EGLD Breaks Key Downtrend – Is This the Beginning?📊 Detailed Technical Analysis (Daily Timeframe):

🔍 1. Market Structure & Chart Pattern

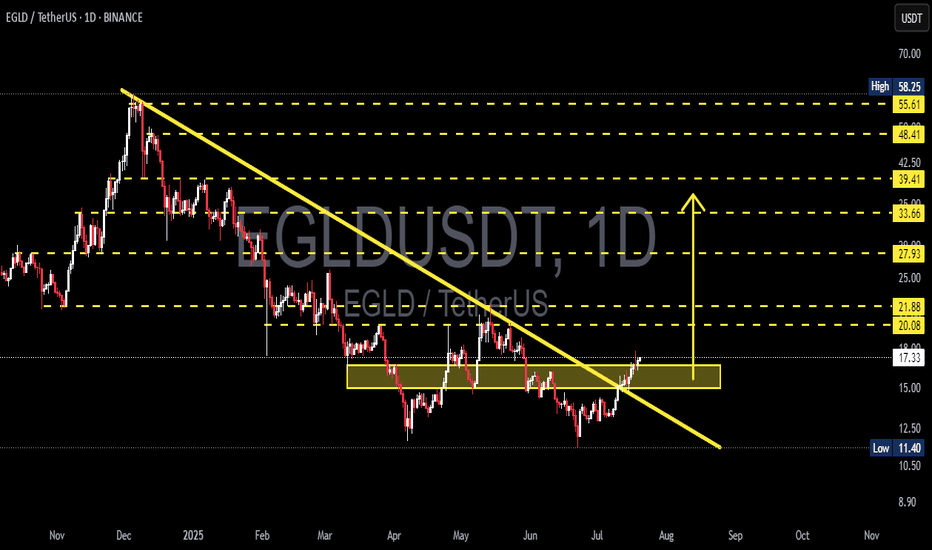

Major Downtrend Line Breakout – Reversal Signal:

After being stuck under a persistent downtrend for nearly 9 months, EGLD has officially broken out of the descending trendline, signaling a potential shift from distribution to expansion phase. This breakout is significant and could mark the beginning of a new bullish trend.

Double Bottom + Accumulation Range:

Price action shows a clear double bottom formation within the $13.00–$16.50 range, which acted as a strong accumulation zone. This horizontal structure suggests buyers have been silently accumulating before triggering this breakout.

Resistance Turned Support (RBS):

The breakout is now being retested around the $17 level. If EGLD holds this area, it would confirm a support flip, which is a classic bullish signal. Holding above this zone would give bulls full control over the next moves.

🟢 2. Bullish Scenario (Base Case):

If the breakout sustains with increasing momentum:

✅ Short-Term Targets:

$20.08 and $21.88 – minor historical resistance levels.

✅ Mid-Term Targets:

$27.93 and $33.66 – key levels aligning with measured move targets and Fibonacci retracements.

✅ Long-Term Targets:

$39.41, $48.41, up to $55.61–$58.25 – previous key highs and psychological zones.

💡 If EGLD successfully retests and holds above $17.00, it presents a strong opportunity for trend-following entries with favorable risk-reward.

🔴 3. Bearish Scenario (Alternative Case):

If this breakout fails (false breakout scenario):

⚠️ Price could fall back into the previous accumulation range between $13.00–$15.50.

A breakdown below that range could drag EGLD further down toward $11.40, or even $10.00 – a crucial long-term support zone.

Lack of volume or weak bullish confirmation would be early signs of a failed breakout.

🧠 4. Sentiment & Broader Context:

🌐 This breakout comes at a time when altcoin capital rotation is starting to emerge as BTC dominance cools off.

🚀 EGLD, as a smart contract platform, historically performs well during altseason waves and ecosystem narratives.

✅ Final Thoughts:

> EGLD has printed a significant breakout from long-term bearish control. With accumulation completed and momentum building, this may be the beginning of a bullish cycle. However, staying above the $17 level is the key validation to confirm this trend reversal.

#EGLD #EGLDUSDT #CryptoBreakout #AltcoinSeason #TrendReversal #CryptoAnalysis #TechnicalAnalysis #BullishSetup #DoubleBottom

Egldusdtlong

Most Will Get Trapped on EGLD’s Next Move Don’t Be One of ThemYello Paradisers, did you catch the EGLD breakout or are you still waiting for confirmation that’s already gone? While most traders are sleeping on this setup, it has just completed one of the cleanest breakout-and-retest patterns we’ve seen in weeks, and what comes next could leave many trapped on the wrong side.

💎#EGLDUSDT recently broke through its descending resistance with strength and has now retested that same level, which is acting as solid support in the $14.30–$15.00 range. This successful flip of resistance into support is a textbook bullish signal, and it’s holding beautifully indicating strong buyer presence and increasing the probability of continued upside.

💎If this support holds firm, #EGLD is eyeing a move toward the $18.00–$18.25 region, where moderate resistance is expected. A break above this could open the path toward the $19.90–$20.40 zone, a significant resistance level that may shape the next macro structure on this chart.

But it’s not all upside. If EGLD fails to hold the $13.00 level and especially the key invalidation point at $11.85 this entire bullish setup breaks down, and sellers will likely take control. The bullish momentum would collapse fast, and the door would open to much deeper downside levels.

MyCryptoParadise

iFeel the success🌴

$EGLD Gearing Up for Next Leg – Bull Flag in PlayCRYPTOCAP:EGLD is forming a clean bull flag on the 6H chart after a strong move up.

Price is holding the trendline, and a breakout above $19.7 could target $27 that’s a 47% potential move.

This setup appears solid, incorporating confluence from Fib levels and volume zones.

Eyes on this breakout that could be explosive.

Flag breakout incoming?

DYOR, NFA.

#EGLDUSDT #Altseason2025

#EGLD/USDT#EGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 16.80.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 17.32

First target: 17.65

Second target: 18.55

Third target: 19.45

#EGLD/USDT#EGLD

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 17.19.

Entry price: 17.82

First target: 18.26

Second target: 18.76

Third target: 19.40

EGLD (MultiverseX) - AltSeason Cycle - Bull RunBINANCE:EGLDUSD (#MultiverseX) is ready to jump.

That's because the #AltSeason shall push #AltCoins to the limits.

Its Market Cap ( CRYPTOCAP:EGLD ) is very low now and about to grow significantly.

This will be the result of #Crypto #MarketCap ( CRYPTOCAP:TOTAL3 & CRYPTOCAP:OTHERS ) breaking through their #ATH.

With #BitcoinDominance ( CRYPTOCAP:BTC.D ) showing signs of #Correction, #eGold should prevail.

What Happened with BINANCE:EGLDUSDT ?

#EGLD managed to spike a bit in the end of '23, thus confirming the start of a larger #Bullish #Cycle.

#Correction is also complete (Q4 in '24), which leaves room for the Bull.

What's next for BINANCE:EGLDUSD ?

An Impressive Rise is expected for $EGLD.

The current levels are to be watched closely by #Traders going #Long.

#MultiverseX #TechnicalAnalysis

- #ElliottWave A-B-C Sequence: Confirmed

- Intermediate (A) & (B) (white): Complete

- #Bullish #Fractal: Commenced

- #Fibonacci Levels: Conditions Met

My BINANCE:EGLDUSDT #Long Levels

#HODL #Trade:

- Entry @ 31.00 USD (or below)

- TP @ 420.00 USD

#Futures #Trading:

- Entry @ 31.00 USD (or below)

- SL @ 10.00 USD

- TP @ 225.00 USD

#EGLD/USDT Ready to launch upwards#EGLD

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 33.25

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 35.32

First target 37.00

Second target 38.50

Third target 40.13

EGLDUSDT - Real project with real targetlet's know about the EGLD project

EGLD (MultiversX) is a fast, scalable blockchain designed for dApps, DeFi, and metaverse projects.

It aims to power next-gen decentralized ecosystems while competing with platforms like Solana and Ethereum.

CHART , TA

weekly chart displays a breakout of falling wedge pattern without retest ... it's extremly bullish sign

clear the red rectangle is important to continue going up ... target is 280$

Best Regards Ceciliones

#EGLD/USDT#EGLD

Our price is moving in a bearish channel on the 12-hour frame and has just crossed it to the upside perfectly.

We have a bounce from the lower border of the channel from the green support area at 27.00

We have a tendency to stabilize above the Moving Average 100

Entry price is 27.00

First goal 34.24

The second goal is 40.00

Third goal 46.27

EGLDUSDT.1DLooking at the current EGLD/USDT chart, we see a fascinating technical landscape unfolding. First, let's discuss the support and resistance levels I've identified:

Resistance Levels (R1 and R2): R1 stands at $52.70, which has acted as a significant barrier since early 2023, and R2 is at $82.25, a level last tested in late 2022. These resistance points are critical for the bullish scenario and would need to be broken with substantial volume for a sustained upward movement.

Support Level (S1): The S1 at $22.60 is pivotal. This level has been tested and held firm throughout mid-2023, indicating strong buying interest.

Now, let's delve into the technical indicators:

Relative Strength Index (RSI): The RSI is currently around 38.97, which suggests that EGLD is neither overbought nor oversold. This neutral RSI provides room for the price to move in either direction without immediate pressure from overbought or oversold conditions.

Moving Average Convergence Divergence (MACD): The MACD line is below the signal line but above the zero line, which typically suggests a bearish momentum. However, the proximity to the zero line also indicates that the negative momentum is not overwhelmingly strong.

Given these observations, my perspective is cautiously optimistic. The support at $22.60 provides a good foundation for potential upward movement, but the market will need to see significant buying volume and a positive shift in broader market sentiment to challenge and possibly break through the resistance levels. Investors should keep a close eye on the MACD and RSI for early signs of momentum changes and adjust their strategies accordingly. If the price fails to hold the S1 support, it could lead to a retest of lower levels, but for now, the setup looks promising for buyers at current levels, provided the support holds strong.