TSLA - leading the charge but one of many to comeTSLA ; despite their occasional run-in with the SEC or hickup from logistics behind timing in production Tesla is a dominate force in an emerging market and can not be ignored as a force to be reckoned with. AMZN found itself in a very similar situation back in 2005 and since then they have proven their value through diversification and exemplary customer service. The only problems Tesla might run into is over diversifying before the time is right. Musk has been diligent as to feed the company cash as it's needed to ensure the success of the business. The fact that NASA was able to effectively privatize space travel is just icing on the cake and I think we see this trend continue... prisons and space leading the charge but there are many other subcategories that have potential for privatization and Amazon and Tesla will be the leading brands into 2030s, at this rate, no doubts.

From the technical side TSLA looks great above 271.85 for the *long* (bullish) ((price to go up))... our next key level and the one acting as resistance presently is 360.47. Beyond this we will push new alltime highs and I believe a catalyst will be required for this to happen and the move will happen quickly.

Emergingmarkets

S&PCLX IPSAY seguimos en la misma zona, a principios de NOV tuvimos una recuperación del soporte que dio un buen rebote, pero no paso mas alla de eso... por ahora seguimos presionados en esta nueva LTB y el piso de los 5138 pts.

Drivers a seguir:

- G20 y reunión Trump/ Xi Jinping

- Cu y su desacoplo con los demás commodities

- Inflación USA

No, Halvings Don't MatterAs I dig deeper, the Bitcoin picture becomes clearer. I'm starting to believe that Bitcoin is the penny stock of the world's finance. I'm comparing Bitcoin to a fund that manages a basket of EM-related assets. This is the reported breakdown as of October:

China 19.95%

Other 16.59%

South Korea 14.78%

Taiwan 11.39%

Russia 8.23%

Brazil 8.01%

South Africa 6.33%

India 5.97%

Cash & Cash Equivalents 5.29%

Peru 3.46%

You can see the almost direct relationship between crypto and the fund. As Bitcoin has grown, the behaviour has become more and more similar between the two. Even back in 2012 there was already a developing parallel.

This has lead me to believe that more than crypto being at the mercy of the dollar, in order for the space to be bullish, the world's finance has to have the right conditions. Investors need to be so confident that they move not only into emerging markets, but go all the way into the penny stock of the world. It isn't yet completely clear to me why EMs top first, but it may have something to do with the low cap nature of crypto. As for the bottoms, there isn't a clear relationship either. I'm inclined to say that crypto rallies first, once again, due to its low cap nature. This isn't always the case, but it could be a good explanation.

Beyond the fact that crypto might simply be a penny stock for people on a macro scale, it seems that "domestic" issues, such as halvings, hacks, news, forks, etc. only seem to affect either the slope of the trend or very localised movements. If we look back at the 2013 rally it doesn't make it implausible to have a move to 10-15k by December. Furthermore, meme lines won't predict or find the real bottom. What you can do is start looking into real world issues. The overall financial world needs a very confident outlook in order for crypto to move. That being said, I feel that emerging markets will have a breather soon, allowing crypto to have a partially bullish move.

TL;DR halvings don't matter for macro trend. For moon or crash you need to look at emerging markets.

EEM. Emerging Index Fund. Possible map of WXYThis is how I see the map for EEM.

It contradicts with the news background as EM countries are under pressure now.

But this is how I see the wave count now.

The wave 5 to the upside is pending and we could see some relief for EM...temporarily.

Invalidation for this count is below the 38.32 when the wave 1 will be broken

Mixed Technique: Bring back strong peso and old school reggaetonWelcome to the series where I play with both technical and fundamental aspects of the market. Leave your suggestions if you want me to cover a specific asset.

Technical story:

As everyone but Maluma noticed, FX_IDC:EURCOP is really close to marking all time... close, but breaking high may come too.

The correlation with emerging markets ( AMEX:VWO ), although broken in 2017 and for the most of 2018, seems to be making a return. It is hard to judge it because the market sell-off usually unites different asset sub-classes better than Santos uniting people of Colombia (no disrespect, calm yourself down). USDCOP broke out of the long-term wedge and seems to be heading higher. We have two main resistance lines to watch now: 3710 and 3910; and two main support lines: 3610 and 3555. For now the EURCOP seems to be making new 52-week high, it may suggest further upward moves. Neither of used indicators is suggesting the end of the rally. VWO coming down would definitely trigger the risk-on mode and bid the COP. If we face a bear market, the COP will definitely not be used as a safe haven.

Fundamental story:

Fundamentals look a little bit better for Colombia. I prepared a couple of charts for you:

GDP seems to be improving, inflation is kept low, debt to GDP is falling. Most of fundamentals suggest there is nothing as bad in Colombia as there was in 2016. Currency is however howering around levels from 2016. I presume it is falling down with the rest of emerging currencies, suggesting risk-off mode.

fred.stlouisfed.org - interest rate differential with USD suggests COP should be way lower. I KNOW IT IS USD, don't cry please. We can see however that heading to 2016 the currency was crushed. This was back when the economy was not doing so good and GDP dropped. Look like worries came back, but they are not to be seen for now.

fred.stlouisfed.org - Real Broad effective exchange rate (RBEER) rallied a lot during this year and the yoy change seems to be too high as for interest rate differential (IRD, used TVC:DE10Y as a proxy for Euro long term interest rate). In the years 2005, 2007, 2010, when it happened, the yoy change in RBEER caught up eventually within 1-2 years. Beware the IRD yoy change is already below zero for more than a year.

fred.stlouisfed.org - my favourite chart. Real interest rate differential vs EURCOP. The currency pair seems to have rallied a bit too much in 2016 and 2017 and we can expect a comeback to the range 3200-3000. Other option is that Colombian yields would have to rally suggesting weakness in Colombia's credibility or economy

d3fy651gv2fhd3.cloudfront.net - Manufacturing PMI is above 50 and suggests a healthy economy

In the first half of 2018 it looked like the FX_IDC:EURCOP was trying to break lower but I believe the current market situation kicked it higher

Conclusions:

Technicals are undecided yet. We are at a cross-road. In my opinion it is flipping a bird at COP bulls and may strengthen EUR against our reggeaton peso. Fundamentals of Colombia are strong and even interest rate differential sugest that the currency should appreciate against the euro. I believe it is a short-term bearish, long-term bullish situation for COP.

Soporte en recuperaciónEn dias de panico extremo en las principales plazas bursatiles, el IPSA de la bolsa de Santiago, ha comenzado a levantar y recuperar el terreno de los 5100 puntos. Es importante seguir el desarrollo del dia y cierre de la presente semana

the worst has pass ?? The newIPSA has been pulled by world wide correction on financial markets, however the support has been working very well, now it is time to do the job and start a new tendence ...

Emerging markets bounce? Emerging Markets ETFs are in a parallel channel. Price just bounced on the lower limit.

Investors are concerned about the high inflation to be expected in the US (3.7% unemployment = wages going up) which would encourage the FED to raise interests even more and drive the USD up. A high USD and higher yields would draw investors away from EM because they could get a decent return at lower risk (Bonds or T-Bills). The trade war risks is obviously not helping. In addition, higher interest rates would result in higher DEBT/GDP ratios in emerging countries that

However, one can argue that those factors have been priced in since EEM is down 25% in 2018, and it could be a good time to buy.

I would not be too confident about that. If the overall trend goes down, EM are likely to perform poorly.

If Trump backs-up on tariffs, which is extremely unlikely, then the outlook could change.

Trade safe!

Opportunity on ECH ?During the month of September, the Chilean indicator has moved a lot, where with the rebalancing product of the departure of 10 companies, the 30 that stayed have suffered several changes in their weighting, which undoubtedly affected this week, coinciding with a bad debut of the new method.

However, when refining the pencil, we can be at a decisive moment and contemplate a stronger fall, if it lose the level of 50% fibo and the ema100. Otherwise, could bounce something during the next few days and finalize a good month ... we must look closely to emerging, and global indicators

Durante el mes de septiembre, se ha movido bastante el indicador Chileno, en donde con el rebalanceo producto de la salida de 10 empresas, las 30 que quedaron sufrieron varias modificaciones en su ponderación, lo cual indudablemente afecto esta semana, coincidiendo con un mal debut del nuevo método.

Sin embargo, al afinar el lápiz, podemos estar en un momento decisivo y contemplar una caída mas fuerte, de perder el 50% fibo y la ema100. Por otro lado, podría rebotar algo durante las próximas horas y finiquitar un buen cierre de mes... a estar muy atento con los emergentes, e indicadores globales

Dollar Index Ready to go to New HighsFundamentally , within the context of the current currency crisis experienced by emerging market economies, the dollar index is set to go to new highs in the upcoming weeks. Capital flights from weaker economies will pump into the dollar. This should have a strong effect on the valuation of the most important currency in the world. Turkey, Iran, Venezuela, Russia, Argentina and Brasil are perfect examples of the weakening of these market economies. For more information about these, please refer to: www.youtube.com .

Technically , the DXY is set to achieve new highs around 101.84 points. This is a FIB level of 0.618 phi in the overall chart.

We can see in this 4H timeframe chart a:

1. Descending Channel (red) after entering the 0.5 phi level between the 0 - 1 FIB level.

2. Consolidation/accumulation within the reversal triangle (blue) that pumped upwards.

3. An Inversed Head & Shoulders pattern that should pump upwards as soon as the DXY manages to break through the base of the pattern.

Now, taking a look at the 1D timeframe chart, we can see the following technicals:

1. A massive Bullish Bat Harmonic Pattern.

2. A massive Megaphone Pattern.

3. A Falling Wedge pattern with the confirmed breakout.

3. A bear trap formed after the rejection of the 0.382 phi and the failed dumped of the megaphone pattern.

This technical structure in the 1D timeframe fits and confirms the upcoming rise prediction of the 4H timeframe chart.

Finally, looking at the 1W timeframe, we can see that the Triangle Reversal Accumulation Pattern the dollar had for about ten years, between 2004 until 2014, fundamentally coincides with the time the emerging markets got into US debt by accessing cheap credit fostered by the IMF among other international entities and institutions.

P.S.: Considering cryptocurrencies are within a Bear Market, I am going to actively start posting charts about Forex, Indexes, Commodities and a Stock Bubble that I see forming in a country in the Americas. Follow me and like my idea to access this content!

Argentine Telecom deep discount breakout on falling wedgeTEO breaks out of deep falling wedge from half its value earlier in year.

* Paid a 17.45% dividend last year and known for double digit dividends

* Telecom 5G play for new subscribers in 2019, or watch until 2019 entry at higher price, likely near $30.

* Growing mid-cap telecom, cable, cellular provider

* Fell out of favor on negative earnings miss building infrastructure

* Revenue growth +35%, Revenue change +24%

* Currently only 20% large fund ownership, which will grow with 5G emergence

* Breaking out from bottom just above $15 and below $20 and going up.

Viewers come to own conclusions with charts and investing.

ENIA LONGENIA is a company that has gotten smashed with most EM's over the past few months, but has had no fundamental changes. Price recently bounced off support at $7.00, and is up over 10% since then on big green volume. This is an easy long to hold over the next few months. My price target is $11.

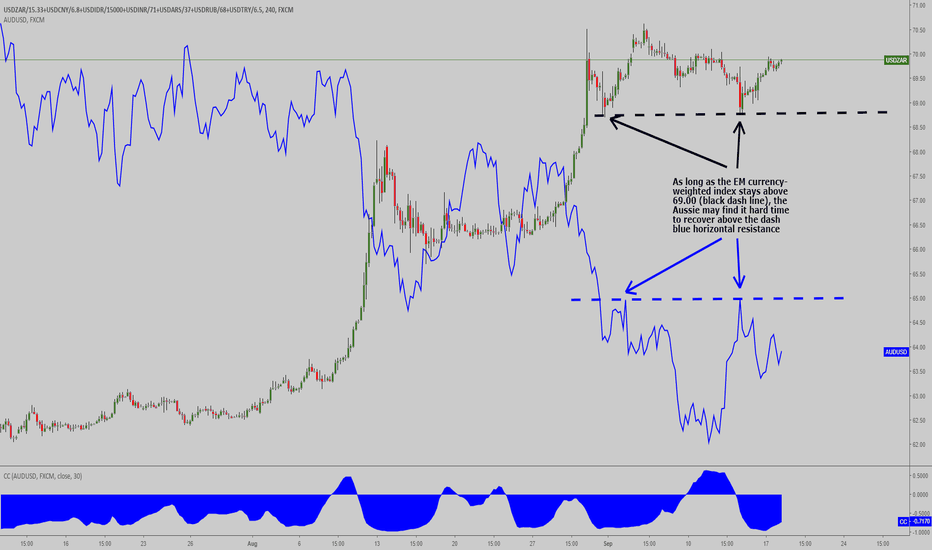

AUD/USD: Looking For Cues Via EM Currency IndexIn this chart exercise, it becomes blatantly clear why the Aussie is often referred to as a proxy for emerging markets.

We've created an EM-weighted index with 7 currencies (Argentinian Peso, Turkish Lira, Russian Ruble, South African Rand, Chinese Yuna, Indonesian Rupiah, Indian Rupee).

Do you notice the extremely strong negative correlation? As long as the trading war keep undermining emerging markets, one can take cues from the EM index to trade the Aussie.

In the latest divergence spotted on Sept 10, notice how we were going through a recovery in emerging markets (candle chart going lower), yet the aussie remained at trend lows?

MSCI emerging markets Similar past, veryYou do not have to be a genius to see the huge similitures of the past charts of the emerging markets msci of exactly 10 years ago¡ , specifically in 2008, where you can clearly see an upturn in investment in these markets msci very, very strong up, reaching a summit to explosion and crach donw , it can practically be seen as a carbon copy 10 years later the same pattern almost yes,

well You may not remember it , but exactly 10 years ago it was the resection in North America.

Well coincidences, possibly.

but without a doubt the Charts are very similar to those of the past.