Ethereum Up 30% — But Is This the Start of a Trend Reversal..?Ethereum Up 30% — But Is This the Start of a Trend Reversal..?

Ethereum has seen a notable bounce this month, climbing approximately 30% from its local bottom of $1,400 to its current level around $1,800. While this rally might appear promising at first glance, a deeper look at the daily timeframe reveals a more cautious picture.

Despite the recent price surge, Ethereum remains technically in a **downtrend**. A well-respected downtrend continues to hold as resistance, and ETH is currently **retesting this trendline**. This point of contact now sets the stage for two potential scenarios:

**Scenario 1: Rejection from the Trendline**

If Ethereum fails to break above the trendline, it’s likely to face **rejection**, which could send the price back toward the $1,400 level. A revisit to this support zone would form a **potential double bottom**, a classic reversal pattern. If that plays out, we could then start to look for signs of a genuine trend reversal.

**Scenario 2: Breakout Above the Trendline**

On the other hand, if ETH manages to **break through the trendline**, that alone shouldn't be a green light to go long just yet. There’s a significant resistance level sitting around **$2,100**, which has previously acted as a ceiling for price action. A true breakout would require Ethereum not only to cross this level but also to **sustain above it for 2–3 days**. Only then could a long position be considered relatively safer, with upside targets extending to **$2,800** and even **$4,000**.

**Final Thoughts**

While the recent rally is encouraging, it's essential to remain cautious. The downtrend isn't officially over until key technical levels are cleared and held. Until Ethereum breaks above both the downtrend and the $2,100 resistance zone — and proves its strength with sustained movement — the **best strategy may be to sit on the sidelines** and let the market play out.

Patience often pays in crypto — and right now, **watching closely** could be the smartest move.

Downtrendbreak

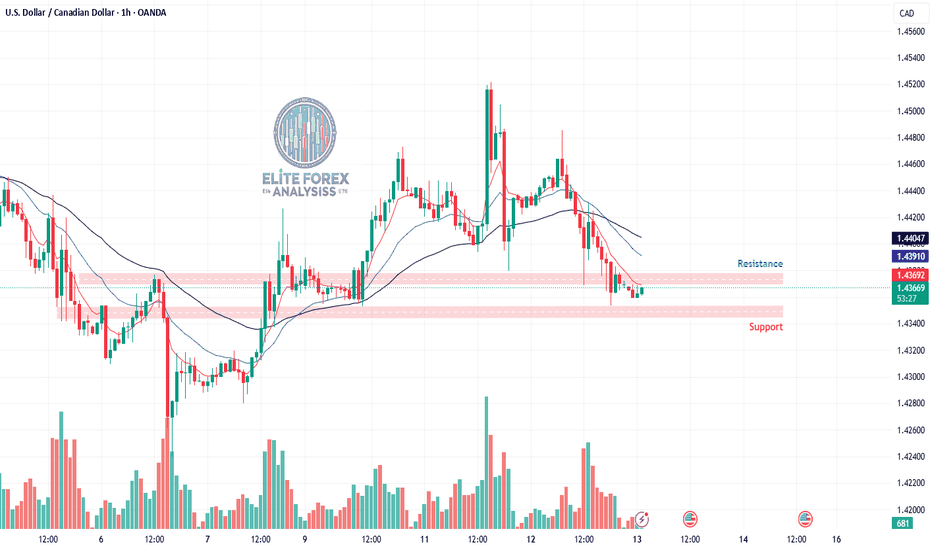

USDCAD Trade Idea (1H Chart Analysis)**USDCAD Trade Idea (1H Chart Analysis)**

**Market Structure:**

- The price is in a **downtrend** on the 1H chart, with lower highs and lower lows forming.

- It is currently testing a **key support level** around **1.4350**.

- The **50 EMA (black line) is above the price**, confirming bearish momentum.

- The recent candles show **decreasing volume**, indicating possible consolidation before the next move.

**Trade Plan**

**Scenario 1: Bearish Breakdown (Sell Trade)**

📉 **Entry:** Below **1.4350**, after a strong bearish candle closes.

🎯 **Target 1:** **1.4320** (previous minor support)

🎯 **Target 2:** **1.4280** (stronger support zone)

🛑 **Stop Loss:** **1.4375** (above recent lower high)

📊 **Risk-to-Reward Ratio:** 1:2 or better

**Confirmation:** If price breaks 1.4350 with strong volume, it signals continuation of the downtrend.

**Scenario 2: Bullish Reversal (Buy Trade)**

📈 **Entry:** If price **bounces from 1.4350** and forms a strong bullish engulfing candle.

🎯 **Target 1:** **1.4395** (previous resistance)

🎯 **Target 2:** **1.4415-1.4420** (major resistance zone)

🛑 **Stop Loss:** **1.4335** (below recent low)

📊 **Risk-to-Reward Ratio:** 1:2

**Confirmation:** A strong rejection from 1.4350 with bullish volume indicates potential reversal.

**Final Thoughts**

- **Bias:** Bearish unless we see a clear reversal signal at 1.4350.

- **Watch for a breakout or bounce at key levels before entering.**

- **Always use risk management** – never risk more than 1-2% per trade!

Centaurus Metals ready to rip?After declining by more than 80%, Centaurus Metals has broken out of its downtrend. While this may be the first step in a multiweek base-building process for the nickel mine developer, the chance of a v-shaped bottom makes Centaurus worthy of a speculative add following this seriously bullish price action.

📉 Downtrend ID Cheatsheet *UPDATED*What Is a Downtrend? A downtrend is a gradual reduction in the price or value of a stock or commodity, or the activity of a financial market. A downtrend can be contrasted with an uptrend. Downtrends are characterized by lower peaks and troughs and mimic changes in the perception of investors. A downtrend is fueled by a change in the supply of stocks investors want to sell compared with the demand for the stock by investors who want to buy. Downtrends are responses to changes that surround the security, whether macroeconomic or those associated with a company's business activity.

🔹Understanding and Identifying Downtrends

As much as it is important to look out for uptrends when trading, it is equally important to understand and identify downtrends. A trader may potentially save money if they decide to sell off a declining stock. If many traders decide to sell a stock at the same time, it will result in a sharp decline in the stock price. The stock market is sentiment-driven, and fear of a further decline may result in even further selloffs of a stock. Some traders that frequently day trade may decide to implement stop-loss orders to protect themselves against a downtrend. A stop-loss order placed with a broker helps a trader sell once the price of the security reaches a certain price. Downtrends can vary from a gradual continuation to a sharp decline. A sharp decline may occur as a result of news-related topics, such as a poor quarterly earnings report or loss of a lawsuit. A downtrend can be identified and understood through various forms of technical analysis. One simple area of technical analysis is the use of trendlines. Trendlines connect a series of high or low points. The reversal of a declining trendline signals an uptrend. Another simple area of technical analysis is the moving average technical indicator. The moving average takes the mean of prices over a period in the past. If the price of a stock tends to stay below the moving average, it signals that the price is on a downtrend.

🔹Trading on a Downtrend

Many traders look to profit from sell offs of a stock. While many traders will sell, taking the view that a price will decrease further in the future, some traders take the opposite view of hoping for a price increase. Downtrends may also lead to attractive valuation and present new opportunities for traders to purchase shares of stock.

In another sense, downtrends allow traders to make money by short-selling stocks. In order to short a stock, a trader borrows shares and immediately sells them, in hopes that the price will fall. If the price of the stock goes down, then the individual will repurchase the shares back at the lower price and return the borrowed shares. The difference between the old price and the new price is the profit that a short-selling trader holds.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📉 Downtrend Identification CheatsheetWhat Is a Downtrend? A downtrend is a gradual reduction in the price or value of a stock or commodity, or the activity of a financial market. A downtrend can be contrasted with an uptrend. Downtrends are characterized by lower peaks and troughs and mimic changes in the perception of investors. A downtrend is fueled by a change in the supply of stocks investors want to sell compared with the demand for the stock by investors who want to buy. Downtrends are responses to changes that surround the security, whether macroeconomic or those associated with a company's business activity.

🔹Understanding and Identifying Downtrends

As much as it is important to look out for uptrends when trading, it is equally important to understand and identify downtrends. A trader may potentially save money if they decide to sell off a declining stock. If many traders decide to sell a stock at the same time, it will result in a sharp decline in the stock price. The stock market is sentiment-driven, and fear of a further decline may result in even further selloffs of a stock. Some traders that frequently day trade may decide to implement stop-loss orders to protect themselves against a downtrend. A stop-loss order placed with a broker helps a trader sell once the price of the security reaches a certain price. Downtrends can vary from a gradual continuation to a sharp decline. A sharp decline may occur as a result of news-related topics, such as a poor quarterly earnings report or loss of a lawsuit. A downtrend can be identified and understood through various forms of technical analysis. One simple area of technical analysis is the use of trendlines. Trendlines connect a series of high or low points. The reversal of a declining trendline signals an uptrend. Another simple area of technical analysis is the moving average technical indicator. The moving average takes the mean of prices over a period in the past. If the price of a stock tends to stay below the moving average, it signals that the price is on a downtrend.

🔹Trading on a Downtrend

Many traders look to profit from sell offs of a stock. While many traders will sell, taking the view that a price will decrease further in the future, some traders take the opposite view of hoping for a price increase. Downtrends may also lead to attractive valuation and present new opportunities for traders to purchase shares of stock.

In another sense, downtrends allow traders to make money by short-selling stocks. In order to short a stock, a trader borrows shares and immediately sells them, in hopes that the price will fall. If the price of the stock goes down, then the individual will repurchase the shares back at the lower price and return the borrowed shares. The difference between the old price and the new price is the profit that a short-selling trader holds.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

JICPT| EURUSD retest bull flag structure on the dailyHello everyone. It's been a while since I published last trade idea. I've been very busy helping clients to review their portfolios in December.

EURUSD got my attention as it tested the key structure of the bull flag pattern. I marked two support zones in yellow color with the lower one expected to be not so easy to break.

Looking at the daily chart, you can identify that the downtrend channel was firmly broken on Oct.25th, a few days after CPI release which is below expectation. That's a turning point where DXY started to pull back from multi-year high.

In addition, the pair refused to create new low and a nice pullback has been formed thereafter.

As mentioned above, two yellow zones are considered to be support zones with 1.0550-75 and 1.0200-1.0300. The latter is a wider zone and we can zoom in to identify bullish reverse pattern on 60 min.

What do you think? Give me a like you're with me.

Bitcoin looking more interesting!Bitcoin has broken above the one year downtrend and after months of trading around the 18000 mark, has now built up a decent floor of support below the market.

We have, what I refer to as a confirmed buy signal on the DMI. This happens when not only is the blue line above the red line (+DI above -DI) but when the blue line breaks above the previous blue peak.

It's looking more interesting at last!

Disclaimer

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current Disclaimer:

opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

LKQ: breakout watchLKQ is currently at a resistance point of a downtrend channel that started back in December 2021.

Watch for LKQ to break that trend line. A break would mark a potential reversal of the downtrend.

I'll be entering a long position on the break, with a stop at 49.50.

The ideal situation is if we break 51.60/51.70, then maybe we can fill the small gap at 53/53.50.

Next targets are 56.48 and 60.14.

Trade safe

Bitcoin Daily Chart - Wyckoff Distribution and Downtrend BreakAs the majority of traders have began showcasing various bearish signals, it is important that at this moment we zoom out of the chart and we observe the longterm pattern that has been created.

On the daily chart we can observe a potential Wyckoff Distribution being completed which should continue with a downtrend.

As of today, bulls are attempting to break off from the downtrend and enter two possible scenarios:

- a shoot to ~47,000 breaching the strong resistance at ~45,000 which has already been tested several times.

- sideways trading to consolidate the downtrend break, and build new support before finally attempting to pump in the ~50,000 price range.

We are still considered to be in no mans land until a confirmation appears.

The most likely scenario is sideways training and here is why:

1. FED actions to taken in consideration

2. Russia - Ukraine situation. Ukraine deciding not to follow their NATO membership ambitions is a positive step towards temporarily resolving the tense circumstances at the border.

3. The crypto ecosystem is technologically booming. A 12-24 months bearish crypto market does not represent the logical uptrend of the overall crypto world, unless external factors are significantly negative.

DATAPRP Morning Star Formation or Continue DowntrendPossibility to form morning star, or forming same pattern as first circle or worst continue downtrend.

Entry 0.460, TP1 0.490, TP2 0.530 and cutloss 0.430. If break downtrend line, possiblity of uptrend movement. Trade at you own risk. Comment if you have different idea. Thank you for your time.

REEF breaks its downtrend for price and RSI. Recovery ahead?Reef Finance finally broke out of its latest downtrend that now lasted over a month.

The support around 0.0165$ held and we got a nice bounce that pushed us through the downtrend trendline.

Next resistance lines are at 0.036$ and 0.05$.

We spot a similar pattern on the RSI where we expect the next resistance to be around 70.

Currently 16 billion REEF tokens out of 20 billion are in circulation.

This is good in terms of inflation risk, meaning there is basically none.

The current price level looks like a nice entry for a long position.

Feel free to comment or ask anything you like.

Always do your own research and keep in mind that my charts and comments cannot be considered financial advice.

Cheers Ctumbler

EUR/USD down trend reversal.A three inside up candlestick formation was completed on August 23rd, on the daily chart, signaling a possible reversal. Later on September first after some nice upward movement, again on the daily chart, the Lux Algo flashed a strong buy signal. A day later on the second a somewhat contradictory signal flashed, the completion of a sell setup on the TD sequential. If we have in fact started a new uptrend I believe this sell signal from the TD sequential will only lead to a small correction. The correction seems likely since the formation of an evening star pattern is currently in the works, though we will still need to wait and see where the August 6th candle closes.

LTO Update: Touched red trend line and broke downtrend.Update on LTO:

As stated a few days ago, it was clear that the price wanted to touch the highlighted red trend line. After doing that, it broke the current downtrend and is ready for some upward movement. Any entry point below 0.5 is golden imho.

Pay close attention to the newly formed uptrend bottom line, if it’s broken, then i’m pretty sure it will retest the red line again.

Good luck, and stay safe!

Not financial advice.