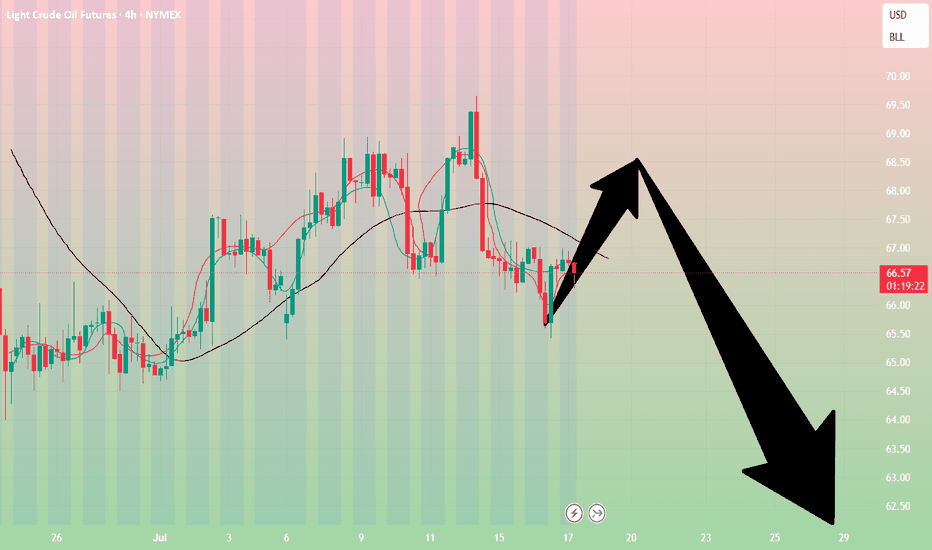

Crude oil-----Sell near 66.80, target 65.00-62.00Crude oil market analysis:

The recent crude oil daily line began to decline, but a small V appeared last night, which was also caused by the situation in the Middle East. Israel bombed Syria and crude oil began to rebound. Overall, crude oil is still bearish. We consider continuing to sell it when it rebounds. It has not broken near 64.00, and it is difficult to form a large unilateral. The suppression position is near 66.80. Consider selling it near it.

Fundamental analysis:

Trump’s dissatisfaction with Powell has not been a day or two. Conflict is inevitable, and the impact on gold is also short-term. Yesterday’s pull-up and dive is a case in point.

Operational suggestions

Crude oil-----Sell near 66.80, target 65.00-62.00

Energy Commodities

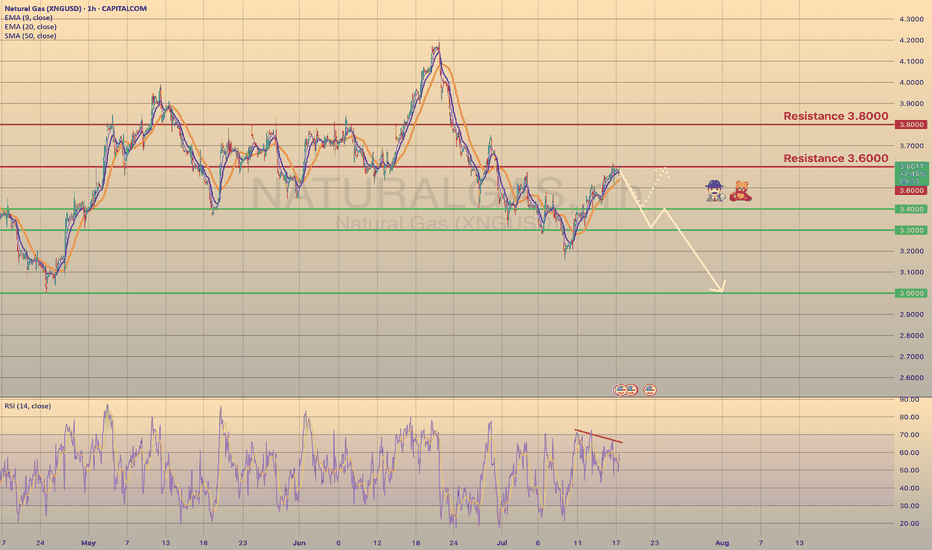

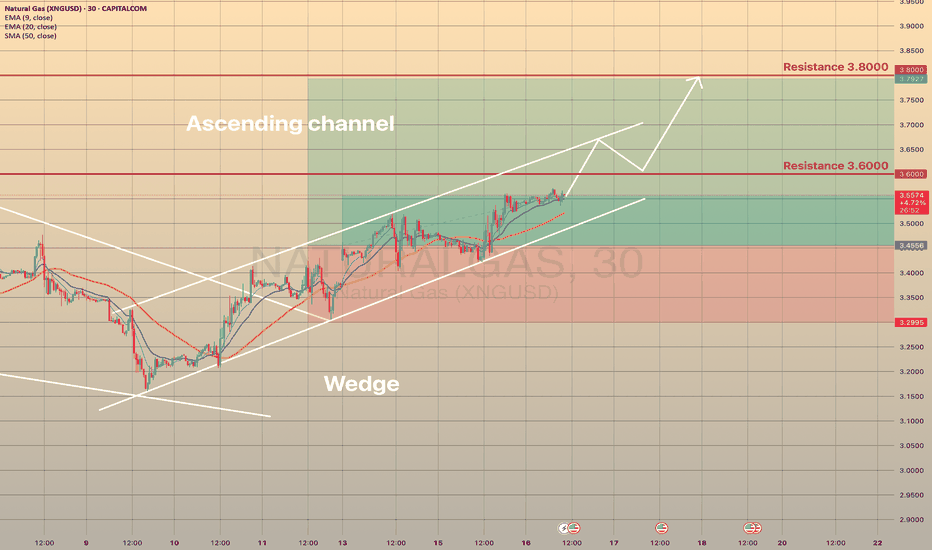

U.S. NATURAL GAS - BEARISH DIVERGENCE DETECTED

U.S. NATURAL GAS - BEARISH DIVERGENCE DETECTED🕵🏻♂️

The Natural gas has been trading bullish for 7 days in a row since last Wednesday, reaching the 3.6000 resistance level. Primarily this happened due to a warm weather in the U.S. states, that supports the demand on gas. Despite warmer-than-normal summer weather, analysts expect energy firms to inject more gas into storage than usual in coming weeks. Record-high output in June, likely to be surpassed in July, and reduced gas flows to LNG export plants since April's peak, support this trend.

Technically chart shows us a bearish divergence on 1-h timeframe. I suppose the price to slowly decline towards major support level of 3.0000 with minor rebounds. The 2nd option is the rebound from 3.4000 support level with a first target of 3.6000.

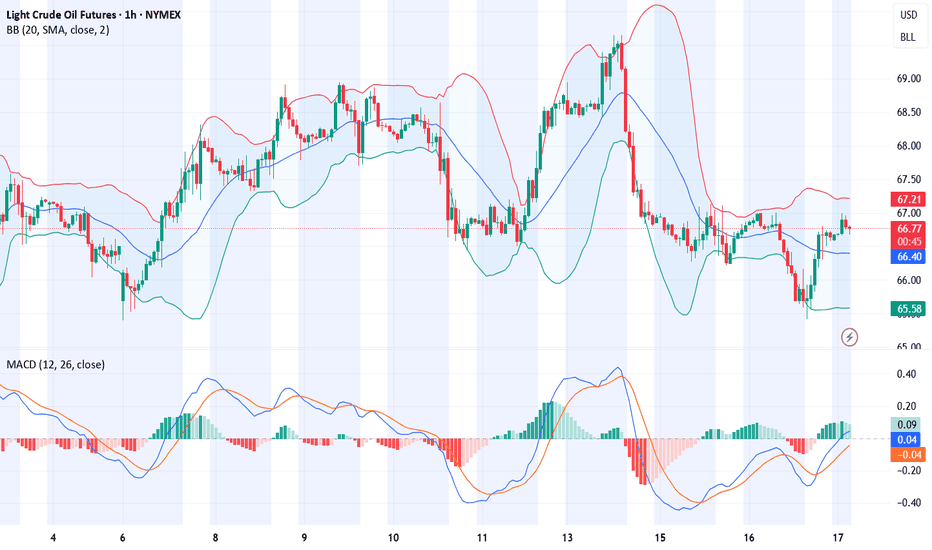

WTI(20250717)Today's AnalysisMarket news:

The annual rate of PPI in the United States in June was 2.3%, lower than the expected 2.5%, the lowest since September 2024, and the previous value was revised up from 2.6% to 2.7%. Federal Reserve Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activity declined slightly, and corporate recruitment remained cautious.

Technical analysis:

Today's buying and selling boundaries:

65.20

Support and resistance levels:

66.59

66.07

65.74

64.67

64.33

63.83

Trading strategy:

If it breaks through 65.74, consider buying in, and the first target price is 66.07

If it breaks through 65.20, consider selling in, and the first target price is 64.67

BRIEFING Week #29-30 : BTC stalling, ETH & then Alts ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

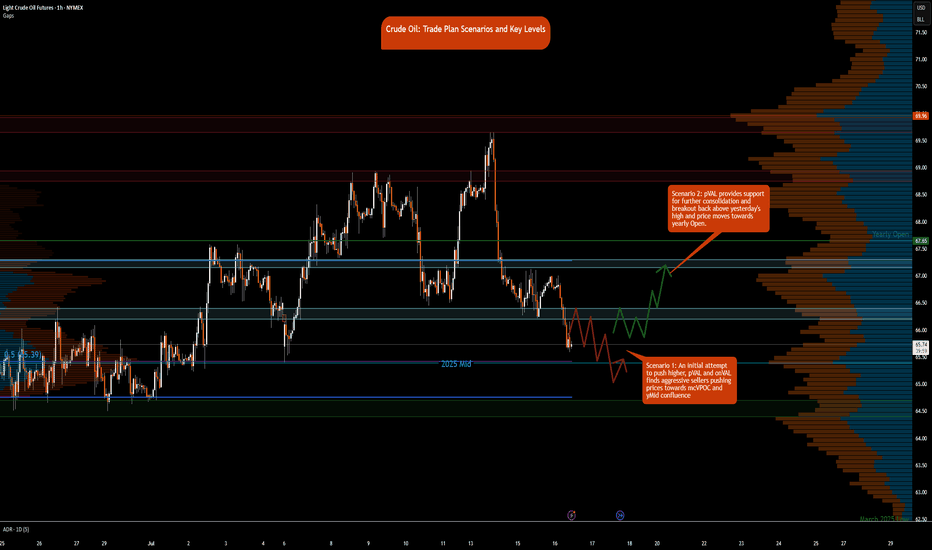

Crude Oil Trade Plan Scenarios and Key Levels

NYMEX:CL1!

It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll tool . The chart shows that rollover is about 70% complete, and CLU25 has higher open interest. Note, the front-month August contract is still trading at higher volume.

What has the market done?

Crude oil is in a multi-distribution profile since the peak witnessed during the Iran-Israel conflict. Crude oil formed a strong base above the 64s and traversed towards the 69s. Prices were rejected at these highs and have since reverted back towards the monthly Volume Point of Control, monthlyVPOC.

What is it trying to do?

The market is in active price discovery mode and has formed multi-distributions since June 23. The market has been consolidating after prices at highs were rejected.

How good of a job is it doing?

The market is active and is also providing setups against key levels. Patience to take trades from these higher time frame levels is what is required to trade crude oil currently. Otherwise, there is a lot of volatility and chop that can throw traders off their plan.

Key Levels:

• Yearly Open: 67.65

• Neutral zone: 67.15–67.30

• 2-Day VAL (Value Area Low): 66.40

• Neutral zone: 66.40–66.20

• 2025 Mid-Range: 65.39

• Key Support: 64.40–64.70

What is more likely to happen from here?

Scenario 1: An initial attempt to push higher, pVAL and onVAL finds aggressive sellers pushing prices towards mcVPOC and yMid confluence

Scenario 2: pVAL provides support for further consolidation and break back above yesterday's high and price moves towards yearly Open.

Glossary:

pVAL: Prior Value Area Low

onVAL: Overnight Value Area Low

yMid: 2025 Mid-Range

mcVPOC: Micro Composite Volume Point of Control

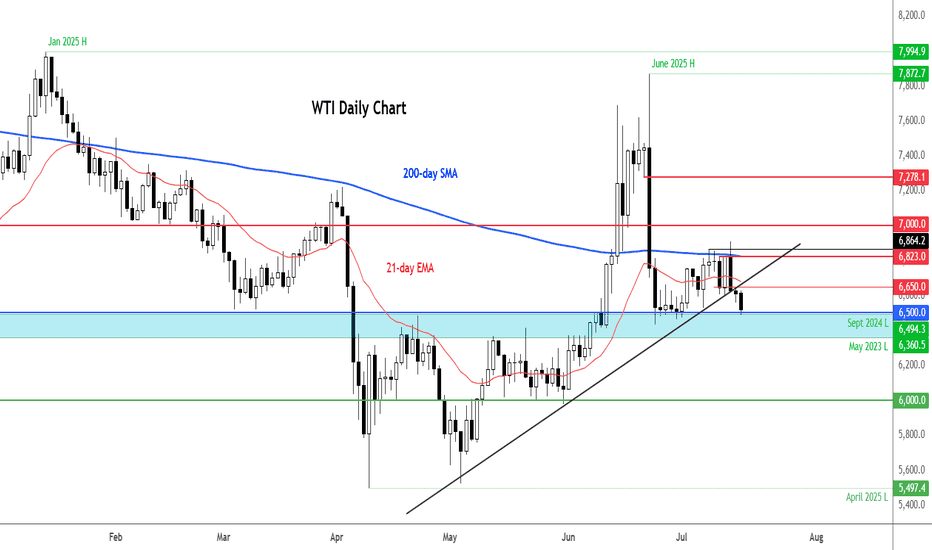

Crude oil extends fallsThe crude oil market has entered a fragile and uncertain phase, with prices retreating from recent highs. While WTI crude is still holding above the critical $65 mark on a closing basis, it was below this handle at the time of writing. So, the overall tone remains cautious, with a bearish tilt expected to persist in the near term.

Technical Outlook: WTI Breaks Key Support

The WTI crude chart shows a breakdown of a short-term bullish trend line, and lower lows. The price failed to reclaim the 200-day moving average and found strong resistance since. Currently, it is testing support around $65.00. A daily close below this level could trigger further bearish momentum, with the next support zones seen at $64, and then the next round handles below that. $60 per barrel could be reached if the macro backdrop doesn't improve.

Geopolitical Factors: Trump’s Tariff Threats Dismissed

Donald Trump’s threats of 100% tariffs on countries buying Russian oil sparked initial concern but were ultimately shrugged off by the market. Traders interpreted the 50-day delay in enforcement and Trump’s historical pattern of backing off such threats as signs that immediate supply disruptions were unlikely.

OPEC+ Strategy: Supply Returning to the Market

OPEC+ has announced a larger-than-expected production increase of 548,000 bpd for August, with another 550,000 bpd potentially coming in September. This roll-back of earlier voluntary cuts aims to recapture market share, especially as U.S. shale production slows. However, the added supply may cap price gains, particularly as demand is expected to ease after the peak U.S. driving season.

By Fawad Razaqzada, Market Analyst with FOREX.com

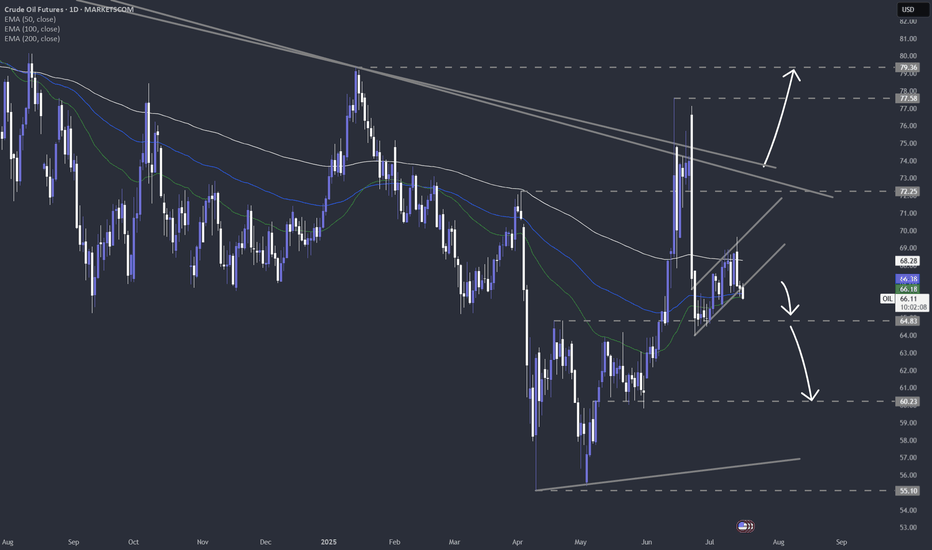

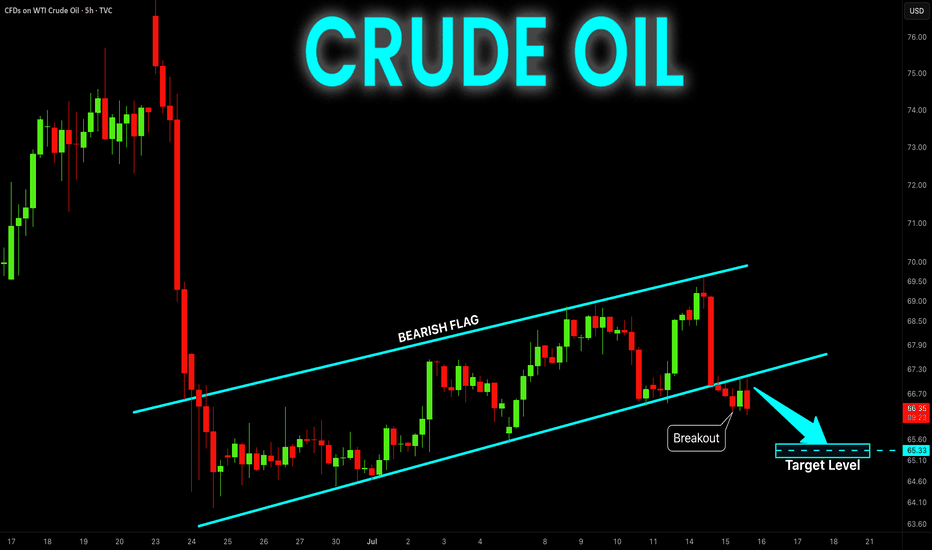

Could we see the WTI oil bears getting pleased any time soon?The technical picture of MARKETSCOM:OIL is showing a possible bearish flag formation, which may lead WTI oil to some lower areas. Is that the case? Let's dig in.

NYMEX:CL1!

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

NATURAL GAS - STILL IN THE GAME TRADING IDEA UPDATE -

NATURAL GAS - STILL IN THE GAME🔥

The XNGUSD goes quite well, as predicted. It held the trendline and moving upwards slowly, but surely. Short-term support here is the EMA20 on 4h timeframe. The asset is just below 3.600 resistance level and sma200. Since the July 10, the asset seems to be moving within the ascending channel (pic 2). I expect that the price will break the 3.6000 resistance level, will go towards upper channel border and then, after quick retest, move towards 3.8000. Not a trading advice! Trade cautiously!

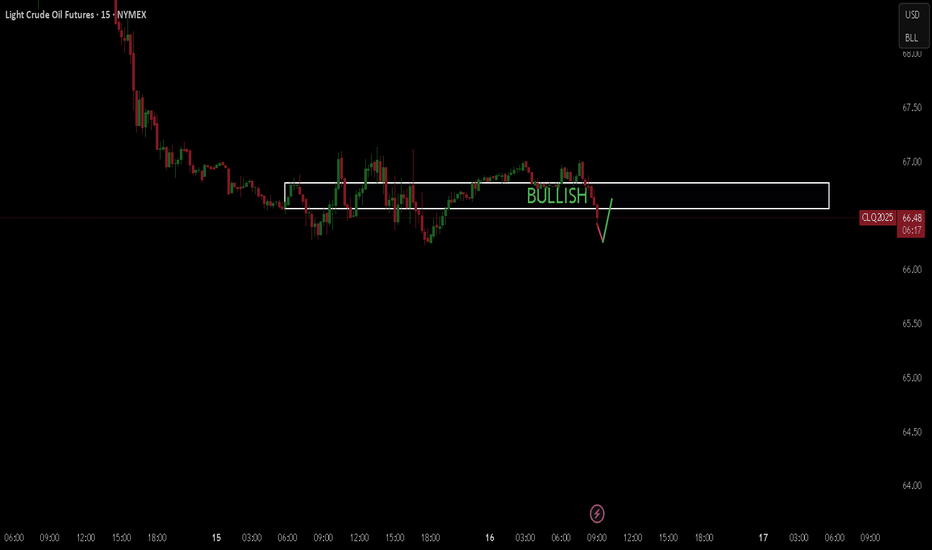

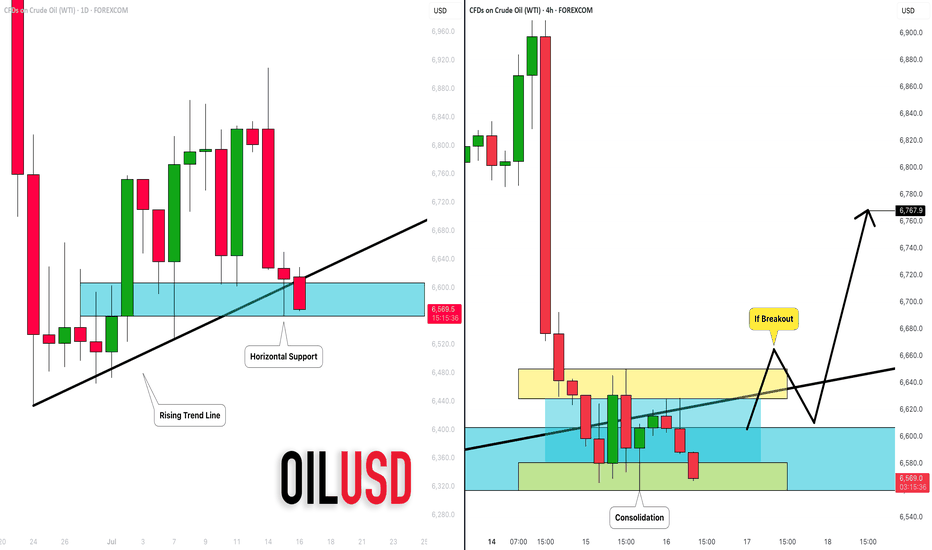

CRUDE OIL (WTI): Your Trading Plan Explained

Do not forget that today we expect Crude Oil Inventories data

release - it will be 10:30 am NY time.

Ahead of this news, the market is testing a significant daily support cluster

that is based on a rising trend line and a horizontal structure.

You signal to buy will be a bullish breakout of a minor intraday

horizontal resistance on a 4H.

4H candle close above 66,5 will be your confirmation.

A bullish continuation will be expected to 67.6 then.

I suggest waiting for the news release first and then check how

the market prices in the news. If our technicals align with fundamentals,

it will provide an accurate setup.

Alternatively, a bearish violation of a blue support will push the prices lower.

❤️Please, support my work with like, thank you!❤️

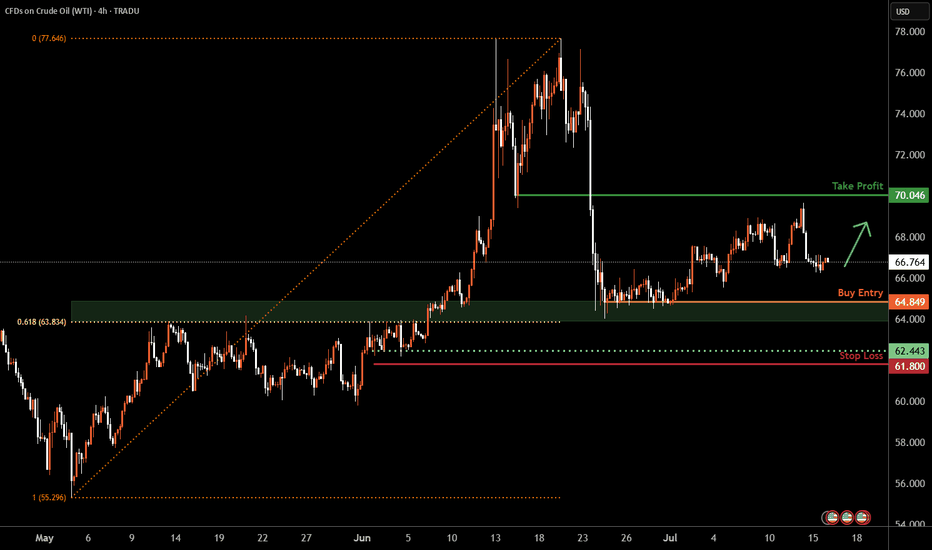

WTI Oil H4 | Potential bounce off a multi-swing-low supportWTI oil (USOIL) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 64.84 which is a multi-swing-low support that aligns closely with the 61.8% Fibonacci retracement.

Stop loss is at 61.80 which is a level that lies underneath a multi-swing-low support.

Take profit is at 70.04 which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Could OIL Slide to $60? a 5% Drop Might Be on the Table? Hey Realistic Traders!

Price action is weakening. Will USOIL find support or slide further?

Let’s Break It Down..

On the 4H timeframe, oil has formed a double top pattern followed by a neckline breakout, which is a classic sign of a potential shift from a bullish to a bearish trend.

This breakout was confirmed by a break below the bullish trendline, accompanied by consecutive bearish full-body candlesticks that reinforce the bearish momentum. Afterward, the price formed a bearish continuation pattern known as a rising wedge, which was followed by a breakdown.

The combination of bearish reversal and continuation pattern breakouts signals further downside movement and confirms the shift into a bearish trend.

Therefore, we foresee the price forming lower lows and lower highs toward the first target at 63.21, with a potential extension to the close the gap at 60.73.

The bearish outlook remains valid as long as the price stays below the key stop-loss level at 69.66.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: This analysis is for educational purposes only and should not be considered a recommendation to take a long or short position on USOIL.

WTI(20250716)Today's AnalysisMarket news:

① The annual rate of the overall CPI in the United States in June rose to 2.7%, the highest since February, in line with market expectations, and the monthly rate was 0.3%, the highest since January, in line with market expectations; the annual rate of the core CPI rose to 2.9%, the highest since February, lower than the expected 3%, but slightly higher than 2.8% last month, and the monthly rate was 0.2%, lower than the market expectation of 0.3%.

② Interest rate futures still show that the Fed is unlikely to cut interest rates this month, but there is a high possibility of a 25 basis point cut in September.

③ Fed mouthpiece: The CPI report will not change the Fed's policy direction.

④ Trump: Consumer prices are low and the federal funds rate should be lowered immediately. The Fed should cut interest rates by 3 percentage points.

⑤ Fed Collins: The core inflation rate is expected to remain at about 3% by the end of the year, and the Fed should maintain active patience.

Technical analysis:

Today's buying and selling boundaries:

65.66

Support and resistance levels:

66.49

66.18

65.98

65.34

65.14

64.83

Trading strategy:

If the price breaks through 65.66, consider buying, the first target price is 65.98

If the price breaks through 65.34, consider selling, the first target price is 65.14

CRUDE OIL Bearish Flag Breakout! Sell!

Hello,Traders!

CRUDE OIL is trading in a local

Downtrend and formed a bearish

Flag pattern and now we are

Seeing a bearish breakout

So we are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US OIL SELL...Hello friends🙌

🔊As you can see, this chart works well in forming a channel, and now that

we have witnessed a price drop, the price has reached the bottom of the channel, and given the previous heavy drop, the channel shows that the power is currently in the hands of sellers and it is likely that the specified targets will move.

🔥Follow us for more signals🔥

Trade safely with us

WTI OIL Is it forming a bottom?WTI Oil (USOIL) Has been trading within a Rising Wedge pattern and since June 02, it has turned its 1D MA50 as a Support. Technically the recent 2-week consolidation within the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line) is a bottom formation on the Higher Lows trend-line of the Rising Wedge.

As long as the 1D MA50 holds, we remain bullish, targeting $80.00 (Resistance 1). If the 1D MA50 breaks (closes a 1D candle below it), we will take the loss, and turn bearish instead, targeting $60.05 (Support 1).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Hellena | Oil (4H): LONG to 50% lvl Fibo area of 70.00.Colleagues, after a long break, I think it is worth returning to oil forecasts. The situation is stabilizing a bit and now I think that the price is in a strong correction (ABC) at the moment I see wave “B”, which may reach the area of 50% Fibonacci 70 level.

It is possible that wave “A” will continue to develop towards the 62-63 area, but I still hope for an upward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Crude oil rises slowly but falls quickly?

💡Message Strategy

International oil prices continued to climb on Monday, but the gains were limited. Brent crude futures rose 8 cents to $70.44 a barrel, continuing Friday's 2.51% rise. U.S. WTI crude rose 5 cents to $68.50, having surged 2.82% the previous trading day.

The main driving force behind this round of gains came from the market's expectation that the United States would further increase sanctions on Russia. U.S. President Trump said on Sunday that he would provide Ukraine with the Patriot air defense missile system and would make a "major statement" on the Russian issue on Monday.

The contradiction between supply and demand is also intensifying. According to market surveys, Brent crude oil rose by 3% last week and WTI rose by 2.2%. The International Energy Agency (IEA) pointed out that although the market supply and demand appear to be balanced on the surface, the actual global oil supply may be tighter than expected due to the summer refining peak and rising electricity demand.

📊Technical aspects

WTI crude oil continued its rebound from last week's low on the daily chart, and the current price is running at the downward support of $66.70, indicating that the short-term bullish power has increased. The MACD indicator shows a golden cross and initial volume, and the momentum column begins to turn positive, indicating that the price is expected to challenge the previous high area (69.50-70.20 US dollars).

The short-term (1H) trend of crude oil is highly repetitive, and the oil price is supported at the lower edge of the wide range and rises again. The short-term objective trend direction is upward within the range. The bullish momentum is sufficient.

💰Strategy Package

Long Position:65.50-66.50,SL:64.00,Target:69.00-70.00

WTI(20250715)Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

66.63

Support and resistance levels:

69.20

68.24

67.62

65.65

65.02

64.06

Trading strategy:

If it breaks through 66.63, consider buying in, the first target price is 67.62

If it breaks through 65.65, consider selling in, the first target price is 65.02

Market Watch UPDATES! Stock Indices, Gold, Silver, US OILWelcome to the Market Watch Updates for Monday, July 14th.

In this video, we will give the forecast updates for the following markets:

S&P500, NASDAQ, DOW JONES, GOLD, SILVER and US OIL.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WTI Crude Oil Reverses Lower Near $70 ResistanceA bearish engulfing candle has formed on the daily WTI crude oil chart, with its high perfectly respecting the 38.2% Fibonacci retracement just beneath the $70 handle. Given that the bounce from the June low has been relatively weak compared to the sharp decline from $78, I’m now on alert for a potential break beneath the $64 support level.

That said, the 200-day SMA and EMA currently sit between $65.21 and $65.31, which could offer near-term support. Should oil prices attempt to grind higher within the 1-hour bullish channel, bears may look to fade rallies into the weekly pivot (67.59) or the $68.00 handle, positioning for a potential rollover. A clean break below the 200-day averages would shift focus firmly back to $64, near the June low.

Matt Simpson, Market Analyst at City Index and Forex.com

CL down sub $60 before moving up above $73Expected support or reversal zone based on last swing high for CL is at $60. This matches with 0.786 fib level of last move up, suggesting a standard SBS structure forming. Expecting a move up to at least $73 (fib 0.236), possibly also well beyond this.

Based on time fib of last swing high I expect the bottom to occur before July 20th.

Crude oil------sell near 70.00, target 66.70-63.00Crude oil market analysis:

Recently, crude oil has been rising, and buying is slowly climbing, but the amplitude is not particularly large. The daily line has not formed a large buying pattern. It is currently a technical repair market after falling too much. Today's idea is to sell on the rebound. Pay attention to the suppression near 70.00. If this position is broken, it may change the short-term trend and buying may rise.

Fundamental analysis:

Last week, Trump increased tariffs on Canada and is about to increase tariffs on Brazil. There is no sign of stopping the tariff war. It is long-term bullish for gold. The situation in the Middle East has not completely stopped, and it is also long-term suppression of the US dollar to support gold.

Operation suggestions:

Crude oil------sell near 70.00, target 66.70-63.00