Why All You Need Is the Chart: Let the Market Speak FirstYou missed the news? Doesn’t matter. The chart already heard it for you.

________________________________________

1. The Myth of Being “Informed”

Modern traders feel pressured to be constantly plugged in:

• Twitter alerts

• Trump’s latest outburst

• CNBC headlines

It feels like you’re missing out if you’re not watching everything.

But here’s the truth:

By the time you read the news, the market already priced it in.

Being "informed" doesn’t make you early . It usually makes you late .

________________________________________

2. The Chart Already Knows

Imagine a bullish surprise in the economy. You didn’t catch it live.

But when you open your chart, you see this:

📈 A bullish engulfing candle bouncing cleanly off major support.

That’s all you need. That’s your trade. You don’t need to know why it happened.

The chart speaks last. And the chart speaks loudest.

________________________________________

3. Price Is the Final Judge

All the noise — opinions, reports, breaking headlines — flows into a single output: price.

• Economic collapse? The chart shows a break.

• Political turmoil? Price still rejects resistance.

Price is truth.

Instead of asking: " What happened? ", start asking: " What is price doing? "

________________________________________

4. Real-Life Analogy

You don’t need to read the newspaper to know it’s raining. Just look out the window. 🌧️

Same with trading. Just look at the chart.

The price is your weather forecast. React to that. Not to noise.

________________________________________

5. What to Do Instead of Watching News:

• Draw clean support/resistance levels

• Wait for real confirmation (engulfings, breakouts, rejections)

• Manage risk — always

• Be patient. Let the market show its hand

________________________________________

Final Thought:

If something important happened, you’ll see it on the chart. You don’t need 10 sources. You don’t need speed. You need clarity.

Let the chart speak. It knows more than the news ever will.

Educationalpost

Educational Video: How Technical Analysis worksThe chart is explained in the video and we can see how you can get an Alpha over the market by knowing when to invest in a stock. Selecting fundamentally strong company is very important but why investing in a Fundamentally strong company when it has a technical breakout can give you a better yield on your investment is explained in the video.

Disclaimer: This is not a recommendation to buy Tata Consumer Product stock but we are using it as an illustration to understand what Technical analysis is and how it works.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Dealing with Stress in Trading: The Silent Killer of PerformanceTrading is hard. But not just technically or economically — emotionally, it's one of the most demanding things you can do.

Charts, indicators, news, setups — they’re all part of the job. But behind every click, there’s a person reacting to fear, frustration, regret, and pressure.

And that’s where stress creeps in.

In this article, we’ll explore:

• Why trading stress hits harder than most think

• How it manifests (and sabotages) your decisions

• Practical ways to reduce and manage stress

• The mindset shift that changes everything

________________________________________

🔥 Why Trading Is Uniquely Stressful

Most jobs reward consistency. Trading, ironically, punishes it at times.

You can do everything “right” and still lose money. You can follow your plan, manage risk, and still watch a red candle wipe your equity.

The problem?

Our brains aren’t built for that kind of randomness. We crave cause-effect logic — but markets aren't and most of all don’t care.

This disconnect creates cognitive dissonance . The result? Stress builds up.

________________________________________

🧠 How Stress Sabotages Traders (Without Them Realizing)

Stress doesn’t always show up as panic. More often, it shows up as:

• Overtrading (trying to ‘fix’ bad trades emotionally)

• Freezing (not taking good setups out of fear)

• Revenge trading (turning a bad trade into a disaster)

• Inconsistency (changing strategy mid-week, mid-trade, mid-breath)

• Physical symptoms (fatigue, headaches, insomnia — yes, it's real)

Left unchecked, stress creates a loop:

Stress → bad trades → more stress → worse decisions.

________________________________________

🛠️ Practical Techniques to Manage Trading Stress

Here’s what actually helps — not the Instagram-fluff, but what real traders use:

1. Create Pre-Defined Trade Plans

Stress loves uncertainty. But when you enter a trade with exact entries, stops, and targets, you leave less room for panic-based decisions.

✅ Pro tip: Write your trade plan down. Don’t trade from memory.

________________________________________

2. Use the 3-Strike Rule

If you take 3 consecutive losses or bad trades — stop for the day, or if you are a swing trader, stop for the week, come back on Monday. It’s not about revenge. It’s about protecting mental capital.

“When in doubt, protect your focus. You can’t trade well without it.”

________________________________________

3. Build a Trading Routine (Like a Ritual)

Start each session the same way. Same coffee, same chart review, same breathing.

Why? It anchors your brain. Predictability in your environment reduces the emotional chaos inside your head.

________________________________________

4. Step Away from the Screen (Yes, Physically)

After a tough trade, move. Walk. Stretch. Get outside. Go to gym, ride your bike(these I do most often). Reset your nervous system. Trading is mental, but stress is physical too.

You’re not a robot. Don't act like one.

________________________________________

5. Track Your Emotional State (Not Just P&L)

Keep a trading journal where you note how you felt before/after trades.

You’ll find patterns like:

• “I lose when I’m bored and looking for action”

• “My best trades happen when I feel calm and centered”

Awareness = control.

________________________________________

🧭 The Mindset Shift: From Outcome to Process

This might be the most important thing I’ll ever tell you:

Detach from results. Fall in love with process.

Your goal isn’t to win every trade.

Your goal is to execute your plan with discipline.

Every time you do that — even on a losing trade — you’re winning the real game.

That’s how stress stops being the master and becomes the servant.

________________________________________

🧘 Final Thought: Stress Will Never Go Away — and That’s Okay

You’ll always feel something. But the goal isn’t to be emotionless — it’s to be aware and in control.

Trading is like martial arts: the best fighters aren’t calm because they feel nothing. They’re calm because they’ve trained their response.

So train yours.

________________________________________

💬 Remember, consistency in mindset creates consistency in results.

Trading is a business

The masses have the wrong ideas about Trading. It is a business and just like others it involves risk. We grow, we learn, earn and scale up. Crafting a plan is essential to success and character also play a key role here.

In this business, risk is an inherent part of the equation. Just like any other enterprise, trading exposes you to challenges and setbacks, but it's how you manage these risks that can differentiate a thriving business from one that falters. Careful risk management—whether through proper position sizing, stop-loss strategies, or diversification—is the foundation that helps protect your capital while you grow your business over time.

Crafting a trading plan is essential. This plan should not only outline your entry and exit strategies based on rigorous analysis but also incorporate a framework to evaluate your performance critically. A well-crafted plan serves as a roadmap, guiding your decisions in both favorable and challenging market conditions. Moreover, it creates a discipline that protects you from emotional reactions that can often lead to impulsive decisions—a common pitfall in trading.

Character plays a crucial role as well. In trading, psychological fortitude, resilience in the face of losses, and the humility to learn from mistakes are qualities that separate the successful from the rest. Many people mistakenly believe that a few big wins can offset a series of missteps; however, it is the consistent, calculated, and disciplined approach that leads to sustainable growth. This business mindset—acknowledging that each trade is a learning opportunity and a step in scaling up your efforts—is what ultimately propels traders to long-term success.

In essence, re-framing trading as a business fosters a mindset where every decision is taken seriously, every mistake is analyzed for improvement, and every trade is seen as a building block for growth. This approach not only minimizes unnecessary risks but also enables you to scale up with confidence.

I'm curious—what elements of your trading plan do you find most effective at keeping your business mindset in check, and are there aspects you'd like to refine further?

12 Tips Every New Forex Trader Should Know!New to Forex? These 12 tips will save you months of frustration.

Forex trading can be overwhelming in the beginning, but it doesn’t have to be. Whether you're just starting out or still finding your feet, these tips are designed to help you avoid common mistakes and fast-track your learning curve.

✅ Save this post

✅ Follow for more Forex insights

✅ Drop a comment with your biggest struggle as a beginner, I might turn it into the next tip!

Let’s grow together. 📈💪

Why I Only Buy Dips / Sell Rallies When I Trade GoldWhen it comes to trading Gold (XAUUSD), I’ve learned one key truth: breakouts lie, but dips/rallies tell the truth.

That’s why I stick to one rule that has kept me consistently profitable:

I only buy dips in an uptrend and only sell rallies in a downtrend.

Let me explain exactly why this approach works so well—especially on Gold, a notoriously tricky market.

________________________________________

1. 🔥 Gold is famous for fake breakouts

Breakouts on Gold often look amazing… until they trap you.

You enter just as price breaks a key level—then suddenly it reverses and stops you out.

This happens because Gold loves to tease liquidity. It breaks highs or lows just enough to activate stop losses or attract breakout traders, only to reverse.

Buying dips or selling rallies protects you from these traps by entering from value, not hype.

________________________________________

2. ✅ I get better stop-loss placement and risk:reward

When I buy a dip, I can place my stop below a strong level (like a support zone or swing low).

That gives me tight risk and allows for big reward potential—often 1:2, 1:3 or more.

Breakout trades, on the other hand, often require wider stops or result in poor entries due to emotional execution.

________________________________________

3. ⏳ I get time to assess the market

False breakouts happen fast. But dips usually form more gradually.

That gives me time to analyze price action, spot confirmation signals, and even scratch the trade at breakeven if it starts to fail.

This reduces emotional decisions and increases my accuracy.

________________________________________

4. 🎯 Gold respects key levels more than it respects momentum

Even in strong trends, Gold often retraces deeply and retests zones before continuing.

That means entries near key levels—on a dip or rally—are more reliable than chasing price.

I’d rather wait for the zone than jump in mid-air.

________________________________________

5. 🔁 Even in aggressive trends, Gold often reverts to the mean

Lately, Gold has been trending hard—no doubt.

But even during explosive moves, it frequently pulls back to key moving averages or demand zones.

That’s why mean reversion entries on dips or rallies continue to offer excellent setups, even in fast-moving markets.

________________________________________

6. 🧠 I benefit from retail trader mistakes

Most traders get excited on breakouts.

But what usually happens? The breakout fails, and the price returns to structure.

By waiting for the dip/rally (when others are panicking or taking losses), I can enter at a discount and ride the move in the right direction.

________________________________________

7. 🧘♂️ This strategy forces patience and discipline

Waiting for dips or rallies requires patience.

You don’t jump in randomly. You plan your entry, your stop, your take profit—calmly.

That mental discipline is a trading edge on its own.

________________________________________

8. 📊 I align myself with probability, not emotion

In an uptrend, buying a dip is logical.

In a downtrend, selling a rally is natural.

Trying to “chase the breakout” is emotional—trying to get in on the action, fearing you'll miss the move.

I trade with the trend, from the right zone, and with a clear plan.

________________________________________

9. 🕒 I can use pending limit orders and walk away

One of the most underrated benefits of trading dips and rallies?

I don’t need to chase the market or be glued to the screen.

When I see a clean level forming, I simply place a buy limit (or sell limit) with my stop and target predefined.

This saves time, reduces overtrading, and keeps my emotions in check.

It’s a set-and-forget approach that fits perfectly with Gold’s tendency to return to key zones—even during high volatility.

________________________________________

🔚 Final thoughts

There’s no perfect trading strategy. But when it comes to Gold, buying dips and selling rallies consistently keeps me on the right side of probability.

I avoid the emotional traps. I get better entries. And most importantly, I protect my capital while maximizing reward.

Next time you see Gold breaking out, ask yourself:

“Is this real… or should I just wait for the dip/rally?”

That question might save you a lot of pain.

There's a Time to Trade and a Time to Watch Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to trade and a time to watch.

Conservation of Capital is Essential 💰

The best traders understand that their capital is their lifeline. It’s not about making trades; it’s about making the right trades.

The market doesn’t reward effort; it rewards patience and precision.

Instead of jumping into mediocre setups, learn to appreciate the value of patience .

Every time you enter a trade that doesn’t meet your criteria, you risk your capital unnecessarily. And every loss chips away at your ability to capitalize on the real opportunities when they come. Capital preservation should be your priority.

Focus Only on A+ Signals 📌

Not every setup is worth your time and money. The goal should be to only enter positions that offer a clear edge – signals that you’ve identified as high-probability opportunities through your experience and strategy.

A + setups are those that offer:

• A clear technical pattern or setup you've mastered.

• A favorable risk-to-reward ratio, ideally 3:1 or better.

• Alignment with your overall strategy and market context.

If these criteria aren't met, it’s often better to do nothing. Waiting for the right setup and market conditions is part of the game.

The Power of Doing Nothing 🤫

Inaction is a skill. It requires discipline to avoid the urge to "force" trades. But the market will always be there tomorrow , and so will the opportunities.

By learning to watch rather than trade during uncertain or suboptimal conditions, you avoid unnecessary losses and conserve your capital for when the market truly presents an edge.

Conclusion 🚀

Trading is about quality, not quantity. Respect your capital and recognize that sometimes, the smartest move is to wait. Let the market be clear.

Remember, there’s a time to trade and a time to watch. Master this balance, and you’ll be miles ahead of most traders.

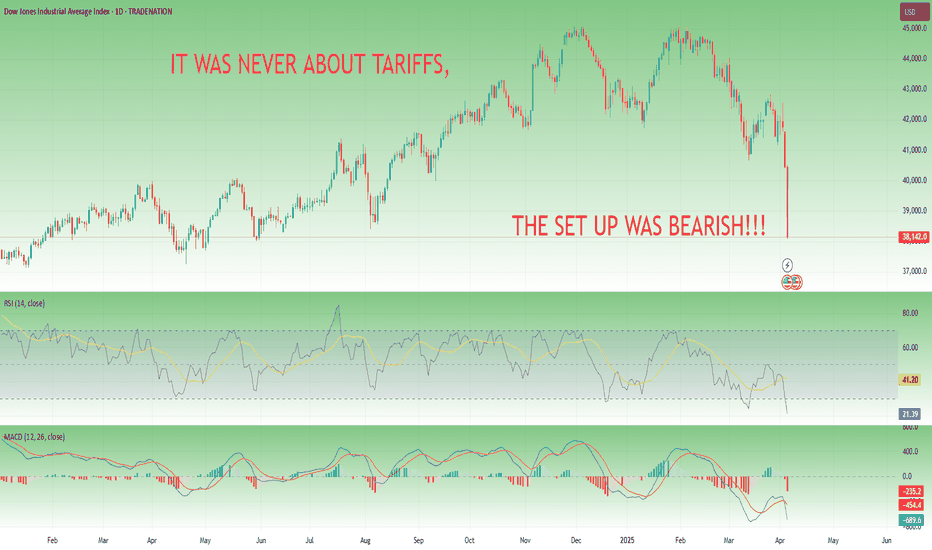

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.

As soon as the wedge broke on NAS100 and SPX broke the double top's neck line the path was clear — risk off.

________________________________________

📉 I Was Calling This Since Q1

The targets were public:

SPX = 5,200. NAS100 = 17,500.

And the logic was simple:

• Overextension in AI-led tech

• Complacent VIX environment

• Crowded long positioning

• Bearish divergences and fading momentum

Double Top and Rising Wedge on SPX and Nas100

We didn’t need a reason to drop. The market had been levitating without support. All we needed was a trigger — and we got one.

________________________________________

🧭 Lesson: Trade the Structure, Not the Story

Here’s what I hope you take away:

✅ Setups come first. News comes later.

✅ If it wasn’t tariffs, it would’ve been CPI, earnings, Fed minutes, or a bird on a wire

✅ Don’t chase headlines. Anticipate setups.

The best trades aren’t reactive. They’re built on structure, sentiment, and timing — not waiting for CNBC to tell them what’s happening.

________________________________________

🔚 Conclusion: It Was Never About Tariffs

Tariffs were the match.

But the market was already soaked in gasoline.

This correction was technical, predictable, and clean.

📝 Post Scriptum — The Setup Shapes the Narrative

Let me be clear:

I’m not a Trump fan. Hoho — not by far.

But I’ll swear this on any chart:

If the setup had been the opposite — double bottom, falling wedge, positive divergences, and improving momentum — these exact same tariffs would’ve been interpreted as “bold leadership,” “pro-growth protectionism,” or “markets pricing in a stronger America.”

That’s how it works.

Price action leads. Narrative follows.

When structure is bullish, traders celebrate even bad news.

When structure is bearish, even good news becomes a reason to sell.

So no — it wasn’t about Trump. It never is. It’s about where the market wants to go. The rest is storytelling.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Understanding Market Downturns: How to Navigate the StormLately, the markets have been in a downtrend, leaving many traders and investors wondering what comes next. Whether it’s stocks, crypto, or other financial assets, downturns are an inevitable part of the game. While they can be unsettling, they also present opportunities—if you know how to navigate them.

Market declines happen for many reasons: economic slowdowns, geopolitical tensions, changes in interest rates, or even shifts in investor sentiment. Regardless of the cause, understanding the different types of market downturns, their impact, and the right strategies to handle them is key to making informed decisions.

So, let’s break down market downturns, how they unfold, and what you can do to stay ahead.

📊 DOWNTURN #1: Down -2% — A Ripple of Volatility

A -2% drop is like a minor speed bump—annoying but not alarming. These small dips are common and often part of natural market fluctuations.

✅ Key Characteristics:

• Typically short-lived and often recovers quickly.

• Can be triggered by minor news events, investor sentiment shifts, or profit-taking.

• Provides opportunities to enter positions at a slightly better price.

💡 Strategy:

• If you're a long-term investor, ignore these small movements. They are normal.

• If you're a trader, these dips can be buying opportunities in an uptrend.

________________________________________

🔄 DOWNTURN #2: Down -5% — The Pullback Perspective

A 5% decline is often called a pullback—a temporary market retreat within an ongoing trend.

✅ Key Characteristics:

• Pullbacks often occur after strong rallies as the market cools off.

• Typically seen as healthy corrections in an overall uptrend.

• Not necessarily a signal of long-term weakness.

💡 Strategy:

• Long-term investors should hold steady and potentially add to positions.

• Swing traders may look for a bounce at key support levels (moving averages, previous highs/lows).

________________________________________

🛑 DOWNTURN #3: Down -10% — Entering Correction Territory

When a market drops 10% from its recent high, it officially enters correction territory.

✅ Key Characteristics:

• Often caused by changes in economic outlook, inflation concerns, or major geopolitical events.

• Moving averages may start crossing downward, signaling caution.

• Momentum shifts, and bearish traders begin to take control.

💡 Strategy:

• If you’re a long-term investor, consider rebalancing your portfolio or hedging with defensive assets.

• Traders may look for short opportunities or play reversals at support levels.

• Be cautious with leverage—downturns can accelerate quickly.

________________________________________

🐻 DOWNTURN #4: Down -20% — The Bear Market Looms

A 20% drop or more marks a bear market, signaling a significant shift in market sentiment.

✅ Key Characteristics:

• Confidence is shaken; investors turn risk-averse.

• Defensive sectors (utilities, consumer staples, healthcare) tend to outperform.

• Market psychology shifts from "buying the dip" to "protecting capital."

💡 Strategy:

• Consider defensive positions, hedging strategies, or increasing cash reserves.

• Avoid high-risk assets—stocks with weak fundamentals often fall the hardest.

• If you’re a trader, look for short-selling opportunities or inverse ETFs.

________________________________________

⚠️ DOWNTURN #5: Down -50% — The Market Crash Crisis

A 50% market decline is rare but catastrophic, often fueled by deep economic crises.

Historical Examples:

• 2008 Financial Crisis: Banks collapsed, and global markets fell over 50%.

• Dot-Com Bubble (2000): Tech stocks crashed after unsustainable hype.

• Oil Crisis (1973-74): Economic stagnation and inflation led to severe losses.

✅ Key Characteristics:

• Panic selling dominates the market.

• Fear-driven liquidation leads to extreme undervaluation.

• Long-term recovery often follows—but timing is uncertain.

💡 Strategy:

• If you have cash reserves, these moments present once-in-a-decade buying opportunities (but patience is needed).

• Dollar-cost averaging (DCA) can be effective for long-term investors.

• Traders should expect extreme volatility—both to the downside and in sharp relief rallies.

________________________________________

🌧️ DOWNTURN #6: Prolonged Downside — The Economic Depression

Unlike a crash, a depression is a long-term, sustained downturn that deeply affects the economy.

✅ Key Characteristics:

• Prolonged recession, lasting years rather than months.

• Unemployment soars, economic activity collapses.

• Investor confidence remains low for an extended period.

Historical Example: The Great Depression (1930s)

• U.S. unemployment hit 25%.

• Stock markets stayed depressed for a decade.

• Industrial production and wages plummeted.

💡 Strategy:

• Preservation of capital is key—cash, gold, and defensive assets become crucial.

• Income-producing investments (dividend stocks, bonds) provide stability.

• Patience is essential; full recovery can take years.

________________________________________

🧭 Conclusion: Navigating Market Downturns Like a Pro

Downturns are an inevitable part of investing and trading. While they can be unsettling, being informed and prepared is the key to staying ahead.

✅ Key Takeaways:

• Minor dips (-2% to -5%) are normal and often present opportunities.

• Corrections (-10%) require caution, but markets usually recover.

• Bear markets (-20%) signal broader economic concerns—risk management is crucial.

• Crashes (-50%) are rare but can create massive buying opportunities for long-term investors.

• Depressions are the most severe and require a long-term, defensive approach.

No matter the downturn, the key is to stay calm, adjust your strategy, and use market cycles to your advantage.

With the right approach, you won’t just survive market downturns—you’ll thrive in the long run. 🚀

Starting over in trading- A short guideThe internet has made it easier than ever to learn trading for free. You have access to blogs, videos, books, podcasts, and more. Yet, most traders still fail.

Why?

Because there’s too much information. It’s overwhelming, confusing, and filled with conflicting advice.

So, if I had to start over from scratch, here’s exactly how I’d do it—step by step.

________________________________________

Step 1: Master Risk Management

No matter what type of trader you become—day trader, swing trader, options trader, quantitative trader, etc.—risk management is the foundation of long-term success.

It’s also one of the easiest things to master, and once you do, it will pay off for the rest of your trading career.

Risk Management Essentials:

✅ Never risk more than 1-2% of your account per trade.

✅ Always use stop losses to protect your capital.

✅ Focus on risk-to-reward ratios (aim for at least 1:2 or better).

✅ Manage position sizing properly to avoid blowing up your account.

Once you understand how to protect your capital, it’s time to expose yourself to the trading world.

________________________________________

Step 2: Learn & Explore Different Trading Styles

When you're just starting, you don’t know what you don’t know.

Your goal at this stage is to explore different trading strategies, tools, and methods.

What to Learn:

🔹 Candlestick patterns & price action

🔹 Indicators (moving averages, RSI , MACD , etc.)

🔹 Chart patterns (head & shoulders, triangles, etc.)

🔹 Market structures (support/resistance, trends, ranges)

🔹 Different trading styles (day trading, swing trading, scalping, momentum trading, etc.)

Mindset for This Phase:

🚀 Keep an open mind—don’t judge strategies too early.

🚀 Focus on learning rather than making money right away.

🚀 Accept that not everything will work for you—and that’s okay.

At this stage, your goal is not to become an expert in everything but to discover what resonates with you.

________________________________________

Step 3: Pick ONE Strategy & Go Deep

After exploring different strategies, you need to commit to ONE.

This eliminates information overload and allows you to focus on mastering a single trading method.

How to Choose a Strategy:

🔹 Does it fit your personality? (e.g., If you hate fast decision-making, avoid scalping.)

🔹 Does it match your lifestyle? (e.g., If you have a full-time job, swing trading might be better than day trading.)

🔹 Can you understand the logic behind it? (A good strategy should be simple, not overly complicated.)

Example: Mean Reversion Strategy in Stocks

• Identify stocks in an uptrend 📈

• Wait for a pullback (price moves lower)

• Enter when the stock shows signs of resuming the trend

• Sell on the next rally

By focusing on one strategy, you eliminate confusion and make faster progress.

________________________________________

Step 4: Create & Refine Your Trading Plan

Now that you have a strategy, it’s time to turn it into a structured trading plan.

Your trading plan should include:

✅ Market Conditions – When will you trade? Trending or ranging markets?

✅ Entry Rules – What signals will you use to enter a trade?

✅ Exit Rules – When will you take profits or cut losses?

✅ Risk Management – How much will you risk per trade?

💡 Example Trading Plan (Momentum Trading):

• Market: Trade only in strong uptrends.

• Entry: Buy when the price breaks above a key resistance level.

• Exit: Take profit at 2x risk, cut losses at a 1x risk.

• Risk Management: Risk only 1% of the account per trade.

A clear, structured plan removes emotion from trading and keeps you disciplined.

________________________________________

Step 5: Test Your Strategy (Before Risking Real Money)

You never know if a strategy works until you test it.

How to Test a Trading Strategy:

🔹 Backtesting – Analyze past data to see if the strategy has worked historically.

🔹 Forward Testing (Paper Trading) – Trade in a demo account without real money.

What You’ll Learn from Testing:

✔️ Does the strategy make money over time?

✔️ How often does it win vs. lose?

✔️ How big are the drawdowns?

✔️ Does it match your risk tolerance?

If the strategy performs well in testing, you now have a solid foundation to trade with real money.

If it doesn’t work, tweak and improve it—this is part of the process.

________________________________________

Final Thoughts: The Key to Long-Term Success

Starting over isn’t about finding the “perfect” system —it’s about following a structured approach.

Here’s the Path to Trading Success:

1️⃣ Master Risk Management – Protect your capital first.

2️⃣ Learn & Explore – Understand different strategies & tools.

3️⃣ Pick ONE Strategy – Focus on a proven method.

4️⃣ Create a Trading Plan – Define your rules clearly.

5️⃣ Test & Improve – Validate your strategy before going live.

🔥 Bonus Tip: Trading success is 80% psychology and 20% strategy. Stay patient, disciplined, and treat trading like a business—not a get-rich-quick scheme.

Trading Miscalibration: Crypto Aims Too High, FX Aims Too LowI was thinking about something fascinating—the way traders approach different markets and, in my opinion...

One of the biggest mistakes traders make is failing to calibrate their expectations based on the market they’re trading.

📌 In crypto, traders dream of 100x gains, refusing to take profits on a 30-50% move because they believe their coin is going to the moon.

📌 In Forex and gold, the same traders shrink their expectations, chasing 20-30 pip moves instead of riding 200-500 pip trends.

Ironically, both approaches lead to frustration:

🔴 Crypto traders regret not taking profits when the market crashes.

🔴 FX and gold traders regret not holding longer when the market runs without them.

If you want to be a profitable trader, you must align your strategy with the reality of the market you’re trading.

________________________________________

Crypto: Stop Aiming for the Moon—Trade Realistic Outcomes

Crypto markets are highly volatile, and while 10x or 100x gains can happen, they are rare and unpredictable. However, many traders have been conditioned to expect extreme returns, leading them to ignore solid 30-50% gains—which are already fantastic trades in any market.

🔴 The Problem: Holding Too Long & Missing Profits

Many traders refuse to take profits on a 30-50% move, convinced that a 10x ride is around the corner. But when the market reverses, those unrealized gains disappear—sometimes turning into losses.

🚨 Frustration:

"I was up 50%, but I got greedy, and now I’m back to break-even—or worse!"

✅ The Fix: Take Profits at 30-50% Instead of Waiting for 10x

✔️ Take partial profits at key resistance levels.

✔️ Use a trailing stop to lock in gains while allowing for further upside.

✔️ Understand that even professional traders take profits when they’re available—they don’t blindly hold for the next 100x.

📉 Example:

If Bitcoin jumps 30% in a month, that’s already a massive move! Instead of waiting for 200%, a disciplined trader locks in profits along the way. Similarly, if an altcoin is up 50% in two weeks, securing profits makes sense—instead of watching it all disappear in a market dump.

________________________________________

FX and Gold: Stop Thinking Small—Aim for Big Market Trends

On the other hand, when it comes to Forex and gold, many traders shrink their expectations too much. Instead of capturing multi-hundred-pip moves, they settle for 20-30 pip scalps, constantly entering and exiting the market, exposing themselves to unnecessary whipsaws.

🔴 The Problem: Exiting Too Early & Missing Big Trends

Unlike crypto, where traders hold too long, in FX and gold, they don’t hold long enough. Instead of riding a 200-500 pip move, they panic-exit for a small profit, only to watch the market continue without them.

🚨 Frustration:

"I closed at 30 pips, but the market kept running for 300 pips! I left so much money on the table!"

✅ The Fix: Target 200-500 Pip Moves Instead of Scalping

✔️ Focus on higher timeframes (4H, daily) for clearer trends.

✔️ Set realistic yet ambitious targets —200-300 pips in Forex, 300-500 pips in gold.

✔️ Use a strong risk-reward ratio (1:2, 1:3, even 1:5) instead of taking premature profits.

📉 Example:

• If EUR/USD starts a strong downtrend, why settle for 30 pips when the pair could drop 250 pips in a week?

• If gold breaks a major resistance level, a move of 300-500 pips is entirely possible—but you won’t catch it if you exit at 50 pips.

________________________________________

Why Traders Fail to Calibrate Properly

So why do traders fall into this misalignment of expectations?

1️⃣ Social Media & Hype Culture – Crypto traders are bombarded with "to the moon" narratives, making them feel like 30-50% gains are not enough. Meanwhile, in Forex, traders get stuck in a scalping mindset, thinking that small, frequent wins are the only way to trade.

2️⃣ Fear of Missing Out (FOMO) vs. Fear of Losing Profits (FOLP)

• In crypto, FOMO keeps traders holding too long. They don’t want to miss "the big one," so they refuse to take profits.

• In FX and gold, fear of losing small profits makes traders exit too soon. They don’t let trades develop because they fear a pullback.

3️⃣ Misunderstanding Market Structure – Each market moves differently. Crypto is highly volatile but doesn’t always go 10x. Forex and gold move slower but offer consistent multi-hundred-pip trends. Many traders don’t adjust their strategies accordingly.

________________________________________

The Solution: Align Your Strategy with the Market

🔥 In crypto, don’t wait for 10x— start taking profits at 30-50%.

🔥 In FX and gold, don’t settle for 30 pips—hold for 200-500 pip moves.

By making this simple mental shift, you’ll:

✅ Trade smarter, not harder

✅ Increase profitability by targeting realistic moves

✅ Reduce stress and overtrading

________________________________________

Final Thoughts: No More Frustration!

The calibration problem leads to frustration in both cases:

⚠️ Crypto traders regret not taking profits when the market crashes.

⚠️ FX and gold traders regret not holding longer when the market trends.

💡 The solution? Trade according to the market's behavior, not emotions.

BTCUSD Daily Chart AnalysisBTCUSD Daily Chart Analysis:

As you can see on the daily chart, Bitcoin is currently at a critical juncture. We've witnessed a strong uptrend culminating in a high near $108,000, followed by a significant correction.

Key Levels:

Support: The $80,000 to $82,000 zone is proving to be a crucial support level.

Resistance: We have immediate resistance around $92,000 to $96,000, and the major resistance at the recent high of $108,000.

Technical Observations:

The recent pullback is testing the aforementioned support zone.

Crucially, I'm observing a bullish divergence on the RSI, indicating potential weakening of the downward momentum.

Additionally, a bullish MACD crossover is imminent, further reinforcing the possibility of a reversal.

Potential Scenarios:

If the $80,000 to $82,000 support holds, the bullish divergence and MACD crossover suggest a strong likelihood of a bounce. We could see a move towards the $92,000 to $96,000 resistance area. A successful break above that level could propel BTC back towards the $108,000 highs.

Conversely, a break below the $80,000 support would invalidate the bullish signals and likely lead to further downside, with potential targets around $76,000 and $72,000.

Conclusion:

Bitcoin is currently presenting a compelling setup. The confluence of a key support test, bullish RSI divergence, and a potential MACD crossover suggests a high probability of a bullish reversal. However, risk management is paramount, and traders should be prepared for potential downside if the support fails.

Stop chasing 20-30 pips if you want to become profitableOne of the biggest obstacles for traders who want to become consistently profitable is the mindset of chasing small 20-30 pip moves.

While it may seem appealing to enter and exit trades quickly for immediate profits, this strategy is often inefficient, risky, and unsustainable in the long run. Here’s why you should change your approach if you want to succeed in trading.

________________________________________

1. Trading Costs Eat Into Your Profits

When you target small moves, you need to open and close many trades. This means that spreads and commissions will eat up a significant portion of your profits. If you have a spread of 2-3 pips (depending on the pair) and you’re only aiming for 20-30 pips per trade, a consistent percentage of your potential gains is lost to execution costs.

________________________________________

2. High Risk Compared to Reward

A smart trader focuses on a favorable risk-reward ratio, such as 1:2, 1:3 or even 1:4. When you chase just 20-30 pips, your stop-loss has to be very tight, making you highly vulnerable to the normal volatility of the market. An unexpected news release or a liquidity spike can stop you out before the price even reaches your target.

________________________________________

3. You Miss Big Moves and Real Opportunities

Professional traders focus on larger trends and significant price movements of hundreds of pips. The market doesn’t move in a straight line; it goes through consolidations, pullbacks, and major trends. If you’re busy trading short-term 20-30 pip moves, you’ll likely miss the big trends that offer more sustainable profits and better risk management.

________________________________________

4. Increased Stress and Emotional Trading

Short-term trading requires constant monitoring and quick decision-making. This increases your level of stress and negative emotions like fear and greed, leading to costly mistakes. In the long run, this trading style is mentally exhausting and difficult to sustain.

________________________________________

How to Change Your Approach to Become Profitable

✅ Think in terms of larger trends – Focus on 200-300+ pip moves instead of small fluctuations.

✅ Aim for a strong risk-reward ratio – Look for setups with at least 1:2 risk-reward to maximize your profits.

✅ Use higher timeframes – Charts like 4H or daily provide clearer signals and reduce market noise.

✅ Be patient and wait for the best setups – Don’t enter trades just for the sake of activity; wait for high-probability opportunities.

Crypto: From "HODL Paradise" to a Speculator’s PlaygroundDuring past bull markets, a simple HODL strategy worked wonders.

Bitcoin and Ethereum set the market trend, and altcoins followed with explosive gains. If you bought the right project before the hype wave, the profits were massive.

However, today’s market is vastly different:

✅ Liquidity is unevenly distributed – Only a handful of major projects attract serious capital, while many altcoins stagnate.

✅ Investors are more sophisticated – Institutional players and smart money dominate, making retail-driven pumps less frequent.

✅ Not all coins pump together – Only projects with real utility and solid tokenomics see sustainable growth.

________________________________________

2. What Matters Now? Strategies for the New Crypto Era

To succeed in the current market, you need a more calculated approach. Here’s what you should focus on:

🔹 Technical Analysis

You can’t just buy blindly and hope for a moonshot. Understanding support and resistance levels, price patterns, trading volumes, etc. is crucial.

Example: If an altcoin has surged 50% in a few days and reaches a strong resistance level, it’s not a buying opportunity—it’s a sell signal for short-term traders.

🔹 Tokenomics and Supply Mechanics

In 2017 and 2021, as long as a project had a compelling whitepaper, it could attract investors. Now, you need to analyze total token supply, distribution models, utility, and vesting schedules.

Example: If a project has an aggressive vesting schedule where early investors and the team receive new tokens monthly, there will be constant selling pressure. No matter how good the technology is, you don’t want to be caught in a dumping cycle.

🔹 Market Psychology and Speculative Cycles

Crypto is driven by emotions. You need to recognize when the crowd is euphoric (time to sell) and when fear dominates (time to buy).

Example: If a project is all over Twitter, Telegram, and TikTok, it might already be near the top. On the other hand, when a solid project is ignored and trading volume is low, it could be a prime accumulation opportunity.

________________________________________

3. Realistic Expectations: 30-50-100% Are the New "100x"

If catching a 10x or 100x was common in the past, those days are largely over. Instead, 30-50-100% gains are far more realistic and sustainable.

Why?

• The market is more mature, and liquidity doesn’t flood into random projects.

• Most "100x" gains were pump & dump schemes, which are now avoided by smart investors.

• Experienced traders take profits earlier, limiting parabolic price action.

Recommended strategy:

1. Enter early in a solid project with clear utility and strong tokenomics.

2. Set realistic profit targets (e.g., take 30% profit at +50%, another 30% at +100%, and hold the rest long-term).

3. Don’t wait for a “super cycle” to make money—take profits consistently.

________________________________________

4. Conclusion: Adapt or Get Left Behind

The crypto market has evolved from a “HODL Paradise” where almost any coin could 10-100x into a speculator’s playground, favoring skilled traders and informed investors.

To stay profitable, you must:

✅ Master technical analysis and identify accumulation vs. distribution zones.

✅ Pick projects with solid tokenomics and avoid those with aggressive unlock schedules.

✅ Set realistic expectations—forget about 100x and aim for sustainable 30-100% gains.

✅ Stay flexible and adapt to market psychology and emerging trends.

Crypto is no longer a game of luck. It’s a game of knowledge and strategy. If you don’t adapt, you’ll be stuck waiting for a 100x that may never come.

So, at least this is my opinion. But what about you? Do you think crypto is still a "HODL paradise," or are we fully in the era of skilled traders and speculators?

Will we ever see another cycle where almost everything pumps together, or is selective investing the new reality?

I’d love to hear your thoughts—drop a comment below and let’s discuss

Mastering MACD- Complete Guide- 10 ways to trade itThe Moving Average Convergence Divergence (MACD) is a versatile indicator that can help traders navigate the markets with precision. From trend identification to momentum assessment, the MACD provides multiple actionable insights. In this educational post, we’ll explore the key ways to use MACD effectively, with an example illustration accompanying each strategy.

________________________________________

1. Signal Line Crossovers

The most common use of MACD is the signal line crossover, which identifies potential shifts in market momentum:

• Bullish Signal: When the MACD line (fast-moving) crosses above the signal line (slow-moving), it suggests upward momentum is increasing. This can be an entry signal for a long trade. Bullish crossovers often occur after a period of consolidation or a downtrend, signaling a reversal in market sentiment.

• Bearish Signal: When the MACD line crosses below the signal line, it signals downward momentum, often triggering a short-selling opportunity. Bearish crossovers can occur during retracements in an uptrend or at the start of a bearish reversal.

How to Use: Look for confirmation from price action or other indicators, such as a breakout above a resistance level for a bullish signal or a breakdown below support for a bearish signal. It's essential to avoid acting solely on a crossover; consider volume (stocks, crypto), candle stick formations and other market conditions.

Example: A bullish crossover on the daily chart on TRADENATION:XAUUSD indicates a potential buying opportunity as the price begins to rise. Add a stop-loss below recent lows to manage risk and look for a 1:2 risk:r eward in the next resistance.

________________________________________

2. Zero Line Crossovers

The MACD’s zero line acts as a boundary between bullish and bearish momentum, making it a valuable trend confirmation tool:

• Above Zero: When the MACD line moves above the zero line, it confirms an uptrend, as the fast-moving average is above the slow-moving average. Sustained movement above zero often indicates a strong bullish trend.

• Below Zero: A MACD line below zero reflects a downtrend, indicating bearish market conditions. Persistent movement below zero confirms bearish momentum.

How to Use: Use the zero line crossover to validate trades based on other signals, such as candlestick patterns or trendline breaks. The crossover can act as a second layer of confirmation for existing trade setups.

Example: MACD on a crypto pair crosses above the zero line, confirming the start of a new bullish trend. Traders can combine this with volume analysis to ensure strong market participation.

________________________________________

3. Histogram Analysis

The histogram represents the distance between the MACD line and the signal line, offering insights into momentum:

• Expanding Histogram: Indicates strengthening momentum in the direction of the trend. Larger bars show increasing dominance of bulls or bears.

• Contracting Histogram: Suggests weakening momentum, signaling a possible reversal or consolidation. Smaller bars indicate a loss of trend strength.

How to Use: Monitor the histogram for early signs of momentum shifts before a crossover occurs. The histogram can act as a leading indicator, providing advanced warning of potential changes in price direction.

Example: A shrinking histogram in a forex pair signals that the bullish momentum is losing steam, warning traders of a possible retracement. This can be a cue to tighten stop-loss levels or take partial profits. Conversely, an expanding histogram during a breakout confirms the strength of the move.

________________________________________

4. Identifying Divergences

MACD divergences are powerful tools for spotting potential reversals:

• Bullish Divergence: Occurs when the price makes a lower low, but the MACD forms a higher low, signaling weakening bearish momentum. This often precedes a trend reversal to the upside.

• Bearish Divergence: Happens when the price makes a higher high, but the MACD forms a lower high, indicating diminishing bullish strength. This suggests a potential reversal to the downside.

How to Use: Combine divergence signals with support or resistance levels to enhance reliability. Divergences are most effective when spotted at major turning points in the market.

Example: On a TRADENATION:EURUSD chart, a bearish divergence signals an upcoming price reversal from an up trend to a down trend.

________________________________________

5. Trend Confirmation

MACD confirms trends by staying consistently above or below the zero line:

• Above Zero: Indicates a strong uptrend. Look for pullbacks to enter long trades. The longer the MACD remains above zero, the stronger the trend.

• Below Zero: Reflects a persistent downtrend. Use rallies as opportunities to short. A sustained period below zero reinforces bearish dominance.

How to Use: Use MACD’s trend confirmation alongside other trend-following tools like moving averages or Ichimoku clouds. Ensure that market conditions align with the broader trend.

Example: Combining MACD trend confirmation with moving averages helps traders stay on the right side of the trend in a stock market index. For example, buy when both MACD and a 50-day moving average indicate an uptrend. Exit trades when the MACD begins to cross below zero or shows a divergence.

________________________________________

6. Overbought and Oversold Conditions

Although MACD is not traditionally an overbought/oversold indicator, extreme deviations between the MACD line and the signal line can hint at stretched market conditions:

• Overbought: When the MACD line is significantly above the signal line, it may indicate a price correction is imminent. This often occurs after an extended rally.

• Oversold: When the MACD line is well below the signal line, it suggests a potential rebound. Such conditions are common following sharp sell-offs.

How to Use: Monitor extreme readings in conjunction with oscillators like RSI for added confidence. Look for reversals near key support or resistance levels.

Example: An extended bearish move with a large MACD-signal line gap warns traders of a potential price correction. This can signal an opportunity to exit. Pair this observation with a bullish candlestick pattern to confirm the move (in this example morning star)

________________________________________

7. Combining MACD with Other Indicators

MACD works best when paired with complementary indicators to provide a more comprehensive market analysis:

• RSI (Relative Strength Index): Use RSI to confirm momentum and overbought/oversold conditions.

• Bollinger Bands: Validate price breakouts or consolidations with MACD signals.

• Support and Resistance: Use MACD signals around key levels for confluence.

How to Use: Wait for MACD signals to align with other indicator readings to improve accuracy. Cross-validation reduces false signals and increases confidence in trades.

Example: A bearish MACD crossover near a key resistance level reinforces a short-selling opportunity.

________________________________________

8. Multi-Timeframe Analysis

Using MACD across different timeframes strengthens trade signals and provides context:

• Higher Timeframe: Identify the broader trend to avoid trading against the market. For instance, if the daily chart shows a bullish MACD, focus on long trades in lower timeframes.

• Lower Timeframe: Pinpoint precise entries and exits within the higher timeframe’s trend. The MACD on lower timeframes can help fine-tune timing.

How to Use: Align MACD signals on both higher and lower timeframes to confirm trade setups. This alignment minimizes the risk of false signals.

________________________________________

9. Customizing MACD Settings

Traders can tailor MACD settings to suit different trading styles and timeframes:

• Shorter Periods: Provide more sensitive signals for scalping or day trading. Shorter settings react quickly to price changes but may generate more false signals.

• Longer Periods: Produce smoother signals for swing trading or position trading. Longer settings are less responsive but more reliable.

How to Use: Experiment with different settings on a demo account to find what works best for your strategy. Adjust settings based on the volatility and nature of the asset.

Example: A scalper uses a 5, 13, 6 MACD setting to capture quick momentum shifts in the market, while a swing trader sticks with the standard 12, 26, 9 for broader trends. Compare results across different markets to refine the approach.

________________________________________

10. Crossovers or Divergence at Key Levels

Combining MACD crossovers with price action levels enhances the reliability of trade signals:

• Horizontal Levels: Use MACD signals to confirm reversals or breakouts at support and resistance levels. Crossovers near these levels are often more reliable.

• Fibonacci Retracements: You can combine MACD with retracement levels to validate potential entries or exits. Confluence with retracements adds weight to the signal.

How to Use: Wait for MACD signals to align with key price levels for higher probability trades. Confirmation from candlestick patterns or volume (stock and crypto) adds further credibility.

Example: A bullish MACD divergence aligns with a strong support level, signaling a strong buy setup. Add confirmation with a candlestick reversal pattern, such as a piercing pattern in our case, to enhance precision.

________________________________________

Conclusion:

The MACD indicator’s flexibility makes it a must-have tool for traders of all styles. By mastering these strategies and integrating them in your trading, you can elevate your trading decisions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Don't Confuse "DYOR" with Confirmation Bias in Crypto TradingIn the crypto space, influencers and self-proclaimed crypto gurus constantly tell you to " do your own research " (DYOR) while presenting coins that will supposedly do 100x or become the "next big thing." They always add, " this is not financial advice ," but few actually explain how to do proper research.

On top of that, most influencers copy each other, get paid by projects to promote them, and—whether they admit it or not—often contribute to confirmation bias.

What is confirmation bias? It’s the psychological tendency to look for information that confirms what we already believe while ignoring evidence that contradicts it.

For example, if you want to believe a certain altcoin will 100x, you’ll naturally look for articles, tweets, and videos that say exactly that—while ignoring red flags.

How do you distinguish real research from confirmation bias?

This article will help you:

• Understand confirmation bias and how it affects your investments

• Learn how to conduct proper, unbiased research

• Discover the best tools and sources for real analysis

________________________________________

What Is Confirmation Bias & How Does It Sabotage Your Investments?

Confirmation bias is the tendency to seek, interpret, and remember information that confirms what we already believe—while ignoring evidence to the contrary.

In crypto, this leads to:

✔️ Only looking for opinions that confirm a coin is "going to the moon"

✔️ Avoiding critical discussions about the project’s weaknesses

✔️ Believing "everyone" is bullish because you're only consuming pro-coin content

The result?

• You make emotional investments instead of rational ones

• You expose yourself to unnecessary risk

• You develop unrealistic expectations and are more vulnerable to FOMO

________________________________________

How to Conduct Proper Research & Avoid Confirmation Bias

1. Verify the Team & Project Fundamentals

A solid crypto project must have a transparent, experienced team. Check:

• Who are the founders and developers? Are they reputable or anonymous?

• Do they have experience? Have they worked on successful projects before?

• Is the code open-source? If not, why?

• Is there a strong whitepaper? It should clearly explain the problem, the solution, and the technology behind it.

Useful tools:

🔹 GitHub – Check development activity

🔹 LinkedIn – Verify the team's background

🔹 CoinMarketCap / CoinGecko – Check market data and tokenomics

2. Analyze Tokenomics & Economic Model

A project can have great technology but fail due to bad tokenomics.

Key questions to ask:

• What’s the maximum supply? A very high supply can limit price growth.

• How are the tokens distributed? If the team and early investors hold most of the supply, there’s a risk of dumping.

• Are there mechanisms like staking or token burning? These can impact long-term sustainability.

Useful tools:

🔹 Token Unlocks – See when tokens will be released into circulation

🔹 Messari – Get detailed tokenomics reports

3. Evaluate the Community Without Being Misled

A large, active community can be a good sign, but beware of:

• Real engagement vs. bots. A high follower count doesn’t always mean real support.

• How does the team respond to tough questions? Avoid projects where criticism is silenced.

• Excessive hype? If all discussions are about "Lambo soon" and "to the moon," be cautious.

Where to check?

🔹 Twitter (X) – Follow discussions about the project

🔹 Reddit – Read community opinions

🔹 – See how the team handles criticism

4. Verify Partnerships & Investors

Many projects exaggerate or fake their partnerships.

• Is it listed on major exchanges? Binance, Coinbase, and Kraken are more selective.

• Are the investors well-known VCs? Funds like A16z, Sequoia, Pantera Capital don’t invest in just anything.

• Do the supposed partners confirm the collaboration? Check their official sites or announcements.

Where to verify?

🔹 Crunchbase – Check a project's investors

🔹 Medium – Many projects announce partnerships here

5. Watch the Team's Actions, Not Just Their Words

• Have they delivered on promises? Compare the roadmap to actual progress.

• What updates have they released? A strong project should have continuous development.

• Are they selling their own tokens? If the team is dumping their coins, it’s a bad sign.

Useful tools:

🔹 Etherscan / BscScan – Track team transactions

🔹 DefiLlama – Check total value locked (TVL) in DeFi projects

________________________________________

Final Thoughts: DYOR Correctly, Not Emotionally

To make smart investments in crypto, you must conduct objective research—not just look for confirmation of what you already believe.

✅ Analyze the team, tokenomics, and partnerships.

✅ Be skeptical of hype and verify all claims.

✅ Use on-chain data, not just opinions.

✅ Don’t let FOMO or emotions drive your decisions.

By following these steps, you’ll be ahead of most retail investors who let emotions—not facts—guide their trades.

How do you do your own research in crypto? Let me know in the comments!

Breaking the Trading Matrix: Lessons from The Matrix MovieThe Matrix is more than just a movie—it’s a mind-expanding experience that continues to offer new insights, no matter how many times you watch it. Beyond its philosophical depth and action-packed sequences, the film carries powerful lessons that can be applied to trading.

Just like in The Matrix, financial markets blur the line between reality and illusion. Success in trading requires a shift in perception, a willingness to embrace harsh truths, and the ability to decode the underlying structure of the market.

Let’s break down the key trading lessons inspired by The Matrix.

🕶️ Building Confidence: The Neo Path

Remember Neo’s journey? He started as Thomas Anderson—doubtful and uncertain—before transforming into the confident savior of humanity. This mirrors a trader’s evolution:

• You start hesitant and unsure.

• Greed and ego take over.

• The market humbles you with losses.

• You develop an edge, learning from experience.

• Over time, confidence and resilience grow.

Like Neo, every trader faces setbacks. But every setback is a setup for a comeback. Persistence and adaptation are key.

🏃♂️ Confirmation Bias: Dodging the Bullet

One of the most iconic scenes in The Matrix is Neo dodging bullets, bending reality to his advantage. Traders must do the same by reshaping their biases.

If you only seek confirmation for your trades, you’ll ignore critical counter-signals. To avoid this trap:

✅ Develop a trading system based on logic, not emotion.

✅ Seek diverse viewpoints instead of reinforcing your bias.

✅ Accept that the market moves on probabilities, not personal beliefs.

Dodge the confirmation bias bullet, and you’ll become a more objective and adaptable trader.

🔴 Take the Red Pill: Embrace Reality

In The Matrix, the red pill symbolizes awakening to the truth. In trading, taking the red pill means accepting the realities of the market:

❌ Traders who take the blue pill:

• Chase high win rates.

• Refuse to accept losses.

• Gamble with oversized positions.

✅ Traders who take the red pill:

• Accept risk as part of the game.

• Prepare for inevitable losses.

• Understand that past performance does not guarantee future results.

Those who ignore market realities are doomed to fail. Take the red pill and see the market for what it truly is.

🥄 There Is No Spoon: The Power of Perspective

In the famous "There is no spoon" scene, Neo learns that reality is shaped by perception. The same applies to trading:

• The market isn’t your enemy—your perception of it is.

• Stop trying to “bend” the market to your will.

• Instead, bend your mind to adapt to market conditions.

Traders who develop flexibility thrive, while those who resist change break.

🔢 Understand the Code – Understand the Matrix

Neo eventually sees the code behind The Matrix. Similarly, traders must understand the market’s underlying structure:

📊 Price Action

📈 Volume

📉 Probabilities

Markets move up, down, and sideways. Your job is to recognize patterns and decode them. The more you understand the code, the more clarity you gain in your trades.

👨💼 Agent Smith and Market Manipulators

Just as Agent Smith was a virus in The Matrix, market manipulators exist to exploit uninformed traders. Beware of:

🚨 Extreme volatility

📉 Unusual price gaps

❌ Pump-and-dump schemes

Stay vigilant and avoid manipulated markets that can drain your capital.

🏋️ Training Simulation: Practice Makes Perfect

Before Neo fought in the real world, he trained in simulated battles. Traders should do the same before risking real money:

✅ Backtest strategies to refine your edge.

✅ Use demo accounts to practice execution.

✅ Paper trade to gain confidence before going live.

Mistakes in training are free. Mistakes in live trading cost money. Train smartly.

🕶️ Morpheus’s Faith: Belief in Yourself

Morpheus believed in Neo before Neo believed in himself. Traders must also develop unwavering self-belief:

✔️ Trust your analysis.

✔️ Stick to your system.

✔️ Make decisions with confidence.

Doubt and hesitation lead to poor execution. Confidence, backed by preparation, leads to success.

🏛️ The Architect’s Plan: Strategy is Key

The Architect had a plan for The Matrix—every possible outcome was accounted for. Traders need the same level of structure:

📝 Develop a clear trading strategy.

🎯 Stick to your plan, even when emotions flare up.

⚖️ Adjust when necessary, but never trade impulsively.

Without a plan, you’re just another gambler in the market.

🧘 Free Your Mind: Emotional Control

Neo’s final test was to free his mind. In trading, emotional control is the ultimate skill:

✅ Backtest your system to understand market behavior.

✅ Risk less until you're comfortable with losses.

✅ Trade small before increasing position sizes.

Your worst enemies in trading?

❌ Ego

❌ Fear

❌ Greed

Master them, or the market will master you.

🔥 Final Words: The Path to Financial Awakening

Trading, like The Matrix, is a journey of self-discovery, discipline, and adaptation. If you want to break free from the illusion of quick riches and truly understand the market, you must:

📌 Develop confidence and resilience.

📌 Avoid confirmation bias and seek objective perspectives.

📌 Accept the harsh realities of trading.

📌 Adapt to market conditions instead of resisting them.

📌 Learn to read price action, volume, and probabilities.

📌 Stay vigilant against market manipulation.

📌 Practice before going live.

📌 Believe in yourself and your system.

📌 Have a structured plan and execute with discipline.

📌 Master your emotions to make rational decisions.

The real question is: Are you ready to free your mind and take control of your trading destiny?

LEMONTREE HOTELS 240 MINS TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

7 Practical Exercises to Build Patience in TradingI often talk about patience, planning, strategy, and money management, yet many of you tell me that you lack patience, can’t resist impulses, and struggle to follow your plan when emotions take over.

So today, we’re skipping the theory and diving straight into practical exercises that will help you train your patience just like you would train a muscle. If you want bigger biceps, you do dumbbell curls. If you want more patience in trading, try these exercises.

________________________________________

1. The “Observer” Exercise – Train Yourself to Resist Impulsive Trading

Goal: Improve discipline and reduce the urge to enter trades impulsively.

How to do it:

• Open your trading platform and set a timer for 2 hours.

• During this time, you are not allowed to take any trades, only observe price action.

• Write down in your journal: What do you feel? Where would you have entered? Would it have been a good decision?

Advanced level: Increase the observation time to a full session.

✅ Benefit: This exercise reduces impulsiveness and helps you better understand market movements before making decisions.

________________________________________

2. The “One Trade Per Day” Rule – Eliminate Overtrading

Goal: Train yourself to select only the best setups.

How to do it:

• Set a rule: “I am allowed to take only one trade per day.”

• If you take a trade, you cannot enter another, no matter what happens in the market.

• At the end of the day, analyze: Did you choose the best opportunity? Were you tempted to overtrade?

✅ Benefit: Helps you filter out bad trades and eliminates overtrading, a common issue for impatient traders.

________________________________________

3. The “Decision Timer” – Avoid Impulsive Entries

Goal: Help you make better-thought-out trading decisions.

How to do it:

• When you feel the urge to enter a trade, set a 30-minute timer and wait.

• During that time, review your strategy: Is this entry aligned with your trading plan? Or is it just an emotional impulse?

• If after 30 minutes you still think the trade is valid, go ahead.

✅ Benefit: This exercise slows down decision-making, helping you think rationally rather than emotionally.

________________________________________

4. The “No-Trade Day” Challenge – Strengthen Your Self-Control

Goal: Prove to yourself that you can stay out of the market without feeling like you're missing out.

How to do it:

• Pick one day per week where you are not allowed to take any trades.

• Instead, use the time to study the market, analyze past trades, and refine your strategy.

• At the end of the day, reflect: Did you experience FOMO? Was it difficult to resist trading?

✅ Benefit: Increases discipline and teaches you that you don’t have to be in the market all the time to succeed.

________________________________________

5. The “Walk Away” Method – Stop Micromanaging Trades

Goal: Reduce stress and prevent over-monitoring after placing a trade.

How to do it:

• After placing a trade, walk away from your screen for 1 to 2 hours.

• Set alerts or use stop-loss/take-profit orders so you’re not tempted to constantly check the price.

✅ Benefit: Reduces emotional reactions and prevents overmanagement of trades.

________________________________________

6. The “Frustration Tolerance” Drill – Train Yourself to Accept Losses and Missed Opportunities

Goal: Build resilience to emotional discomfort in trading.

How to do it:

• Watch the market and deliberately let a good opportunity pass without taking it.

• Observe your frustration, but do not act. Instead, write in your journal: How does missing this opportunity make me feel?

• Remind yourself that there will always be another opportunity and that chasing trades leads to bad decisions.

✅ Benefit: Helps reduce FOMO and makes you a calmer, more disciplined trader.

________________________________________

7. The “Trading Plan Repetition” Exercise – Build a Strong Habit

Goal: Reinforce discipline and reduce deviations from your plan.

How to do it:

• Every morning, before opening your trading platform, write down your trading rules by hand.

• Example:

o “I will not enter a trade unless all my conditions are met.”

o “I will not move my stop-loss further away.”

o “I will close my platform after placing a trade.”

• Handwriting strengthens mental reinforcement, and daily repetition turns it into a habit.

✅ Benefit: Increases self-discipline and keeps you committed to your strategy.

________________________________________

Final Thoughts

If you’ve read this far, you now have a concrete plan to build patience in trading. Remember, trading success isn’t just about technical analysis and strategies—it’s about discipline and emotional control.

Just like a bodybuilder follows a structured routine to develop muscles, you must practice patience and discipline daily to master trading psychology.

Impulsive Trading:Understanding the Risks and Regaining ControlHave you found yourself hastily clicking the “Buy” or “Sell” button only to be engulfed by regret almost immediately afterward? If so, you're in good company 😃.

Impulsive trading is a widespread issue that affects traders of all experience levels, often leading to significant financial losses. Studies reveal that a considerable portion of traders battle with impulsive decision-making, which can drastically influence their overall financial health.

Impulsive trading typically arises from emotions rather than careful market analysis or strategic planning. Factors such as the fear of missing out (FOMO), frustration after a loss, or the temptation of quick profits often cloud judgment, resulting in decisions that deviate from disciplined trading practices. This behavior is especially pronounced during volatile market conditions, where emotions can run high. Acknowledging the signs of impulsive trading is essential for fostering discipline and achieving sustained trading success.

Understanding the Risks of Impulsive Trading

The implications of impulsive trading reach far beyond individual poor trades. Each impulsive action can generate a cascade of errors, diverting traders from their predefined strategies. Engaging in impulsive trading often leads to overtrading, where traders make numerous trades in quick succession while hoping for fast returns, ultimately resulting in mounting losses. This not only increases exposure to market volatility but also raises transaction costs, systematically eroding any potential gains.

Another major risk associated with impulsive trading is flawed decision-making. Actions born out of emotional responses lack the rational foundation necessary for sound trading, pushing traders towards choices that diverge from their overall objectives. For instance, abandoning a Stop Loss order or ramping up position sizes following a loss can lead to dramatic financial damage. Moreover, the psychological impact of impulsive trading can result in burnout, heightened stress, and diminished confidence, all of which threaten a trader's long-term viability. Recognizing and understanding these risks highlights the need for self-regulation and a disciplined approach—critical elements for successful trading.

Psychological Triggers Behind Impulsive Trading

The tendency to trade impulsively often stems from various psychological factors that can be difficult to manage. One of the main culprits is the fear of missing out (FOMO); in fast-paced markets, traders may feel an urgent need to enter positions quickly to seize potential profits. This urgency can lead to ill-timed trades, making them more vulnerable to reversals.