NSE IONQ - Are we ready for a breakout?The corrective phase is complete and an impulse move appears likely. A strong buy above the A-B-C channel could target levels around 30 - 37 - 45 or higher. Good entry is possible above 26. However, if conditions worsen, further corrections may ensue.

I will update further information soon.

Elliottwaveretracement

HBAR (Local) Elliot Wave ii UnderwayHBAR appears to have completed a leading diagonal for wave 1 after finding a bottom at the major support high volume node (HVN).

Wave 2 has retraced the expected 61.8% Fibonacci but alt coins have their own Golden Pocket at the 78.6% retracement which aligns with the S1 pivot and high volume node.

The descending resistance line has been tested as support leaving a doji but does not look strong enough to be the bottom yet.

Wave 3 should be a powerful move up.

This analysis is invalidated below macro wave 4 -$0.12556

Safe trading

Gold 1M & 15M Bearish Breaker Block Setup, Targeting 3,202 ZoneI’ve marked a bearish breaker block on the 1-minute chart (3,316–3,319), also visible on the 15M timeframe.

✅ Last bullish push before the sharp downside breakout.

✅ Price retested this zone, wicked through it, and then sold off aggressively — reinforcing bearish order flow and the potential for deeper downside.

I’m tracking this move as the final C wave of an ABC corrective pattern.

✅ The C wave started from the 3,319 high and is unfolding in a 5-wave substructure.

✅ 1-Minute breaker block around 3,316–3,319 — I’m watching for rejection here, which aligns with the 0.618 Fib retracement as an estimated end of wave 2.

✅ My current expectation: wave (3) and (5) of C could extend lower to the 3,256–3,202 zone.

🧩 Key Confluences:

Bearish breaker block rejection

15M downtrend structure remains intact

#XAUUSD #gold #forex #elliottwave #bearishbreakerblock #orderflow #priceaction

EURJPY: Short Setup with Target Zones in FocusEURJPY outlines a clear W-X-Y corrective pattern. Wave (W) ended at 161.297 , followed by an upward corrective move in Wave (X), which topped at 162.665 with a classic ABC formation.

Currently, the price is hovering around 162.084, likely forming Wave B of the final Y leg. A brief move higher could complete this B wave before the pair resumes its decline toward the 160.922–160.680 area, which marks the projected end of Wave C of (Y).

The broader correction is framed by two descending blue trendlines, providing dynamic resistance and support, while a short-term red ascending trendline is currently holding the price action but may soon give way. If the price stalls or rejects around the 162.3–162.5 zone, it could signal the start of the next leg down, making it a potential setup for short positions. After the reversal from Wave Y, potential upside targets are 161.600, 162.500 , and 163.100 .

We will update it soon!

Binance Coin BNB is Likely to go down, until at least end of MayBNB has been in a correction since the start of December '24. And as time went by, it developed into an combo correction.

I believe we are at the end of the purple B-wave of the green (Y) wave.

We are right now finithing the white ((c)) wave of purple B wave, so we are going to see a small wave up until around the 630-640 level. And after this the purple C wave is going to take on downwards.

And since very rarely the c wave has a shorter timespan than the a wave, we are not going to see this correction end until the end of may/ start of june.

I believe the purple C wave are going to take us down to the 382 level in that yellow box.

The 383 level is the 61.8% retracement of the primary white ((1)) wave. And this level is also roughly around the 100% Fib level of the purple A wave.

If price comes to the green box I've drawn out. I belive that would be a good time to start looking for a confirmation to short.

Bearish Setup on NFLX: Correction Wave (C) UnfoldingTF: 4h

NFLX appears bearish at the moment. The corrective structure on the 4-hour timeframe suggests a potential decline. The current formation indicates that wave B likely completed at 998.61 , and the stock has now begun its descent into wave (C) of the correction.

The correction may extend to the 100% projection of wave A at 788.67 , or potentially deepen to 659.06 , aligning with the 1.618 Fibonacci extension of wave A. After the completion of wave (C), traders can buy for the target up to wave B at 998.61 .

I will continue to update the situation as it evolves.

NVDA’s Final Act: A Breakout Waiting to HappenNVDA appears to be nearing the completion of its corrective phase, setting the stage for a potential move to new highs. The current pattern resembles a falling wedge, indicative of an ending diagonal formation, which often signals a reversal and the start of an upward trend.

The structure of the corrective channel, along with the termination of the diagonal pattern, suggests a high likelihood of a running flat formation. Buyers are likely to intensify demand pressure as the price approaches the lower boundary of the trendline. A trend reversal may occur if there is a decisive breakout above the Wave 4 level of the ending diagonal.

Buying opportunity with minimal stop is possible after the reversal from lower side of the channel. Targets can be 112 - 120 - 132 - 140.

I'll be sharing more details shortly.

GBP/USD Technical Outlook: Elliott Wave Mapping the Next MoveThis GBP/USD 4H chart presents an Elliott Wave analysis.

Wave (1) and (2): The market had an impulsive bullish movement in Wave 1, followed by a corrective Wave 2.

Wave (3): A strong bullish move with momentum.

Wave (4): A corrective phase, forming a triangle pattern (a-b-c-d-e), which suggests the market is preparing for another impulsive leg.

Entry Confirmation: A breakout above the triangle pattern.

First Target: 1.31457 (Fibonacci 0.382)

Second Target: 1.32105 (Fibonacci 0.5)

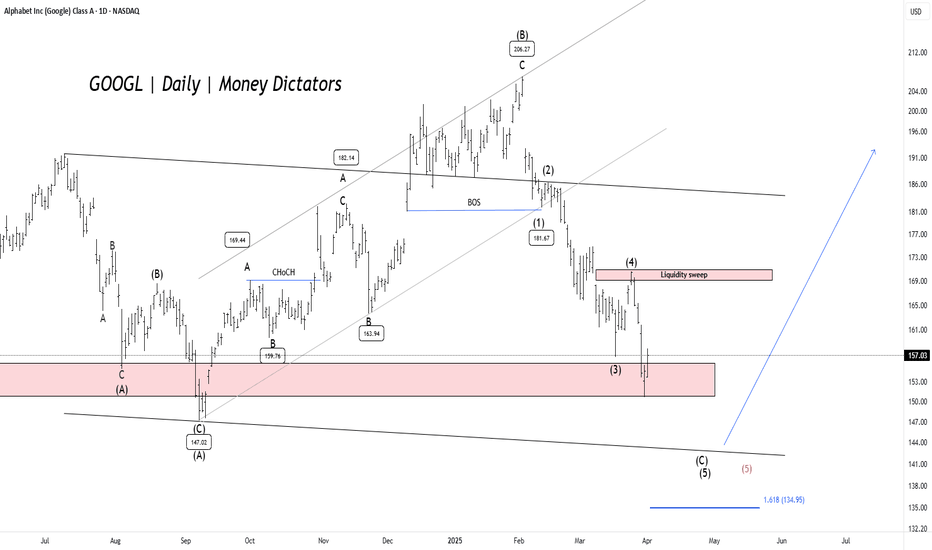

GOOGL - Elliott Wave Final ShowdownGOOGL has dropped over 27.28% , reaching a minor profit-booking zone. The $150 level serves as a key demand zone, where a potential price reversal could occur. The formation is either expanded flat or a running flat on the daily timeframe chart.

Confirmation is best observed near the lower trendline of the parallel channel. If bearish momentum persists, prices may decline further to the $142-$140 range before a strong rebound. Once the correction ends, the upside targets are $168, $180, and $195.

A new low will form if the previous low is breached. Further research will be uploaded soon.

XAUUSD - 4H Update: Potential End of Impulse Wave StructureGold continues its impulsive rally, currently completing what appears to be the final leg of wave ⑤ within an ascending channel. This aligns with the larger Elliott Wave count we've been tracking.

Key points to consider:

Wave Structure : We can observe the completion of five internal waves within wave ⑤, with price now at critical resistance levels near the 2.618 Fibonacci extension ($3,065.338).

Bearish RSI Divergence : While price has continued to climb, RSI has started to show signs of bearish divergence, signalling weakening momentum and a potential reversal.

Support Levels : Should a correction materialize, the next key areas to watch are the 0.236 ($3,025.340) and 0.382 ($2,997.608) Fibonacci retracement levels, which align with the lower trendline of the ascending channels.

Wave ⑤ may be nearing exhaustion, with both the Fibonacci extension and bearish divergence suggesting caution for longs. We could see a retracement to support zones if price reverses.

Asian Paints Weekly Elliott Wave Analysis – March 17, 2025The price action of Asian Paints (NSE: ASIANPAINT) has been following a clear Elliott Wave structure.

The stock completed a primary wave (3) at the peak, with a truncated 5th wave, indicating weakness in the final leg of the impulse.

It is currently undergoing a wave (4) correction, following a W-X-Y pattern, with the price moving lower towards the 1.618 Fibonacci extension target at ₹1,931.

The invalidity level is set at ₹1,297, below which the larger wave structure would need reconsideration.

Indicators like RSI and MACD are reflecting oversold conditions, suggesting a potential bounce or consolidation before further downside.

A confirmation of wave (4) completion would signal the start of wave (5) towards new highs.

📉 Key Levels to Watch:

Support: ₹1,931 (1.618 Fib Extension)

Resistance: ₹2,492 (Wave Y previous support)

Invalidation Level: ₹1,297

This wave count suggests that Asian Paints is nearing the end of its correction phase. A reversal from the target zone could set the stage for the next bullish impulse.

📢 Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational and study purposes only. Any profits or losses from trading based on this analysis are entirely your own responsibility. Do your own research before making any trading decisions.

$SPOT the overvalued stock..Be real.. I’m an Apple Music/ Apple applications guy. This stock just seems a little too bloated for me. I’d like to see a retrace to that gap up, this market is volatile and this thing can move hardbody either direction. I’d take my chances with a short for about 50 days out, $560 is the target. I got a bearish rising wedge forming possibly here and some FIB retrace and Elliot Waves. Very expensive premiums as well. Have fun.

WsL

GOAT/USDT Elliott Wave Analysis Short-Term The chart highlights a descending channel pattern integrated with Elliott Wave analysis, indicating possible short-term price movements. Currently, the price is navigating through Wave 4 and nearing a key resistance zone.

Key Observations

The price action reflects an Elliott Wave corrective structure within a descending channel.

The ongoing Wave 4 suggests an upward move towards $0.69, a significant resistance level.

After testing this resistance, the price could retrace to $0.32, completing Wave 5.

Strategic Implications

Watch for potential rejection or breakout signals around the $0.69 resistance zone for short-term opportunities.

The projected dip to $0.32 could be a better area to re-enter for short-term trades.

Focus on confirmation of Wave 5 completion to reassess the trend and strategy.

Short-term traders should remain cautious and agile as the pattern unfolds.

$NATH to Play with Macro Tops & Bottoms, Falling to $70 by AprilNASDAQ:NATH

Nathan's Famous has completed an Elliott Wave Motive Phase, and now enters the Corrective Phase. With the stock having no existing stiff resistance level at ~91.25, the stock is going to return to it's comfort zone in the $70's.

TLT BONDS ELLIOTT WAVE ANALYSIS: 19 DEC, 2024©Master of Elliott Wave: Hua (Shane) Cuong, CEWA-M (Master's Designation).

The entire ((4))-navy wave most recently finished as an (A)(B)(C)-orange Zigzag, and the ((5))-navy wave is turning back to push lower.

It is subdividing into waves 1,2-grey, and they are complete, since the high of 94.85 the 3-grey wave is unfolding to push lower, targeting the low of 83.58.

Ready for the next wave?After reaching its low in early August, the chart of Unity Software Inc. has shown a textbook bullish move. The Elliott Wave count is marked on the chart. Now, with the correction phase seemingly complete, the price appears poised to kickstart the next bullish impulse from the 38.2% Fibonacci level, supported by the 50-day SMA.

Bitcoin Market Outlook Elliot Wave Theory (W42/2024) // AlgoFyreThe market shows a bullish scenario with potential for an impulse wave up after a correction, possibly surpassing the all-time high post-election. However, two bearish scenarios suggest a major drop to 20K in the long term, highlighting significant downside risk.

🟢 Short-Term Outlook (Next Few Weeks to Months) - Bullish Scenario

🔸 Leading Diagonal (Green) Complete : The green lines on the chart represent the completion of the leading diagonal, which is the first wave of a larger impulse (wave 1). Leading diagonals often occur in the first wave of a new trend, indicating that a bullish trend is beginning. This is particularly important because it sets the foundation for a stronger upward movement that could follow after a corrective phase.

🔸 Corrective Phase (Red ABC) : After completing the first wave, we are now expecting a corrective structure. The red lines represent a potential ABC correction, a typical 3-wave corrective pattern in Elliott Wave theory. This correction could retrace some of the gains made in the leading diagonal, potentially finding support near key Fibonacci retracement levels (like the 0.25, 0.5, or 0.75 levels) drawn in orange on the chart.

🔸 Timing Around the US Election : The chart indicates that this ABC correction may take place leading into the US election, which is often a period of increased market uncertainty and volatility. It seems that the correction is expected to conclude before or around this event, setting the stage for the next major move.

🔸 Bullish Impulse (Wave 3) : After the correction, the chart projects a strong bullish impulse (the large green arrow), which would be the beginning of wave 3. In Elliott Wave theory, wave 3 is typically the most powerful and extended wave in an impulsive structure, often leading to significant gains. The breakout above previous highs around the 67,000-68,000 level (marked by the green wave 5 in the diagonal) would confirm the start of this impulsive wave, which could target much higher levels, possibly into the 70,000+ range.

🔸 Bullish Summary (TLDR):

The leading diagonal in green (wave 1) suggests that a new bullish cycle is underway.

We are currently expecting a 3-wave corrective move (ABC) before the next leg up.

The correction could end around key Fibonacci levels, potentially coinciding with the US election.

After the correction, a powerful wave 3 impulse is expected, likely driving prices significantly higher.

🔴 Short-Term Outlook (Next Few Weeks to Months) - Bearish Scenario

🔸 Bigger ABC Correction : The market is in the midst of a larger corrective pattern. The current movement is within the B-wave of this ABC structure.

🔸 Flat Pattern for B-Wave : The B-wave is forming a flat correction, which typically indicates a sideways consolidation with a final leg up before a downward movement.

🔸 C-Wave to 52K Area : After completing the B-wave, we expect a C-wave to the downside, targeting around the 52K level. This drop represents the completion of the B-wave within the larger ABC pattern.

🔸 Larger C-Wave Up : Following this drop, the final C-wave to the upside is projected. While this wave could potentially retest or even exceed the all-time high (ATH), it's not guaranteed. The key idea is that a significant rally is expected after the corrective B-wave down.

🔸 Major Downtrend Next Year : After this anticipated rally, a substantial downtrend is expected in the following year, potentially driving the price down to 20K or lower.

🔸 Bearish Summary (TLDR):

Completing a B-wave flat correction within a larger ABC structure.

Expecting a C-wave down to around 52K before a potential larger rally.

After the larger C-wave up, a significant decline is expected, leading to 20K or lower in the following year.

🔴 Mid-Term Outlook (Next Few Months to Year) - Bearish Scenario

🔸 Leading Diagonal Completed (Red) : The red structure shows the formation of a large leading diagonal to the downside, suggesting that a strong downtrend has already been established.

🔸 Corrective ABC (Green) : After the diagonal, a corrective ABC pattern has formed. This correction has reached the 0.786 Fibonacci retracement level, which is a common level for corrections to complete before resuming the primary trend.

🔸 Major Move to the Downside : Following the completion of this corrective phase, the chart is signaling the beginning of a significant bearish move, potentially leading to a price target near the 20K level. This aligns with the broader bearish outlook.

🔸 Bearish Summary (TLDR):

Finished a leading diagonal to the downside, followed by a corrective ABC pattern.

Correction reached the 0.786 Fibonacci retracement level.

Expecting a major bearish move from this point, with a potential target of 20K.

🔶 Key Takeaway

The market presents both bullish and bearish possibilities. The bullish scenario suggests that after a leading diagonal (wave 1) completes, a short-term ABC correction will occur, followed by a powerful wave 3 impulse to the upside, potentially pushing prices beyond the all-time high after the US election. On the other hand, the bearish scenarios indicate a significant downturn: one expects a C-wave drop to around 52K before a larger rally, followed by a steep decline to 20K or lower next year, while the other points to a completed leading diagonal with a corrective ABC reaching the 0.786 Fibonacci level, signaling the start of a major move down to 20K. Despite the potential short-term upside, both bearish scenarios ultimately point to a substantial long-term decline.

XAUUSD: Final Wave Completion – What’s Next?XAUUSD has formed a corrective pattern on the hourly chart, offering a potential breakout setup. The correction has spanned over two weeks, during which the price has frequently crossed the EMAs (50/100/200 ) on the hourly timeframe. Meanwhile, the 20 EMA has consistently acted as solid support on the daily timeframe.

The pair has completed its final wave 5 of wave (C) at 2604 and has since started to rise sharply. Currently, XAUUSD faces a strong resistance level at 2670 , which marks the high of wave (B). If the price breaks above 2670 , traders can target the following levels: 2685 - 2715 - 2735 +. If the breakout fails, the correction may continue, as 2670 is the key hurdle for the bulls to overcome.

Further updates will follow soon.

USDCAD - More downside look likelyFrom an Elliott Wave perspective, it looks like more downside is probable on the USDCAD. We have two have count possibilities (white and red numbering) and both point to another leg lower that should take prices below the previous low of 1.3436. We could go short at the market with a stop above 1.3630 for a great R:R.

GOLD → False break of range support led to a reboundFX:XAUUSD reaches the liquidity zone of 2370, forming a false breakdown, confirms the presence of a strong range boundary. The market may move into a sideways trend.

Fundamentally, the situation is still complicated.

The U.S. regulators are trying to change the market's mind on the recession issue, trying to keep the market calm. The question of aggressive actions of regulators is still open.

At the moment everyone is watching the actions in the Middle East, as the activity on the background of the war already unleashed can again affect the price of gold.

Markets continue to estimate almost 90% probability of a 50 basis points cut in US interest rates in September. Let me remind you that it is not the fact of reduction that matters, but the hints and comments of regulators.

At this time, gold is forming a global range of 2480 - 2370.

Resistance levels: 2420

Support levels: 2400

Technically, gold may go into a consolidation phase, but in the future it is worth watching the resistance at 2420. As a pre-breakout consolidation or a quick retest may lead to a breakout attempt and growth

Rate, share your opinion and questions, let's discuss what's going on with ★GOLD ;)

Regards R. Linda!

Wave 2 of 5 in progress - where does wave 3 begin? The Elliott wave channel guidelines are some of the handiest tools in the box.

Here the final channel (2-4) is well broken, indicating the impulse is done and wave 2 is in progress, further evidenced in the break of the base channel below. Ideally this decline finds the red channel of the larger degree impulse of which this is proposed to be wave 2 of 5.

Another guideline that fits in with the channels is the 'right look' - such a wave 2 would ideally make a reactionary wave advance into around that green level before dropping to tag the red channel at the 50-61.8% retracement level (perhaps tightened to about 61,233-61,000 USD).

However it gets there though, this level would present a perfect buy setup for the proposed move towards $120K.

As a swing trader, this trade in a vacuum makes me nervous by $56,587.65, abandoning the trade below 53,534.55 and provisionally targeting the $125k area.

As there will usually be chances to increase the position size on pull-backs (imagine wave 2 of 3 for example), the first entry doesn't need to be the whole allocation.