WTI Oil D1 | Approaching a swing-high resistanceWTI oil (USOIL) could rise towards a swing-high resistance and potentially reverse off this level to drop lower.

Sell entry is at 62.71 which is a swing-high resistance.

Stop loss is at 66.00 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 58.18 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Energy Commodities

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed higher on the daily chart. It held above 18,360 at the close, and today’s candle formed a golden cross as the MACD crossed above the Signal line, creating a potential buy signal. However, this signal will only be confirmed if the candle closes as a solid bullish bar, so it's too early to say that a buy confirmation has been established.

On the weekly chart, although the index has not yet reclaimed the 5-week MA, it has gapped above it. Overall, the index appears to be forming a box range between the 3-week and 10-week MAs, and if further upside occurs, we could potentially see a move toward the 60-week MA. However, since the MACD and Signal line on the weekly chart are still sloping downward, there's a high possibility of a medium-term pullback even if the index rallies to the 10-week MA.

On the daily chart, the index is still meeting resistance at the 20-day MA, and the key point now is whether the MACD completes the golden cross or turns downward again. Since the index has managed to hold above 18,360, the potential for a rebound remains open. Buying during pullbacks near the lower wick remains a favorable strategy.

On the 240-minute chart, the MACD is turning upward after finding support at the Signal line, forming a potential third wave of buying. In short-term timeframes, buying on dips remains favorable.

This week, the Retail Sales data is scheduled for Wednesday, and the U.S. markets will be closed on Friday. Please keep that in mind for risk management.

Crude Oil

Crude oil closed higher in a narrow range on the daily chart. On the weekly chart, a long lower wick formed, finishing with a doji candle, suggesting indecision. Last week, oil was rejected at the 3-week MA, forming an upper wick. If it rallies this week, it could target the 5-week MA. The $65 level, near both the 5-week and 240-week MAs, remains a strong resistance zone, making it a potentially favorable area to consider short trades.

On the daily chart, oil has entered a box range between the 5-day and 10-day MAs. Though the MACD and Signal line still point downward, oil is currently holding within a supportive range. There is a possibility the MACD could begin to turn upward, so keeping both bullish and bearish scenarios open is advisable.

On the 240-minute chart, the MACD is still rising after a golden cross but remains below the zero line, suggesting a potential for another pullback. Overall, monitor intraday movements and continue to trade within the range.

Gold

Gold closed higher, setting a new all-time high. The weekly chart formed a strong bullish candle, resuming its upward trend. Buying near the 3-week MA remains favorable. As the price has overshot the previous target of $3,216, we’ve now entered an overshooting zone, making it difficult to define the next resistance. Therefore, caution is advised for short positions, and it’s best to focus on buying the dips.

On the daily chart, the new all-time high generated a bullish signal, and buying near the 3-day MA is recommended. Gold may enter a sideways consolidation phase while aligning its moving averages. In that case, buying near the 5-day MA may also be considered, but avoid chasing the price higher.

The MACD has made another golden cross, and it’s important that the MACD doesn’t create a divergence by failing to surpass its previous peak. Avoid shorts, and stick with buy-the-dip strategies. On the 240-minute chart, buying momentum remains strong. The RSI is in overbought territory, so again, avoid shorting and focus only on buying during pullbacks.

Market Outlook

Compared to the last two weeks of high volatility, this week is expected to be more subdued. After a period of extreme moves, the market is likely to consolidate and seek direction. Rather than swinging for home runs, it's better to focus on small base hits and steadily build profits.

Wishing you a successful trading week!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

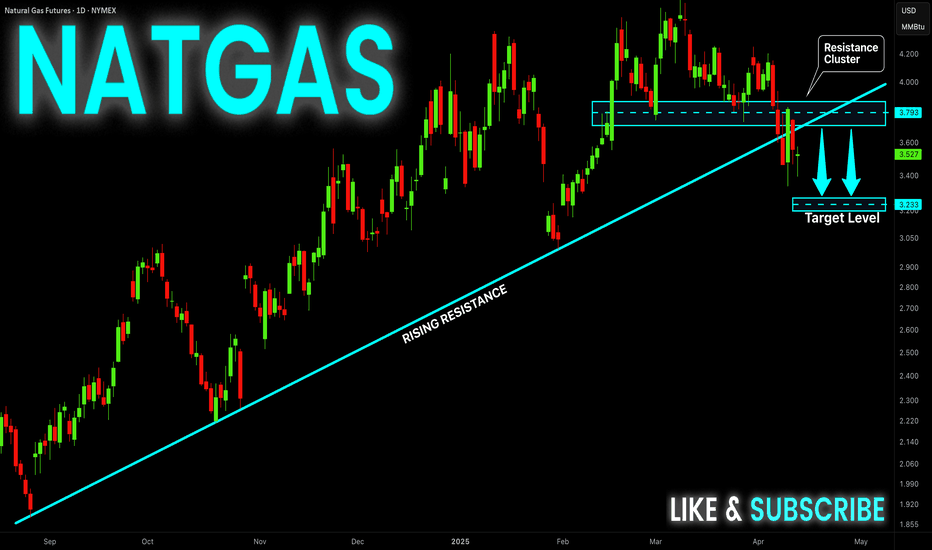

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

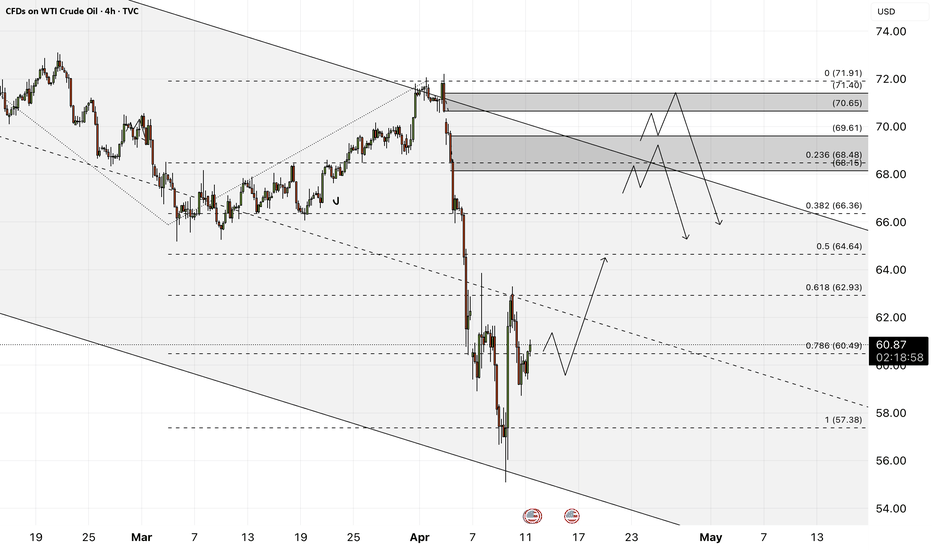

Strategic Analysis of Crude Oil for Next WeekBehind the current fluctuations in international oil prices lies the market's deep anxiety over the extreme uncertainty of global trade policies. Trump's "suspension + escalation" approach has, in the short term, stabilized relations with non - Chinese economies, but it has also dealt a blow to the global supply chain and energy consumption confidence.

In terms of the trading ideas for crude oil next week, it is recommended to mainly go short at high levels during rebounds and go long at low levels during pullbacks as a supplement. In the short term, pay attention to the resistance level in the range of 62.8 - 63.2. In the short term, focus on the support level in the range of 60.5 - 59.5.

Oil trading strategy:

sell @ 61.90-62.10

sl 62.80

tp 61.70-61.40

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

USOIL may continue to decline due to tariffsRestricted Economic Growth : The United States imposes tariffs, and other countries take countermeasures, intensifying global trade frictions and greatly increasing the risk of economic recession. NIESR predicts that if Trump imposes a 10% tariff on the world and a 60% tariff on China, the global GDP will shrink by 2% and the trade volume will decrease by 6% within five years 😕. The weak economy causes the demand for crude oil in various industries to decline, leading to a drop in the price of USOIL 📉.

Changes in Crude Oil Supply and Demand :

Demand Side: China imposes tariffs on U.S. crude oil, raising the import cost and reducing the import volume. The United States imposes tariffs on energy imports from Canada and Mexico, affecting the crude oil exports of these two countries to the U.S., reducing the demand for crude oil in the United States and putting pressure on the price of USOIL 😟.

Supply Side: After China reduces its imports of U.S. crude oil, it increases imports from other exporting countries, changing the global crude oil supply pattern and possibly strengthening the expectation of a supply surplus. The decrease in U.S. crude oil exports may lead to an increase in domestic inventory, exerting downward pressure on the price of USOIL 😣.

Influenced Market Sentiment :

The uncertainty of tariff policies and the escalation of trade frictions trigger market panic and speculation, intensifying the volatility of the crude oil market. Investors, being pessimistic, sell futures contracts, further driving down the price of USOIL 😨.

This upward movement has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟.

💰💰💰 USOIL💰💰💰

🎯 Sell@61.0 - 61.5

🎯 TP 59.0 - 58.0

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

USOIL BULLISH BIAS RIGHT NOW| LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 61.45

Target Level: 73.89

Stop Loss: 53.11

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XOM Analysis: Oil's Next Move & Policy ShiftsNYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—could significantly influence the energy landscape.

My intuition suggests Trump’s "Mar-a-Lago Accord" might involve major global economies reducing holdings of US dollar assets, swapping short-term treasuries for century bonds. Such currency shifts and reduced drilling activity could lead to a tighter oil supply, benefiting prices. Additionally, a weakening US dollar could positively impact technology stocks, as investors rotate towards sectors less affected by traditional commodities.

Technical Analysis (Daily & Hourly Chart)

Current Price: Approximately $103.00

Key Resistance Levels:

Immediate resistance: $103.93 (L.Vol ST 1b)

Important resistance zone: $104.74 (118 AVWAP)

Critical resistance (Last week's high): ~$106.46

Key Support Levels:

Near-term support: $101.13 (Weeks Low Long)

Major support: $97.92 (Best Price Short)

Trading Scenarios

Bullish Scenario (Continued oil strength & supportive policy shifts):

Entry Trigger: Sustained breakout and close above immediate resistance at $103.93.

Profit Targets:

Target 1: $104.74 (AVWAP resistance)

Target 2: $106.46 (recent swing high)

Stop Loss: Below recent pivot around $101.00, limiting risk effectively.

Bearish Scenario (Oil price weakness or production surge):

Entry Trigger: Failure to sustain the above resistance at $103.93 or a breakdown below near-term support at $101.13.

Profit Targets:

Target 1: $99.00 (psychological & short-term support)

Target 2: $97.92 (strong support, ideal short target)

Stop Loss: Above $104.75 to control risk in case of a reversal.

Thought Process & Final Thoughts

Given the current geopolitical and regulatory environment, XOM appears poised for potential upside if oil prices remain strong and policy shifts materialize. However, caution is warranted, as oil companies seem hesitant to increase production due to profitability concerns. Clearly defined technical levels will help navigate trade entries and exits effectively around these evolving macroeconomic conditions.

Earnings Date: May 2nd—Keep positions nimble as earnings can significantly impact short-term volatility.

USOIL Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for USOIL below:

The price is coiling around a solid key level - 61.43

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 60.40

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Long Term Brent Outlook, $32 by 2026Weekly Brent has broken a clear barrier and formed a Bull Flag pattern, but the subsequent rally has been weak, not even reaching the breakout level.

The global economy is showing signs of weakening, leading to a reduction in oil demand. Concurrently, Trump's move to lift US production restrictions is boosting oil supply. However, the slight depreciation of the dollar is providing upward pressure on oil prices.

Given these factors, Brent remains relatively weak, and we may see a continued decline in line with Scenario 1, potentially targeting ML by 2026. Further downside is also likely.

Given the current conditions, I consider shorting oil at any reasonable price on lower timeframes.

BRIEFING Week #15 : Arbitrages on the lookoutHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

USOIL: Local Bearish Bias! Short!

My dear friends,

Today we will analyse USOIL together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 61.501 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

"WTI / U.S Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WTI / U.S Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 30mins timeframe (58.000) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 66.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🛢"WTI / U.S Crude Oil" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"XNG/USD Natural Gas" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "XNG/USD Natural Gas" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 2h timeframe (3.800) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 3.200

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

⛽💨"XNG/USD Natural Gas" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Outlook Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Crude oil------sell near 63.00, target 60.00-57.00Crude oil market analysis:

The recent daily crude oil line is still not very strong. There was a rebound, but it was just a rebound. Gold rose strongly, but crude oil did not rise strongly. Yesterday's crude oil also ran down slightly. Today's crude oil is still around 63.00 and 65.00, which are opportunities to consider selling. If it continues to decline and stabilizes around 57.00, buy it back. Crude oil does not reflect the fundamentals so strongly.

Fundamental analysis:

The CPI announced yesterday did not have a big impact on the market, but the data difference was still relatively large, and the result was -0.1%. The bulls only rose slightly. The bottoming out and rebound of the US stock market was mainly due to Trump's withdrawal of some tariff policies.

Operational suggestions

Crude oil------sell near 63.00, target 60.00-57.00

WTI Oil H4 | Approaching a swing-high resistanceWTI oil (USOIL) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 62.71 which is a swing-high resistance.

Stop loss is at 66.00 which is a level that sits above the 61.8% Fibonacci retracement and a pullback resistance.

Take profit is at 57.01 which is a swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

WTI - Will Iran return to the group of oil producers?!WTI oil is below the EMA200 and EMA50 on the 4-hour timeframe and is moving in its medium-term descending channel. If the correction towards the supply zone continues, the next oil selling opportunity with a suitable reward for risk will be provided for us. In this direction, with confirmation, we can look for oil buying transactions.

The U.S. Energy Information Administration (EIA), in its latest report, has downgraded its forecasts for oil and natural gas production, consumption, and prices for 2025 and 2026, while warning about the uncertain outlook of the energy market amidst economic volatility and escalating trade tensions.

According to the updated estimates, U.S. crude oil production in 2025 is expected to reach 13.51 million barrels per day, down from the previous forecast of 13.61 million barrels. For 2026, the figure has been revised to 13.56 million barrels per day, a reduction from the earlier 13.76 million forecast. Monthly data shows average U.S. oil output stood at 13.44 million barrels per day in April and 13.55 million in March, with similar levels expected in May.

Globally, EIA projects oil production in 2025 to be around 104.1 million barrels per day, slightly down from the earlier estimate of 104.2 million. For 2026, the revised figure stands at 105.3 million barrels per day compared to the previous 105.8 million.

On the demand side, global oil consumption forecasts have also been reduced. In 2025, demand is now estimated at 103.6 million barrels per day instead of 104.1 million, and for 2026 it is projected at 104.7 million barrels per day, down from the prior estimate of 105.3 million.

Regarding natural gas, the EIA reports that average U.S. gas production in April will be around 115 billion cubic feet per day, slightly lower than the 115.3 billion cubic feet reported in March. May’s forecast stands at 115.4 billion cubic feet. Demand has also dipped, with estimates for 2025 now at 91.2 billion cubic feet per day (down from 92), and for 2026 at 90.5 billion (previously 91.1).

In terms of pricing, EIA has made significant downward revisions. The average price of West Texas Intermediate (WTI) crude oil is now forecast to be $63.88 per barrel in 2025, compared to the earlier $70.68. For 2026, this drops further to $57.48. Brent crude is now estimated at $67.87 for 2025 and $61.48 for 2026, both notably lower than prior projections.

One key highlight from the report is EIA’s warning about high volatility in major commodity prices, especially crude oil. The agency underlined that reciprocal tariffs between China and the U.S. could heavily impact markets, particularly the propane sector.

EIA noted that U.S. liquefied natural gas (LNG) exports are likely to remain resilient despite trade disputes. This is attributed to strong global demand and the flexible nature of U.S. export contracts, which allow unrestricted shipments to multiple destinations.

However, when it comes to oil and petroleum products, the agency maintained a more cautious tone, emphasizing that recent shifts in global trade policies and oil production patterns may slow the growth of demand for petroleum-based products through 2026.

Altogether, the downward revisions by the EIA carry a clear message: the energy market outlook over the coming years is fraught with uncertainty. From supply and demand to pricing, political and economic forces such as trade wars and potential global recessions are expected to play decisive roles.

Meanwhile, according to Reuters, after U.S. President Donald Trump once again threatened military action if Tehran refuses to agree to a nuclear deal, a senior Iranian official responded by warning that Iran may halt its cooperation with the U.N.’s nuclear watchdog.

Reports indicate that American and Iranian diplomats will meet in Oman on Saturday to begin talks on Tehran’s nuclear program. Trump stated that he would have the final say on whether the negotiations are failing, which could place Iran in a highly dangerous position.

Ali Shamkhani, a senior adviser to Iran’s Supreme Leader, posted on X (formerly Twitter) that ongoing foreign threats and the looming threat of military confrontation could lead to deterrent actions such as expelling International Atomic Energy Agency (IAEA) inspectors and cutting ties with the agency.He also mentioned that relocating enriched uranium to secure, undisclosed locations within Iran may be under consideration

Crude Oil Found Support: What's Next?FenzoFx—Crude oil tested the $58.9 level as support and bounced back from it. The primary trend is bearish; therefore, it will likely resume if the price closes and stabilizes below this support.

If this scenario unfolds, the next bearish target could be the $55.15 support level.

>>> Win $160.0 prize every week by joining FenzoFx contest.

GBP/USD at a Crossroads: Imminent Breakout or Bull Trap?The weekly chart of GBP/USD shows a strong recovery following the late-April correction, which brought the price down to a key demand zone between 1.2550 and 1.2600. The bounce was sharp and decisive, but the pair is now facing resistance between 1.3000 and 1.3150 — a previously sold area marked by a visible supply block in red.

The current weekly candle reflects a bullish reaction, but the overall structure suggests a potential exhaustion zone for upward momentum. Price action reveals a series of lower highs in the short term, and while the RSI is bouncing, it remains far from overbought, hinting that this move may be just a technical rebound.

From a trading perspective, a confirmed weakness around the 1.3000–1.3150 zone could offer short opportunities with an initial target near 1.2700 and, if extended, down to 1.2550 — a key dynamic support area. On the flip side, a clean breakout above 1.3150 with strong volume and a weekly close would open the door for a new bullish leg toward 1.3300–1.3400.

Conclusion: GBP/USD is currently at a critical juncture. The next directional move will depend on how price reacts to this resistance zone: a confirmed rejection could trigger renewed selling pressure, while a confirmed breakout may reignite the bullish trend.

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed lower following news of additional tariffs on China. On the daily chart, the index failed to break above the 20-day moving average and pulled back to the 5-day MA, continuing its box-range movement. Since the 5-day MA is still acting as support, the current trend can still be seen as a sideways consolidation, with 18,500 acting as a central pivot level.

The MACD on the daily chart has not yet clearly broken above the Signal line, so it remains uncertain whether it will make a golden cross with additional upward momentum, or turn downward again. Thus, it’s best to adopt a neutral range-bound trading strategy, keeping strict stop-losses on both sides.

On the 240-minute chart, both the MACD and Signal line have moved above the zero line, entering a key area to observe whether the third wave of MACD upside begins after this box-range consolidation. Since the current price is correcting after a rebound from a double bottom, and is maintaining the center of the prior bullish candle, buying remains more favorable. Unless the previous day’s low is broken, it’s better to stay buy-biased.

Please note that today's PPI data release is scheduled, which may lead to increased volatility around the announcement time.

Crude Oil

Crude oil closed lower with a large bearish candle. On the daily chart, it failed to hold the 5-day and 10-day moving averages, breaking below the 5-day MA. The MACD continues its downward slope, and unless oil clearly reclaims the 10-day MA, the market will remain bear-biased.

There is resistance now at the 3-day and 5-day MAs, so it’s important to see whether further downside unfolds. As previously noted, the $59 level is a key support zone — watch closely for any breakdowns.

On the 240-minute chart, the MACD is trending up and pulling the Signal line along, but both remain below the zero line. If oil continues in a box range but the MACD turns downward again and forms a dead cross, there could be another leg lower. For now, continue to focus on buying near the $59 level, and maintain a range-trading approach until further confirmation.

Gold

Gold closed higher with another strong rally. On the daily chart, the MACD has now crossed above the Signal line, generating a buy signal. However, this signal will only be valid if today’s candle closes as a bullish bar, so watching the daily close is critical.

Gold hit new all-time highs during the pre-market session, with the long-awaited 3,216 level, which has been the target since March, now within reach. Beyond this level, we enter the overshooting zone, where it’s difficult to define a precise top. Therefore, it's best to stick to dip-buying strategies, as safe-haven demand continues to surge.

Even though the MACD has crossed bullishly, divergence may form if the current MACD fails to exceed the previous peak. Avoid chasing long positions at the top; instead, look for entries during pullbacks.

On the 240-minute chart, the MACD has climbed above the zero line, showing a strong one-way bullish trend. RSI across intraday charts is now in overbought territory, so it’s best to avoid short positions entirely for today.

Market Sentiment & VIX

Looking at the VIX index, the daily candle has once again broken above the 5-day MA, indicating that volatility could expand further at any time. With Trump’s remarks shaking markets, it’s impossible to predict what new developments might emerge over the weekend.

Avoid holding overnight positions due to heightened headline risk, and make sure to wrap up this trading week with solid risk management.

Wishing you a profitable trading day!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!