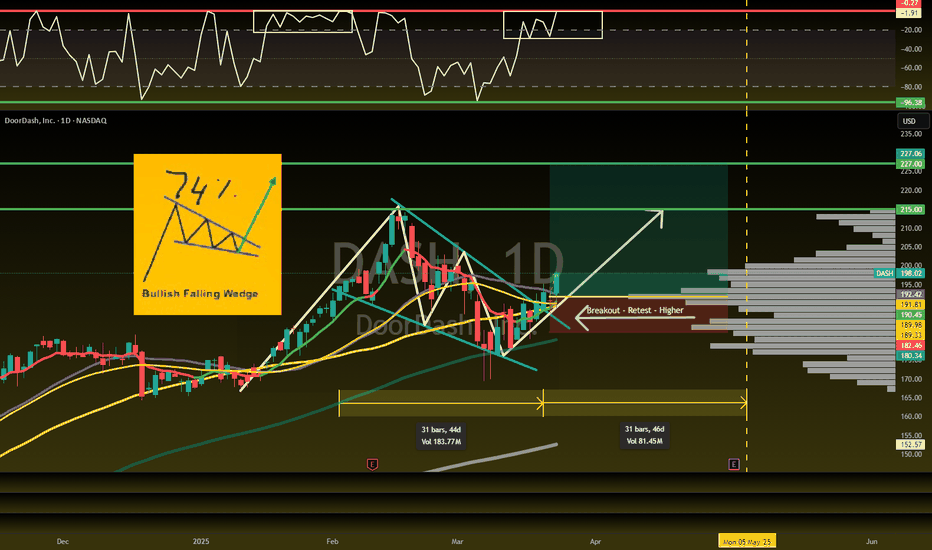

DASH Weekly Options Trade — June 15, 2025📈 DASH Weekly Options Trade — June 15, 2025

💡 Ticker: DASH

🎯 Strategy: Bullish Swing — Call Option

📅 Expiry: June 20, 2025

⏱ Entry Timing: Market Open (only if breakout confirmed)

📈 Confidence: 70%

🔍 Analysis Summary

All four models (Grok, Llama, Gemini, DeepSeek) point to short-term bullish momentum with DASH currently trading:

🔼 Above key EMAs on the 5-min and daily charts

🧭 MACD & RSI in bullish alignment

💬 Supported by strong volume and market sentiment

While there is caution due to overbought RSI and a wide gap between price and max pain ($187.50), the models favor a breakout scenario if DASH clears resistance at $219–$220.

✅ Trade Recommendation

🛒 Trade Type: Long CALL (Naked)

🎯 Strike: $230.00

💵 Entry Price: ~$0.67

📅 Expiration: June 20, 2025 (weekly)

📈 Profit Target: ~$1.34 (100% gain)

🛑 Stop Loss: ~$0.33 (50% loss)

🔎 Entry Note: Only enter if price confirms breakout above $219–$220 zone at open

🧠 Key Risks to Monitor

❗ Overbought signals could lead to a pullback before continuation

⚖️ Max pain at $187.50 may pressure price toward expiration

📉 Avoid entry if DASH fails to hold above $219 at open

🔄 Wider bid/ask spreads due to volatility—manage slippage carefully

🚨 Watchlist Trade: This setup is conditional. Enter only on breakout confirmation above $220.

Let’s see if DASH delivers another leg up—or stalls at resistance.

Doordash

DoorDash (NASDAQ: $DASH) Gains Strength Ahead of May EarningsDoorDash, Inc. (NASDAQ: NASDAQ:DASH ) is showing strong momentum in a volatile market. As of April 11, DASH closed at $180.49, up 1.10% for the day. The stock has risen about 9% year-to-date, while the overall Computer and Technology sector has dropped around 11.8%. This places DoorDash ahead of many of its peers.

DoorDash belongs to the Computer and Technology group, which ranks #6 out of 16 sectors based on the Zacks Sector Rank. The company currently holds a Zacks Rank of #2 (Buy), signaling positive analyst sentiment. Over the last three months, analysts have revised DoorDash's full-year earnings estimate up by 14.7%. This indicates growing confidence in the company’s future performance.

Investors are now watching closely as DoorDash prepares to release its earnings report on May 7, 2025. The stock's upward trend and revised estimates may influence how it reacts to the upcoming results.

Technical Analysis

The daily chart shows that DASH recently bounced off a strong support zone around $162. This zone has acted as a demand area before, pushing the price higher in past sessions. Currently, DASH is approaching key resistance level at $200. A break above these could lead the stock toward the recent high at $215.25. The chart also suggests a possible retracement before a new leg up, reflecting a bullish continuation structure.

Volume increased during the bounce, indicating strong buying interest. RSI is at 48.16, which suggests neutral momentum with room for further upside. DoorDash remains one to watch heading into earnings season.

DoorDash: Is it another advantage or a liquidity trap?Reading a slightly bearish sentiment on DASH at the moment. We have the swing high anchored VWAP combined with a riding wedge. In the short term, it could potentially reach 195, potentially creating a false breakout and trapping long liquidity. Therefore, it’s advisable to exercise caution and closely monitor this situation. Let’s see how it unfolds!

DOORDASH ($DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSEDOORDASH ( NASDAQ:DASH ) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33/share—the second profitable quarter since going public! 💰

• Net revenue margin: 13.5%, inching up from last quarter.

• Plus, a SEED_TVCODER77_ETHBTCDATA:5B share repurchase plan signals management’s confidence in future earnings. 💎

(3/7) – SECTOR COMPARISON

• Market cap ~$80.2B, with the buyback at ~5% of that.

• Analysts (e.g., Oppenheimer) raising price targets → suggests undervaluation vs. Uber Eats & Grubhub. 🤔

• Strong performance in new verticals & international markets = diversification & growth advantage. 🌐

(4/7) – RISK FACTORS

• Market saturation: Competitors might lower prices or offer bigger discounts. 🛍️

• Regulatory: Gig worker laws could drive up costs. ⚖️

• Economic sensitivity: Consumer spending on delivery can be fickle during downturns. 💸

• Restaurant health: If restaurants stumble, so does DoorDash. 🍽️

(5/7) – SWOT HIGHLIGHTS

Strengths:

• Leading U.S. food delivery market share 🍔

• Expanding into grocery & retail → less restaurant dependence 🛒

• Solid international growth 🌍

Weaknesses:

• High operational costs to maintain delivery network 🚚

• Customer loyalty can be promo-driven vs. brand-driven 💳

Opportunities:

• Enter underpenetrated regions → more global share 🌐

• Expand non-restaurant deliveries → bigger wallet share 🏪

• AI-driven efficiency → streamlined ops 🤖

Threats:

• Heavy competition (direct & from self-delivery restaurants) ⚔️

• Consumer shift back to in-person dining if economy improves 🍴

(6/7) – BULL OR BEAR?

With 25% growth and a second profitable quarter, is DoorDash set to dominate? Or are looming regulatory and market saturation risks a speed bump? 🏁

(7/7) Where do you stand on DoorDash?

1️⃣ Bullish—They’ll keep delivering the goods! 🚀

2️⃣ Neutral—Impressed, but risks loom 🤔

3️⃣ Bearish—Competition & costs will weigh them down 🐻

Vote below! 🗳️👇

DoorDash Shares Surge 13% Following Strong Q2 Revenue BeatShares of DoorDash ( NASDAQ:DASH ) surged 13% in extended trading on Friday after the food delivery giant reported impressive second-quarter results that surpassed Wall Street's revenue expectations. The company's revenue growth and order volume highlights its resilience and continued expansion in the competitive food delivery market.

Key Financial Highlights

-Revenue: DoorDash reported a revenue of $2.63 billion, a 23% increase from the $2.13 billion recorded a year earlier. This figure also beat analysts’ expectations of $2.54 billion.

- Net Loss: The company narrowed its net loss to $157 million, or 38 cents per share, from $170 million, or 44 cents per share, in the same period last year.

- Total Orders: DoorDash received a total of 635 million orders in Q2, marking a 19% year-over-year increase.

- Marketplace GOV: The total value of orders, referred to as Marketplace Gross Order Value (GOV), reached $19.71 billion, a 20% increase from the previous year.

Strong Performance Indicators

DoorDash's Q2 performance reflects the company's strategic investments and product innovations aimed at enhancing user experience and operational efficiency. The significant increase in total orders and Marketplace GOV indicates robust demand and successful market penetration.

“We are very pleased with our financial performance in Q2 2024, as it reflects years of investment and product-level focus that drove strong growth and improved unit economics in several major areas of our business,” DoorDash stated in its release.

Looking Ahead

For the third quarter, DoorDash projects its Marketplace GOV to be between $19.4 billion and $19.8 billion, aligning closely with analysts’ estimates of $19.51 billion. This guidance underscores the company’s confidence in sustaining its growth momentum.

The upcoming quarterly call with investors, scheduled for 5:00 p.m. ET, will provide further insights into DoorDash’s strategic initiatives and future outlook. Investors and market analysts will be keenly observing how the company plans to navigate the evolving food delivery landscape and capitalize on emerging opportunities.

Conclusion

DoorDash’s strong Q2 performance and optimistic future outlook have bolstered investor confidence, reflected in the 13% surge in its stock price. With continuous growth in revenue and order volume, DoorDash is well-positioned to maintain its leadership in the food delivery sector.

The company's ability to narrow its net loss while significantly increasing revenue and total orders demonstrates effective management and strategic foresight. As DoorDash continues to innovate and expand, it remains a compelling player to watch in the coming quarters.

Key Takeaways

- Revenue Growth: 23% increase to $2.63 billion, beating expectations.

- Order Volume: 19% rise in total orders to 635 million.

- Market Confidence: Projected Q3 Marketplace GOV aligns with analysts’ estimates.

DoorDash: Sizzling Growth Amidst the Food Delivery RevolutionDoorDash ( NASDAQ:DASH ) stands tall as a beacon of innovation and resilience. Despite the challenges posed by elusive profitability, DoorDash ( NASDAQ:DASH ) has continued to surge ahead, gaining customers, expanding its offerings, and solidifying its position as the undisputed leader in the market.

Dominance and Moat:

DoorDash's ( NASDAQ:DASH ) dominance in the food delivery service is undeniable, with a staggering 65% market share that erects formidable barriers to entry for competitors. This dominance isn't merely a result of market share but also stems from a massive moat built on the back of its growing network of restaurants. In an environment where convenience reigns supreme, DoorDash ( NASDAQ:DASH ) emerges as the incumbent of choice for both restaurants and customers alike, ensuring seamless transactions and unparalleled convenience.

Revenue Growth and Margin Expansion:

Despite the industry's notorious struggle with profitability, DoorDash ( NASDAQ:DASH ) has demonstrated remarkable resilience in driving revenue growth and expanding its margins. With a strategic focus on increasing its take rate, DoorDash ( NASDAQ:DASH ) has managed to boost its net revenue margin significantly over the past two years. The recent Q4 2023 earnings report bears testimony to this success, with revenues soaring to $2.30 billion, surpassing analyst estimates and reflecting a robust year-over-year growth of 26.7%. Moreover, adjusted EBITDA saw a commendable rise, underscoring DoorDash's commitment to sustainable growth and financial health.

Subscription Surge:

One of DoorDash's key growth drivers lies in its growing subscription memberships, exemplified by the success of DashPass and Wolt+. With over 18 million users subscribed by the end of Q4 2023, DoorDash's subscription model continues to resonate with customers, offering access to a plethora of benefits including waived delivery fees and exclusive discounts. This surge in subscriptions not only bolsters DoorDash's revenue streams but also fosters customer loyalty, laying the groundwork for long-term sustainability.

Diversification and Innovation:

DoorDash ( NASDAQ:DASH ) remains at the forefront of innovation, continually diversifying its offerings to meet evolving demands. Beyond food delivery, DoorDash ( NASDAQ:DASH ) has expanded its services to include same-day grocery, staples, retail, liquor, flowers, and even medicine delivery. The company's foray into experimental ventures such as delivery drones underscores its commitment to pushing the boundaries of possibility and redefining the future of logistics.

Partnerships and Collaborations:

Central to DoorDash's expansion strategy are its strategic partnerships and collaborations with leading brands and retailers. By forging alliances with household names like Aldi, Safeway, and Target, DoorDash ( NASDAQ:DASH ) has cemented its position as the go-to platform for a diverse array of delivery needs. Moreover, with over 150,000 non-restaurant partners spanning industries from beauty to pet care, DoorDash ( NASDAQ:DASH ) has created a vast ecosystem that caters to the varied preferences of its customer base.

Technical Outlook

DoorDash ( NASDAQ:DASH ) stock is trading the 200, 100 and 50- Day Moving Averages (MA) respectively with a weak Relative Strenght Index (RSI) of 21 positioning itself in the oversold region.

Doordash Bottom Formed, Strengthens idea to go LongHi guys! Welcome to an analysis on macro developments of Doordash (DASH). With the markets doing what they've been doing this year, we have to ask, " Will the % gains come to stocks that are still many many % down from their tops"? Or are some stocks just doomed to fizzle out and take time to re-build/ grow?

Well, if we are in a Bull market, which i personally think we are... Assets with Solid Market Structure & Technicals will also be included into the liquidity being injected into the markets.

Taking a glance under the hood with DASH, i can see some promising developments playing out. Making me consider DASH as a Long play.

This analysis is strictly on Technicals and is on the 1 Week timeframe to get a big picture view.

From the Lows of Doordash we ended up forming a Ascending Triangle Pattern.

We ended up with a clean break, followed by 3 weeks of testing supporting at the breakout point, the flat trendline.

Ascending triangles are usually Continuation patterns.

BUT at market bottoms, it can act as a Bottoming pattern.

The breakout of the Ascending Triangle allowed us to break resistance at the time, now turned SUPPORT.

We hit our measured move of the Ascending Triangle, to the T.

We ended up retracing back to the Resistance turned "Support Zone (Green rectangle).

We tested support for 2 weeks, followed by the print of a Bullish Engulfing Candle (last week) which confirmed our Support here.

The reason to go long here is of 2 folds:

1. The presence of a bottoming pattern, the Ascending triangle in this case.

2. The confirmation of MAJOR SUpport at this "Support Zone".

These 2 things enhance our chances of price gains to the "MAJOR RESISTANCE" line.

This would be a Major area to take profits.

ALong with these, my MOmentum indicators are showing potential for BULLISH momentum to come in.

STOCH RSI is crossing Bullish, once it moves ABOVE the 20 level. This will indicate Positive momentum to come into this asset.

ALong with MACD, last week printed a Dark Green histogram. This shows strengthening of Bullish momentum.

We are also ABOVE the 0 level, as long as we stay above with a BUllish cross, probabilities of further Price Gains are likely.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on DASH in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

DASH DoorDash Options Ahead of EarningsSalary raise for door delivery workers are inevitable, in my opinion!

DASH is Overbought right now!

If you haven`t seen DASH`s chart pattern here:

Then analyzing the options chain and the chart patterns of DASH DoorDash prior to the earnings report this week,

I would consider purchasing the 85usd strike price Puts with

an expiration date of 2023-9-15,

for a premium of approximately $3.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

All set to hit 80?It has been consolidating around 60 and looks like it wants to hit 80. It must stay above 59 which should be your SL at the current price.

DASH DoorDash Options Ahead of EarningsAfter the record users and orders in the pandemic:

Now DASH is threatened by UBER eats and other food delivery apps while orders are declining thanks to the covid restrictions lift.

Looking at the DASH DoorDash options chain ahead of earnings , I would buy the $55 strike price Puts with

2023-3-17 expiration date for about

$4.40 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

If you want to buy it for the long run, after these earnings retracement, it might not be a bad idea.

Food delivery is here to stay!

Looking forward to read your opinion about it.

DOORDASH - Bounce Along Downtrend DoorDash has formed a double bottom along the current downtrend

This is comparable to a previous double bottom seen, which correlates well with indicator used

A bullish move was the result

Lets see if it follows the same pattern

DOORDASH - $DASHDoorDash is down 65% from it's all time high back in November.

Still no signs of a reversal but interesting to see insiders buying up this week. They've been buying up around the $84-$93 range.

Insider Buying this week as on FinViz:

DASH SC US (TTGP), LTD. Mar 08 Buy 84.65 390,276 shares 33,036,355 634,926 Mar 10 06:52 PM

DASH SC US (TTGP), LTD. Mar 09 Buy 92.38 183,224 shares 16,926,044 818,150 Mar 10 06:52 PM

DASH SC US (TTGP), LTD. Mar 08 Buy 84.65 390,276 shares 33,036,355 634,926 Mar 10 06:52 PM

DASH SC US (TTGP), LTD. Mar 09 Buy 92.38 183,224 shares 16,926,044 818,150 Mar 10 06:52 PM

DASH SC US (TTGP), LTD. Mar 08 Buy 84.65 390,276 shares 33,036,355 634,926 Mar 10 06:51 PM

DASH SC US (TTGP), LTD. Mar 09 Buy 92.38 183,224 shares 16,926,044 818,150 Mar 10 06:51 PM

DASH Lin Alfred Director Mar 08 Buy 84.65 390,276 shares 33,036,355 634,926 Mar 10 06:51 PM

DASH Lin Alfred Director Mar 09 Buy 92.38 183,224 shares 16,926,044 818,150 Mar 10 06:51 PM

Currently we hold no positions in DoorDash.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.

Feel free to give us a follow and shoot us a like for more analysis updates.

DASH record users and ordersDASH bounced from the fair value of its IPO. DoorDash priced its IPO at $102 a share, after an already increased price of $90/share. But the IPO's bankers sold the offering at $182 a share. This year the fair values was reached, 91 usd per share.

Q4 sales rose 34% from last year to $1.3 billion, active customer base of around 25 million, 2.5 times higher than prior to the pandemic.

Paid members more than 10 million, more than double the level prior to its December 2020 IPO.

For this reason i believe the $133 price target is fair valued right now.

$162 is the one year price target from JPMorgan Chase & Co.

$MQ swing trade*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

Recap: Marqeta $MQ has developed a card issuing platform that provides clients such as Coinbase, Doordash, and Square with the infrastructure and tools necessary to offer payment options without the involvement of a traditional bank. $MQ generates the majority of its revenue through transaction fees for cards issued on its platform.

My team took advantage of todays dip and purchased $MQ shares at $14.25 per share. Our first take profit is $17.50.

FIRST ENTRY: $14.25

TAKE PROFIT 1: $17.50

TAKE PROFIT 2: $19.50

If you want to see more, please like and follow us @SimplyShowMeTheMoney

WTRH's Upside Looks Tremendous However, Support Not SettledThe waves never lie, though sometimes we read them wrong.

(at most, wave 1 could see the boxed area before capsizing).

Doordash will get smashed!1) Currently unprofitable

2) Amid the dropping revenue, Co-Founder XU takes half a billion in compensation, that's unheard.. This guy is milking as much as he can before the cow gets old

3) 14x the book value, but hey, these days everyone is flying way above their fair values, so what? Well lets compare to the main competitor the UBER then. While uber is undervalued, doordash being overvalued is odd.

4) Total of 10% of all shares outstanding were sold within 3-6 month period. Not a tragedy but still, 10% man, not just some pennies we are talking about.

5) Upcoming interest rate hike and tapering is all hanging on the price right now adding extra weight for stock to pull.

Short $DASH - Chart indicates a slow decline from hereYou should not be surprised if Doordash retraces towards $190 and fill the gap

DoorDash: The Stock that Hedge Funds LoveIn this post, I'll be taking a fundamental and technical approach to DoorDash ($DASH), an American delivery & takeout platform.

For more information on the company since its IPO, make sure to check out the post I uploaded in Dec. 2020 by clicking the chart below.

Disclaimer: This is not investment advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

Fundamentals

- DoorDash has shown tremendous growth compared to its counterparts like GrubHub and UberEats, during the Covid pandemic.

- In terms of meal delivery shares, DoorDash currently covers 57%.

- Dashers - the deliverymen on DoorDash - are gig workers, but the Biden administration has signaled that they should be classified as employees

- This would induce additional costs, and with DoorDash still not being a profitable company yet, this could negatively impact the stock's price.

- While this company is still not profitable, their Q2 financials demonstrate great growth trajectory

- Their increase in revenue isn't amazing, but the absolute value is quite high.

- Their Gross Order Value (GOV) has been growing for 5 consecutive quarters.

Technical Analysis

- The chart demonstrates that the stock is very volatile.

- But ever since we tested the IPO price support in May, we have been in an uptrend, forming higher lows and higher highs.

- The price is trading above the Exponential Moving Average (EMA) Ribbon

- A break and close above $214 could lead this stock to retest its all time highs at $256

Institutional Investors

- SoftBank holds the most stocks, owning 12.89% of the company (43.5m shares)

- The runner up on the list is Sequoia Capital, with 11.66%

- Tiger Global Management holds 3.23%, and Morgan Stanley Investment Management holds 3.13%

- Among known hedge fund managers as well, the top holders on the list (by order) are:

- Chase Coleman (Tiger Global Management)

- Jim Simons (Renaissance Technologies)

- Ray Dalio (Bridgewater Associates)

- Ken Griffin (Citadel)

Conclusion

DoorDash is a very interesting company with a business model proven successful by other companies overseas. It would be important to see the continuation in growth momentum and the company turning profitable in the next few years. Especially with a lot of institutional interest, this stock could definitely be added to your watchlist.

If you like this analysis, please make sure to like the post, and follow for more quality content!

I would also appreciate it if you could leave a comment below with some original insight :)