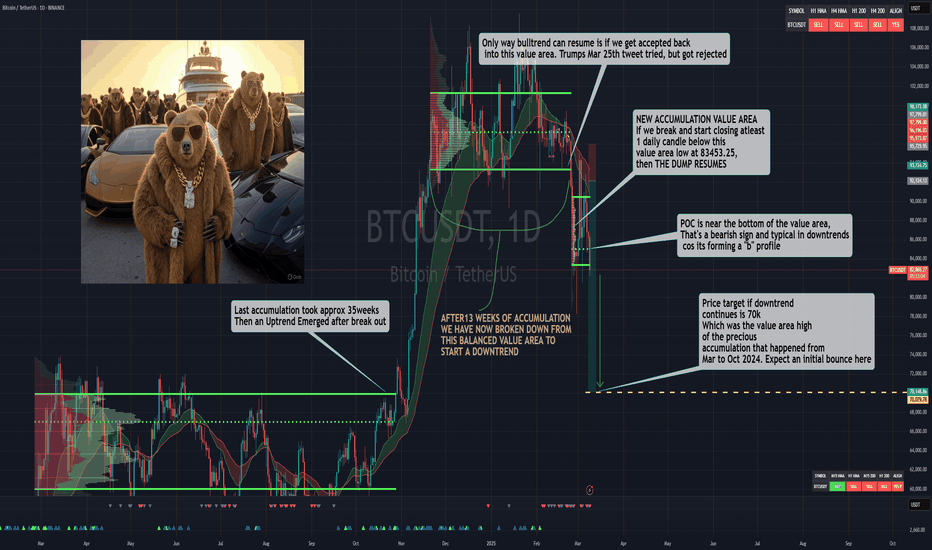

Sweet Spot To Sell The BTC Pullback In a strong downtrend. Every pullback on the 4hr and Daily chart will be hyped by the bulls & super cycle evangelists as a "WE'RE BACK" moment.

I will continue to take this same setup, selling Major swing highs on 4HR & Daily chart on BTC until the Daily Chart flips bullish. Until then or some news come out, we will remain in the downtrend until we hit the target shown in my last analysis, see link below.

Economic Cycles

Solana's important supporthello friends

Due to the heavy demand of Solana and the construction of new floors based on the market cycle, we expect a new floor within the specified range.

If we reach the support range of 105-110 dollars, we can buy with confirmation, of course, with capital management...

*Trade safely with us*

BTC Upward WedgeWedge patterna usually require 5 touch points to confirm the pattern. Which, officially, Bitcoin has done.

This upward wedge means revearsal for a bear market, while a downward wedge means reversal for a bull market.

We are still inside this wedge which means even though this pattern is hypothetically confirmed on BTC, we could either see a rally up through the wedge until it finally breaks, or we may even break now into the end of March if BTC continues sideways.

This pattern overall suggests that we are likely to see an early top for BTC if the pattern confirms in the next few weeks, otherwise there's still room for a late 2025 top for BTC even with the upward bearish wedge in play.

Normal Cycle Despite DespairEvery cycle, when the weekly 233 EMA crosses above the weekly 200 MA, shortly after there is a circa 30% drawdown. That is happening now and is normal but feels more intense because 30% of 100k is bigger than entire price range of 2017 cycle.

2013 - 2017 cycle

• 136 weeks from top to halving

• 48 weeks to 233/200 cross

• 37% dump from cross swing high

• 26 weeks to 2017 cycle top

2017 - 2021 cycle

• 126 weeks from 2017 top to halving

• 41 weeks to 233/200 cross

• 31% dump from cross swing high

• 42 weeks to cycle top

2021 - Now

• 127 weeks from top to halving

• 41 weeks to 233/200 cross

• 28% dump from cross swing high so far

• Estimted hitting upper band - late October early November if cycle follows previous

Bought more BTC last night at 81.1k

Welcome To The Long Awaited BTC Bear Market Fade the trend at your own risk.. It's always a good idea to SELL into WEAKNESS, and BUY into STENGTH.

The daily btc chart is confirmed bearish. Only the monthly and weekly chart are still bullish, but if the downtrend continues on the daily trend, then it will make its way to the Weekly chart and eventually the monthly chart.. This is going to happen slowly or a mega dump could speed it up. but the target remain the same.

We were all promised a "SUPER-CYCLE" and alot of people are still riding the narrative fueled by social media and constantly getting rekt . Trust ONLY what you see on charts ONLY !!.

I already started shorting the market way back since January when i stopped listening to the hype and started focusing on trading the trend on the chart as soon my trend indicator gave me a sell signal on the daily timeframe, everyone taught i was crazy in the chats for my bearish call outs. So far its been the BEST DECISION EVER !!

If you want to buy anything, just make sure its on Spot, you buy with the mindset that you are buying to hold until at least 2027 .There is no magical super cycle..The party is over until something crazy bullish happens or trump does something that sparks a new rally.

Reworked Kaspa Weekly and Daily Cycles using KAS/USDReworked Cycle counts on Kaspa/USD chart

Using Fiance Camels "How to set up Cyvle count on a specific Asset", I reworked the Dailt (DCL) and Weekly (WCL) counts.

DCL form in 60 days (+/- 10%), and there are 5 DCL within the larger WCL (D/WCL-DCL-DCL-DCL-DD/Wcl)

WCLs are ~ 32 WKs (+/- 10%)

DXY (Dollar Index) and Pamp/Dump BTC. Markets Cycles.USA Dollar Index + Bitcoin Pamp/Dump Cycles. Logarithm. Time frame 1 week. Minima and maxima of bitcoin secondary trends are shown. Everything is detailed and shown, including what everyone always wants to know. Cyclicality. Accuracy.

This is what it looks like on a line chart to illustrate simple things.

Lunar Signal Generator My Lunar signal generator uses a sinusoidal wave which is matched in frequency to the sinusoidal motion of the moon. The indicator is based on research which suggests that there are increased returns on days surrounding the new moon and decreased returns on days surrounding the full moon.

The indicator represents a two week trading strategy and prints buy signals before the new moon, and prints sell signals on the full moon. If used as a trading strategy the 5 & 10 year win rates are 70%, profitability is dependent on your choice of stoploss. I suggest a 9% Stoploss however this is discretionary. Can be used on any financial product, however it works best on large cap equities.

Just place on any chart, and trade according to the buy and sell signals

Check out my website, (press the little globe below my profile description)

Please reach out for any questions/concerns

Weekly Review – Week 10, Prepping for Week 11### **Weekly Review – Week 10, Prepping for Week 11**

#### **Market Context: Higher Time Frames Still Bullish, But Short-Term Consolidation**

- **Quarterly:** Q1 2025 remains in expansion mode, continuing the pattern of higher highs and higher lows over the last six quarters. Price is currently trading above Q4 2024, which acted as a stall candle—reinforcing that the **higher time frames remain in a bullish breakout phase**.

- **Monthly:** February followed through with **bullish momentum**, closing above January’s high. However, the long wick to the upside signals **rejection of higher prices**.

- **Monthly imbalance at 2780**, aligning with **October 2024's STH-HH at 2790**—a key **Point of Interest (POI)** for long setups if price retraces.

#### **Weekly Chart: Defined Range & Potential for Deeper Pullback**

- **Week 10 printed an inside bar**, following Week 9’s engulfing move—**creating both a swing high and swing low**.

- **Weekly Equilibrium at 2745** – Optimal long positions may form below this level, providing a **higher probability setup in discount pricing**.

- Given the defined range, this supports a case for **short-term shorts**, with **long setups likely to emerge at lower levels**.

#### **Daily Chart: Expansion, Consolidation, Breakdown – Is 2830 Weak?**

- **Recent Structure:** Price expanded, consolidated, and then broke down, forming a **swing low at 2830**.

- This swing low **failed to push higher and take out 2955**, which would have confirmed continued bullish structure.

- **Daily consolidation zone at 2935-2940** was the origin of the last **bearish expansion**. If price revisits this area, it becomes a **prime shorting opportunity**, targeting a break of 2830.

- A break below **2830 confirms short-term bearish control**, increasing the probability of a move toward **weekly range equilibrium at 2750**.

---

### **Trading Plan for the Week Ahead**

🔹 **Short Bias Above Recent Swing High at 2930**

- Looking for shorts within the **Daily Bearish POI (2935-2940)**.

- If price rejects and moves down, **targets = 2830**, with potential for an extended move into **weekly equilibrium at 2750**.

🔹 **Longs Not Off the Table – But Caution Needed**

- **Higher time frames remain bullish**, so we are not married to short positions.

- If price shows **strong buying interest we will re-evaluate.

🔹 **Key Events to Watch in Week 11**

- **CPI on Wednesday** and **PPI on Thursday** – These could be **major catalysts for volatility**.

- **Post-NFP reaction was muted**, so we anticipate **stronger price moves following economic data this week**.

---

### **Execution Mindset: Trade the Plan, Stay in Control**

🚨 **No Bias Marriages – We Execute, Then Evaluate**

- Every position is **planned, executed, and then reviewed**.

- **If a setup fails, we adjust. If a setup succeeds, we analyze why.**

🎯 **Focus for March:**

- **Refining the scaling-in model**—balancing profit-taking while managing drawdowns.

- **Strengthening market structure analysis** across multiple time frames.

- **Sticking to daily swing trades** at key reversal points (springs & upthrusts on lower time frames).

🔹 **Let’s see what price prints. We trade what we see, not what we expect.**

#WeeklyReview #Trading #XAUUSD #PriceAction #HandDrawnCharts

Russel 2000 Compared to General MarketTVC:RUT has continued to sell off since my last couple posts and I believe we could see a huge market correction this year if price doesn't look to stop selling.

The next play on RUT I would like to see price pullback to the last breakout zone ($2,200) to confirm a continuation in trend

This play also looks very familiar to the 2022 selloff with equal highs to our current price structure. Seeing that AMEX:SPY is at a higher high tells me there is market-wide divergence and a topping pattern could be in play.

Now when we add CRYPTOCAP:BTC and $OTHER to the mix we can see bitcoin actually tops out first while Alts and SPX look to make one more leg up before crashing out.

The Trend Reader at the lower tab has topped out and has a bearish crossing in the overbought zone indicating we can see a long term play to the downside.

TSLA SELLING PRESSURE MAY REDUCE AS SHARE PRICE DIPS INTO SUPPORTesla’s support level between 200 and 260 may act as a buffer to hold the share price amid ongoing selling pressure. Will there be rejections on TSLA in coming week(s)?

N.B!

- TSLA price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#tsla

#nasdaq

#nyse