Elliottwaveanalyis

XAG/USD Eyes Upside Targets as Wave C MaturesXAG/USD is currently trading in a corrective phase where wave B appears to have completed, and wave C is currently forming. Based on the current price action, it doesn’t seem likely that this entire move will result in a full bullish recovery. The structure suggests that this could be sub-wave C of wave 4, potentially completing around the 26.79944 level. Going forward, if the 5th wave begins to unfold, potential targets could be in the range of 29.74182 to 30.57528.

dollar elliott wave countingdxy is falling since it peaked in Q4 2022

since their last 75bps hike dollar is constantly falling and stocks, gold, bitcoin constantly rising and making new all time high

wave W = wave Y

(equal in length, 100% projection for wave Y)

since starting of the year due to trump tariff dollar is falling

this is year in first half dollar saw biggest collapse since end of gold standard

now 100% projection target for wave Y at 95 area is big static support level

if dxy recover back to 100 area then this will be first sign of reversal

Dollar In Fifth Wave-Reversal In Trend May Not Be Far Away.The Fed will announce its latest policy decision later, and expectations are that Powell will keep rates on hold, especially after last week's slightly higher inflation print and still solid US jobs data. We can see some stabilization in the US dollar ahead of this event, but we have to keep an eye on geopolitical tensions in the Middle East, which coudl also play a key role in driving safe haven flows.

Meanwhile, the stock market continues to trade sideways, and I don't expect any major breakouts or strong moves ahead of the Fed. Also, tomorrow is a holiday in the US, so that could contribute to slower market conditions into the end of the week, unless, of course, the situation in the Middle East gets worse.

Looking at the DXY waves structure, I see athree-wave move from the most recent lows, so the fourth wave I highlighted a few days ago could now be approaching completion near this week’s key resistance around the 99 level. That’s definitely a level to watch for a potential fresh, but possibly final sell-off toward new lows around 97, maybe even 96.

That’s where the DXY could stabilize, as ending diagonal pattern signals that we are likely in the late stages of wave five, meaning this bearish cycle could soon come to an end.

Gold (XAUUSD) – Lower TF Wave (B) Top in Place? Higher TF Conflu⚠️ Price has now completed what appears to be a clean 5-wave advance into the key supply zone — potentially completing wave ((C)) of (B) on the lower timeframe.

• Wave ((ii)) = expanding flat

• Wave ((iv)) = expanding triangle

• Final ((v)) push into supply with RSI/MACD divergence

A breakdown below 3435 could confirm the reversal into wave (C). Downside fib targets align around 3400, 3350, and 3280.

A marginal high can’t be ruled out, but structure is now favouring bears short term.

Hellena | EUR/USD (4H): LONG to the resistance area 1.15691.Colleagues, I believe that wave “5” of higher order has actively started an upward movement.

At the moment I see movement in wave “1” of medium order and it means that a correction in wave “2” to the area of 50% Fibonacci level (1.12434) is expected. But I would still advise to consider only upward movement and use pending limit orders.

I see the maximum of wave “3” - resistance area 1.15691 as the target.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

SOL Hits Major Resistance — Patience Over FOMOOne of the most common mistakes traders make—especially in fast-moving markets—is jumping into trades impulsively at major resistance. It feels exciting when price is surging, but ironically, this is often where risk is highest and reward is most limited.

Why? Because historical resistance zones—like the $175–$183 region on SOL—tend to attract heavy sell pressure. These are levels where many past buyers look to exit, where smart money hunts liquidity, and where false breakouts are most common. Without volume confirmation and a proper retest, breakouts through such zones often fail.

That’s why experienced traders wait. The smarter approach is to let the market come to you, and only act when one of two things happens:

A pullback into a well-defined, confluence-rich support zone

A clean breakout above resistance, followed by a retest and confirmation

SOL has respected structure beautifully, but now is not the time to chase. Either wait for a healthy correction into support, or let price prove its strength through a confirmed breakout. No trade is also a trade — and capital preservation is the foundation of long-term success.

Patience isn’t passive — it’s a strategy. Let the market come to your desired levels. You don't need to catch every move, only the high-probability trades and there aren’t born from impulse — they’re built on patience, structure, and right timing. 💎

Technical Breakdown

SOL has entered a major resistance zone between $175 and $183 — a historically significant level respected for over a year.

Within this zone lie two key highs:

$179.85: Recently swept with a clean Swing Failure Pattern (SFP)

$180.52: Still untested — if broken, it would confirm a strong bullish continuation

Breaking through such a well-established resistance on the first attempt is uncommon — it typically requires momentum and structure. A rejection here would suggest that SOL needs a healthy correction before mustering the strength for a true breakout.

📉 Elliott Wave Count

Looking at the structure, we’ve completed a 5-wave sequence — signaling the potential end of this impulse leg. According to Elliott Wave Theory, a corrective phase is now expected before continuation.

📐 Additional Confluence: Fib Speed Fan

The 0.618 Fib Speed Fan — drawn from the all-time high at $295.83 to the swing low at $95.26 — aligns perfectly with this resistance zone, adding more weight to the idea of a potential rejection or pause.

🟢 Long Setup: The Next High-Probability Entry Zone

We now shift our focus to where the next long opportunity could arise. Here’s the technical confluence:

Anchored VWAP from the recent low at $141.41 sits at $164.70

4H bullish order block around $164.46

0.382 Fib retracement of the full 5-wave impulse: $165.42

0.412 Fib retracement: $164.25

All these levels converge in a tight band, providing a solid long entry zone between:

Long Entry Zone: $165.50 to $164.25

Stop-Loss: Below $160 (to protect against any deep wick)

Targets:

TP1: $171.75 (Point of Control from the range)

TP2: $180.00 (resistance retest)

TP3: $200.00 (psychological level)

Estimated R:R: ~6:1 — High-conviction setup

Bonus: If price returns to this $165 zone within 24 hours, it will also be supported by the 0.618 Speed Fan — adding one more layer of support.

🔴 Short Setup: Reversal Play at $200

For those watching from the sidelines or looking to fade the rally, the psychological level at $200 presents a strong short opportunity — but only on confirmation (e.g., SFP or bearish engulfing).

Short Entry: On rejection at $200

Stop-Loss: $206.10

Target: $187.00

Estimated R:R: ~2:1

🧠 Summary:

Completed 5-wave structure → potential correction phase underway

Strong resistance at $175–$183 with SFP and speed fan alignment

High-probability long setup at $165.5–$164.25 with multi-layered confluence

Potential short at $200 on confirmation

⚠️ Key Takeaway: Don’t Chase the Highs

This is where many traders slip — FOMOing into trades at major resistance. Please, don’t do it. Instead, wait for:

A pullback into well-defined support (like the $165 zone), or

A clean breakout above $180, followed by a confirmed retest

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Gold Is Doing What Ever Gold Wants To DoPreviously I posted a reading where I said gold was to go a bit down before is went up. But Gold didn't go down, and went straight up.

But it did go up right :D

Right now I strongly believe gold is in a wxy correction.

And I think will finish the y-wave i the green box area somewhere between 3,147 and 3,077, which is the 100-123% fib-level of the w-wave.

The reason I believe this, is at that timewise the y-wave will here have taken as long as the w-wave, and I the price is heading for that cyan median line. And normally price will also go to the bottom and a bit below of the Kennedy line.

Multiple factors are pointing to that level.

When price hits that level, I believe we will see a 5th level to the upside where 4,000 definitely is in play.

I will include a link to a higher degree reading, where you can see I believe gold has finished a third wave, so we still need a 5th wave to the upside.

Russell 2000 - Sell till late May & Buy in Early June?

Wave (ii) is still in progress. Slight update to the primary wave count from the previous one below.

200 & 100 SMA's are sloping firmly to the downside therefore I will continue to keep selling at technical levels. Late May or early June would be a good time to go long...

Support levels are shown in green.

[BTC/USDT] Wave (4) Completed? Road to $140K Begins HereBitcoin is consolidating just above key support after a textbook correction. The first chart shows a completed Falling Wedge breakout from Wave ④, while the second chart lays out macro Fibonacci targets for Wave (5).

Chart 1 (Daily): Local Breakout Setup

• Falling wedge breakout above 83.9K–84.3K

• Completed structure: Wave ③ → ④ → Potential Wave ⑤

• Invalidation: Below 73.8K or worst-case 69.5K

• Bullish continuation requires break & close above 86K

Chart 2 (Weekly): Macro Target Projections

Using Fibonacci extension from Wave (3), BTC shows:

• 0.618 Target = $114,983

• 1.000 Target = $140,033

• 1.618 Target = $180,560

If current support holds, Bitcoin could be entering a massive Wave (5) cycle with upside potential towards $140K–$180K. Reclaiming levels like $92.5K, $101K, and $106K will confirm the bullish structure.

What’s your Wave 5 target?

#Bitcoin #BTC #BTCUSDT #CryptoAnalysis #ElliottWave #Fibonacci #CryptoTA

Russell 2000 - one more drop to complete the correction?Looking for the double zig zag correction to complete (Y) leg in the blue zone. Will be looking for five waves to the downside for the target.

Updated the wave count from my previous chart below...

This drop from the 25th November 2024 to the expected target zone would be more or less similar to the Covid drop in terms of percentage.

Russell 2000 - time to Buy pullbacks...Shorts were good while it lasted... looks like a good time to buy pullbacks.

It would be wise to wait for a clear 3 wave correction though.

Elliot Wave Analysis shows a larger degree wave IV was completed in March 2020.

Since then, the Russell 2000 has been nesting within a bullish rectangle chart pattern, possibly working its way up to the larger degree wave V.

Seasonality Chart shows a bullish April with a possible correction in May.

Nevertheless, I will not commit to long trades till the chart clearly shows that we are out of the woods. A clear 3 waves move down closer to 1800 in the hourly/4 hourly time frame would be a good setup.

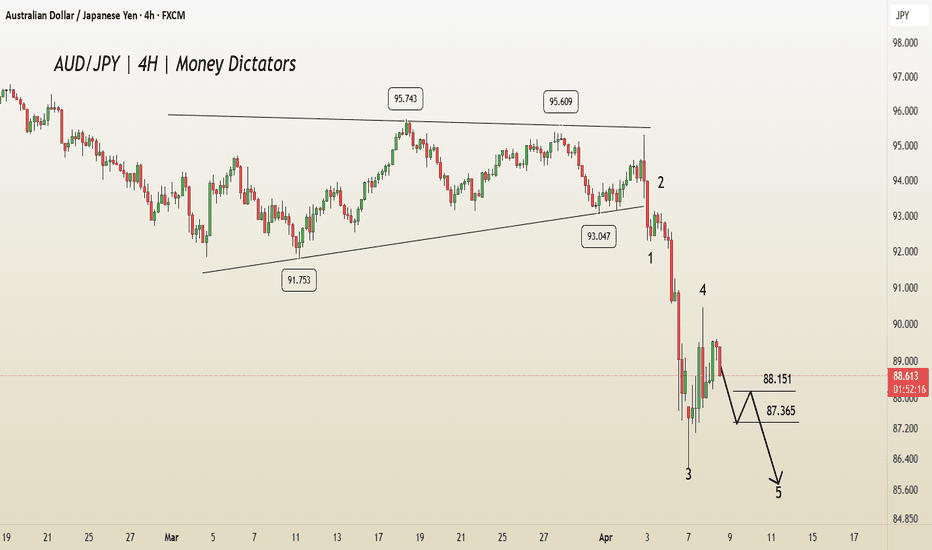

AUD/JPY Technical Outlook: Wave 5 Completion in SightIn AUD/JPY, the 4th wave has been completed, and the 5th wave is in progress. According to Elliott Wave theory, there is a high probability of the market continuing its downward movement.

Regarding potential targets, the price may reach 88.151 and 87.365 on the downside. However, a bullish move could also emerge if the market breaks above 89.645 .

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

Alphabet Stock (GOOGL): Bounce Incoming?There is growing potential that a major price top has formed, particularly after the break below the November low, which has increased the probability of this scenario. The move down from the February high appears to be a three-wave structure, and I am watching for a bounce from the current region. However, this could simply be a B-wave in the yellow scenario, setting up for much lower prices.

At this stage, it's too early to confirm a major top with certainty. The structure of the next rally will provide crucial insights. The current downward move is not yet a clear five-wave decline, leaving the door open for higher prices in the white scenario. However, even that becomes increasingly unlikely with a break below $157.50.

For now, the working thesis is that a major top has formed, but confirmation of new highs would only come with a break above $196.69. In the short term, the price should ideally react to the current region, but we need to see a break above $173 (closing the last gap) to indicate a local low is in place. If that happens, we could be in a B-wave, which would likely target the $183 to $196 zone before the next major decision point.

U.UN Sprott Physical Uranium OutlookLooking for TSX:U.UN to have progressed higher in 3 waves, with current price action potentially being in the later stages, if not already completed, of a WXY pull back. Watching for a reversal and breakout to form, after which another 3 wave move higher could unfold. Simlar view on LSE:YCA may get an update out on that soon.

DXY Dollar Index OutlookThis is my current Elliott Wave count for the DXY Dollar index. I have a couple of variations which I will share but this one sees a decline starting with a leading diagonal in red wave 1 which is close to completion. May see a pull back in red 2 before a strong move lower in 3. The alternative is a nesting 1,2,1,2. If that's the case then a strong decline could continue from here.

Avalanche: Long-Term Bullish Above Support & Other SignalsThe end of February didn't do much harm to Avalanche, which is a bullish signal. In early February, the lowest price hit was $21, in late February the lowest price was $20. The difference is only 5%. This small gap between these lows indicate that the bearish force is over.

Let me explain. There was a low on the 13-January session at $32, the low in February was $21. That's a big gap.

For a new low to be considered of any value from a technical standpoint, the minimum, after the $21 low, would be $17 or much lower around $9 or $8. When we get $21 first followed by $20, we are simply looking at a double-bottom. A double-bottom is a bottom pattern and tends to lead to a trend reversal.

The next little fact that is of interest to us, Cryptocurrency bulls, is the existence of a long-term support, on this chart labelled as "baseline." A lower low as mentioned above would require a break of this level. This is highly unlikely.

Well, let's not go too deep into this type of technical analysis, let's consider a different perspective.

In late 2023 after a strong period of sideways with a downward bent, a complex correction, AVAXUSDT moved to produce a 5-up waves bullish impulse. As this impulse ended, we have the same dynamics as before, between January and November 2023, a long complex correction.

The action that AVAX has been witnessing since March 2024 is all part of a correction in Elliott Wave Theory terms. Once this correction is over, we will have a new bullish wave. This bullish wave tends to develop in five steps. Three steps forward and two backwards. The 2025 bull-market. This impulse will end in a very strong new All-Time High.

This is simple technical analysis and it will end up being right.

Do you agree?

If you do, make sure to show your support by following me.

2025 is going to be big. It will be big. Trust.

Patience is key.

The worldwide adoption of Cryptocurrencies as a means of payments will result in world peace.

Namaste.

Nifty 50 Elliott Wave Analysis: Potential Retracement LevelsNifty 50 Elliott Wave Analysis: Potential Retracement Levels

The wave count for Nifty 50 has been structured from the Covid-19 lows of 23rd March 2020. Since then, the index has undergone a well-defined Elliott Wave progression, forming distinct impulsive and corrective waves. Below is a breakdown of the wave structure and the potential retracement targets.

Wave Count Breakdown:

1. Intermediate Wave (1):

o Completed in October 2021 with a high of 18,604.45.

2. Corrective Wave (WXY) - Intermediate Wave (2):

o A corrective retracement followed, unfolding in a WXY pattern.

o The correction concluded on 13th June 2022, with a low of 15,183.40.

o The retracement was less than 38%, indicating a strong bullish phase.

3. Intermediate Wave (3):

o Nifty commenced its third wave, subdividing into a five-wave structure of a minor degree.

o This bullish wave extended significantly and peaked on 23rd September 2024, with a high of 26,277.35.

Retracement Expectations:

• Wave (3) exhibited an extended Wave 3, and according to the Elliott Wave principle, when Wave 3 is extended within a subordinate wave structure, a retracement typically occurs towards:

o The bottom of subordinate Wave 4 or

o 38.2% Fibonacci retracement level

• Key levels to watch for potential retracement:

o 38.2% Fibonacci retracement: 22,039.45

o Wave 4 bottom (4th June lows): 21,281.45

If the retracement aligns with Elliott Wave rules, we may see a pullback toward these levels before the next bullish wave resumes.

Pls follow for such insightful ideas.

Disclaimer :

This analysis is for educational and informational purposes only and should not be considered as financial or investment advice. Market movements are subject to various factors, and past patterns do not guarantee future performance. Please consult with a certified financial advisor before making any investment decisions.

________________________________________

With these insights, traders and investors can monitor Nifty 50's price action closely to determine whether the expected retracement unfolds as anticipated.