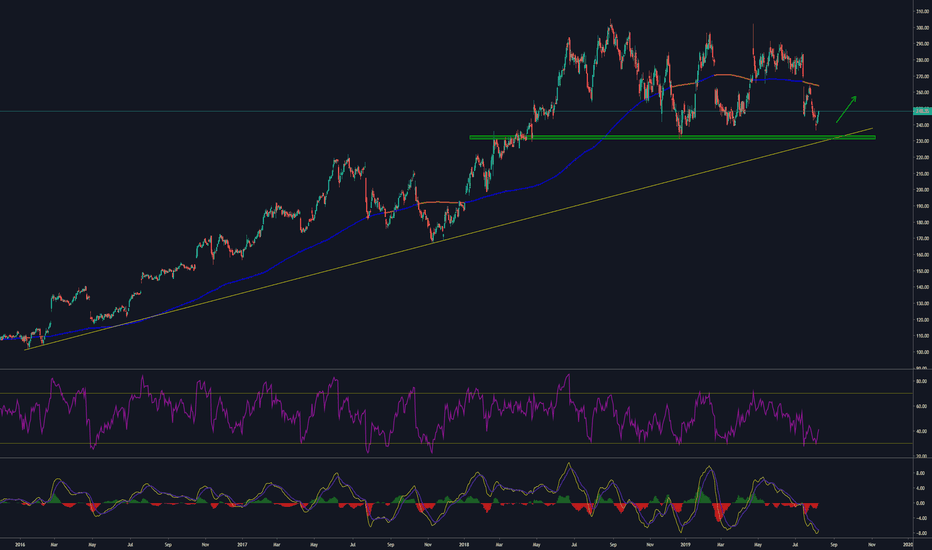

BTC.Dominance - ALT SEASON IS COMING.ALT SEASON IS COMING.

Many altcoins are looking to go grown.

Bitcoin dominance shows that growth is possible.

You will learn the best place where we can trade this instrument at low risk.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade.

Dominos

Domino's Pizza Goes UPHello guys, NYSE:DPZ is moving around the SMA(200) and this could be a possibility to profit going long.

You can enter the trade when you see a reversal signal.

TP = 422.15$

SL = 370.57$

This trade has a P/L rateo around 3 and it could offer a nice 10% profit by my point of view.

Follow me for other analysis and if you have any question or suggestion let me know commenting below.

Thanks for reading 😀.

DPZ Looks Interesting, And It's About To Pay A DividendReaders hoping to buy Domino's Pizza, Inc. (NYSE:DPZ) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Ex-dividend means that investors that purchase the stock on or after the 14th of December will not receive this dividend, which will be paid on the 30th of December.

Domino's Pizza's next dividend payment will be US$0.78 per share, on the back of last year when the company paid a total of US$3.12 to shareholders. Based on the last year's worth of payments, Domino's Pizza stock has a trailing yield of around 0.8% on the current share price of $384.97. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

(DPZ) Simon Says Short Domino's Pizza Rising wedge pattern - idea to short stock

$315 price target. Stop loss $415.

Reward to risk = 3.8

Not financial advice, just what I see here.

DPZ breaking out from the falling wedge pattern.. keep watchingDPZ breaking out from the falling wedge pattern.. keep watching, this stock has done well during lockdown...

DOMINO'S 🟥 Correction into earnings may present bullish levels💬 Domino's (DPZ) has performed very well recently as delivery options were expanded and people relied on the delivery giant during COVID.

We love cheap delicious pizza, and we may fall in love with Domino's going into earnings July 16th, let's see what levels look like going into earnings for the DPZ bulls and bears alike.

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

-----

Support:

S1: The S1 orderblock at the most recent swing low is the first point of support for the bulls, we are essentially already at this level, and it would be a logical place for the bulls to hold above. That said, earnings are a ways off, so lower support may be needed.

S2: The S2 S/R flip is where price most likely finds support. It would be logical for price to remain range-bound until earnings, and this level is the one to hold if that does end up being the case.

S3: If the COVID fears get the better of the market, or if we see some unexpected DPZ FUD, then the S3 orderblock could work as a support of last resort for the bulls.

Resistance:

R1: The R1 bearish orderblock is the only real resistance to worry about here. If the bulls can send it past R1, then we are almost certainly going to make new highs. If the bears can defend R1, especially after earnings, then it is a bad look for this titan of pizza.

-----

Summary:

The bulls will want to hold the current range into earnings, likely by way of an ABC correction as shown on the chart. A move off S2 and above R1 into earnings or after it is ideal for the bulls.

The bears will want to defend R1 to ensure the Domino's COVID FOMO ends here.

Resources:

www.earningswhispers.com + wtop.com

✨ Drop a comment asking for an update, we do NEW setups every day! ✨

DPZ Likely Breakout Next WeekDPZ seems to be creating an inverse head and shoulders before breaking out at $385 next week, if it continues with it's current up trend line.

Dominos Pizza Short Term Analysis- Stand aside1h Chart Analysis - Currently the market can move in both direction - the main trend is still Bullish.

I was not able to find any interesting signal/patter to determine the level for the option A. While, if the red line work as resistance the price can jump back to a 276.0 level (approximately)

Dominos Pizza Bullish Flag - Currently Stand asideBased on a daily chart (long term analysis)

It can not be a broadening formation (dotted line and red line) as it seems to work more as a continuation pattern.

It is more a Bullish Flag (red line and black line). The bullish flag is drawn considering only the closure price as per Dow Theory and not the intraday variation.

To me it still seems a market out of control (see volumes and triangles drawn on the chart), hence I personally would stay out.

Overall it is a bullish Market, but it does not give any certain signal to buy yet.

Nobody wants pizza Beside the fact that Coronavirus is crushing stock prices - Dominos has been in a long painful correction since better than expected Q4 earnings, taking it's price to ATH and testing new ground. Price has broken through the descending channel shown, turning this into the upper axis of a flag pattern, the lower axis being support at 334. A close below 334 will give us that last push down, if support holds I imagine price will continue into the triangles boiling point.

DOMINOS PIZZA $DPZTrendline is broken. holds above 50 day MA and corona will help $DPZ to increase their sales. Rsi is still weak though i would wait to get over 60

Domino's About To Breakout??Breakout of $305, I'll enter and hold on..

Not financial advice

DotcomJack

Dominos in bearish controlStill hard to tell if Dominos will continue this downtrend, but it looks like the bears are taking control here. In large it looks like we are still in a bull flag like we had in sep-dec 2018. But key diffrence is that RSI is below transition zone. Takeaway from this is that we will likely go down instead of going up. Best place to short will be the S/R flip or at the EMA's if price gets there.

Domino's updatePatience paid off. Line tested and rejected in a great spinning top candle. Good Luck!

Domino's pizza updateDomino's pizza stock approached the support buy zone, near a big daily trend line. Major banks like JP Morgan have a $270 price target at the moment, labelling the stock as 'overweight'. Investment funds like Maxim Group targets at $300 back to the highs of this stock. Overall banks and investment funds believe the stock is considered under priced.

Technically, stock almost hit support at oversold on indicators. Would be best to see if the stock hits the support zone first before buying in. Good Luck!

Short DPZ put spreadShort DPZ Put spread

Debit spread.

$999 Entry, Max gain $2001.

230/260 Put Spread.

DPZ slowing growth. Downturn is happening holding till target of $1000 USD.

Is Domino's days numbered as a growth stock. Growth investors have stepped in over the last 2 years every time Domino's has disappointing at report time or had negative news regarding their buyback. I think we are going to find out very soon if growth investors patience has run to thin. from a technical point of view DMP looks a high probabilty of breaking to the downside. Furthermore, its hard to see a clear level from a technical point of view where support may come in. Perhaps around $33.

Dominos Pizza, Inc. (DPZ) Buy $277.70 >>> $290.00NYSE:DPZ

Dominos Pizza, Inc.

------

Buy = $277.70

Take Profit = $290.00

Stop Loss = $270.40

------

Profit:Risk = 1.68 : 1

Profit:Risk = +4.43% : -2.63%

Dominos Pizza (DPZ)(NYSE) Buy $286.00 >>> $269.95Deal on breakdown and return prices.

NYSE:DPZ

Dominos Pizza Inc

Stock - NYSE (USA)

Profit:Risk = 1:1

---

Sell = $286.00

Take Profit = $269.95

Stop Loss = $302.06

------

Take Profit = +5.61%

Stop Loss = -5.62%

Dominos Pizza, Inc (DPZ)(NYSE) Sell $265.00 >>> Target $257.00NYSE:DPZ

Dominos Pizza, Inc

Stock - NYSE (USA)

Will break down (Short Signal)

This deal Profit:Risk = 2:1

---

Sell = $265.00

Take Profit = $257.00

Stop Loss = $269.00

------

Take Profit = +3.02%

Stop Loss = -1.51%