Accumulate for Long TermNestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :)

Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of strategic initiatives and a strong product portfolio. Key factors contributing to this sustained growth include:

1. Innovation and Product Diversification: Nestlé India has prioritized innovation, launching over 140 new products in the past eight years. These introductions span various categories, including science-led nutrition solutions, millet-based products, and plant-based protein options, catering to diverse consumer needs.

BUSINESS-STANDARD.COM

2. Strengthening Core Brands: The company has focused on reinforcing its flagship brands:

Maggi: Achieved the status of the largest market globally for Maggi, driven by balanced product mix, pricing strategies, and volume growth.

THE HINDU BUSINESS LINE

KitKat: India became the second-largest market for KitKat worldwide, reflecting robust performance in the confectionery segment.

THE HINDU BUSINESS LINE

Nescafé: The beverage segment, particularly Nescafé, has seen significant growth, introducing coffee to over 30 million households in the last seven years.

THE HINDU BUSINESS LINE

3. Expansion into New Categories: Nestlé India is exploring opportunities in emerging sectors such as healthy aging products, plant-based nutrition, healthy snacking, and toddler nutrition. These initiatives aim to tap into evolving consumer preferences and health-conscious trends.

CFO.ECONOMICTIMES.INDIATIMES.COM

4. Focus on Premiumization: The company is enhancing its premium product offerings, including the introduction of Nespresso and health science products. This strategic move aims to have premium products contribute to 20% of sales in the long term, up from the current 12-13%.

GOODRETURNS.IN

5. Strategic Partnerships: A notable collaboration with Dr. Reddy's Laboratories to form a joint venture in the nutraceuticals space underscores Nestlé India's commitment to expanding its health science portfolio and leveraging synergies for growth.

THE HINDU BUSINESS LINE

Collectively, these strategies have enabled Nestlé India to maintain a consistent upward trajectory in revenue, effectively adapting to market dynamics and consumer demands.

Earnings

Long for Long Term - Discount price in terms of Revenue/shareAs seen in the Revenue Grid indicator, stock is currently trading at 2 to 2.5 times it's Revenue per share, which is a very low valuation historically. It crossed below this valuation, only at covid pandemic crash. Given the consistent Revenue increase, this is a fair value to buy for a long term view.

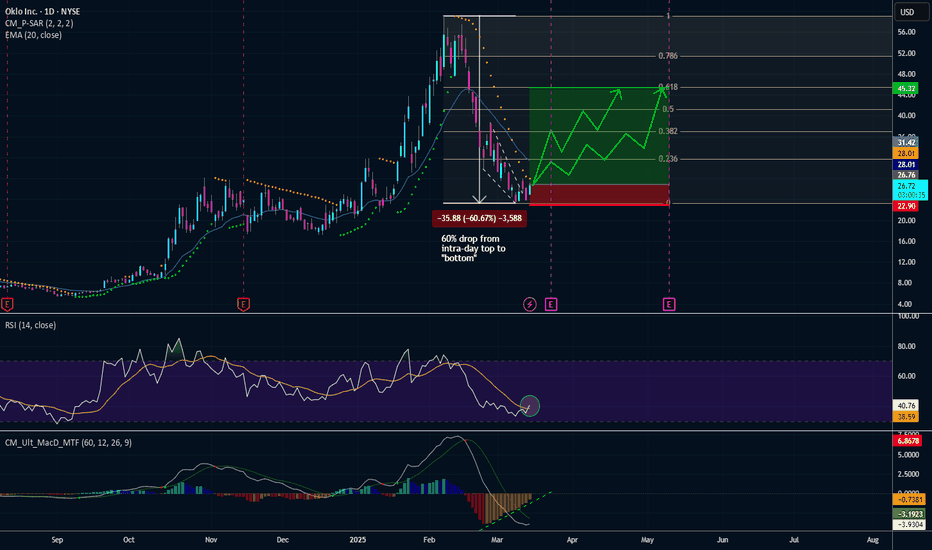

70% Upside Potential in this Nuclear StockOKLO is my personal favorite nuclear play that feeds off the AI energy. Really beat up since it's height in early February, down over 50% as of today (as are a lot of other stocks given the macroeconomic backdrop). Chris Wright, a member of its Board of Directors, was confirmed as the U.S. Secretary of Energy on February 3, 2025. As a result, Wright has stepped down from Oklo’s Board to assume this critical role in advancing the nation’s energy policies.

I can see upside trade heading closer to Q4 earnings March 24.

Bullish Technicals:

- Rounding Bottom

- RSI breaking above RSI MA

- MACD: histogram trending up

- Moving out of the falling wedge

- Just sitting below daily PSAR

OKLO's Key Focus Areas:

- Microreactors – Oklo’s primary product is the Aurora microreactor, a compact and efficient reactor designed to produce power for remote areas, industrial sites, and off-grid locations.

- Fast Reactors – Their reactors use a fast neutron spectrum and liquid metal coolant (like sodium) rather than water, making them more efficient and capable of reusing nuclear waste as fuel.

- Fuel Recycling – Oklo aims to use recycled nuclear fuel (like spent fuel from conventional reactors), reducing nuclear waste and increasing fuel efficiency.

- Long Lifespan – The Aurora reactor is designed to operate for up to 20 years without refueling, minimizing maintenance and operational costs.

Don't Confuse "DYOR" with Confirmation Bias in Crypto TradingIn the crypto space, influencers and self-proclaimed crypto gurus constantly tell you to " do your own research " (DYOR) while presenting coins that will supposedly do 100x or become the "next big thing." They always add, " this is not financial advice ," but few actually explain how to do proper research.

On top of that, most influencers copy each other, get paid by projects to promote them, and—whether they admit it or not—often contribute to confirmation bias.

What is confirmation bias? It’s the psychological tendency to look for information that confirms what we already believe while ignoring evidence that contradicts it.

For example, if you want to believe a certain altcoin will 100x, you’ll naturally look for articles, tweets, and videos that say exactly that—while ignoring red flags.

How do you distinguish real research from confirmation bias?

This article will help you:

• Understand confirmation bias and how it affects your investments

• Learn how to conduct proper, unbiased research

• Discover the best tools and sources for real analysis

________________________________________

What Is Confirmation Bias & How Does It Sabotage Your Investments?

Confirmation bias is the tendency to seek, interpret, and remember information that confirms what we already believe—while ignoring evidence to the contrary.

In crypto, this leads to:

✔️ Only looking for opinions that confirm a coin is "going to the moon"

✔️ Avoiding critical discussions about the project’s weaknesses

✔️ Believing "everyone" is bullish because you're only consuming pro-coin content

The result?

• You make emotional investments instead of rational ones

• You expose yourself to unnecessary risk

• You develop unrealistic expectations and are more vulnerable to FOMO

________________________________________

How to Conduct Proper Research & Avoid Confirmation Bias

1. Verify the Team & Project Fundamentals

A solid crypto project must have a transparent, experienced team. Check:

• Who are the founders and developers? Are they reputable or anonymous?

• Do they have experience? Have they worked on successful projects before?

• Is the code open-source? If not, why?

• Is there a strong whitepaper? It should clearly explain the problem, the solution, and the technology behind it.

Useful tools:

🔹 GitHub – Check development activity

🔹 LinkedIn – Verify the team's background

🔹 CoinMarketCap / CoinGecko – Check market data and tokenomics

2. Analyze Tokenomics & Economic Model

A project can have great technology but fail due to bad tokenomics.

Key questions to ask:

• What’s the maximum supply? A very high supply can limit price growth.

• How are the tokens distributed? If the team and early investors hold most of the supply, there’s a risk of dumping.

• Are there mechanisms like staking or token burning? These can impact long-term sustainability.

Useful tools:

🔹 Token Unlocks – See when tokens will be released into circulation

🔹 Messari – Get detailed tokenomics reports

3. Evaluate the Community Without Being Misled

A large, active community can be a good sign, but beware of:

• Real engagement vs. bots. A high follower count doesn’t always mean real support.

• How does the team respond to tough questions? Avoid projects where criticism is silenced.

• Excessive hype? If all discussions are about "Lambo soon" and "to the moon," be cautious.

Where to check?

🔹 Twitter (X) – Follow discussions about the project

🔹 Reddit – Read community opinions

🔹 – See how the team handles criticism

4. Verify Partnerships & Investors

Many projects exaggerate or fake their partnerships.

• Is it listed on major exchanges? Binance, Coinbase, and Kraken are more selective.

• Are the investors well-known VCs? Funds like A16z, Sequoia, Pantera Capital don’t invest in just anything.

• Do the supposed partners confirm the collaboration? Check their official sites or announcements.

Where to verify?

🔹 Crunchbase – Check a project's investors

🔹 Medium – Many projects announce partnerships here

5. Watch the Team's Actions, Not Just Their Words

• Have they delivered on promises? Compare the roadmap to actual progress.

• What updates have they released? A strong project should have continuous development.

• Are they selling their own tokens? If the team is dumping their coins, it’s a bad sign.

Useful tools:

🔹 Etherscan / BscScan – Track team transactions

🔹 DefiLlama – Check total value locked (TVL) in DeFi projects

________________________________________

Final Thoughts: DYOR Correctly, Not Emotionally

To make smart investments in crypto, you must conduct objective research—not just look for confirmation of what you already believe.

✅ Analyze the team, tokenomics, and partnerships.

✅ Be skeptical of hype and verify all claims.

✅ Use on-chain data, not just opinions.

✅ Don’t let FOMO or emotions drive your decisions.

By following these steps, you’ll be ahead of most retail investors who let emotions—not facts—guide their trades.

How do you do your own research in crypto? Let me know in the comments!

Learn To Invest: Global Liquidity Index & BitcoinGlobal Liquidity Index & BitCoin:

🚀 Positive Vibes for Your Financial Journey! 🚀

BITSTAMP:BTCUSD

Look at this chart! It's the Global Liquidity Index , a measure of how much extra money is flowing through the world's financial systems.

Why is this important? Because when this index is high, it often means good things for investments like #Bitcoin! 📈

Think of it like this: when there's more money flowing, people are often more willing to take risks and invest in things like Bitcoin.

See those "BullRun" boxes? That means things are looking bright! It's showing that money is flowing, and that's often a good sign for potential Bitcoin growth. 🌟

Even if you're not a pro, it's easy to see the good news here. Understanding these trends can help you make smarter decisions.

Let's all aim for growth and success! 💪

Long SBIN - Trading exactly at Rev/share = 1.As per the Revenue Grid indicator, SBI is trading exactly at it's Revenue per share value. That means current price of 1 share is same as that of the revenue it is generating per share. Historically it has traded around this valuation. But given the steady growth of SBI over the years, This is a good price to buy for long term. Happy Trading :)

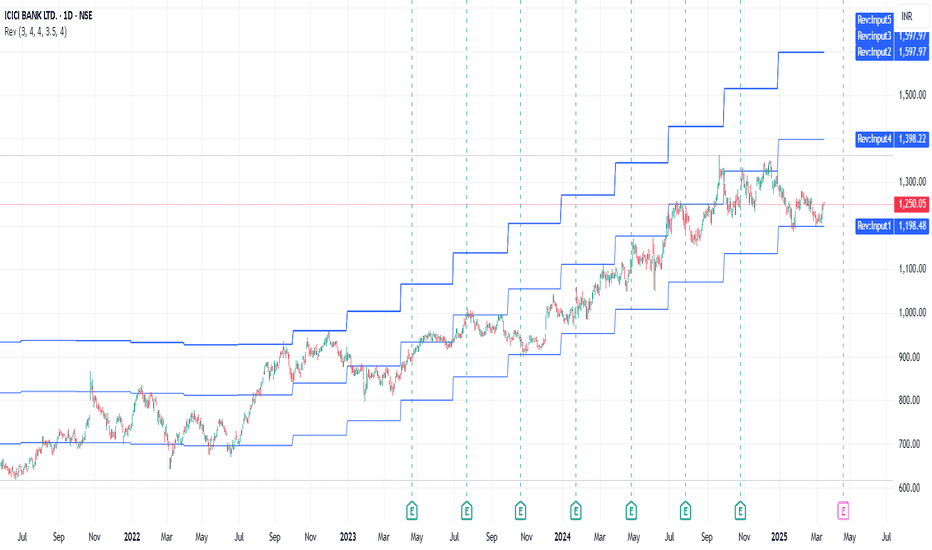

Long ICICI BankSince August 2021, ICICI Bank stock has been trading nicely between Revenue/share multiple of 3, 3.5 and 4. That means it is trading at 3 to 3.5 times it's revenue per share. It is clearly visible using Revenue Grid Indicator applied on daily chart. As per that, this is a good time to buy for a long term view. We can wait for 21 Apr 2025 for it's next earnings results also :) Happy Trading :)

Short term bearish Daily - 03/10/25

Broke and closed under 50MA; seems bearish.

Trend: From 13.98 to 66.91. (Overnight trading price touched $40.00.)

Gaps: There are gaps that may need to be filled between 25.31 - 34.20.

Potential Buy Area: If the price tests and rejects 34.20, it could present a buying opportunity.

Indicators: Use RSI and MACD to confirm that buyers are in control. If the price breaks & Rejects 34.20, we’ll most likely see it drop to 25.31 and close those gaps before we make our way back up for earnings.

Disclaimer: This is not investment advice; invest at your own risk.

Applied Materials (AMAT) Stock Analysis ReportApplied Materials, Inc. (NASDAQ: AMAT) is a global leader in materials engineering solutions for semiconductor manufacturing. The company provides equipment, software, and services to help produce advanced chips used in various high-tech applications, including AI, 5G, and automotive industries. As a key player in the semiconductor equipment sector, AMAT competes with companies like ASML (ASML), KLA Corporation (KLAC), Lam Research (LRCX), Teradyne (TER), and Tokyo Electron.

Financial Performance Analysis

Profitability Metrics

Gross Margin:

47.46% (AMAT) vs. KLAC (61.19%), ASML (49.82%), Teradyne (54.83%)

Operating Margin:

28.95% (AMAT) vs. ASML (31.92%), KLAC (39.03%), Teradyne (19.46%)

AMAT maintains a strong gross margin but lags behind KLAC and ASML. However, its operating margin of 28.95% demonstrates effective cost control and efficient operations.

Return on Equity & Capital Efficiency

Return on Equity (ROE):

40.61% (AMAT) vs. KLAC (87.85%), ASML (48.19%), Teradyne (20.29%)

Cash-to-Debt Ratio: 1.43

While AMAT’s ROE is strong, KLAC significantly outperforms. AMAT’s cash-to-debt ratio of 1.43 suggests a manageable debt level, ensuring financial flexibility.

R&D Investment Efficiency

R&D-to-Revenue Ratio :

11.9% (AMAT) vs. ASML (13.95%), KLAC (13.06%)

A lower R&D-to-revenue ratio indicates AMAT is able to generate high revenue with relatively lower R&D spending, signaling operational efficiency and competitive advantages in innovation management. While ASML and KLAC invest more heavily, AMAT’s ability to maintain growth with a lower R&D ratio demonstrates strong execution.

Cash Flow

Free Cash Flow Margin : 27.55%

With a free cash flow margin of 27.55%, AMAT generates solid cash, supporting dividends and buybacks.

Industry Outlook & Growth Potential

The semiconductor industry is poised for strong growth due to increasing demand for AI chips, high-performance computing, and electric vehicles. However, the U.S. government’s new tariffs on Chinese semiconductor-related imports may impact AMAT’s global sales, particularly if China retaliates.

Despite this, AMAT remains well-positioned due to:

Its strong presence in leading-edge chip manufacturing.

Expansion in AI-related semiconductor production.

High free cash flow generation, allowing for reinvestment and shareholder returns.

Risks & Challenges

Impact of U.S.-China Trade Tensions

New U.S. tariffs on semiconductor equipment could reduce AMAT’s revenue from Chinese customers. If China restricts access to key materials, AMAT may face supply chain disruptions.

Competitive Pressure

ASML dominates the lithography equipment market, while KLAC and Lam Research lead in process diagnostics and wafer fabrication. AMAT must continue innovating to defend its market position.

Semiconductor Industry Cyclicality

Downturns in semiconductor demand could hurt AMAT’s revenue, as seen in previous industry cycles.

Investment Outlook & Valuation

Current Price: $155.68

Intrinsic Value: $207.38 (Safety Margin 24.93%)

Earnings Yield: 4.91%

Dividend Yield: 0.81%

AMAT’s intrinsic value suggests the stock is undervalued by 24.93%, making it an attractive long-term investment.

Bullish Case

Strong profitability and efficiency despite lower R&D spending.

High cash flow generation supporting shareholder returns.

Undervalued stock with strong upside potential.

Bearish Case

U.S. tariffs could impact sales in China.

Competition from ASML, KLAC, and Lam Research remains intense.

Semiconductor demand cycles may cause short-term volatility.

Final Verdict: Buy, Hold, or Sell?

Given AMAT’s undervaluation, strong margins, and efficient R&D spending, the stock presents a Buy opportunity for long-term investors. However, geopolitical risks should be monitored closely.

Investment Strategy:

Accumulate AMAT on dips, targeting a price range of $190-$210 over the next 12-18 months.

AVGO - Can we bounce off of good earnigns?AVGO A Powerhouse Investment Opportunity

Broadcom Inc. has emerged as a standout in the tech industry, demonstrating remarkable resilience and growth potential that makes it a compelling pick for investors. Here are some key highlights that underscore its appeal:

Robust Financial Performance: Broadcom consistently delivers impressive revenue growth and profitability. Its solid balance sheet, high margins, and strategic capital allocation provide investors with confidence in its long-term financial health.

Diverse and Innovative Product Portfolio: With strong positions in semiconductors, enterprise software, and infrastructure solutions, Broadcom benefits from multiple revenue streams. This diversification reduces risk while positioning the company to capitalize on various market trends.

Strategic Acquisitions and Partnerships: Broadcom has a proven track record of making smart acquisitions and forging strategic partnerships. These moves not only expand its technological capabilities but also open up new market opportunities.

Leadership in a High-Demand Industry: As the global demand for high-speed connectivity, cloud computing, and next-generation technologies continues to surge, Broadcom is well-positioned to meet these needs with its cutting-edge solutions.

Investor Confidence: The company’s consistent performance, coupled with its forward-looking strategy, has earned the trust of both institutional and retail investors. Its commitment to innovation and efficiency makes it a stock to watch for long-term growth.

Overall, Broadcom stands out as a reliable and dynamic investment, poised to thrive in the evolving tech landscape. For investors looking to add a resilient, high-performing asset to their portfolio, Broadcom stock is certainly a top contender.

Entry: 191

Target 1 - 219

Target 2 - 244

SL Just below the gap which will serve as our insurance : 176

BYD - What next post-earnings and the BoC's stimulus?HKEX:1211 has had a strong year in growth prospects, reporting solid earnings growth thanks to its robust EV sales and expanding footprint in international markets. The recent earnings beat highlighted an impressive increase in revenue, driven by the demand for both their electric and hybrid vehicles. But what we can notice is that the stock has only reflected this as a c.16% rise in price YTD. However, the question now is: where does BYD go from here?

- More recently, the BoC's latest stimulus measures, including rate cuts and support for the real estate sector, could indirectly benefit BYD. With increased liquidity and consumer confidence, domestic demand for EV's could rise, especially if coupled with additional green energy incentives.

- As for the earnings release, the markets reacted well, and with this new-found optimism in the markets, with both the SEE Composite Index SSE:000001 and the Hang Seng Index TVC:HSI up 5.78% and 9.28% in the past 5 days, is this the turn-around for China as a whole?

Zoetis | ZTS | Long at $156.94Zoetis NYSE:ZTS , the largest global animal health company, generated more than $9 billion in revenue in 2024 and earnings have grown 9.3% per year over the past 5 years. Free cash flow for FY2024 was over $2.2 billion. Dividend consistently raised every year for the past for years (currently 1.28%). The growth of the company isn't expected to slow any time soon, and I believe the animal health care market will grow right alongside the human health care market - if not potentially faster (people love their pets).

Thus, at $156.94, NYSE:ZTS is in a personal buy zone. There may be some near-term risk with the potential for a daily price-gap close near $136.00, but I personally view that as an even better buy opportunity (unless fundamentals change).

Targets

$170.00

$180.00

$200.00

Hormel Foods Co | HRL | Long at $28.98Food stocks are gaining momentum. I anticipate another round of inflation could boost them in the coming 1-2 years. Hormel NYSE:HRL is trading at a price-to-earnings of 20x and pays a dividend of 4.05%. Insiders have been awarded options and are buying shares below $30. Earnings are forecast to grow 9.16% per year and the company has a very low debt-to-equity ratio (0.36x). Thus, at $28.98, NYSE:HRL is in a personal buy zone.

Targets:

$34.00

$36.00

... $50.00 (very long-term, inflationary environment, etc)

Abbott Laboratories | ABT | Long at $110.00Abbott Laboratories NYSE:ABT has been making higher highs and lower lows over the last year, potentially signaling a reversal in its downward trend. Monkeypox and the return of cold/flu/COVID season may spark another run to close the price gap on the daily chart around $140. It is currently in a personal buy zone at $110.00.

Target #1 = $118.00

Target #2 = $140.00

JD.COM - we had amazing earnings, waiting for the yearly report!JD.com is scheduled to release its fourth-quarter and full-year 2024 financial results on March 6, 2025.Analysts are optimistic about the company's performance, with several key indicators pointing toward positive growth:

Earnings Projections:

Earnings Per Share (EPS): The consensus estimate for the upcoming quarter is $0.85, reflecting an increase from last year's $0.73 for the same period.

Revenue Growth: Projections indicate a year-over-year revenue growth of approximately 6.61%, with expected revenues rising from $43.11 billion to $45.96 billion.

Analyst Ratings:

Strong Buy Recommendation: Based on evaluations from nine analysts, JD.com has received a consensus rating of "Strong Buy," underscoring confidence in the company's growth trajectory.

Future Outlook:

Earnings Growth: Forecasts suggest JD.com's earnings will grow by 13% per annum, with an anticipated EPS growth rate of 12.8% annually.

Revenue Projections: The company's revenue is expected to increase by 5.6% per year, indicating sustained business expansion.

These positive indicators reflect JD.com's robust market position and its potential for continued growth in the upcoming earnings release.

Entry: 42.00

Target 70.00

Salesforce - Integration of AI with great earnings = growth!Hi guys today we would be looking into Salesforce - with the upcomming Q4 earnings report it's expected for some great growth : Fundamentals below -

Salesforce is poised for a promising earnings report, reflecting its robust performance and strategic advancements. In the third quarter, the company reported an 8% year-over-year revenue increase to $9.44 billion, surpassing analysts' expectations. This growth is attributed to strong client spending on its enterprise cloud services and data cloud, driven by the integration of artificial intelligence to streamline corporate workflows.

The introduction of Agentforce 2.0, an advanced version of its AI agent program, allows users to deploy AI agents within the Slack app and includes enhanced features such as improved reasoning, integration, and customization. The full release is expected in February 2025. Wall Street has responded positively, with analysts maintaining optimistic projections. Salesforce plans to hire 2,000 people to promote its AI software, countering the industry trend of layoffs due to the high costs of AI projects. Salesforce's stock surged by 11% after the initial announcement and has risen 33% year-to-date, outperforming the S&P 500. Analysts anticipate continued investor enthusiasm and potential gains of up to $80 per share as more businesses adopt the platform.

Analysts are optimistic about Salesforce's financial outlook. Wedbush analyst Dan Ives has raised the Q1 2026 earnings estimate to $1.90 per share, up from the prior estimate of $1.88, maintaining an "Outperform" rating with a $375 price target.

The consensus estimate for Salesforce’s current full-year earnings is $7.48 per share.

The company's stock performance has been strong, with shares trading at $361.99 as of the latest report. The stock has a market cap of $346.06 billion, a price-to-earnings ratio of 59.54, and a beta of 1.30. The business has a 50-day simple moving average of $309.97 and a two-hundred day simple moving average of $272.88.

In summary, Salesforce's strategic focus on AI integration, strong financial performance, and positive market reception position the company for continued success in the upcoming earnings report.

Target: 365 - Just below the ATH so we can have some protection of the trade

SL: 294 - just below the formulated GAP which we covered

MSFT ChannelBetween January 2023 and July 2024 NASDAQ:MSFT had a nearly 100% expansion showing aggressive growth. For the last 8 months however, MSFT has been trading sideways in a channel between ~$455 and ~$400. During the last earnings report future growth guidance came in under expectations. Technically, there was large gap down following earnings and a retraction to the 21 EMA offering a short entry window. I took a short position here with a stop loss placed above the 21 EMA, I will be adding to this position when price breaks the support of $400 and again if it continues to fall and retracts to the $400 level. First target is the previous $373 support level, second target is the $330 support level.

Walmart Earnings Trade Setup: Two Key Levels to WatchWalmart ( NYSE:WMT ) has earnings coming up tomorrow, and I’m eyeing two potential trade setups depending on how the market reacts.

Bullish Scenario : If Walmart pumps post-earnings, I’m targeting a move up to $115. Momentum could easily carry it to this key resistance level.

Bearish Pullback & Reversal : If Walmart sells off on earnings, I’ll be looking at the $96 area as a strong level for a long entry. This zone has historical significance and could provide a solid buying opportunity.

Earnings moves can be unpredictable, but these two levels give me a clear game plan.

Let’s see how it plays out!

What’s your take—will WMT rip or dip?