AUDJPY: Bearish Move From Resistance Confirmed 🇦🇺🇯🇵

There is a high chance that AUDJPY will continue retracing

from the underlined intraday/daily resistance.

As a confirmation, I see a breakout of a neckline of a double top pattern

and a violation of a support line of a rising channel.

With a high probability, the price will retrace at least to 89.9 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Double Top or Bottom

USDT Dominance Update (1H)First, it’s important to remember that USDT Dominance (USDT.D) tends to move inversely with the market. In simple terms:

— If USDT.D rises, the crypto market usually drops.

— If USDT.D falls, the market typically rallies.

On the lower timeframes, USDT.D has broken out of a descending wedge formation, which is generally considered bullish.

Additionally, a double bottom pattern appears to be forming and is on the verge of breaking out to the upside.

Taking all of this into account, USDT.D could potentially rise toward the 5.81% level — suggesting that the broader crypto market may experience a short-term correction.

This outlook also aligns with one of my recent Bitcoin analyses.

Be sure to check my latest Bitcoin breakdown to understand where the market might be headed next.

— Thanks for reading.

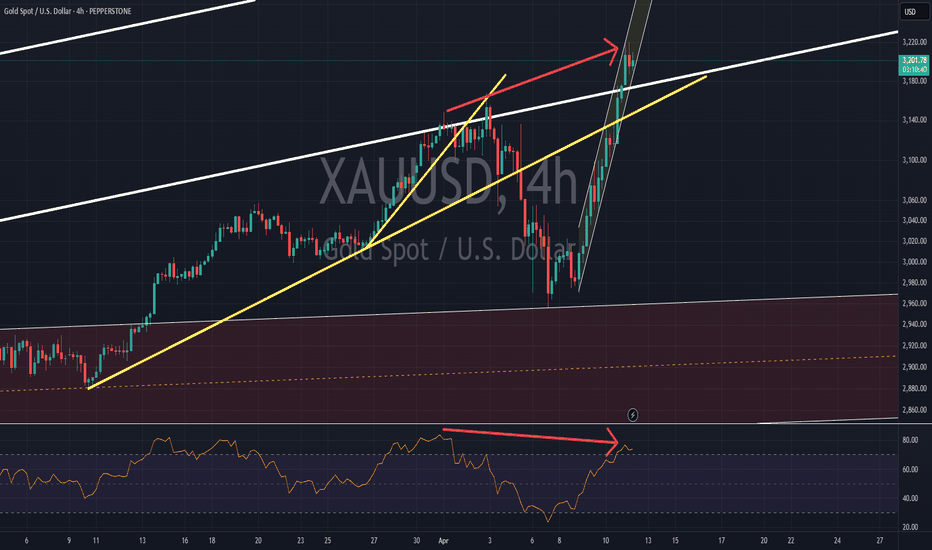

4/15 Gold Trading StrategyYesterday, gold experienced a mild pullback and found support near the 3200 level. As mentioned during intraday updates, as long as 3188 holds, it remains a good opportunity to consider buying. Currently, the price has rebounded above 3220. From the candlestick formation, the trend remains strong, and there is still room for further upside. The previous high near 3245 is likely to be tested again, and there’s potential for a move towards 3260.

However, it’s important to pay close attention to the 3230–3240 zone, which was a key area of trapped long positions from last week. This supply zone hasn’t been fully tested since the last drop, and as prices revisit this area, those looking to break even may create significant selling pressure. If this pressure leads to a rejection, we could see a sharp pullback.

Structurally, a failure to break above this resistance could signal the formation of a short-term top, presenting a tactical opportunity for the bears. Conversely, if gold manages to break and hold above 3245, short-term bullish momentum may continue, though the 3250–3270 region remains a strong resistance zone.

On the downside, if prices retreat again and break below 3188, it will likely confirm a deeper correction. Key support then shifts to the 3158–3147 range, which represents a significant medium-term support zone.

Today’s Trading Recommendations:

Sell Zone: 3250-3270 – A strong resistance area, suitable for initiating short positions for aggressive traders.

Buy Zone: 3158 - 3147 – A technical support region ideal for light long entries if price pulls back.

Range Trading: 3240 -3200 and 3178 -3220 – These zones are suitable for flexible trading strategies based on real-time momentum and price behavior.

Summary:

Gold remains in a short-term bullish trend, but significant resistance lies ahead. Caution is advised when chasing long positions at higher levels. If holding short positions from the 3230+ area, avoid emotional stop-losses—patience could offer better exit opportunities as the market corrects. A bearish setup is brewing, and once a clear direction emerges, volatility may increase rapidly. Be prepared with a solid plan in advance.

Gold is brewing a big drop!After the tariff issue was moderately cooled, gold returned to calm and volatility gradually narrowed! From the candle chart, although gold did not form an effective decline, the bullish momentum slowed down significantly!

Since gold rose near 2970, it has reached a high of around 3246. The bulls did not get a respite. After the news returned to calm, gold may usher in a technical retracement repair; gold has been blocked near 3246 many times in the past two days, and the upper shadow line clearly shows a rejection signal! In the current gold structure, gold has formed a secondary high point near 3232, and it is very likely to combine the 3246 high point to form a double top structure, which is conducive to the decline of gold to a certain extent;

In addition, compared with the market's expected targets of 3300 and 3400, the upper side belongs to an unknown area and is more risky, while the lower side has a previous historical track. From the perspective of market psychology and risk preference, gold prices may be more willing to retreat.

So in the short term, I will still not give up my short position. Once gold falls below the 3205-3200 zone, the area around 3190 will not be able to stop the decline of gold. The retracement target area is located in: 3160-3140 zone.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XRP/USDT I Reverse Short Squeeze Alert! Resistance at 2 USDTHey Traders after the success of my Previous trade this month on NASDAQ:HOOD hitting Target 1 & 2 in 2 days more than 16%+

With a Similar Trade setup But Crypto I bring you today

BINANCE:XRPUSDT

Short opportunity

- Market structure

- Head and shoulder pattern

- Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal which is taking place as we speak- 4 Hour TF.

- Breakdown and retest

- Risk Aversion Dynamics in Cryptocurrency Markets

PROTIP/-

Entry on Bearish candle stick pattern on Current Levels

Stop Loss : 2.2292

Target 1 : 1.4707

Target 2 : 1.0507

Technical View

The orange circle marks a double top within the supply zone, acting as the shoulders of a larger head and shoulders pattern, suggesting strong resistance.

Bearish Trendline

breakdown + Retest

Risk Aversion Dynamics in Cryptocurrency Markets

Fundamental View - How Current Affairs can effect this pair!

The proposed imposition of significant tariffs, such as the 60% levy on Chinese imports suggested by former U.S. President Donald Trump, could trigger a chain reaction across global markets. This scenario would likely amplify risk aversion among investors, potentially catalyzing a sell-off in risk-sensitive assets like XRP (Ripple) in favor of perceived safe havens such as the U.S. dollar (and by extension, Tether/USDT). Below, we analyze the mechanics of this relationship and its implications for the XRP/USDT trading pair.

1. Tariff Escalation and Its Macroeconomic Consequences

1.1 Direct Impact on China’s Economy

A 60% tariff on Chinese exports to the U.S. would directly reduce China’s export competitiveness, potentially lowering its GDP growth by 1.5–2.5 percentage points annually, according to UBS economists. This slowdown would exacerbate existing vulnerabilities in China’s economy, including a property market crisis, weak domestic demand, and deflationary pressures (June 2024 CPI: 0.2% YoY). Reduced economic activity in China—the world’s second-largest economy—could dampen global trade volumes and commodity prices, indirectly affecting risk sentiment in financial markets.

1.2 Global Spillover Effects

The UBS analysis highlights that retaliatory measures by China or other nations could amplify trade fragmentation, further destabilizing supply chains and corporate earnings. For example, the April 2025 announcement of 25% U.S. tariffs on automotive imports triggered a 2.9% drop in the S&P 500 and a 5–7% decline in major Asian equity indices. Such volatility often precedes broader risk aversion, as investors reassess exposure to growth-dependent assets.

2. Risk Aversion Dynamics in Cryptocurrency Markets

2.1 Flight to Safety and USD Appreciation

During periods of economic uncertainty, capital typically flows into safe-haven assets like U.S. Treasuries and the dollar. Tether (USDT), a stable coin pegged 1:1 to the USD, often benefits from this dynamic as crypto traders seek stability. For instance, Bitcoin’s role as a “weak safe haven” for the USD in acute crises suggests that stable coins like USDT could see increased demand during tariff-induced turmoil, while altcoins like XRP face selling pressure.

2.2 XRP’s Sensitivity to Risk Sentiment

XRP, unlike Bitcoin, lacks established safe-haven credentials. Its price action in Q2 2025 exemplifies this vulnerability: a 7.5% decline over 30 days (peaking at 2.57 USDT on March 19 and bottoming at 1.64 USDT on April 7). This volatility aligns with broader patterns where altcoins underperform during risk-off periods. A global slowdown would likely intensify this trend, as retail and institutional investors reduce exposure to speculative crypto assets.

3. Mechanism: From Tariffs to XRP/USDT Price Decline

3.1 Investor Behavior in Risk-Off Environments

Tariff Announcements → Equity Market Sell-Off: The April 2025 auto tariffs caused a 6–7% drop in Asian equities, signaling growing risk aversion.

Liquidity Reallocation: Investors exit equities and crypto (including XRP) to hold cash or cash equivalents like USDT.

USD/USDT Demand Surge: Increased demand for USD lifts USDT’s relative value, pressuring XRP/USDT downward.

3.2 Technical and Fundamental Pressure on XRP

Supply-Demand Imbalance: As sellers dominate XRP markets, the token’s price in USDT terms declines. The 14.56% 90-day volatility in XRP/USDT suggests heightened sensitivity to macroeconomic shocks.

Liquidity Crunch: A broader crypto market downturn could reduce trading volumes, exacerbating price swings.

4. Historical Precedents and Limitations

4.1 Bitcoin’s Mixed Performance as a Hedge

While Bitcoin has shown limited safe-haven properties for the USD in short-term crises, its decoupling from altcoins like XRP during stress periods is well-documented. For example, Bitcoin’s 40% rebound post-COVID crash contrasted with XRP’s prolonged slump in 2020–2021.

4.2 Mitigating Factors

Stimulus Measures: If China implements aggressive fiscal stimulus, as UBS posits, a partial recovery in risk appetite could cushion XRP’s decline.

Crypto-Specific Catalysts: Regulatory clarity or Ripple-related developments (e.g., SEC case resolutions) could counteract macro-driven selling.

5. Conclusion: Bearish Outlook for XRP/USDT in Tariff Scenario

In a tariff-driven slowdown, the XRP/USDT pair faces downward pressure due to:

Risk Aversion: Capital rotation from crypto to stable coins.

USD Strength: USDT demand surges as a proxy for dollar safety.

Altcoin Underperformance: Historical precedent of XRP lagging during macro stress.

People interested should monitor China’s policy response and U.S. tariff implementation timelines, as these factors will determine the severity of XRP/USDT’s downside. A breach below the April 7 low of 1.64 USDT could signal prolonged bearish momentum.

This analysis synthesizes macroeconomic triggers, market psychology, and cryptocurrency-specific dynamics to outline a plausible pathway for XRP/USDT depreciation amid escalating trade tensions.

Not An Investment Advise

GBPAUD: Pullback From Support 🇬🇧🇦🇺

GBPAUD nicely reacted to the underlined intraday support.

The price formed a double bottom pattern on that

and violated its horizontal neckline.

With a high probability, the price will rise more

and reach 2.0907 resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold: It may Fall below 3180 todayOver the weekend, Trump announced a pause on tariffs for popular consumer electronics, prompting gold to gap down to 3210 at today’s open;

✅ Our recommended short entries at 3230–3260 are already in profit;

New semiconductor tariff announcements are due during the U.S. session today — the key driver for gold’s next move;

Given the fragile U.S. political/economic backdrop, escalating tariff conflict is unlikely, increasing the chance of bearish impact on gold;

With gold already trading at a premium, any "tariff relief" narrative will likely trigger speculative sell-offs;

If you're holding short positions, consider being patient — avoid premature exits due to emotional reaction to minor pullbacks.

Maintain key short entry zone: 3230 – 3260;

Expect gold to test below 3180 if market sentiment shifts

Bitcoin Double Top Signals Caution: Key Support Zones to WatchCRYPTOCAP:BTC previously formed a strong double bottom around the $74,500 level, which led to a bullish rally pushing the price up to a saturation zone near $86,000. However, current price action suggests a double top formation — a classic bearish reversal pattern. This aligns with RSI trendline rejection and signs of bearish divergence, reinforcing the bearish sentiment.

The key question: Is this a correction or the start of a deeper dump?

If BTC holds above $79,000, it may just be a healthy correction.

A breakdown below $79,000 brings the next support near $76,000 into focus.

If that fails, Bitcoin could revisit the $69,000 zone, which aligns with earlier consolidation.

Traders should monitor RSI closely and watch for reaction at the support zones. Opportunities exist for both short-term scalps and long-term positions near key levels.

Risks gradually accumulate, and short gold in batchesAt present, the highest price of gold has reached around 3244, but it soon fell back to below 3240; and the PPI data is obviously bullish for gold, but gold has not shown a significant upward fluctuation, indicating that as gold rises sharply, market sentiment tends to be more cautious, so that liquidity is insufficient. So from this point of view, gold still has a need for a correction!

In the past three trading days, the increase in gold has reached $270. So even if gold remains strong at present, we should not blindly chase more gold. On the contrary, we can still gradually establish short positions in batches. As long as we strictly control the number of transactions in the transaction, we don’t have to worry too much about the transaction risk!

Let us wait patiently for the market to gradually accumulate risk sentiment. Once it accumulates to the critical point, it only takes one opportunity for gold to collapse soon.

SHORT ON GOLD (XAU/USD)Gold has found a ceiling and has given a bit of a double top with a change of market structure from up to down.

Its currently retesting the supply area that provided the choc (change of character)

I will be selling gold to the next support level looking to make a $50 move which is 500 pips.

EURCHF, Bullish, Fundamental and Technical AnalysisFundamental Analysis

1. Fundamentals scoring data indicates EUR is stong buy while CHF is CHF is on selling side

2. Seasonality shows EURCHF is Bullish from mid of aprail till end of month

3. COT data shows increase in long positions in EUR

Technical Analysis

1. Currently at strong Support area

2. Double Bottom formation

3. Bullish divergence

4. Buy in 2 parts with sl below support area

5. Take profit on resistance levels

gold and inflation in 1970s stagflation fomc member repeatedly saying this is not stagflation like 1970s

but gold bug on social media constantly pump stagflation narrative after gold historic run from $2000 to $3000 in just one year

with usa cpi and gold chart in one image you can get idea

how gold moved in last stagflation crisis with big political news : when paul volcker comes into fed and when Ronald Reagan wins election

gold first makes double top before multi year bear market

inflation peaked after volcker get fed control but before election result.

is this is really replay of 1970s ?

we got same old president trump and same old fed chair powell

✅ biden forced fed to do big size 50bps cut pre election to choose inflation over higher unemployment which is stagflation

✅ in his first term trump in election year March 2020 use covid as excuse to cut 0% and do QE and trillion dollar fiscal policy stimulus check. choosing inflation over high employment which is stagflation but it was biden who has to face most of the inflation spike to 9%

✅trump raise tariff to 100 years high to choose high employment over inflation which is recession

✅ in next 4 years it will be clear is this replay of 70s or not.

in future we will have more inflation and gold price data to confirm

ANOTHER BULL RUN FOR BITCOINAs of April 12, 2025, Bitcoin (BTC) is trading at approximately $84,892, reflecting a 1.5% increase as it attempts to break a three-month downtrend.

Several factors have contributed to Bitcoin's recent price surge:

1. U.S. Tariff Exemptions: The Trump administration's decision to exempt key tech products from reciprocal tariffs has alleviated trade tensions, boosting investor confidence in risk assets like Bitcoin.

2. Strategic Bitcoin Reserve: The U.S. government's establishment of a Strategic Bitcoin Reserve signals institutional support for digital assets, enhancing market sentiment.

3. Market Dynamics: A significant amount of Bitcoin has been withdrawn from exchanges, indicating strong holding sentiment among investors. Additionally, a short squeeze has contributed to upward price momentum.

Finance Magnates

4. Global Adoption: Institutions like Lomond School in Scotland accepting Bitcoin for tuition fees reflect growing mainstream acceptance of cryptocurrency.

Latest news & breaking headlines

This could be the bull run we've all been waiting for.

There is a good probability on the bullish side.There is a strong support zone holding on the weekly timeframe, and it's exactly from this level that a reversal signal has appeared on the four-hour chart, along with a structure shift and a candle close. Moreover, the RSI indicates a bullish divergence. Now, it's just the weekly trendline that needs to be broken—once that happens, nothing can stop ETH from turning bullish.

Volume fades, double top forms – is Bitcoin headed to 70k?CRYPTOCAP:BTC is showing signs of exhaustion near the $83,500–$84,000 zone, with repeated rejections indicating weakening bullish momentum. Volume is steadily declining, which typically signals a lack of conviction from buyers.

We may be witnessing the formation of a potential double top – a bearish reversal pattern. If confirmed, this could trigger a correction toward $78K, $74K, or even the $70K–$68K zone.

Key Levels to Watch:

Resistance: $83,500–$84,000

Support: $78,000 → $74,000 → $70,000 → $68,000

This corrective move could be healthy for the market, potentially flushing out weak hands and injecting fresh liquidity for a stronger upward rally in the coming weeks.

LONG ON GBP/CHFGBP/CHF Has a Perfect Double bottom pattern at a major demand area.

Price has broken the neckline of the double top and is currently pulling back to sweep liquidity and balance out price at any FVG's (Fair Value Gaps)

Liquidity sits behind the 2 wicks on the double bottom, so price may sweep that BEFORE rising.

Must give you stop loss space behind the wicks to survive the trade.

I have a buy limit order setup to take advantage of the pullback which will place me in the trade at discount price.

From there im looking to catch 300 pips to the previous swing high.

''Altseason 2025''Welcome back dearest reader,

I will probably get alot of backlash from bitcoin maxi's for writing this post, i have read and heard it all by now. I'm not disregarding their opinion on bitcoin and i think it will do well, but not as well as some altcoins which i have monitored.

First the technical part:

~Bitcoin has seemingly formed a double top pattern with now on the weekly a gravestone doji (confirming this sunday). Looking at previous action from 2019 and 2020, these have been topping indicators and indicate a bearish reversal which in turn will be bullish for altcoins.

~ MFI --> massively overbought.

~ Stoch RSI --> nearly at 100! Screaming for a reversal.

Over the past months everyone seemed to think ''this is the top, only to see dominance rise further and alts bleeding''. It is possible that BTC.D doesn't correct immediately, but i do suspect an altseason to be really close.

Sentiment: When everyone... i mean EVERYONE is bearish. ''Alts to zero'', ''bitcoin is the only good coin'', ''Ethereum is dead''. This has historically been the perfect time to buy. And that time is now.

''But, there are over 13 million altcoins now!''

Yes this is true, i don't think all of them are going to do well, stick to the ones available on big exchanges. Those have 400 different ones on average. From those i have covered some allready which i think are going to do well, it's worth your time to look at those ideas.

Any questions?

Ask.

~Rustle

EurUsdThe EUR/USD market initially tested a significant daily resistance zone, which prompted an expected bearish continuation. Following this, the market formed a clear M-pattern, indicating a potential reversal. As the price retested the neckline of the M-pattern, this confirmed the continuation of the bearish trend. Consequently, further selling pressure was anticipated, aligning with the established market structure and technical signals.