Domino (DPZ) recovering after Q3 profit miss?Technically speaking I see this rebound as the start of a possible recovery. The price is already over the VWAP on 2 hours, the MFI is oversold since October 8 on 4 hours, the ADX is slightly moving down from the current bearish micro-trend also on 4 hours, so for me, the bearish momentum seems to be getting weaker.

Hopefully, the price will stay above the 233 SMA, the green line. 🤞

My first target is the closest yellow line above the price, the average APT (Analyst Price Target) at $431.12, and two more targets at 127.20% and 150% Fibonacci levels. Stop-loss already moved to a small percent above break-even.

If the price gets me out I will enter again at the yellow line below the price, which is the average lowest projection made by some analysts which at the same time converges with a high volume area, the purple line. 👌

From my point of view, the fundamentals aren't terrible, I believe indeed they are promising. If you want to go deeper you will easily find many analysts talking about the company.

I'm in since yesterday, and I will do my second entry in a possible retracement close to the $397.

This isn't trading advice. I've no idea what I'm talking about 😉.

Trade with caution! 🚨

Have a good day! 🤟

Dominospizza

DOMINO'S 🟥 Correction into earnings may present bullish levels💬 Domino's (DPZ) has performed very well recently as delivery options were expanded and people relied on the delivery giant during COVID.

We love cheap delicious pizza, and we may fall in love with Domino's going into earnings July 16th, let's see what levels look like going into earnings for the DPZ bulls and bears alike.

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

-----

Support:

S1: The S1 orderblock at the most recent swing low is the first point of support for the bulls, we are essentially already at this level, and it would be a logical place for the bulls to hold above. That said, earnings are a ways off, so lower support may be needed.

S2: The S2 S/R flip is where price most likely finds support. It would be logical for price to remain range-bound until earnings, and this level is the one to hold if that does end up being the case.

S3: If the COVID fears get the better of the market, or if we see some unexpected DPZ FUD, then the S3 orderblock could work as a support of last resort for the bulls.

Resistance:

R1: The R1 bearish orderblock is the only real resistance to worry about here. If the bulls can send it past R1, then we are almost certainly going to make new highs. If the bears can defend R1, especially after earnings, then it is a bad look for this titan of pizza.

-----

Summary:

The bulls will want to hold the current range into earnings, likely by way of an ABC correction as shown on the chart. A move off S2 and above R1 into earnings or after it is ideal for the bulls.

The bears will want to defend R1 to ensure the Domino's COVID FOMO ends here.

Resources:

www.earningswhispers.com + wtop.com

✨ Drop a comment asking for an update, we do NEW setups every day! ✨

June 01 2020 – Leading Stocks To Watch For A Breakout This WeekJune 01 2020 – Leading Stocks To Watch For A Breakout This Week

Contact me for the page to review the details.

NASDAQ:IXIC

NASDAQ:NDX

NASDAQ:TSLA

NASDAQ:MSFT

NYSE:UNH

NYSE:DPZ

NASDAQ:AAPL

$^IXIC #nasdaq $TSLA #tesla $MSFT #microsoft $UNH #unitedhealthgroup $DPZ #dominospizza #technology #semiconductors #coronavirus #financialforecast #stocks #stockstowatch #stockmarket #wallstreet #nyse #sp500 #investing #investors #trading #traders #elliottwave #markets #finance #economy

NASDAQ:NDX

Dominos Pizza $DPZDPZ is worth to watch stock. It is very close to break out. needs to hold above $385.97 and watch for rsi break out too.

12 months Consensus Price Target: $375.59

if you find my charts useful, please leave me "like" or "comment".

Please don't trade according to the ideas, rely on your own knowledge.

Thx

Dominos Pizza Short Term Analysis- Stand aside1h Chart Analysis - Currently the market can move in both direction - the main trend is still Bullish.

I was not able to find any interesting signal/patter to determine the level for the option A. While, if the red line work as resistance the price can jump back to a 276.0 level (approximately)

Dominos Pizza Bullish Flag - Currently Stand asideBased on a daily chart (long term analysis)

It can not be a broadening formation (dotted line and red line) as it seems to work more as a continuation pattern.

It is more a Bullish Flag (red line and black line). The bullish flag is drawn considering only the closure price as per Dow Theory and not the intraday variation.

To me it still seems a market out of control (see volumes and triangles drawn on the chart), hence I personally would stay out.

Overall it is a bullish Market, but it does not give any certain signal to buy yet.

DOMINOS PIZZA $DPZTrendline is broken. holds above 50 day MA and corona will help $DPZ to increase their sales. Rsi is still weak though i would wait to get over 60

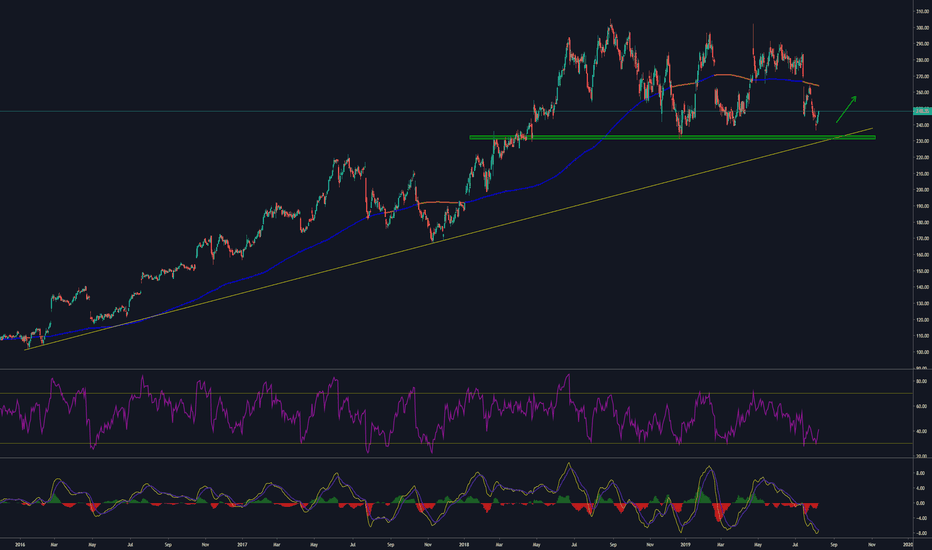

Dominos in bearish controlStill hard to tell if Dominos will continue this downtrend, but it looks like the bears are taking control here. In large it looks like we are still in a bull flag like we had in sep-dec 2018. But key diffrence is that RSI is below transition zone. Takeaway from this is that we will likely go down instead of going up. Best place to short will be the S/R flip or at the EMA's if price gets there.

Domino's pizza updateDomino's pizza stock approached the support buy zone, near a big daily trend line. Major banks like JP Morgan have a $270 price target at the moment, labelling the stock as 'overweight'. Investment funds like Maxim Group targets at $300 back to the highs of this stock. Overall banks and investment funds believe the stock is considered under priced.

Technically, stock almost hit support at oversold on indicators. Would be best to see if the stock hits the support zone first before buying in. Good Luck!

Is Domino's days numbered as a growth stock. Growth investors have stepped in over the last 2 years every time Domino's has disappointing at report time or had negative news regarding their buyback. I think we are going to find out very soon if growth investors patience has run to thin. from a technical point of view DMP looks a high probabilty of breaking to the downside. Furthermore, its hard to see a clear level from a technical point of view where support may come in. Perhaps around $33.

Dominos Pizza, Inc. (DPZ) Buy $277.70 >>> $290.00NYSE:DPZ

Dominos Pizza, Inc.

------

Buy = $277.70

Take Profit = $290.00

Stop Loss = $270.40

------

Profit:Risk = 1.68 : 1

Profit:Risk = +4.43% : -2.63%

Dominos Pizza (DPZ)(NYSE) Buy $286.00 >>> $269.95Deal on breakdown and return prices.

NYSE:DPZ

Dominos Pizza Inc

Stock - NYSE (USA)

Profit:Risk = 1:1

---

Sell = $286.00

Take Profit = $269.95

Stop Loss = $302.06

------

Take Profit = +5.61%

Stop Loss = -5.62%

Dominos Pizza, Inc (DPZ)(NYSE) Sell $265.00 >>> Target $257.00NYSE:DPZ

Dominos Pizza, Inc

Stock - NYSE (USA)

Will break down (Short Signal)

This deal Profit:Risk = 2:1

---

Sell = $265.00

Take Profit = $257.00

Stop Loss = $269.00

------

Take Profit = +3.02%

Stop Loss = -1.51%