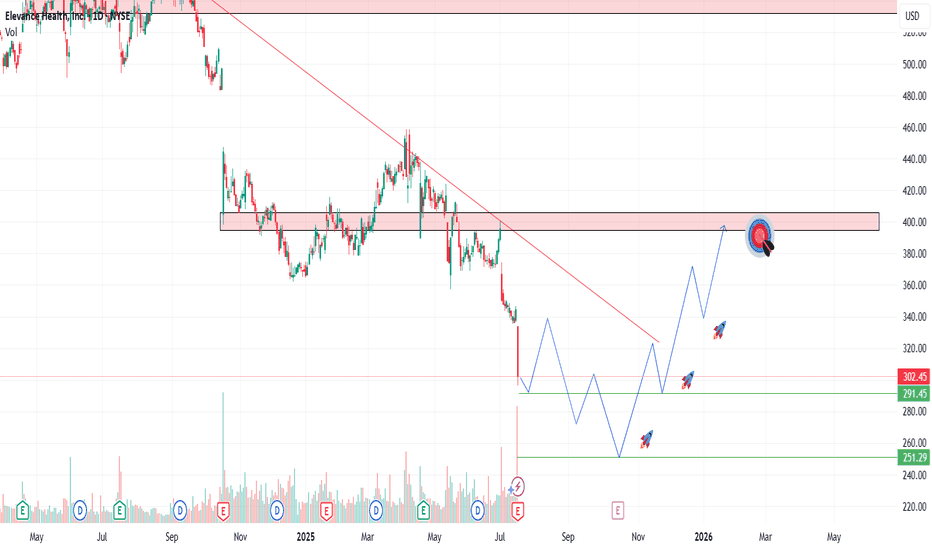

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions are crushing them to get in - it's just near-term noise, in my opinion. My personal strategy is buy and hold every healthcare opportunity (i.e. NYSE:CNC , NYSE:UNH , NYSE:HUM etc).

Elevance Health NYSE:ELV just dropped heavily due to lower-than-expected Q2 2025 earnings, a cut in full-year profit guidance from $34.15-$34.85 to ~$30 EPS, and elevated medical costs in Medicaid and ACA plans. It's near-term pain (may last 1-2 years) which will highly likely lead to long-term growth. The price has touched my historical simple moving average "crash" band. I would not be shocked to see the price drop further into the $260s before a rise. However, the near-term doom could go further into the year. I am anticipating another drop to the "major crash" simple moving average band into the $190s and $220s to close out the remaining price gaps on the daily chart that occurred during the COVID crash. Not to say it will absolutely reach that area, but it's locations on the chart I have for additional buys.

Thus, at $286.00, NYSE:ELV is in a personal buy zone (starter position) with more opportunities to gather shares likely near $260 before a bounce. However, if the market or healthcare industry really turns, additional buys planned for $245 and $212 for a long-term hold.

Targets into 2028:

$335.00 (+17.1%)

$386.00 (+35.0%)

ELV

ELV (Elevance Health) – Catching the Knife or Catching Value?Elevance (ELV) just took a 12% hit after Q2 earnings missed estimates and full-year guidance was cut significantly. But here's the thing—the selloff may be overdone. The stock now trades at a forward P/E of ~10, well below industry peers, and is approaching multi-year support levels.

📥 Entry Plan :

✅ Entry 1: $302.45 (market price)

✅ Entry 2: $285 (historical support zone)

✅ Entry 3: $250 (capitulation panic level)

🎯 Target Levels:

TP1: $330 – recent gap zone + psychological resistance

TP2: $360 – key horizontal + potential MLR rebound narrative

TP3: $400 – longer-term recovery level, aligns with prior institutional range

🔔 Follow me for more deep-value setups, smart risk-reward trades, and weekly strategy posts!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial advice. I am not a financial advisor. Always do your own research and consult with a qualified professional before making any investment decisions. Trading and investing involve risk, including the potential loss of capital

ELV Swing Trade Setup - May 2025Fundamentally undervalued with a strong balance sheet, consistent earnings beats, and a low P/E ratio. Recent drop (~33% from 52-week highs) appears overdone relative to earnings strength likely due to short-term Medicaid cost concerns, not long-term deterioration.

📊 Position Type:

✅ Swing Trade to Core Position

Start small and build over time if technicals stabilize. Could evolve into a 6–12 month hold depending on market environment and how the stock reacts to future earnings or policy updates.

Entry Zone:

📍$380-360

📍$340

📍$300

Profit Targets

🎯 TP1: $415

🎯 TP2: $445

🎯 TP3: $500+

📌 Final Word

ELV is trading near a critical support zone after a 30% drop, yet it keeps delivering solid earnings. With strong cash flow and a powerful Carelon segment, this could be one of the best risk-reward setups in healthcare right now.

Disclaimer: This is not financial advice. Do your own research before investing.

$ELV Earnings Preview: Oversold Potential + Key Metrics AheadEarnings Estimates: Analysts forecast an EPS of $3.82 for the upcoming quarter, indicating a 32% year-over-year decline. Revenue is projected at $44.67 billion, a 5.2% increase from the same period last year.

Oversold Potential: With an oversold score of 59%, NYSE:ELV appears attractive for accumulation.

PEG Ratio: The PEG ratio stands at -0.77, suggesting undervaluation despite negative growth.

Valuation Metrics: A forward P/E of 11.03, lower than the trailing P/E of 14.14, indicates potential undervaluation.

Revenue Growth: Positive quarterly revenue growth estimates point to resilient performance.

In the previous quarter, Elevance reported an EPS of $8.37, missing the consensus estimate of $9.66, but achieved a 5.3% year-over-year revenue increase to $44.72 billion.

Guidance: In the previous quarter, Elevance Health revised its full-year 2024 adjusted EPS guidance downward to approximately $33, down from the prior estimate of $37.20, due to challenges in its Medicaid business.

Despite these hurdles, Elevance's diversified portfolio and strategic initiatives position it for potential growth.

ELV | Informative NYSE:ELV

If the stock price manages to surpass the bullish line, which is positioned around $469.79, the main target on the bullish side to monitor would be Target Price 1 at $480.96.

On the other hand, if the stock price breaks below the bearish line, set at $458.39, there are several potential downside targets. The first target on the bearish side would be Target Price 1 at $450.10. Should this level be breached, the subsequent target to keep an eye on would be Target Price 2 at $440.76.

ELV Elevance Health Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELV Elevance Health prior to the earnings report this week,

I would consider purchasing the 450usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ELV approaching significant overhead resistanceElevance Health Inc. (ELV) approaching significant overhead resistance, able to absorb monthly buying pressures.

From here, (ELV) can reject and fall lower to channel support, eliciting losses of 15% - 20% over the following 2 - 3 months.

Inversely, a weekly settlement above resistance would place (ELV) into a buy-signal where gains of 15% - 20% would be expected over the following 2 - 5 months.

A tight stop for Elevance Health Required Elevance Health NYSE:ELV - Long term positioning

Positive earnings are causing a pump in price but be careful here though. Earnings positive since April 2020, why the pump? If i was entering a long term position here i would be waiting for the bottom of the parallel channel and RSI resistance line or at least harboring some cash on the side and splitting my position.

Chart Requirements

- A retest of RSI resistance line preferred

- Ideal levels outlined on chart

- If entering here, please place a tight stop loss as there is a more ideal entry lower