Weekly Market Analysis - 22nd Mar 2025Ok, here we go with another weekly market analysis!

So, what I'm feeling from my charting is that we may get a lower USD, but not before a little retracement first, particularly an iFVG on the 2W timeframe. After that, lower prices. This coincides with some of my analysis of other pairs, but not all of them. Whilst everything is not aligned yet, my instincts are usually pretty good. But, this not mean I am jumping into any trades yet. I have my own techniques for getting in and out of trades.

Check out the video and see if your own analysis flows with mine!

Analyzed pairs: DXY, EURUSD, NZDUSD, USDCHF, USDCAD, USDJPY, OIL, XPD, XPT, XAU, BTC.

Happy trading!

- R2F Trading

Energy Commodities

WTI CRUDE OIL: Hard rebound on 1.5 year support targeting $72.WTI Crude Oil is neutral on its 1D technical outlook (RSI = 48.748, MACD = -1.080, ADX = 23.603), which indicates the slow transition from a bearish trend to bullish. This started when the price hit the S1 level, a 1.5 year Support, and bottomed. The slow rebound that we're having since formed a Channel Up on a bullish 1D RSI, much like the one in September 2024, which eventually peaked after a +10.70% price increase. A similar rebound is expected to test the 1D MA200. The trade is long, TP = 72.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USOil The Final dealBased on current market conditions, we predict an upward movement for USOil.

The first resistance level is set at 69.000. This level has proven to be a significant hurdle in previous price actions, with selling pressure often emerging as the price approaches it.

However, given the current positive momentum, there's a strong likelihood of breaking through this resistance.

On the downside, the primary support level stands at 67.000. This level has been tested multiple times and has held firm, acting as a floor for the price.

Below this, we have a second support at 66.500. This secondary support is crucial as it provides an additional buffer against significant price drops. If the price manages to stay above the 67.000 support, the upward trend is likely to continue towards the 69.000 resistance and potentially beyond.

💎💎💎USOil 💎💎💎

🎁 Buy@67.500 - 67.700

🎁 TP 68.800 - 69.000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

OIL Today's strategyCurrently, crude oil prices are fluctuating near the resistance level. Recently, the increase in US crude oil inventories has affected the supply dynamics and exerted certain pressure on oil prices. However, overall, the geopolitical tensions and supply risks have a relatively significant supporting effect on oil prices at present.

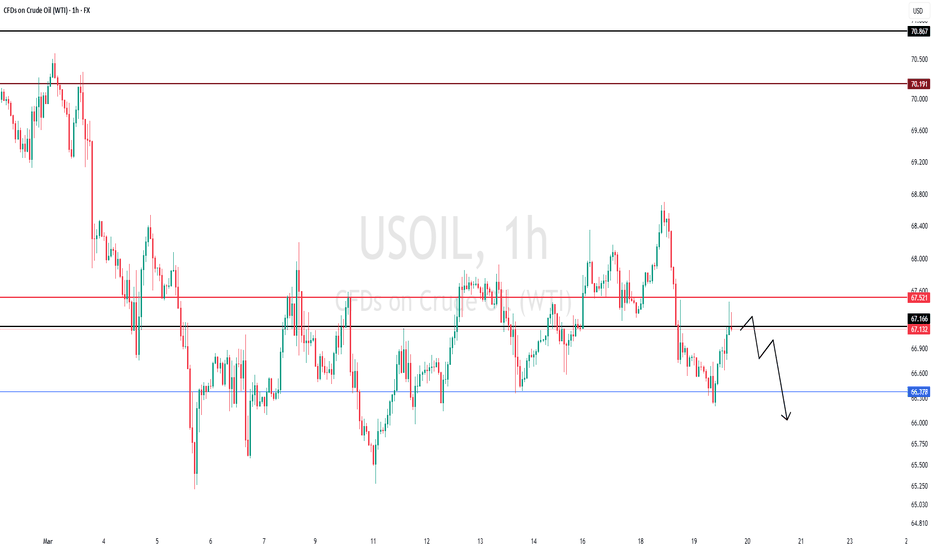

OIL Today's strategy

sell@68.5-68.8

buy:67.2-67.6

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

Crude oil ------- sell around 70.00, targeCrude oil market analysis:

Yesterday's crude oil daily line closed with a big positive, is it a buying opportunity? In fact, looking at the pattern, it has been hovering at this position for a long time, and the short-term is basically a snake. If the position of 70.00 is not broken, it is difficult to form a buying opportunity. The idea of crude oil today is still bearish. Continue to sell on the rebound. The previous contract delivery of crude oil has not changed the trend. I think it still needs to fluctuate.

Operation suggestion:

Crude oil ------- sell around 70.00, target 68.00-66.00

CRUDE OIL Free Signal! Sell!

Hello,Traders!

CRUDE OIL made a sharp

And sudden move up

And it seems that it will

Soon hit a horizontal

Resistance level of 68.80$

From where we can go short

On Oil with the TP of 67.67$

And the SL of 68.87$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Oil Market at Risk: Potential Breakdown Below Key SupportThe oil market is showing signs of weakness, with a technical triangle formation on the verge of breaking down. Key support at USD 66.50 per barrel is under threat, and several fundamental and macroeconomic factors suggest further downside risks.

Some Key Bearish Factors for Oil

1. Weakening Global Economy

Economic indicators across major economies are flashing warning signs. A slowdown in global growth, particularly in China and Europe, is reducing industrial demand for oil. Weaker economic activity typically translates to lower energy consumption, putting pressure on oil prices.

2. Stronger U.S. Dollar

A rising USD makes oil more expensive for buyers using other currencies, leading to lower demand. If the Federal Reserve maintains its hawkish stance on interest rates, a stronger dollar could continue weighing on oil prices.

3. Supply Overhang and Shale Resilience

Despite OPEC+ production cuts, oil supply remains ample. U.S. shale producers have kept output steady, while global inventories are rising. If supply continues to outpace demand, downward pressure on prices is likely.

4. China’s Slowing Recovery

China, the world’s largest oil importer, has struggled with weaker-than-expected economic data. Lower manufacturing activity and sluggish domestic demand are reducing the country’s need for crude oil, further dampening market sentiment.

5. Geopolitical De-escalation

A potential ceasefire in Ukraine could ease concerns over energy supply disruptions. Lower geopolitical risk would reduce the war-driven risk premium on oil, potentially triggering a price decline.

6. Growth in Alternative Energy

The increasing adoption of electric vehicles (EVs) and renewable energy is gradually reducing structural demand for crude oil. As governments push for greener energy solutions, long-term oil consumption trends may continue declining.

7. Speculative Unwinding

Traders and hedge funds could accelerate the sell-off if USD 66.50 support breaks. Technical breakdowns often lead to increased short-selling and stop-loss triggers, intensifying downward momentum.

Conclusion: More Downside Ahead?

With a weakening economy, strong dollar, and growing supply concerns, oil faces multiple headwinds. If key technical support at USD 66.50 breaks, the market could see further declines in the short term. Unless demand picks up or supply constraints emerge, the bearish trend may persist.

#OilMarket #CrudeOil #BearishOutlook #Energy

NG1! NATURAL GAS SHORT TERM TARGETNatural Gas Price Forecast: Rises to Five Day High

Natural gas strengthened on Wednesday and reached a five-day high of $4.25. The high for the day was a successful test of resistance around a trendline

Following a breakdown from the trendline last week natural gas consolidated in a relatively narrow four-day price range, largely below the trendline and the 20-Day MA.

Short term entry and targets

We can chose ,because of volatility and high uncertainty,tariffs,news... between 2 profit targets

If the 1st profit target hits,and NG reverses,possibility 1 to take profit

If it passes through, we take profit at 2nd target.

Entries:

In case to entry currently Buy1

If pullback Buy2

If pullback deep Buy3 level.

Alternatives:

Entry 1 Buy1

Entry2 cover

Entry3 Cover2

Bearish potential detected for WHCEntry conditions:

(i) lower share price for ASX:WHC along with swing up of the DMI indicators and swing down of the RSI indicator, and

(ii) observation of market reaction at the support level at $5.55.

Stop loss for the trade would be, dependent of risk tolerance:

(i) above the resistance level from the open of 21st February (i.e.: above $5.80),

(ii) above the resistance level from the open of 13th January (i.e.: above $5.91), or

(iii) above the resistance level from the open of 30th December (i.e.: above $6.00).

Crude oil---sell near 68.20, target 66.00-65.20Crude oil market analysis:

Crude oil has been hovering at the bottom recently. It is necessary to short it at the high suppression position. It is difficult to make a profit by shorting in the middle and chasing. Today's idea is to continue to short it after the rebound. Pay attention to the suppression near 68.00-68.50. Crude oil is basically difficult to change the trend in the short term. Yesterday's crude oil contract delivery was not big. The price of the new contract is basically the same as the old one.

Fundamental analysis:

The Federal Reserve will maintain the benchmark interest rate at 4.25%-4.50%, which is in line with market expectations. The dot plot shows that it is expected to cut interest rates twice in 2025. The Federal Reserve will begin to slow down the pace of balance sheet reduction on April 1.

Operational suggestions:

Crude oil---sell near 68.20, target 66.00-65.20

US-OIL Long Buy due to lower SupportHello Traders

In This Chart XTIUSD HOURLY Forex Forecast By FOREX PLANET

today XTIUSD analysis 👆

🟢This Chart includes_ (XTIUSD market update)

🟢What is The Next Opportunity on XTIUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

WTI Possible Scenarios:

1- Bullish Scenario:

If the price holds above 66.160, it could push towards 67.900, filling the Fair Value Gap.

A break above 67.900 could confirm further upside potential.

2-Bearish Scenario:

If price breaks below 65.800, it could signal further downside towards 65.500 or lower.

The trendline resistance could push price lower if rejection occurs.

Entry Zone: Around 66.160.

Stop Loss: Around 65.800.

Target Price: Around 67.895.

OIL Today's strategyIn the short term, there is a simultaneous advance of the long positions in crude oil. The price has tested the vicinity of $68.5 several times but encountered resistance. Moreover, after reaching around $65.2 at the lower level, it rebounded rapidly. The market still needs further testing. In the short term, it is advisable to sell high and buy low within the range of $68.5 to $65.2.

OIL Today's strategy

sell@67.5-67.9

buy:65.7-66.2

If you don't know how to do it, you can refer to my transaction.

Oil head and shoulder ( must read caption)This chart shows a Head and Shoulders pattern on a Crude Oil Futures (4H) timeframe, which is a bearish reversal signal.

Key Points:

1. Pattern Formation:

The Left Shoulder, Head, and Right Shoulder are clearly marked.

A resistance level is identified around $68.00, where the price previously failed to break higher.

2. Breakdown Confirmation:

Price has broken the neckline (support level), confirming the bearish pattern.

The breakdown suggests further downside movement.

3. Price Targets:

First target: $64.84 (-2.58%)

Second target: $63.66 (-1.89%)

Final target: $63.00 (-1.93%)

Trading Strategy:

Bearish Bias: Traders may look for short opportunities below the neckline.

Stop Loss: Above the right shoulder (~$68.00) to limit risk.

Take Profit: Scaling out near $64.84, $63.66, and $63.00.

This setup aligns with technical analysis principles, indicating a likely continuation of the downtrend. However, traders should monitor volume and external factors like oil supply data and geopolitical events for confirmation.

USOIL Strategy AnalysisInternational crude oil prices have been trending sideways-to-downward recently. As of March 19, WTI crude oil was priced at $66.58/barrel, marking a cumulative decline of over 7% since the beginning of the year. The current core market contradiction focuses on the dual pressures of loose supply expectations and divergent demand prospects.

Oil trading strategy:

sell @ 68.2

buy @ 66

If you are currently unsatisfied with your crude oil trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

USOIL BULLISH BIAS RIGHT NOW| LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 66.30

Target Level: 67.73

Stop Loss: 65.34

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅