Japan's coalition loses majority, yen higherThe Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.71, down 0.07% on the day.

Japanese Prime Minister Ishiba's ruling coalition failed to win a majority in the election for the upper house of parliament on Sunday. The result is a humiliating blow to Ishiba, as the government lost its majority in the lower house in October.

The stinging defeat could be the end of the road for Ishiba. The Prime Minister has declared he will remain in office, but there is bound to be pressure from within the coalition for Ishiba to resign.

The election result was not a surprise, as voters were expected to punish the government at the ballot box due to the high cost of food and falling incomes. The price of rice, a staple food, has soared 100% in a year, causing a full-blown crisis for the government, which has resorted to selling stockpiled rice from national reserves to the public.

The election has greatly weakened Ishiba's standing, which is bad news as Japan is locked in intense trade talks with the US. President Trump has warned that he will impose 25% tariffs on Japanese goods if a deal isn't reached by August 1. Japan is particularly concerned about its automobile industry, the driver of its export-reliant economy.

The Bank of Japan meets on July 31 and is widely expected to continue its wait-and-see stance on rate policy. The BoJ has been an outlier among major central banks as it looks to normalize policy and raise interest rates. However, with the economic turbulence and uncertainty due to President Trump's erratic tariff policy, the Bank has stayed on the sidelines and hasn't raised rates since January. Japan releases Tokyo Core CPI on Friday, the last tier-1 event before the rate meeting.

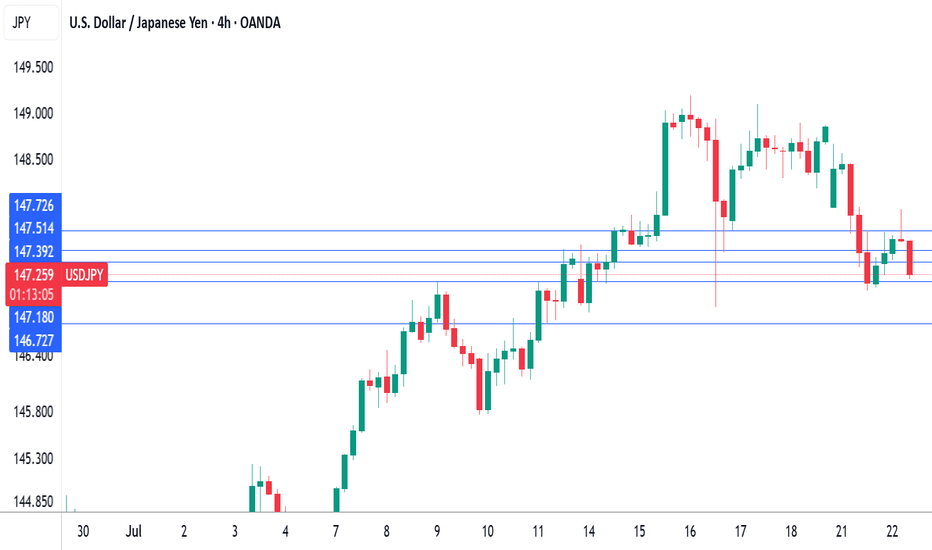

There is resistance at 148.39 and 149.08

147.95 and 147.70 are the next support levels

Election

Why election risk means yen volatility could rise this weekThe Japanese yen remains vulnerable ahead of Japan’s Upper House election on July 20.

Polls suggest the ruling LDP-Komeito coalition may lose its Upper House majority. Such an outcome would further weaken Prime Minister Shigeru Ishiba’s position, with his government already operating as a minority in the Lower House.

Adding to the pressure, the U.S. is set to impose 25% tariffs on Japanese goods from August 1—part of a broader protectionist push.

Europe’s Center is CRUMBLING: VGK on the Brink? 🚨 Europe’s Center is CRUMBLING: VGK on the Brink? 🚨

Europe’s elections just lit a FUSE! 💥 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) held off populists, but the center’s hanging by a thread—50% in Poland went right-wing, Portugal’s Chega is shaking things up.

Immigration and globalization fury could rattle EU trade & policy. 📉 VGK ($75.53) is inches from its yearly high ($75.56)—ready to crash or soar?

💡 Trade Idea: Plot VGK price action with election dates (May 4, May 18, June 1, 2025) to spot volatility breakouts. Watch for support near $70 or resistance at $76.

❓ Your Move? Will VGK tank or rally on Europe’s chaos? Drop your trade below! 👇

Europe’s Political Powder Keg: Markets on Edge!🔥 Europe’s Political Powder Keg: Markets on Edge! 🔥

Europe’s elections just dropped a BOMB! 💣 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) rejected far-right surges, but the center’s crumbling. 🇪🇺 Poland’s pro-EU Trzaskowski barely leads—June 1 runoff could flip it! Portugal’s Chega is shaking the old guard, and Romania’s Nicușor Dan rides an anti-corruption wave.

Why care? Political chaos = market volatility. 📉 EUR/USD is wobbling, DAX could tank, and defense stocks (🇺🇦 ties) are in play.

💡 Trade Idea: Overlay EUR/USD with election dates (May 4, May 18, June 1) to catch volatility spikes.

❓ What’s your move? Will Europe’s turmoil crash markets or spark a rally? Drop your take below! 👇

Australian dollar hits five-month high after Australian electionThe Australian dollar continues to impress and has posted strong gains on Monday. European session, AUD/USD is trading at 0.6491, up 0.72% on the day and its highest level since early December 2025.

Prime Minister Anthony Albanese cruised to a resounding victory in Saturday's national election. Albanese' centre-left Labor Party increased its majority and thumped the Liberal Party opposition. The coalition's defeat was marked by its leader, Peter Dutton losing his own seat.

The long shadow of US President Donald Trump was a factor in the election. Dutton adopted right-wing policies such as promising tougher immigration laws and establishing a platform to reduce the waste of public funds. The similarities between Dutton and Trump hurt the Liberal leader as many voters were upset with Trump's 10% tariffs on Australia.

At the start of the year, Albanese was trailing badly in the opinion polls. However, he struck a receptive chord among voters on domestic issues such as health care and housing, and benefited from the anti-Trump sentiment, which proved to be a winning recipe.

US nonfarm payrolls, a key gauge of the US labor market, dipped slightly to 177 thousand in April, down from a revised 185 thousand in March. This easily beat the market estimate of 130 thousand. The positive unemployment report points to a resilient labor market which remains strong despite the US economy declining in the first quarter.

The markets have responded by lowering the odds of a rate hike in June to 33%, down sharply from 60% a week ago, according to the CME's FedWatch. The Federal Reserve meets on Wednesday and is virtually certain to maintain the benchmark rate of 4.25%-4.5%.

Canadian dollar in holding pattern on Election DayThe Canadian dollar is showing limited movement on Monday. In the European session, USD/CAD is trading at 1.3868, up 0.10% on the day. There are no economic releases out of the US or Canada today.

It's Election Day in Canada. Prime Minister Mark Carney, who has only been in office since March, is favored to win the election. Carney's Liberal Party was badly trailing the Conservatives but US President Trump has ignited Canadian nationalism and turned the election race upside down.

Trump has talked about annexing Canada and although most Canadians don't expect that to happen, there is strong resentment against the US tariff policy, which has hit Canada even though the two countries have a free trade agreement.

Carney is viewed as a strong leader who can stand up to Trump and the markets have priced in a Liberal majority. If the Liberals are forced to make a coalition with the smaller parties, the new government would be considered less stable and that would likely trigger some CAD weakness. If the Conservatives manage to pull out a surprise election victory, the Canadian dollar would likely get a boost.

Canada's retail sales declined 0.4% m/m in February but bounced back in March with a strong gain of 0.7%. On an annualized basis, retail sales slipped to 4.7% in February, down from a revised 5.3% in January.

The improvement in March was driven by consumers making purchases ahead of US tariffs, but consumer spending is likely to deteriorate. The Bank of Canada will be keeping a close eye and will have to consider further rate cuts if upcoming economic data is weak. The BoC maintained the cash rate at 2.75% earlier this month and meets next on June 4.

USD/CAD is testing resistance at 1.3868. Above, there is resistance at 1.3880 and 1.3910

1.3850 and 1.3838 are the next support levels

Educated Gambling!! LOL. Call Options that go $POWW or OW!! Were in a Double Bottom and a Bearish Pennant on the daily so who knows, and the chart doesn't look great either. This one is at the top of my degenerate list, pure speculation. My idea is either a big bang or a misfire. I've been buying NASDAQ:POWW $2.50 calls expiring 1/17/25. Started off buying at $15 then $10 and now $5 per call. And sometimes no one is even selling these options when they list for .01 (actually cost $5 min) My thought is NASDAQ:POWW could either run in the next 3 weeks or all the way up to Inauguration Day on January 20, 2025, hope to at least fill the gap at 2.46 and then get back to June 3rd high of $2.86. Most of us can figure out why it could possibly go parabolic so close to the Election. I hope for God's sake and love of country I'm actually wrong about this and pray for peace. But at the same time, as some of the corrupt powers to be say "never let a crisis go to waste"... Safe Trading Everyone!!

Oil ($USOIL) – Diesel Demand Soars as Cold Grips U.S.Oil ( TVC:USOIL ) – Diesel Demand Soars as Cold Grips U.S.

(1/9)

Good morning, Tradingview! Oil is dipping slightly 📉, at $ 74.93, down 0.1% from yesterday’s close, as per February 27, 2025, data. Cold weather’s driving up U.S. diesel demand 💪, and Texas power systems are hitting clean energy milestones 🌿. Let’s dive into this oil play! 🔍

(2/9) – REVENUE PERFORMANCE 📊

• Post-Election: $ 74.93, down 0.1% from $ 75.00 💰

• Feb 27, 2025: Diesel demand rises due to cold weather 📏

• Texas Power: Clean energy milestones achieved 🌟

TVC:USOIL steady, with diesel’s boost! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approximately $ 1.05B, tracks WTI crude tight 🏆

• Diesel Spike: Cold lifts usage, per Reuters ⏰

• Energy Shift: Texas clean power climbs 🎯

TVC:USOIL firm, frost pays off! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Cold Snap: Boosts diesel usage across U.S. 🔄

• Texas Grid: Clean energy marks met 🌍

• Market Reaction: Down 0.1% post-election 📋

TVC:USOIL adapting, chill’s the star! 💡

(5/9) – RISKS IN FOCUS ⚡

• Election Aftermath: Policy shifts may affect prices 🔍

• Green Energy Growth: Challenges oil’s dominance 📉

• Weather Flux: Diesel demand may fluctuate ❄️

TVC:USOIL tough, but risks hover! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Diesel Lift: Cold weather props up demand 🥇

• Oil Core: Fundamental to energy needs 📊

• Resilience: Handles market fluctuations 🔧

TVC:USOIL got heat in the freeze! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Election haze, green energy bite 📉

• Opportunities: Continued cold weather, rising demand 📈

Can AMEX:USO bank on the frost to gains? 🤔

(8/9) – OIL’s $ 74.93 dip, diesel up in Feb 2025, your take? 🗳️

• Bullish: $ 80+ soon, cold lasts 🐂

• Neutral: Steady, risks in check ⚖️

• Bearish: $ 70 looms, green wins 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

TVC:USOIL $ 74.93 dip masks diesel’s cold surge 📈, Texas green strides mix it up 🌿. Election stings, yet dips are our DCA gold 💰. We grab ‘em low, climb like pros! Gem or bust?

The Trump DumpCaution to the sensitive bulls, you're not going to like this one...

I know we all like hopium and up-only charts, but this isn't it. Those only exist in fairytales. This is trading and we have to stay grounded if you plan to actually profit outside of the HODL philosophy.

The truth is that elections don't matter, new events doesn't matter. At least not how the majority thinks they do. These events merely mark points in time, they can be catalysts or pivots. But those time points don't care about your philosophy on the actual event.

Let the emotion and philosophy in and you'll lose, guaranteed. Close those out and look only at the charts, using those events to understand important time points to pay attention to and you might see that this one is going to be critical.

On a macro picture, this market structure has been clear, simply a series of expansions and ranges (I know, obvious, this is how all price moves). But recently we had a strong expansion beyond the all-time high, which might seem bullish at first glance but is going to be a liquidity trap in hindsight.

On a more local view, we have our range forming after this larger expansion and that range has already generated a fakeout higher and come back into the range, with the next breakout of the range to be to the downside. I do not trade blind FVGs or other ICT stuff, but there will be a lot of hindsight analysis from people claiming that this daily FVG was obvious.

Combine this with the important time events that has everyone so bullish, like elections or whatever, and you have the perfect recipe to wreck almost everyone.

From here, I am looking for AT LEAST a 30% drop . Targets may get lower as data comes in, but keeping it conservative until more high timeframe candles come in.

You may disagree with the post, but at least it has a clear bias.

$USGDPQQ -U.S GDP (Q3/2024)ECONOMICS:USGDPQQ

(Q3/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 3.1% in Q3, higher than 2.8% in the 2nd estimate and above 3% in Q2.

The update primarily reflected upward revisions to exports and consumer spending that were partly offset by a downward revision to private inventory investment.

Imports, which are a subtraction in the calculation of GDP, were revised up.

What about DXY?I haven't updated my DXY analysis for a while. So let's dust it off.

The last update was in September when the atmosphere was changing in a way that we couldn't predict the US Election clearly and for a short period, the market thought the results wouldn't be as it is today. That was why I was a bit bearish on DXY. By getting closer to Election Day the clouds were going away and it got easier for the market to see the outcome. So, it strengthened the dollar while weakening the Gold as we expected the geopolitical tensions to cool off.

What's next?

For now, I see the 10-year bond yield can show a bit more weakness to come just below 3.99%. Then after that, we should update our analysis and see what comes next. But I think ~4% is low for now and after that, I like to see a jump back up. In this short-term correction DXY would follow the 10-year bond yield and most probably come into the range of 104 to 105. That's also can be a small driver for Gold to go higher a bit.

21k before Trump will lose USA elections in November.So it's obvious, that BTC will rally to reach new ATH before November and will collapse miserably after Trump will lose USA election and stock market crash. Also, COVID-19 will create real apocalypse in the USA (I'm talking about riots and shooting in the streets because bastards there have too many guns and not so much brain). But if Russia will help Trump with reelection, bitcoin will pump further to the moon.

#shorttesla

TOTAL to 7 to 10TWith BINANCE:BTCUSDT at a new ATH of 90k it brings up the rest of the market and raises all boats.

We are still in November of 2024 right after the election. Lots of people remained sidelined and lots of capital is sidelined. Come next year all the investments that are up on the year that have been invested in equities and any other assets will get their appreciation reinvested at an alarming rate due to it being the beginning of the year.

I say that to say this: things could get very silly in crypto and a 7 to 10 trillion TOTAL crypto marketcap is a very real possibility in the next 1-2 years.

It is not a guarantee but the time to position into risk assets is now quite frankly. It was a better time to position in back during the summer but now we have a clearer vision we are headed down with the election behind us.

I wish anyone investing and trading a great end of the year and an even better next year.

Never get liquidated. Keep clicking.

Politics vs Profits | The US elections & Crypto Harris, Trump, or Crypto ? Only One Goes Brrrr !

1/ The crypto market typically dips ahead of US elections

In 2016, there was a 10% dip, in 2020, a 6% decline, and so far in 2024, a 6% decrease. However, these drops aren't unusual; they can happen without clear triggers on any given day or week. So attributing extra significance to the current dip due to election is overblown it’s just business as usual in crypto

2/ The election results will trigger either a market boom or bust

Markets crave certainty over specific candidates. Once the election is over, investors can look ahead and allocate accordingly. In the grand scheme, Bitcoin and the wider crypto market don’t care who sits in the Oval Office. Whether it’s a red, blue, or mixed government, historically, crypto trends upward over time.

3/ Trump/Harris will be terrible for the economy

While Republicans and Democrats have vast differences (more so now than ever), unity isn’t our forte. How can we bring the nation together? Maybe start with a common interest and go from there

One thing’s certain, both parties have an affinity for money printing , While it’s a headache for the US’s debt situation, it benefits crypto.Why? Because a share of that newly minted money typically flows into crypto assets, which have limited or predictable inflation.

In essence, money printing devalues the US dollar but bolsters the value of scarce assets (like crypto) over time.Regardless of who wins, the money printer is expected to stay active.

While election may provide market clarity, it’s not a sure thing. Close elections can take days to finalize. So, if you feel like panicking, just remember this:

Zoom out → stay calm → remember…In the long run, crypto tends to prevail.

November is off to a roaring start with several significant market events – and that’s just in the first week! But before we look ahead, let’s review October to see where we stand:

1/ October Recap

Expectations were high for ‘Moontober,’ and it delivered (though gains were modest).

October saw:

- $ BTC up 11%, with the broader crypto market up 10%

- US Bitcoin ETFs purchased 5.83 times more CRYPTOCAP:BTC than was mined in October.

This demand and limited supply helped push the total crypto market cap out of an 8 month descending trend, signaling a potential reversal.

2/ Macro Outlook

Now, on to November. This week features two major macro events:

- US Elections – Tuesday, Nov 5th

- Rate Cuts – Thursday, Nov 7th

Markets expect a 0.25% rate cut. Though smaller than September’s 0.50% cut, it could ease market pressure.Lower borrowing costs reduce debt servicing expenses, freeing up cash for spending and potentially boosting both the economy and crypto markets.

The bonus? Historically, Bitcoin’s average return in November is +43%

If this trend holds, we could see CRYPTOCAP:BTC hit $100k by month’s end!

Cross your fingers, toes, and eyes!

3/ Token Unlocks

October had $5.4B worth of token unlocks, creating potential sell pressure. Thankfully, November’s unlocks are lighter at $2.6B, which may limit that pressure.

4/ Earnings Reports

This week brings earnings from:

- Franklin Templeton (managers of the AMEX:EZBC Bitcoin ETF)

- Arm (semiconductor architecture designers)

- Qualcomm (wireless tech products)

- Sony (self-explanatory)

But November 20th is the main event, with Nvidia ( NASDAQ:NVDA ) – the AI powerhouse – reporting earnings.That’s November in a nutshell.

We’ll be here daily with updates as events unfold

Bitcoin Events and the PI Cycle Top Indicator

### Chart Description :

* Title :* Bitcoin Weekly Cycle Analysis with Key Indicators and Events

* Time Frame :* Weekly

* Indicators :*

- * Pi Cycle Top Indicato r:*

- This indicator uses two moving averages:

- 111-day Moving Average (111DMA)

- 350-day Moving Average multiplied by two (350DMA x 2)

- *Functionality:* When the 111DMA crosses above the 350DMA x 2, it historically signals that Bitcoin might be reaching a peak in its market cycle. This indicator has been noted for its accuracy in predicting Bitcoin's market tops to within days.

* Event Markers :*

- * U.S. Election Dates :*

- Marked on the chart are vertical lines at the points where U.S. presidential elections occurred. This helps in analyze how political events influence Bitcoin's price movements.

- * Bitcoin Halving Dates :*

- Highlighted with vertical lines. Bitcoin halvings occur approximately every four years, reducing the reward for mining new blocks by half, which typically impacts Bitcoin's supply and often leads to price appreciation due to increased scarcity.

* Cycle All Time Highs :*

- Place markers on the chart where Bitcoin has reached its all-time highs in each cycle. This can provide context on how close the peaks are to halvings or elections, potentially illustrating patterns or correlations.

* Price Prediction *

$148 in Q3 2025

How the U.S. Election Could Impact USD and EUR/USD Trading"As the U.S. presidential election approaches, it’s time to consider how it might impact our trading strategies, particularly with the U.S. dollar and EUR/USD. Political shifts bring market volatility, so let’s break down how each outcome could influence the dollar and the EUR/USD pair.

Election Outcomes and Market Impact

1. If Democrats Win: A Democratic victory could weaken the dollar, as policies may lead to lower inflation and reduced real interest rates. This scenario might push the EUR/USD pair higher, with potential targets around 1.1300–1.1850. For traders, this could mean a favorable environment to consider EUR/USD gains.

2. If Republicans Win: On the other hand, a Republican win might initially strengthen the dollar, thanks to expected trade policies and rising interest rates. However, this strength could be short-lived. Long-term factors may introduce volatility, potentially giving the euro a chance to regain ground against the dollar.

Key Levels to Watch in EUR/USD

From a technical standpoint, keep an eye on resistance levels from 1.1275 to 1.1750 for potential bullish moves, while support around 1.1000 and a critical level at 1.0900 could indicate a downturn. Combining these levels with election news can help you make informed trade adjustments.

How to Trade Before, During, and After the Election

Leading up to the election, watch for narrowing polls, as this could introduce uncertainty and increased volatility. During the election itself, expect the market to react strongly—prepare for a Trump win to potentially strengthen the dollar and a Harris victory to have the opposite effe

USD/JPY surges as Trump storms to victoryThe US dollar is on a tear against the major currencies after Donald Trump’s sweeping victory in the US presidential election. In the North American session, USD/JPY is trading at 154.62, up a massive 2.0% on the day.

There are still plenty of votes to count in the US election but it looking increasingly likely that Republican Donald Trump has been re-elected as President. Trump and Democrat Kamala Harris were in a dead heat going into the election on Tuesday and there was concern that declaring a winner could take days or even weeks, which would have led to prolonged uncertainty.

In what was a huge surprise to both sides, Trump cruised to victory. The win is even sweeter for the Republicans as they likely have won control of both the House of Representatives and the Senate. With the Republicans in charge, Trump’s agenda will be easier to push through Congress. It should be noted that at the time of writing, the vote count is incomplete and Harris has not conceded defeat.

The US dollar has responded to the Trump win with sharp gains and the yen is in full retreat. Trump’s threats to slap stiff tariffs on China, Europe and Mexico would support the dollar, as tariffs would raise inflation and interest rates. If Trump’s policies lead to trade wars, market sentiment will fall, further boosting the dollar.

The Bank of Japan released the minutes of its September meeting today. At the meeting, the BoJ kept rates at 0.25% and Governor Ueda said that BoJ would not rush to raise rates during market volatility. Those comments were a response to a stock market slide after weak US employment reports raised fears that the US economy was deteriorating much more quickly than expected. Those fears were unfounded and the markets don’t expect a BoJ rate hike before early 2025, although if the weak yen takes a dive, it could accelerate plans to raise rates.

USD/JPY has pushed past resistance at 151.86, 152.87 and 153.84. The next resistance line is 153.95

150.78 and 149.77 are providing support