Price floor: The opportunity to buy has arrived.Hello friends🙌

According to the decline we had, you can see that the price has reached its historical low, which has given good profits whenever it reaches this low. Now, with capital and risk management, we can buy within the limits of the low and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

DOTBTC

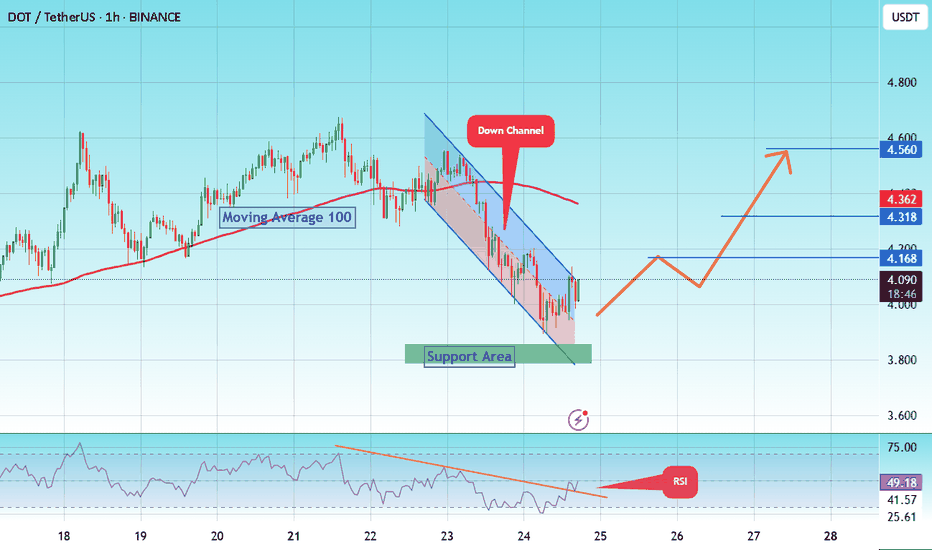

#DOT/Eyes 15% Rally, Targeting Key $ 4.560 Resistance Level#DOT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 3,870, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 3,800.

Entry price: 4.084

First target: 4.168

Second target: 4.318

Third target: 4.560

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

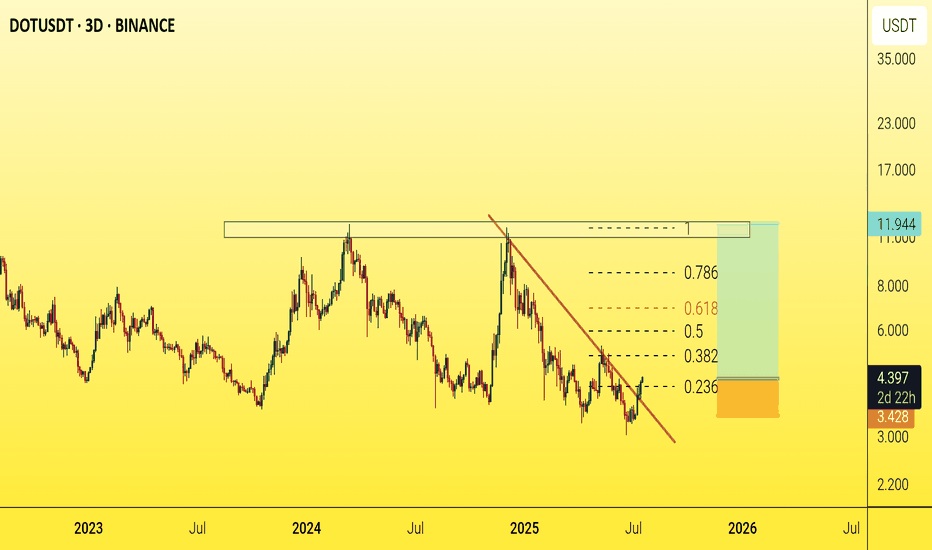

DOTUSDT - A Sleeping Giant in the Bull Market?Polkadot (DOT) has always been one of the leading assets during bull markets

A $10 target now seems inevitable after a clean breakout above the main trendline, followed by a successful retest.🎯

This $10 level has historically acted as a major resistance zone, often manipulated during each bull cycle — price touches it, then sharply pulls back.

But the big question is:

Will DOT break this psychological barrier this time?

Why not?

With many investors losing faith in the crypto market and considering leaving altogether, this might actually be the perfect setup for a massive price explosion.

Historically, the craziest pumps tend to come when confidence is at its lowest.🚀

Best regards Ceciliones 🎯

DOT Will Pump 200% Next Few MonthsWe are headed to 12$ - 11$ over this year - Profiting 200%

STOP LOSS : Dailly Close Bellow 3.30$ (-15%)

Low Risq Big WIN!

Not Financial Advice , But I'm in Baby ;)

CRYPTOCAP:DOT BINANCE:DOTUSDT COINBASE:DOTM2025 BYBIT:DOTUSDT.P BYBIT:DOTUSDT COINBASE:DOTUSDT BINANCE:DOTBTC

#DOT/USDT#DOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.120.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 4.170

First target: 4.220

Second target: 4.246

Third target: 4.323

DOTUSDT Is Hanging by a Thread! Breakdown Ahead?Yello, Paradisers! Is #DOT about to hit new yearly lows? The structure is getting ugly again—don’t get caught off guard as this setup is starting to turn dangerous fast.

💎After a brief and weak corrective bounce, DOTUSDT is once again losing steam. The price has already broken down from a descending triangle—a bearish continuation pattern—and is now threatening to breach its key ascending support level. Momentum is shifting aggressively back in favor of the bears.

💎#DOTUSDT is now hanging to the critical $3.90 support level. A decisive breakdown below this zone would likely trigger another wave of selling pressure, opening the door for a drop toward the next moderate support range at $3.72 to $3.65. While this area could attract some short-term profit-taking, the broader trend remains clearly vulnerable, with bearish momentum continuing to dominate.

💎Should bearish pressure continue, and it’s highly likely at this stage that DOT could fall all the way toward the stronger support zone between $3.40 and $3.35. This region marks the 52-week low, and it's where bulls might step in to defend and attempt a meaningful rebound.

💎Additionally, the 2-hour EMA-200 has shown itself to be a strong trend guide. Every time DOT traded above it, bulls had a slight edge. But now that price has once again broken below this moving average, momentum is back with the bears.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

DOT the most important historical support!DOT / USDT

The price just toke the liquidity and come back above the most important suppprt level in dot chart with long green wick (strong buy action)

As long as the price continues to close above the current level we think for strong bounce in the coming weeks

However, if and only if the price lose this level on HTF DOT will make new lows

Conclusion: this support acts as DO or DIE for future price action … bullish as long as it stay above it but if it lost on HTF it will into strong bearish

Note: many coins have same chart

Best of wishes

#DOT/USDT#DOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.05.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 4.08

First target: 4.10

Second target: 4.15

Third target: 4.20

Polkadot Vs Bitcoin —Augmented Reality—1,000X Better Than Fiat!DOTBTC peaked in May 2021, it will soon be exactly four years.

The bear market bottom and lowest price was hit 3-February 2025. This week, we have a double-bottom.

A double-bottom is a bullish signal and points to a change of trend. There is another bullish signal hidden within this signal.

The low 3-Feb. was set at 0.00004134, this week (14-Apr.) it was 0.00004167, slightly higher.

The 3-Feb. session closed as a hammer, a reversal signal on its own.

The current session is also a hammer and the week closes tomorrow. Current prices or higher and a very strong bullish signal is confirmed. Lower prices wouldn't change anything, the bottom is in.

There isn't much data before 2021. The 2021 bull market here was cut short. It is hard to make any predictions and projections about how high prices can go for this pair. I can be making a huge mistake by underestimating the market, but there is nothing to go by as I work with the chart.

Here we have almost 12X potential. This wouldn't be too surprising for a Cryptocurrency trading pair within a bull market, it would be somewhat normal to see this kind of growth. That's why the mistake can be aiming too low but soon we will know.

Compared to USDT pairs, here we have to buy and hold and wait to see how the market will develop because anything goes. It can happen that these pairs peak before Bitcoin and then Bitcoin produces a final run which ends the bull market, or, these pairs produce a correction while Bitcoin prints its All-Time High, when the ATH is in, the Altcoins vs Bitcoin pairs produce a final run bigger anything we've seen before. Since Bitcoin is now worth trillions, when this money moves around the Altcoins can blow up. The second scenario is the prefered but I don't have any way of knowing which one of the two will be the case. It can happen that some pairs follow the first scenario and other pairs the second one; the ones following the second one will be the luckiest one, these can ending reaching highs in proportions that are very hard to understand. 30, 40, 50 or even 60X.

Right it is early because we are literally at bottom prices, but this wont' be forever the case. In just a few months, the sentiment will be so different that it will be hard to recall the feeling you are having today. You will be so high and feeling nice, that you might end up making more commitments than the ones you can handle, that is how good things will get.

It will become really good, make no mistake. It will be awesome. I can't wait to show you, you will be surprise and you will be so happy with the results, you will be so happy, that you will love Cryptocurrency for years to come. You will be able to hold through the entire bear market and you will be able to participate in each cycle for as long as the Internet is on. This will be our bank account, trading will be our job. Easy passive income with maximum growth.

Cryptocurrencies pay at least 1,000 times more than fiat currencies.

Thanks a lot for your continued support.

Namaste.

DOT/USD "Polkadot vs U.S Dollar" Crypto Heist (Scalping / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DOT/USD "Polkadot vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (3.450) Scalping/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 4.000

💰💵💸DOT/USD "Polkadot vs U.S Dollar" Crypto Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#DOT/USDT#DOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.40.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.43

First target: 4.50

Second target: 4.57

Third target: 4.64

#DOT/USDT#DOT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 4.22.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.30

First target: 4.37

Second target: 4.46

Third target: 4.57

#DOT/USDT#DOT

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 4.50

Entry price 4.60

First target 4.72

Second target 4.85

Third target 4.99

#DOT/USDT#DOT

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly

We have a bounce from the lower limit of the descending channel, this support is at a price of 4.10

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.60

First target 5.40

Second target 6.02

Third target 6.80

Best Buy in DOT📊 DOT/USDT Analysis

🔹 The price remains in a short-term downtrend, currently testing the dynamic resistance of the descending trendline.

🔹 The EMA50 ($7.26) is acting as strong resistance, and breaking above it could trigger a bullish wave.

🔹 Key support lies in the $6.11 - $6.90 range, and losing this zone might lead to further downside risk.

🔹 If resistance levels are broken, the next target could be the $10.42 range. 🚀

📈 RSI Indicator suggests reduced selling pressure and a potential trend reversal.

💡 What do you think of this analysis? Is DOT ready for a breakout? 🤔

DOT - Getting ready to bounce back#DOT/USDT #Analysis

Description

---------------------------------------------------------------

+ DOT is forming a higher low and price is getting consolidated within the zone.

+ I'm expecting a clear bounce back from this zone.

+ Price can easily reach the previous ATH

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 7.47

Stop Loss: 4.8

------------------------------

Target 1: 10

Target 2:16

Target 3: 23

Target 4: 31

Target 5: 40

------------------------------

Timeframe: 1W

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

DOTUSDT - Buying is safe there!Weekly chart displays successful breakout✅ , Retest ✅ of the multi years down trend

Red Area is a very potential support ... buying there is safe

DOT is a strong and highly promising investment project, with many networks built on it.

Accumulate as much as you can within the red zone.

The coin’s targets are very ambitious—$30 is just the beginning, with this target expected to be reached in Q1 2025.

Best regards Ceciliones 🎯

#DOT/USDT Ready to go higher#DOT

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 6.60

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 7.00

First target 7.30

Second target 7.83

Third target 8.43

DOTUSDT | FIRST LINE OF DEFENSEDOTUSDT: Potential Support at the Green Box

In this analysis, the green box emerges as a promising support area worth keeping on our radar.

This zone holds significance for two reasons:

It represents a key demand area, where buying interest could outweigh selling pressure.

It serves as the first line of defense, a crucial level that could prevent further downside.

Trading Strategy

Lower Time Frame Reactions: The focus is on monitoring price action within the green box and the adjacent blue box zone.

Long Trade Opportunities: If the price shows favorable reactions (e.g., bullish patterns or increased volume) in these areas, it can set the stage for well-structured long trades.

This approach emphasizes precision and patience, allowing for entries that align with market dynamics.

Summary

The green box in DOTUSDT is a zone to watch closely as a potential pivot for the next upward move. Stay alert to lower time frame signals to fine-tune trade setups and capitalize on this opportunity.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total