Editorspick

Retro Editors' picks 2021Going further in our retro EP selection , we present to you a collection of additional scripts from 2021 that have earned a spot in our Editors' picks. These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless of when they were published. To the authors of these highlighted scripts: our sincere thanks, on behalf of all TradingViewers. Congrats!

Circular Candlestick Chart - alexgrover

Dominance Pie Chart - fikira

Tape - LucF

ta (library) - TradingView

MathConstants (library) - RicardoSantos

MathStatisticsKernelFunctions (library) - RicardoSantos

Zigzag Candles - Trendoscope

Over the next three months, in the last week of each month, we will share retro Editors' picks for subsequent years:

July: retro EPs for 2022

August: retro EPs for 2023

September: retro EPs for 2024

They will be visible in the Editors' picks feed.

Previously published retro Editors' picks:

May: retro EPs for 2020

█ What are Editors' picks?

The Editors' picks showcase the best open-source script publications selected by our PineCoders team. Many of these scripts are original and only available on TradingView. These picks are not recommendations to buy or sell anything or use a specific indicator. We aim to highlight the most interesting publications to encourage learning and sharing in our community.

Any open-source script publication in the Community Scripts can be picked if it is original, provides good potential value to traders, includes a helpful description, and complies with the House Rules.

— The PineCoders team

The SECRET is Compounding Tiny Objectives & Finding SatisfactionIn this video I talk about what I don't really find people talking about, which is how important it is to find satisfaction in your trading. When I say 'satisfaction', I am talking about the monetary kind. What do I mean by this?

A problem I used to have in my earlier days was over-trading, revenge trading, blowing accounts, the usual story. I even had a decently high win-rate and I was good at understanding price. What I discovered was that I was not finding satisfaction because I was not risking enough on my trades. You see.. my strategy had a high win-rate with a positive R average, but the setups did not appear that often. Not as rare as a unicorn, but still, I'd have to sit around and wait and wait and wait. By the time my setup came, I put on a small risk, and I won small. Subconsciously, I found that quite frustrating, even though I was actually winning most of my trades. You can imagine how I felt when I lost a trade. I felt like I invested all that time for nothing. One could argue that I was being careful, but the problem was I was being too careful. I age the same as everyone else, and everyone else ages the same as me. I am investing my time into this strategy, time I will never get back. If I am not utilizing my time in relation to the earning potential, then that is a bad investment. Being a psychologically prone person, I made it a serious rule that all my criteria for my setup must be hit before I take that trade, no exceptions. I kept myself on the higher timeframes so that my mental state can safely process what I needed to process, whether it was analytical or just psychological.

Another point was getting over what others were showcasing or doing. Material luxuries and large wins are all subjective things. It was frustrating seeing people trade every single day, most of them with green days. I felt like I had to do the same too to be a good trader. I was WRONG. What I actually need to do was make my system work for me, and that included how I implemented risk and what was satisfying enough for me to pursue. Like I said in the video, if what you want to do is not interesting or attractive to you, you won't want to do it. As long as what you want to do makes sense and isn't you trying to go from zero to a hundred in 2.5 seconds. As the title says, compound tiny objectives but make it satisfying in terms of risk and your time invested.

- R2F Trading

Why Higher Timeframe Analysis Increases Your WIN-RATE!Many traders focus too heavily on lower timeframes, chasing setups without any real context. But what if the secret to improving your consistency was as simple as zooming out?

In this video, we break down why analyzing higher timeframes—and trading in their direction—can significantly increase your win rate across Forex, crypto, stocks, and futures. This isn’t just a theory. It’s a principle used by institutional traders, prop firms, and consistently profitable independent traders.

✅ Here’s what you’ll learn in this deep-dive:

The real purpose of higher timeframe analysis and how it acts like a GPS for your trading decisions.

How to identify structure, liquidity, and key levels on the daily, 4H, and weekly charts

Why trading against the higher timeframe flow often leads to premature stop-outs or fakeouts

The power of multi-timeframe alignment: how to sync HTF bias with LTF entries

How trading with higher timeframe momentum helps filter noise, reduce overtrading, and increase conviction

A walkthrough example showing how to use HTF context to validate a lower timeframe setup

Whether you're trading ICT concepts, Fibs, RSI, VWAP, or your own system—this principle applies. Trading in alignment with the higher timeframe doesn’t just increase your odds, it adds structure, patience, and confidence to your process.

📌 Key takeaway: When you understand what the market is doing on the higher timeframe, you stop guessing and start positioning yourself with the move—not against it.

🛠️ Helpful for traders using:

Smart money concepts (SMC)

ICT-based models (like AMD, OTE, and NDOG)

Supply and demand strategies

Price action or indicator-based systems

PRACTICALLY ANY TYPE OF STRATEGY OR METHODOLOGY

So, I hope the video was insightful for you. Let me know if you apply higher timeframe analysis, and how it has helped you.

- R2F Trading

Retro Editors' picks 2020As we move forward through time, we occasionally must look backward to evaluate our progress and address our shortcomings.

For years, PineCoders has voluntarily analyzed numerous published scripts, selecting the most exceptional among them as Editors' picks . To enhance our process and spotlight more high-quality work from our community, we've conducted a comprehensive review of script publications from the past five years. Through this effort, we've identified several additional scripts that deserve greater recognition than they initially received.

Below is a collection of additional scripts from 2020 that have earned a spot in our Editors' picks. These retrospective selections reflect our continued commitment to honoring outstanding contributions in our community, regardless of when they were published. To the authors of these highlighted scripts: our sincere thanks, on behalf of all TradingViewers. Congrats!

Support Resistance Channels - LonesomeTheBlue

BERLIN Candles - lejmer

Delta Volume Columns Pro - LucF

Range Filter - DonovanWall

Over the next four months, in the last week of each month, we will share retro Editors' picks for subsequent years:

June: retro EPs for 2021

July: retro EPs for 2022

August: retro EPs for 2023

September: retro EPs for 2024

They will be visible in the Editors' picks feed .

█ What are Editors' picks ?

The Editors' picks showcase the best open-source script publications selected by our PineCoders team. Many of these scripts are original and only available on TradingView. These picks are not recommendations to buy or sell anything or use a specific indicator. We aim to highlight the most interesting publications to encourage learning and sharing in our community.

Any open-source script publication in the Community Scripts can be picked if it is original, provides good potential value to traders, includes a helpful description, and complies with the House Rules.

— The PineCoders team

Sail BullishAfter a long consolidation at the bottom Sail has formed a Bullish engulfing candle at the bottom and giving a breakout of the resistance level.

Entry- 111-112

Support- 107.5-107

Target- 120, 125

Disclaimer- This is just for educational purpose please take advice from your financial advisor before making any decision.

Jai Shree Ram

Breaking key resistance — could $BGM repeat $RGC’s 100x rally?Let me introduce a stock that has already generated a profit of nearly 40% and I have no intention of selling it yet. Because both the chart and fundamentals suggest the stock seems to be approaching the point of potential explosion, and it is even possible to increase several times.

This stock is NASDAQ:BGM , a traditional Chinese pharmaceutical chemical company but now it has transformed into an AI productivty platform. More on that later—let’s first take a look at the technicals, which I always pay close attention to.

Firstly,the uptrend remains intact.

Since last year’s stock split, the price has been climbing steadily within a clear uptrend. After breaking above $8.50, it has consistently held above that level for months, showing strong momentum. (I bought in when it dipped back to $8.50 earlier this year and have held since.)

In the recent days, the stock price has successfully broken through the upper limit of the consolidation range that has persisted for nearly 3 months, and has stabilized above $12.

This is a significant breakthrough, and it may indicate that the stock price could potentially start a significant upward rally at any time.

Secondly,the stock is almost fully controlled by the market maker.

There’s a saying in trading: “Volume precedes price.” Since December 2024, BGM’s trading volume has clearly increased, with each spike in volume followed by a small price uptick—money was buying.

Interestingly, each rise is followed by a pullback, but on much lower volume. This volume pattern—rising on gains and shrinking on pullbacks—suggests that the maket maker have accumulated most of the shares and now have strong control. The dips are likely just shakeouts to flush weak hands before a bigger breakout.

Thirdly, low short interest means minimal resistance to a price surge.

According to Nasdaq's data, BGM’s short position was 34,466 shares by 31th March, but dropping to 18,889 shares by April 30,the number of short positions has significantly decreased.

This was showing that as the stock price rose, short sellers mostly exited or turned bullish—clearing major obstacles for further gains.

Technically, everything is set—just waiting for the trigger. Pull the trigger could spark a massive rally, and that trigger may come anytime as the company nears to complete a key transformation.

Yes, the company is transforming from a traditional pharmaceutical firm into a leading AI tech ecosystem. Since last year, it has been actively acquiring companies to enter AI-driven healthcare, insurance, and wellness sectors, aiming to become an industry leader.

①In December 2024, BGM acquired RONS Tech and Xinbao Investment, integrating the AI insurance platform “Duxiaobao” (powered by Baidu’s NASDAQ:BIDU technology). Leveraging 704 million monthly active users, they aim to disrupt traditional insurance sales and drive exponential customer growth.

②In April 2025, BGM acquired YX Management to boost AI applications in insurance and transportation, accelerating the “pharma-insurance-health” ecosystem.

③In May 2025, BGM acquired HM Management and its two subsidiaries—SHUDA Technology and New Media Star—strengthening its algorithm optimization、data modeling and traffic-driven customer acquisition capabilities

After several acquisitions, the company has initially completed its transformation plan. So the "trigger" we are pursuing might emerge during the next major acquisition by the company to complete the final transformation.This is an important milestone. According to reliable sources, the company's next acquisition is likely to take place in the coming June. Let's wait and see.

Another "trigger" may be the company’s next earnings report, which will include the “Duxiaobao” AI insurance business for the first time, expected to add over $5 million in revenue, might to confirm the initial success of the company's transformation. And this is potentially spark a strong stock rally.

These two potential "triggers" are both approaching soon.

If all goes well, how far could this rally go? Let’s refer to the recent strong gains of Chinese stocks like $RGC.

Technically, RGC saw a clear volume increase and price rise around July-August 2024. Then it had a six-month shakeout with low volume pullback (similar to BGM’s current pattern). In March 2025, it launched a major rally, rising over tenfold.

In May, RGC surged again, supported by fundamental news: the company announced FDA approval for its new neurostimulation chip and a Parkinson’s study with Mayo Clinic. From the start to the peak, RGC gained over 100 times in a short period!

Looking at BGM again: after the breakout, the stock will likely first test resistance near $15, which may not be a big hurdle. The real test could be at $24—the pre-split high and the upper boundary of the current “megaphone” consolidation.

Even if the price only reaches around $24 , current investors could nearly double their money. After the company’s fundamental transformation, its revenue and profits potential could grow beyond RGC. So, how high can BGM’s stock go? Let’s wait and see.

Next BTC Peak in Dec 2025?#Bitcoin Duration of Expansion Phases Above Previous All-Time Highs (ATH)

Historically, the time Bitcoin spends above its previous ATH increases with each cycle.

> In 2017, the expansion phase lasted 211 days.

> In 2021, it extended to 285 days, a 74-day increase (+29%).

If this trend continues, the current cycle’s expansion phase (starting Oct 2024) could last 425 days (+29% from 2021), projecting an end in Dec 2025.

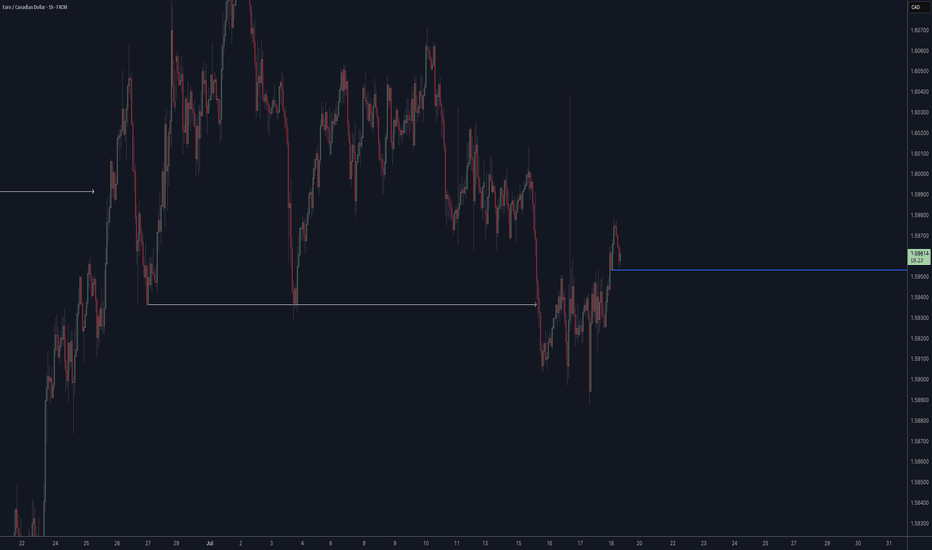

Why you should WAIT for trades to come to YOU!In this video, we dive deep into one of the most underrated but powerful habits that separates consistently profitable traders from the rest: waiting for the trade to come to you.

It sounds simple, even obvious. But in reality, most traders—especially newer ones—feel the constant urge to do something. They scan for setups all day, jump in at the first sign of movement, and confuse activity with progress. That mindset usually leads to emotional trading, overtrading, and eventually burnout.

If you've ever felt the pressure to chase price, force trades, or trade just because you're bored… this video is for you.

I’ll walk you through:

1. Why chasing trades destroys your edge—even when the setup “kind of” looks right

2. How waiting allows you to trade from a position of strength, not desperation

3. The psychological shift that happens when you stop trading to feel busy and start trading to feel precise

4. How the pros use waiting as a weapon, not a weakness

The truth is, trading is a game of probabilities and precision. And that means you don’t need 10 trades a day—you need a few good ones a week that truly align with your plan.

Patience doesn’t mean doing nothing, it means doing the right thing at the right time. And when you develop the skill to sit back, trust your process, and wait for price to come to your level… everything changes. Your confidence grows. Your equity curve smooths out. And most importantly, your decision-making gets sharper.

So if you're tired of overtrading, feeling frustrated, or constantly second-guessing your entries—take a breath, slow it down, and start thinking like a sniper instead of a machine gun.

Let the market come to you. That’s where the real edge is.