominance Update

Bitcoin Dominance is bouncing from the long horizontal support line and also tests the psychological support of 50%. There are two possible scenarios now.

The first one is that Dominance bounced from here and test the 58% resistance area and if breaks above it we see a retest of 64% resistance area. In that case, alts will bleed in the BTC pair.

The second case is that Dominance breaks and closes below the 50% area. That will trigger the targets of 45% area and after that 40% area. This is bullish for alts and we see a good altseason in BTC pair. However, there is a low probability that Dominance goes to the 40% level sooner.

Alts market is going parabolic since January 2021 and we see huge gains in the alts market already. Check any altcoin chart and you see a parabolic move without any correction. We expecting a correction in the alt market before the next rally start. We will continue to find TA + FA gems that will give good returns in every situation. For now, open every new trade with a stop loss. Keep Earning

Bitcoin Dominance Chart ( Altcoins session end..? )#Bitcoin Dominance Update:-

Currently dominance is 51.50%

And now dominance is trading at very important support level.

So as I predicted dominance fall down from 71% to 50%

And I also told you when 71% dominance buy Altcoins bags.

Now max Altcoins 10x-20x profit.

Hope you followed me.

Now...?

Now dominance trading at very strong support level so we can expect bounce back from here and Altcoins can go more dump.

But if 50% level break down then again ready for Big Altcoins sessions.

I will also update here.

Support: 50% / 40%

Resistance: 53% / 58%

Below support:- Bullish Altcoins

Above support:- Bearish Altcoins

Please click LIKE button and Appreciate my hard work.

Must follow me for latest crypto real time updates.

Thank you.

Dominating The Market Btc.d #Bitcoin $BTC #BitdHere we see our Bitcoin Dominance chart which today dipped into 51 area ! This is major ! Our expected Altseason won't happen with a high Bitcoin Dominance chart so it's great to see this dipping even lower right now! You can see we are under the daily Ichimoku cloud . We are under both the 50 MA and the 200 MA . And we have hit a TD Sequential 9 in red on this daily chart as well as the 3 day chart . This chart is just red ! And whilst the Dominance of Bitcoin in the market goes down - the rise of Altcoins in the market should continue up , even giving us a bit of Altseason! So this is very Bullish for our Alts . Last Bullrun of late 2017 saw Bitcoin Dominance actually fall to 36 area at end of December 2017/early January 2018 !! That's quite a bit lower even than we are now though there's no guarantee how low it goes . No one can say yet but so far it seems like our altrun will be looking good all year .

Bitcoin dominance and the growth of altcoinsAs you can see in the figure.

The fall of bitcoin was a bad thing for those who opened long positions and lost their capital.

But here is the important point.

Bitcoin dominance is coming down This means that money is coming out of Bitcoin.

In most cases, this causes the altcoins to grow and rise sharply.

Bitcoin Dominance.When wll we move to the 3d phase of altseason?BTC. Dominance update🧨

If consider that now we are in 2-nd phase of altseason, chart says that we meet the major support 51-52%. From here we probably will bounce up a bit, then consolidate some time and then if we go below the major support, we may say that we are moving to the 3-d phase of altseason. Also for information, altseason is over when we will come back to 60% Bitcoin Dominance. As we see on a lot of altcoins against BTC pair, they have not finished they cycle yet, the same is for ETH/BTC which looks very good💪

P.S.

It is my personal opinion. I am not financial adviser. DYOR.

Have a nice day!!!

If you like my reviews and it help you to understand the current market situation, subscribe to the channel, like and follow the updates of ideas that are not trade recommendations.

Thanks to your likes, I understand how many people rated my review positively. Thank you very much and thank the sympathetic commentators for understanding. I spend my personal time monitoring the market situation and share my opinion with you openly. I ask you to take this point into account and treats with understanding.

BTC: Prospects for a bounceWhile I think BTC may be starting now a major correction akin to those in January and February, we should bear in mind two other things:

1) On the BTC Dominance chart, this last drop coincides with a historical support level that was important twice in the past: 03 April 2019, and 23 September 2018. The next major support level down dates to 29 March 2018.

2) On the BTC money flow index, the trendline marked has until now provided a bounce to the upside. We have broken down through this line at present. Nonetheless, there is strong upside pressure below it. An indicator to watch in the days ahead.

Feel free to comment.

BTC Domi - a one, three, five storyI could clearly see a 5 wave impulse up,

A nice correction of ABC whereas we are in leg C with wave 3 downwards. Support below so we would probably wick below it and then reverse to previous high for wave 4 from where a massive alt season and btc domi going down to 1.618 extension of wave A. From then on, BTC crushes

BTCUSD : NEW POTENTIAL ATH IS COMINGHi to all,

BTC broke its descending correction move in main bullish trend. Now i'm waiting a new ath from BTC between 62.8K & 64.2K in short term.

Bitcoin Dominance is below 56 and at the same time Total marketcap is growing-up over 2bn. It means a new rally is coming at BTC and AltCoins.

58.800$ is the support before this bullish wave. Good Luck to all.

If you find it useful, please support this idea with LIKE and feel free to ask all your questions as a COMMENT.