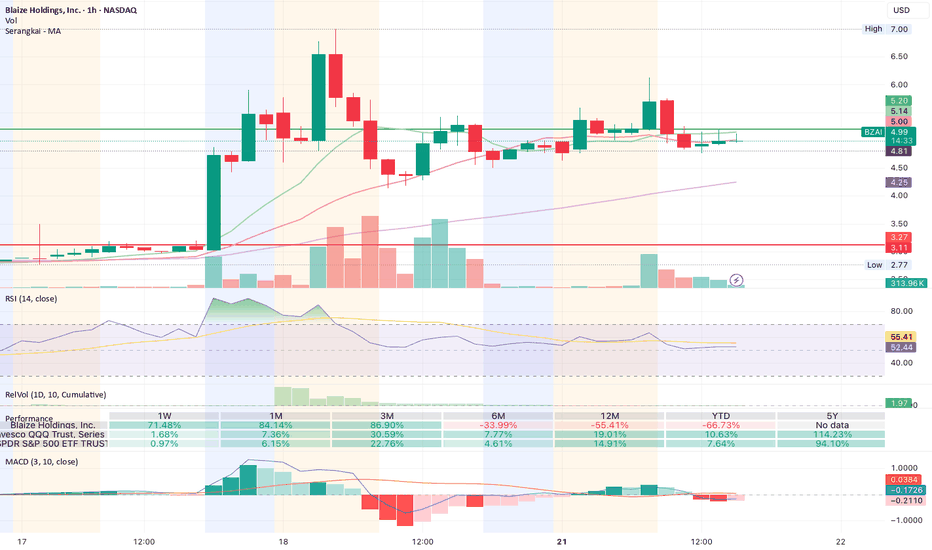

BZAI consolidating, getting ready to moveThis edge AI startup is moving into new business territory.

After a big gain, it's been consolidating price and getting ready for a move. Waiting for news or price action before jumping in.

Still a risky future play so it could go south, but a recent $100m contract reinforces future growth. Watching closely.

EDGE

BTCUSD – Price Approaching The Edge of the Channel📍 BTCUSD – Price Approaching The Edge of the Channel

Bitcoin has surged sharply from the lower boundary of its descending channel and is now reaching another “Edge” — the upper resistance line.

🎯 Two Key Scenarios:

🟩 Bullish Breakout: A clear breakout above ~$108,000 with strong volume could initiate a new leg toward $111K and beyond

🟨 Bearish Rejection: Failure to break the channel may lead to a corrective wave back toward $103K or lower

This is a classic "decision point" — where market structure and momentum meet supply and resistance.

—

#BTCUSD #Bitcoin #CryptoTrading #TechnicalAnalysis #PriceAction #TheEdge #ChannelTrading #EMA #BitcoinResistance #MJTrading #CryptoSetup #SwingTrade #MarketStructure #BreakoutOrRejection #KeyLevel #TrendWatch

What Makes a Chart Tradable – Part TwoIn the previous post , we explored the foundations of technical trading. We examined how market behavior can appear structured even when it results from randomness, how bias affects interpretation and how volatility persistence helps explain why certain moves tend to cluster rather than appear in isolation. This post builds on that foundation by focusing on how to recognize meaningful movement and determine whether a chart structure is tradable.

Technical charts often present a wide range of setups, patterns, and interpretations. But a core distinction must be made between coincidental formations and actual price behavior driven by imbalance. Not all movements are equal, and recognizing the difference between random fluctuation and purposeful structure is essential.

A common assumption in technical analysis is that certain patterns or shapes inherently provide a specific outcome. This assumption is problematic without a defined context. The ability to recognize a flag or wedge does not imply statistical validity. For a price movement to be tradable, there should be characteristics that suggest underlying buying or selling pressure.

Unusual Movement

To determine whether a price move is meaningful, it must be assessed in relation to what is typical for that market. All assets have their own average range, pace and rhythm. When price breaks from that baseline through unusually strong or sustained movement, it can signal momentum or imbalance.

What makes these moves relevant is not their size alone, but the fact that they differ from normal behavior. This kind of shift may reflect changes in supply and demand or a reaction to new information. Such movements could mark a change in behavior and can serve as reference points. Their value lies in being statistically uncommon, which may suggest that market conditions have changed.

Pullbacks as Rebalance

Following strong directional movement, price tends to enter a state of reversion or pause. This is known as a pullback, a controlled retracement .It is not merely a pause. It reflects a psychological reset and the temporary rebalancing of order flow in response to imbalance.

Not all pullbacks are viable. For a setup to be considered tradable, the retracement must occur in the context of a meaningful prior move. When the underlying trend is intact and the pullback is controlled, the structure can offer a more reliable opportunity.

The Role of Standardization

Trading should be based on discretion. It involves interpretation, context and deliberate decision-making. But without structure, it risks becoming inconsistent and reactive.

Therefore movement and momentum should be measurable. What appears meaningful must be evaluated relative to the asset’s own historical behavior, not assumed based on surface-level appearance. Without a reference, the evaluation may lack foundation.

Measurement supports model building. Standardization supports disciplined execution. A trader might believe a move is strong based on visual cues or pattern familiarity, but if it lacks historical context or fails to meet defined criteria, that evaluation could be flawed.

Framework and Models

There are categories of tools that can be incorporated to support standardization. The choice is not fixed and should be based on personal preference, methods and research. Example:

Volatility Measure: Could be used to confirm when price moves outside a volatility-based envelope, indicating movement beyond the average range.

Momentum Measure: Could be used to confirm whether current price action is faster or stronger compared to recent historical behavior.

Such models are used to define context, not to predict outcomes. They help standardize analysis and filter out questionable movements and patterns.

Conclusion

The textbook patterns often referenced on their own do not create edge. Tradable charts are those where meaningful movement, defined by momentum, imbalance and structure, can be observed and evaluated using standardized methods. The purpose is not precision but repeatability. Discretionary trading is built on contextual evaluation supported by consistency and objective tools.

Foundation of Technical Trading: What Makes a Chart Tradable?The Foundation of Technical Trading

There is an abundance of information on price charts, technical methods, indicators, and various tools. However, the required first step is to understand basic market structure. Without this foundational knowledge, technical applications risk becoming inconsistent and disconnected from broader market behavior.

It is also important to question whether technical charts and tools are effective at all. What makes the market responsive to a trendline, a pattern, or an indicator? And why, at other times, do these tools seem entirely irrelevant? Is the market random? If certain events are predictable, under what conditions can such occurrences be expected?

Experiment: Random Charts

Here is an illustration of four charts; two showing real price data and two randomly generated. While some visual distortion gives away subtle differences, there are more refined methods to construct this experiment that makes telling the difference between real and random almost impossible.

All these charts show viable patterns and possible applications. When presented with these, even experienced people tend to construct narratives, whether or not structure is present. This raises a fundamental question; how can one distinguish real occurrences from coincidental formations on a chart? In case all movements are considered random, then this should indicate that applied methods perform no better than coincidence?

Bias and Distortion

It’s also important to comprehend the influence our perception. As humans we are wired to find patterns, even in random data, which can lead to various cognitive biases that distort our interpretation. For example, confirmation bias may lead us to focus only on evidence that supports our expectations, while apophenia causes us to see patterns where none exist. Similarly, hindsight bias can trick us into believing past patterns were obvious, which can develop overconfidence in future decisions. Awareness of these biases allows us to approach technical tools and charts with greater objectivity, with more focus on probabilistic methods and calculated risks.

Experiment: Random Levels

Perform the following experiment; open a chart and hide the price data. Then draw a few horizontal lines at random levels.

Then reveal the price again. You’ll notice that price can touch or reverse near these lines, as if they were relevant levels.

The same thing can happen with various indicators and tools. This experiment shows how easy it is to find confluence by chance. It also raises an important question, is your equipment and approach to the markets more reliable than random?

Market Disorder

Financial markets consist of various participants including banks, funds, traders and algorithmic systems. These participants operate with different objectives and across multiple timeframes resulting in a wide range of interpretations of market behavior. Trades are executed for various reasons such as speculation, hedging, rebalancing, liquidation or automation; directional intent could be unclear. For instance, the prior may serve to offset exposure, and portfolio rebalancing could require the execution of large orders without directional intent.

Technical and chart-based trading likely makes up a minor segment of the overall market; even within this subset, there is considerable variation in perception and interpretation. There could be differences in timeframe, reference points, pattern relevance and responses to similar information. The market is broader, more complex and less definitive than it appears. The point is that markets contain a high degree of structural disorder, which means most assumptions should be questioned and perceived as estimative.

The effect of buying and selling pressure on multiple timeframes sets the foundation for oscillation in price movements, rather than linear and monotonic movements. This pattern of rising and falling in a series of waves sets the points for where the current structure transitions between balance and imbalance. An overall equilibrium between buying and selling pressure results in consolidative price movement, whereas dominance leads to trending or progressive movement.

Volatility Distribution

To answer the main question: What differentiates real market behavior and charts from random data, and ultimately makes it tradable, is the distribution of volatility. This forms the basis for the phenomenon of volatility clustering, where periods of high volatility tend to follow high volatility, and low volatility follows low volatility. It is rare for the market to shift into a volatile state and then immediately revert to inactivity without some degree of persistence. Research supports the presence of this volatility persistence, though with the important caveat that it does not imply directional intent.

Volatility Cycles

These phases tend to occur in alternation, known as volatility cycles, which set the foundation for tradable price structures. This sequence consists of a contractive phase, marked by compression in price movements, followed by an expansive phase, characterized by increased volatility and directional movement. The alternation reflects shifts in underlying buying and selling pressure. This behavior offers a practical approach to interpret market behavior. A more detailed explanation of the concept could be explored in a future post.

Conclusion

While the idea of profitability through technical trading is often questioned, it remains a viable approach when based on sound principles. The edges available to the average trader are smaller and less frequent than commonly presumed. The concepts of volatility and the ability to locate areas of imbalance forms the basis for identifying conditions where market behavior becomes less random and more structured. This sets the foundation for developing technical edges.

The content in this post is adapted from the book The Art of Technical Trading for educational purposes.

Is there a secret profit day in EURUSD?Unfortunately, no secret day of the week has been found for the Euro!☹️

Hello, on a day off you can take your mind off trading and do important things like analyzing and looking for patterns.

Today I would like to present the result of a statistical test for statistically significant relationship between the day of the week and the price movement from the opening to the closing price of the day.

Instrument: Euro (Forex)

Data set: from 01.03.2022 to 21.02.2025

Test: ANOVA (Analysis of Variance)

Here are the steps taken:

1.Calculate the price change (close - open) for each row in the data frame.

2.Group the data by day of the week and calculate the average price change for each day.

3.Perform an ANOVA test to determine if the differences in the average price change are statistically significant.

Test results and interpretation:

👉The result of the ANOVA test is a F-value of 1.23 and a p-value of 0.30.suggests that there is no statistically significant relationship😞 between the day of the week and the price change from open to close.

A lot of room to grow for $EDGE in DePINEDGE has been in a major uptrend since december fueled by new attention to its supercloud products that have been in development for over a decade and its recent partnership with Tinder, gaining them as a client to run the YearInSwipe competition on the edge network. This year there is a large number of releases to be expected, from its all new storage product, VPN, to AI Agents. Revenue has been on the rise to the tune of 1.3 million USD ARR from users of the supercloud, which is similar to some 10x valued project like Akash. Combined with the fact that it is not on any reputeable CEX yet, exchange listings can be seen as catalysts for further growth. In summary, a lot is aligning in the macro-picture for EDGE this year giving it the very good chance to catch up and overtake other DePIN projects price-wise. This is a project solving real-world issues with growing real-world revenue and deflationary tokenomics, making it an ideal long-term hold

EURNZD BULLISH SHARKHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

BULLISH BUTTERFLYHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

NZDJPY BUTTERFLYHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

How To Have An Edge Over The Markets!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today I want to share a basic trading plan that you can follow to quantify your trading edge.

📌Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. is it bullish, bearish or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone as price has 50% change to go either up or down. Thus no edge!

📚Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2

📌Step 2:

No matter how strong a horizontal / non-horizontal support or resistance is, it can still be broken. Thus don't buy/sell blindly as price approaches a support/resistance.

Instead, zoom in to lower timeframes like H1 and M30 to look for setups.

🏹A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a support for the bulls to take over.

This would be the confirmation to enter the trade.

⚙️Of course, your second edge would be through risk management by targeting at least double than your indented risk.

But that's a topic for another post 😉

Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All Strategies Are Good; If Managed Properly!

~Rich

GOVT ETF: Bullish Reversal on the Horizon?The GOVT ETF, representing U.S. Treasury Bonds, shows signs of a potential bullish reversal, according to our proprietary QuantEdge Momentum System.

Key Indicators:

Z-Score:

The Z-Score has surged to 1.60, signaling an overextension to the downside in the past months. This indicates that the recent downward momentum might be exhausted, leading to a possible trend reversal.

Z-Score of RSI:

The Z-Score of RSI at 1.72 shows a significant bullish momentum shift. This suggests that the asset might be gaining strength, with buyers stepping in to push prices higher. The crossing above 0 confirms that bullish sentiment is currently prevailing.

Cumulative Volume Delta (CVD):

The CVD indicator reflects a strong buying pressure, as demonstrated by the marked shift from deep negative territory (-451,481,504) towards a less pronounced negative reading. This shift suggests that the selling pressure has weakened, and buyers are beginning to dominate the market.

Price Action:

The price has broken above the green momentum cloud, signaling a potential shift from a downtrend to an uptrend. Given the alignment of other indicators, this could be the beginning of a bullish phase for GOVT.

Projection:

Over the next quarter, GOVT is likely to experience a bullish correction, driven by strong buying momentum. The ETF could target resistance levels in the $25.00-$26.00 range if the current momentum continues. The Z-Score and RSI suggest that the upside could be substantial as the ETF looks to recover from recent losses.

However, caution is warranted if the Z-Score or RSI starts to diverge negatively, as it could indicate the potential for a correction or consolidation before resuming the uptrend. Monitoring these indicators will be crucial to confirm the strength of the reversal.

Based on the proprietary QuantEdge Momentum System, GOVT appears poised for a bullish quarter. Investors looking to capitalize on U.S. Treasury Bonds might find this an opportune time to consider GOVT as a potential buy.

EDGE - #DePin Infrastructure long term playThis is NOT a short term indicator play. It's a cyclic infrastructure investment #DePin, with a real product and revenue, token burning mechanism. Great entry on a 365 ema retrace touch which gives the best possible RR given the nature of this investment. I will also be participating in providing a node and staking. Little birdie told me good alpha about the roadmap. DYOR

Head and Shoulders Pattern Forming on the DXY Dollar IndexWhen the dollar is running, most other assets are dropping. This has been my experience in the markets and is why the DXY is on my watchlist and is ALWAYS one of the first charts that I check before jumping into the markets. When the DXY is high, that means that people are demanding dollars, and when it's dropping, those dollars are flowing into other assets.

Learning to watch the DXY and it's movements will give you some good edge in the markets. Not everything will be effected. There are always other market conditions to watch for, news, etc that can move the markets as well, but keeping your eye on what the USD is doing is certainly something you want to add to your trading routine.

So the Head and Shoulders pattern is a strong reversal pattern in the markets. Nothing is ever 100% and the pattern could fail, so you always have to be ready for that. The regular Head and Shoulders is a bearish reversal pattern meaning we have found the local top in that market at that time. An Inverted Head and Shoulders pattern is the opposite. It usually shows at a market bottom and indicates the possibility of bullish movement.

What we see here is that the DXY is knocking on the door of a breakout of this pattern and if it keeps going up, well, you will want your trading account to be in the dollar, or looking for shorting opportunities in other assets like crypto and FOREX pairs, that is if you are trading futures or options. If you are trading spot, this is the time to be in the dollar and waiting for your chosen asset to hit a fire sale clearance price, then go in an scoop up what you can with what you have!

Of course none of this is financial advice, just some things I have learned along my journey in this crazy world of trading that has helped me make some successful trades.

As always make sure you have a solid risk management plan before diving into the deep end! Doing this will help you gain some edge in the markets and trade logically!

My Trading Strategy in 3 Steps 📊As per @TradingView 's previous post, in this article, I am going to share my trading strategy in three steps.

📌 Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. Is it bullish, bearish, or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone, as the price has a 50% chance to go either up or down. Thus, there's no edge!

Remember: No trade is also a trade.

📚Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2.

📌Step 2:

Zoom in to lower timeframes like H1 and M30 to look for any reversal setups.

A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a support for the bulls to take over.

This would be the confirmation to enter the trade.

Just like a sniper waiting for the perfect shot!

📌Step 3:

Target at least a 1/2 risk-to-reward ratio. This way, even with a 50% win rate, you can still be profitable.

Remember: We are risk managers, not traders. We can't control the market; the only thing we have control over is our risk.

📚Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All strategies are good; if managed properly!

~Richard Nasr

📕Low-Quality setups (UNCLEAR) VS High quality (CLEAR) setups📕High quality (Clear) vs Low Quality (Unclear, wicky, random, guessing)

Setups in Our Trading

High quality clear (HQC) setups are best representations of your EDGE, they allow you to feel confident in the MOMENT of placing a trade, and you can feel relatively good about it even if it’s a loser, because you know you traded in clear market environment and did your best

HQC setups bring you HEALTHY excitement and joy from the process of your trading, in case of a winner, usually not leading to overconfidence and doesn’t lead to attachment to random reward, and in case of a loser - you are not dragged into revenge or depression, because you know losers are also part of your strategy and your execution was good

When you enter HQC setups that speaks about you as about a trader you tested their strategy, who knows what they want to see in the market and applied effort to stay away from bad condition and wait for a better one. These skills alone are so much better than 1 random +3R or +5R winner

Low quality unclear (LQU) setups mean something is out of your mental game today, you feel not feel good in longterm perspective trading them, because you kind of KNOW you should trade them, but you still do. It all sucks you into an emotional circle.

LQU setups bring you UNHEALTHY , short term lived overexcitement in case of a winner, attaching you to random rewards, which is fatal for a trader. Every time entering a LQU setup you develop a habit or “teach” yourself that it is easy and fast way of earning money. Just see something distantly reminding about your setup and enter. Sometimes you’ll get away, but longterm you’ll lose more.

LQU setups means you are you fully confident in your core strategy, and so you may unconsciously search for random entries, because you entered like this before and it brought you reward. Trading LQU setups is destroying your mental game and account in the short, medium and longterm

Picture attribution Frame Border PNGs by Vecteezy

Understanding Your Statistical Edge STATISTICAL EDGE

A player's advantage in a game of chance that ensures favorable outcomes over the long run is referred to as a statistical edge. Think about a situation where a coin is rigged so that one side has a 51% chance of dropping heads while the other has a 49% chance. When a player wins, they are paid 1, and when they lose, their opponent is paid 1.

This establishes the rules of a game of chance, such as the likelihood of winning and losing, the reward for winning, and the penalty for losing. We may calculate the expectation using these parameters, which determines whether or not one has a statistical edge.

If the expectation is higher than 0, the player has a statistical advantage that could result in long-term financial success. The player who wins the coin game 51% of the time will make money in the long run because the expectation in this example is 0.02.

The metrics of a trading strategy are similar; the win rate, which measures the likelihood of winning, and the average Reward to Risk Ratio (RRR), which measures the average profit divided by the average loss of your trades, are both used. Consider a system that wins 40% of the time and has an RRR of 2, which means that winning is worth twice as much as losing. In this scenario, you risk 1R on each trade, and out of 100 trades, you win 40 and lose 60.

Your expectancy is then calculated by multiplying the number of winning trades by the reward (2R) and subtracting the number of losing trades by the risk (1R), resulting in a profit of 20R over 100 trades. Therefore, your expectancy is $0.2, meaning that for every 0.1 you risk on a trade, you earn $0.2 on average.

A successful approach, however, will fall short if proper risk management practices are not followed. A trading strategy is a tool, but risk management is what allows you to profit.

WINRATE & LOSES

The chart above displays your chances of having consecutive loses based win rate. As seen in chart above even if your trading method is 60% successful, there is still a 70% risk that you will suffer four consecutive losses. You have a greater than 50% risk of suffering eight consecutive losses if your strategy only succeeds 40% of the time. Knowing these numbers is very important as it helps with your psychology when you find yourself losing a lots of trades and you're questioning your strategy.

IMPROVING YOUR RISK TO REWARD

One way to improve your reward on trades is by using your MAE and MFE metrics to determine stops and take profit.

A trader's stop-loss and take-profit levels can be determined using the metrics MAE (Maximum Adverse Excursion) and MFE (Maximum Favorable Excursion).

No matter whether a trade is profitable or not, MAE calculates the maximum drawdown that can occur from the deal's highest point to its lowest position. However, regardless of whether a transaction is ultimately lucrative or not, MFE evaluates the highest profit a trade can achieve from its entry point.

In the above image we can see MAE calculations on trades. We can see that of all the trades taken the trades that have the best performance (above the blue line) are the trades with the least amount of drawdown. This information can help a trader determine at what point he/she should be closing trades if not running in their direction.

Trading professionals can better understand the behavior of the market and set more sensible stop-loss and take-profit levels by looking at the MAE and MFE of their transactions.

For instance, a trader may want to tighten their stop-loss level to reduce potential losses if they notice that their trades frequently encounter a significant MAE before eventually reaching their take-profit level. On the other hand, if a trader notices that their trades frequently encounter a significant MFE before being ultimately stopped out at a loss, they might want to think about establishing a broader stop-loss level to give their trades more breathing room. Overall, using MAE and MFE can assist traders in better understanding the advantages and disadvantages of their trading strategy and in adjusting their risk management plan accordingly.

gbpjpy analysis - 01 mar 2023happy first of the month!! hope we all have profitable months :)

so here it goes...

- on the daily market closed below the downward trendline yesterday

- down to the H4 a bearish engulfing formed closing two previous bullish candles

- a head and shoulder pattern formed which is more clearer on the H1

- entry could have been taken at the london open where the right shoulder formed

- but now we WAIT for a breakout of the neckline and depending on how aggressive your entries are you can enter at the immediate breakout or wait for a retest of the neckline

- and just like every other trade I DO NOT KNOW WHAT WILL HAPPEN NEXT, i'll just act on my edge and SEE WHAT HAPPENS

gbpjpy analysis - 27 feb 2023so here's what i see...

- market has been forming HH and HL on higher timeframes

- market is currently showing signs of breaking through the previous HH

- so i'll wait for market to retest that level of the previous high which will be the new HL if it does not i do not take the trade

- but as with other trades there is no 100% guarantee with my predictions

How To Have An Edge Over The Markets 📚Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Today I want to share a basic trading plan that you can follow to quantify your trading edge.

📌 Step 1:

First, start from the higher timeframes like Daily/Weekly to identify the current long-term trend. is it bullish, bearish or stuck inside a range?

If the price is sitting in the middle of nowhere, then it is a NO trade zone as price has 50% change to go either up or down. Thus no edge!

📚 Wait for the price to approach the lower bound or upper bound. Then proceed to Step 2

📌 Step 2:

No matter how strong a horizontal / non-horizontal support or resistance is, it can still be broken. Thus don't buy/sell blindly as price approaches a support/resistance.

Instead, zoom in to lower timeframes like H1 and M30 to look for setups.

🏹A basic approach would be to wait for a swing low to be broken downward around a resistance as a signal that the bears are taking over.

In parallel, wait for a swing high to be broken upward around a suppor t for the bulls to take over.

This would be the confirmation to enter the trade.

Of course, your second edge would be through risk management by targeting at least double than your indented risk.

But that's a topic for another post 😉

Always follow your trading plan regarding entry, risk management, and trade management.

Hope you find the content of this post useful 🙏

All Strategies Are Good; If Managed Properly!

~Rich

🖐 5 Rules For Successful Trading!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Trading is simple, but not easy. Traders have difficulty succeeding simply because they are unable to follow clear rules over extended periods of time.

So what are the rules that every trader should follow?

💸 1- Only invest what you Can Afford to Lose.

Only invest money you can afford to lose, never ever borrow money or take a loan from the bank to invest. Because if you do, you will get emotional and make irrational mistakes.

⚔️ 2- 1% Risk per Trade.

We only risk a small portion of our account per trade. We enter with 1% risk per trade (2% max). We enter with a fixed risk per trade, not with a fixed stop loss in pips, nor with a fixed lot size.

Remember: All Trades Have To Have The Same Weight / Effect On Our Account!

📉 3- Three Confluences Trades. (Technical Edge)

Trading is nothing but a game probability. Moreover, we consider ourselves risk managers not only traders, as the only thing we have control over is "risk". The market can go anywhere.

To be on the winning side, we need to have an edge over the market.

One way to put the odds in our favor is by only entering trades when we have at least three confluences/clues, three things telling us to buy or sell lined-up together. One confluence may be random.

For example: Only enter when you have a pattern, support, and divergence. And your rules have to be objective following a well-defined / back-tested trading plan.

📕 4- Positive RRR - Risk Reward Ratio. (Risk Management Edge)

Our second edge is going to be through risk and money management by entering with a positive risk-reward ratio. That’s exactly why we enter with a ½ RRR (or higher), which means we always target at least double our stop loss. This way even with a 50% win rate, we are still profitable.

Remember: It is not about how many trades you win, what matters is how much you win when you are right, and how much you lose when you are wrong.

🧘♂️ 5- Emotional stability.

In the trading world, emotions are considered the enemy of traders. Knowing how to control emotions while trading can prove to be the difference between success and failure. When getting into a bad trade, the trader who can manage his psychology well will be able to minimize risk, while the trader who is emotional may make the situation worse.

Remember: You Are Getting Paid; To Wait!

Moreover, if you are not feeling well, don't trade.

Remember: You don't have to catch every trade, and you don't have to trade every week.

In fact, our 5 rules are all connected in a way or another.

If you invest money you can’t afford to lose or enter with 10% risk per trade, chances are that you will get emotional and not follow your trading plan objectively by closing your trades before reaching 2R or even entering trades that are not according to your strategy.

In parallel, even if you invest money you can afford to lose and risk 1% per trade, you won’t be consistently profitable if you don’t have a well-defined strategy that gives you an edge over the market technically or through risk management.

In brief, stay away from trading if you don’t have these 5 rules.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

USDJPYHello traders.

I see a poin of interest here. Fundamentally speaking, Bank of Japan has initiated the intervention in order to mitigate the Yen 's depreciation.

Technically speaking we are inside weekly supply zone which is not checked as support up to today.

I see an M pattern forming in daily time frame.

I see two potential entries. One immediate entry and another one if it goes up to test the highs.

142 price are is nice for take profits.

Note: M patterns are not always symmetrical as a nice double top. it can include second high lower that the previous one because they do not want to release the late buyers who bought at the top. They want to grab their money. So, this is a reason I believe it may start selling from now.

Anyhow, Friaday is NFP and it may cause volatility with USD spikes testing Key levels so I want to be safe by reducing the lot seriously and increasing the SL much higher.

If the M is going to form a High> previous top, I will still consider it as a nice entry for short due to stop hunt routine for sellers. (M pattern not symmetrical again)

Good luck!