XAUUSD 15MINTS CHART PATTERN. NEXT MOVE POSSIBLE.This chart is a 15-minute Gold (XAU/USD) price analysis with a technical pattern projection.

Key Observations:

1. Support & Resistance:

A strong horizontal support level is marked at $3,000.14.

Price recently peaked near $3,016.13 and is showing signs of a potential reversal.

2. Price Structure & Pattern:

The blue lines indicate wave-like price movements, possibly an Elliott Wave or price action structure.

The pattern suggests that the market previously experienced a strong bullish impulse, but now a retracement is expected.

3. Projected Movement:

The downward arrows suggest a bearish correction towards $3,000.14, which could act as a key support zone.

If price respects this support, a potential bounce-back might occur. Otherwise, a breakdown could lead to further declines.

Possible Trading Plan:

Short Setup: If price starts rejecting resistance near $3,016 and forms bearish confirmation (e.g., candlestick patterns like engulfing or pin bars).

Buy Opportunity: If price reaches $3,000.14 and shows strong support confirmation (like a bullish engulfing or double bottom).

Would you like a more detailed trading plan based on this setup?

Double Top or Bottom

Potential Countertrend Trade Idea for E/UDoulbe top forming clearly on Daily and 4hr, after recent bull run. This could be the start of a daily and weekly pullback, before the trend continues. However, if you are feeling adventurous this could provide an opportunity to forge some pips.

option 1: Entry after STRONG BEARISH candle break of neckline

option 2: Entry after BREAK AND RETEST of neckline

AUDJPY 4H Double BottomThe price already cross the neckline(94.720) of a double bottom, the objective should be around 97.700 but I set 97.0 as my goal because a pivot point around that level. The stop loss is a little below the first support around 93.634 even though the price seems to already be on its way, I guess there is a chance to get in if there is a pullback.

Gold Double Top 15 minGold has tested the high (HH) at 3004.83, then tested 2,994.03 twice and tested the neck at 2,986.13 for the 8th time. If the neck is tested and the price falls below, it is considered a Double Top. The target is expected to be 2960.36. If the target is divided, the first target could be 2971. Good luck in your trading.

Flight Centre Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Flight Centre Stock Quote

- Double Formation

* (Reversal Argument)) | Completed Survey

* (Flag Structure) | Short Bias Entry | Subdivision 1

- Triple Formation

* ABC Flat Feature | Wave Set Up | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 84.00 AUD

* Entry At 74.00 AUD

* Take Profit At 54.00 AUD

* (Downtrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

PFE Operation PlanFor this trade on Pfizer (PFE), we will implement a staggered entry strategy with three designated entry points at $26, $25, and $24.5. This approach allows for a cost-averaging method and improved risk management as the market fluctuates.

Our profit targets are set at $28, $30.5, and $31, ensuring we capture gains incrementally as the price moves upward. These targets are based on our technical analysis and current market dynamics. Additionally, strict stop-loss protocols will be in place to mitigate downside risks.

Disclaimer:

This information is provided for educational and informational purposes only and should not be considered financial advice. Trading involves substantial risk, and past performance is not indicative of future results. Always conduct your own research or consult a professional financial advisor before making any investment decisions.

Is PI Network About to Reclaim $3 Again ?Hello Traders 🐺

In this idea, I want to talk about the PI coin, which, in my opinion, is the best mobile mining app so far. I've been mining PI coins for at least 4 years and still holding them. PI Network has a solid team behind it and a strong community!

If you're still holding or planning to buy some for the upcoming Altcoin Season, I'm here to break down the chart and show you what's happening right now. So stay tuned until the end, and don't forget to like and follow for more support! 🌟

Chart Analysis 📈

As you can see, we have a strong downward-sloping blue trend line. Currently, the price seems to be forming an Inverse Head and Shoulders Pattern, which is a bullish signal. 🎯

However, make sure to wait for the breakout and retest as new support, at least on the 1H time frame. Regarding the price target of this pattern, I personally believe the next major resistance to the upside is the current all-time high around $3. 💰🔥

I hope you enjoy this idea! 💡

🐺 KIU_COIN 🐺

Dow Jones 3-daily OutlookLooks like a confirmed double-top, might turn into a Head/Shoulders even.

Head Shoulders:

A common scenario with these is, it looks like a double top, then has a strong reclaim of the neckline, which is around 41.9k, and then a 2nd loss of it shortly after w/ yet another re-test with failure to reclaim.

Double Top:

Another common scenario is just a re-test and failure to reclaim, and this is a textbook double-top.

50/200 3-daily EMAs and MAs:

After losing the 50 EMA and MA, we keep dropping below the 200 EMA and MA on the 3 daily chart during stronger dips, and then finally recovering back above both.

Recovery or Recession?

Recovery:

If we want to see a recovery, we need to do that again. So, a strong move back above the 200 and 50 EMAs/MAs after losing both, down to around 38.5k and then 37.5k, possibly as low as 36.3ish.

Or, for a more immediate flip to bullish, we need to reclaim ~41.9k during any re-tests, and then head to a new ATH above 45k.

Recession:

If we don't bounce from just below the 200 EMA and MA, we might see an extended move down or even a recession.

Btcusd support for pullback This Bitcoin (BTC/USD) price analysis on a 1-day timeframe (from Coinbase) includes key technical indicators:

1. Double Top Formation – Marked at the resistance level, this pattern typically signals a potential price reversal. The price failed to break above this level twice before declining.

2. Resistance Level – A trendline acting as a strong resistance, previously rejecting price movements. The chart suggests that Bitcoin needs to break through this level for further bullish momentum.

3. Support Zones – Two green zones indicate key support levels where buying pressure has historically increased, preventing further declines.

4. Projected Price Action – The analysis suggests a short-term decline towards support, followed by a bullish rebound. The price is expected to test resistance again and potentially break out toward $104,283.

5. Volume Profile – The right side of the chart shows the volume traded at different price levels. Higher volume zones indicate strong areas of interest for buyers and sellers.

Overall, this analysis suggests a temporary dip followed by a potential breakout to new highs, contingent on Bitcoin holding support and overcoming resistance.

BTC/USDT Reversal scenariosThere is bear mood in market, its exactly what is needed for reversal, lets have a look closer. I see 3 options.

1) Manipulation is over, we reached the target of local FIBO 1.618 at 77055$

2) Level 73764$ - its the target of Double TOP , the edge/high of the last block and 0.618 level of grand FIBO

3) POC level of last accumulation block which lasted for 255d at 67436$ - we could reach this level only with fast squeeze and fast buy back, leaving long needle on higher timeframe

BTC Double Bottom Formation Likely - Strong SupportEntering another BRC Long at the current level of support. Appears we have a lot stronger potential for a bounce here. Looking at RSI we see oversold conditions with larger time frames holding bull divergences.

Looking at this to be a low risk trade with lots of potential. Loading in now.

Have fun and as always protect that capital.

Nasdaq Hits Double Top Target – What's Next?Amid declining economic confidence and economic growth forecasts, stimulated by expanding trade wars, the Nasdaq has reached the double top pattern target formed between the December 2024 and February 2025 peaks at 19,100.

This level also aligns with the 0.618 Fibonacci retracement of the uptrend from the August 2024 low (17,230) to the February 2025 high (22,245).

The 19,000 barrier holds significant technical weight, as it coincides with:

The golden Fibonacci ratio and the double top pattern target.

Oversold conditions on the daily RSI, previously seen in August 2024 and dating back to similar levels in 2022 on the 3-day time frame.

Key Levels to Watch:

🔻 Downside Risk: If market turbulence intensifies and the Nasdaq drops below 19,000, the next key level is the 0.786 Fibonacci retracement at 18,300, with potential interim support at 18,700.

🔺 Upside Potential: If markets respond to oversold momentum conditions, a break above the short-term resistance at 19,700 could trigger rallies toward 20,000, 20,300, 20,700, and 21,000. A strong hold above 21,000 could extend bullish momentum back toward record highs.

Key Events to Watch:

US PPI Data (Today)

US-Canada Trade War Developments

US Consumer Sentiment Report (Friday)

- Razan Hilal, CMT

US Market Reversal Emerged? This Week's Closing is CrucialThe final trading day of February. I always take the opportunity to analyze the monthly chart closely.

We saw an inverted hammer. From the cash chart, clearly, we can see the inverted hammer. Beyond that, it also appears to be a potential double top for the Nasdaq.

E-mini Nasdaq Futures & Options

Ticker: NQ

Minimum fluctuation:

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

Trading the Micro: cmegroup.com/markets/microsuite.html

BBWI Buy Setup - Strong Support, Risk/Reward 1/16Ticker: NYSE:BBWI (Bath & Body Works)

Long Entry: Near current strong historical support level

Target: Last high (considered as take profit point)

Stop-Loss: Just below current support

Risk-Reward Ratio: ~1:16

Analysis:

NYSE:BBWI has reached a strong historical support level and recently formed a local higher high, signaling a potential reversal to the upside. Additionally, volume has spiked, suggesting that recent panic selling may have seen shares shift from amateurs to professionals, who tend to buy at strong support levels. Owning alongside professional buyers can be advantageous, as it often reflects more strategic positioning.

The current setup provides a solid risk-to-reward ratio of about 1:16 up to the last high, which can be considered a key take-profit point. While this high serves as a primary target, I plan to manage my position flexibly, potentially closing portions earlier or holding some for further upside if the trend remains favorable.

Strategy:

Entry: Buy near current support level

Stop-Loss: Set just below support

Target: Last high as primary take-profit level; partial closes based on trend continuation

Key Points:

Volume spike at support suggests strong buying interest, possibly from professional buyers

Local higher high supports a potential uptrend

Risk management is crucial, with a close stop to limit downside and a favorable target ahead

Conclusion:

With strong support, higher volume, and potential professional buying, NYSE:BBWI offers a compelling long opportunity with a favorable 1:16 risk-reward ratio up to the last high. This setup allows for both targeted and flexible profit-taking as the trend develops.

Note: I’m already in this position—I entered 7 weeks ago at the bullish engulfing pattern around the $29.21 level. I meant to share the idea back then, but the current market conditions are still quite similar, reinforcing my confidence in this setup.

Disclaimer: This is not financial advice. All information is for educational and informational purposes only. Trading and investing involve risk, and it’s essential to do your own research or consult a licensed financial advisor before making any financial decisions.

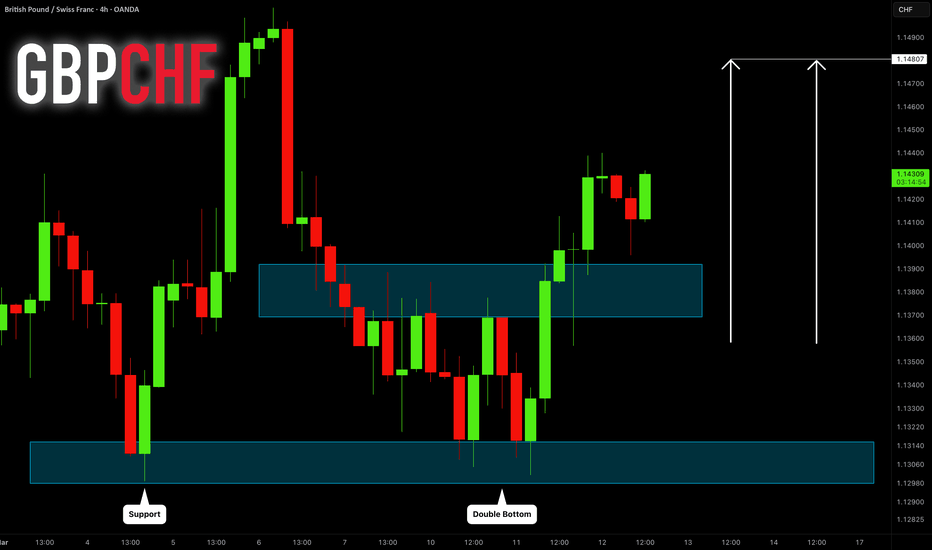

GBPCHF: Bullish Wave Continues 🇬🇧🇨🇭

As I predicted yesterday, GBPCHF went up from support.

I see one more bullish pattern today:

this time we have a confirmed breakout of a neckline of a double bottom.

The market is going to rise and reach 1.148 level soon.

❤️Please, support my work with like, thank you!❤️