Dominancebtc

Dominance Dump ! Btc ? #Bitcoin #crypto #btcEven on the 1 day dominance chart for Bitcoin we have now hit a TDSeq9 in red - are whales playing here ? Are the whales coming out of their alt positions soon ? Will Dominance finally rise ? I believe we will see significant rise here by the end of July . See my previous idea below . It's still true - we've just now moved to the higher timeframes.

250% Alt market Cap against BTC market Cap on Jun 2021 As you see I did Calculate the AltCap/BTCCap by BTC Dominance CRYPTOCAP:BTC.D .

The rate has just break the 2 year down trend. I predict we will be On 0.78 on Nov 2020 and 2.48 in Jun 2021.

If you are interested please send your comment and share this idea.

#BTC Dominance breaks! Altseason continues until this happens!Welcome to this quick update.

Thanks for the unmatchable support you've shown so far. Keep supporting if you find my work deserving.

1. Dominance broke down an important support level which held for the last 122 days.

2. As per fractals it should fall for approximately -5.88 % to the lower green support level from here which will result in anther alt rally for the next 4 to 6 weeks.

INVALIDATION POINT:

1. If it breaks above the 50D MA (Red line) and closes above it.

2. A positive daily close above the support line (Red Line).

This breakdown will result in 200 to 300% profit in the next 4 to 6 weeks in many altcoins. Follow me to know the TOP 10 altcoins to trade this season.

THE BEST THING ABOUT TRADINGVIEW IS YOUR CHARTS DOES THE TALKING, So go through my previous altcoin updates to know about my accuracy. If you find it deserving please like and shoot a follow for more future updates.

Thanks for reading

Stay safe

#PEACE

Bitcoin Dominance Bottoms Out ! Turnaround 4hr ? #btc #bitcoin Bitcoin dominance has absolutely bottomed out on the 4hr chart and looks to be doing same on 1 day chart too . Surely the turnaround will happen soon - and we'll see Bitcoin dominance and Btc price start to rise - perhaps through towards August . As you can see we hit a TD Sequential 9 in red and there's hard divergence down with all MAs pointing down as well. Rsi is bottomong out at 6 ! This is gonna turn soon in my opinion and head back up . I wouldn't be surprised if people are coming out of their alt postions soon ( or already . )

Is the altseason already nearby?📊 The breakdown of support and BTC dominance index downward movement strongly affected the entire cryptocurrency market. Altcoins are gradually starting to reveal their potential. A lot of coins are pumping now.

Chainlink, for example, has reached its ATH.

And Dogecoin made more than 100% in just 2 days.

👀 Flat movement of BTC led to a drop in the domination index to 64% level and has a positive effect on altcoins, which will continue to grow against BTC and possibly return to their March values.

📉 The index has formed LL and BOS on the chart. This indicates a continuation of the downtrend.

🗣 However, do not forget that in case of a strong BTC impulse, money will begin to flow back. This might directly affect the alts. Part of the coins will go in to correction. Some will follow bitcoin.

✨ A breakdown of the 62.5% BTC.D level will open the doors for the altseason similar to 2017-2018. Remember that it begins after BTC completed its upward movement.

⚠️ The worst option for altcoins is domination above 73% level. It’s not even worth saying what will happen to the coins.

Bitcoin dominance & ALTSEASONI like it all the more that, despite the impulse movements of BTC, shitcoins do not experience such extreme drops, so it can be said that they are strong and relatively stable. I've always kept from thinking about ALTSEASON until after the breakdown of the primary support trend. Until yesterday, I was waiting for a more prominent daily candle, which will confirm the breakdown, and that's how it happened.

Looking at today's daily candle and yesterday's close, we can say that it really didn't hold the trend and the dominance should start its journey DOWN. 4H-12H MACD + Histogram bearish, Daily turns towards bearish cross. 3D and even Weekly indicate a potential bearish cross, which, if this week closes, confirms the idea of a medium-term shift of focus away from BTC. The RSI is in the neutral zone on all High TFs, so it has plenty of room to drop.

1D chart:

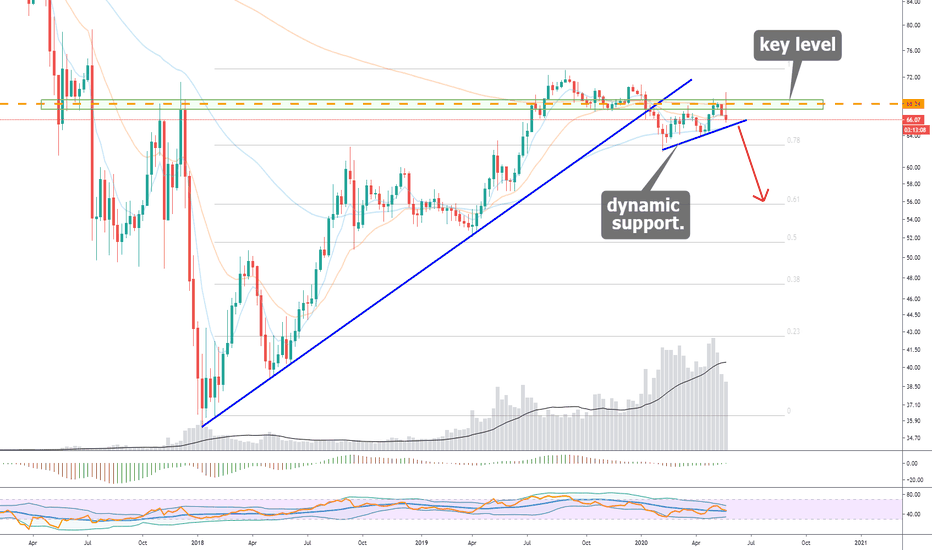

3rd Alt season of 2020 over Bitcoin to regain dominanceHI.

We can see the Bitcoin domination chart.

Every time Bitcoin fell into a channel, alt season occured.

And then Bitcoin regain dominance and left altcoins way behind.

That happend 3 times in 2020, we had great gains in several altcoins

but now it is time for Bitcoin to shine.

We can see a formated channel and strong support lines. If Bitcoin catches these lines and breaks out of the channel, it is over for alts for some time.

So if you trade altcoins, do it in BTC pair and use Stoploss.

Regards

Geting ready for the altseasonHello there,

Nothing serious here just recognition of possible ALT SEASON based on the MACD cycle.

-------------

Disclaimer:

I´m not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and therefore I´m unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

#BTC Dominance at decisive point. Will alt season continue?Guys first of all please hit that like button to support my work. It takes time keep you all updated with the market.

Follow me for more future updates.

Let's get back. to this quick update:

BTC Dominance followed our previous charts correctly with a 100% accuracy, you can check it by. yourself (I'll post the links in this update).

You can observe in the chart itself how the fractals have played out in the chart. Currently it is trading under a channel just like before. Not to ignore that that the current red channel is a rising wedge too which is bearish and we can also see a breakdown which will result in the continuation in this alt season.

How do I know when to exit the altcoins if required?

Well this is pretty simple if you can observe the chart. If this support holds within 16 june which means if any Daily candle closes in Green making a higher highs, we will exit alts (Not a financial advice). This will confirm the reversal in the trend.

And If any daily candle close below the support line alts will continue to rally.

I will be posting more updates on BTC altcoins stay tuned and please follow me for more future updates.

Stay safe

#PEACE

New Month Bitcoin Dominance ChartWith the May Candle now closed, we continue to see a squeeze into the nose of a triangle. Short moving averages suggest upwards pressure, however Ichimoku cloud and MACD both suggest downward pressure. Price action is inside of the forming cloud. Traders will be ready for imminent breakout of the triangle in either direction for a strong rally in either direction. Will altcoins go nuts or will bitcoin defend its claim to fame?

BTC.D - Alt SeasonBitcoin's dominance is dropping.

We've now stopped at an average moving 66%.

On 1d timeframe shows a downtrend.

Alt season is already happening.

I laid out a lot of posts with altcoin.

if we go back to 70, I would be surprised)

Push ❤️ if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Thanks for your support!

BTC% dominance When is the pump season? The Dragon. ABCD PatternOn the% chart, bitcoin prevails in the cryptocurrency market. I followed a little over a year. All the key movements during this time I predicted. This percentage of bitcoin dominance is very much related to the transfer of altcoins.

Each minor correction and decline in dominance is accompanied by a shot on average 30-50% of altcoins. Some overt fraudulent altcoins with little market capitalization will then be pumped up by a larger percentage. But most continue to "die further."

Therefore, it is very important to use this period in your trade. You also need to work with those altcoins in which there is a “presence” of a major player.

The principle of using BTC% dominance is that the higher the dominance, the greater the “cry of altcoins”. This dominance chart can be used as an indicator for the rise / fall of altcoins.

The real long-awaited long-awaited “altcoin pumping season” will begin only when the bitcoin dominance% is below 62-63%, and there is a clear downward movement, the beginning of which we have after the arrival of the rising wedge.

An increase in dominance above 72-73% will mean the death of the not yet completely “dead altcoins” (complete surrender of the altcoin market).

According to the trading chart of bitcoin dominance. There was an upward wedge (bearish formation) that was broken. Now the Dragon figure is formed, or rather, the target tail of this pattern. The downtrend line (Dragon Ridge) has been broken, now the dominance of% BTC is above it.

It is worth noting that after 3 days, BTC is divided in half. If in the future we will see the development of all target zones of the “Dragon tail”, then the high probability of the formation of a harmonious pattern AB = CD (part of the ascending channel). I showed important pivot zones on the chart.

My past idea is about this analysis tool.

When is the season for altcoin pumps? BTC dominance July 23, 2019.

Soon pump season altcoins? Head and shoulders. Inverted Dragon. Nov 16, 2019

Bitcoin dominance Formation of an ascending wedge before halving Jan 8 2020

Comparison of trends. BTC domination - halving + LTC - halving. Jan 8 2020

Breakdown of the support of the rising wedge. February 6, 2020

The situation is now. As we see, after breaking through the support of the rising wedge, the% dominance began to fall and moved from the rising to a pronounced lateral movement.

About the figure of the Dragon. Read in this training idea:

Dragon figure. Formation. Structure. Target.

here is my trading idea with the potential formation of a dragon figure. Coin BLZ

BLZ (Bluzelle) Dragon. Potential. Channel work 45%

Full take of the target area of the tail of the Dragon + 80%

In this tutorial, you can read about the AB = CD pattern.

Which could potentially form if all of the target areas of the Dragon's tail are taken.

TRAINING + WORK Harmonious drawing ABCD + "Three movements" BAT

Notice how the price behaved on this trading idea.

The downward movement continued, but the support was not confirmed, but made its way.

Therefore, there was no entry point.

It is desirable that this occur in% of BTC dominance. I think the desire is clear. Remember, here the opposite situation is an expression of a downtrend, the better for us. How it will revitalize the altcoin market.

Trading is not an easy path to easy money. It is open to all, but not all of it will pass ..

BTC.D - the altocoins will come to life. With the fall of dominance, altcoins will grow to BTC.

The triangle is about uncertainty.

But now there's a specific clamp to the lower boundary;

are likely to fall.

Push ❤️ if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Thanks for your support!

#BTC DOMINANCE ALT Season incoming? Don't miss this!Hello guys, welcome to this update.

This chart is very simple to understand.

Please HIT THAT LIKE BUTTON for the simplicity of this chart!

In the chart we can see Dominance got rejected from the Resistance trendline of the expanding channel.

If it follows the speculated direction, It is highly likely that we can see a 15%+ Decrease in Dominance.

You know what it means? Alts will be pumping crazily!! The alts with strong fundamentals in the coming 2 months will provide as high as 100 to 300% + profits. I will update the charts of those altcoins one by one. Follow me for those updates.

We need to watch the red zone+70 level, which is a strong resistance. Unless Dominance breaks above this major resistance I think holding alts will be Very Profitable. Besides most of the alts are showing Bullish signals in Daily Time frames.

For more such updates follow me and share this idea with your friends.

Your views are welcomed in the comment section.

#PEACE

Altcoins performed better after the last Halving than BTC/USDDuring the next days after the last halving the Alts market cap more than doubled and BItcoin's dominance dropped quite a bit. It will be interesting to see what happens this year though it seems that the interaction has changed with altcoins and Bitcoin been more correlated perhaps due to the larger FIAT pools with stable coins. In 2016 most altcoins had to be adquired via Bitcoin (ETH/BTC, XRP/BTC, LTC/BTC, etc) and this year this is not the case anymore since there are many altcoins paired with stablecoins.