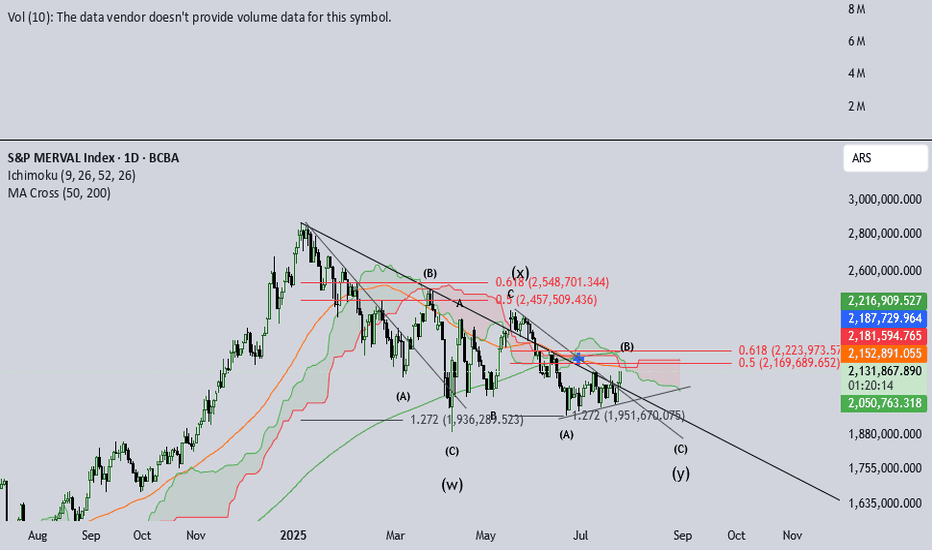

IMV Multiple analysisIMV, Argentina's Merval Index valued in pesos, has been in a downtrend since jan-25. Due to electoral process, noise has been increasing this last week, amidst some shade on what seemed as an easy win for Milei's gov.

The amount of chatter the Merval has brought up is inmense. This psychology is similar to that expected in IVth elliott's waves. Also, jul 2022 - dic 2024 saw huge gains, signaling IIIrd elliot´s wave behavior.

This long and extended IVth can be seen after such huge rallies. Anxiety begins to build up and retail investors begin to be shaken out. This IVth wave seems to be a triple-three type. Volatile and fast, this structure destroys an investor's patience.

Recent developements in the money market seem to have calmed down and peace seems to be partially restored. September elections are around the corner and this little Pax may be threatened.

I'm inclined to believe NOTHING WILL HAPPEN in these elections the govt faces, nor will the gov succeed enourmously, nor will it fail badly. So, I believe the index will likely test previous (W) wave bottoms, to then breakout for a final Vth wave. This analysis is compatible with a triangle-shaped breakout.

Elections

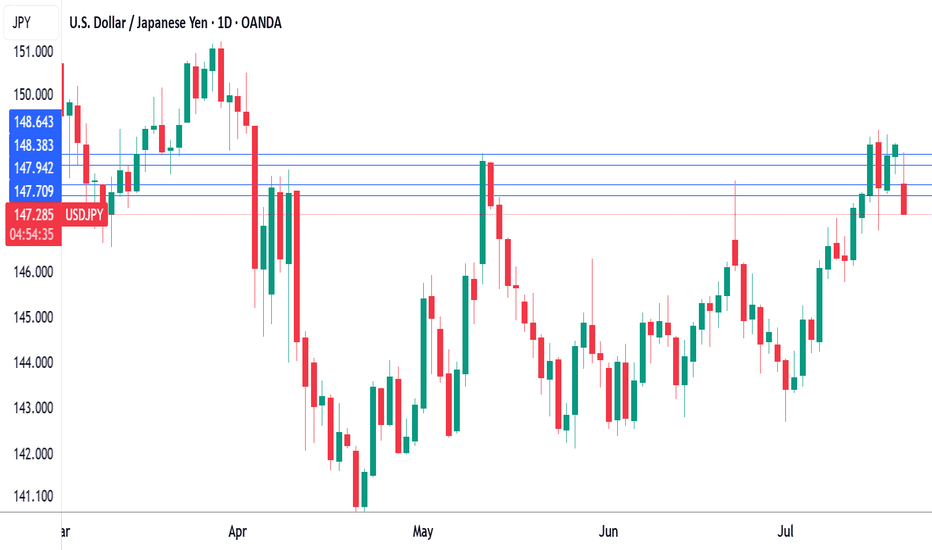

Japan's coalition loses majority, yen higherThe Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.71, down 0.73% on the day.

Japanese Prime Minister Ishiba's ruling coalition failed to win a majority in the election for the

upper house of parliament on Sunday. The result is a humiliating blow to Ishiba, as the government lost its majority in the lower house in October. The stinging defeat could be the end of the road for Ishiba. The Prime Minister has declared he will remain in office, but there is bound to be pressure from within the coalition for Ishiba to resign.

The election result was not a surprise, as voters were expected to punish the government at the ballot box due to the high cost of food and falling incomes. The price of rice, a staple food, has soared 100% in a year, causing a full-blown crisis for the government, which has resorted to selling stockpiled rice from national reserves to the public.

The election has greatly weakened Ishiba's standing, which is bad news as Japan is locked in intense trade talks with the US. President Trump has warned that he will impose 25% tariffs on Japanese goods if a deal isn't reached by August 1. Japan is particularly concerned about its automobile industry, the driver of its export-reliant economy.

The Bank of Japan meets on July 31 and is widely expected to continue its wait-and-see stance on rate policy. The BoJ has been an outlier among major central banks as it looks to normalize policy and raise interest rates. However, with the economic turbulence and uncertainty due to President Trump's erratic tariff policy, the Bank has stayed on the sidelines and hasn't raised rates since January. Japan releases Tokyo Core CPI on Friday, the last tier-1 event before the rate meeting.

EURUSD’s zone of interest after German election Polls have now closed in Germany’s parliamentary elections.

Exit polls indicate Friedrich Merz’s center-right Christian Democratic Union (CDU) has secured a clear victory, positioning him as Germany’s next chancellor.

The far-right AfD is projected to achieve its best result yet, currently in second place with 20.2%, nearly doubling its 2021 support. However, the Bundestag’s composition remains uncertain, and Merz has ruled out cooperation with the AfD.

Prolonged coalition talks could lead to a government divided on economic recovery and international policy, which could be bearish for the euro. With this in mind, the 61.8% to 50.0% Fibonacci zone could be an area of interest (to begin with at least), which coincides with flattening longer moving averages.

EURUSD Flat To Start November Elections Ahead The EURUSD has been quite flat to start the month of November. The current market price is hovering around 1.08730, which is within about 10 pips of the November month open price. Today the Bank of Australia will be releasing new data regarding interest rates, this could possibly give some volatility to the market for US pairs. Don't forget that the US Federal Election will be held tomorrow. Traders will be looking for a spike, for now we will be waiting for the news.

Bitcoin is going to 63k???!!!Hey guys!

I know it's weekends, but some of the markets are working today and I decide to talk about current BTC position.

So, we're making this cool off, which is also almost full A correctional wave and in 2 days we have US elections, which can be really affective.

Plus the volumes have convergence with the movement RSI is still uncertain, and MA cross on 4H is bearish.

For me, we could easily fulfill the C wave and after we can find the next enter point.

Your thoughts? How elections will influence?

Brief drop due to Electrions chaos, then back up a month afterI was checking last elections on 2012, 2016 and 2020. Seems that there is a brief drop before elections each time (5% to 10%) in the overall S&P500 (SPX). This year, seems that drop is not meaningful yet. Regarthless, I think going defensive this week to be heavy in cash. Then buy back into the market if price hits 5400 previous to Dec. It it do, I'll buy back 25% of SPX and wait if the trend still going in the direction to hit ~5000. If it do, might be back fully invested into the market to hope for a bounce back up signal.

We can protect ourselves of a 10% loss if I get this one right OR we can miss 5% on profits if the trend keeps going up in Nov and Dec.

Messy chart but I put my resistances and trends in here.

Any thoughts?

Bitcoin UpdateHey hey,

Bitcoin finally managed to reach the top of the channel again and finally seems to have broken out of it.

The weekly chart provides a better view since we've now had 2 weekly candlesticks close above the upper channel line.

It's clear that price is now consolidating just below the $70k psychological barrier and it seems to be only a matter of time before we're slashing through and continue towards the ATH level.

I have really started to like looking at the BTC ETF flow data to combine it with the technical view and again it adds up to a positive scenario.

Net inflows have increased to a new ATH and have grown by 20% since my last update exactly a month ago in our community.

The coming week will evolve around the elections and I don't expect a significant move until the election outome is clear.

Overall, my picture is bullish but it comes down to the elections this 5th of nov.

The rise in the price of Bitcoin after the U.S. elections...☝️ US #elections and the impact on #Bitcoin

If you look at the election date the last 3 times, then each time after the elections, BTC showed explosive #growth for 12-13 months:

🟢 November 2012 - December 2013

🟢 November 2016 - December 2017

🟢 November 2020 - November 2021

🟢 November 2024 - November/December 2025(???)

Of course, there are no guarantees that such a scenario will be repeated for Bitcoin now, but if you ask me, I definitely think that something similar will happen again and I bet on it💰

#crypto #Cryptocurency #cycles

Is Gold ready to retrace?Gold has experienced a significant appreciation of 48.18% since 6 October 2023. This remarkable increase can be attributed to rising global uncertainties, including the ongoing conflict in Ukraine, escalating tensions in the Middle East, and the impending US presidential elections.

New Highs and Market Indicators

From a technical standpoint, gold is currently trading at historic highs, placing it in uncharted territory with no established resistance levels on the daily chart. The Relative Strength Index (RSI) indicated a reading of 77.26 on 26 September, suggesting that gold may be in an overbought condition. Generally, RSI readings above 70 signal potential exhaustion of buying momentum.

The price has also been trading above the 200-period Average for 254 candles, which tends to show a potentially ageing upward trend on the daily chart. The longer the price remains on the same side of a Moving Average, the more prone it is to a retraction.

So, considering these elements:

1. High appreciation of more than 48% in Gold prices over the past 12 months,

2. Recent RSI reading at 77.26, indicating overbought conditions

3. Potentially ageing uptrend, with 254 candles above the SMA200,

Given these factors, there is a possibility that gold may experience a slightly stronger pullback if it manages to break below the uptrend line drawn on the chart between 5 August and 10 October. Such a movement could lead to a decline toward the 2480.00 level within a few days.

The Influence of Political Uncertainty

On the other hand, gold is often viewed as a safe haven during uncertain times. As recent US election polls indicate a technical tie between Donald Trump and Kamala Harris, it is plausible that a more definitive movement in gold prices may not occur until after the election results are announced.

Navigating the Gold Market

In conclusion, while the current indicators suggest a potential for price retraction, gold's status as a haven and the upcoming political landscape may heavily influence future price actions. Traders should remain vigilant and consider these elements in their market strategies.

Disclaimer:

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK.

Dollar Index Bullish to $109!I am looking for a 3 Sub-Wave correction into $109 for 2025.

I believe this'll be fuelled by the U.S. elections. Donald Trump will be selected as the next puppet to run the U.S. economy. His 'MAGA (Make America Great Again' phase will push liquidity into the US Dollar. This is how I think the market will reach $109.

How High/Low Could The US Election Day Send Us?CRYPTO:BTCUSD New visits to lower levels are highly expected, as that would constitute a continuation of the short-mid term downtrend we are in. Keep cash on the sidelines to progressively accumulate and give yourself some peace of mind. Finding liquidity at around 40k before a big run pushed by new debt is a real possibility, count on it and be prepared for that scenario. Remember DCA is king because Time on the market is. ♥

DJT might flyDJT (Trump Media)

Short Interest % Float 15,93 %

Off-Exchange Short Volume Ratio 57,52 %

With the upcoming political events and elections and this stock being a potential investment vehicle for allies, and also considering how far the stock has been sold down by now, this seems like an ideal candidate for a massive short squeeze.

Disclaimer: This idea is not intended as investment advice and should not be interpreted as an offer to sell or a recommendation to purchase any asset. Any decisions made based on the information presented in this idea are the sole responsibility of the individual. All investment decisions should be made independently, taking into account your financial situation and objectives.

Election Year Jitters: How to Navigate the Volatile US Equity MaUS Presidential Elections and US Equities are a match made in heaven. History shows that market swings more up than down. This year, prepare for a wild ride full of twists.

Sadly, former President Donald Trump was shot at a rally over the weekend. He survived and is safe. Investors are expected to shift into haven assets. Gold could test all-time highs. The Dollar, Yen and Bitcoin will rise.

WHAT IS THE US PRESIDENTIAL ELECTION CYCLE THEORY?

Yale Hirsch introduced this theory. It posits that stock markets are weakest in the year following Presidential elections. The presidential election impacts economic policies and consequently market sentiment. Theory suggests that US equities perform best during the third followed by the fourth year of a Presidential term.

In 1967, Yale Hirsch (a market researcher) published the first edition of the Stock Trader’s Almanac. According to the book, the President typically indulges the special interest group who got him elected in the first two years after assuming the office.

With the next election round the corner, the President shifts focus on shoring up the economy to get re-elected during the third and fourth year. Consequently, equities gain during the second half of the Presidential term.

That's the theory, but does it hold true? The answer turns out to be an emphatic yes.

S&P500 Index Performance since 1960 with election years highlighted

BUT HOW ABOUT SECOND HALF OF THE ELECTION YEAR?

With half of the election year behind us, crucially, how do markets perform during the second half of an election year?

Over the last 6 decades, the S&P500 on average delivered positive returns in 13 of the 16 election years during the second half of the year.

2008 was a washout year for equities with global financial crisis crushing equities. The S&P500 returns for the first half of election year was 4.1% followed by 3.2% in the second half on average even after including 2008.

S&P500 tends have positive bias in election years

Excluding 2008, average S&P500 returns for the first half of election year was 4.9% followed by 5.4% in the second half.

S&P500 positive bias during election years is even more pronounced when 2008 GFC abnormal returns are excluded

PAST RESULTS ARE NOT INDICATIVE OF FUTURE PERFORMANCE

History has shown time and again that timing the market is futile. Using Hirsch’s theory as gospel can be dangerous. Presidential elections occur once only every four years.

Even though the analysis above covers 6 decades, it only has 16 data points. By any measure, that's far too little to arrive at definitive conclusions.

As any sensible statistician would tell you, even if two variables are correlated (election cycle and S&P500), it does not guarantee causation.

WHAT CAN INVESTORS EXPECT DURING 2024 ELECTION YEAR?

It is not just historical precedent that suggests upside in the next six months, market conditions also suggest equities could see further upside.

2024 has been a stunning year. Gen AI frenzy has fuelled powerful rally. It has been the strongest tailwind since the dot-com mania. Unlike the dot-gone era, companies are producing eye-popping revenues and profits that support the rally.

The recession that never came has been a powerful tailwind that has helped equity markets soar to heights never seen before.

Inflation has been easing. Labour markets are tightening. Expectations of rate cuts are rising fast.

The next Fed meeting is scheduled on 31st July. Markets are pricing 93% chance of the Fed Fund rates remaining unchanged at the current 525-550 basis points (bps).

The picture is starkly different for the Fed meeting on 18th September. Markets are pricing >90% chance of the Fed starting to cut the rates by 25bps based on CME FedWatch tool as of close of markets on 12th July 2024.

Slowing economy and rising unemployment will trigger the Fed to commence its rate cutting cycle

Citi analysts predict that the Fed will slash rates by 200 bps (2% in total) by the summer of 2025. 25bps of rate cuts in eight successive meetings, starting in September. A slowing economy and growing unemployment are cited as the basis for this aggressive rate cut cycle.

RATE CUTS WILL PUT MARKETS ON TOP GEAR

Two active wars. Extreme weather conditions. Shocks from elections across the globe. None of these have had any dampening effect on equities. Such is the euphoria.

Rate cuts will put a turbo charged market on steroids. Investors out to be cautious to assess if rate cuts are already priced into equities given that S&P 500 is up >11% over last three months including 2.8% so far in July.

It is essential to make risk mitigated moves in the second half of an election year.

WHAT ALTERNATIVES DO INVESTORS HAVE?

There are many alternatives. Three common possibilities are (a) Long Micro E-Mini S&P 500 index futures, (b) Long call options on Micro E-Mini S&P 500 index futures, and (c) Bullish put spread on Micro E-Mini S&P 500 index futures.

Futures enable direct, liquid, and efficient access to the index.

Long call enables investors to gain from rising S&P 500 and from volatility expansion.

Bullish put spread allows the trader to harvest put options premium as the index rises. The bull put spread consists of one short put with a higher strike and one long put with a lower strike.

Given the sharp run-up in the index and expected volatility, long calls are not viable. Risk reward ratios for a bullish put are not compelling. Hence, a hypothetical trade set up using futures.

HYPOTHETICAL TRADE SETUP

With equity markets in euphoria and rate cuts expected starting in September, US equities are poised to rally further. Historical precedent shows that 2H of election years tends to results in positive returns in the S&P 500. Investors can express this view using Micro E-Mini S&P 500 Index futures.

Trade set up using Micro E-Mini S&P500 Index Futures expiring in Dec 2024 (MESZ2024) is summarised below:

• Entry: 5650

• Target: 6030

• Stoploss: 5400

• Profit at target: USD 1,900 (6030 – 5650 = 380 index points; Profit = 380 points x USD 5/point = USD 1,900)

• Loss at Stop: USD 1,250 (5400 – 5650 = 250 index points; Loss = 250 points x USD 5/point = USD 1,250)

• Reward to Risk: 1.5x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

French election shock: What will FX markets say? France is on the brink of a hung parliament, with the left-wing coalition capturing the most seats in a stunning upset over Marine Le Pen’s National Rally.

Obviously, the forex markets are closed on the weekend. So will be interesting to see the reaction to these shock election results in France on the EUR/USD and EUR/GBP when the market opens. Regardless of whether the market thinks this turn of events is good for France or the Eurozone as a whole, this might be trumped by its dislike of surprises.

The left-wing alliance, projected to win between 180 and 215 seats in the 577-seat National Assembly, outpaced President Macron’s liberal bloc, which is forecast to secure 150-180 seats. The far-right National Rally, led by Le Pen, and its allies are anticipated to hold 120-150 seats.

Le Pen's National Rally led in the first round of voting last week and aimed to achieve a historic majority. However, strategic voting and alliances among left-wing parties have thwarted her efforts. Le Pen’s ties to Russia, including past opposition to EU sanctions, might have also harmed her campaign. Over the weekend, Le Pen had vowed to cancel permission for Kyiv to use French-supplied long-range weapons against targets in Russia.

Is the mexican index in danger?Even with great companies conforming this index, it's impossible to ignore the effect that Claudia Sheinbaum's victory had over the markets. It's shocking to see the pessimism of the markets after her victory. Unfortunately, this has now created an infliction point in the BMV:ME index. With no recent clear support, it could be possible for price to drop quite a bit more, opening great buying opportunities.

However, if price does not begin to reverse this trend soon, it's possible that we will test lower lows.

Trials and Elections: 3 Market-adjacent events to watch Trump and Hunter Biden Trials

Former U.S. President Donald Trump was convicted last week on all counts of falsifying business records. Trump faces sentencing in one month’s time on July 11. Each of the 34 felony counts could result in up to four years in prison, although first-time offenders (or ex-presidents) like Trump are rarely incarcerated.

Meanwhile, a jury was sworn in on Monday for a (show?) trial of Hunter Biden, son of President Joe Biden, on gun charges.

Mexican Election

The Mexican peso continues to fall sharply towards 18.0 per USD, its lowest since October 2023, following results indicating a supermajority win for the Moderna party and its allies in Congress. Claudia Sheinbaum, the Moderna party candidate, won the presidential election by a significant margin.

As noted in Reuters, "The peso is underperforming amid growing concerns that the governing coalition's supermajority in the lower house might lead to the implementation of non-market-friendly policies,".

Indian Election

The Indian rupee plunged past 83.5 per USD, nearing its record-low of 83.7 from April. This movement erased the sharp rally triggered by early vote tallies, as updated counts indicated that incumbent PM Narendra Modi’s Bharatiya Janata Party is likely to secure a much narrower victory than anticipated.

Amidst the election turmoil in the world's largest democracy, the Reserve Bank of India's (RBI) monetary policy decision is also expected this week. In April 2024, the RBI maintained its benchmark repo rate at 6.5% for the seventh consecutive meeting.

Could India continue to drive returns for Emerging Markets?India shined as one of the best performing markets globally in 2023 despite high global inflation, rising interest rates, and unstable geopolitics. The Sensex and Nifty, two widely followed benchmarks for the Indian markets, grew 19.57% and 21.11% respectively in US Dollar (USD) terms1.

India’s economy displayed strong local retail demand, moderate inflation, stable interest rates and healthy foreign exchange reserves. India also enjoyed relatively healthy relations with most major economies of the world and cautiously navigated the geopolitical conflicts.

As we look ahead in 2024, we remain confident that India, driven by a host of macroeconomic factors, is a long-term story and one that could last for years if not decades to come. National elections are due to be held around May 2024. Current Prime Minister Narendra Modi is seeking a historic third term and it is highly likely that the ruling party, Bharatiya Janata Party (BJP), will once again win with a full majority.

India benefits from Modi’s pro-business and pro-growth policies and a stable political environment further boosts prospects to realise rapid growth. We analysed the performance of BSE Sensex, one of the widely followed benchmarks of the Indian stock market, pre and post elections.

On average, the Indian markets displayed positive performance, delivering over 31% returns over the year leading up to elections, combined with the year after election results. This is despite the global financial crisis of 2008, and the COVID-19 drawdown negatively impacting the performance leading to 2009 elections, and after the 2019 elections respectively. We expect this trend to continue with the likely return of the incumbent government.

Of course, should Modi lose, some of the recent gains might reverse. However, that seems highly unlikely, given the state of opposition, as multiple political parties, including some with completely unaligned agendas have joined hands to prevent a third Modi term. This was evident over the five recent elections in which the BJP won by huge majority in three of the largest states with a high proportion of the Lok Sabha (national election) constituencies.

Other important factors that investors might want to keep an eye on during the year:

1. Rate cuts – The Federal Reserve’s pace and timing on rate cuts will impact global markets and India is no different. The quicker and higher the cuts, the more the capital expected to be diverted towards equities, and with a strong momentum from the previous year, India might be one of the top picks in the Emerging Markets.

2. Crude oil prices – The Indian economy heavily depends on the import of crude oil. The higher the crude oil prices, the more the stress on India’s foreign current accounts. Drops in crude oil could help India’s economy grow faster and allow more room for spending on growth and infrastructure. India is simultaneously also working to reduce dependency on crude oil by diversifying into ethanol. Over the last few years, ethanol production has increased manifold and there is rising pressure to increase the usage of ethanol-blended fuel to power vehicles. This could potentially save the country much needed cash and help direct it to fuel economic growth and reduce fiscal deficits.

3. China decoupling – India has emerged as one of the most credible contenders to help diversify manufacturing out of China. For example, Apple established a considerable footprint and plans to scale up operations multi-fold; significant investments and subsidies were introduced to attract semiconductor companies from Taiwan; and there are also suggestions that Tesla is looking to enter India with a USD 2 billion investment into a manufacturing facility based in the state of Gujrat.

One of the most iconic policies of the current government over the last decade has been ‘Make in India’. The government will be pushing hard to attract more companies to set up manufacturing plants in India and leverage the success of ‘Make in India’ among voters.

4. Geopolitical instability – India has been relatively less impacted by geopolitical conflicts around the globe. India maintained its neutral stance and successfully managed to stand firm despite pressure from the west by importing discounted oil from Russia to ensure its energy security, while at the same time pitched itself as a closer ally to the US to counter the growing China threat.

5. Retail flows – In the recent years, India witnessed increasing participation of retail investors in the stock market. There are 80 million unique investors in the Indian stock markets that invest through the NSE.2 Moreover, the size of mutual fund AUM is around 24% currently compared to 11% a decade ago. The strong retail presence helps add stability to the Indian markets in events of global instability and Foreign Institutional Investor (FII) outflows.

Conclusion

We strongly believe that India is a multi-decade story, and we are in very early stages of it. India has made tremendous progress in privatising corruption and debt-ridden state-owned companies, with disinvestments fetching USD 50 billion for the government over the last 10 years, out of which close to USD 40 billion was realised from sales of minority stakes, while close to USD 10 billion was realised from strategic transactions in 10 CPSEs – with the most notable being Air India3. This has helped in making companies more accountable to investors and more accessible via the stock market.

Sources

1 Source: WisdomTree, Bloomberg.

2 Source: According to recent comments from CEO of National Stock Exchange (NSE)

3 See: Disinvestment fetches over Rs 4.20 lakh cr in 10 years but target to be missed again in FY24, December 2023

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

BTC - Great buying op next 2 monthsHey, folks. Great buying opportunity for BTC coming up in December and January.

But first, BTC should fall 50%. Don't be afraid. It has happened before, as shown in the chart above.

Two cycles ago, in 2014, BTC fell from about $450 in October 2014 to around $175 by January 2015. That was a drop of about 61% in just 3 months. January 2015 was the low.

One cycle ago, in 2018, BTC fell from about $6,500 in October 2018 to around $3,200 by December 2018. That was a drop of about 51% in just 2 months. December 2018 was the low.

This time should be the same. We should see BTC fall about 50% to 60% from October to December or January. Currently at around $19,500, it should fall to around $9,500 to $7,500 over the next 2 or 3 months.

One reason why this happens at this time in the cycle is because of the US mid-term elections, which occurred in November 2014, November 2018, and will occur again next month in November 2022. The US dollar generally strengthens following the mid-term elections which take place at the beginning of November. When the dollar strengthens, BTC, gold, and currencies tend to fall.

Keep in mind that following the mid-term elections of 2014, BTC rose a bit and then fell 60%, so it may rise a bit this time too before falling 50-60%. However, following the mid-term elections of 2018, BTC did not rise at all but simply fell right away.

Either way, this December and January should be great buying opportunities. Be prepared for a big fall first. The price could be cut in half soon. That would be a great opportunity.

Bitcoin Price Correlation Presidential & Midterm ElectionsTake a look at the correlation between Bitcoin price and Presidential & Midterm Elections over the past 10 years. In 2012, 2016, and 2020, price started to rally on election day. These were also years of the Bitcoin halving. In 2014 and 2018, price started to drop substantially on election day. Will we see the same for 2022?