Drones

Is Red Cat Holdings a Drone Industry Maverick?Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions, particularly the escalating demand for advanced military drone capabilities, create a favorable backdrop for companies like Red Cat, which offer NDAA-compliant and Blue UAS-certified solutions. These certifications are critical, ensuring drones meet stringent U.S. defense and security standards, differentiating Red Cat from foreign competitors.

Despite its strategic positioning and significant contract wins, Red Cat faces considerable financial and operational challenges. The company currently operates at a loss, with a net loss of $23.1 million in Q1 2025 against modest revenues of $1.6 million. Its revenue projections of $80-$120 million for 2025 underscore the lumpy nature of government contracts. To bolster its capital, Red Cat completed a $30 million equity offering in April 2025. This financial volatility is compounded by an ongoing class action lawsuit. This lawsuit alleges misleading statements regarding the production capacity of its Salt Lake City facility and the value of its U.S. Army Short Range Reconnaissance (SRR) program contract.

The SRR contract, which could involve up to 5,880 Teal 2 systems over five years, represents a substantial opportunity. However, the lawsuit highlights a significant discrepancy, with allegations from short-seller Kerrisdale Capital suggesting a much lower annual budget allocation for the program compared to Red Cat's initially intimated "hundreds of millions to over a billion dollars." This legal challenge and the inherent risks of government funding cycles contribute to the stock's high volatility and elevated short interest, which recently exceeded 18%. For risk-tolerant investors, Red Cat presents a "moonshot" opportunity, contingent on its ability to convert contract wins into sustainable, scalable revenue and successfully navigate its legal and financial hurdles.

Can Ondas Holdings Redefine Defense Tech Investment?Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers. A pivotal partnership with Klear, a financial technology firm, provides Ondas and its growing ecosystem with non-dilutive working capital. This off-balance-sheet financing mechanism is crucial, enabling rapid expansion and strategic acquisitions within the capital-intensive defense, homeland security, and critical infrastructure sectors without shareholder dilution.

Furthermore, Ondas's American Robotics subsidiary, a leader in FAA Type Certified autonomous drones, recently cemented a strategic manufacturing and supply chain partnership with Detroit Manufacturing Systems (DMS). This collaboration leverages U.S.-based production to enhance scalability, efficiency, and resilience in delivering American Robotics' advanced drone platforms. This domestic manufacturing focus aligns seamlessly with initiatives like the "Unleashing American Drone Dominance" executive order, which aims to bolster the U.S. drone industry, fostering innovation while safeguarding national security against foreign competition.

The company's offerings directly address the paradigm shift in modern warfare. Ondas's private industrial wireless networks (FullMAX) provide critical secure communication for C4ISR and battlefield operations, while its autonomous drone solutions (like the Optimus System and Iron Drone Raider for counter-UAS) are integral to evolving surveillance, reconnaissance, and combat strategies. As geopolitical instabilities intensify, driving unprecedented demand for advanced defense capabilities, Ondas’s integrated operational and financial platform is primed for significant growth, attracting considerable investor interest with its innovative approach to capital deployment and technological advancement.

$BKSY to ~20NYSE:BKSY has been base-ing above all meaningful AVWAPS (the Sep 2024 low/split, the Feb '25 high, and the April 2025 bottom.) It's now over a number of key, rising moving averages on the daily and weekly time frames. There is a "launchpad" of high volume when looking at the volume profile around 12-13... above here it gets thin and price could move quickly, once $13-14 is breachd, and head to ~$18-22 quickly, the old high. above that level, it is all "blue sky" for "black sky" ;)

(the geopolitical background of Israel/Iran and modern warfare being top of mind may also draw eyeballs to this drone name and the space as a whole)

The Leonardo (D)assaultIt is not a secret that Europe’s defence landscape has shifted dramatically to a pace unseen since the Cold War. In 2022, Central and Western Europe’s combined military outlays reached $345 billion, surpassing 1989 levels as the Cold War ended1. Where there is a commonly cited “peace dividend”, this is the era reaping the rearmament rewards. Even traditionally pacifist countries are upping their defence outlays, while frontline states like Poland and the Baltic nations are planning well above 2% of GDP (the NATO defence spending target) to bolster their militaries.

Of note, European officials, including the European Central Bank (ECB) (monetary) policymaker Olli Rehn, have explicitly called for joint EU programs to fund air defence and drone production to support Ukraine and strengthen Europe’s own defence, even if it means loosening fiscal rules2. When the monetary policy folks start weighing in on defence spending, it is best not to ignore it.

Dassault Aviation and Leonardo SpA, are integral to Europe’s defence-industrial base and they will be pivotal beneficiaries of the continent’s rearmament. Crucially, unmanned aerial vehicles (UAVs)—from surveillance drones to combat-capable systems—are an area where both firms are actively developing capabilities, aligning with Europe’s defence priorities.

Dassault Aviation, long synonymous with fighter jets, spearheaded Europe’s stealth unmanned combat air vehicle (UCAV) demonstrator nEUROn. Launched in the 2000s as a multinational project, nEUROn was led by Dassault Aviation with contributions from several European partners including Leonardo SpA (then Alenia)3. nEUROn combines many of the critical components of modern warfare systems including autonomous flight controls and low-observable (stealth) design. The project is also demonstrative of pan-European collaboration in UAVs. Not to be outdone, Leonardo SpA has developed its own family of medium drones (such as the Falco UAV series). Not to mention, its collaborations with companies like BAE Systems in the Eurofighter Typhoon and next-gen Tempest/GCAP fighter programs.

In essence, Dassault Aviation and Leonardo SpA are key enablers of Europe’s push for strategic autonomy in defence and are poised to benefit from the pivot to UAVs—a shift that began slowly at the beginning of the 21st Century and accelerated meaningfully with the experience gained from the conflict in Ukraine. European militaries have been paying attention; drones have proven their value for reconnaissance, target acquisition, and even precision strikes, fundamentally changing battlefield dynamics. It is a UAV world; legacy tech is just living in it.

While Dassault Aviation and Leonardo SpA aren’t major producers of small drones, it is not as though the two are going to be left behind. Leonardo SpA is developing anti-drone defences and electronic jamming systems. This makes sense. Increased drone usage increases demand for counter-UAV technologies, an area where Leonardo SpA’s electronics division is poised to benefit from radar and laser-based drone neutralisation4.

Alliances are the way forward

The surge in European defence spending is expanding the pie for industry, but it’s also intensifying both competition and collaboration among defence contractors. Interestingly, in the realm of UAVs, collaboration is often seen as the fastest way to close capability gaps. Both Dassault Aviation and Leonardo SpA have shown a willingness to team up with traditional competitors or even non-European firms when strategic.

To this point, Leonardo SpA embarked on a joint venture with Turkey’s Baykar Technologies to produce UAVs in Italy to exploit Baykar’s Ukraine combat-proven designs with Leonardo’s sensors and electronics. In a rapid turnaround, the venture plans to deliver its first product (based on Baykar’s Akıncı heavy drone) within 18 months5. And this is unlikely to be a one-off. Leonardo SpA’s CEO recently emphasised “alliances would be the way forward” to boost defence production without excessive new infrastructure6. The underlying theme is straightforward – making more stuff quickly is the goal.

Dassault Aviation and Leonardo SpA find themselves at the nexus of this transformation—bolstered by macroeconomic trends and political resolve and delivering the technologies that will define European security in the coming decades. The unfolding emphasis on UAVs is a microcosm of the broader story: drones have moved from peripheral acquisitions to must-have capabilities. UAV development, in particular, stands out as both a growth avenue and a strategic imperative. Dassault Aviation and Leonardo SpA are leveraging their deep expertise and forging new partnerships to ensure Europe’s militaries have the drones they require.

Conclusion

The narrative? Reallocation and rearmament. The timeline might be best described as “defence for the long run”. The beneficiaries are those positioned to meet Europe’s capability gaps. Dassault Aviation carries the mantle of Europe’s aerospace prowess and is now backed by a strong wind of political will and funding.

Sources:

1World military expenditure reaches new record high as European spending surges | SIPRI

2ECB's Rehn calls for joint European investment in air defence, drones | Reuters

3Dassault nEUROn to fly again, driving France’s new combat drone development - AeroTime

4Leonardo projects €30 billion in revenue by 2029 | Shephard

5Italy's Leonardo, Turkey's Baykar to set up drone joint venture | Reuters

6Leonardo CEO denies talks with automakers on military production | Reuters

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

PDYN: High Momentum AI Drone Software Play -> Projected EntriesPDYN is a turnaround growth AI Drone Software company. en.wikipedia.org From a purely Gann technical standpoint, at about $250 MM market cap, the company stands to potentially achieve substantial gains from AI, Drone, and Small Cap tailwinds in the coming months. PDYN also has an existing contract with RCAT to deliver it's drone software to. investor.palladyneai.com

As we can see from the green vertical lines. These are points where Gann analysis expects to see turnaround points for the stock. It has fallen substantially from it's 15$ 52 week high on December 30th, but has had a reaction (correction) period of 51 days. I will note 3 Gann-based forecasts tools that substantiate a potential 40-50% rally in the next coming weeks or months.

1. The price failed to structurally break below the 50% Gann support level from the 15$ high. Aka the support level that is 50% below $15 -> $7.50. This is marked by the thick horizontal blue line.

2. It has shown signs that the 30-35 day reaction period is the bottom. The Jan 29th-Feb 3rd period. If this reaction period is not correct and the price does not breakout, then the next important bottom dates are Feb 28th - Mar 5th (the 60-65 day reaction points). These reaction pivotal times are marked by the green vertical lines. However, we also are showing signs of bottoming at the 45-49 day reaction period of Feb 12th-18th (also marked with vertical green lines). Let's see what happens!

3. Finally, one of Gann's rules is that if the 1st rally high is broken, a trend change is underway. So it stands that the Feb10th breaking of the 1st rally high of $11.86 on Jan 22nd is evidence that a trend change is underway for PDYN.

STOP LOSS: $6.50

Ideally should set a stop loss 1 point from the 50% Support Level of 7.50. Risk no more than 10% of your capital on this trade.

High Risk Play: ACHR Pullback to 9.50-9.75 Before EarningsCurrently holding 20 puts at 9.50 strike expiring 21-FEB-25.

I'm looking at capturing a decent pullback from 10.35 close on Friday to around 9.50-9.75 before 21-FEB due to retracement levels, strong support and resistant levels, and the two most recent catalysts:

1. Blackrock's entry announced on 11-FEB-25 at the 8.50 level. This was announced before earnings so as to not hamper the massive gains expected to come from the 27-FEB-25 report.

2. There is no announced reason as to why the underlying is rising to 10.35 before earnings. I think this is a pump before a general market pullback.

Overall I'm bullish on ACHR and will aim to enter $10 calls before 21-FEB-25 provided the underlying does what I am praying for :)

Could BA be a wrinkle in the market?BA seems to be facing challenges. However, advancements in technology, along with opportunities in space and defense spending, present a gap that could benefit the company. While I don't have a specific time horizon, I see an opportunity to profit by going against the grain. It's a difficult path, but the potential is there.

I like this UAVS set upI like the profits and the earnings, and to be honest I don’t want the stock price to go up because I want cheaper shares. I have some buys set up around .47 and looking to double down below .30

This set up looks like it could pop…

- Major MA’s are crossing.

- looking to break out of the descending triangle with strong weekly candles.

- could easily hit .67, 1.37, 1.87 and possibly crest into the 2$ range.

This scenario may be followed by a sharp retest of 52W lows before attempting to climb into 5y highs

Not financial advice

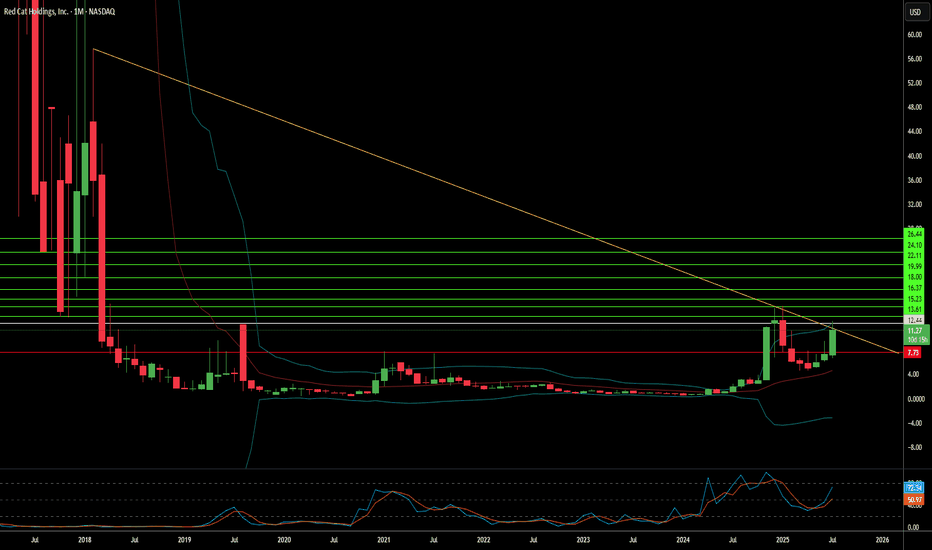

RCAT | Very Oversold Condition | LONGRed Cat Holdings, Inc., through its subsidiaries, provides various products, services, and solutions to the drone industry. It offers commercial and government unmanned aerial vehicle technology for reconnaissance, public safety, and inspection applications. The company also provides First Person View (FPV) video goggles; and software and hardware solutions that enable drones to complete inspection services in locations where global positioning systems are not available. In addition, it is involved in the sales of FPV drones and equipment primarily to the consumer marketplace. Red Cat Holdings, Inc.is based in San Juan, Puerto Rico.

UAVS | Nice Entry | Dollar Cost Average InAgEagle Aerial Systems, Inc. engages in designing and delivering autonomous unmanned aerial systems for the energy/utilities, infrastructure, agriculture, and government industries worldwide. The company operates in three segments: Drones and Custom Manufacturing; Sensors; and Software-as-a-Service (SaaS). It offers fixed-wing drones, including eBee Ag, eBee Geo, eBee TAC, and eBee X; and sensor solutions, such as Altum-PT, RedEdge-MX, RedEdge-MX Dual Camera Imaging System, RedEdge-P, Aeria X, Duet M, Duet T, S.O.D.A., S.O.D.A. 3D, and S.O.D.A. Corridor. The company also provides software solutions comprising FarmLens, a subscription cloud analytics service that processes data collected with a drone for use by farmers and agronomists; HempOverview, a web- and map-based technologies to streamline and standardize hemp cultivation; Ground Control that provides individual pilots and large enterprises to automate and scale drone operations workflows; and eMotion, a drone flight and data management solutions. AgEagle Aerial Systems, Inc. was founded in 2010 and is headquartered in Wichita, Kansas.

What is dollar cost averaging?

Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. It's a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.

Let's say you invest $100 every month. When the market is up, your $100 will buy fewer shares, but when the market is down, your money will buy more. Over time, this strategy could lower your average cost per share—compared to what you would have paid if you'd bought all your shares at once when they were more expensive than the average.

Amazon Free Game Downloads for March Gameday Happens in Madden NFL 22. Dominate with Ultimate Team rewards for Prime members and check back each month to claim your packs. All-new features like Next Gen Stats star-drive AI and immersive Dynamic Gameday deliver the most authentic gameplay experience ever.

Surviving Mars

Surviving Mars is a sci-fi city builder all about colonizing Mars and surviving the process. Choose a space agency for resources and financial support before determining a location for your colony. Build domes and infrastructure, research new possibilities, and utilize drones to unlock more elaborate ways to shape and expand your settlement. Cultivate your food, mine minerals, or just relax by the bar after a hard day’s work.

FLT Showing Strength After Last Drop (Bullish)With multiple patents and permits being acquired recently by FLT there's clearly strong growth from a business standpoint. From a chart / technical standpoint, we seem to be bottoming out from the last drop. We've set a higher low, a positive sign for a bullish case, now the only question is whether a higher high will be printed. On a lower time frame, a break of the local high ($1.38 - $1.41) would also confirm a strong bull case. With the Covid delta variant causing fear, there is a general uncertainty in the market. To be absolutely certain I would wait for a break of the monthly high ($1.77), which would definitively confirm a bull case on a higher time frame. This is an exciting space with a strong and practical outlook for the future.

UAVsAeroVironment, Inc. is an American defense contractor headquartered in Arlington, Virginia, that is primarily involved in unmanned aerial vehicles (UAVs) (Wikipedia)

I have been eyeing the military industry for some time, but the stocks have never reached the price I would take. Anyway, AeroVironment looks among the best in the sector from both technical and fundamental perspectives.

The technicals:

There is a double top pattern that developed itself into a triangle. The bottom is specified by two significant lows exceeding a round number 100.0 to the downside. The most significant gap is in the location too.

I expect a lot of liquidity below the yellow rectangle. If we ever reach there without an overall market crash, I'll create the entry there. It's probably the last line of DEFENSE against the bear market. Remember, that the big players need that extra liquidity to open a significant position.

The fundamentals:

The drones were used in recent conflicts against both a professional army and militia/guerrilla force with great success. Even though, the army makes it clear that UAVs are not a replacement for any part of the military, the spendings on both the research and the development increases over time (Statista).

However, the coronavirus might cause some material issues, and increases in spending might be halted (Ibisworld), it is a kind of technology the US will not want to fall behind in. Well, it has already started to fall behind as Turkey develops the first 'dronecraft carrier'. I think the cuts are rather to hit other parts of the defense sector.

I like AeroVironment specifically because, with its focus on UAVs, it is likely to fight for the contracts in this category most hard and the price is as a result derived mostly from this growing part of the sector.

The crash:

The question is if there is enough time for the buying opportunity to develop & profit from before the markets crash. I will be looking for an opportunity between 95-100$, but might not decide to invest at all in the end.

$FLT.V Drone Delivery Canada Watchlist - needs Vol to confirm$FLT.V $TAKOF is tightening up and having buyers step in recently. Still needs to do some work with volume and price but this could present a swing trade up to the mean with respect to LR. $1.65 Profit Target. I do not have a position in this security.

Please do your own DD and follow your trading rules.

Cheers,

Luke

AVAV : BLUE SKY / SWING TRADEAgEagle Aerial stock jumps in wake of AeroVironment's Arcturus deal

AgEagle Aerial Systems (NYSEMKT:UAVS) shares fly up 21% after a $405M acquisition announced late yesterday in the unmanned aircraft systems space may be be raising investors' hopes for more consolidation in the industry.

After Wednesday's close AeroVironment (NASDAQ:AVAV) agreed to acquire privately held Arcturus UAV in cash and stock.

In the past year, UAVS shares have skyrocketed to $9.39 from 55 cents, with its ascent accelerating midyear amid speculation that the company was working with Amazon on a delivery drone.

UAVS shares surge more than 1,000% in the past year.

SOURCE : Jan. 14, 2021 4:02 PM ETAgEagle Aerial Systems, Inc. (UAVS)By: Liz Kiesche, SA News Editor, SeekingAlpha

seekingalpha.com

DLRWF - Drone n Autonomous Warehouse System - The KingDLRWF - Drone n Autonomous Warehouse System - The King