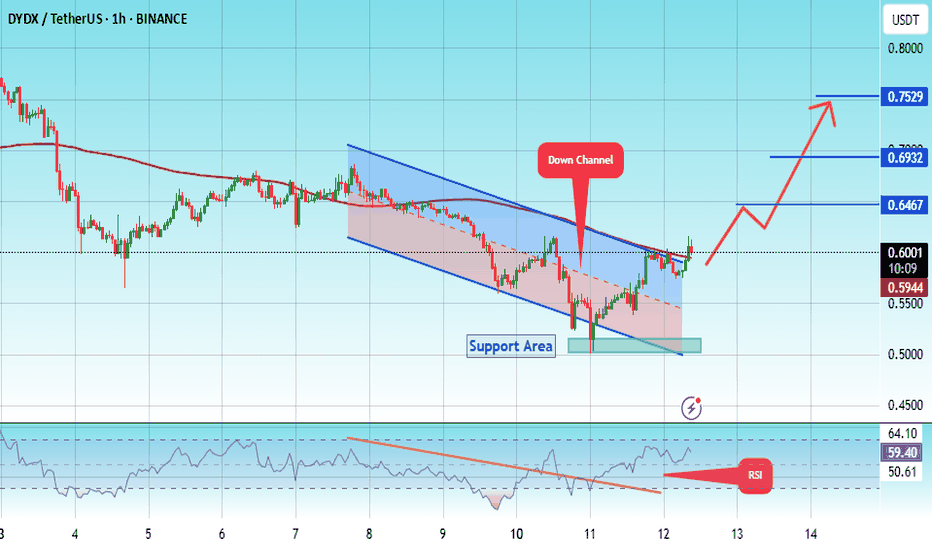

#DYDX/USDT#DYDX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.5050.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.7529

First target: 0.6467

Second target: 0.6932

Third target: 0.7529

DYDXUSDT

DYDX/USDT – Working within the horizontal channel. Continuation.dYdX - is DeFi’s pro trading platform and a pioneer in decentralized finance, known for being the first to offer decentralized margin trading and derivatives, as well as inventing flash loans and DEX aggregators in 2018. Built on a custom Layer-1 blockchain using the Cosmos SDK, dYdX provides a professional-grade, decentralized trading experience with high leverage, deep liquidity, and low fees. Governed by the community through the DYDX token, dYdX is focused on delivering a transparent and user-driven financial system.

CoinMarketCap : #107

I've been working within this channel for about 2.5 years.

From my previous trading idea, two marked zones were reached:

1.6447 (+80%)

2.5007 (+176%)

The maximum squeeze reached +185.5%.

I'm continuing to work within the channel.

Last time, liquidity was accumulated below the support of the inner channel.

Now, liquidity is being gathered below the support of the outer channel—as always.

I've marked potential final liquidity grabs on the chart, as well as resistance zones where the price is likely to react.

The profit is significant, and if you work with compound interest, well… I'll just keep quiet—not everyone understands this and keeps waiting for the final rally.

A reminder:

Right now, fear dominates across all coins. This is the phase where nobody wants to buy or where many have already run out of funds. Why? Because, as always, most people buy at the top.

Take all of this into account in your trading strategy.

DYDX (dYdX) | DYDX/USDT-Daily Tmeframe

Still in a downtrend since the price is below the 200-day moving average (1.1810 USDT).

Consolidating around 0.78 USDT, meaning no further drop for now, but no strong uptrend either.

RSI (39.84) is still below 50, so buyers aren’t strong yet, but it has exited the oversold zone, which is a good sign.

Low trading volume, meaning big players haven’t stepped in yet.

Don’t rush to buy! Better to wait for a breakout above 0.85 - 0.90 USDT or strong buying momentum.

If you already bought, watch how it reacts to resistance before deciding.

Stop-loss below 0.70 USDT makes sense—stick to it if you enter.

No strong buy signal yet, but it’s stabilizing a bit. If you want to take the risk, use a stop-loss and keep an eye on resistance levels.

Good luck everyone & Be profitable🤘🏼

📌 It's not financial advice 📌

DYDX: Easy 2025 Target @$6.22 —But Wait, Much Higher Is PossibleSome projects produced a very strong bullish wave to end 2024. Other projects didn't do much.

We have pairs that are now very close to their All-Time High.

Some other pairs are trading at, or very near to, an All-Time Low.

I think this is why it is so very important to consider each chart individually. We can have a general market perspective and develop a general bias, but when it comes to trading, buying and selling, each pair needs to be considered on its own.

DYDXUSDT recently hit a new All-Time Low. This is not bad. Actually, this is very good.

A pair like this we can buy without reservation because the downside is very limited, especially when the next advance is fully confirmed.

As for the 2025 bull-market top, we say that higher lows lead to higher highs. A lower low can lead to a lower high, that is, no new All-Time High in 2025.

When a project's chart looks like this one we become more conservative with the final target.

Not that a new ATH won't happen but that weakness has been revealed and we work with this information.

The bottom for DYDX is likely in. We have the same volume dynamic as mentioned in a previous publication; a lower low with decreasing volume. On this chart, bull volume is predominant and this is a signal of strength.

The final flash-crash seems like a shakeout move; the market looking for liquidity by breaking support. This thinking would be reinforced if a strong and fast recovery were to happen in the coming weeks and days. If the price remains low and trades lower for a while before recovering then we have to go with the weakness theory.

My belief is that DYDX will recover and it will grow super strong in the coming months.

If I had to make a prediction for a final target, I would say $18-19 is possible. The target mapped on the chart is an easy one and amounts to ~700%.

Thank you for reading.

After the bull-market starts to unravel, many pairs will move ahead of the pack and reveal what will be coming to the rest of the market. At that time, we can update our peak numbers and make more accurate predictions.

It is still too early, but we know the bull-market will be huge. The fact that the top Cryptos are not dropping and have been consolidating for months near resistance means that the market is not ready to sell. If the market isn't selling it is because it sees value in what it holds. If the whales and exchanges are ready to hold, this means that they are going to pump this market like never before.

Namaste.

DYDX/USDT: Long Opportunity Above $0.7450Greetings, traders,

A more detailed analysis of the DYDXUSDT chart will follow in the comments section below.

For now, a potential long opportunity presents itself above $0.7450.

Entry: Above $0.7450

Take Profit: About $0.8350

Stop Loss: $0.7250

BINANCE:DYDXUSDT

I will post a detail analysis of DYDXUSDT in comment.

Profitable trades to all!

#DYDX/USDT #DYDX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.00

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.04

First target 1.08

Second target 1.35

Third target 1.20

DYDX/BTC: Bottoming Out or More Pain Ahead?DYDX/BTC has been in a steep downtrend for months, but we might be seeing signs of a potential reversal. The pair is currently testing a key support level within a descending channel, with price action suggesting a possible bounce.

Key Levels to Watch:

Support Zone: ~0.00000900 - 0.00000950

Resistance Levels: ~0.00001200 (short-term), ~0.00001500 (major)

Target: 0.00001316 (+32.92%)

Stop Loss: 0.00000850 (-5.21%)

Risk/Reward Ratio: 5.2

Indicators & Market Structure:

The price is hovering around the lower bound of the channel, which has previously acted as a strong demand zone.

DMF Index shows a potential momentum shift, with green bars indicating early bullish divergence.

If bulls can hold this zone, we might see a relief rally towards mid-channel resistance.

Strategy Outlook:

A long position from the current levels offers an attractive R/R ratio. However, a breakdown below 0.00000850 could signal further downside. The coming days will be critical in confirming whether this is a local bottom or just another temporary pause before further declines.

DYDX swing trades. Indicators analysisBINANCE:DYDXUSDT

This chart based on my indicators set on D timeframe

Take a look explanation

Take Profit - Reject at take profit and exit line

Trade On - 2 signals to sell confirmed

ADZ - Came in again in neutral zone. Might be going lower where whales start accumulate again

Direction - 5Feb got an alert to close position. Waiting drop lower to see accumulation alerts

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

DYDX - Fear before unlockBINANCE:DYDXUSDT

DYDX and upcoming 15% total supply unlock.

Psychology of retail investors always the same! Now everyone see the unlock date and ready to sell their coins because majority think in a same day all funds drop the price. But usually it works in opposite way.

To sell big amount of coins funds and earlier investors need liquidity, so they will sell it step by step.

Now ill not be impress if we will see some big media posts about DYDX and future of this DEX. So after

over 250 days in a range everyone who want it accumulate a lot.

Possible Targets and explanation idea

➡️By ADZ big players accumulate a lot on Weekly timeframe and we can see huge divergency.

➡️ Long time period accumulation in a range.

➡️We got FVG on monthly timeframe in red block zone (full fill will be exactly at 0.23 level by FIb)

➡️We trade in a range exactly at -0.27 zone

➡️3rd Feb day of 15% unlock. But we hypothetically can see moves where funds start sell at 4, 6, 10$ in 3 waves

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

DYDX correction to 5.20$BINANCE:DYDXUSDT

Dydx now underrated. Where ill start buy Dydx again? Where ill take a profit on local correction? And why Dydx can pump to 5.20$?

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️Fib since drop in April.

➡️Perfect call to sell by "Trade On" indicator

➡️Accumulation phase between -0.18 and -0.618 levels

➡️Forming lower low in June and took liquidity. Correction to drop can be at least to 0.5 level by fib 5.20$

➡️2 signals Strong Buy in May and June

➡️Rejected at "Take profit" line. If we capitulate one more time we can drop to 1.05 (now its a "Buy line")

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

#DYDX/USDT Ready to go higher#DYDX

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.20

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.32

First target 1.38

Second target 1.45

Third target 1.55

#DYDX/USDT Ready to go higher#DYDX

The price is moving in a descending channel on the 30-minute frame and is sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.30

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.34

First target 1.36

Second target 1.40

Third target 1.44

dydx buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

TradeCityPro | DYDX: Daily Trend Line Reaction & Momentum Shift👋 Welcome to TradeCityPro!

In this analysis, I will examine the DYDX coin, which is associated with the DYDX exchange, one of the well-known decentralized exchanges (DEXs) with a focus specifically on futures.

📅 Daily Timeframe: Reaction to the Curved Trend Line In the daily timeframe, after a price drop and recording new lows, we observed a rounding at the bottom of the chart which gradually reduced the bearish momentum and selling volume in the market, followed by an influx of bullish volume and momentum.

✨ After breaking through $1.4362, the price moved upwards more freely, breaking the $1.8702 area and continuing its movement up to $2.5747. However, it could not stabilize in these areas and started correcting, eventually falling back to $1.4362.

📈 The market volume has been decreasing during the bearish phase, gradually diminishing, which indicates the strength of the bullish trend. In my opinion, if we observe a trend change in the shorter timeframes, the next price leg will begin.

🛒 The main price trigger for going long is breaking $2.5747, but an earlier and riskier trigger would be $1.8702. For spot purchases, the trigger at $2.5747 is suitable, but the main trigger will be at $4.3949.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

DYDX usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

dydxusdt sell "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Binance’s Cease of Support for DYDX on Ethereum Raises ConcernsBinance’s recent announcement to end support for DYDX token deposits and withdrawals via the Ethereum (ERC20) network has triggered ripples across the cryptocurrency market. Effective February 12, 2025, this move has sparked debates about market stability, liquidity challenges, and the future prospects of DYDX, which is closely tied to the decentralized dYdX exchange.

Implications of Binance’s Decision

On December 31, Binance announced it will discontinue CRYPTOCAP:DYDX token transactions on the Ethereum (ERC20) network. While the exchange clarified that DYDX transactions would remain supported through other networks on its platform, the move has raised concerns among investors and traders. Notably, deposits made via the ERC20 network after the February 12 deadline will not be credited, creating potential risks of asset loss for users unaware of the changes.

This decision aligns with Binance’s ongoing efforts to optimize its network offerings, but it has sparked questions about the impact on DYDX’s liquidity and market position. Historically, Binance’s support decisions have significantly influenced token dynamics, with the recent addition of Phala Network (PHA) and dForce (DF) tokens leading to notable price surges.

In contrast, DYDX’s price reacted negatively to the announcement, dipping 2% to trade at $1.48. The token’s market cap currently stands at $1 billion, with a 24-hour trading volume of $37 million. This downturn underscores the sensitivity of the market to such announcements, especially for tokens heavily reliant on major exchange listings.

Technical Analysis

From a technical perspective, CRYPTOCAP:DYDX is showing signs of potential recovery despite the bearish sentiment. The token’s Relative Strength Index (RSI) currently hovers at 42, approaching the oversold region. This indicates a potential buying opportunity for traders anticipating a rebound.

Key support is identified at its 1-month low of $1.447, a critical level to watch for further price stability. On the upside, a reversal could see resistance at the 38.2% Fibonacci retracement level, a pivotal point for traders eyeing short-term gains.

In the broader context, DYDX’s 24-hour price range of $1.447 to $1.558 highlights a narrow trading window, suggesting cautious market activity. The dYdX exchange’s robust futures trading volume—$231 million over the past 24 hours—shows continued engagement, with BTC/USD and ETH/USD pairs leading at $94 million and $46 million, respectively. This robust trading activity provides a foundation for potential recovery, contingent on improved sentiment.

Market Dynamics and Future Outlook

Binance’s decision reflects a broader trend of network optimizations among major exchanges. While this strategy aims to streamline operations and enhance user experience, it inevitably impacts specific tokens. The divergence in market responses—DYDX’s dip versus the rally of tokens like PHA and DF—underscores the importance of exchange support in shaping token trajectories.

For CRYPTOCAP:DYDX , the coming weeks will be critical. The token’s ability to maintain liquidity and attract traders despite reduced support on Ethereum will determine its resilience. Investors should closely monitor updates from Binance and the dYdX exchange, as well as technical indicators like RSI and Fibonacci retracement levels, for informed decision-making.

Conclusion

Binance’s withdrawal of DYDX support on Ethereum highlights the evolving dynamics of crypto exchanges and their influence on token performance. While the immediate impact has been a price dip, DYDX’s technical setup suggests potential recovery opportunities. As the February 2025 deadline approaches, traders and investors must adapt to the changing landscape, leveraging both fundamental insights and technical analysis to navigate the market effectively.

DYDXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked).

Everything on the chart.

Entry zone: market and lower

Targets: 3 - 5 - 7

after first target reached move ur stop to breakeven

Stop: (depending of ur risk).

ALWAYS follow ur RM

risk is justified

It's not financial advice.

DYOR!