Sit and Wait on the USDWith the looming US Presidential elections, and the recent mixed messages from the Federal Reserve, the direction of the USD is unclear for now. Wait for more clarity before choosing a side.

Could the USD downtrend be coming to an end? The charts of many currencies vs the USD are quite inconclusive on where the USD is headed in the near term. Charts do not always have to point up or down. They can often show signs of indecision as there are many conflicting factors driving the USD at the moment. Stay neutral and wait for clearer opportunities for now.

Elections

DXY possible scenarioIt's been a long time..

I brought here some ideas for the dollar index for the upcoming weeks. As you know, the elections are around the corner and that should trgger some high volatility movements.

On the screen, you can see a bearish movement over the last months, which shows the weakness of the USDOLLAR. On my opinion, that movment is a first bearish impulse of the index, which has eneded on the last fifth impulse. Is probably to see an "ABC" correction on the nexts weeks, testing the 38.6%-78.6% fibonacci retracement ( 93-96). Then, we could see a rejection of that levels and a next bearish impulse below the 90.00 level.

I'll keep updating the analysis..

Ethereum Heading into a New Bear Trend till end of 2020Hi traders, I hope everyone is safe and healthy in these tough time. Here is the outlook for Ethereum for the next few months. Hit follow and like to show your support:

:arrow_forward: :chart_with_upwards_trend: Next level to consider rebuying some back if bullish is at $310-290 and $285-275 bottom of that broadening wedge where the bulls must try reversing it back up above $400 immediately to preserve the rounding bottom and bull trend :chart_with_upwards_trend: .

:chart_with_downwards_trend: Note that if we break that $285-275 support, then we may go in an extended bear market AGAIN unfortunately until end of 2020 after which a new bull market would start Q1 2021 which is a substantial delay again due to the US elections and US economical/pandemic mismanagement/incompetence of Trump's presidency.

If the bear trend confirms, then I do think we find a bottom on ETHUSD and BTCUSD sometime September or October before the US elections and I am currently looking at $220-210 for a rebuy/relong longterm for that bottom after which we'd see ETHUSD recover back up mid October to November 2020 back above $275-285 similar to July-October 2017 action...

:arrow_forward: Overall portfolio management wise, it is best to flip 50% to fiat and 50% ETH longterm and just watch. If we regain $400s+ then we can consider reinvesting the rest. If those 2 years of bear market in Crypto taught us something new, it is effective and proper risk, portfolio and trade management and most importantly banking profit/cash and withdrawing that profit to the bank account and enjoy it. Do not take any long-term outlook for granted and always take profit, else we'd suffer continuous losses over the years at the mercy of the high frequency algos and CME institutional entities.

Stay safe!

BTCUSDT | Bitcoin has crashed but is the growth phase finished?Overview

Bitcoin broke up through $12 000 but is now crashing. Gold set a new all-time high but has since pulled back. The S&P 500 keeps on setting high after high. Still, all of these assets have one thing in common: they’re all at risk for a sizable correction, primarily due to the dark cloud hanging over the coming United States 2020 Presidential election. However such explanation can describe short-term effect on Bitcoin's price action but what about long-term perspective?

Fractals

Bitcoin global ATH $19 798 was reached on December 17th in 2017. Afterwards the whole cryptocurrency industry entered a consolidation phase decreasing until April 2nd in 2018 when a new growth stage started. After 3 months of ascending trend Bitcoin made a local peak of $13 970 on June 26th where consolidation started again making a Fractal pattern.

Why are these Fractal patterns so important now?

Bitcoin price action tried to consolidate at previously broken resistance levels to stop crashing during the first Fractal in 2018. Retrospectively we can see it failed after several attempts reaching major support which was also rejected thus it resulted in a dramatic crash to base level of $3 156. Currently we see the very similar situation:

- Local support of $11 400 was broken

- Previously broken resistance level of $10 400 level is being tested but has low probability to withstand

Based on the Pitchfork and trend analysis we see a high probability of breaking down the level and further retest of major support level. Which will confirm repeating Fractal pattern and will signal for descending trend

Conclusion

Bitcoin is at decisive moment. The long-term price action development depends on whether BTC succeed to consolidate above $10 400 level or not. Most traders from SkyRock Signals think Bitcoin will break the level within next days because of bearish fundamental background, negative results of trend and technical indicators analyses. The scenario will bring the leading cryptocurrency to Major support near with $8 893 level. On a contrast with the first Fractal this level is close to fundamental production value which increase chances of bouncing back. However it is hard to accurately forecast what will happen when Bitcoin touches major Support because Fractal patterns do not guarantee retrospective will happen again. The most important now is to set tight risk management settings to your cryptocurrency assets positions until decisive moment is passed

Stay safe and confident. We will update this trading idea so stay tuned

Best regard,

SkyRock Signals team

NOG is worth a gambleNOG is a oil and gas company in Minnesota, which is an interest stock that poped up on r/pennystocks and think it might be worth to toss in some money into it. It hasn't perform well at all, yet the reason for this gamble is that the election is coming up and Republicans are pro oil and gas as further green technology is being developed, yet the Democrats want to go full green with their green new deal which could destroy the oil and gas and company.

News

-Elections are coming up this November for the US and Minnesota is a key battleground state. It was Democrat in 2016, yet this year its classified as a battleground state and following 2016 Democrats won with a 1.5% margin. Pretty dam close. Current polls shows that biden was winning by 18, yet now only 2.

Source: projects.fivethirtyeight.com

-ER wasn't great, yet could be due to fact of the covid 19. According to USAtoday as of 8/25, Minnesota is growing in the number of cases.

TA

-Now the upside potential out weights the downside with .6377 being on the table which is a 8.6% drop in price. The upside ranges from 5.7%-50% in the short term from tagets of .742, .8515, and 1.0494.

-This stock is in a long term downtrend, yet high vpvr shows a range of .742-.8515 would be in the realm of possibilities and could be a nice short term trade.

-MACD is rising which is bullish

-RSI is just overbought, yet could be overcome with sideways movements or extreme volatility coming soon.

Final Thoughts

My political view has no affect, yet I would assume a Trump victory would push this stock higher or lower. Whatever party you are a small gamble in a small oil and gas stock from a battle ground state wouldn't be a bad idea. I took a position in this stock today just to see where it goes when we get close to the election/debates/ and after the elctions. If movement starts going up showing massive buys you could suspect the oil sector will being pushing up rapidly. So in the meantime watch the polls, if they are even worth to watch after 2016, to see who Minnesota favors and watch tweets from Trump about Oil and Gas.

SNP Headed for a double topThe rate of SNP at which recovered since the bottom on March 23rd 2020 is regressing into a logarithmic recovery (see blue line), which is similar to the bottom of December 2018, although not as steep as 2020.

In 2018 the recovery stopped when we reached the previous high around $2,940, then we saw a a fibonacci retracement to the second level ~$2,726 .

If this pattern repeats we would see the S&P climbing to its previous high ~$3,400, slowly loosing momentum, then, when the bears will take control we might see a retracement to $2,950 which is also the previous high, which would work as additional support.

The price might find support at the 200 SMA or the first level of Fibonacci retracement , which is around $3,100. Hopefully by the time we reach the peak the 200 SMA will have moved up, hopefully to the -23.6% Fibonacci level so we might reverse there, but if the economic data and polical tensions continue to create headwins we might see a further retracement to $2,950

DXY leading up to RE*election yearsalways drops, and markets always pump as a result. Note this is used during RE (key) elections. During the other cycles, it is evident that DXY does quite the opposite (gets pumped) and thus making the markets dump. This results in the "other side" using the economy as a bargaining tool for their elections. (Or rather 1 party who seems to be controlling all of this!)

SPY In-Depth Fundamental and Technical Analysis This is simply an analysis, not an invitation to go short or long, please do your own research

As you can see besides the technical analysis indicating a possible fall for SPY, we have also many fundamentals which pushes me to say that there is a decent probability we can see SPY go down to support before either going back up to top channel, or completing the ascending channel and going below the bottom channel, which at that point a recession is very likely. This will depend on the election results mainly in my opinion.

We can't forget about the fact that half a year ago we saw the dividend yield reversal, which has been a great indicator for recessions (Which I don't see happening right now). The current market is driven purely by greed. Pretty much everything is trading at values that are much higher than they are supposed to be.

Political uncertainty in the US is also very important to remember, we have elections coming up soon and besides that we also have massive proposals from candidates like Bernie Sanders which are proposing a massive reform to the economy. The DNC and the censuses will be big players in helping us trace market movements as they have in the past.

An economic slowdown is still not yet obvious, consumer spending has been doing great for the last couple of years and companies are releasing great reports and earnings, but that doesn't mean that SPY is correctly priced today, I find a price correction likely.

No one can predict with certainty where the market will be in a year or two, which is why I need to repeat that this is not a signal or any sort, but purely what is currently happening in the market.

If you have a different opinion or if you believe I got something wrong feel free to leave a comment.

Follow me for more related conten

GBPCHF Long IdeaHi everyone I had an idea on going long on GBPCHF, here is my analysis:

Its obviously not news if I tell you that on Thursday the UK Parliamentary Elections will take place, which predicts a Tories majority, which is seen as bullish for the market.

For CHF, CHF is known to be a ''safe haven'' in Europe, so it would make sens shorting it against the GBP.

I am open to any opinions in the comments below, we are all here to help each other out and learn!

4 Fibs all lining up, Sell GBPUSD!!Starting with the April 2018 high down to the September 2019 low, price retraced up to the 62 fib during the British elections, also bouncing off its years long resistance trendline .

From the election high down to the December 23rd low, the 62 fib was touched on December 31st.

From that high down to the January 3rd low, price jumped just above the 62 fib yesterday on the 7th.

Now from that high back down to yesterdays low, the high today just touched the 62 fib.

Today's and yesterdays bounces are less strong than the higher timeframe ones, so I have my stop losses staggered just above these different highs. Choose your risk comfort, I plan to hold all the way down to the 200 daily moving average around 1.27-1.28, lots of profit to be had!

GLTA, cheers

The 2020 OUTLOOK: Broad Market Analysis and Guidance (Part 4/4)The 2020 Outlook: Series on Equities , part (4/4); Dec 28th, 2019

Very simple and straight forward chart. Obviously, very unlikely that it'll completely follow the drawn structure, but here are the few things that I am expecting in 2020.

1. It will be a slow year. Mostly because of all of the election noise, smart money will be waiting on the outcome of the elections. The importance of the elections, is that it's one of the most polarized election in recent history. It will basically be a coin-toss whether, we will have a sell-off post elections or not. Either-way, speculators will kick in 2020, and volatility should rise . Momentum is still bullish.

2. Global macro trends have bounced and are somewhat recovery. I am waiting to see whether the recovery will continue in Q1 and Q2 before I completely dismiss any bearish ideas . Corporate profits have recovered(fred.stlouisfed.org), but they still do not support the current valuation(P/E well above historical average).

3. As of now, "Not QE" balance sheet expansion program by the FED, is planned to be cancelled in January, but options are open for further action. Post QT, liquidity is still low, and the yield curve is flat. Expecting further accomadative monetary policy, perhaps even an actual QE-4 announcement by May.

4. The trade/cold war is HERE TO STAY. It's not going away! It will be prolonged, until most US companies move their supply chains out of China. This will dramatically decrease global growth in the short run . In fact, I think upon announcement of Phase I, it'll be a good sell news.

This is it for 2019, happy New year! It's been a year full of events, developments and progress. Hoping for an even better 2020. Wishing everyone better health, better relationships and of course, larger trading P/L's!

This is it on my series on the 2020 Outlook. Make sure to check the previous parts, charts and discussions are welcome! Thank you for the continuous support and feedback!

Investing Strategies: Momentum vs Value Investing

Liquidity Significance:

For those of you interested in investing in GOLD:

-Step_ahead_ofthemarket-

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up and follow is greatly appreciated!

Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

ridethepig | UK Elections [LIVE COVERAGE] UK Election Chartbook

With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier to track:

=> A Tory majority which will deliver the Johnson/May deal with a hard brexit via Irish sea border and less activity with the EU (70% odds).

=> A Labour minority government with a helping hand from Lib Dems et al, here we can expect a second referendum in 2020 with a choice between a soft exit or remain (28% odds).

Any further gridlock in Parliament is currently sitting at <2% and does not remain in play. This would dramatically short-circuit GBP as markets will be caught out of position.

UK markets pricing a Conservative majority as a " positive resolution " to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

In any case, a ruthless Downing Street (with the help of Cambridge Analytica and co) have a free pass to do what they want and say what they want with scandal after scandal yet the masses remain on mute simply wanting to " get brexit done " ... bitterness in the public will last for a very long time and history will mark the collapse of the Crown, a fall that will stretch decades turning little England into a house of economic bondage.

A quick review of the UK Election Opinion Polls :

Survation: CON: 45% (+3) LAB: 31% (-2) LDEM: 11 (-) BREX: 4% (+1) GRN: 2% (-2), 05 - 07 Dec Chgs. w/ 30 Nov

BMG: CON: 41% (+2) LAB: 32% (-1) LDEM: 14% (+1) GRN: 4% (-1) BREX: 4% (-), 04 - 06 Dec Chgs. w/ 29 Nov

YouGov: CON: 43% (+1) LAB: 33% (-) LDEM: 13% (+1) BREX: 3% (1) GRN: 3% (-1), 05 - 06 Dec Chgs. w/ 03 Dec

Deltapoll: CON: 44% (-1) LAB: 33% (+1) LDEM: 11% (-4) BREX: 3% (-) Chgs. w/ 30 Nov

Panelbase (Scotland): SNP: 39% (-1) CON: 29% (+1) LAB: 21% (+1) LDEM: 10% (-1), 03 - 06 Dec Chgs. w/ 22 Nov

Exit polls will start at 10pm (GMT) via SKY/ITV/BBC. Usually the exit poll is very accurate so it is highly likely we will be able to clear the knee jerk flows quickly unless there is a major surprise. We can draw a tree below to showcase the forward walk with Brexit:

- UK Elections (we are here) => Conservative majority => No transition extension (most likely scenario)

or,

- UK Elections (we are here) => Hung parliament => Second referendum (least likely scenario)

On the macro side, I have widely covered segments on growth, inflation and policies in the Telegram and in previous ideas in the archives (see attached). A major round of fiscal easing is coming, this will artificially keep growth supported in the short-term however the output gap will not close. Inflation will once again tick above target, however not via a robust consumer as many predict but rather via supply side constraints and uncertainty. The BOE will remain sidelined till 2H20 and provide a decent profit taking opportunity for our macro short positions.

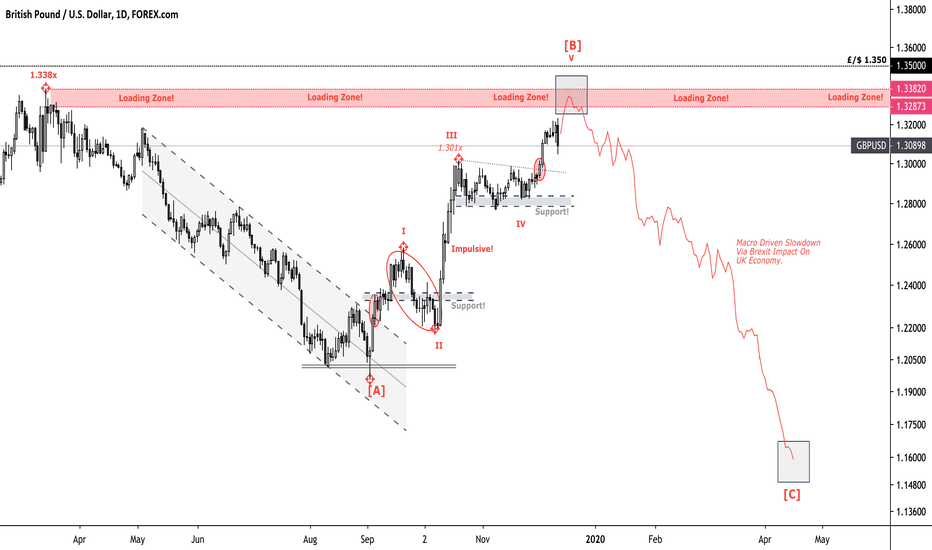

For the technical flows we are tracking the infamous 1.35xx psychological resistance. This is a great level to track for macro positions in 2020 on the sell side. Here I am tracking for a leg from 1.35xx => 1.15xx via Tory majority and the Brexit fact impact leg. A quick recap of the same levels we traded here live on tradingview earlier in the year. We are sitting at the same levels as before which we were loading into and traded a +/- 2000 tick swing !!!

Here I am becoming increasingly bearish on UK outlooks with either scenario. In my books Johnson will win by a country mile and we will immediately be able to trade the final flush in Pound (stage two of our rumour/fact impact legs). Populism is spelling danger across the global economy and shows no signs of abating.

...Best of luck to all those on the sell side and looking to increase exposure across portfolios. As usual thanks for keeping your support coming with likes and comments !!!

The Monday moveYesterday several indicators was leaning towards a big move today from yesterday’s post (will link below), but I remained bullish and was too busy to pay attention to the charts. Nothing really stood out. After breaking 7024 and now well below 7k. There is now more downside coming soon.

Targets of now would recommend a retest of 6.5k and if you been following since the double bottom or first break to 6.5k are long term bearish target is that 5.2k range.

Why would it go to 5.2k lower? Well vpvr shows most trading volumes in that area also let’s talk politics.

US election is next year with the halving. I predict we rebound to 7k closer to the halving, but more bleeding as Congress is looking towards election instead of regulation of crypto. Will be another slow year till next fall. Also with price the war between China miners vs western miners since China has the cheapest compared to western miners it wouldn’t be surprise if there’s attack of more sell pressure to eleminate western mining farms to control the network.

So now we will play the bearish side till next year.

FTSE Bottoming Pattern on 4 Hour Trade/ British ElectionsJust before I talk about this trade, just a fair warning that the British Elections are this week on Thursday December 12th. So a high risk event, and will be dominated by Brexit promises.

I have spoken about how Central Banks in the Western world are stuck, and they are now attempting to maintain confidence in the system. They want to go back to easing and QE but remember, QE was supposed to be a one time desperate policy to prevent a 1920-30's like great depression. When we go back to QE, people will realize it did not work in the first place. They will use different names to mask QE, but this is the confidence crisis that looms.

These central banks have one role now: to keep assets propped. This will eventually be morphed into buyers of LAST RESORT (instead of lenders of last resort...which was the central banks original mandate when they were first being formed).

I am expecting higher equity prices in the US because there is nowhere to go for yield anymore. Also, many investors know the Fed will support this market. Not to mention the President needs high stock markets if he wants to win the next election using "Keeping America Great" slogan.

Yes, we will have pullbacks, but equity markets will go higher. I speak about why this can be a problem for the Fed and the US Dollar. Post linked below.

In terms of the current FTSE chart, we did make a bottoming/ double bottom pattern at a flip/support zone. From here, we had a nice break above a flip zone marked in blue, a strong break, and now it seems we are making our first higher low which will be confirmed with this current 4 hour candle close.

Target will be the flip zone at 7340 for the trade.

The UK General Election 2019. All you need to know.The UK General Election 2019. All you need to know.

Plus, a great betting opportunity guide as a bonus.

As we all know, The UK General Election is to take place on 15th of October, deciding the fate of the country not only for the next 5 years, but for the decades to come!

The need for the election was obvious, given the Brexit impasse in the parliament, that was unable to deliver Brexit for more than 3 years, sabotaging the will of the people. Having a Remainer prime minister without the real majority did not help the cause either.

Now, with new Brexiteer prime minister Boris Johnson at the helm, and the ERG-the European Research Group, the eurosceptic parliamentary fraction within the Conservative party, the country has got a chance to see some real action. Yet, we saw the parliament going to great lengths to sabotage the new government, ranging from using the powers of a scandalously biased speaker- John Bercow, to prevent voting from happening to using the newly created supreme court, who’s politically motivated decision undermined the government and the Brexit proceedings.

Getting to the election was a massive struggle in itself with the opposition blocking the motion to call for an election, which Implies the oppositions grim outlook on its electoral prospects.

Now, with less than 8 days to go, let's have a look at the election scene the way I see it.

So, the Tories are leading in the polls, entering this election as a ruling party, with some recent success in the Brexit talks, a charismatic energetic leader, and a clear Brexit position, which is now declared to be the hard Brexit, with a proper trade deal afterwards. The, who wins this election will decide not only the manner of leaving the EU but also the future relationship with the Block.

Brexit seems to be the key focus issue of the Tories in this election, and they are trying to steer all the debate into this channel. There is a grain of salt in there for Boris, however, as he promised to take the country out of the EU by 31st of October, and, as we can see, he did not. Not his fault though, but, a good aim for criticism for the competitors.

There are some spending promises from Tories too, for NHS In particular, which seems to have become the sacred cow of UK politics.

Boris Jonson himself is both an asset and a liability in the increasingly «presidential» in style UK elections. He is vocal and charismatic, bold and aggressive. Compared by many to Donald Trump in both the political style and in the way he looks. Some might remember him as a liberal mayor of London, for others, especially the young swing voters, his Brexit stance and his style might be a massive put off.

On the bright side, one of the highlights of the last debate was Boris’s clear position on Scottish independence. He said that the Union is more important than Brexit and than anything else, which is appealing to the part of the electorate that values the Union, which, let's be honest, is a majority, even in Scotland. Seats before current parliament dissolution: 298

Labor, in contrast, is entering the election mired In the antisemitism scandal, with Jeremy Corbyn as a leader and an unclear Brexit position. Corbyn, being a geriatric incoherent Marxist, who miraculously managed to become the Labor leader is a massive scarecrow for swing voters of all stripes.

The last election momentum surge, that deprived the Conservatives of their majority was largely due to the voter’s delusion of Labor being a Ramain party. That advantage is gone, with labor spending all 3 years of Brexit struggle sitting on a fence, calling it “constructive ambiguity” and now, becoming a second referendum party. Labor wants to renegotiate Boris Jonson's deal and then put the result to another public vote, with the Remain as a second option.

Unsurprisingly, Labor talks mainly about the “starved” public services, the river of cash for the NHS, the free broadband for everyone, in addition to their plans to nationalize Water, Rail, and Electricity.

More free stuff for everyone paid for by the money form the magic money tree, which is how Labor sees the government borrowing and taxation. Should labor get in power, having half their plan done is certain to put the country on the brink of insolvency. They call that ending the austerity, which turns out to be a maximum affordable level of spending when put under scrutiny. The fact that the public services used to get more funding in the pre-crisis Labor era simply means that the latter tend to spend beyond the means.

Another cornerstone of labor criticism of the Conservative opponents is the trade deal with the US which might be struck, should Brexit go as planned by the current government. Labor screams about the dreaded chlorinated chicken, lower labor protection and the sacred cow-the NHS being up for sale for the US health providers. For that, it is only fair to repeat Jonson’s joke, that the only chlorinated chicken here is Jeremy Corbyn himself. Seats before current parliament dissolution: 243

Lib Dems gamble on being a Remain party, with the policy to cancel Brexit seems to have backfired, with such pandering being perceived as unconstitutional and undemocratic by most of the people. Also, fake grotesque confidence exhibited by its newly elected leader, styling herself to the next Prime Minister which is almost impossible, has turned voters away.

The third mistake was remaining fiscally conservative, as it was expected for the Tories to go on a spending spree, so the Lib Dems wanted to appeal to the Tory voters, who are disappointed with the so-called current conservative's swing to the right, but who can’t vote labor. Having a female leader- a fresh face that is not mired in the “dirt” of the coalition years might help, yet, I don’t see the Lib Dems as a formidable contender. Seats before current parliament dissolution: 20

SNP- the Scottish independence party is interesting to watch with the independence talk being reinvigorated by Brexit, with not only the majority of Scotts voting Remain in the Brexit referendum, but also, previously, many voted to stay in the UK during the Scottish independence referendum, because of the UK’s membership in the EU. Now, with the UK set to leave the EU, SNP is making the case for another independence referendum, arguing that the post-Brexit UK would be such a different country, that another referendum is needed. Seats before current parliament dissolution: 35

The other parties are most likely to keep their insignificant number of seats and are largely irrelevant for this analysis. Independent MP’s: 24, DUP:10, Others:22. The total number of seats in the house of commons:650.

There is another interesting element in this election: the Brexit Party. A newly formed party starring in the latest EU parliamentary elections, which theoretically were not supposed to take place in the UK due to Brexit, humiliating Britain with its inability to get the job done.

The party is Nigel Farage’s child, who is arguably the most notorious and well-spoken Brexiteer, who advocated for the UK leaving the EU for the last 20 years.

The party was meant to be a boogieman for the Tories, pushing the latter further south on the scale of the Brexit hardness, threatening to steal the leave voters from the tories around the country.

The Brexit party's current position exposes the inadequacies of the UK’s current electoral system. The first-past-the-post (FPTP) system, where single MPs are picked per constituency on a non-proportional basis, means that smaller parties have virtually no chance of getting any representation in the parliament, ensuring the two main party’s lead position.

UKIP- the UK independence party, a former Nigel Farage’s project is a perfect example of the inflexibility of the FPTP system, with the UKIP polling in 7-12 percent at times, yet failing to get a single MP in the commons for years.

Voters might like your agenda, yet people vote for the party that has got chances of being in power at the end of the day. In other words, it is theoretically possible for the party to get 30% of the popular vote, but with it being distributed evenly among the constituencies, the party gets ZERO representatives in the parliament.

The recent study shows that nearly 14 million voters are living in constituencies that have been held by the same political party since at least the second world war, with some not having changed hands for more than a hundred years.

The Brexit party’s power, while having no chance of getting a single MP, is in that it could steal some voters from the Conservatives in each constituency, delivering victory to the Labor.

That is how it was supposed to work. This position might have shifted the Conservatives position, so the plan worked. Now, however, with the Tories being the only ones, who can deliver any Brexit at all, Nigel Farage said they are not targeting Conservative seats.

The same complication haunts the Lib Dems, with the Conservatives saying: vote Lib Dem-get Corbyn in power. And that is a reasonable claim.

It is clear, that this election is going to be about who you hate the least, not the who you like the most.

With no one having made a single major gaff yet, the campaigns have been quite dry and boring, the debates were toothless and uneventful. Taking this into account, with just a week left to go, the polls and the common sense suggest a high chance of the Conservative majority, with the bookmakers supporting this view with 2/5 odds on this scenario vs 6/1 on the Labor Minority being a second likeliest one.

Labor Minority, which Implies that Labor takes more seats than the Conservatives, yet less than needed for the majority, is wildly unlikely, due to the fact that Lib Dems are mostly targeting Labor seats. SNP might gain in Scotland, taking seats from both labor and Conservatives. So Torie seats are largely the only ones, that Labor can be targeting , which will prove to be a hard thing to do, given the current poor state of the labor party.

Tories minority government seems to be the second likeliest option to me with the odds around 10/1 making it an excellent betting opportunity. Here is why. If Tories don’t get the majority, labor might indeed try to form a coalition government by promising SNP a second independence referendum and offering Lib Dems a seat at the table and a second Brexit referendum with even softer Brexit option on the table. Labor will need both SNP and Lib Dems to form a coalition, which makes it an unlikely option, given the limited time given to form the government and the difficulty and instability of the Trilateral relationships. The prospects of the coalition are further undermined by the Lib Dem's bad memories from the coalition with Tories. Will they risk another one? Who knows. The unlikelihood of the coalition government is reflected in the 22/1 odds, making it a formidable betting option too, because, while being less likely than the Conservative Majority/Minority government it is still possible given how volatile politics has become.

Common sense suggests that the Tories majority is the best scenario for the UK now, as this option provides certainty with regards to Brexit, makes the US trade deal possible, and keeps the Union intact by denying the SNP their second referendum, which is an insane endeavor, to begin with. Not least because they had one already. And such votes are supposed to be a once in a generation thing at best. You can't just throw in an independence vote now and then for a laugh. Also, we can trust the Conservatives to be fiscally responsible, which will help the country prepare for both the possible global crisis and the headwinds of the first post-Brexit years.

On a side note, Brexit and all the other issues that the UK faced in the last 5 years exposed an outdated political system unfit for the 21st century. The need for the electoral reform, giving more power to smaller parties while also allowing for the new ideas to come onto the political scene, forcing major parties to adopt, is clear as day.

There is a need for a written constitution too, now that the UK has got a supreme court, which was able to overturn the decisions of the government recently while being unelected and unlimited in the scope and direction of its decisions by a written constitution. Finally, a radical decentralization is crucial to keep the Union, or one, and also to allow for the county to be run more efficiently, whereas now almost all the power rests in London.

The end.

Please, like, comment and subscribe.

EU Elections, the USA isn't ready for peace & RF monetary policyIt is not surprising that nothing significant in the dynamics of prices for financial assets occurred duo to calm mood on the USA and the UK financial markets.

Tuesday in terms of macroeconomic statistics also promises to be a very calm day. But we do not wait for a lull in the markets - after 3 days of rest, traders and investors with redoubled efforts could begin to follow current trends and news background.

The main news on Monday was the announcement of the results of elections to the European Parliament. The main parties of the European Union retained their positions. And the main fear, the victory of the populists, turned out to be only a fear: Euro-skeptics and the ultra-right took 171 places in total, against 503 places of four pro-European parties. In this light, we believe that our position - buying the euro against the dollar - is one less threat.

Trump went to Japan over the weekend. According to him, the United States has achieved "significant progress" in trade negotiations with Japan. But it is not necessary to count on any final deal upcoming days. Nevertheless, this kind of information rather favorably and reassuringly influenced the mood of investors and traders.

As for the main front of trade wars - between the United States and China. Trump said that the United States is not ready for the current version of the deal "and that it is not easy to pay duties to Washington for Chinese authorities, therefore they will agree to conclude a trade agreement with the United States, in the end. So the United States will continue to push.

Quite interesting information about the Russian ruble was recently shared in Bloomberg. Experts at Bloomberg Economics believe that the Central Bank of the Russian Federation will lower the rate on June 14, and then again in September and December. So, after a rather long period of inactivity, the Central Bank of Russia is entering an active phase of easing monetary policy. What does this mean for the ruble? That it will become even less “attractive” for foreign investors. We consider such information as confirmation of our basic trading idea - the sale of the Russian ruble. Considering that recently the Russian ruble has strengthened, we believe that its sale is more relevant than ever.

Since nothing special happened yesterday, our trading positions did not change: we will look for points for buying of the euro and the Canadian dollar against the US dollar, sales of oil and the Russian ruble, as well as buying of gold and the Japanese yen. In addition, we will carefully buy a pound.

We are preparing for European elections & referendum in the UKToday, we shall consider important topics, near future and opportunities.

Elections to the European Parliament will be held in Europe this week. (Elections will be held in 28 countries from May 23 to 26, 2019, 751 members will be elected. Those elected people will represent more than 512 million Europeans, which makes these elections the largest transnational elections in history.) The event is quite dangerous for the euro buyers. The fact is that the victory of the euro “skeptics” might cause difficulties in adopting the EU budget. And the Italian populists, with their plans to violate the EU budget deficit requirements, do not contribute to the faith growth in the bright future of the euro.

Another potential victim of election results could be the pound. It is all about the attention that has been focused on internal political squabbles and negotiations in the UK. There are two sides in Brexit process, they are the UK and the EU. However, the EU could not make a compromise and then there will be no agreement at all. And there will be a “rigid” Brexit. In this light, we continue to remind you of the risks incising working in pound pairs, especially when it comes to buying pounds.

Confirming our thesis about how is everything uncertain over the pound and Brexit, we cannot but note that British Prime Minister Theresa May will invite members of the House of Commons of the British Parliament to hold a new Brexit referendum. May wants to propose to British to decide, on their own, whether to approve her version of the deal or not, following the example of the majority of parliamentarians who have repeatedly voted against, or to abandon the idea of “divorce” altogether. Pound after the appearance of this news soared by a hundred points, but then returned to the original.

(in chronological order of publication) Inflation statistics from the UK, data on retail sales in Canada, as well as the text of the minutes of the last FOMC Fed meeting publication, are the most interesting events.

We note that recently the Canadian dollar has strengthened in the foreign exchange market. This is due to news that the US will soon cancel duties on steel and aluminum from Canada and Mexico. That is, the attitude of the markets towards the Canadian dollar is positive. So, the positive statistics on retail sales will definitely give an upward momentum to the currency of Canada. Recall that this week we recommend looking for points for buying of the Canadian dollar.

Our trading positions for today are as follows: we will look for points for buying of the euro against the US dollar, sales of oil and the Russian ruble, as well as buying of gold and the Japanese yen.

Oil - Eyes on 41.38I never expected a drop this far/this quickly and have felt the pain looking for a bottom too soon; but here we are. With prices closing on the weekly below Sep '16 - June '17 Support (43.x), I see potential for a continued grind down as prices are right back in the eye of the 2015/2016 storm. IF... prices close a weekly bar below 41.38, then I believe we may see clustering/ranging between 34.x-41.x finding midterm support in the overall bottoming process; however I also see potential for a spring down to test and possibly crack the 30 level where I would expect very strong buying at the Feb 2016 neckline between 29-30. In summary - I am looking for a bottoming process between 34.x-41.x with a possible quick spring down to 29.x - this could create a great buying opportunity heading into late 2019-2020

Overall - I believe this could accompany Equities (S&P) retesting the 1800-2100 levels and feel this deflating/inflating - if oil prices run back up to 60/70 heading into 2020 will be very healthy for the economy ------- heading into 2020 elections, wink wink....

Merry Christmas and Good trading all!

The US Midterm elections to drive the "Aussie"Trade Set up - In theory, tactically shorting the ‘Aussie’ around 0.7100, targeting the psychological level of 0.7000 level would make sense for technical trades, given the entry would be aligned to a strong underlying trend. That said, the big picture and set-up on the daily makes us cautious to take that trade, in fact, we would look to initiate a long entry if we see a daily close above 0.7160 level.

Why we like it - The ‘Aussie’ has been trading a bearish trend on a technical basis since the beginning of the year and this trend appears to be very mature. We can see bullish divergence between price and (slow) stochastic momentum, suggesting a potential reversal could be in play. A close through 0.7160 would go someway to confirming this.

The US Midterm elections next week could cause volatility in the market, and we see the risk to the USD skewed to the downside, which would support AUDUSD on its way higher. The Democrats appear to be ahead of Republicans to control the House and while this is likely in the price we could see FX speculators fad US exposures into this event risk. Large players might start closing profitable short AUDUSD positions ahead of the risk event, and this short covering fuels our bullish case for AUDUSD.

For this trade to play out we need to see a daily candle close above 0.71600 level where buyers might step it, and our potentially bullish stance heightened on a close through the 55-day moving average. Traders should approach this trade tactically and way for the market to provide an opportunity for a long entry above 0.71600. Given the CPI data due on Wednesday traders should consider keeping their positions to a minimum.

We have also explained the US Midterm election in this video

Disclaimer

Trading leveraged products carries a high level of risk and may result in you losing substantially more than your initial investment. Pepperstone Group Limited is licensed and regulated by the Australian Securities and Investments Commission (AFSL 414530). Pepperstone Limited is authorised and regulated by the United Kingdom Financial Conduct Authority (FRN 684312). This information not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation