Donaldtrump

New Market Pattern ?So I was visiting my sister and she asked how did I get good at forex. I said I see things, sometimes I see faces and the market talks to me I just know. She asked where Do I see a face and I said what do you see. She looked at this and Said its Donald trump face, I actually see it too.. and he moves the markets, so it makes sense.

Why stocks are not falling???So first of all while markets were crashing during march we saw them crash in a perfect Elliot wave of 0.A.B.C. , later the price correction occurred in a Elliot triple combo wave while being inside a Quarter-Circle which means slowing down of Momentum.

After when the Momentum Approached Zero the markets were meant to crash all the way again but due to the Interference of Fed it started Consolidating in the Box only enlarging the Bubble.Now what needs to be took care of is that the more the market will be delayed the more badly it will crash.

If markets would have crashed by now Trump still might have had enough time to bring it back on time, but the more he is delaying the more he is losing his chances of winning the next election.

FIB Circle Analysis for timing of CrashSo here is another analysis to time the inception of another crash if we look closely the market started to fall in march when hey resided inside the blue circle of 1.618 they kept falling until they reached to the center of the circle or at 0 Diameter. now look closely when they started to rise there has been a short chnge in trend whenever the market exited an inner circle to enter in another concentric circle and now we are again in the 1.618 as soon as the market leaves this circle we can say the market will be 'un-stabilised' and another crash will occur so now its just a matter of days.

No fed banks and no Negative Interest rates can save the collapse of economy, which i know is sad but we have to embrace the truth also the ones debating over V-Shaped recovery should know that it would have been possible only if there was huge delivery of volumes after first bottom was made and people would have started to invest enough for recovery but now sadly all hope is gone. TVC:SPX

S&PThoughts on the S&P500

Looking at the Daily chart here it seems it went for a pull back and now it looking like it has hit the sellers "trap" (Order block) it looks like it has been rejecting today.. BUT if it goes past this it could hit the uptrend trendline and start building back....

DONALD TRUMP since he has became President gone up more than 50% now this could be another reason why he has had a dip down...Maybe all the investors 401k consumers want out just incase it dips back down to 3k?

My personal opinion is that I dont think the dip in this is from the virus (coronavirus)

--- Another fact into the dip ---

We are seeing debates happening in USA at the moment to run against DT with some news outlets suggesting Bernie is winnging this could be reacting the the news of what may happen if Bernie does get into the white House.

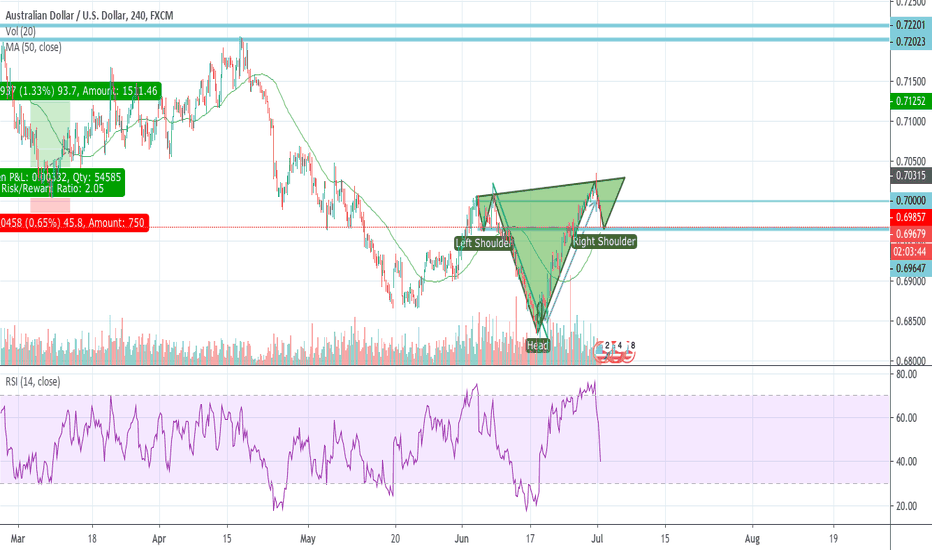

AUD/USD Long Trade Channel FormingAs the daily price has move directly down towards our trend line a clear long order is emerging, with the daily channels clearly defined we will be entering long around the 0.68500 level.

The US/ Iran saga is something to consider within this position. Remember to use good risk/reward ratios.

Check out all our in depth analysis and trade ideas here

www.orionfxmarkets.com

The 2020 Presidential Election (Pat's Crystal Ball Vision)On this cold wintry night in North East USA,

I trek through the wet snow, and down the rock wall through the rabies ridden ravine of plastic and brush, close to the steaming waters of the Passaic River.. ONLY THERE is where I gathered my supplies for the future eyes. A nuclear salamander, a deformed frog, a defective exhaust pipe, a bit of river pool slime.. everything I needed.

A flash freeze, to an immediate smelting, A slow mix with a pinch of salt..

And as I looked into my crystal ball

This is all I saw

The older I get the more cynical I am of politics. I'm not one to argue about them, but I definitely have more of an opinion than I did when I was 18. I don't know enough to say who should do what or where or when... I just like to look at charts..

Opinions from all sides are welcome

I SAY THANK YOU DONALD! LOOL!Well, well - I have to thank Mr Trump for breaking the news that he's gonna raise tariffs on China about an hour before the open of the markets last night. The DJI and loads of other markets took a dive. I'm short of course, and trailing a 2H ATR trendline. On open of the markets there was a gap down of about 430 points. Never before have I seen anything like this on a Sunday night.

As usual the bulls did their thing, trying to close the gap but were beaten back badly up to this morning. This does not mean they won't come around again for another bludgeoning.

The bulls had of course been drunk over the last 4 weeks. They were pricing in hopes that the Fed would reduce interest rates. Powell delivered a nasty surprise. Then last night hopes that the China trade deal was coming to fruition got a shower of ice cold water. It's strange but not so strange that traders were gagging for the deal to come through. Reality was that for the last 6 weeks reputable sources knew that the deal was in trouble. Hey ho - I'm not here to stop anybody listening to or reading mainstream media.

My speculation is that Mr Trump knows or knew the deal is dead (or near dead) so didn't want that to hit suddenly on Friday (the big day) - as bad news on a Friday would cause catastrophic meltdown (either on Friday or the following Monday). So methinks the gave a heads up to avoid the bubble popping 'too suddenly' - if there is any such thing. Well, for Donald anything is possible! LOL