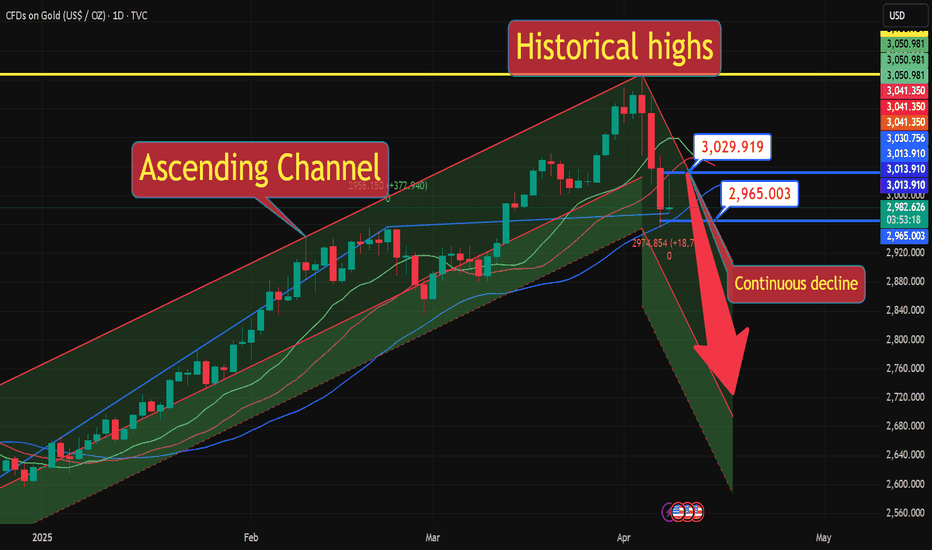

Interpretation of technical analysis of gold market opening operDue to the influence of Easter, the market was closed on Friday this week. After hitting a high of 3357, gold also ushered in a short-term adjustment! In the previous interpretation, we also emphasized to everyone that after hitting a new high, we should guard against the pullback caused by profit-taking. Especially at the critical time point when the market is about to close, but this does not mean the end of the bullish trend. After the sharp rise in gold, although there is selling pressure, gold still rose by 2.5% this week and closed above 3300.

So how should we trade gold next week?

The biggest driving factor for the rise in gold prices this time is Trump’s repeated tariff policy, coupled with the recent tense geopolitical situation, and the pace of global central banks buying gold. In the medium and long term, it is still a driving force for gold to rise.

Short-term operation: Pay attention to the first support level, which is 3310, which has been touched many times.

Short-term key support below: 3285-90

Short-term focus on high points above: 3340-45

If the breakthrough accelerates to the historical high point, everyone should be cautious in chasing more!

Dxyanalysis

DXY / Dollar Index Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (103.300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (101.700) Day / Scalping trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

💰💸💵DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DXY / Dollar Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.550) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.800) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

DXY / Dollar Index Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY The Fake Dance- One of the most important barometers for global currencies and markets in the world.

- Most of the time DXY is a well used machine to supress markets (forex, stocks, cryptos, etc..)

- When they don't start the printing machine, DXY keeps is strength.

- When they start to print DXY starts to dip and markets boom up.

- it's really basic and based on "BRRR Machine".

- i had a hard time to decrypt this fake peace of resilience.

- actually there's none visible divergences on the 1M or 3M Timeframes.

- So i decided to push my analysis to 6M Timeframe and noticed few things :

- You can notice that from 2008 ( Post crises ), DXY was in a perma bullish trend.

- So now check MACD and will notice this fake move on January 2021 ( in graph the red ? )

- MACD was about to cross down, columns smaller and smaller, then a Pump from nowhere lol.

- i rarely saw that in my trading life on a 6M Timeframe.

- So to understand more this trend, i used ADX (Average Directional Index)

- ADX is used to determine when the price is trending strongly.

- In many cases, it is the ultimate trend indicator.

- So if you look well ADX columns, you will notice that a strong divergence is on the way.

- First check the Yellow Doted Line in July 2022 when DXY reached 115ish and look the size of the green columns.

- Now check today (red doted Line), and look again the ADX green columns is higher, but DXY diped to 105ish.

- So like always, i can be wrong, but i bet on a fast DXY dip soon or later.

- it's possible to fake pumps, but it's harder to fake traders.

Happy Tr4Ding !

DXY Bullish Reversal Setup – Long Entry from Support Zone TowardEMA 30 (Red Line): Currently at 99.700 — tracks short-term trend, and price is hovering near this level.

EMA 200 (Blue Line): At 100.935 — indicates long-term trend, acting as dynamic resistance above.

📈 Trade Setup

✅ Entry Point:

Price: 99.699

Rationale: This level has been tested multiple times, forming a support zone. A bounce here signals a potential long entry.

🎯 Target Point (Take Profit):

Price: 102.738

Distance: ~3.04 points or 3.43% potential move upward.

Note: Marked as EA TARGET POINT, which suggests a calculated area possibly based on previous resistance or algorithmic strategy.

🛑 Stop Loss:

Price: 98.624

Reasoning: Just below the defined support zone (highlighted purple area), ensuring protection against downside breakouts.

📊 Risk-to-Reward Ratio

Entry: 99.699

Target: 102.738 → Gain of ~3.04

Stop: 98.624 → Risk of ~1.08

R/R Ratio: ~2.8:1 — favorable setup

📌 Overall Sentiment

This chart indicates a bullish reversal setup from a strong support zone, possibly targeting a mean reversion or trend reversal toward the 200 EMA and beyond.

However, keep in mind:

The price is currently below both EMAs, so the trend is still bearish.

The trade is counter-trend, relying on support holding and momentum shifting.

DeGRAM | DXY has broken the downward structureThe DXY is under a descending channel above the trend lines.

The price has broken the upper trend line.

The chart maintains a harmonic pattern and has already broken the descending structure.

We expect a rise after consolidation above the resistance level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | DXY dropped below 100 pointsDXY is in a descending channel between trend lines.

On the downside, the price has formed a gap and dropped below 100 pips and has already reached the lower trend line.

The chart maintains a descending structure but has already formed a harmonic pattern and a descending wedge.

On the major timeframes, the index relative strength is in the oversold zone and on the 30m Timeframe it is forming a bullish convergence.

We expect a reversal after a support retest.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

U.S. Dollar Index (DXY) – Key Resistance & Bearish Target Analys📊 Key Observations:

🔵 Resistance Zone (📍~103.5 Level)

A strong resistance area (🔵 blue box) is marked, indicating potential selling pressure if the price reaches this level.

The price is moving upwards (📈) towards this resistance, so watch for rejection or breakout.

🔵 Support/Target Zone (📍~101.5 Level)

A lower support zone (🔵 blue box) is marked as the bearish target 🎯.

If the price fails at resistance, it may head downwards (📉) to this level.

📉 Recent Price Action:

🚀 Sharp drop followed by a rebound (📈).

The price is currently moving back up (🔼), possibly forming a lower high before another drop.

📌 Exponential Moving Average (DEMA 9 - 102.488)

The price is hovering above the 9-period DEMA (📏), showing short-term bullish momentum.

If the price rejects resistance and falls below the DEMA, a bearish continuation (📉) is likely.

🚀 Potential Scenarios:

✅ Bullish Breakout: If price breaks above 🔵 resistance, it may continue rising (📈) to higher levels.

❌ Bearish Rejection: If price fails at resistance, expect a drop (📉) towards 101.5 🎯.

4.11 Interpretation of gold technical ideas4.11 Interpretation of gold operation ideas: Gold prices rose sharply to a new high. How to trade next?

The daily line closed with a big positive line, and the closing price was far away from the previous high. This is a truly effective breakthrough!

There are two types of breakthroughs: 1. The amplitude and strength of the breakthrough! 2. The closing price after the breakthrough!

At present, the intraday pattern of gold prices is unbalanced. The rise and fall depends entirely on the international situation. The US dollar has fallen below 100 points, which has led to panic selling by investors and a sharp rise in gold prices. Therefore, if the situation eases, we must be wary of a rapid decline in gold prices. After a wave of accelerated rises in the morning, today's main focus is on the trend of the afternoon and US markets.

At present, the price of gold is hovering in the 3210 range. If it falls back, it is expected to rebound in the 3200-3190 range. If the European market breaks through the high for the second time and continues to strengthen during the day, then the US stock market will usher in a bullish opportunity again.

The market is always full of opportunities! The above strategies are for reference only, and personal opinions are for reference only. The specific operation is subject to real-time operation. If you want to obtain core member signals and increase account profits, please contact Ailen❤️❤️❤️

DeGRAM | DXY broke the triangle downwardDXY is in a descending channel under a triangle.

The price is moving from the upper boundary of the channel, resistance level and upper trendline, which previously acted as a pullback point.

The chart failed to form an ascending structure, but it formed a harmonic pattern and broke down the mirror support level, which now acts as resistance.

On the main timeframes, the relative strength index is below 50 points.

We expect the decline to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Gold V-shaped reversal breaks through new highs to usher in a buFundamental analysis:

The erratic tariff plans of the US administration have shaken the entire global market, with market participants scrambling for direction and certainty. This is usually supportive for gold, which has risen 18% so far this year. Gold has also been boosted by expectations of further monetary easing by the Federal Reserve and central bank purchases.

Technical interpretation:

From the 4-hour chart, spot gold has completed a typical V-shaped reversal pattern, rebounding strongly after a deep correction. After hitting a low of $2,956.67, gold prices launched a counterattack, breaking through the suppression of multiple moving averages in one fell swoop, and finally stood firm at the key resistance level of $3,100. It is worth noting that gold prices are currently running above the rising trend line, which indicates that the short-term trend has clearly turned bullish.

The MACD indicator shows a strong bullish signal, with the DIFF line and the DEA line forming a golden cross, and the DIFF value is 13.58 and the DEA value is -1.55, indicating that the upward momentum is accumulating at an accelerated rate. At the same time, the MACD bar chart continues to expand, further confirming the strengthening of bullish power.

Although the daily MACD indicator temporarily shows signs of high divergence, the DIFF value is 35.22 and the DEA value is 40.67, but both are at high levels, indicating that the medium- and long-term momentum is still strong. The daily RSI is 62.58, which is in a moderately strong area and does not show obvious overbought. The daily CCI is 74.30, which also shows that the medium-term upward momentum is still continuing.

Analysis of short-term operation ideas:

After the gold price broke through the key resistance of $3,100, the technical side showed a clear trend of strengthening. If it can stand firm at this level, the next target will point to the historical high of $3,167.60, and a new round of upside will be opened after the breakthrough. In terms of support, $3,060.00 (previous breakthrough position) will provide effective support. If it fails, it may pull back to the lower track of the rising channel near $2,968.00. Recent US inflation data and trade situation developments will become key catalysts for short-term trends.

Gold continues to strengthen and fluctuates widely in the short Gold stabilized near the 200-period moving average at the beginning of this week, and the current upward trend is supported by the daily chart oscillator indicators. Both the daily RSI and MACD remain in the bullish range, with obvious momentum;

The upper target is concentrated in the 3167-3168 US dollar line, which is the historical high set at the beginning of this month; if it successfully breaks through this area, the gold price may enter a new upward channel.

In the short term, the support level below $3100 is concentrated in the 3065-3060 US dollar range, and a break below it will open a downward channel to $3000. The $3000 mark coincides with the 200-period moving average of the 4-hour chart, which is the key long-short dividing point;

If it falls below this point, it means that gold has entered the correction stage, and bulls need to remain vigilant; but the current fundamentals and market sentiment still strongly support the gold price to maintain high volatility.

DeGRAM | DXY seeks to close the gapDXY is in a descending channel between trend lines.

The price is moving from the support level, which has already acted as a reversal point twice.

During the decline, the chart formed a gap and afterwards formed an inverted hammer and a harmonic pattern.

On the 1H Timeframe, the Relative Strength Index is in the oversold zone and indicates bullish convergence.

We expect the index to head towards the gap after breaking the 38.2% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Gold continues to rise and break through!Gold was driven by risk aversion news, and soared more than $100 in a single day yesterday, with a huge positive line on the daily line! At present, it has broken through the 3100 mark. It is difficult for gold to continue to be long and short. The next step is more of a big sweep!

At present, the 3100 mark will be the key to the next long and short positions. It is under pressure to continue to be bearish. The key 3055-50 area below is the long breakthrough point, which is also the support area for the two declines in the US market. Once it breaks down, it indicates that the rise started at 2970 yesterday has ended and returned to the short position.

If gold breaks upward and stands above the 3100 mark with the help of news, the long position will gradually rise to 3115-20 and 3135-40 (last Friday's high point) and even test the historical high of 3167 to build a daily double top!

Intraday operation:

The 3100 mark is used as a long-short boundary. If it breaks through, you can consider short-term long positions. After pulling up, refer to the above target position, which is also a resistance position, and arrange short positions again.

Technical analysis of short-term operations in the US market on 4,9 US trading operation interpretation ideas:

Today, there was a bottoming out and rebound. In the morning, it first went south and then north. It fell sharply to 2970 and then quickly counterattacked 3000 after entering the Asian session! I emphasized in the morning that the gold short may be coming to an end! It will enter a short-term sharp decline and then rebound! But the current trend is obvious that today's increase has exceeded expectations!

We must beware of the possibility of a V-reversal in the US market! Although the large-scale purchase of gold caused by the selling of US bonds is still difficult to confirm the long position in the US market!

The intraday increase is close to 90 points! There may be two emotions.

1: The market impact after the tariffs are implemented has not been eliminated

2: If the bullish trend continues in the US market, it may retreat to around 3045 in the future, and continue to be bullish later!

Short-term support: 3045---3030----3000

Pressure level: 3075---3080---3100---3135

4.9 Gold price trend after the Fed meetingIn the early European session, spot gold maintained its amazing intraday gains, and the current price is around $3046/oz, up $64 on the day.

Gold's latest technical trading analysis:

Gold's recent sharp decline from its all-time high has stalled near the 61.8% Fibonacci retracement level of the February-April rally. The support level is around the $2957-2956/oz area, or the multi-week low hit on Monday, followed by the 50-day moving average (currently around $2952/oz). If gold falls below the latter, it will be seen as a new trigger by bearish traders and drag gold to the next important support level around $2920/oz, and then all the way down to $2900/oz.

On the other hand, the momentum of gold breaking through the overnight high (around the $3023/oz area) could push gold prices to the $3055-3056/oz barrier. Some follow-up buying should pave the way for gold to return to the $3,100/oz mark, with some intermediate barriers around $3,075-3,080/oz.

Support: 3,030 3,018 3,000

Resistance: 3,045 3,068 3,080

We will update regularly every day to introduce how we manage active thinking and settings. Thank you for your likes, comments and attention. Thank you very much

4.9 Technical analysis of short-term gold operations!Gold market analysis

Gold idea: We need to pay attention to whether the daily line will rise after reaching a low. The daily line is hovering at the bottom. In a volatile market, we must find a range of volatility. Finding the rhythm is the most important thing. Yesterday, the daily line formed a cross star again. Today, the white market is expected to fluctuate. In addition, there are many fundamentals in the near future. The market has been led by the rhythm. Gold rose well before. The sharp drop was also due to Trump’s tariff policy. The global tariff war is inevitable in the future. It will support the US dollar in the long term and suppress gold. The short-term top of the weekly line may be a long-term top.

Today’s idea: Let’s focus on the 2969-3022 volatility range. If the white market rebounds first and approaches 3022, go short first. On the contrary, if gold breaks and stands on 3022, it will also fluctuate, but the center of gravity of the volatility will rise to the 3000-3055 range. The volatility requires patience to wait for the position, and waiting is also part of the transaction.

Support level: 2990-2969,

Pressure: 3022 3035

4.9 gold rebound increases resistance level and continues shortiFundamentals:

On Tuesday (April 8), the price of gold fluctuated slightly higher in the early US trading. The market is currently expecting a continuous decline, and at the same time paying attention to the logic of short selling at resistance points. After briefly hitting a four-week low on Monday, the price of gold rebounded quickly and rebounded strongly to above $3,000 in the Asian and European trading on Tuesday.

Against this background, gold, as the ultimate safe-haven asset with "zero credit risk", has once again become the main allocation target of market funds. Every macro policy imbalance and external shock will bring cyclical buying to gold, and this time the intensity may be stronger. The current gold price has stabilized at the psychological level of $3,000 and is showing a short-term rising structure. From a technical perspective, the gold price in the daily chart quickly rose after stepping back on the Fibonacci 61.8% retracement level ($2,956), showing the resilience of buying. If the gold price breaks through the short-term resistance of $3,020, the upward target will be the $3,055 and $3,080 areas, and further may rise to the $3,100 mark. The key support level below is still around $2956. If it fails, it may test the 50-day moving average support (about $2947). Once this level is lost, it may trigger more technical selling pressure. The biggest variable facing the current market is no longer inflation data, but the destructive impact of Trump's tariff increase on the global trade pattern. The Fed's policy space is opening up rapidly. Driven by the expectation of interest rate cuts and risk aversion demand, gold not only stabilizes the $3,000 mark, but is also likely to re-enter the main upward trend.

Personal operation analysis:

Trend: shock trend

Support: 3000----2983------2965

Resistance: 3008-----3030-------3050

Strategy:

Viewpoint logic:

Short view near 3030, stop loss 3036, take profit near 3000----2970, and track stop loss 300 points.