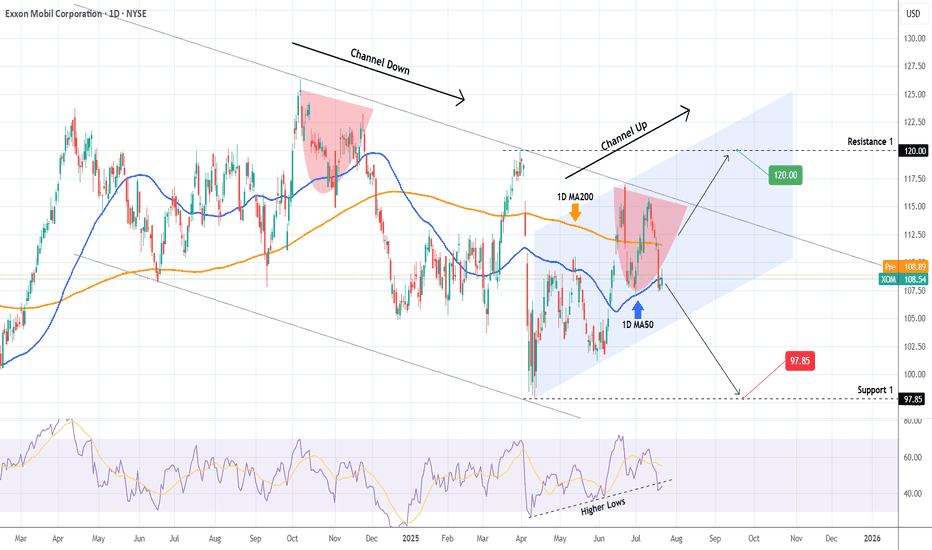

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and test at least Support 1 (97.85).

If however it breaks above the 1D MA200 it will invalidate all prior Lower High patterns, and will most likely follow the (blue) Channel Up to break above the Channel Down. In that case, we will be targeting Resistance 1 (120.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Energystocks

ADANI GREEN ENERGY Ready to FIRE ( LONG TERM IDEA ) !!!Weekly counts for ADANI Green Energy are recommended, with a bullish wave structure.

Both appear to be optimistic, and this stock's invalidation number is 758.

Investing in declines is a smart move for long-term players.

Long-term investors prepare for strong returns over the next two to five years.

The energy sector has a promising future.

Every graphic / chart used to comprehend the theory of elliot waves, harmonic waves, gann theory, and time theory

Every chart is for educational purposes.

We have no accountability for profit or loss.

Hallador Energy Company (HNRG) – Vertically Integrated PowerhousCompany Snapshot:

Hallador Energy NASDAQ:HNRG is redefining resilience in the energy sector with its fully integrated model, controlling both fuel supply and power generation. In today’s volatile energy landscape, this structure provides exceptional cost control and long-term strategic advantages.

Key Catalysts:

Vertically Integrated Model = Margin Power 💰

Manages ~90% of variable costs

Insulated from commodity price swings

Scales profitably as energy prices rise

Exclusive Grid Access ⚙️

Owns generator interconnection assets

Guarantees locked-in grid access—a rare competitive advantage

Strong positioning in a tight, regulated market

Revenue Visibility 💼

~$1.6B forward-contracted sales backlog

Ensures predictable cash flow and capital flexibility

Enables debt paydown, reinvestment, or shareholder returns

Tailwinds from Energy Demand 📈

U.S. power demand rising from AI/data centers, electrification

HNRG is well-positioned to benefit from stable base-load energy needs

Investment Outlook:

✅ Bullish Above: $12.00–$12.25

🚀 Target Range: $22.00–$23.00

🔑 Thesis: Structural cost control + grid access moat + revenue certainty = powerful upside potential

📢 HNRG: A rare energy stock with stability, growth, and moat strength.

#EnergyStocks #GridInfrastructure #PowerGeneration #HNRG #CashFlowStrong #ValuePlay

Potential outside week and bullish potential for KAREntry conditions:

(i) higher share price for ASX:KAR above the level of the potential outside week noted on 14th March (i.e.: above the level of $1.595).

Stop loss for the trade would be:

(i) below the low of the outside week on 11th March (i.e.: below $1.465), should the trade activate.

Comstock Resources (CRK) – Expanding U.S. Natural Gas DominanceCompany Overview:

Comstock Resources NYSE:CRK is accelerating natural gas production, reinforcing its position in the Western Haynesville play, a key U.S. gas region.

Key Catalysts:

Production Expansion & Strategic Acquisitions ⛽

Increasing drilling rigs from 5 to 7 for higher output.

Acquired 64,000 net acres in Haynesville, boosting reserves & market share.

Investment in Drilling & Midstream Infrastructure 🏗️

$1.0-$1.1 billion planned for 46 horizontal wells in 2025.

$130-$150 million allocated to midstream development, optimizing gas transport & profitability.

Market Strength & Growth Outlook 📈

Positioned to capitalize on rising U.S. natural gas demand & global LNG expansion.

Investment Outlook:

Bullish Case: We are bullish on CRK above $15.50-$16.00, supported by production growth & infrastructure investment.

Upside Potential: Our price target is $30.00-$31.00, driven by expansion, operational efficiency, and market strength.

🔥 CRK – Fueling the Future of U.S. Natural Gas. #CRK #NaturalGas #EnergyStocks

Chevron (CVX) – Strong Growth & Cash Flow ExpansionCompany Overview:

Chevron NYSE:CVX continues to demonstrate strong operational efficiency, strategic expansion, and record-breaking U.S. production.

Key Catalysts:

Production Growth & Profitability 🚀

Global production up 7% in 2024.

U.S. output surged 19% to record levels.

Permian Basin nearing 1M bpd, reinforcing cash flow strength.

Strategic Expansion & Sustainability 🌍

Gulf of Mexico projects targeting a boost from 200K to 300K bpd.

Future Growth Project in Kazakhstan enhances long-term production & ESG alignment.

Navigating Venezuelan challenges while leveraging stable U.S. policies for continued growth.

Investment Outlook:

Bullish Case: We remain bullish on CVX above $139.00-$140.00, backed by resilient production growth & execution.

Upside Potential: Our price target is $215.00-$220.00, supported by strong cash flow & expansion initiatives.

🔥 Chevron – Powering the Future with Growth & Stability. #CVX #EnergyStocks #OilAndGas

Defensive Sector with Growth PotentialSupporting Arguments

Current Market Uncertainty Sustains Demand for the Defensive Sector. NEE represents the defensive utility sector. Given the current political and economic uncertainty in the market, there could be an additional catalyst for the company's stock price growth.

Demand for Green Energy from the IT Sector. More than 80% of the company's portfolio consists of renewable energy sources (RES). Demand from data centers in the IT sector may allow the company to outperform competitors.

Attractive Valuation Levels and Technical Outlook

Investment Thesis

NextEra Energy (NEE) has strong long-term growth prospects due to the increasing demand for RES and the electrification of various sectors. Their integrated business model, combining the regulated utility business FPL and the competitive renewable energy business NEER, ensures both stability and growth opportunities. NEE's leadership in RES production, along with investments in battery energy storage and gas infrastructure, allows the company to benefit from the growing demand for clean energy solutions.

Current Market Uncertainty Could Drive Stock Price Growth. Tariffs imposed by the administration on imports and their potential impact on the U.S. economy remain in investors' focus. The market has responded to high uncertainty with a significant correction in overheated sectors, and pressure may persist for some time. As a representative of the utility sector, NEE benefits from uncertainty and may continue its growth.

Demand for Green Energy from the IT Sector. The largest public companies continue to increase capital expenditures on AI infrastructure to stay competitive. A key component of such infrastructure is data centers, which consume large amounts of energy and contribute to increased environmental pollution. As a result, data center owners create strong demand for companies that provide access to RES. More than 80% of the company’s portfolio consists of renewable energy sources. Already, the company’s annual profit growth rate is twice as high as that of its competitors.

Attractive Valuation Levels and Technical Outlook. The company's stock is trading at the 200-day moving average and recently rebounded from the resistance line at the 50-day moving average, which could serve as a strong catalyst for movement toward the previous peak of $84.8. Based on the forward PEG ratio, the company is trading at about the same level as companies engaged in traditional energy sources for household supply, while maintaining profitability 5-15% higher than competitors. Based on the forward P/E ratio, the company appears cheaper than its closest direct competitors (18x vs. 20.5x).

Our target price is $82, with a "Buy" recommendation. We recommend setting a stop-loss at $64

$APA: APA Corporation – Oil’s Wild Ride or Steady Bet?(1/9)

Good afternoon, everyone! ☀️

NASDAQ:APA : APA Corporation – Oil’s Wild Ride or Steady Bet?

With APA at $19.70, is this energy titan a fuel for profit or a risky barrel? Let’s drill down! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 19.70 as of Mar 17, 2025 💰

• Recent Move: Down from higher levels, reflecting oil price volatility 📏

• Sector Trend: Energy sector volatile amid economic uncertainties 🌟

It’s a rollercoaster—hold tight! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $6.1B (310M shares outstanding) 🏆

• Operations: Oil and gas exploration in key regions like U.S., Egypt ⏰

• Trend: Vulnerable to oil price swings, but diversified operations offer stability 🎯

Firm in its niche, but subject to market winds! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Oil Price Dynamics: Recent drops impact revenue and earnings 🌍

• Company Strategies: Focus on cost management and strategic investments 📋

• Market Reaction: Stock price reflects current market sentiments 💡

Navigating through turbulent waters! 💪

(5/9) – RISKS IN FOCUS ⚡

• Oil Price Volatility: Primary driver of performance 🔍

• Regulatory Changes: Environmental regulations and transition to renewables 📉

• Geopolitical Tensions: Impact on supply chains and prices ❄️

It’s a risky venture—stay alert! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Established Presence: Key oil-producing regions like Permian Basin 🥇

• Diversified Portfolio: Operations across multiple geographies 📊

• Financial Stability: Strong balance sheet, per historical data 🔧

Got solid foundations! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Vulnerable to oil price drops, regulatory risks 📉

• Opportunities: Expansion into new markets, M&A activities, potential oil price rebound 📈

Can it weather the storm and shine again? 🤔

(8/9) – POLL TIME! 📢

APA at $19.70—your take? 🗳️

• Bullish: $25+ soon, oil prices rebound 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $15 looms, further downturn ahead 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

APA’s $19.70 price reflects current market challenges 📈, but its long-term potential remains. DCA-on-dips could be a strategy to average in over time. Gem or bust?

How Can You Trade Energy Commodities?How Can You Trade Energy Commodities?

Energy trading connects global markets to the vital resources that power economies—oil and natural gas. These commodities aren’t just essential for industries and homes; they’re also dynamic assets for traders, influenced by geopolitics, supply, and demand.

Whether you’re exploring benchmarks like Brent Crude and WTI or understanding natural gas markets, this article unpacks the essentials of energy commodities and how to trade them.

What Is Energy Trading?

Energy trading involves buying and selling energy resources that power industries and households worldwide. These commodities are essential for modern life and are traded in global markets both as physical products and financial instruments.

Energy commodities include resources like oil, natural gas, gasoline, coal, ethanol, uranium, and more. In this article, we’ll focus on the two that traders interact with the most: oil and natural gas.

Oil is often divided into benchmarks like Brent Crude and WTI, which set global and regional pricing standards. These benchmarks represent crude oil that varies in quality and origin, impacting its trade and refining applications.

Natural gas, on the other hand, plays a critical role in electricity generation, heating, and industrial processes. It’s traded in various forms, including pipeline gas and liquefied natural gas (LNG), offering flexibility in transportation and supply.

What makes energy commodities unique is their global demand and sensitivity to external factors. Weather patterns, geopolitical developments, and economic activity all heavily influence their prices. For traders, this creates a dynamic market with potential opportunities to take advantage of price movements.

Additionally, energy commodities can act as economic indicators. A surge in oil prices, for example, might reflect growing demand from expanding industries, while a drop could indicate reduced consumption. Understanding these resources isn’t just about their practical use—it’s about grasping their role in shaping global markets and financial systems.

Oil: Brent Crude vs WTI

Brent Crude and WTI (West Texas Intermediate) are the world’s two leading oil benchmarks, shaping prices for a resource critical to industries and economies. Despite both being types of crude oil, they differ significantly in origin, quality, and market influence.

Brent Crude

Brent Crude is a globally recognised benchmark for oil pricing, primarily sourced from fields in the North Sea. Its importance lies in its role as a pricing reference for about two-thirds of the world’s oil supply. What makes Brent unique is its lighter and sweeter quality, meaning it has lower sulphur content and is easier to refine into fuels like petrol and diesel.

This benchmark is particularly significant in European, African, and Asian markets, where it serves as a key indicator of global oil prices. Its value is heavily influenced by international demand, geopolitical events, and production levels in major exporting countries. For traders, Brent offers a window into global supply and demand trends, making it a critical component of energy markets.

West Texas Intermediate (WTI)

WTI, or West Texas Intermediate, is the benchmark for oil produced in the United States. Extracted primarily from Texas and surrounding regions, WTI is even lighter and sweeter than Brent, making it suitable for refining into high-value products like petrol.

WTI’s pricing is heavily tied to North American markets, with its hub in Cushing, Oklahoma, a key point for storage and distribution. Localised factors, like US production rates and storage capacity, often create price differentials between WTI and Brent, with Brent typically trading at a premium. For example, logistical bottlenecks in the US can drive WTI prices lower.

The main distinction between the two lies in their geographical focus: while Brent captures the international market’s pulse, WTI provides insights into North American energy dynamics. Together, they form the foundation of global oil pricing.

Natural Gas: A Growing Energy Commodity

Natural gas is a cornerstone of the global energy market, valued for its versatility and role in powering economies. It’s used extensively for electricity generation, heating, and industrial processes, with demand continuing to rise as countries seek cleaner alternatives to coal and oil.

This energy commodity comes in two primary forms for trade: pipeline natural gas and liquefied natural gas (LNG). Pipeline gas is delivered directly via extensive networks, making it dominant in regions like North America and Europe.

LNG, on the other hand, is supercooled to a liquid state for transportation across oceans, opening up markets that lack pipeline infrastructure. LNG trade has grown rapidly in recent years, with key suppliers like Qatar, Australia, and the US meeting surging demand in Asia.

Pricing for natural gas varies regionally, with hubs like Henry Hub in the US and the National Balancing Point (NBP) in the UK serving as benchmarks. These hubs reflect regional dynamics, such as weather conditions, storage levels, and local supply disruptions.

Natural gas prices are also closely tied to broader geopolitical and economic factors. For example, harsh winters often drive up heating demand, while conflicts or sanctions affecting major producers can create supply constraints. This volatility makes natural gas an active and highly watched market for traders, offering potential opportunities tied to shifting global conditions.

Price Factors of Energy Commodities

Energy commodity prices are influenced by a mix of global events, market fundamentals, and local factors. Here’s a breakdown of key elements driving oil and gas trading prices:

- Supply and Production Levels: Output from major producers like OPEC nations, the US, and Russia has a direct impact on prices. Supply cuts or surges can quickly move markets.

- Geopolitical Events: Conflicts, sanctions, or political instability in oil and gas-rich regions often disrupt supply chains, creating volatility.

- Weather and Seasonal Demand: Cold winters boost natural gas demand for heating, while summer driving seasons often increase oil consumption. Extreme weather events, such as hurricanes, can also damage infrastructure and reduce supply.

- Economic Growth: Expanding economies typically consume more energy, driving demand and prices higher. Conversely, a slowdown or recession can weaken demand.

- Storage Levels: Inventories act as a cushion against supply disruptions. Low storage levels often signal tighter markets, pushing prices up.

- Transportation Costs: The cost of shipping oil or LNG across regions impacts pricing, particularly for seaborne commodities like Brent Crude and LNG.

- Exchange Rates: Energy commodities are usually priced in dollars, meaning currency fluctuations can affect affordability in non-dollar markets.

- Market Sentiment: Traders’ expectations, shaped by reports like US inventory data or OPEC forecasts, can influence short-term price movements.

How to Trade Energy Commodities

Trading energy commodities like oil and natural gas involves navigating dynamic markets with the right tools, strategies, and risk awareness. Here’s a breakdown of how traders typically approach energy commodity trading:

Instruments for Energy Trading

Energy commodities can be traded through various instruments, typically through an oil and gas trading platform. For instance, FXOpen provides access to oil and gas CFDs alongside 700+ other markets, including currency pairs, stocks, ETFs, and more.

- CFDs (Contracts for Difference): Popular among retail traders because they allow access to global energy markets without owning the physical assets. They offer leverage and provide flexibility to take advantage of both rising and falling prices. Additionally, CFDs have lower entry costs, no expiration dates, and eliminate concerns like storage or delivery logistics. Please remember that leverage trading increases risks.

- Futures: These are contracts to buy or sell commodities at a future date. While they provide leverage and flexibility, trading energy derivatives like futures is often unnecessarily complex for the average retail trader.

- ETFs (Exchange-Traded Funds): Energy ETFs diversify exposure to energy commodities or related sectors.

- Energy Stocks: Shares in oil and gas companies provide indirect exposure to commodity price changes.

Analysis: Fundamental and Technical

Energy traders rely on two primary types of analysis:

- Fundamental Analysis: Examines supply and demand factors like OPEC decisions, weather patterns, geopolitical tensions, and economic indicators such as GDP growth or industrial output.

- Technical Analysis: Focuses on price charts, identifying patterns, trends, and important levels to anticipate potential market movements.

Combining these approaches can offer a broader perspective, helping traders refine their strategies.

Taking a Position and Managing Risk

Once traders identify potential opportunities, they decide on position size and duration based on their analysis. Risk management is critical to help traders potentially mitigate losses in these volatile markets. Strategies often include:

- Diversifying positions to reduce exposure to a single commodity.

- Setting limits on position sizes to align with overall portfolio risk.

- Monitoring leverage carefully, as it can amplify both potential returns and losses.

Risk Factors in Energy Commodities Trading

Trading energy commodities like oil and natural gas offer potential opportunities, but it also comes with significant risks due to the market's volatility and global nature.

- Price Volatility: Energy markets are highly sensitive to geopolitical events, economic shifts, and supply disruptions. This can lead to rapid price swings, particularly if the event is unexpected.

- Leverage Risks: Many instruments, like CFDs and futures, allow traders to use leverage, amplifying both potential returns and losses. Mismanaging leverage can lead to significant setbacks.

- Geopolitical Uncertainty: Events like conflicts in oil-producing regions or trade sanctions can disrupt supply chains and sharply impact prices.

- Market Sentiment: Energy prices can react strongly to reports like inventory data, OPEC announcements, or unexpected news, creating rapid shifts in sentiment and price direction.

- Overexposure: Focusing too heavily on a single energy commodity can magnify losses if the market moves against the position.

- Economic Factors: Slowing industrial activity or recession fears can reduce demand for energy, putting downward pressure on prices.

The Bottom Line

Energy commodities trading offers potential opportunities, driven by global demand and supply. Whether focusing on oil, natural gas, or other energy assets, understanding the fundamentals and risks is key to navigating this complex market. Ready to explore oil and gas commodity trading via CFDs? Open an FXOpen account to access advanced tools, competitive spreads, low commissions, and four trading platforms designed to support your journey.

FAQ

What Are Energy Commodities?

Energy commodities are natural resources used to power industries, homes, and transportation. Key examples include crude oil, natural gas, and coal. These commodities are traded globally as physical assets or through financial instruments like futures and CFDs.

Can I Make Money Trading Commodities?

Trading commodities offers potential opportunities to take advantage of price movements, but it also involves significant risks. The effectiveness of your trades depends on understanding of market dynamics, analyses of supply and demand, and risk management. While some traders achieve returns, losses are also common, especially in volatile markets like energy.

How Do I Start Investing in Energy?

Investing in energy typically begins with choosing an instrument like ETFs or stocks, depending on your goals and risk tolerance. Researching market fundamentals, monitoring geopolitical and economic factors, and practising sound risk management are essential steps for new investors.

What Is an Energy Trading Platform?

An energy trading platform, or power trading platform, is software that enables traders to buy and sell energy commodities. These energy trading solutions provide access to pricing data, charting tools, and news feeds, helping traders analyse markets and execute trades efficiently.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Wall Street Rallies on Trade Optimism: $SPX Performance Wall Street Rallies on Trade Optimism: S&P 500 Performance Update 📈

1/9

The S&P 500 Index ( SP:SPX ) closed higher today, fueled by optimism surrounding U.S.-China trade negotiations. Energy stocks led the charge, driven by rising oil prices and demand forecasts. 🔋📊

2/9

Energy Sector Surge: Energy stocks played a crucial role in today's SPX gains. Rising global demand and oil price increases are sparking investor confidence. 🚀 Is this trend sustainable?

3/9

Trade Optimism: President Trump's decision to delay tariffs on Canada and Mexico boosted sentiment. However, new U.S. tariffs on China and China's retaliatory measures remain key risks. ⚖️ Trade talks are still a tightrope walk.

4/9

Corporate movers today:

PepsiCo and Estée Lauder fell after weak earnings forecasts. 📉

Palantir soared on a strong revenue outlook. 📈

Earnings season continues to shape sector performance!

5/9

Investors now await Alphabet's earnings, set to drop after market close. Tech giants like Alphabet can significantly impact SPX momentum in coming sessions. Will it be a bullish or bearish catalyst? 🕰️

6/9

Economic Context: The SPX's performance today highlights a market adapting to trade uncertainties. Investors are shifting their focus from immediate trade impacts to longer-term prospects. 💡

7/9

Looking Forward: Alphabet's earnings could either reinforce today's rally or inject new volatility into the market. Tech earnings remain a major influence on overall market sentiment. 🧮

8/9

Today's SPX rally is a reminder of the market's sensitivity to macroeconomic factors—trade policy, sector rotation, and earnings expectations are all in play. Are you positioned for these shifts? 📊

9/9

What’s your market outlook for the SPX this week? Vote now! 🗳️

SPX will continue rising 📈

Expect some volatility 🔄

Bearish pullback ahead 📉

EXXON MOBIL Will it recover the devastating December?Exxon Mobil (XOM) gave us an excellent buy signal on our last idea (September 27 2024, see chart below) as it quickly hit our $120 Target:

Since the November 22 2024 (Lower) High though, it had an aggressive sell-of that stopped on the December 20 2024 Low. The price has stabilized for now but hasn't yet gained the necessary momentum to stage a rebound.

On the other hand, there are some very encouraging signals that justify going long as the Risk/ Reward Ratio has turned very favorable for buying. The price might not be exactly at the bottom (Higher Lows trend-line) of the Channel Up but the 1W RSI is on the 38.35 Support, which is the exact level where the it bottomed on January 19 2024, on the previous Higher Low.

At the same time, the 1D MACD has completed a Bullish Cross, which has always been a solid buy entry below the 0.0 level. As a result, even though the stock may deliver one last pull-back to test the bottom of the 14-month Channel Up, it is worth buying now as the upside is significantly higher. Our Target is the Resistance 2 level at $126.40.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

S&P/TSX Composite Index Continues Record-Breaking MomentumCurrent Market Situation:

The S&P/TSX Composite Index closed slightly above 24,050 on Friday, marking a 0.7% weekly gain and continuing its record-breaking trend.

Driving Factors:

Weak GDP data for August pointed to economic stagnation, reinforcing expectations of a dovish stance from the Bank of Canada, which improved market sentiment.

Gains in energy and financial sectors helped buoy the index. Notable stocks like Imperial Oil and TD Bank rose over 0.6%.

Challenges:

Declines in major stocks, including CIBC, TC Energy, and First Quantum, each down over 1.3%, weighed on the broader market's performance.

Outlook:

Despite some sector-specific declines, the index maintained its upward trajectory, remaining poised for a positive close to the week.

#SPTSX #StockMarket #CanadaEconomy #EnergyStocks #FinancialSector #MarketSentiment

XNGUSD Looking for Bullish continuation LONGXNGUSD is still in oversold and undervalued territory as demand may be mitigated

by anticipation of milder weather and supplies seem to be more than adequate. XNGUSD

may move higher if either of those factors changes. The chart shows price about 15% above

support and about 60% below heavy resistance. The RSI indicator shows the faster RSI line

above the 50 level and so I think the bullish move is supported by buying volume. I will take

a long trade on forex and in UNG / UNL on the equities market.

EXXON MOBIL This sell signal will take it to $105.00 minimum.Exxon Mobil (XOM) has been on a tremendous since the January 18 bottom and even more so since the start of this month (March). We are about to form a Golden Cross on the 1D time-frame and last time this pattern emerged (September 20 2023), the market top was formed a week after.

In fact all Tops since November 2022 where formed on a Higher High sequence, confirmed by a 1D MACD Bearish Cross. As a result, we are waiting for the ideal sell opportunity on Exxon's next High and we will enter it after the MACD forms a Bearish Cross. All previous 3 corrective waves have hit at least the 0.618 Fibonacci retracement level. That gives us a medium-term Target of $105.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

UEC an uranium miner rerverses and warms up LONGUEC in the past several days has put in a double and bottom appears to be gaining bullish

momentum based on the trend angle from today. The volatility indicator triggered buying

price pressure five days ago as shown on the indicator and encirled. the volatility of yesterday

and today may be shorts covering to close synergized with new buyers. The uranium sector

is heating up at this time. Many of the stocks in this sector are over the counter. The ETFs

are URA and URNM. I will add to my long position in UEC now.

EOAN or EO.N or Energy Long positionWe are currently in an uptrend with the 200 green ma line slooping up and the price beeing above it.

We hit a support that has previously been resisistance with multiple tops in the past.

From this support we have had positive uptrend bullish candles.

Now we set stoploss under the last bottom and go for a 1/1 ratio stoploss and take profit.

FCEL Energy Penny Stock Buy the near term Bottom LongFCEL a penny alternative energy stock is at a near-term bottom sitting at the POC line

of the volume profile and a standard deviation below the intermediate-term mean VWAP

about a month out from a good earnings beat. Given the current administrations unwavering

support for green enerby sometimes with grants subsidies and other hand- outs I see FCEL

as getting some trader attention of the good kind unlike PLUG which announced a large public

offering to dilute investors. FCEL could steal some of those investors. The supertrend indicator

is signaling a reversal at the confluence of the POC line with the VWAP band as

mentioned. My target is the mean VWAP at 1.50 for about 35% upside with a stop loss at

the recent pivot low of $1.09 making for a reward-to-risk ratio of better than 6.

I see this as a swing trade with potentially 75 days in front of it given the earning report

for 24Q1 is due a bit beyond that and best risk management would be to take a partial

and size down going into earnings.

UROY Short Sell Trade from High Tight Flag Breakdown SHORTUROY topped out as shown by my other ideas. Profits are redeployed into it in a short trade

to play the volatility. Expect 10% in 1-3 days. Text box comments are on the chart. The

volatility is increased;the uranium sector is hot ( no pun here) given the climate warming and t

the ongoing debates on fossil fuels and government initiatives supporting green energy and

trying to wean the oil addiction. ( ZOOM out and to the left for text comments )

EXXON MOBIL on the 1 year Support but on bearish bias.The Exxon Mobil Corporation (XOM) is again testing Support 1 (97.85), which is holding since the March 13 2023 Low but on a bearish note as it recently broke below the October 2020 Higher Lows trend-line (was the long-term Support) and remains below the 1W MA50 (blue trend-line) for the 12th week in a row.

This is obviously a long-term analysis on the 1W time-frame, but the chart can provide a clear view of the trend depending on the break-out. If the stock closes a 1W candle above the 1W MA50, we will turn bullish targeting $120.00 (just below Resistance 1). If it closes below Support 1, we will turn bearish targeting 84.50, just above Support 2 and the 1W MA200 (orange trend-line).

Note that the 1W RSI has been on a huge Bearish Divergence (Channel Down) since January 2022.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Renergen is turning BULLISH after the crash Target to R23.72Cup and Handle seems to now be forming on Renergen.

It seems like there is a change in the wind for the stock as last year we predicted a big crash which struck at R9.33.

And This time around, we're seeing a Cup and Handle form.

It's not exactly there yet and we do need a break above the brim. But when it does so, we will see the price go above 200MA and head to the first target of R23.72.

Let's ee how it plays out.

Looming Threats to Food and Energy SecurityThe global food and energy markets face growing uncertainty and volatility in the coming years due to converging factors that could lead to supply shortages, price spikes, and potential shocks.

One concern is the impact of declining sunspot cycles on the climate. Scientists predict that a grand solar minimum could occur in the coming decades, causing global cooling and disruptive weather patterns, negatively affecting grain production in key agricultural. With grain supplies tightened, any further demand increases would send prices a lot higher.

Global grain consumption has grown steadily, increasing by over 2% in the last 25 years. Rising disposable incomes in developing countries have enabled consumers to add more protein foods like meat and dairy to their diets. However, this dietary shift puts pressure on grains, since over 8 pounds of grain is needed to produce just 1 pound of beef. Hence, increased meat consumption indirectly leads to higher demand for grains.

The ongoing war in Ukraine has severely impacted global grain markets, compounding the risks. Combined, Russia and Ukraine account for nearly 25-30% of worldwide wheat exports. With both countries blocking or threatening to destroy grain shipments, the conflict poses a huge threat to food security especially in import-dependent regions like North Africa and the Middle East. Export restrictions like India's recent rice export ban to protect domestic food security are also tightening global grains trade. As supplies dwindle, agricultural commodities become more vulnerable to price shocks.

These supply uncertainties make soft commodities like cocoa, coffee, and sugar especially at risk of price spikes in coming years. Prolonged droughts related to climate cycles like La Niña and El Niño could severely reduce yields of these crops grown in tropical regions of Southeast Asia, Africa, and South America. For instance, a drought in West Africa's prime cocoa-growing areas could significantly impact production. Cocoa prices are already trading near 6-year highs in anticipation of shortages. If drought hits key coffee-growing regions of Vietnam and Brazil, substantial price increases could follow.

Similar severe drought potential exists in the U.S. Midwest this summer. Lack of rainfall and moisture could cause severe yield reductions in America's corn and soybean belts. Since the U.S. is the world's largest corn and soybean exporter, this would cause severe upward price pressures globally. The rise in agricultural commodities ETF Invesco DBA likely reflects investor concerns about impending supply shortages across farming sectors, and its price might be leading the spot price of agricultural commodities.

Fertilizer prices also contribute to food market uncertainty. In 2021-2022 fertilizer prices skyrocketed due to energy costs rising, directly raising the cost of food production. When fertilizer prices surge, it puts immense pressure on farmers' costs to grow crops and indirectly influences food prices. However, falling fertilizer prices do not necessarily translate into lower food costs for consumers. Fertilizer prices have dropped substantially over the last year, without that meaning everything is fine with fertilizer production. Dropping fertilizer prices could actually indicate a slowdown in agriculture, as, lower demand for fertilizers could mean fewer farmers are investing in maximizing crop yields. In that case, food production may decline leading to higher prices due to supply and demand fundamentals. At the same time, if other farm expenses like machinery, seeds, or labor rise due to factors like high energy costs, overall production costs could still increase even as fertilizer prices decline.

The energy markets face a similar mix of uncertainty and volatility ahead. Despite substantial declines in prices, the energy sector ETF XLE has held up well, suggesting investors anticipate a rebound in oil and natural gas. Fundamentally, both commodities could trade a lot higher in the long term, however in the medium term I believe that oil is poised to drop further to the $55-60 area before tightening supplies lead to much higher prices. Essentially what’s missing is a capitulation to flush bullish sentiment, and then lead to much higher prices. At the moment the market has found a balance between a weakening global economy and OPEC+ supply cuts.

A key uncertainty is China's massive oil stockpiling in recent years, now totaling nearly 1 billion barrels. If oil exceeds $80-85 per barrel, China could temper price rallies by releasing some of these reserves, as it did in 2021. With China's economy in turmoil, further reserve releases may be needed to stimulate growth, but it’s unclear whether its economy will be able to come back easily. Weak demand from China is already an issue for the oil market, and releases from the Chinese SPR could restrain oil prices over the next year. However, on the bullish side, the world remains heavily dependent on fossil fuels lacking viable large-scale alternatives, even as ESG trends continue. OPEC's dwindling spare production capacity raises risks of undersupply. Even an economic recession may only briefly dampen oil prices before supply cuts by major producers again tighten markets.

Ultimately, sustained high energy prices will restrain broader economic growth by reducing demand across sectors. The outlook for food and energy markets remains uncertain, with significant risks of continued volatility over the next few years. Multiple converging factors point to potential supply shortages and price spikes across agricultural commodities and fossil fuels. While prices may fluctuate in the short-term (6-12 months), the medium-term trajectory appears to be toward tighter supplies and higher costs for food and energy (2-5 years). To close on a more positive note, I believe that food and energy prices will see significant deflation as extreme technological progress pushes prices down in the long term (5+ years).

ERX a leveraged ETF reflects the energy sector rise LONGERX as shown on the daily chart shows a VWAP band breakout into the mean VWAP

from the lower VWAP lines coupled with a rising momentum on the PMO targeting

72 as the YTD pivot high. Given this is a leverage play in the supertrend shift in a

major sector I see this as a low risk moderate reward potential type of trade

I will take this trade long expecting to reap simple modest unrealized profit.

The stop loss is @ 58.6 while the upside is 10%. Please comment if you need

more details or are requesting a call option setup specifics.

x